|

市場調查報告書

商品編碼

1850180

雲端電視 - 市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030 年)Cloud TV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

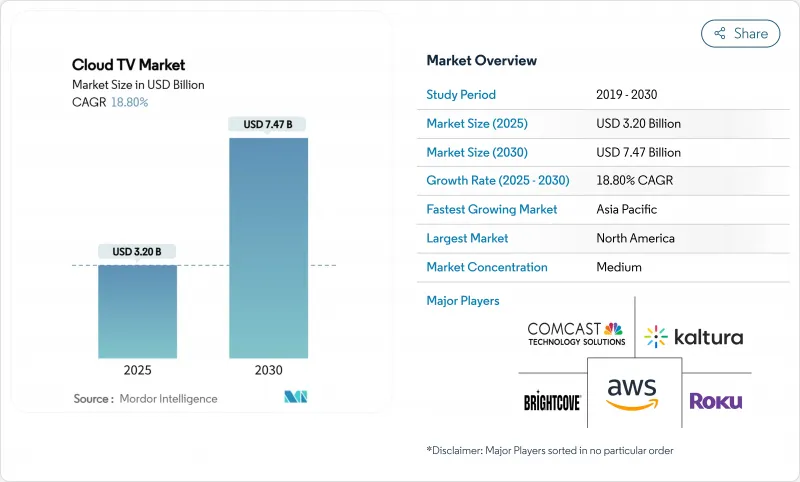

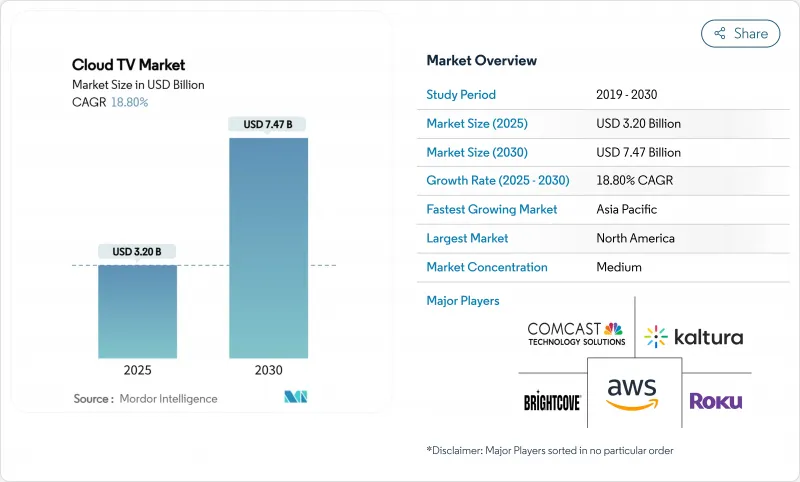

預計 2025 年雲端電視市場價值將達到 32 億美元,到 2030 年將成長至 74.7 億美元,2025 年至 2030 年的複合年成長率為 18.8%。

可擴展視訊工作流程需求的激增、5G 的快速部署以及通訊業者融合策略正在推動應用的普及。雖然公共雲端部署仍占主導地位,但隨著媒體公司在彈性和廣播級效能之間取得平衡,混合架構正日益受到青睞。監管碎片化、半導體供應限制以及 iOS 採購成本的上升仍然是成長的阻力。平台營運商、設備製造商和通訊業者之間日益激烈的競爭迫使供應商透過人工智慧主導的發現、情境廣告和整合式雲端遊戲服務來實現差異化。亞太地區快速的網路部署和智慧型手機的大規模普及,使參與企業獲得了不對稱的優勢。

全球雲端電視 - 市場趨勢與洞察

持續光纖家庭部署,實現穩定的 OTT 傳輸

在大多數已開發市場,FTTH 的普及率超過 50%,為雲端電視市場提供了無緩衝 4K 和 8K 串流媒體所需的頻寬可靠性。像 AT&T 這樣的通訊業者正在投資 150 億美元,到 2025 年為 3,000 萬戶家庭鋪設光纖,以減少對昂貴邊緣快取的依賴,並促進優質的體育賽事直播。營運商將透過捆綁無限流量套餐(取消位元率上限)並利用確定性 QoS 來支援互動功能,進一步實現光纖收益。

5G固定無線存取在北美和歐洲農村地區快速擴張

5G FWA 提供 100-200Mbps 的下行速度和低於 10ms 的延遲,將先前服務不足的農村地區轉變為可行的雲端電視市場。包括 T-Mobile 和 Verizon 在內的通訊業者計劃在 2025 年簽約 400 萬至 500 萬 FWA用戶,加速服務普及,而無需花費數年時間進行鋪設。寬頻+電視捆綁套餐以及針對房車車主的可攜式雲端電視用例正在進一步推動農村地區的需求。

新興非洲和加勒比地區的 CDN 分佈分散

非洲大部分地區的平均國內延遲達到78毫秒,而北美則不到45毫秒,這限制了1080p串流媒體的穩定傳輸。該地區約50%的網路流量透過海外上游供應商傳輸,2024年西非的一次海底電纜中斷導致13個國家陷入癱瘓。由於缺乏本地接入點(PoP),雲端電視服務供應商被迫降低位元率,從而影響了體驗品質和廣告收益。

細分分析

到 2024 年,公共雲端將佔營收的 52%,而隨著廣播公司追求具有可預測 QoS 的靈活突發容量,混合配置預計到 2030 年將以 21.3% 的複合年成長率成長。這種組合允許版權所有者將優質體育檔案儲存在私人叢集上,同時依靠超大規模伺服器來處理實況活動。隨著內容擁有者根據成本曲線調整其工作負載並放棄老化的內部編碼器,混合部署的雲端電視市場規模預計將加速成長。公共媒體等受監管行業已經將其 45% 的工作流程遷移到混合節點以本地化用戶資料。無論用例如何,逐步遷移都可以避免遺留系統退役的風險,即使在旺季也能支援不間斷的觀眾覆蓋範圍。

混合採用還能解決跨境版權管理問題。營運商在靠近僑民的公共區域部署來源快取,同時在私人域運行浮水印和DRM邏輯。供應商則使用基於Kubernetes的轉碼器,彈性擴展兩者的覆蓋範圍。因此,收費從資本支出轉向精細化使用,使中端網路無需購買新的ASIC即可測試4K交付。 2030年,雲端電視投資決策架構可能會優先考慮能源效率、碳排放揭露和主權雲端授權,以及位元率經濟性。

到2024年,聯網電視(CTV) 將佔總收入的40%,其中智慧型手機將成為成長最快的終端,預計複合年成長率將達到23.5%。 Open RAN 5G 和價格實惠的 OLED 面板正在縮小體驗差距,6.7 吋螢幕上的 4K HDR 畫質堪比客廳電視。豎屏短劇集佔據了 Z 世代的觀看列表,迫使發行商同時為垂直螢幕和橫屏畫面製作故事板。到2027年,預計行動雲端電視的市佔率將在東南亞多個國家超越連網電視。

廣告主利用家庭圖譜技術,在同一天晚上在行動裝置上投放 15 秒的預告片,在連網電視上投放 30 秒的深度廣告,並在平板電腦上投放可購物的疊加廣告。雲端編碼器供應商嵌入了 SSAI 標記,這些標記可作為動態QR碼提示,並根據當前螢幕大小進行自適應。這種融合重新定義了主螢幕的提案,而致勝之道在於提供順暢的切換體驗,而非特定於裝置的使用者體驗。

雲端電視市場報告按部署方式(公共雲端、私有雲端、混合雲端)、設備類型(機上盒、行動電話、聯網電視)、應用領域(電信、娛樂和媒體、其他)、組織規模(中小型企業、大型企業)和地區進行細分。市場預測以美元計算。

區域分析

北美佔2024年總收入的43%,這得益於成熟的寬頻普及率、較高的SVOD疊加以及早期採用的情境廣告技術。該地區的CDN節點提供亞秒Start-Ups時間,推動了4K和杜比視界層級的付費意願。然而,iOS CPI的不斷上漲威脅著小型工作室的盈利,促使支出轉向Android和網路管道。零售媒體網路的興起,例如沃爾瑪整合VIZIO的SmartCast作業系統,顯示擁有豐富資料資源的零售商能夠繞過傳統廣播公司,將不斷成長的聯網電視庫存直接銷售給品牌。

亞太地區是成長最快的地區,複合年成長率高達21%,這得益於5G的大規模普及、價格實惠的安卓電視以及區域語言的整合。印度的Cloud TV-3.0計畫新增了10種方言的語音助手,讓先前只能收看有線電視的觀眾得以解放。中國OEM廠商正在預先安裝自家的電視作業系統,並將其作為商業閘道器,讓設備品牌獲得更高的廣告收入佔有率。韓國透過5G SA試辦8K直播2024年亞運會,為身臨其境型廣播樹立了標竿。這些因素正在加速觀眾從地面電波電視向IP發送服務的遷移。

歐洲機會與限制並存。高可支配收入支持優質套餐的普及。在斯堪地那維亞市場,光纖家庭平均擁有兩款付費電視應用程式和一張雲端遊戲通行證。德國的網路切片試驗已證明,專用頻寬可以保證 AAA 雲端遊戲 20 毫秒的往返時間,但特定國家的分紅規定使泛歐盟部署變得複雜。同時,瑞士電信收購沃達豐義大利等跨國併購交易標誌著將頻寬、光纖骨幹網路和串流版權整合到更少的保護傘下的舉措,可能實現更廣泛的覆蓋協同效應。歐洲的淨零承諾可能會鼓勵廣播公司將播出轉移到更環保的資料中心,並加速向混合雲的遷移。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 光纖家庭的持續推廣實現了可靠的 OTT 傳輸

- 5G固定無線存取在北美和歐洲農村地區快速擴張

- 主要付費電視業者轉向「雲端優先」機上盒

- 亞洲雲端電視解決方案和聯網電視晶片組的 OEM 捆綁產品

- FAST Channel收益模式加速歐洲出版商的採用

- 可降低中型企業 TCO 的多租戶 SaaS 平台

- 市場限制

- 非洲和加勒比海新興島嶼的 CDN 分佈分散

- 持續的盜版和憑證共用影響收益保障

- UHD/HDR 內容的初始編碼/轉碼成本高

- 傳統 CAS/DRM互通性差距阻礙小型 MSO 的遷移

- 監理展望

- 技術展望

- 五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

第5章市場規模及成長預測

- 按部署

- 公共雲端

- 私有雲端

- 混合雲端

- 依設備類型

- 網路電視

- 行動電話

- 機上盒(STB)

- 按用途

- 娛樂和媒體

- 通訊

- 資訊科技

- 消費電視

- 其他用途

- 按公司規模

- 主要企業

- 小型企業

- 按地區

- 北美洲

- 美國

- 加拿大

- 南美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 紐西蘭

- 其他亞太地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- Strategic Developments

- Vendor Positioning Analysis

- 公司簡介

- Brightcove Inc.

- Kaltura Inc.

- Ooyala Inc.

- Amino Technologies PLC

- DaCast LLC

- MatrixStream Technologies Inc.

- PCCW Ltd.

- Liberty Global PLC

- Charter Communications(Spectrum)

- Roku Inc.

- Comcast Technology Solutions

- Amazon Web Services

- Google(YouTube TV)

- Apple Inc.(tvOS Services)

- Netflix Inc.

- MUVI LLC

- UpLynk LLC

- Minoto Video Inc.

- Monetize Media Inc.

- Fordela Corp.

- Wowza Media Systems

- Edgecast(Edgio)

- Tencent Cloud

- Huawei Cloud

- Akamai Technologies

第7章 市場機會與未來展望

The Cloud TV market size is estimated at USD 3.20 billion in 2025 and is forecast to expand to USD 7.47 billion by 2030, reflecting an 18.8% CAGR for 2025-2030.

Surging demand for scalable video workflows, rapid 5G deployment, and telco convergence strategies are propelling adoption. Public cloud deployments still dominate, but hybrid architectures are gaining favour as media companies balance elasticity with broadcast-grade performance. Regulatory fragmentation, semiconductor supply constraints, and rising iOS acquisition costs remain growth headwinds. Intensifying competition between platform operators, device OEMs, and telcos is pushing vendors to differentiate through AI-driven discovery, contextual advertising, and integrated cloud gaming services. Early movers in Asia-Pacific are capturing asymmetric advantages thanks to faster network roll-outs and mass smartphone uptake.

Global Cloud TV Market Trends and Insights

Continued Fiber-to-Home Roll-outs Enabling Stable OTT Delivery

FTTH penetration has surpassed 50% in most developed markets, creating the bandwidth reliability the Cloud TV market needs for unbuffered 4K and 8K streams. Carriers such as AT&T are allocating USD 15 billion through 2025 to extend fiber to 30 million premises, which lowers reliance on costly edge caches and fosters premium live sports streaming. Operators further monetize fiber by bundling unlimited data tiers that remove bitrate ceilings and by leveraging deterministic QoS to support interactive features.

