|

市場調查報告書

商品編碼

1850029

管理資訊服務:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Managed Information Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

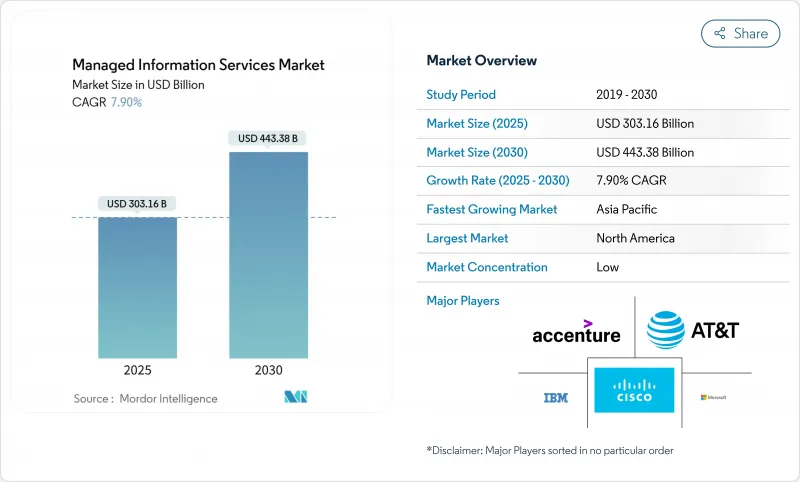

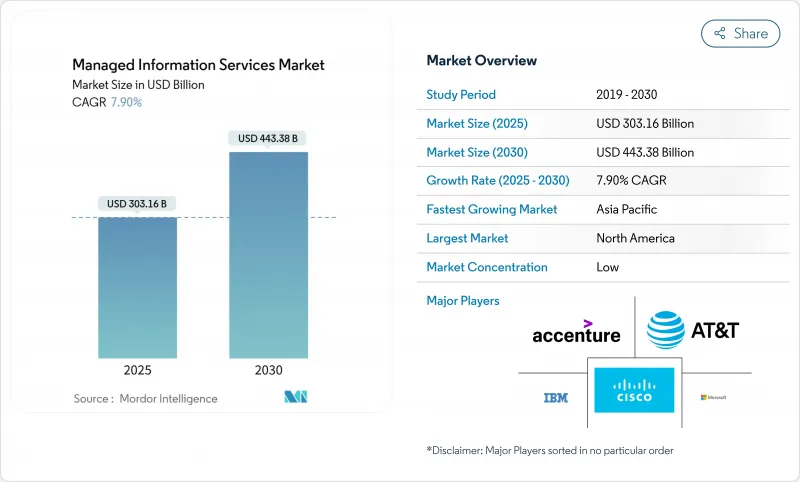

託管資訊服務市場預計將在 2025 年達到 3,031.6 億美元,以 7.9% 的複合年成長率成長,到 2030 年達到 4,433.8 億美元。

隨著企業從所有權模式向消費模式轉型,加速其雲端優先藍圖,並透過將自動化和人工智慧融入日常營運的專業合作夥伴來彌補關鍵人才缺口,託管資訊服務市場持續保持強勁成長勢頭。此外,網路風險上升、監管壓力加大以及對持續運作的需求也使託管資訊服務市場受益,而大多數內部IT團隊無法提供資金或大規模配備人員。北美仍然是全球支出中心,但亞太地區的快速數位化正在縮小這一差距。競爭優勢正在轉向能夠提供基於成果的合約、混合架構的整合管理以及持續保全行動以滿足不斷變化的合規性需求的供應商。

全球管理資訊服務市場趨勢與洞察

轉向混合/多重雲端架構

混合雲和多重雲端已成為董事會層面的當務之急,而非工具偏好,預計到 2027 年將有 90% 的公司採用這種方法。工作負載可攜性、資料駐留規則和供應商多樣性正在增加營運複雜性,並促使公司從第三方專家購買整合管理。思科報告稱,53% 的企業每週都會在本地端和雲端環境之間遷移工作負載,這使得對編配平台和跨域管治服務的需求持續成長。能夠提供一致的策略執行、整合的可觀察性和跨不同平台的自動化工作負載分配的提供者現在擁有更高的價格。在必須同時滿足合規性和創新目標的嚴格監管行業中,採用混合雲和多雲最為明顯,這強化了能夠將本地控制與雲端敏捷性相結合的託管服務的提案主張。

