|

市場調查報告書

商品編碼

1849866

機器狀態監測:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Machine Condition Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

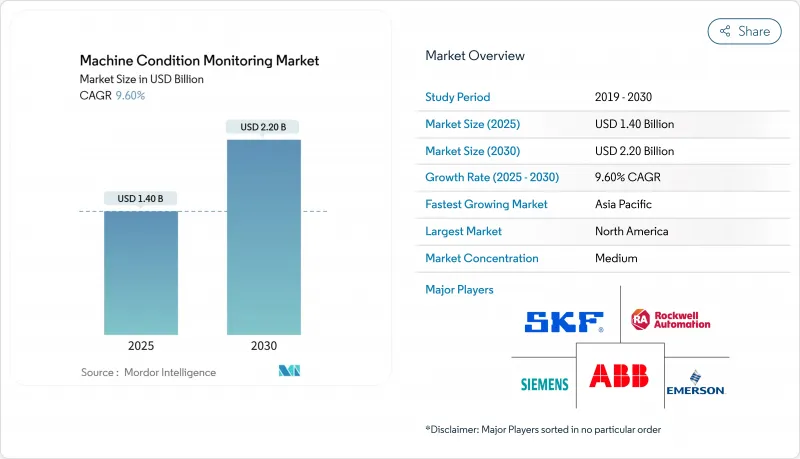

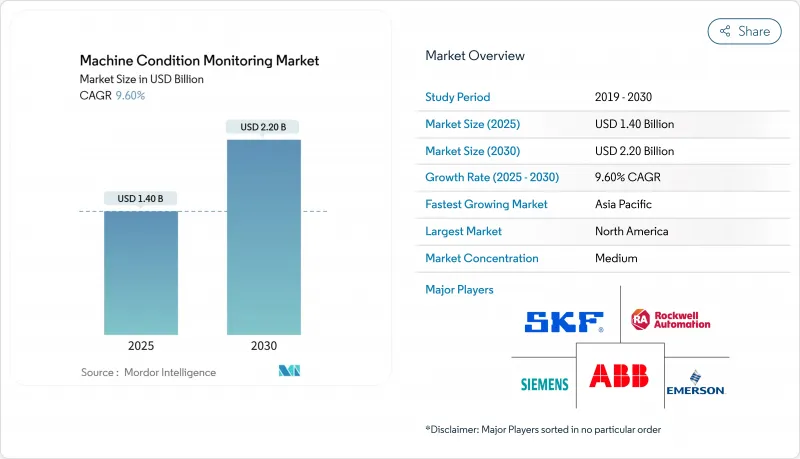

機器狀態監測市場預計到 2025 年將達到 14 億美元,到 2030 年將達到 22 億美元,複合年成長率為 9.6%。

這一勢頭的推動力源於無線工業物聯網感測器和人工智慧診斷平台的日益普及,這些平台縮短了決策週期。工業生產商面臨勞動力限制和更高的執行時間目標,這推動了對自動故障檢測系統的需求。無線感測器節點與邊緣分析相結合,降低了整體擁有成本,並將覆蓋範圍擴大到先前未受監控的小型資產。永續性要求將進一步推動採用,因為持續的能源性能洞察有助於製造商滿足排放揭露規則。競爭強度將保持適度,因為現有企業依賴其裝置量的規模,而專注於人工智慧的參與企業則透過高級分析和軟體即服務 (SaaS) 產品在價值上競爭。

全球機器狀態監測市場趨勢與洞察

強調預測性維護以減少非計劃性停機時間

由於非計畫停機每年對製造業造成500億美元的損失,企業正在用預測性方法取代基於日曆的維護,從而將停機時間減少20-50%,維護成本降低5-10%。機器學習演算法使用多感測器資料流提前數週識別故障,使團隊能夠在計劃停機期間進行干預。在汽車工廠,寶馬和特斯拉成功地利用即時分析來延長設備生命週期。數位雙胞胎模型透過模擬磨損場景和最佳化零件採購來改進計劃。

採用工業 4.0 邊緣分析平台

邊緣處理將分析功能轉移到感測器節點,消除了延遲,同時在網路中斷期間保持洞察。意法半導體將其微控制器定位於需要亞秒級檢測的狀態監控用例。西門子的 SIMOCODE M-CP 透過單對乙太網路將監控功能嵌入馬達控制中心,從而減少了佈線工作量,並將診斷功能擴展到小型馬達。早期採用者報告稱,其異常檢測精度達到毫秒級,頻寬節省高達 50%。

維修遺留棕地資產的成本

老舊設施通常缺乏感測器支架和網路主幹,因此實施需要進行工程變更、獲得安全核准,並分階段停工,這些過程可能持續一年半以上。美國指出,相互衝突的遺留政策是採用「基於狀態的維護升級版」的一大障礙,這與民用加工廠面臨的類似困境如出一轍。無線設備減輕了佈線的負擔,但電源和危險區域認證仍然會推高預算,促使企業根據計劃的關鍵程度分階段實施。

細分分析

到2024年,硬體將佔銷售額的45%,凸顯了感測器、閘道器和資料擷取單元在每個裝置中所扮演的重要角色。這一細分市場受益於微機電系統的穩定發展,該系統在提高靈敏度的同時降低了功耗。西門子透過SIMOCODE M-CP將硬體與可授權的分析模組結合,簡化了配電盤使用者的部署。斯凱孚與LKAB簽訂的價值6000萬美元的合約將振動測量和遠距離診斷整合到多年期協議中。

無線工業物聯網感測器網路預計年增率為 12.4%,證實了客戶對便利維修的偏好。隨著部署的擴展,整合平台將原始資料流轉換為維護工單,從而產生經常性的 SaaS 收入。這些因素為現有企業維持了規模經濟,同時為分析訂閱引入了新的利潤池。

到2024年,振動分析將保持34.2%的佔有率,因為專業人員依賴豐富的旋轉資產故障特徵庫,而設備製造商將加速計與採購捆綁銷售,從而增強了網路效應。由於工廠注重早期軸承故障檢測和壓縮空氣洩漏識別,即使在高噪音區域,超音波輻射預計將以每年11.8%的速度成長。

熱成像技術的應用將日益廣泛,人工智慧技術將在雲端儀錶板上標記熱異常,並藉助Teledyne FLIR與RealWear夥伴關係等穿戴式裝置的整合。馬達電流特徵和油液分析將增強診斷信心,並完善涵蓋電氣和潤滑系統的多模態套件。

區域分析

受嚴格的安全法規和工業4.0的早期部署支撐,北美地區將佔2024年銷售額的32.4%。美國美國)的排放報告和加州第253條法規正在推動企業持續進行效率測量。成熟的客戶群將進一步推動邊緣感測器的升級週期。

亞太地區年增率將達9.9%。中國和印度的智慧製造補貼將降低啟動成本,日本感測器創新中心將在2024年IEEE感測器大會上展示其專業知識。電池、半導體和可再生能源設備工廠將迅速擴張,並將預測性維護納入規劃中。

歐洲正在利用 ESG 框架來證明投資的合理性,中東正在調整對石油和天然氣大型企劃的監控,而隨著礦業公司將傳送帶車隊數位化以及水力發電廠尋求提高可靠性,拉丁美洲正在實現新的成長。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 專注於預測性維護以減少非計劃性停機時間

- 推出工業 4.0 邊緣分析平台

- 新興亞洲資產密集型產業快速成長

- 無線工業物聯網感測器大幅降低整體擁有成本

- 推動ESG主導的節能工廠營運

- 要求零容錯的軍事和太空計劃(低調)

- 市場限制

- 棕地資產維修成本

- 振動分析專家短缺

- 始終在線系統的網路安全問題

- 不斷上升的貿易壁壘正悄悄限制硬體供應鏈

- 價值/供應鏈分析

- 監管格局

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 按報價

- 硬體

- 軟體

- 服務

- 按監測方式

- 振動分析

- 熱成像

- 超音波發射

- 潤滑油分析

- 馬達電流特徵

- 腐蝕和磨損碎片

- 其他技術

- 按部署

- 線上/連續系統

- 可攜式/定期儀器

- 無線工業物聯網感測器網路

- 按最終用戶產業

- 石油和天然氣

- 發電

- 金屬和採礦

- 化學/石化產品

- 汽車和運輸

- 航太和國防

- 飲食

- 海洋

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 南美洲

- 巴西

- 阿根廷

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 亞洲

- 中國

- 日本

- 印度

- 韓國

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 非洲

- 南非

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- SKF AB

- Emerson Electric Co.(Bently Nevada)

- Rockwell Automation Inc.

- ABB Ltd.

- Siemens AG

- Meggitt PLC

- Bruel and Kjaer Vibro

- Fluke Corporation

- FLIR Systems Inc.

- Parker Hannifin Corp.(Kittiwake)

- AMETEK Inc.(Spectro Scientific)

- Thermo Fisher Scientific Inc.

