|

市場調查報告書

商品編碼

1850127

軟性飲料包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Soft Drinks Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

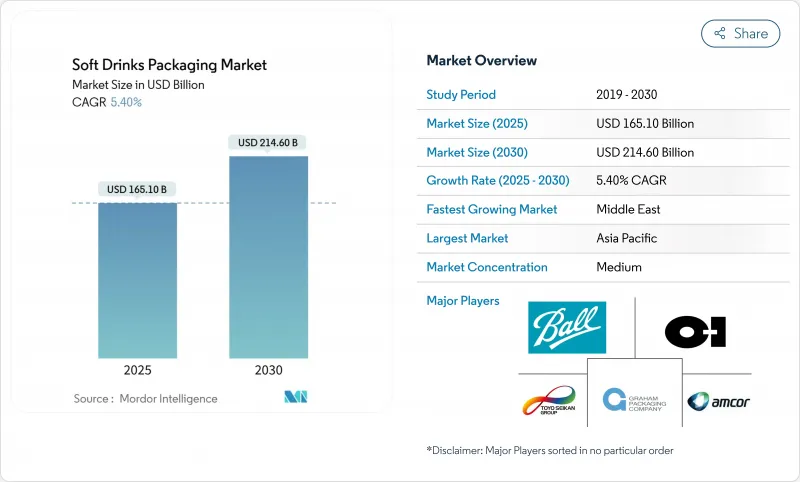

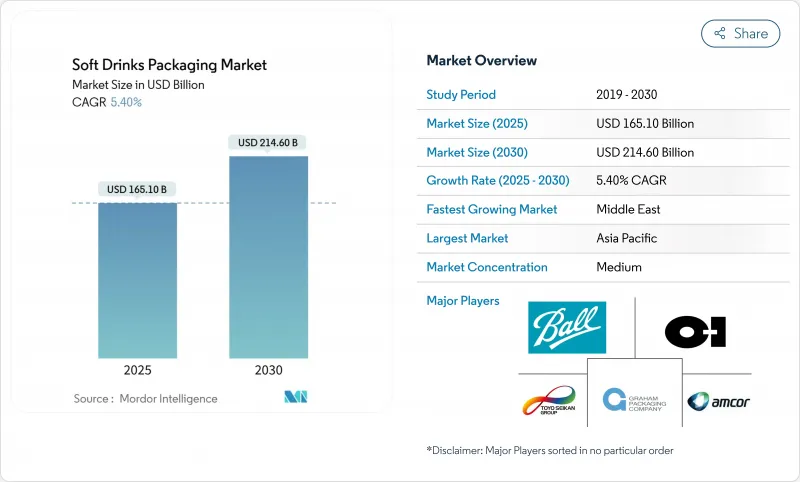

預計到 2025 年,軟性飲料包裝市場規模將達到 1,651 億美元,到 2030 年將達到 2,146 億美元,年複合成長率為 5.4%。

這一成長反映了監管機構對可回收性的日益嚴格要求、品牌加速投資高階和智慧包裝,以及化學回收資產的快速擴張。日益嚴格的法規,例如歐盟強制要求到2030年寶特瓶含有30%的再生材料,正在推動rPET產能的擴張,同時也迫使各種包裝形式進行重新設計。品牌也轉向使用更輕的瓶子和生物基聚合物以減少碳排放,而Z世代對分量控制、視覺獨特的包裝的偏好也強化了這一轉變。同時,像Amkor收購Very Global這樣價值84億美元的併購案凸顯了該產業為實現規模經濟和創新發展而展開的競爭。從區域來看,亞太地區都市化中產階級的需求推動了這一成長,而中東地區由於各國政府鼓勵本地飲料生產,成長速度最快。

全球軟性飲料包裝市場趨勢與洞察

更輕的寶特瓶和rPET整合量的激增

監管目標和成本壓力迫使加工商減少樹脂用量,日本寶特瓶的重量已不足20克,僅為傳統瓶子重量的一半。印度的Ganesha Ecopet公司正在擴大rPET的生產規模,目標是到2026年將產量提升至4.2萬噸,以回收當地25%的瓶子廢棄物。輕量化可降低15-20%的材料成本並減少運輸排放,但需要良好的氧氣和二氧化碳阻隔性,以確保產品在保存期限後仍能保持風味。