成本最佳化和 OPEX 偏好

經濟不確定性和技術的快速更替正推動財務主管轉向可預測的訂閱支出。託管服務將資本支出轉化為營運支出,同時將硬體淘汰、許可證管理和人才招募的風險轉移給供應商。中小企業最快地接受了這種模式,因為它們無需大量的前期投資即可獲得企業級安全和分析功能。供應商也承擔合規性報告和事件回應的責任,使內部團隊能夠將稀缺的技能轉向面向客戶的創新。因此,營運成本主導的合約通常包含不僅與基礎設施可用性相關的結果保證,還與服務水準、使用者體驗和業務指標相關。

遺留整合和監管複雜性

許多公司的核心應用程式運作在數十年歷史的系統上,這些系統難以輕鬆與現代託管平台對接。銀行、公共產業和公共機構面臨嚴格的審核要求,需要客製化控制、專用適配器和延長檢驗週期。客製化整合會增加計劃成本,並削弱規模經濟效應,而規模經濟正是託管服務的吸引力。 《薩班斯-奧克斯利法案》(SOX) 和《一般資料保護規範》(GDPR) 等合規框架通常要求本地審核記錄和資料隔離,迫使提供者部署專用環境,從而增加交付工作量。這些因素會延長銷售週期並延遲價值實現時間,尤其對於承擔多種監管義務的跨國公司而言。

細分分析

至2024年,本地環境將佔據託管資訊服務市場佔有率的54.1%。對私人資料中心和延遲敏感型工作負載的巨額投資進一步推動了這一趨勢。然而,雲端基礎的託管服務預計將以13.8%的複合年成長率成長,凸顯了重視敏捷性和彈性消費的產業工作負載遷移的加速。混合環境現已成為主流,要求服務供應商在兩種環境中提供單一管理平台的可視性、自動化配置漂移修復和統一的安全管理。

雲端加速也反映出人們對超大規模平台日益成長的信任,這些平台目前提供特定產業的合規藍圖、主權雲端區域和精細加密選項。此外,企業意識到雲端現代化與應用程式轉型密不可分,這推動了對重構、DevSecOps 流程和持續合規監控的需求。擁有經過認證的雲端專業知識、專有遷移加速器和強大財務最佳化工具的託管服務合作夥伴正在贏得更大的合約範圍。相反,由於客戶採用雲端原生設計模式並期望獲得工作負載佈局經濟性的主動指導,那些局限於資料中心外包的供應商可能會面臨合約流失的風險。

至2024年,託管安全服務將佔總收入的28.5%,複合年成長率為14.7%。高級服務結合了威脅情報、行為分析和透過整合平台執行的自動回應,從而減少了人工分類的工作量。

對零信任網路存取、雲端工作負載保護和供應鏈風險評估的需求也在不斷成長。同時,託管資料中心和網路服務繼續提供可預測的收入來源,但由於基礎設施自動化壓縮了傳統的工單量,成長的驅動力在於安全性。因此,服務組合正向安全的多雲功能方向整合,供應商整合身分管治、預防資料外泄和合規性儀表板。 Canalys 強調,與獨立提案相比,安全與雲端最佳化服務的組合可產生 1.6 倍的交叉銷售收益。因此,投資於多重雲端平台、安全分析和專業事件回應團隊的供應商正在獲得差異化的利潤。

託管資訊服務市場按配置(雲端 vs. 本地部署)、服務類型(託管資料中心、託管安全、託管通訊(統一通訊 vs. VoIP)等)、最終用戶公司規模(中小企業 vs. 大型企業)、最終用戶垂直領域(IT 和電信、金融服務、保險、醫療保健等)和區域細分。市場預測以美元計算。

區域分析

2024年,北美將維持35.4%的收入成長,這得益於早期雲端運算應用、先進的網路安全法規以及豐富的一級供應商生態系統。美國企業通常需要預測分析、人工智慧輔助營運以及將費用與業務KPI掛鉤的基於成果的合約。加拿大正憑藉聯邦政府的「數位政府」計畫和依賴安全多重雲端彈性的現代銀行舉措獲得發展勢頭。許多供應商正在部署區域交付中心和主權雲端區,以遵守不斷發展的州級隱私法,同時維持低延遲的服務水準。

亞太地區是成長最快的地區,複合年成長率達12.9%,正在縮小與其他地區的差距。中國正在透過智慧城市投資和製造業升級政策來擴展託管資訊服務,這些政策需要邊緣編配和安全連接。東南亞國家正在透過採用雲端託管應用程式和行動優先商務來擺脫傳統基礎設施,這需要合作夥伴在網路最佳化和法規遵循方面提供支援。建立合資企業、多語言服務台和區域性垂直解決方案的供應商將佔據有利地位,搶佔市場佔有率。

在《一般資料保護規範》(GDPR)、數位化營運韌性法律和永續性報告義務的推動下,歐洲的需求正日趨成熟且具韌性。德國和英國仍然是支出最高的國家,但隨著歐盟復甦基金對數位化計劃的支持,南歐的支出正在加速成長。供應商透過提供可衡量的碳減排舉措、歐盟專屬的資料駐留以及可審核的合規交付成果來脫穎而出。隨著時間的推移,環境法規的加強將使採購標準轉向那些在可再生能源採購和循環經濟硬體實踐方面取得檢驗進展的合作夥伴。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 轉向混合/多重雲端架構

- 成本最佳化和營運支出優先級

- 網路威脅和日益成長的合規壓力

- 需要本地 MSP 節點的邊緣運算部署

- 綠色管理服務的永續性要求

- 人工智慧驅動的自主運作 (AIOps) 成熟度

- 市場限制

- 遺留整合和監管複雜性

- 資料主權/隱私問題

- 技能人才短缺推高了 MSP 成本

- 無伺服器/無操作架構縮小了 MSP 範圍

- 價值鏈分析

- 監管格局

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章市場規模及成長預測

- 按部署

- 本地部署

- 雲

- 按服務類型

- 託管資料中心

- 託管安全

- 託管通訊(UC 和 VoIP)

- 託管網路(LAN/WAN/SASE)

- 託管基礎設施(伺服器/儲存)

- 管理行動性和設備

- 託管應用程式和 DevOps

- 按最終用戶公司規模

- 小型企業

- 主要企業

- 按最終用戶

- BFSI

- 資訊科技和通訊

- 衛生保健

- 媒體和娛樂

- 零售與電子商務

- 製造業

- 政府和公共部門

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 西班牙

- 瑞士

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 新加坡

- 越南

- 印尼

- 其他亞太地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 奈及利亞

- 南非

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- IBM Corporation

- Accenture plc

- Cisco Systems Inc.

- Microsoft Corporation

- AT&T Inc.

- Fujitsu Ltd

- Hewlett Packard Enterprise(HPE)

- Dell Technologies Inc.

- Verizon Communications Inc.

- Rackspace Technology

- Deutsche Telekom AG(T-Systems)

- Nokia Solutions and Networks

- Telefonaktiebolaget LM Ericsson

- Tata Consultancy Services(TCS)

- Wipro Ltd

- HCL Technologies Ltd

- Cognizant Technology Solutions

- NTT DATA Corporation

- Capgemini SE

- Kyndryl Holdings Inc.

- Orange Business Services

第7章 市場機會與未來展望

The managed information services market reached USD 303.16 billion in 2025 and is forecast to expand at a 7.9% CAGR, delivering a managed information services market size of USD 443.38 billion by 2030.

Robust demand persists because enterprises are shifting from ownership to consumption models, accelerating cloud-first roadmaps, and closing critical talent gaps through specialist partners that embed automation and artificial intelligence into day-to-day operations. The managed information services market also benefits from cyber-risk escalation, mounting regulatory pressure, and the need for always-on resilience that most internal IT teams cannot fund or staff at scale. North America continues to anchor global spending, although rapid digitalization across Asia-Pacific is narrowing the gap. Competitive advantage now flows to providers capable of outcome-based contracts, unified management across hybrid architectures, and continuous security operations that align with evolving compliance mandates.

Global Managed Information Services Market Trends and Insights

Shift to Hybrid / Multi-Cloud Architectures

Hybrid and multi-cloud have become a board-level imperative rather than a tooling preference, with 90% of enterprises projected to adopt the approach by 2027. Workload portability, data residency rules, and vendor diversification multiply operational complexity, prompting organisations to source unified management from third-party specialists. Cisco reports that 53% of firms move workloads between on-premise and cloud environments each week, creating sustained demand for orchestration platforms and cross-domain governance services. Providers that supply consistent policy enforcement, integrated observability, and automated workload placement across dissimilar platforms currently command premium pricing. Adoption is most visible in highly regulated sectors that must simultaneously satisfy compliance and innovation goals, reinforcing the value proposition of managed services that can blend local control with cloud agility.

Cost-Optimization and OPEX Preference

Economic uncertainty and rapid technology churn are driving finance leaders toward predictable subscription spending. Managed services convert capital outlays into operating expenses while transferring hardware obsolescence, licence management, and talent retention risks to the vendor. Small and medium enterprises are embracing the model fastest because it unlocks enterprise-grade security and analytics without heavy up-front investment. Providers also assume compliance reporting and incident response responsibilities, allowing internal teams to redirect scarce skills toward customer-facing innovation. As a result, OPEX-driven contracts increasingly include outcome guarantees tied to service levels, user experience, and business metrics rather than infrastructure availability alone.

Legacy Integration and Regulatory Complexity

Many enterprises run core applications on decades-old systems that cannot easily interface with modern managed platforms. Banking, utilities, and public-sector agencies face stringent audit requirements that demand bespoke controls, specialised adapters, and extended validation cycles. Custom integration inflates project costs and erodes the economies of scale that make managed services attractive. Compliance frameworks such as SOX and GDPR often mandate on-premise audit logging and data segregation, forcing providers to deploy dedicated environments that increase delivery effort. These factors lengthen sales cycles and delay time-to-value, especially for global organisations with diverse regulatory obligations.

Other drivers and restraints analyzed in the detailed report include:

- Escalating Cyber-Threat and Compliance Pressure

- Edge-Computing Roll-Outs Requiring Local MSP Nodes

- Serverless / No-Ops Architectures Reducing MSP Scope

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

On-premise environments retained 54.1% of managed information services market share in 2024 because many highly regulated firms continue to demand direct infrastructure custody. Heavy investments in private data centres and latency-sensitive workloads further anchor this preference. Yet cloud-based managed services are on track for a 13.8% CAGR, underscoring that workload migration is gathering pace across industries that prize agility and elastic consumption. Hybrid estates now prevail, compelling service providers to offer single-pane visibility, automated configuration drift remediation, and uniform security controls across both venues.

Cloud acceleration also reflects growing trust in hyperscale platforms that now provide sector-specific compliance blueprints, sovereign cloud zones, and granular encryption options. Enterprises moreover recognise that cloud modernisation is inseparable from application transformation, driving demand for refactoring, DevSecOps pipelines, and continuous compliance monitoring. Managed services partners that demonstrate certified cloud expertise, proprietary migration accelerators, and robust financial optimisation tooling are winning larger contract scopes. Conversely, providers limited to data-centre outsourcing risk contract attrition as clients adopt cloud-native design patterns and expect proactive guidance on workload placement economics.

Managed security services controlled 28.5% of the total revenue pool in 2024 and are expanding at 14.7% CAGR, reflecting cyber risk's elevation to an enterprise-wide priority. Advanced services now blend threat intelligence, behaviour analytics, and automated response executed through unified platforms, reducing manual triage workloads.

Demand also rises for zero-trust network access, cloud workload protection, and supply-chain risk assessments. In parallel, managed data-centre and network services continue to deliver predictable annuity streams, but their growth trails security because infrastructure automation compresses traditional ticket volumes. Service portfolios are therefore converging around secure multi-cloud enablement, with providers integrating identity governance, data loss prevention, and compliance dashboards. Canalys highlights that combined security and cloud optimisation offerings generate 1.6 times higher cross-sell revenue relative to siloed propositions. Vendors investing in MDR platforms, security analytics, and specialist incident-response teams consequently command differentiated margins.

Managed Information Services Market is Segmented by Deployment (Cloud and On-Premise), Service Type (Managed Data Centre, Managed Security, Managed Communications (UC and VoIP) and More), End-User Enterprise Size (Small and Medium-Sized Enterprises and Large Enterprises), End-User Vertical (IT and Telecom, BFSI, Healthcare, and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 35.4% of 2024 revenue due to early cloud adoption, sophisticated cybersecurity regulations, and a deep ecosystem of tier-one providers. Enterprises in the United States routinely demand predictive analytics, AI-assisted operations, and outcome-based contracts that tie fees to business KPIs. Canada adds momentum through federal digital-government programmes and modern banking initiatives that depend on secure multi-cloud elasticity. Many providers deploy regional delivery hubs and sovereign cloud zones to comply with evolving state-level privacy laws while sustaining low-latency service levels.

Asia-Pacific is the fastest-growing theatre at 12.9% CAGR and is closing the gap on incumbent regions. China scales managed information services through smart-city investments and manufacturing upgrade policies that require edge orchestration and secure connectivity. Southeast Asian nations are leapfrogging legacy infrastructure by adopting cloud-hosted applications and mobile-first commerce, necessitating partner support for network optimisation and regulatory compliance. Providers that establish joint ventures, multilingual service desks, and region-specific vertical solutions are well positioned to capture wallet share.

Europe shows mature yet resilient demand anchored in GDPR, the Digital Operational Resilience Act, and sustainability reporting obligations. Germany and the United Kingdom remain top spenders, but southern Europe is accelerating as EU recovery funds support digitisation projects. Providers differentiate by offering measurable carbon-reduction initiatives, EU-only data residency, and audit-ready compliance artefacts. Over time, tighter environmental rules will shift procurement criteria toward partners that demonstrate verifiable progress on renewable energy sourcing and circular-economy hardware practices

- IBM Corporation

- Accenture plc

- Cisco Systems Inc.

- Microsoft Corporation

- AT&T Inc.

- Fujitsu Ltd

- Hewlett Packard Enterprise (HPE)

- Dell Technologies Inc.

- Verizon Communications Inc.

- Rackspace Technology

- Deutsche Telekom AG (T-Systems)

- Nokia Solutions and Networks

- Telefonaktiebolaget LM Ericsson

- Tata Consultancy Services (TCS)

- Wipro Ltd

- HCL Technologies Ltd

- Cognizant Technology Solutions

- NTT DATA Corporation

- Capgemini SE

- Kyndryl Holdings Inc.

- Orange Business Services

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift to hybrid / multi-cloud architectures

- 4.2.2 Cost-optimisation and OPEX preference

- 4.2.3 Escalating cyber-threat and compliance pressure

- 4.2.4 Edge-computing roll-outs needing local MSP nodes

- 4.2.5 Sustainability mandates for green managed services

- 4.2.6 AI-driven autonomous operations (AIOps) maturity

- 4.3 Market Restraints

- 4.3.1 Legacy integration and regulatory complexity

- 4.3.2 Data-sovereignty / privacy concerns

- 4.3.3 Skilled-talent crunch inflating MSP costs

- 4.3.4 Serverless / No-Ops architectures reducing MSP scope

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Service Type

- 5.2.1 Managed Data Centre

- 5.2.2 Managed Security

- 5.2.3 Managed Communications (UC and VoIP)

- 5.2.4 Managed Network (LAN/WAN/SASE)

- 5.2.5 Managed Infrastructure (Server / Storage)

- 5.2.6 Managed Mobility and Device

- 5.2.7 Managed Application and DevOps

- 5.3 By End-user Enterprise Size

- 5.3.1 Small and Medium Enterprises (SME)

- 5.3.2 Large Enterprises

- 5.4 By End-user Vertical

- 5.4.1 BFSI

- 5.4.2 IT and Telecom

- 5.4.3 Healthcare

- 5.4.4 Media and Entertainment

- 5.4.5 Retail and E-commerce

- 5.4.6 Manufacturing

- 5.4.7 Government and Public Sector

- 5.4.8 Other Verticals

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Spain

- 5.5.3.7 Switzerland

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Malaysia

- 5.5.4.6 Singapore

- 5.5.4.7 Vietnam

- 5.5.4.8 Indonesia

- 5.5.4.9 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 Nigeria

- 5.5.5.2.2 South Africa

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Accenture plc

- 6.4.3 Cisco Systems Inc.

- 6.4.4 Microsoft Corporation

- 6.4.5 AT&T Inc.

- 6.4.6 Fujitsu Ltd

- 6.4.7 Hewlett Packard Enterprise (HPE)

- 6.4.8 Dell Technologies Inc.

- 6.4.9 Verizon Communications Inc.

- 6.4.10 Rackspace Technology

- 6.4.11 Deutsche Telekom AG (T-Systems)

- 6.4.12 Nokia Solutions and Networks

- 6.4.13 Telefonaktiebolaget LM Ericsson

- 6.4.14 Tata Consultancy Services (TCS)

- 6.4.15 Wipro Ltd

- 6.4.16 HCL Technologies Ltd

- 6.4.17 Cognizant Technology Solutions

- 6.4.18 NTT DATA Corporation

- 6.4.19 Capgemini SE

- 6.4.20 Kyndryl Holdings Inc.

- 6.4.21 Orange Business Services

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment