|

市場調查報告書

商品編碼

1821514

管理服務的全球市場(~2035年):各服務形式,各部署類型,各類型企業,各產業類型,各地區,產業趨勢,預測Managed Services Market, Till 2035: Distribution by Type of Service, Type of Deployment, Type of Enterprise, Type of Vertical, and Geographical Regions: Industry Trends and Global Forecasts |

||||||

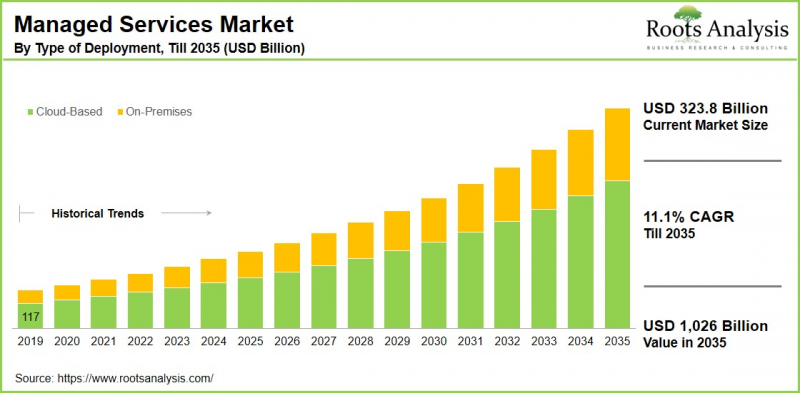

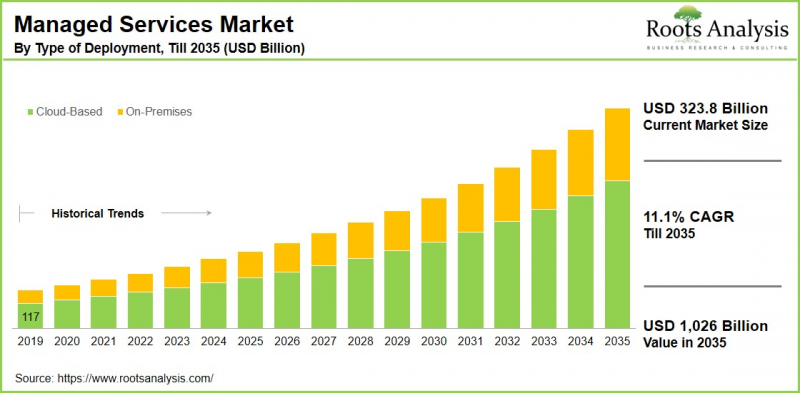

預計到 2035 年,全球託管服務市場規模將從目前的 3,238 億美元增長至 1.026 兆美元,預測期內複合年增長率為 11.1%。

託管服務市場:成長與趨勢

IT 產業不斷發展,數位轉型及其不斷擴展的作用和範圍,顯著增加了對託管服務的需求。託管服務是指由第三方監督企業 IT 服務的安排。在這種模式下,企業將各種IT功能和基礎設施的管理和監控外包給外部服務提供者。託管服務的目標是透過將日常任務交給專家來降低成本並提高服務品質。

託管服務市場正在經歷重大變革,這得益於IT基礎設施管理日益複雜的現狀以及雲端運算解決方案日益受到青睞。企業正在尋求外部專業知識來簡化IT營運並獲得競爭優勢。這種轉變推動了對業務連續性和應用管理服務的需求。

此外,企業優化營運和提高生產力的努力對於永續成長至關重要。在這種環境下,為了保持競爭力,企業正在採用託管服務解決方案,使其能夠利用專家知識,同時確保在不斷變化的技術環境中保持營運彈性。 IT基礎設施管理的未來取決於能否認識到與經驗豐富的託管服務提供者合作的重要性,這些提供者能夠提供滿足特定業務需求的創新客製化解決方案。然而,託管服務市場面臨的挑戰,例如網路安全威脅和法規遵循需求,可能會阻礙市場成長。