尋求高階包裝的“功能性蘇打水”SKU數量成長

預計到2026年,全球機能飲料銷售額將達到1,981億美元,要求包裝能展現產品的健康特性並講述成分故事。 Z世代已推動該品類38%的成長,他們重視透明度,促使百事公司在包裝上融入故事敘述,以證明其20-30%的包裝成本是合理的。金屬罐因其遮光性和優異的氣體阻隔性能而日益受到青睞,無需添加防腐劑即可保護活性成分,保持貨架穩定性,並營造高階形象。

生產者延伸責任制(EPR)費用擠壓利潤空間

美國已有五個州頒布了生產者責任延伸制度(EPR),要求生產商在2031年承擔90%的路邊回收成本。與可回收性設計掛鉤的環境調整費用可能會使包裝成本增加2-3%,從而擠壓飲料行業的利潤空間。同時,在多個州為生產者責任延伸機構(PRO)提供服務會增加行政負擔,並提高違規規處罰的風險。

細分市場分析

到2024年, 寶特瓶和rPET瓶將佔總銷售額的71%,這反映了數十年來成本、透明度和生產線適配性方面的調整。預計到2025年,PET軟性飲料包裝市場規模將達到1,172億美元,隨著食品級rPET供應的改善,市場將維持穩定的中位數個位數成長。 Avantium的PEF和Danimer的PHA產品線將推動生質塑膠達到17.4%的複合年成長率。

品牌目標的變化、淨零排放承諾以及再生材料含量配額的實施,正在加速rPET(再生聚對苯二甲酸乙二醇酯)的普及,即使在價格敏感的市場也是如此。例如,印度已強制規定到2025年,消費後回收材料(PCR)含量必須達到30%。鋁罐的優點在於其無限循環利用,在歐洲的回收率高達76.1%,但價格波動較大,正在擠壓加工商的利潤空間。玻璃在工藝品領域享有盛譽,但在物流存在劣勢。紙板產業正爭相在禁令生效前替換PFAS塗層。

2024年,瓶裝飲料將佔總銷售額的59%,這主要得益於成熟的吹塑成型線、豐富的產品規格以及環繞式標籤的普及。到2030年,瓶裝軟性飲料包裝市場預計將超過1,220億美元,部分原因是阻隔技術創新帶來的輕量化瓶坯的普及。然而,纖細的鋁罐正以8.9%的複合年成長率快速成長,因為Z世代更注重便攜性和適合拍照的外形,而非容量。

零售商正積極採用這種包裝形式,以提高貨架陳列效率,品牌商在相同包裝容量下可獲得高達 20% 的價格上漲。隨著利樂公司轉向使用植物來源高密度聚乙烯(HDPE)瓶蓋,紙盒包裝在冷藏果汁貨架上的佔有率正在不斷成長。儘管面臨環境稅的挑戰,小袋包裝在新興市場仍然佔據重要地位,因為它提供了一個超低成本的切入點。

區域分析

亞太地區43%的銷售佔有率源自中階購買力的快速成長、密集的都市區零售業以及健全的消費後PET回收體系,這些都促進了低成本rPET循環利用。日本的PET回收率高達90%,為國內加工商提供原料;中國則透過補貼化學品回收中心來實現其雄心勃勃的回收率目標。印度的生產者責任延伸(EPR)藍圖正在提振對瓶級rPET的需求,使該地區成為擴大循環經濟規模的先驅。

2030年,中東地區將以7.1%的複合年成長率領跑,沙烏地阿拉伯和阿拉伯聯合大公國正加快建造本地鋁罐軋延線和食品飲料工廠,以應對食品安全挑戰。儘管全球鋁價波動,但年輕消費者越來越青睞高階罐裝能量飲料,從而提振了金屬需求。政府對永續產業叢集的激勵措施將進一步推動波灣合作理事會)罐裝採用rPET瓶坯。

北美正面臨EPR成本上漲和鋁供需緊張的雙重挑戰,但人工智慧主導的設計軟體的領先商業試驗縮短了新產品開發週期,使北美市場受益匪淺。 PPWR回收強制令推動了對單一材料軟性薄膜和先進解聚合的投資。南美洲受益於巴西新建的ALPLA HDPE回收廠以及都市區千禧世代對機能飲料消費量的成長,實現了穩步成長。非洲市場雖然仍處於起步階段,但憑藉著都市區擴張和低溫運輸物流的發展,已實現了兩位數的銷售成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 更輕的寶特瓶和rPET的大量應用

- 「功能性汽水」SKU的成長對高階包裝的需求日益成長

- Z世代消費者要求隨時隨地購買纖細罐裝飲料

- 建造瓶到瓶化學品回收能力

- 人工智慧設計平台縮短了包裝開發前置作業時間

- 碳負排放的PEF和PHA試點計畫達到商業規模

- 市場限制

- 生產者延伸責任制(EPR)費用擠壓利潤空間

- 鋁價波動和供應瓶頸

- PFAS逐步淘汰對阻隔塗層紙板造成衝擊

- 零售商禁止使用一次性再生塑膠

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析(資本投資與曼德勒趨勢)

第5章 市場規模與成長預測

- 材料

- 塑膠(PET、rPET、HDPE、生質塑膠)

- 金屬(鋁、鋼)

- 玻璃

- 紙張和紙板

- 軟性可堆肥薄膜

- 依產品類型

- 瓶子

- 能

- 紙箱和無菌Brick

- 小袋和小袋

- 襯袋紙盒/分裝包

- 按產能

- 少於250毫升

- 251~600ml

- 601ml~1 L

- 1公升或以上的家庭裝

- 按封閉類型

- 螺旋蓋和運動蓋

- 皇冠和拉環

- 卡扣式/壓入式

- 智慧/互聯門鎖

- 軟性飲料類別

- 碳酸飲料

- 果汁和花蜜

- 能量飲料和功能飲料

- 即飲茶和咖啡

- 風味氣泡水

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 亞太其他地區

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amcor PLC

- Ball Corporation

- Tetra Pak International SA

- Crown Holdings Inc.

- Toyo Seikan Group Holdings Ltd

- Owens-Illinois Inc.

- Graham Packaging Company

- Ardagh Group SA

- CAN-PACK SA

- Refresco Group NV

- CKS Packaging Inc.

- Pacific Can China Holdings

- Berry Global Group Inc.

- Silgan Holdings Inc.

- Huhtamaki Oyj

- Mondi plc

- WestRock Company

- Plastipak Holdings Inc.

- UFlex Ltd.

- Nihon Yamamura Glass Co. Ltd

- Vetropack Holding AG

- Visy Industries

第7章 市場機會與未來展望

The soft drink packaging market generated USD 165.1 billion in 2025 and is projected to reach USD 214.6 billion by 2030, advancing at a 5.4% CAGR.

Growth reflects rising regulatory demands for recyclability, accelerating brand investments in premium, connected packs, and rapid scale-up of chemical recycling assets. Stricter mandates-such as the European Union's requirement for 30% recycled content in PET bottles by 2030-are forcing redesigns across formats while spurring rPET capacity expansion. Brands are also pivoting toward lightweight bottles and bio-based polymers that lower carbon footprints, a shift intensified by Gen-Z preferences for portion-controlled, visually distinctive packs. Meanwhile, mergers such as the USD 8.4 billion Amcor-Berry Global deal highlight an industry racing to secure scale economies and innovation pipelines. Across regions, Asia-Pacific's urbanizing middle class anchors demand, and the Middle East posts the fastest growth as governments court local beverage production.

Global Soft Drinks Packaging Market Trends and Insights

Surge in PET bottle lightweighting and rPET integration

Regulatory targets and cost pressure are pushing converters to cut resin use, with some Japanese PET bottles now below 20 g-half the traditional weight. High collection rates-90% in Japan versus 75% in Europe-underpin closed-loop economics, while India's Ganesha Ecopet is scaling to 42,000 t rPET to capture 25% of local bottle waste by 2026. Lightweighting trims material cost 15-20% and lowers freight emissions, but demands superior oxygen and CO2 barriers to safeguard taste over shelf life.

Growth of "functional soda" SKUs demanding premium packs

Global functional beverage sales headed toward USD 198.1 billion by 2026 are forcing packs that signal health credentials and enable ingredient storytelling. Gen-Z already drives 38% of category expansion and values transparency, prompting PepsiCo to embed on-pack narratives that justify 20-30% higher packaging spend. Metal cans win favor for their light-blocking and superior gas barriers that protect active compounds without preservatives, sustaining shelf stability and delivering premium cues.

Extended Producer-Responsibility (EPR) fees squeezing margins

Five U.S. states have enacted EPR laws that shift 90% of curbside recycling costs to producers by 2031. Eco-modulated charges tied to design recyclability can push packaging spend up 2-3%, compressing beverage margins while firms retool to lighter, mono-material formats. Navigating multiple state PROs adds administrative load and penalty risk for non-compliance.

Other drivers and restraints analyzed in the detailed report include:

- On-the-go slim-can demand from Gen-Z consumers

- Bottle-to-bottle chemical recycling capacity build-out

- Volatile aluminium premiums and supply bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PET and rPET bottles dominated with 71% revenue in 2024, reflecting a decades-long alignment of cost, clarity, and line compatibility. The soft drink packaging market size for PET equated to USD 117.2 billion in 2025 and is set for stable mid-single-digit expansion as the supply of food-grade rPET improves. Avantium's PEF and Danimer's PHA pipelines underpin a 17.4% CAGR for bioplastics, a niche today but one poised to carve premium categories with superior barrier metrics and lower cradle-to-grave footprints.

Shifting brand targets, net-zero pledges, and recycled-content quotas are hastening rPET uptake even in price-sensitive markets, with India mandating 30% PCR by 2025. Aluminium cans benefit from infinite recyclability and a 76.1% European recycling rate, yet volatile premiums dent converter margins. Glass retains cachet in craft lines but carries logistics penalties, while paperboard innovators scramble to replace PFAS coatings before looming bans take hold.

Bottles commanded 59% of 2024 sales thanks to entrenched blow-molding fleets, broad SKU sizes, and wrap-label real estate. The soft drink packaging market size for bottles is forecast to cross USD 122 billion by 2030, aided by barrier innovations allowing lower-weight preforms. Slim aluminum cans, however, are surging at 8.9% CAGR as Gen-Z ranks portability and Instagram-ready silhouettes above volume.

Retailers embrace the format's shelf efficiencies, and brands glean up to 20% price uplifts on identical fill volumes. Cartons gain share in chilled juice aisles as Tetra Pak shifts to plant-derived HDPE caps. Sachets remain vital in emerging markets, delivering ultra-low-cost entry points even as eco-taxes loom.

The Soft Drinks Packaging Market Report Segments the Industry Into by Material (Plastic, Metal, Glass and More), Product Type (Bottle, Can, Cartons and Boxes), Capacity (Less Than 250 Ml, 251-600 Ml and More), Closure Type (Screw and Sports Caps, Crown and Pull-Tab and More), Soft-Drink Category (Carbonated Soft Drinks, Juices and Nectars and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's 43% revenue share stems from surging middle-class purchasing power, dense urban retail, and robust post-consumer PET recovery systems that fuel low-cost rPET loops. Japan's 90% PET collection rate supplies domestic converters, while China subsidizes chemical recycling hubs to beat ambitious recycled-content goals. India's EPR roadmap intensifies demand for bottle-grade rPET, positioning the region as a bellwether for circular-economy scale-up.

The Middle East posts the highest 7.1% CAGR to 2030 as Saudi Arabia and the UAE fast-track local can-sheet rolling lines and beverage plants in pursuit of food-security agendas. Youthful demographics gravitate to energy drinks packaged in sleek cans, reinforcing metal demand despite global aluminium price swings. Government incentives for sustainable industry clusters further spur adoption of rPET preforms in Gulf Cooperation Council filling lines.

North America wrestles with EPR-induced cost headwinds and aluminium sheet tightness, yet benefits from first-mover commercial trials of AI-driven design software that cuts new-SKU timelines. Europe continues to set the regulatory pace: the PPWR's recyclability mandates catalyze investment in mono-material flexible films and advanced depolymerization. South America secures steady gains through Brazil's new ALPLA HDPE recycling plant and rising consumption of functional drinks among urban millennials. Africa, still nascent, observes double-digit volume growth on the back of urban sprawl and expanding cold-chain logistics, though inadequate collection infrastructure tempers rPET uptake.

- Amcor PLC

- Ball Corporation

- Tetra Pak International SA

- Crown Holdings Inc.

- Toyo Seikan Group Holdings Ltd

- Owens-Illinois Inc.

- Graham Packaging Company

- Ardagh Group SA

- CAN-PACK SA

- Refresco Group NV

- CKS Packaging Inc.

- Pacific Can China Holdings

- Berry Global Group Inc.

- Silgan Holdings Inc.

- Huhtamaki Oyj

- Mondi plc

- WestRock Company

- Plastipak Holdings Inc.

- UFlex Ltd.

- Nihon Yamamura Glass Co. Ltd

- Vetropack Holding AG

- Visy Industries

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in PET bottle lightweighting and rPET integration

- 4.2.2 Growth of "functional soda" SKUs demanding premium packs

- 4.2.3 On-the-go slim-can demand from Gen-Z consumers

- 4.2.4 Bottle-to-bottle chemical recycling capacity build-out

- 4.2.5 AI-enabled design platforms cutting packaging development lead-times

- 4.2.6 Carbon-negative PEF and PHA pilots reaching commercial scale

- 4.3 Market Restraints

- 4.3.1 Extended Producer-Responsibility (EPR) fees squeezing margins

- 4.3.2 Volatile aluminium premiums and supply bottlenecks

- 4.3.3 PFAS phase-outs disrupting barrier-coated paperboard

- 4.3.4 Retailer bans on single-use secondary plastics

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Investment Analysis (CapEx and MandA Trends)

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Material

- 5.1.1 Plastic (PET, rPET, HDPE, Bioplastics)

- 5.1.2 Metal (Aluminium, Steel)

- 5.1.3 Glass

- 5.1.4 Paper and Paperboard

- 5.1.5 Flexible and Compostable Films

- 5.2 By Product Type

- 5.2.1 Bottles

- 5.2.2 Cans

- 5.2.3 Cartons and Aseptic Bricks

- 5.2.4 Pouches and Sachets

- 5.2.5 Bag-in-Box / Dispense Packs

- 5.3 By Capacity

- 5.3.1 Less Than 250 ml

- 5.3.2 251-600 ml

- 5.3.3 601-1 L

- 5.3.4 More Than 1 L Family Packs

- 5.4 By Closure Type

- 5.4.1 Screw and Sports Caps

- 5.4.2 Crown and Pull-tab

- 5.4.3 Snap-on / Press-fit

- 5.4.4 Smart / Connected Closures

- 5.5 By Soft-Drink Category

- 5.5.1 Carbonated Soft Drinks

- 5.5.2 Juices and Nectars

- 5.5.3 Energy and Functional Drinks

- 5.5.4 RTD Tea and Coffee

- 5.5.5 Flavoured and Sparkling Water

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 Israel

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Turkey

- 5.6.5.5 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Egypt

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Amcor PLC

- 6.4.2 Ball Corporation

- 6.4.3 Tetra Pak International SA

- 6.4.4 Crown Holdings Inc.

- 6.4.5 Toyo Seikan Group Holdings Ltd

- 6.4.6 Owens-Illinois Inc.

- 6.4.7 Graham Packaging Company

- 6.4.8 Ardagh Group SA

- 6.4.9 CAN-PACK SA

- 6.4.10 Refresco Group NV

- 6.4.11 CKS Packaging Inc.

- 6.4.12 Pacific Can China Holdings

- 6.4.13 Berry Global Group Inc.

- 6.4.14 Silgan Holdings Inc.

- 6.4.15 Huhtamaki Oyj

- 6.4.16 Mondi plc

- 6.4.17 WestRock Company

- 6.4.18 Plastipak Holdings Inc.

- 6.4.19 UFlex Ltd.

- 6.4.20 Nihon Yamamura Glass Co. Ltd

- 6.4.21 Vetropack Holding AG

- 6.4.22 Visy Industries

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment