|

市場調查報告書

商品編碼

1850156

人機介面(HMI):市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Human Machine Interface - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

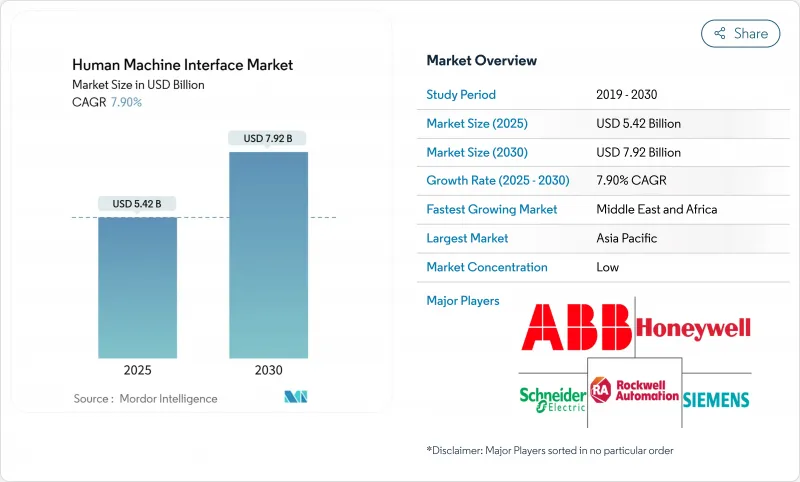

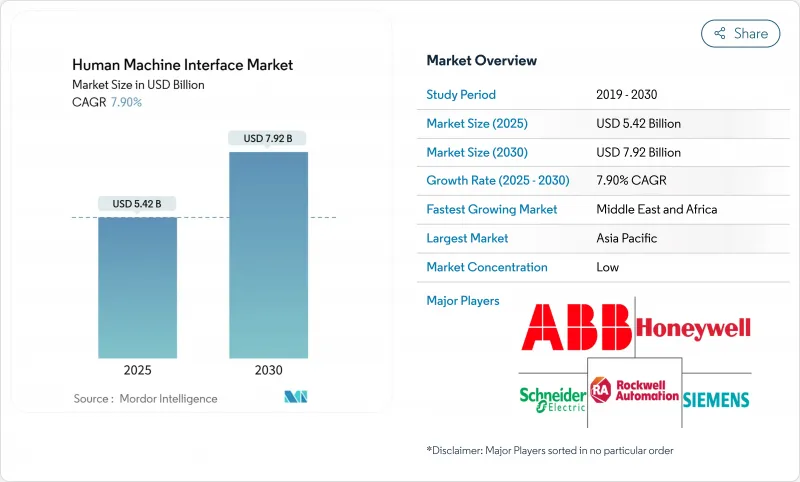

預計到 2025 年,人機介面 (HMI) 市場規模將達到 54.2 億美元,到 2030 年將達到 79.2 億美元,複合年成長率為 7.9%。

強大的工廠數位化專案、日益成長的OT-IT整合以及向人性化的工業5.0生產模式的轉變是推動市場需求的核心因素。隨著製造商優先考慮即時洞察、減少停機時間和提高勞動生產率,對邊緣連接面板、身臨其境型視覺化和安全設計架構的投資也不斷增加。儘管硬體仍然是市場的主要驅動力,專用工業用電腦和麵板的應用,但軟體定義的HMI和低程式碼配置工具正在加速小型工廠的採用。從區域來看,亞太地區的大規模自動化和中東及非洲地區的快速現代化專案是HMI市場的主要受益者,而北美和歐洲則更關注網路安全合規性和進階分析整合。

全球人機介面(HMI)市場趨勢與洞察

加速工業4.0的普及

工業4.0專案將人機介面(HMI)從被動顯示器轉變為數據驅動的指揮中心,將感測器、製造執行系統(MES)和企業資源計畫(ERP)的數據整合到情境感知儀表板中。在許多工廠,操作員現在使用HMI來控制協作機器人、協調批次變更並推出預測性維護工作流程。 MDPI在2025年的一項研究強調了工業5.0對協作機器人的重視,並指出直覺的HMI對於實現無縫的人機協作至關重要。西門子報告稱,其Senseye平台利用人工智慧異常警報功能,避免了酪農工廠代價高昂的停機,這充分證明了互聯HMI的實際投資回報率。