受IT基礎設施管理解決方案需求不斷增長以及為解決網路安全問題而對託管安全服務日益增長的需求的推動,預計託管服務市場在預測期內將大幅增長。

本報告研究了全球託管服務市場,並提供了市場規模估算、機會分析、競爭格局和公司概況。

目錄

章節1 報告概要

第1章 序文

第2章 調查手法

第3章 市場動態

第4章 宏觀經濟指標

章節2 定性知識和見解

第5章 摘要整理

第6章 簡介

第7章 法規Scenario

章節3 市場概要

第8章 主要企業整體性資料庫

第9章 競爭情形

第10章 閒置頻段的分析

第11章 企業的競爭力的分析

第12章 管理服務市場上Start-Ups生態系統

章節4 企業簡介

第13章 企業簡介

- 章概要

- Accenture

- Amazon

- AT&T

- Atos

- Braodcom

- Capgemini

- Cisco

- Digital Reality

- Dimension Data

- DXC

- Fujitsu

- GTT

- HCL

- IBM

- Infosys

- Microsoft

- NTT DATA

- Rackspace

- ScalePad Software

- Tata Communication Services

- Telefonaktiebolaget

章節5 市場趨勢

第14章 大趨勢的分析

第15章 未滿足需求的分析

第16章 專利分析

第17章 近幾年的發展

章節6 市場機會分析

第18章 全球管理服務市場

第19章 市場機會:各服務形式

第20章 市場機會:各部署類型

第21章 市場機會:各類型企業

第22章 市場機會:各產業類型

第23章 北美的管理服務市場機會

第24章 歐洲的管理服務市場機會

第25章 亞洲的管理服務市場機會

第26章 中東·北非(MENA)的管理服務市場機會

第27章 南美的管理服務市場機會

第28章 其他地區的管理服務市場機會

第29章 市場集中的分析:各主要企業

第30章 鄰近市場的分析

章節7 策略性工具

第31章 重要的勝利策略

第32章 波特的五力分析

第33章 SWOT的分析

第34章 價值鏈的分析

第35章 Roots的策略性建議

章節8 其他獨家知識和見解

第36章 初步研究結果

第37章 報告的結論

章節9 附錄

Managed Services Market Overview

As per Roots Analysis, the global managed services market size is estimated to grow from USD 323.8 billion in the current year to USD 1,026 billion by 2035, at a CAGR of 11.1% during the forecast period, till 2035.

The opportunity for managed services market has been distributed across the following segments:

Type of Service

- Managed Backup and Disaster Recovery

- Managed Communication Service

- Managed UCaaS

- Managed VoIP

- Others

- Managed IT Infrastructure Service

- Manage Data Analytics

- Managed Print Service

- Server Management

- Storage Management

- Other IT and Data Center Services

- Managed Mobility Services

- Application Management

- Device Life Cycle Management

- Managed Network Services

- Managed LAN

- Managed VPN

- Managed WAN

- Managed Wi-Fi

- Networking Monitoring

- Others

- Managed Security Service

- Managed Identify & Access Management

- Managed Risk and Compliance Management

- Managed Security Information & Event Management

- Management Farewell

- Others

Type of Deployment

- Cloud-Based

- On-Premises

Type of Enterprise

- Large Enterprises

- Small and Medium-sized Enterprises

Type of Vertical

- BFSI

- Energy & Utility

- Government

- Healthcare

- IT & Telecommunication

- Manufacturing

- Retail & E-commerce

- Others

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

Managed Services Market: Growth and Trends

The information technology industry is continuously evolving, and the digital transformation, along with its expanding roles and areas, has significantly increased the need for managed services. Managed services entail an arrangement where a third party oversees business IT services. In this model, organizations delegate the management and monitoring of various IT functions and infrastructure to an external service provider. The goal of managed services is to reduce costs and improve service quality by transferring routine tasks to experts.

The managed service market is undergoing significant change fueled by the growing complexity of IT infrastructure management and a rising preference for cloud computing solutions. Companies are turning to external expertise to streamline IT operations and achieve competitive advantages. This shift has led to a heightened demand for business continuity and application management services.

Moreover, organizations looking to optimize their operations and boost productivity have become essential for sustainable growth. In this landscape, to stay competitive, businesses are adopting managed service solutions that allow them to tap into expert knowledge while ensuring operational resilience within a constantly changing technological environment. The future of IT infrastructure management hinges on recognizing the importance of collaborations with skilled managed service providers capable of delivering innovative, customized solutions to meet specific business needs. Nevertheless, challenges in the managed service market, such as cybersecurity threats and the need for regulatory compliance, could hinder market growth.

Driven by the increasing demand for IT infrastructure management solutions and the escalating need for managed security services to tackle cybersecurity issues, the managed services market is expected to grow significantly during the forecast period.

Managed Services Market: Key Segments

Market Share by Type of Service

Based on type of service, the global managed services market is segmented into managed backup and disaster recovery, managed communication service, managed IT infrastructure service, managed mobility services, managed network services, and managed security services. According to our estimates, currently, the IT infrastructure services captures the majority of the market share. This can be attributed to the increasing need for dependable IT infrastructure management, aiding enterprises in overseeing their servers, storage, databases, and data centers.

However, the managed network service segment is expected to grow at a higher CAGR throughout the forecast period, propelled by a rising demand for enhanced connectivity networks that include WAN, LAN, and SD-WAN to ensure uninterrupted connectivity and dependable network performance.

Market Share by Type of Deployment

Based on type of deployment, the global managed services market is segmented into cloud-based and on-premises. According to our estimates, currently, the cloud-based deployment segment captures the majority of the market share. This can be attributed to its distinctive advantages, such as scalability, cost-effectiveness, remote accessibility, flexibility, swift implementation, and effective disaster recovery. Additionally, cloud-based services involve the outsourcing of IT operations, infrastructure, and applications to manage services that are hosted on a cloud platform.

However, the on-premises deployment is expected to grow at a higher CAGR throughout the forecast period, due to its advantages in providing enhanced security and privacy.

Market Share by Type of Enterprise

Based on type of enterprise, the global managed services market is segmented into small and medium-sized enterprises and large enterprises. According to our estimates, currently, the large enterprises capture the majority of the market share. This can be attributed to their complex operations, extensive IT infrastructure, and global reach.

However, the small and medium-sized enterprises is expected to grow at a higher CAGR during the forecast period, driven by the need for managed services due to their limited resources, insufficient internal IT capabilities to manage intricate systems, and the need for scalable solutions.

Market Share by Type of Vertical

Based on type of vertical, the global managed services market is segmented into BFSI, energy & utility, government, healthcare, it & telecommunication, manufacturing, retail & e-commerce, and others. According to our estimates, currently, the BFSI sector captures the majority of the market share. This can be attributed to the advantages of managed services in the banking, financial services, and insurance sectors, where they provide the necessary expertise and support to meet specific needs.

However, the IT and telecommunications sector is expected to grow at a higher CAGR during the forecast period. This can be attributed to the fact that these industries require IT infrastructure, cloud solutions, and network management services to adapt to rapid technological advancements.

Market Share by Geographical Regions

Based on geographical regions, the managed services market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently, North America captures the majority share of the market. However, the market in Asia is expected to grow at a higher CAGR during the forecast period, driven by swift digital transformation and economic development in emerging countries.

In particular, nations like China, India, and South Korea are seeing substantial investments from both governments and organizations in digital transformation to enhance efficiency, competitiveness, and customer engagement.

Example Players in Managed Services Market

- Applied Material

- AU Optronics

- BOE Technology

- Corning Incorporated

- Accenture

- Amazon

- AT&T

- Atos

- Broadcom

- Capgemini

- Cisco

- Digital Reality

- Dimension Data

- DXC

- DXC

- Fujitsu

- GTT

- HCL

- IBM

- Infosys

- Microsoft

- NITT DATA

- Rackspace

- ScalPad Software

- Tata Communication Services

- Telefonaktiebolaget

Managed Services Market: Research Coverage

The report on the managed services market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the managed services market, focusing on key market segments, including [A] type of service, [B] type of deployment, [C] type of enterprise, [D] type of vertical, and [E] geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the managed services market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the managed services market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] managed services portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- Megatrends: An evaluation of ongoing megatrends in the managed services industry.

- Patent Analysis: An insightful analysis of patents filed / granted in the managed services domain, based on relevant parameters, including [A] type of patent, [B] patent publication year, [C] patent age and [D] leading players.

- Recent Developments: An overview of the recent developments made in the managed services market, along with analysis based on relevant parameters, including [A] year of initiative, [B] type of initiative, [C] geographical distribution and [D] most active players.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the managed services market, including threats of new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute products and rivalry among existing competitors.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the managed services market.

Key Questions Answered in this Report

- How many companies are currently engaged in managed services market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. MARKET DYNAMICS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Managed Service Market

- 6.2.1. Type of Service

- 6.2.2. Type of Deployment

- 6.2.3. Type of Enterprise Size

- 6.2.4. Type of Vertical

- 6.3. Future Perspective

7. REGULATORY SCENARIO

SECTION III: MARKET OVERVIEW

8. COMPREHENSIVE DATABASE OF LEADING PLAYERS

9. COMPETITIVE LANDSCAPE

- 9.1. Chapter Overview

- 9.2. Managed Service: Overall Market Landscape

- 9.2.1. Analysis by Year of Establishment

- 9.2.2. Analysis by Company Size

- 9.2.3. Analysis by Location of Headquarters

- 9.2.4. Analysis by Ownership Structure

10. WHITE SPACE ANALYSIS

11. COMPANY COMPETITIVENESS ANALYSIS

12. STARTUP ECOSYSTEM IN THE MANAGED SERVICE MARKET

- 12.1. Managed Services: Market Landscape of Startups

- 12.1.1. Analysis by Year of Establishment

- 12.1.2. Analysis by Company Size

- 12.1.3. Analysis by Company Size and Year of Establishment

- 12.1.4. Analysis by Location of Headquarters

- 12.1.5. Analysis by Company Size and Location of Headquarters

- 12.1.6. Analysis by Ownership Structure

- 12.2. Key Findings

SECTION IV: COMPANY PROFILES

13. COMPANY PROFILES

- 13.1. Chapter Overview

- 13.2. Accenture*

- 13.2.1. Company Overview

- 13.2.2. Company Mission

- 13.2.3. Company Footprint

- 13.2.4. Management Team

- 13.2.5. Contact Details

- 13.2.6. Financial Performance

- 13.2.7. Operating Business Segments

- 13.2.8. Service / Product Portfolio (project specific)

- 13.2.9. MOAT Analysis

- 13.2.10. Recent Developments and Future Outlook

- 13.3. Amazon

- 13.4. AT&T

- 13.5. Atos

- 13.6. Braodcom

- 13.7. Capgemini

- 13.8. Cisco

- 13.9. Digital Reality

- 13.10. Dimension Data

- 13.11. DXC

- 13.12. Fujitsu

- 13.13. GTT

- 13.14. HCL

- 13.15. IBM

- 13.16. Infosys

- 13.17. Microsoft

- 13.18. NTT DATA

- 13.19. Rackspace

- 13.20. ScalePad Software

- 13.21. Tata Communication Services

- 13.22. Telefonaktiebolaget

SECTION V: MARKET TRENDS

14. MEGA TRENDS ANALYSIS

15. UNMEET NEED ANALYSIS

16. PATENT ANALYSIS

17. RECENT DEVELOPMENTS

- 17.1. Chapter Overview

- 17.2. Recent Funding

- 17.3. Recent Partnerships

- 17.4. Other Recent Initiatives

SECTION VI: MARKET OPPORTUNITY ANALYSIS

18. GLOBAL MANAGED SERVICE MARKET

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Trends Disruption Impacting Market

- 18.4. Demand Side Trends

- 18.5. Supply Side Trends

- 18.6. Global Managed Service Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Multivariate Scenario Analysis

- 18.7.1. Conservative Scenario

- 18.7.2. Optimistic Scenario

- 18.8. Investment Feasibility Index

- 18.9. Key Market Segmentations

19. MARKET OPPORTUNITIES BASED ON TYPE OF SERVICE

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Managed Service Market for Managed Backup and Disaster Recovery: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. Managed Service Market for Managed Communication Service: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.8. Managed Service Market for Managed IT Infrastructure Service: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.9. Managed Service Market for Managed Mobility Services: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.10. Managed Service Market for Managed Network Services: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.11. Managed Service Market for Managed Security Service: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.12. Data Triangulation and Validation

- 19.12.1. Secondary Sources

- 19.12.2. Primary Sources

- 19.12.3. Statistical Modeling

20. MARKET OPPORTUNITIES BASED ON TYPE OF DEPLOYMENT

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Managed Service Market for Cloud-Based: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. Managed Service Market for On-Premises: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.8. Data Triangulation and Validation

- 20.8.1. Secondary Sources

- 20.8.2. Primary Sources

- 20.8.3. Statistical Modeling

21. MARKET OPPORTUNITIES BASED ON TYPE OF ENTERPRISE

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Managed Service Market for Large Enterprises: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Managed Service Market for Small and Medium-Sized Enterprises: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.8. Data Triangulation and Validation

- 21.8.1. Secondary Sources

- 21.8.2. Primary Sources

- 21.8.3. Statistical Modeling

22. MARKET OPPORTUNITIES BASED ON TYPE OF VERTICAL

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Managed Service Market for BFSI: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. Managed Service Market for Energy & Utility: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.8. Managed Service Market for Government: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.9. Managed Service Market for Healthcare: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.10. Managed Service Market for IT & Telecommunication: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.11. Managed Service Market for Manufacturing: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.12. Managed Service Market for Retail & E-commerce: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.13. Managed Service Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.14. Data Triangulation and Validation

- 22.14.1. Secondary Sources

- 22.14.2. Primary Sources

- 22.14.3. Statistical Modeling

23. MARKET OPPORTUNITIES FOR MANAGED SERVICES IN NORTH AMERICA

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Managed Service Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.1. Managed Service Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.2. Managed Service Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.3. Managed Service Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.4. Managed Service Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.7. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR MANAGED SERVICES IN EUROPE

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Managed Service Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.1. Managed Service Market in Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.2. Managed Service Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.3. Managed Service Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.4. Managed Service Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.5. Managed Service Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.6. Managed Service Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.7. Managed Service Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.8. Managed Service Market in Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.9. Managed Service Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.10. Managed Service Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.11. Managed Service Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.12. Managed Service Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.13. Managed Service Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.14. Managed Service Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.15. Managed Service Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR MANAGED SERVICES IN ASIA

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. Managed Service Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.1. Managed Service Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.2. Managed Service Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.3. Managed Service Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.4. Managed Service Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.5. Managed Service Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.6. Managed Service Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. MARKET OPPORTUNITIES FOR MANAGED SERVICES IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. Managed Service Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.1. Managed Service Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 26.6.2. Managed Service Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.3. Managed Service Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.4. Managed Service Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.5. Managed Service Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.6. Managed Service Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.7. Managed Service Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.8. Managed Service Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.7. Data Triangulation and Validation

27. MARKET OPPORTUNITIES FOR MANAGED SERVICES IN LATIN AMERICA

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Revenue Shift Analysis

- 27.4. Market Movement Analysis

- 27.5. Penetration-Growth (P-G) Matrix

- 27.6. Managed Service Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.1. Managed Service Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.2. Managed Service Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.3. Managed Service Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.4. Managed Service Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.5. Managed Service Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.6. Managed Service Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.7. Data Triangulation and Validation

28 MARKET OPPORTUNITIES FOR MANAGED SERVICES IN REST OF THE WORLD

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Revenue Shift Analysis

- 28.4. Market Movement Analysis

- 28.5. Penetration-Growth (P-G) Matrix

- 28.6. Managed Service Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.1. Managed Service Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.2. Managed Service Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.3. Managed Service Market in Other Countries

- 28.7. Data Triangulation and Validation

29. MARKET CONCENTRATION ANALYSIS: DISTRIBUTION BY LEADING PLAYERS

- 29.1. Leading Player 1

- 29.2. Leading Player 2

- 29.3. Leading Player 3

- 29.4. Leading Player 4

- 29.5. Leading Player 5

- 29.6. Leading Player 6

- 29.7. Leading Player 7

- 29.8. Leading Player 8

30. ADJACENT MARKET ANALYSIS

SECTION VII: STRATEGIC TOOLS

31. KEY WINNING STRATEGIES

32. PORTER'S FIVE FORCES ANALYSIS

33. SWOT ANALYSIS

34. VALUE CHAIN ANALYSIS

35. ROOTS STRATEGIC RECOMMENDATIONS

- 35.1. Chapter Overview

- 35.2. Key Business-related Strategies

- 35.2.1. Research & Development

- 35.2.2. Product Manufacturing

- 35.2.3. Commercialization / Go-to-Market

- 35.2.4. Sales and Marketing

- 35.3. Key Operations-related Strategies

- 35.3.1. Risk Management

- 35.3.2. Workforce

- 35.3.3. Finance

- 35.3.4. Others