|

市場調查報告書

商品編碼

1849875

印度農業化學品產業:市場佔有率分析、產業趨勢、統計和成長預測(2025-2030 年)Agrochemical Industry In India - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

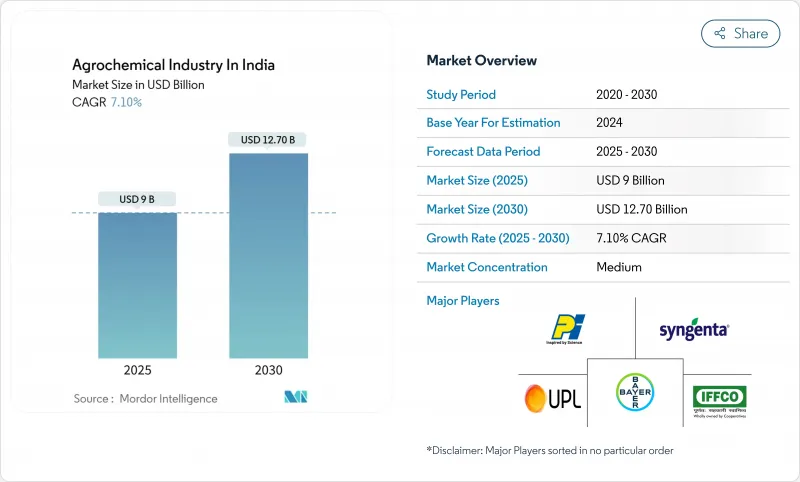

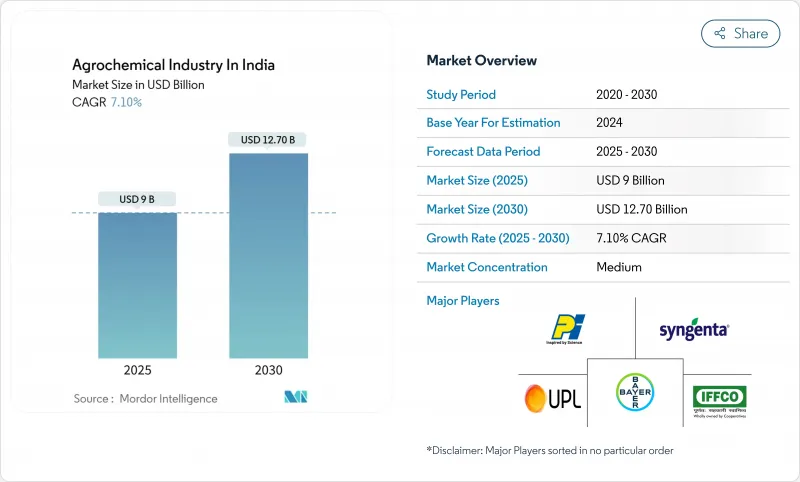

印度農業化學品產業市場規模預計在 2025 年為 90 億美元,預計到 2030 年將達到 127 億美元,預測期內複合年成長率為 7.10%。

強大的國內生產能力、不斷成長的出口管道以及有利於永續投入的政策獎勵正在推動這一發展勢頭。印度仍是世界第四大農化產品生產國,每年向歐洲、東南亞和西非出口價值50億美元的成品。製劑科學也在不斷發展,奈米營養液和水分散粒劑因其減少用量和提高田間安全性而越來越受到農民的認可。然而,對中國原料的依賴以及各邦之間錯綜複雜的毒性禁令,繼續為印度農化市場帶來成本波動和合規複雜性。

印度農化產業市場趨勢與洞察

政府補助合理化刺激生物投入的採用

新的補貼框架獎勵各州減少化肥消耗,並將預算支持用於堆肥、生物肥料和奈米營養液。 2025年聯邦預算中包含了農業預算撥款,並啟動了「總理農業計畫」(PM Dhan Dhanya Krishi Yojana),為改用認證生物肥料的農民提供正式的補貼機制。 PM-PRANAM等平行計畫將支出與化學品減量目標掛鉤,並鼓勵管理人員加快訓練模組和田間示範。

數位化農業信貸和電子商務網路拓展最後一英里

政府資助的數位基礎設施已將土地記錄、土壤健康卡和農民信用卡限額與統一農民登記冊整合,使投入品公司能夠在幾分鐘內審查信用狀況,並透過基於應用程式的平台發送訂單。例如,IFFCO 的 e-Bazar 在上個會計年度處理了超過 20 萬筆線上交易,並向 2.7 萬個郵遞區號的地區配送產品。對於印度農化市場而言,這些數位化管道將轉化為優質製劑銷售量的成長,尤其是在長期以來供應受限的偏遠地區。

對中國原料的依賴增加了成本波動

印度工廠從中國供應商進口大部分技術中間體,例如鉍、碲和石墨,這使得國內製劑製造商在地緣政治危機期間面臨價格波動和運輸延誤的風險。國內生產商必須持有更高的安全庫存,在全球運費上漲期間,這會佔用營運資金並侵蝕淨利率。一個政府工作小組已經確定了印度100%依賴進口的10種關鍵礦產,並正在起草獎勵方案,以迅速採用替代資源。

細分分析

化肥佔印度農業化學品市場的55.2%,持續支持稻米、小麥和甘蔗種植體系的糧食安全政策。磷酸二銨和尿素仍占主導地位,但補貼改革正在推動農民對微量營養素混合物和奈米液體肥料的需求,這些肥料可以最大限度地減少地下水污染。

預計到2030年,生物製藥銷售額的複合年成長率將達到10.52%,這得益於較小的基數、堆肥激勵措施、與殘留物掛鉤的出口標準以及不斷擴大的有機認證區域。微生物菌叢和海藻促效劑的日益普及,正在鼓勵傳統肥料製造商成立專門的生物部門。在延長保存期限、低溫運輸獨立包裝和農民教育方面擁有專業知識的生產商可能會獲得先發優勢。

到2024年,穀物和穀類將佔印度農化市場規模的47.3%,反映了印度-甘迪卡特平原水稻、小麥和玉米的種植面積。政府採購價格下限保護種植者免受週期性衰退的影響,即使在平均季風年份也能維持對投入品的需求。水果和蔬菜目前僅佔印度農化收益的一小部分,但隨著出口級芒果、葡萄和香蕉轉向棚架、灌溉和氣候控制環境,投入強度增加,預計其複合年成長率將達到9.13%。

普納、班加羅爾和納西克周邊的溫室叢集對殘留殺菌劑和生物基殺蟲劑的需求正在成長。油籽和豆類種植對價格相對敏感,但受益於國家自給自足計劃,該計劃為高硫肥料和生物固氮劑提供補貼。

印度農業化學品產業報告按產品類型(肥料、殺蟲劑、其他)、用途(作物型、非作物型)、劑型(液體、其他)和分銷管道(直銷、其他)進行細分。市場預測以美元計算。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 政府補助合理化促進生物投入的採用

- 數位化農業信貸和電子商務平台擴大了化學品的覆蓋範圍

- 精準無人機噴灑釋放小農戶尚未開發的需求

- 專利到期分子浪潮擴大了出口管道

- 氣候相關蟲害爆發增加農藥使用量

- 政府計劃提高國內製造能力

- 市場限制

- 對中國原料的嚴重依賴加劇了成本波動

- 加速國家層級禁用劇毒活性物質

- 仿冒品通路的增加正在減少流通中的品牌商品數量。

- 對傳統殺蟲劑的抗藥性不斷增強

- 監管格局

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 依產品類型

- 肥料

- 殺蟲劑

- 殺蟲劑

- 除草劑

- 消毒劑

- 佐劑

- 植物生長調節劑

- 按用途

- 以作物為基礎

- 糧食

- 油籽和豆類

- 水果和蔬菜

- 非作物

- 草坪和觀賞植物

- 林業及其他

- 以作物為基礎

- 按處方

- 液體

- 顆粒/粉末

- 奈米/微膠囊化

- 按分銷管道

- 直接面向農民

- 農業供應零售商

- 電商平台

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Bayer AG

- BASF SE

- Syngenta India Private Limited

- UPL

- Corteva Agriscience

- PI Industries

- IFFCO

- Coromandel International Ltd.

- Chambal Fertilisers and Chemicals Limited

- Rallis India Limited

- Deepak Fertilisers and Petrochemicals Corporation Limited(DFPCL)

- Crystal Crop Protection Ltd.

- Sumitomo Chemical India Ltd.

- Dhanuka Agritech Ltd.

- Indofil Industries Limited(Modi Enterprises)

第7章 市場機會與未來展望

The Agrochemical Industry in India Market size is estimated at USD 9 billion in 2025, and is anticipated to reach USD 12.70 billion by 2030, at a CAGR of 7.10% during the forecast period.

Strong domestic manufacturing capacity, expanding export pipelines, and policy incentives that favor sustainable inputs are propelling this momentum. India remains the fourth-largest global producer, shipping finished products worth USD 5 billion each year to destinations in Europe, Southeast Asia, and West Africa. Formulation science is also evolving, nano-nutrient liquids and water-dispersible granules are gaining farmer acceptance because they cut dosage rates and improve field safety. Nonetheless, raw-material dependence on China and a patchwork of state-level toxicity bans continue to inject cost volatility and compliance complexity into the India agrochemicals market.

Agrochemical Industry In India Market Trends and Insights

Government Subsidy Rationalization Spurring Bio-inputs Adoption

New subsidy frameworks reward states for curbing blanket fertilizer consumption and channel budgetary support toward compost, biofertilizers, and nano-nutrient liquids. The 2025 Union Budget set aside for agriculture and launched the Prime Minister Dhan-Dhanya Krishi Yojana, creating a formal mechanism to reimburse farmers who switch to certified biologicals. Parallel programs such as PM-PRANAM link disbursements to chemical reduction targets, encouraging administrators to fast-track training modules and field demonstrations.

Digitized Agri-credit and E-commerce Networks Widening Last-mile Reach

Government-funded digital infrastructure now integrates land records, soil health cards, and Kisan Credit Card limits into a unified farmer registry, allowing input companies to vet credit profiles in minutes and dispatch orders through app-based platforms. IFFCO e-Bazar, for example, fulfilled more than 200,000 online transactions in the past fiscal year and delivered to 27,000 pin codes, a scale previously unimaginable for bulk inputs. For the India agrochemicals market, these digital rails translate into higher off-take of premium formulations, especially in tier-II districts where assortment depth had long been a constraint.

Disruptive Raw-material Dependence on China Raising Cost Volatility

Indian plants import a bulk of technical intermediates such as bismuth, tellurium, and graphite from Chinese suppliers, leaving local formulators exposed to price swings and shipping delays during geopolitical flashpoints. Domestic producers must carry higher safety stocks, locking working capital and eroding margins when global freight rates spike. Government task forces have identified 10 critical minerals where India is 100% import-dependent and are drafting incentive packages to fast-track alternative sources.

Other drivers and restraints analyzed in the detailed report include:

- Drone-based Precision Spraying Unlocking Smallholder Demand

- Off-patent Molecule Wave Expanding Export Pipeline

- Accelerating State-level Bans on High-toxicity Actives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fertilizers captured 55.2% of the India agrochemicals market size, and continue to anchor food security policies for rice, wheat, and sugarcane systems. Di-ammonium phosphate and urea dominate volumes, yet escalating subsidy reforms are nudging growers toward micronutrient blends and nano-liquids that minimize groundwater contamination.

Biologicals, though starting from a smaller base, are projected to add nearly incremental sales by 2030 at a 10.52% CAGR, underpinned by compost incentives, residue-linked export standards, and expanding organic certification acreage. The rising popularity of microbial consortia and seaweed-based stimulants is encouraging conventional fertilizer majors to launch dedicated bio-divisions. Producers that master shelf-life extension, cold-chain independent packaging, and farmer education stand to capture early mover loyalty.

Grains and cereals commanded 47.3% of the India agrochemicals market size in 2024, reflecting the scale of paddy, wheat, and maize acreage across the Indo-Gangetic plain. Government procurement price floors insulate growers from cyclical dips and sustain input demand even in sub-normal monsoon years. Fruits and vegetables, while contributing a smaller revenue share today, are projected to expand at a 9.13% CAGR as export-class mangoes, grapes, and bananas shift to trellis, fertigation, and climate-controlled environments that lift input intensity.

Demand for residue-compliant fungicides and biorational insecticides is rising in greenhouse clusters around Pune, Bengaluru, and Nashik. Oilseed and pulse acreage are relatively price-sensitive but benefit from national self-sufficiency missions that subsidize sulfur-rich fertilizers and bio-nitrogen fixers.

The Agrochemical Industry in India Report is Segmented by Product Type (Fertilizers, Pesticides, and More), by Application (Crop-Based and Non-Crop-Based), by Formulation (Liquid, and More), and by Distribution Channel (Direct To Farmer, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Bayer AG

- BASF SE

- Syngenta India Private Limited

- UPL

- Corteva Agriscience

- PI Industries

- IFFCO

- Coromandel International Ltd.

- Chambal Fertilisers and Chemicals Limited

- Rallis India Limited

- Deepak Fertilisers and Petrochemicals Corporation Limited (DFPCL)

- Crystal Crop Protection Ltd.

- Sumitomo Chemical India Ltd.

- Dhanuka Agritech Ltd.

- Indofil Industries Limited (Modi Enterprises)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government subsidy rationalization spurring bio-inputs adoption

- 4.2.2 Digitized agri-credit and e-commerce platforms expanding chemical reach

- 4.2.3 Drone-based precision spraying unlocking untapped smallholder demand

- 4.2.4 Off-patent molecule wave enlarges export pipeline

- 4.2.5 Climate-linked pest outbreaks increasing pesticide intensity

- 4.2.6 Government schemes boosting domestic manufacturing capacity

- 4.3 Market Restraints

- 4.3.1 Disruptive raw-material dependence on China raising cost volatility

- 4.3.2 Accelerating state-level bans on high-toxicity actives

- 4.3.3 Growing counterfeit channel eroding branded volumes

- 4.3.4 Intensifying resistance to legacy insecticides

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Fertilizers

- 5.1.2 Pesticides

- 5.1.2.1 Insecticides

- 5.1.2.2 Herbicides

- 5.1.2.3 Fungicides

- 5.1.3 Adjuvants

- 5.1.4 Plant Growth Regulators

- 5.2 By Application

- 5.2.1 Crop-based

- 5.2.1.1 Grains and Cereals

- 5.2.1.2 Oilseeds and Pulses

- 5.2.1.3 Fruits and Vegetables

- 5.2.2 Non-crop-based

- 5.2.2.1 Turf and Ornamental

- 5.2.2.2 Forestry and Other

- 5.2.1 Crop-based

- 5.3 By Formulation

- 5.3.1 Liquid

- 5.3.2 Granular/Powder

- 5.3.3 Nano/Micro-encapsulated

- 5.4 By Distribution Channel

- 5.4.1 Direct to Farmer

- 5.4.2 Agri-input Retailers

- 5.4.3 E-commerce Platforms

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Bayer AG

- 6.4.2 BASF SE

- 6.4.3 Syngenta India Private Limited

- 6.4.4 UPL

- 6.4.5 Corteva Agriscience

- 6.4.6 PI Industries

- 6.4.7 IFFCO

- 6.4.8 Coromandel International Ltd.

- 6.4.9 Chambal Fertilisers and Chemicals Limited

- 6.4.10 Rallis India Limited

- 6.4.11 Deepak Fertilisers and Petrochemicals Corporation Limited (DFPCL)

- 6.4.12 Crystal Crop Protection Ltd.

- 6.4.13 Sumitomo Chemical India Ltd.

- 6.4.14 Dhanuka Agritech Ltd.

- 6.4.15 Indofil Industries Limited (Modi Enterprises)