- Bentley Nevada(Baker Hughes)

- Schaeffler Group

- Azima DLI

- Honeywell International Inc.

- National Instruments Corp.

- Schneider Electric SE

- Gastops Ltd.

- Wilcoxon Sensing Technologies

第7章 市場機會與未來展望

The machine condition monitoring market reached a value of USD 1.4 billion in 2025 and is on course to attain USD 2.2 billion by 2030, reflecting a 9.6% CAGR.

The shift from reactive repair to data-driven predictive maintenance underpins this momentum, supported by rising wireless IIoT sensor deployments and AI-enabled diagnostics platforms that shorten decision cycles. Industrial producers face constrained workforces and escalating uptime targets, which heighten demand for automated fault-detection systems. Wireless sensor nodes paired with edge analytics reduce total cost of ownership and unlock coverage for smaller, previously unmonitored assets. Sustainability mandates further elevate adoption because continuous insight into energy performance helps manufacturers meet emissions disclosure rules. Competitive intensity remains moderate as incumbents rely on installed-base scale while AI-centric entrants contest value through advanced analytics and SaaS delivery.

Global Machine Condition Monitoring Market Trends and Insights

Predictive-maintenance focus to cut unplanned downtime

Manufacturing operations lose USD 50 billion each year to surprise stoppages, so firms are replacing calendar-based servicing with predictive approaches that trim downtime by 20-50% and maintenance spend by 5-10% . Machine-learning algorithms draw on multi-sensor data streams to pinpoint failures weeks ahead, letting teams intervene during scheduled pauses. Automotive plants show success as BMW and Tesla extend equipment life cycles using real-time analytics . Digital twin models refine schedules by simulating wear scenarios and optimizing parts procurement.

Adoption of industry 4.0 edge-analytics platforms

Edge processing moves analytics to the sensor node, eliminating latency while maintaining insight during network outages. STMicroelectronics positions its microcontrollers for condition monitoring use cases that require sub-second detection . Siemens' SIMOCODE M-CP embeds monitoring within motor control centers via Single Pair Ethernet, trimming wiring effort and extending diagnostics to smaller motors . Early adopters report millisecond-level anomaly detection and bandwidth cuts of up to 50%.

Retrofit cost for legacy brown-field assets

Older facilities rarely feature sensor mounts or network backbones, so rollout involves engineering changes, safety approvals, and staged shutdowns that can stretch over 18 months. The US Marine Corps flagged conflicting legacy policies as barriers during Condition Based Maintenance Plus adoption, echoing similar struggles in civilian process plants. Wireless devices ease wiring pain yet power delivery and hazardous-area certification still raise budgets, prompting firms to phase projects by criticality.

Other drivers and restraints analyzed in the detailed report include:

- Surging Asset-intensive sectors in emerging Asia

- Wireless IIoT sensors slashing total cost of ownership

- ESG-driven push for energy-efficient plant operations

- Shortage of vibration-analysis specialists

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware claimed 45% of 2024 revenue, underscoring the indispensable role of sensors, gateways, and acquisition units in every installation. This segment benefits from steady advances in micro-electromechanical systems that boost sensitivity while lowering power draw. Siemens blended hardware with licensable analytics modules in its SIMOCODE M-CP to simplify adoption for switchboard users . Services revenue expands as manufacturers outsource round-the-clock surveillance; SKF's USD 60 million agreement with LKAB packages vibration measurements and remote diagnostics into a multi-year contract.

Wireless IIoT sensor networks are forecast to grow at 12.4% annually, underlining customer preference for low-touch retrofits. As adoption broadens, integrated platforms convert raw streams into maintenance tickets, creating recurring SaaS income. These factors collectively preserve scale benefits for incumbents while introducing fresh margin pools in analytics subscriptions.

Vibration analysis retained 34.2% share in 2024. Practitioners trust its rich fault signature library for rotating assets, and equipment makers bundle accelerometers at purchase, reinforcing network effects. Ultrasound emission is projected to expand 11.8% per year as plants value early bearing fault detection and compressed-air leak identification even in high-noise areas.

Thermography adoption rises with AI that flags thermal anomalies in cloud dashboards, aided by wearable integrations like the Teledyne FLIR and RealWear partnership. Motor current signature and oil analysis round out multi-modal suites that boost diagnostic confidence and extend reach into electrical and lubrication systems.

The Machine Condition Monitoring Market report segments the industry into Type (Hardware [Vibration Condition Monitoring Equipment, Thermography Equipment, and more], Software, Services), End User Industry (Oil and Gas, Power Generation, and more), and Geography (North America [United States, Canada], Europe [United Kingdom, Germany, France], Asia [China, Japan, India], and more).

Geography Analysis

North America held 32.4% of 2024 revenue, sustained by stringent safety codes and early Industry 4.0 rollouts. SEC emissions reporting and California SB 253 guide firms toward continuous efficiency measurement . Mature installed bases further encourage upgrade cycles to edge-capable sensors.

Asia-Pacific is poised for 9.9% annual growth. Smart-manufacturing subsidies in China and India defray upfront costs, while Japan's sensor innovation hub showcases domain expertise at IEEE SENSORS 2024 . Rapid expansion of battery, semiconductor, and renewable-equipment factories embeds predictive maintenance from conception.

Europe leverages ESG frameworks to justify investment, and the Middle East aligns monitoring with oil and gas mega-projects. Latin America records emerging growth as miners digitalize conveyor fleets and hydro plants seek reliability uplift.

- SKF AB

- Emerson Electric Co. (Bently Nevada)

- Rockwell Automation Inc.

- ABB Ltd.

- Siemens AG

- Meggitt PLC

- Bruel and Kjaer Vibro

- Fluke Corporation

- FLIR Systems Inc.

- Parker Hannifin Corp. (Kittiwake)

- AMETEK Inc. (Spectro Scientific)

- Thermo Fisher Scientific Inc.

- Bentley Nevada (Baker Hughes)

- Schaeffler Group

- Azima DLI

- Honeywell International Inc.

- National Instruments Corp.

- Schneider Electric SE

- Gastops Ltd.

- Wilcoxon Sensing Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Predictive-maintenance focus to cut unplanned downtime

- 4.2.2 Adoption of Industry 4.0 edge-analytics platforms

- 4.2.3 Surging asset-intensive sectors in emerging Asia

- 4.2.4 Wireless IIoT sensors slashing total cost of ownership

- 4.2.5 ESG-driven push for energy-efficient plant operations

- 4.2.6 Military & space programs requiring zero-fault tolerance (under-the-radar)

- 4.3 Market Restraints

- 4.3.1 Retrofit cost for legacy brown-field assets

- 4.3.2 Shortage of vibration-analysis specialists

- 4.3.3 Cyber-security concerns in always-connected systems

- 4.3.4 Rising trade barriers limiting hardware supply chains (under-the-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE & GROWTH FORECASTS

- 5.1 By Offering

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Monitoring Technique

- 5.2.1 Vibration Analysis

- 5.2.2 Thermography

- 5.2.3 Ultrasound Emission

- 5.2.4 Lubricating-Oil Analysis

- 5.2.5 Motor-Current Signature

- 5.2.6 Corrosion & Wear Debris

- 5.2.7 Other Techniques

- 5.3 By Deployment

- 5.3.1 Online/Continuous Systems

- 5.3.2 Portable/Periodic Instruments

- 5.3.3 Wireless IIoT Sensor Networks

- 5.4 By End-user Industry

- 5.4.1 Oil & Gas

- 5.4.2 Power Generation

- 5.4.3 Metals & Mining

- 5.4.4 Chemicals & Petrochemicals

- 5.4.5 Automotive & Transportation

- 5.4.6 Aerospace & Defense

- 5.4.7 Food & Beverage

- 5.4.8 Marine

- 5.4.9 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Russia

- 5.5.4 Asia

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.5 Middle East & Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 UAE

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 SKF AB

- 6.4.2 Emerson Electric Co. (Bently Nevada)

- 6.4.3 Rockwell Automation Inc.

- 6.4.4 ABB Ltd.

- 6.4.5 Siemens AG

- 6.4.6 Meggitt PLC

- 6.4.7 Bruel and Kjaer Vibro

- 6.4.8 Fluke Corporation

- 6.4.9 FLIR Systems Inc.

- 6.4.10 Parker Hannifin Corp. (Kittiwake)

- 6.4.11 AMETEK Inc. (Spectro Scientific)

- 6.4.12 Thermo Fisher Scientific Inc.

- 6.4.13 Bentley Nevada (Baker Hughes)

- 6.4.14 Schaeffler Group

- 6.4.15 Azima DLI

- 6.4.16 Honeywell International Inc.

- 6.4.17 National Instruments Corp.

- 6.4.18 Schneider Electric SE

- 6.4.19 Gastops Ltd.

- 6.4.20 Wilcoxon Sensing Technologies

7 MARKET OPPORTUNITIES & FUTURE OUTLOOK

- 7.1 White-space & Unmet-need Assessment