Rapid Expansion of 5G Fixed Wireless Access in Rural North America and Europe

5G FWA provides 100-200 Mbps downlinks at sub-10 millisecond latencies, turning previously underserved rural zones into viable Cloud TV market addresses. Operators, including T-Mobile and Verizon, aim to sign 4-5 million FWA subscribers by 2025, accelerating service reach without multi-year trenching costs. Bundled broadband-plus-TV plans and portable cloud-TV use cases for RV owners further inflate rural demand.

Fragmented CDN Footprint in Emerging Africa and Caribbean Islands

Average in-country latency hits 78 milliseconds across much of Africa versus sub-45 milliseconds in North America, limiting consistent 1080p streaming. Roughly 50% of the region's internet traffic transits foreign upstream providers; outages on West African submarine cables in 2024 crippled 13 nations, highlighting fragility. Without local PoPs, Cloud TV service providers must downshift bitrates, impairing the quality of experience and ad yields.

Other drivers and restraints analyzed in the detailed report include:

- Tier-1 Pay-TV Operators' Shift to Cloud-First STB Replacement

- OEM Bundling of Cloud-TV Solutions with Connected-TV Chipsets in Asia

- Persistent Piracy and Credential-Sharing Impacting Revenue Assurance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Public cloud held 52% of revenue in 2024, yet hybrid configurations are set to grow at a 21.3% CAGR to 2030 as broadcasters pursue flexible burst capacity alongside predictable QoS. This mix lets rights-holders keep premium sports archives in private clusters while relying on hyperscalers for live-event traffic. The Cloud TV market size for hybrid deployments is projected to accelerate as content owners map workloads to cost curves and exit ageing on-prem encoders. Regulatory-sensitive verticals such as public-sector media have already moved 45% of workflows to hybrid nodes to localise user data. Across use-cases, phased migrations de-risk legacy decommissioning, supporting uninterrupted audience reach during peak seasons.

Hybrid adoption also solves cross-border rights management: operators deploy origin caches in public regions close to diaspora populations while watermarking and DRM logic run in private domains. Vendors have responded with Kubernetes-based transcoders that elastically scale across both footprints. As a result, billing shifts from capex to granular usage, letting mid-tier networks test 4K distribution without buying new ASICs. By 2030, decision frameworks for cloud TV investment will weigh energy efficiency, carbon disclosure, and sovereign-cloud mandates as heavily as bitrate economics.

Connected TVs (CTV) delivered 40% of 2024 revenue, yet smartphones are the fastest-growing end-point with a 23.5% CAGR forecast. Open-RAN 5G plus cheaper OLED panels have blurred the experiential gap so that 4K HDR on a 6.7-inch screen rivals lounge-room sets. Short-form series cut for vertical orientation dominate Gen-Z watchlists, forcing publishers to storyboard concurrently for tall and wide frames. The Cloud TV market share of mobile usage is expected to overtake CTVs in several Southeast Asian countries by 2027, powered by lower data tariffs and instalment-plan handset upgrades.

Multi-device sync is now table-stakes: advertisers use household graph technology to sequence a 15-second teaser on mobile, a 30-second deep-dive on CTV, and a shoppable overlay on tablet within the same evening. Cloud encoder vendors embed SSAI markers that cue dynamic QR codes aligned with active screen size. Such convergence recasts the notion of a primary screen; the winning proposition will offer frictionless hand-off rather than device-specific UX.

Cloud TV Market Report is Segment by Deployment (Public Cloud, Private Cloud, Hybrid Cloud), Device Type (STB, Mobile Phones, Connected TV), Applications (Telecom, Entertainment and Media, and More), Organization Size (Small and Medium Enterprises, Large Enterprises), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 43% of 2024 revenue owing to mature broadband penetration, high SVOD stacking, and early adoption of contextual ad tech. Regional CDN nodes deliver sub-second start-up times, reinforcing willingness to pay for 4K and Dolby Vision tiers. Yet elevated iOS CPI threatens smaller studios' profitability, nudging spend toward Android and web channels. The emergence of retail media networks, exemplified by Walmart's integration of VIZIO's SmartCast OS, demonstrates how data-rich retailers can bypass traditional broadcasters and sell incremental connected-TV inventory directly to brands .

Asia-Pacific is the fastest-growing region at a 21% CAGR, propelled by mass 5G roll-out, affordable Android TVs, and regional language curation. India's Cloud TV 3.0 initiative adds voice assistants in 10 dialects, unlocking audiences previously tied to cable. Chinese OEMs preload proprietary TV operating systems that double as commerce gateways, giving device brands a bigger revenue share from advertising. South Korea piloted 8K livestreams of the 2024 Asian Games over 5G SA, setting a benchmark for immersive broadcasting. Collectively, these factors speed viewer migration from terrestrial TV to IP-delivered services.

