|

市場調查報告書

商品編碼

1850129

ADAS(高級駕駛輔助系統):市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Advanced Driver Assistance Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

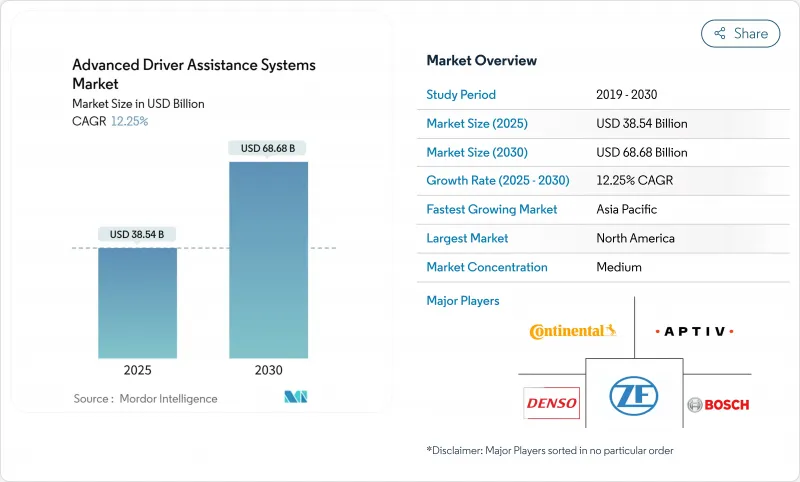

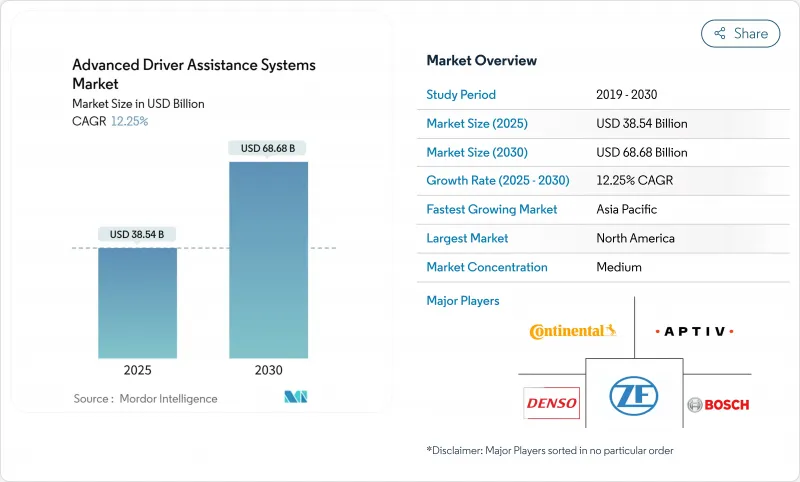

全球高級駕駛輔助系統 (ADAS) 市場預計到 2025 年收入將達到 385.4 億美元,到 2030 年將達到 686.8 億美元,複合年成長率為 12.25%。

美國、歐盟和中國強而有力的監管政策、雷達、攝影機和LiDAR感測器成本的快速下降,以及汽車產業向軟體定義車輛(SDV)平台的轉型,都是推動這一成長的關鍵因素。汽車製造商正在將L2+功能整合到中階車型中,而空中下載(OTA)升級途徑則帶來了持續的軟體收入。同時,亞洲半導體產能的提升與新型4奈米汽車系統晶片的出現,提高了感測器融合的精度,並推動ADAS市場向量產車型邁進。競爭格局正向垂直平台模式轉變,一級供應商、雲端超大規模資料中心業者和無晶圓廠晶片設計商攜手合作,共同掌控感知堆疊、訓練資料和可獲利的軟體服務。

全球高階駕駛輔助系統 (ADAS) 市場趨勢與洞察

嚴格的安全法規支持市場成長

目前,駕駛輔助系統已被法規視為必要的基礎設施。美國國家公路交通安全管理局 (NHTSA) 將要求自 2029 年 9 月起,美國所有新生產的輕型車輛都必須配備自動緊急煞車系統,目標年安裝量約為 1,700 萬輛。歐洲的《通用安全法規 II》(GSRR II) 也強制要求自 2024 年 7 月起,所有新車都必須配備智慧速度援助、車道維持援助和緊急煞車系統,這將迫使汽車製造商重新設計其電氣架構,以實現 ADAS 功能的標準化。中國已將 ADAS 性能納入新車評估體系,將五星安全評級與感測器配置和演算法精度掛鉤。這些法規將消除消費者的隨意購買決策,並將 ADAS 市場轉變為以合主導性和銷售量為導向的市場,加速各個價格分佈的安裝速度。

基於人工智慧的感應器融合解鎖功能商品搭售

片上神經網路技術的進步使得低成本處理器也能實現高階感知功能。 Mobileye 的 EyeQ6 Lite 將八個攝影機資料流和 4D 雷達輸入整合到單一 5 瓦設備中,從而降低了 L2+ 高速公路自動駕駛套件的物料成本。博世整合了微軟的生成式人工智慧服務,實現了預測性路徑規劃,能夠預判駕駛員意圖和橫向交通操作。這些發展使得原始設備製造商 (OEM) 可以將主動式車距維持定速系統、車道居中保持和交通標誌識別功能打包到單一訂閱服務中,從而減少每個功能的硬體冗餘,並提高軟體利潤率。

高昂的感測器套件成本仍然是一大障礙。

即使價格大幅下降,一套完整的L2+感測器套件也將使B級掀背車的製造成本增加2000至4000美元。保險業數據顯示,輕微碰撞後更換雷達的費用超過每輛車900美元,而攝影機重新校準的平均費用為450美元。這些成本抑制了高階價格分佈以外的消費者購買意願,並削弱了維修基礎設施有限的新興經濟體的售後市場需求。

細分市場分析

高級駕駛輔助系統 (ADAS) 系統級解決方案的市場規模主要由主動式車距維持定速系統驅動,預計到 2024 年,自適應巡航控制將貢獻 22.41% 的收入,這得益於其與現有電子煞車模組的兼容性以及消費者在遠距旅行中的廣泛接受度。自動緊急煞車系統 (AEB) 的複合年成長率 (CAGR) 為 16.21%,這主要受法規要求所有新車配備前向碰撞緩解系統的推動。供應商目前正將行人偵測和騎乘者偵測功能整合到同一控制單元中,從而在各個細分市場實現規模經濟。預計到 2030 年,原始設備製造商 (OEM) 將把城市緊急煞車系統擴展到摩托車和輕型商用車,從而擴大安全覆蓋範圍並增加安裝數量。

從歷史資料來看,該細分市場2020年至2024年的複合成長率為8.5%,但美國國家公路交通安全管理局(NHTSA)和歐盟的強制規定將使這項成長率在預測期內翻倍。入門級預警功能,例如車道偏離預警和前碰撞警報,在低價位車型中得以保留,而高級配置包則整合了360度全景鏡頭、高清地圖和人工智慧輔助的十字路口轉彎預測制動系統。這種漸進式升級路徑能夠帶來持續的空中下載收入,並增強擁有感知技術堆疊的一級供應商的平台用戶黏性。

雷達46.07%的市佔率凸顯了其在雨、霧、雪等惡劣天氣條件下的出色表現,鞏固了其作為自動緊急煞車主要觸發因素的地位。 ADAS市場正受惠於77GHz前角雷達模組的普及,這些模組目前採用28nm射頻CMOS製程生產。配備10nm以下影像訊號處理器的攝影機感測器也緊跟其後,以經濟高效的方式支援深度學習感知架構。

雷射雷達的市場佔有率雖然仍然較小,但成長迅速,預計複合年成長率將達到21.35%。固態、無移動部件架構和晶圓級光學技術已將變動成本降至350美元,使中型SUV成為下一個目標市場。為了在ADAS(高級駕駛輔助系統)市場佔據更大的佔有率,LiDAR供應商正與OEM(原始設備製造商)設計工作室合作,將感測器嵌入頭燈叢集,從而避免在車頂安裝影響美觀的燈罩。超音波和紅外線在泊車和夜視領域仍然佔據著一定的市場佔有率。集中融合訊號處理技術正在興起,它減少了佈線,並支援基於空中下載(OTA)的演算法改進,從而延長硬體週期。

區域分析

美國正透過降低第三人意外責任險和提高NCAP碰撞測試評分來增加對ADAS(高級駕駛輔助系統)普及的獎勵,而加拿大則正使其汽車安全法規與美國標準接軌,以確保跨境車型的一致性。領先的供應商正在亞利桑那州、密西根州和安大略省開展檢驗車隊,以收集極端情況下的數據,從而改進針對雪地和眩光等惡劣天氣條件的感測器融合演算法。

亞太地區是成長最快的地區,到2030年複合年成長率將達到14.55%,這主要得益於中國雄心勃勃的「智慧汽車」藍圖。該路線圖在2023年第三季發放了超過30萬張L2+級智慧汽車牌照。北京方面關於群眾外包高清地圖的指導方針將促進資料網路效應,使比亞迪和小鵬等國內汽車製造商受益。針對印度半導體工廠和電子元件的生產獎勵將鼓勵本地ADAS ECU(高級駕駛輔助系統ECU)的生產,從而降低材料成本並加快其在小型掀背車的應用。

歐洲在通用安全法規II的指導下持續保持穩定成長,該法規要求汽車製造商在所有新車中整合九項安全功能。德國聯邦參議院核准了限速60公里/小時的高速公路脫手駕駛,加速了L3級自動駕駛的推出。法國和西班牙優先為重型卡車車隊的維修提供津貼,以滿足「零願景」事故目標。在南美洲,巴西強制所有新車配備電子穩定控制系統,並計畫在2027年(可能提前至2030年)開始評估車道偏離預警系統。智利和哥倫比亞正在推出與安裝自動緊急煞車系統相關的道路稅減免政策,並鼓勵進口商在入門級車型上標配雷達。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 美國、歐盟和中國都有嚴格的安全法規。

- 基於人工智慧的感測器融合實現了L2+功能的整合。

- SDV/OTA架構釋出售後收入潛力

- 快速降低感測器成本並實現模組化整合

- SUV和豪華車在新興市場的滲透率不斷提高

- 基於使用量的保險折扣加快了原廠配件的適配速度

- 市場限制

- LiDAR/雷達系統高成本

- 惡劣天氣或光線造成的功能限制

- 網路安全責任與資料隱私風險

- 毫米波晶片組和基板供應瓶頸

- 價值鏈/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依系統類型

- 停車輔助系統

- 主動式轉向頭燈

- 夜視系統

- 盲點偵測

- 自動緊急制動

- 前方碰撞警報

- 駕駛員疲勞警告

- 交通標誌識別

- 車道偏離警示

- 主動車距控制巡航系統

- 依感測器類型

- 雷達

- LiDAR

- 相機

- 超音波

- 紅外線的

- 按車輛類型

- 摩托車

- 搭乘用車

- 中型和重型商用車輛

- 依自主程度

- L1

- L2

- L3

- L4

- L5

- 按銷售管道

- 原廠適配

- 售後改裝

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 印尼

- 亞太其他地區

- 中東和非洲

- 土耳其

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 市佔率分析

- 公司簡介

- Continental AG

- Robert Bosch GmbH

- DENSO Corporation

- Aptiv PLC

- ZF Friedrichshafen AG

- Magna International

- Valeo SA

- Hyundai Mobis

- Aisin Corporation

- Mobileye(Intel)

- NVIDIA Corporation

- NXP Semiconductors

- Infineon Technologies

- Renesas Electronics

- ON Semiconductor

- STMicroelectronics

- Hitachi Astemo

- Autoliv Inc.

第7章 市場機會與未來展望

The global ADAS market posted USD 38.54 billion in revenue in 2025 and is on course to reach USD 68.68 billion by 2030, expanding at a 12.25% CAGR.

Robust regulatory mandates in the United States, the European Union, and China, rapid cost deflation in radar, camera, and LiDAR sensors, and the auto sector's migration to software-defined vehicle (SDV) platforms are the prime forces sustaining this growth. Automakers are bundling Level 2+ features on mid-segment vehicles while over-the-air (OTA) upgrade pathways increasingly generate recurring software revenue. Simultaneously, the expansion of semiconductor capacity in Asia and new 4-nanometer automotive system-on-chips enable higher sensor fusion accuracy, pushing the ADAS market deeper into mass-volume models. Competitive dynamics are shifting toward vertical platform plays in which Tier-1 suppliers, cloud hyperscalers, and fabless chip designers collaborate to control perception stacks, training data, and monetisable software services.

Global Advanced Driver Assistance Systems Market Trends and Insights

Stringent Safety Mandates Anchor Market Growth

Regulations now treat driver-assistance as mandatory infrastructure. The NHTSA requires automatic emergency braking on all new US light vehicles from September 2029, setting a baseline of roughly 17 million units per year. Europe's General Safety Regulation II has required intelligent speed assistance, lane-keeping assistance, and emergency braking on every new model since July 2024, forcing OEMs to redesign electrical architectures for standardised ADAS functions. China integrated ADAS performance into its New Car Assessment Programme, linking five-star safety scores to sensor configuration and algorithm accuracy. These rules remove discretionary purchasing decisions and transform the ADAS market into a compliance-driven volume business, accelerating fitment rates across all price points.

AI-Based Sensor Fusion Unlocks Feature Bundling

Advances in on-chip neural networks now permit high-level perception on inexpensive processors. Mobileye's EyeQ6 Lite combines eight camera streams and 4-D radar inputs on a single 5-Watt device, lowering bill-of-materials costs for L2+ highway pilot packages. Bosch's integration of Microsoft's generative AI services enables predictive path planning that anticipates driver intent and cross-traffic manoeuvres. These developments allow OEMs to package adaptive cruise control, lane centering, and traffic sign recognition under one subscription, reducing per-feature hardware redundancy and increasing software margins.

High Sensor Suite Cost Remains a Barrier

Even with steep price declines, a complete L2+ sensor pack adds USD 2,000-4,000 to build cost for a B-segment hatchback. Insurance-sector data show radar replacement after minor collisions exceeding USD 900 per unit, while camera recalibration averages USD 450. These costs dampen consumer uptake outside premium tiers and slow retrofit demand in developing economies lacking repair infrastructure.

Other drivers and restraints analyzed in the detailed report include:

- SDV Architectures Redefine Revenue Models

- Sensor Cost Deflation Broadens Mass-Market Access

- Weather Vulnerabilities Challenge Reliability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The ADAS market size for system-level solutions remains anchored by adaptive cruise control, which generated 22.41% of 2024 revenue thanks to its compatibility with existing electronic braking modules and consumer acceptance during long-distance travel. Automatic emergency braking is accelerating at a 16.21% CAGR, propelled by regulations that demand forward collision mitigation on all new vehicles. Suppliers now integrate pedestrian and cyclist detection in the same control unit, creating cross-segment economies of scale. Over the period to 2030, OEMs are expected to extend urban emergency braking to two-wheelers and light commercial vans, broadening safety coverage and raising fitment volumes.

Historical data underline the regulatory inflection, between 2020-2024 the sub-segment posted 8.5% compound growth, but the NHTSA and EU mandates double that pace in the forecast window. Entry-level warning functions such as lane departure and forward collision alerts persist for low-cost trims, whereas advanced premium packages integrate 360-degree cameras, HD maps and AI-enabled predictive braking during intersection turns. This layered upgrade pathway encourages recurring OTA revenues and deepens platform stickiness for Tier-1 suppliers that own the perception stack.

Radar's 46.07% share underscores its robustness in rain, fog, and snow, attributes that secure its position as the primary trigger for automatic emergency braking. The ADAS market benefits from the commoditisation of 77 GHz front-corner radar modules now produced in 28-nanometer RF CMOS. Camera sensors, powered by sub-10 nm image-signal processors, are followed closely by enabling deep-learning perception architectures cost-effectively.

LiDAR, though still accounts for minimal market share, is the flash-growth element with a projected 21.35% CAGR. Solid-state, no-moving-parts architecture plus wafer-level optics lower variable cost to USD 350, making mid-segment SUVs the next target. For ADAS market share gains, LiDAR suppliers partner with OEM design studios to embed sensors into headlamp clusters, avoiding rooftop domes that hinder aesthetics. Ultrasonic and infrared retain niche duties for parking and night vision. A cross-trend of centrally fused signal processing is emerging, reducing wiring mass and enabling OTA-based algorithm improvements that prolong hardware cycles.

The Advanced Driver Assistance Systems Market Report is Segmented by System Type (Parking Assist Systems, Adaptive Front-Lighting, and More), Sensor Type (Radar, Lidar, and More), Vehicle Type (Two-Wheeler, and More), Level of Anatomy (L1, L2, and More), Sales Channel (OEM-Fitted and Aftermarket Retrofit), and Geography (North America and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

North America generated 34.33% of global revenue in 2024 as federal mandates, insurance incentives, and high SUV penetration created a receptive base for Level 2+ bundles. The United States incentivises ADAS deployment further through reduced liability premiums and positive NCAP scoring, while Canada aligns its Motor Vehicle Safety Regulations to US norms, ensuring cross-border model harmonisation. Major suppliers run validation fleets across Arizona, Michigan, and Ontario, collecting edge-case data that refines sensor-fusion algorithms for snow and glare conditions.

Asia-Pacific is the fastest-growing region at a 14.55% CAGR to 2030, propelled by China's aggressive "smart-vehicle" roadmap that awarded more than 300,000 L2+ licences in Q3 2023. Beijing's guidelines on HD map crowdsourcing encourage data-network effects that benefit domestic OEMs such as BYD and Xpeng. India's Production-Linked Incentive for semiconductor fabs and electronic components incentivises local ADAS ECU manufacturing, cutting bill-of-materials costs and quickening fitment among compact hatchbacks.

Europe continues at a steady growth rate under General Safety Regulation II, which obliges automakers to integrate nine safety functions on every new model. Germany's Bundesrat approved limited hands-off motorway driving at speeds up to 60 km/h, accelerating Level 3 debut timelines. France and Spain prioritise retrofit subsidies for heavy-duty truck fleets to meet Vision Zero accident targets. South America shows potential through 2030 as Brazil mandates electronic stability control on all new cars and evaluates lane departure alerts for 2027. Chile and Colombia roll out vehicle tax rebates tied to AEB fitment, spurring importers to specify radar on entry models.

- Continental AG

- Robert Bosch GmbH

- DENSO Corporation

- Aptiv PLC

- ZF Friedrichshafen AG

- Magna International

- Valeo SA

- Hyundai Mobis

- Aisin Corporation

- Mobileye (Intel)

- NVIDIA Corporation

- NXP Semiconductors

- Infineon Technologies

- Renesas Electronics

- ON Semiconductor

- STMicroelectronics

- Hitachi Astemo

- Autoliv Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent safety mandates in United States, European Union, China

- 4.2.2 AI-based sensor fusion enabling L2+ feature bundling

- 4.2.3 SDV/OTA architectures unlocking post-sale revenue

- 4.2.4 Rapid sensor-cost deflation & module integration

- 4.2.5 Growing SUV & premium-car penetration in Emerging Markets

- 4.2.6 Usage-based-insurance discounts accelerating OEM fitment

- 4.3 Market Restraints

- 4.3.1 High LiDAR/Radar system cost

- 4.3.2 Functional limitations in poor weather & lighting

- 4.3.3 Cyber-security liability & data-privacy risk

- 4.3.4 mmWave chipset & substrate supply bottlenecks

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By System Type

- 5.1.1 Parking Assist Systems

- 5.1.2 Adaptive Front-Lighting

- 5.1.3 Night Vision Systems

- 5.1.4 Blind-Spot Detection

- 5.1.5 Automatic Emergency Braking

- 5.1.6 Forward Collision Warning

- 5.1.7 Driver Drowsiness Alert

- 5.1.8 Traffic Sign Recognition

- 5.1.9 Lane Departure Warning

- 5.1.10 Adaptive Cruise Control

- 5.2 By Sensor Type

- 5.2.1 Radar

- 5.2.2 LiDAR

- 5.2.3 Camera

- 5.2.4 Ultrasonic

- 5.2.5 Infra-red

- 5.3 By Vehicle Type

- 5.3.1 Two-Wheelers

- 5.3.2 Passenger Cars

- 5.3.3 Medium and Heavy Commercial Vehicles

- 5.4 By Level of Autonomy

- 5.4.1 L1

- 5.4.2 L2

- 5.4.3 L3

- 5.4.4 L4

- 5.4.5 L5

- 5.5 By Sales Channel

- 5.5.1 OEM-Fitted

- 5.5.2 Aftermarket Retrofit

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Indonesia

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Turkey

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 South Africa

- 5.6.5.5 Egypt

- 5.6.5.6 Nigeria

- 5.6.5.7 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.3.1 Continental AG

- 6.3.2 Robert Bosch GmbH

- 6.3.3 DENSO Corporation

- 6.3.4 Aptiv PLC

- 6.3.5 ZF Friedrichshafen AG

- 6.3.6 Magna International

- 6.3.7 Valeo SA

- 6.3.8 Hyundai Mobis

- 6.3.9 Aisin Corporation

- 6.3.10 Mobileye (Intel)

- 6.3.11 NVIDIA Corporation

- 6.3.12 NXP Semiconductors

- 6.3.13 Infineon Technologies

- 6.3.14 Renesas Electronics

- 6.3.15 ON Semiconductor

- 6.3.16 STMicroelectronics

- 6.3.17 Hitachi Astemo

- 6.3.18 Autoliv Inc.