OT-IT網路安全需求的融合

遠端連線和企業雲端鏈路使傳統控制面板面臨現代攻擊面的威脅,促使人們轉向零信任架構。歐盟的NIS2指令要求關鍵基礎設施營運商在所有HMI節點上採用嚴格的身份驗證和基於角色的控制。 Telefonica Tech強調,多因素身份驗證和持續檢驗正迅速成為基準介面功能。供應商目前正在整合安全啟動、簽署韌體和加密通訊協定來滿足這些要求。

持久存在的傳統PLC裝置量

老舊的控制器缺乏最新的通訊協定,造成整合難題。工廠不願輕易更換成熟的設備,而是選擇堆砌通訊協定閘道器,這增加了成本和複雜性。 《食品工程》雜誌指出,專有匯流排與現代 OPC UA 和 MQTT 框架存在衝突,導致版本控制方面的難題。

細分市場分析

到2024年,硬體將佔人機介面(HMI)市場的57%,因為加固型面板、工業用電腦和邊緣閘道器仍然是關鍵任務型設備。德克薩斯(TI)認為,嵌入式人工智慧(AI)將成為平衡確定性控制和預測分析的關鍵技術。服務領域以11.4%的複合年成長率成長,反映出市場對整合、網路安全增強和持續培訓的需求不斷成長。 Control Global認為,供應商正在從一次性計劃轉向採用訂閱模式的全生命週期夥伴關係,以實現介面最佳化。

硬體發展趨勢有利於模組化電路板和符合 Class I, Division 2 區域認證的高亮度顯示器。供應商正在整合熱插拔 SSD 插槽和可現場升級的 CPU,以延長產品壽命。同時,託管服務團隊正在進行遠端使用者體驗審核、修復關鍵漏洞,並對操作人員進行再培訓,以充分利用新功能。預計到 2030 年,這種發展趨勢將推動業務收益佔人機介面 (HMI) 市場總收入的近三分之一。

到2024年,觸控螢幕仍將佔據71%的人機介面(HMI)市場佔有率,因為其相容手套操作的電容層和化學強化玻璃能夠滿足嚴苛的工廠環境需求。多點觸控手勢可以加快導航速度並降低錯誤率,尤其是在批次切換過程中。然而,擴增實境/虛擬實境(AR/VR)介面成長最快,複合年成長率(CAGR)高達18.7%,並且正在重塑操作員互動模式。 MDPI一項關於基於XR的機器人程式設計的研究表明,與傳統的手持式程式設計方法相比,XR程式設計可以加快試運行並減少停機時間。

支援擴增實境(AR)功能的頭戴式設備可提供空間疊加功能,使工程師能夠可視化隱藏的管道、扭矩目標和即時分析。汽車原始設備製造商(OEM)正在進行身臨其境型設計評審,取代了傳統的油泥模型,並縮短了概念設計週期。遊戲引擎與工業數據的這種交叉融合正在為空間計算控制室鋪平道路,預計到2030年,這將提升人機互動(HMI)的市場佔有率。

人機介面 (HMI) 市場按產品類型(硬體、軟體等)、介面技術(觸控螢幕、按鈕/小鍵盤等)、配置(嵌入式 HMI、獨立式 HMI 等)、終端用戶產業(汽車、食品飲料等)和地區進行細分。市場預測以美元計價。

區域分析

預計到2024年,亞太地區將以38%的市佔率引領人機介面(HMI)市場。隨著智慧工廠的擴張,中國的HMI裝置量預計將超過1,825萬台,累計92.8億元人民幣(約13.9億美元)的收入。日本和韓國正持續推動下一代OLED面板的商業化,而印度的生產連結獎勵計畫正在推動製藥和消費品產業的自動化發展。Delta電子等區域供應商正在擴大在地化生產,讓更多消費者能夠獲得具有成本競爭力的面板。

中東和非洲地區以9.8%的複合年成長率呈現最高成長。沙烏地阿拉伯的「2030願景」計畫和阿拉伯聯合大公國的「3000億行動」計畫正在投資建造石化、物流和可再生能源領域的數位化工廠。未來非洲製造大會重點關注如何提升勞動力技能,使其能夠勝任人工智慧驅動的品管和自動化工作,這預示著一系列重大計劃將持續推進。

北美受惠於企業回流獎勵和成熟的工業軟體生態系統。例如,Inductive Automation 的 Ignition 等平台採用無限授權模式,降低了多站點部署的整體擁有成本。網路安全法規(例如 CISA 指南)正在推動安全啟動人機介面 (HMI) 的普及,進一步鞏固了國防和關鍵基礎設施垂直行業的需求。

歐洲在人機介面 (HMI) 市場佔據重要佔有率,這得益於嚴格的法規和永續性的領先地位。符合 NIS2 標準和環境設計要求,使得節能型 IEC 62443 認證面板更受青睞。西門子在歐洲投資 20 億美元擴建其數位化中心,彰顯了引領歐洲以人性化、低碳產業發展的決心。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 加速採用工業4.0

- OT-IT網路安全需求的融合

- 用於預測使用者體驗的邊緣人工智慧

- 擴充的低程式碼/無程式碼 HMI 設定工具

- 工業顯示器能源效率法規

- 相容於 5G 的超低延遲遠端人機介面

- 市場限制

- 持久存在的傳統PLC裝置量

- 特種半導體供應鏈的不穩定性

- 各地區使用者體驗標準分散

- OT勒索軟體造成的損失飆升

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 報價

- 硬體

- 人機介面面板

- 工業用電腦

- 軟體

- 配置/程式設計

- 服務

- 硬體

- 介面技術

- 觸控螢幕

- 按鈕/小鍵盤

- 基於手勢

- 語音控制

- AR/VR支持

- 按最終用戶行業分類

- 車

- 食品/飲料

- 包裹

- 製藥

- 石油和天然氣

- 金屬和採礦

- 能源與公共產業

- 航太與國防

- 半導體和電子學

- 其他最終用戶

- 成分

- 嵌入式人機介面

- 獨立式人機介面

- 分散式/遠端人機介面

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ABB Ltd

- Honeywell International Inc.

- Rockwell Automation, Inc.

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Emerson Electric Co.

- GE Vernova(Industrial Automation)

- Texas Instruments Inc.

- Yokogawa Electric Corporation

- Siemens AG

- Robert Bosch GmbH

- Eaton Corporation plc

- Advantech Co., Ltd.

- Delta Electronics, Inc.

- Beijer Electronics Group

- Omron Corporation

- Parker Hannifin Corporation

- Phoenix Contact GmbH

- Red Lion Controls(Spectris)

- Moxa Inc.

第7章 市場機會與未來展望

The HMI market size is estimated at USD 5.42 billion in 2025 and is forecast to reach USD 7.92 billion by 2030, reflecting a 7.9% CAGR.

Strong factory digitalization programs, expanding OT-IT integration, and the shift toward human-centric Industry 5.0 production models are the core demand catalysts. Investments in edge-connected panels, immersive visualization, and secure-by-design architectures continue to rise as manufacturers prioritize real-time insight, lower downtime, and workforce productivity. Hardware retains a clear lead thanks to purpose-built industrial PCs and panels, yet software-defined HMIs and low-code configuration tools are accelerating adoption among smaller plants. Regionally, the HMI market benefits most from large-scale automation in Asia-Pacific and rapid modernization programs in the Middle East & Africa, while North America and Europe focus on cybersecurity compliance and advanced analytics integration.

Global Human Machine Interface Market Trends and Insights

Accelerated Industry 4.0 adoption

Industry 4.0 programs transform HMIs from passive displays into data-driven command hubs that aggregate sensor, MES, and ERP feeds into context-aware dashboards. In many plants, operators now use HMIs to orchestrate co-bots, coordinate batch changes, and launch predictive maintenance workflows. A 2025 MDPI study highlights Industry 5.0's emphasis on collaborative robots, noting that intuitive HMIs are essential for seamless human-machine teamwork. Siemens reported its Senseye platform prevented costly downtime at a dairy facility through AI-enabled anomaly alerts, demonstrating tangible ROI for connected HMIs.

Convergence of OT-IT cybersecurity requirements

Remote connectivity and enterprise cloud links expose legacy panels to modern attack surfaces, prompting a move toward Zero Trust Architecture. The European Union's NIS2 directive compels critical-infrastructure operators to adopt strict authentication and role-based controls on every HMI node. Telefonica Tech underscores that multi-factor authentication and continuous verification are quickly becoming baseline interface functions. Vendors now embed secure boot, signed firmware, and encrypted protocols to satisfy these mandates.

Persistent legacy PLC installed base

Older controllers lack modern protocols, creating integration hurdles. Plants hesitate to rip and replace mature assets, instead layering protocol gateways that add cost and complexity. Food Engineering notes version-control headaches when proprietary buses clash with modern OPC UA or MQTT frameworks.

Other drivers and restraints analyzed in the detailed report include:

- Edge-AI enabling predictive UX

- Low-code/no-code HMI configuration tools

- Energy-efficient industrial displays

- 5G-enabled ultra-low-latency remote HMI

- Supply-chain volatility for specialty semiconductors

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware generated 57% of the HMI market in 2024 as rugged panels, industrial PCs, and edge gateways remain mission critical. Texas Instruments confirms a pivot toward embedded AI to balance deterministic control with predictive analytics. The services segment, advancing at 11.4% CAGR, reflects mounting demand for integration, cybersecurity hardening, and continuous training. Control Global observes suppliers shifting from one-off projects to lifecycle partnerships with subscription models for interface optimization.

Hardware evolution now favours modular boards, and high brightness displays certified for Class I, Division 2 zones. Vendors integrate hot-swap SSD bays and field-upgradeable CPUs to extend lifespan. Meanwhile, managed services teams conduct remote UX audits, patch critical vulnerabilities, and retrain operators to exploit new features, a dynamic expected to lift service revenues to nearly one third of overall HMI market size by 2030.

Touchscreens retained 71% of the HMI market in 2024 because glove-friendly capacitive layers and chemically strengthened glass satisfy harsh-plant demands. Multi-touch gestures shorten navigation time and cut error rates, especially in batch changeovers. Yet AR/VR interfaces are scaling fastest at 18.7% CAGR, reshaping operator interaction paradigms. An MDPI study on XR-based robot programming reported faster commissioning and lower downtime than traditional pendant methods.

AR-equipped headsets provide spatial overlays, letting technicians visualize hidden piping, torque targets, or live analytics. Automotive OEMs run immersive design reviews that replace clay modelling and shorten concept loops. This cross-pollination of gaming engines and industrial data paves the way for spatial computing control rooms, potentially capturing an expanded share of HMI market size through 2030.

Human Machine Interface Market is Segmented by Offering (Hardware, Software and More), Interface Technology (Touchscreen, Push-Button / Keypad and More), Configuration (Embedded HMI, Stand-Alone HMI and More), End-User Industry (Automotive, Food & Beverage and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led the HMI market with 38% share in 2024. Chinese installations surpassed 18.25 million units, generating revenue of CNY 9.28 billion (USD 1.39 billion) amid a climb in smart-factory rollouts. Japan and South Korea continue to commercialize next-gen OLED panels, while India's production-linked incentives propel automation uptake in pharmaceuticals and consumer durables. Regional suppliers such as Delta Electronics are scaling local manufacturing, widening access to cost-competitive panels.

The Middle East and Africa registers the highest growth at 9.8% CAGR. Vision 2030 initiatives in Saudi Arabia and the UAE's Operation 300bn plan are investing in digital plants for petrochemicals, logistics, and renewables. The Future Manufacturing Africa Conference spotlights AI-driven quality control and workforce upskilling for automation, signalling sustained large-project pipelines.

North America benefits from reshoring incentives and an established industrial-software ecosystem. Platforms like Ignition by Inductive Automation employ unlimited licensing to cut total cost of ownership for multi-site rollouts. Cybersecurity regulations such as CISA guidelines fuel adoption of secure-boot HMIs, further solidifying market demand across defence and critical-infrastructure verticals.

Europe maintains a sizeable slice of the HMI market on the back of regulatory rigor and sustainability leadership. Compliance with NIS2 and eco-design mandates drives preference for energy-efficient, IEC 62443-certified panels. Siemens' USD 2 billion European investment into digital-center expansions underscores the continent's determination to lead in human-centric, low-carbon industry.

- ABB Ltd

- Honeywell International Inc.

- Rockwell Automation, Inc.

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Emerson Electric Co.

- GE Vernova (Industrial Automation)

- Texas Instruments Inc.

- Yokogawa Electric Corporation

- Siemens AG

- Robert Bosch GmbH

- Eaton Corporation plc

- Advantech Co., Ltd.

- Delta Electronics, Inc.

- Beijer Electronics Group

- Omron Corporation

- Parker Hannifin Corporation

- Phoenix Contact GmbH

- Red Lion Controls (Spectris)

- Moxa Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Industry 4.0 adoption

- 4.2.2 Convergence of OT-IT cybersecurity requirements

- 4.2.3 Edge-AI enabling predictive UX

- 4.2.4 Expansion of low-code/no-code HMI configuration tools

- 4.2.5 Energy-efficiency mandates for industrial displays

- 4.2.6 5G-enabled ultra-low-latency remote HMI

- 4.3 Market Restraints

- 4.3.1 Persistent legacy PLC installed base

- 4.3.2 Supply-chain volatility for specialty semiconductors

- 4.3.3 Fragmented UX standards across regions

- 4.3.4 Escalating OT-focused ransomware costs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering

- 5.1.1 Hardware

- 5.1.1.1 HMI Panels

- 5.1.1.2 Industrial PCs

- 5.1.2 Software

- 5.1.2.1 Configuration / Programming

- 5.1.3 Services

- 5.1.1 Hardware

- 5.2 By Interface Technology

- 5.2.1 Touchscreen

- 5.2.2 Push-button / Keypad

- 5.2.3 Gesture-based

- 5.2.4 Voice-controlled

- 5.2.5 AR / VR-assisted

- 5.3 By End-User Industry

- 5.3.1 Automotive

- 5.3.2 Food and Beverage

- 5.3.3 Packaging

- 5.3.4 Pharmaceutical

- 5.3.5 Oil and Gas

- 5.3.6 Metal and Mining

- 5.3.7 Energy and Utilities

- 5.3.8 Aerospace and Defense

- 5.3.9 Semiconductors and Electronics

- 5.3.10 Other End Users

- 5.4 By Configuration

- 5.4.1 Embedded HMI

- 5.4.2 Stand-alone HMI

- 5.4.3 Distributed / Remote HMI

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Russia

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Saudi Arabia

- 5.5.4.2 United Arab Emirates

- 5.5.4.3 Turkey

- 5.5.4.4 South Africa

- 5.5.4.5 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd

- 6.4.2 Honeywell International Inc.

- 6.4.3 Rockwell Automation, Inc.

- 6.4.4 Mitsubishi Electric Corporation

- 6.4.5 Schneider Electric SE

- 6.4.6 Emerson Electric Co.

- 6.4.7 GE Vernova (Industrial Automation)

- 6.4.8 Texas Instruments Inc.

- 6.4.9 Yokogawa Electric Corporation

- 6.4.10 Siemens AG

- 6.4.11 Robert Bosch GmbH

- 6.4.12 Eaton Corporation plc

- 6.4.13 Advantech Co., Ltd.

- 6.4.14 Delta Electronics, Inc.

- 6.4.15 Beijer Electronics Group

- 6.4.16 Omron Corporation

- 6.4.17 Parker Hannifin Corporation

- 6.4.18 Phoenix Contact GmbH

- 6.4.19 Red Lion Controls (Spectris)

- 6.4.20 Moxa Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment