|

市場調查報告書

商品編碼

1773260

企業行動管理市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Enterprise Mobility Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

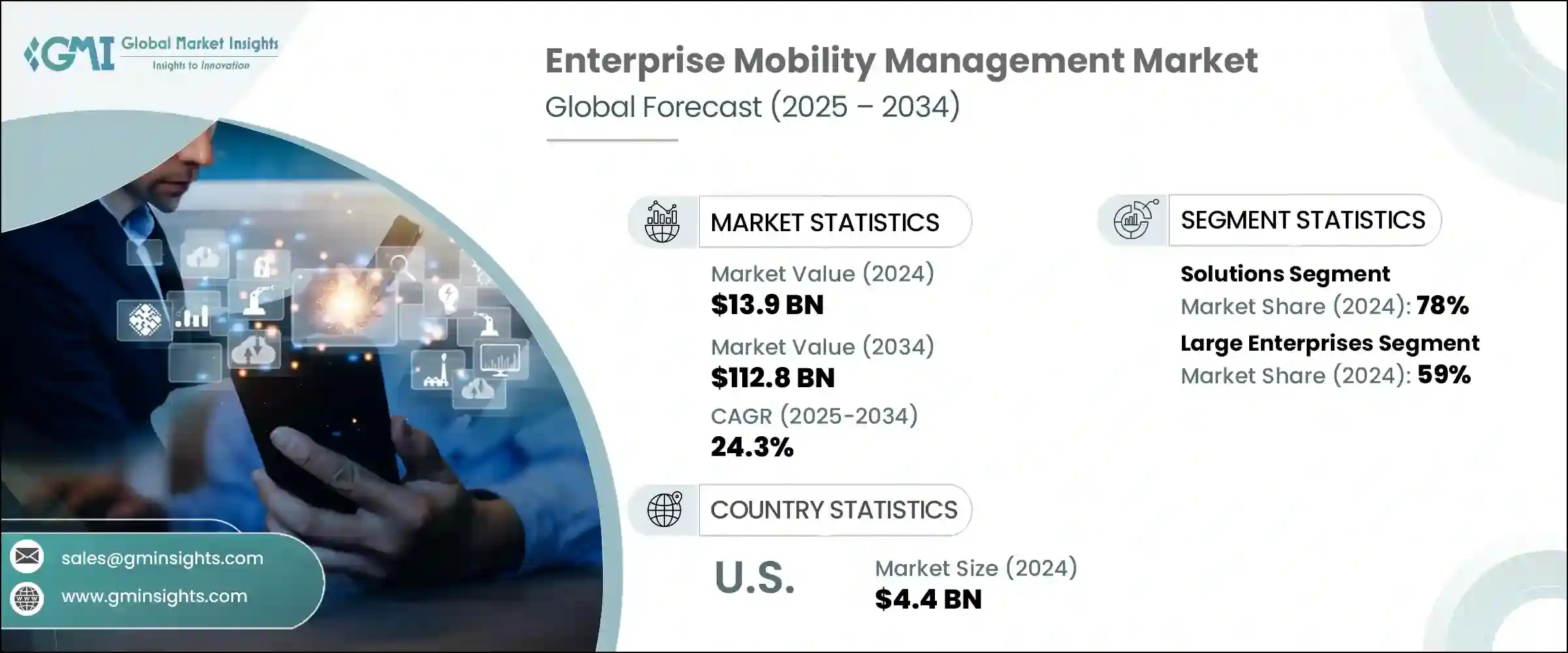

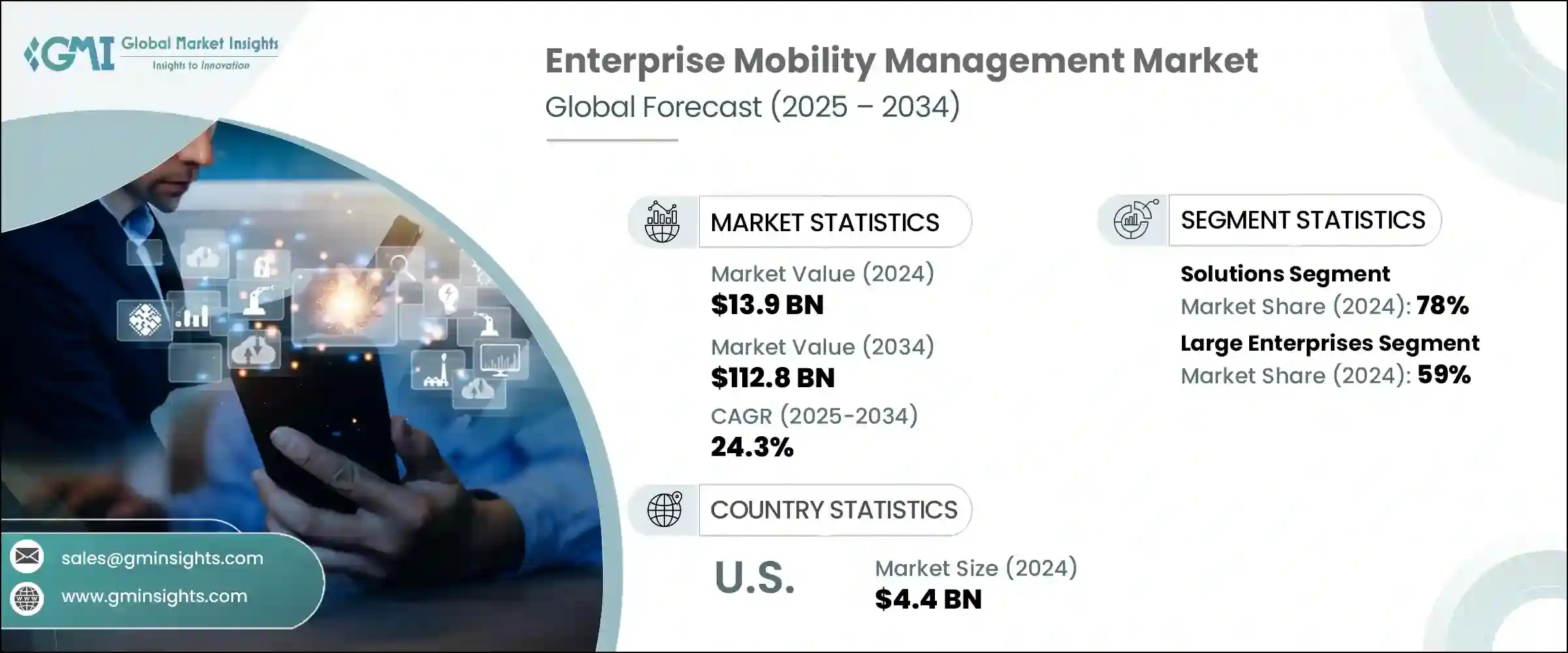

2024年,全球企業行動管理市場規模達139億美元,預計到2034年將以24.3%的複合年成長率成長,達到1128億美元。智慧型手機、平板電腦和筆記型電腦在工作場所的使用激增,推動了對強大EMM解決方案的需求。隨著員工越來越依賴個人和企業設備進行遠距辦公,企業正在擁抱「行動優先」策略,要求每個端點都能實現無縫管理和安全保障。 EMM平台集中設備監管,簡化連接,並強制執行策略以保護敏感資料,同時確保營運順暢。自帶設備辦公 (BYOD) 計劃的普及進一步加速了對全面、經濟實惠、能夠安全高效地處理各種設備的EMM工具的需求。

隨著網路釣魚、勒索軟體和資料外洩等網路威脅的增多,企業必須加強行動安全以保護關鍵資訊。遵守 GDPR、HIPAA 和 CCPA 等法規使得資料隱私比以往任何時候都更加重要,迫使企業採用能夠提供強式身分驗證、加密、遠端抹除功能和早期入侵偵測的解決方案。 EMM 系統控制對公司資料的存取並維護詳細的審計追蹤,從而降低違規風險並減輕合規負擔。日益成長的安全擔憂以及可能產生的高昂法律處罰,促使全球採用統一、廣泛的 EMM 平台。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 139億美元 |

| 預測值 | 1128億美元 |

| 複合年成長率 | 24.3% |

2024年,解決方案細分市場佔據78%的市場佔有率,預計2025-2034年期間的複合年成長率將達到23%。現代行動管理平台利用人工智慧實現設備設定自動化、即時策略執行、偵測新興威脅,並在最需要的地方提供支援。這些平台在後台悄無聲息地運行,自動部署補丁,無需人工干預即可強制執行合規性,並在出現可疑活動時進行標記。這種自動化使IT團隊能夠專注於策略計劃,而不是例行故障排除,從而提高組織的整體效率。

大型企業細分市場在2024年佔據59%的市場佔有率,預計到2034年將維持23%的複合年成長率。許多頂級企業已將統一端點管理 (UEM) 作為其行動策略的基礎,使IT員工能夠透過單一儀表板監控筆記型電腦、智慧型手機和物聯網設備。由於遠端員工從不同地點連接並頻繁切換設備以完成不同項目,對統一端點管理的需求激增。透過將眾多EMM功能整合到一個平台,UEM提高了生產力,同時減少了服務台的工作量。其簡化安全流程和減少IT手動工作量的承諾,尤其吸引了那些專注於加強治理和提高營運敏捷性的企業。

2024年,美國企業行動管理市場佔83%的市場佔有率,產值達44億美元。美國公司迅速採用基於雲端的EMM解決方案以及廣泛的BYOD政策,以管理員工使用的複雜設備組合。這些工具有效地隔離個人資料和工作數據,控制使用者權限並偵測異常——這正是EMM平台的核心優勢。這種動態推動了遠距辦公技術在美國的快速普及,其他地區也正在努力迎頭趕上。

推動全球企業行動管理產業發展的關鍵參與者包括 IBM、SAP SE、VMware、微軟、思科系統、Jamf 和 SOTI Inc.。為了鞏固在企業行動管理 (EMM) 市場的領先地位,各公司專注於整合人工智慧和機器學習,以增強威脅偵測能力並實現日常任務的自動化。策略合作夥伴關係和收購拓展了產品組合和地理覆蓋範圍,使企業能夠更有效地滿足多樣化的企業需求。

許多供應商優先考慮雲端原生解決方案,以滿足分散式員工對可擴展且靈活的行動管理日益成長的需求。以客戶為中心的創新,例如直覺的使用者介面和無縫的跨平台相容性,有助於提高採用率。透過強調合規性準備和進階安全功能,供應商將自己定位為資料保護領域值得信賴的合作夥伴。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 企業內行動裝置的激增

- 轉向遠程和混合模式

- 日益成長的網路安全問題和資料保護法規

- 與基於雲端的基礎設施和 SaaS 應用程式整合

- 產業陷阱與挑戰

- 與遺留系統的整合複雜性

- 使用者抵制和採用障礙

- 市場機會

- 統一端點管理需求不斷成長

- 受監管行業的成長需要合規解決方案

- 透過 BYOD 和雲端技術拓展新興市場

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 用例

- 最佳情況

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 解決方案

- 行動裝置管理

- 行動應用程式管理

- 行動內容管理

- 身分和存取管理

- 服務

- 專業服務

- 諮詢

- 整合與部署

- 支援與維護

- 專業服務

5.3.2. 託管服務

第6章:市場估計與預測:依部署模式,2021 - 2034 年

- 主要趨勢

- 本地

- 基於雲端

第7章:市場估計與預測:依企業規模,2021 - 2034 年

- 主要趨勢

- 中小企業

- 大型企業

第8章:市場估計與預測:按作業系統,2021 - 2034 年

- 主要趨勢

- iOS

- 安卓

- 視窗

- 其他

第9章:市場估計與預測:依產業垂直,2021-2034

- 主要趨勢

- 資訊科技和電信

- 金融服務業

- 衛生保健

- 零售與電子商務

- 製造業

- 政府和公共部門

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- 42Gears Mobility Systems

- Baramundi Software

- BlackBerry Limited

- Cisco Systems

- Citadel

- Citrix Systems

- IBM

- Jamf

- ManageEngine

- Matrix42

- Microsoft

- Mitsogo

- MobileIron

- SAP SE

- Scalefusion

- Snow Software

- Sophos

- SOTI

- VMware

The Global Enterprise Mobility Management Market was valued at USD 13.9 billion in 2024 and is estimated to grow at a CAGR of 24.3% to reach USD 112.8 billion by 2034. The surge in smartphone, tablet, and laptop usage across workplaces is driving the need for robust EMM solutions. Companies are embracing mobile-first strategies as employees increasingly rely on both personal and corporate devices to work remotely, demanding seamless management and security for every endpoint. EMM platforms centralize device oversight, streamline connectivity, and enforce policies to safeguard sensitive data while ensuring smooth operations. The proliferation of bring-your-own-device (BYOD) programs has further accelerated demand for comprehensive, affordable EMM tools that can handle diverse devices securely and efficiently.

With the rise in cyber threats such as phishing, ransomware, and data breaches, organizations must strengthen mobile security to protect critical information. Compliance with regulations like GDPR, HIPAA, and CCPA has made data privacy more critical than ever, forcing businesses to adopt solutions that offer strong authentication, encryption, remote wiping capabilities, and early intrusion detection. EMM systems control access to corporate data and maintain detailed audit trails, reducing breach risks and easing compliance burdens. Growing security concerns and the potential for costly legal penalties have driven global adoption of unified, wide-ranging EMM platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.9 Billion |

| Forecast Value | $112.8 Billion |

| CAGR | 24.3% |

In 2024, the solutions segment held a 78% share and is projected to grow at a CAGR of 23% during 2025-2034. Modern mobility management platforms leverage artificial intelligence to automate device setup, enforce policies in real-time, detect emerging threats, and direct support where it's needed most. These platforms operate quietly in the background, deploying patches automatically, enforcing compliance without manual intervention, and flagging suspicious activities as they arise. This automation frees IT teams to focus on strategic initiatives rather than routine troubleshooting, increasing overall organizational efficiency.

The large enterprises segment held 59% share in 2024 and is expected to maintain a CAGR of 23% through 2034. Many top corporations have made unified endpoint management (UEM) the foundation of their mobility strategies, allowing IT staff to monitor laptops, smartphones, and IoT devices from a single dashboard. Demand surged as remote employees connected from various locations and frequently switched devices for different projects. By consolidating numerous EMM functions into one platform, UEM has improved productivity while reducing helpdesk workloads. Its promise of simplified security and reduced manual IT work has particularly appealed to firms focused on tightening governance and improving operational agility.

United States Enterprise Mobility Management Market held an 83% share in 2024, generating USD 4.4 billion. American companies rapidly adopted cloud-based EMM solutions alongside widespread BYOD policies to manage the complex mix of devices employees use. These tools effectively segregate personal and work data, control user permissions, and detect anomalies - core strengths of EMM platforms. This dynamic has fueled the rapid adoption of remote work technologies across the U.S., leaving other regions working to catch up.

Key players driving the Global Enterprise Mobility Management Industry include IBM, SAP SE, VMware, Microsoft, Cisco Systems, Jamf, and SOTI Inc. To strengthen their foothold in the EMM market, companies have focused on integrating artificial intelligence and machine learning to enhance threat detection and automate routine tasks. Strategic partnerships and acquisitions have expanded product portfolios and geographical reach, enabling firms to serve diverse enterprise needs more effectively.

Many providers prioritize cloud-native solutions, catering to the growing demand for scalable and flexible mobile management across distributed workforces. Customer-centric innovation, such as intuitive user interfaces and seamless cross-platform compatibility, helps improve adoption rates. By emphasizing compliance readiness and advanced security features, vendors position themselves as trusted partners in data protection.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment mode

- 2.2.4 Enterprise size

- 2.2.5 Operating system

- 2.2.6 Industry vertical

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Proliferation of mobile devices across enterprises

- 3.2.1.2 Shift towards remote and hybrid models

- 3.2.1.3 Rising cybersecurity concerns and data protection regulations

- 3.2.1.4 Integration with cloud-based infrastructure & SaaS application

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Integration complexity with legacy systems

- 3.2.2.2 User resistance and adoption barriers

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for unified endpoint management

- 3.2.3.2 Growth in regulated industries needs compliance-ready solutions

- 3.2.3.3 Expansion across emerging markets with BYOD and cloud adoption

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

- 3.12 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Solutions

- 5.2.1 Mobile device management

- 5.2.2 Mobile application management

- 5.2.3 Mobile content management

- 5.2.4 Identity and access management

- 5.3 Services

- 5.3.1 Professional services

- 5.3.1.1 Consulting

- 5.3.1.2 Integration & deployment

- 5.3.1.3 Support & maintenance

- 5.3.1 Professional services

5.3.2. Managed services

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud-based

Chapter 7 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Small & medium-sized enterprises

- 7.3 Large enterprises

Chapter 8 Market Estimates & Forecast, By Operating System, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 iOS

- 8.3 Android

- 8.4 Windows

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Industry Vertical, 2021 -2034 (USD Million)

- 9.1 Key trends

- 9.2 IT & Telecom

- 9.3 BFSI

- 9.4 Healthcare

- 9.5 Retail & E-commerce

- 9.6 Manufacturing

- 9.7 Government & public sector

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 42Gears Mobility Systems

- 11.2 Baramundi Software

- 11.3 BlackBerry Limited

- 11.4 Cisco Systems

- 11.5 Citadel

- 11.6 Citrix Systems

- 11.7 IBM

- 11.8 Jamf

- 11.9 ManageEngine

- 11.10 Matrix42

- 11.11 Microsoft

- 11.12 Mitsogo

- 11.13 MobileIron

- 11.14 SAP SE

- 11.15 Scalefusion

- 11.16 Snow Software

- 11.17 Sophos

- 11.18 SOTI

- 11.19 VMware