Europe presents a patchwork of opportunities and constraints. High disposable income supports premium bundle uptake, as seen in Scandinavian markets where fibre households average two paid TV apps plus one cloud gaming pass. Network-slicing pilots in Germany prove that dedicated bandwidth can guarantee 20 ms round-trip for AAA cloud titles, yet country-specific loot-box rules complicate pan-EU launches. At the same time, cross-border M&A such as Swisscom's acquisition of Vodafone Italia signals a drive to consolidate spectrum, fibre backbones, and streaming rights under fewer umbrellas, promising broader footprint synergies swisscom.com. Europe's net-zero commitments are prompting broadcasters to move playout into greener data centres, potentially accelerating hybrid-cloud migrations.

- Brightcove Inc.

- Kaltura Inc.

- Ooyala Inc.

- Amino Technologies PLC

- DaCast LLC

- MatrixStream Technologies Inc.

- PCCW Ltd.

- Liberty Global PLC

- Charter Communications (Spectrum)

- Roku Inc.

- Comcast Technology Solutions

- Amazon Web Services

- Google (YouTube TV)

- Apple Inc. (tvOS Services)

- Netflix Inc.

- MUVI LLC

- UpLynk LLC

- Minoto Video Inc.

- Monetize Media Inc.

- Fordela Corp.

- Wowza Media Systems

- Edgecast (Edgio)

- Tencent Cloud

- Huawei Cloud

- Akamai Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Continued Fiber-to-Home Roll-outs Enabling Stable OTT Delivery

- 4.2.2 Rapid Expansion of 5G Fixed Wireless Access in Rural North America and Europe

- 4.2.3 Tier-1 Pay-TV Operators' Shift to "Cloud-first" STB Replacement

- 4.2.4 OEM Bundling of Cloud-TV Solutions with Connected-TV Chipsets in Asia

- 4.2.5 FAST Channel Monetisation Models Accelerating Publisher Adoption in Europe

- 4.2.6 Multi-tenant SaaS Platforms Reducing TCO for Mid-tier Operators

- 4.3 Market Restraints

- 4.3.1 Fragmented CDN Footprint in Emerging Africa and Caribbean Islands

- 4.3.2 Persistent Piracy and Credential-Sharing Impacting Revenue Assurance

- 4.3.3 High Initial Encoding/Transcoding Costs for UHD/HDR Content

- 4.3.4 Legacy CAS/DRM Interoperability Gaps Slowing Migration for Small MSOs

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porters Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Intensity of Competitive Rivalry

- 4.6.5 Threat of Substitute Products

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 Public Cloud

- 5.1.2 Private Cloud

- 5.1.3 Hybrid Cloud

- 5.2 By Device Type

- 5.2.1 Connected TV

- 5.2.2 Mobile Phones

- 5.2.3 Set-Top Box (STB)

- 5.3 By Application

- 5.3.1 Entertainment and Media

- 5.3.2 Telecom

- 5.3.3 Information Technology

- 5.3.4 Consumer Television

- 5.3.5 Other Applications

- 5.4 By Organisation Size

- 5.4.1 Large Enterprise

- 5.4.2 Small and Medium Enterprise

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Mexico

- 5.5.2.4 Rest of Latin America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 New Zealand

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.3.1 Brightcove Inc.

- 6.3.2 Kaltura Inc.

- 6.3.3 Ooyala Inc.

- 6.3.4 Amino Technologies PLC

- 6.3.5 DaCast LLC

- 6.3.6 MatrixStream Technologies Inc.

- 6.3.7 PCCW Ltd.

- 6.3.8 Liberty Global PLC

- 6.3.9 Charter Communications (Spectrum)

- 6.3.10 Roku Inc.

- 6.3.11 Comcast Technology Solutions

- 6.3.12 Amazon Web Services

- 6.3.13 Google (YouTube TV)

- 6.3.14 Apple Inc. (tvOS Services)

- 6.3.15 Netflix Inc.

- 6.3.16 MUVI LLC

- 6.3.17 UpLynk LLC

- 6.3.18 Minoto Video Inc.

- 6.3.19 Monetize Media Inc.

- 6.3.20 Fordela Corp.

- 6.3.21 Wowza Media Systems

- 6.3.22 Edgecast (Edgio)

- 6.3.23 Tencent Cloud

- 6.3.24 Huawei Cloud

- 6.3.25 Akamai Technologies

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment