|

市場調查報告書

商品編碼

1848124

中東歐貨運與物流:市場佔有率分析、產業趨勢、統計數據與成長預測(2025-2030 年)Central And Eastern Europe Freight And Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

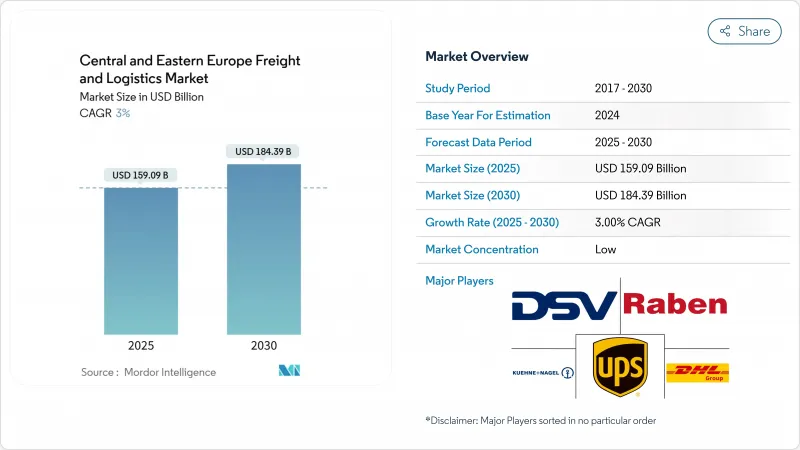

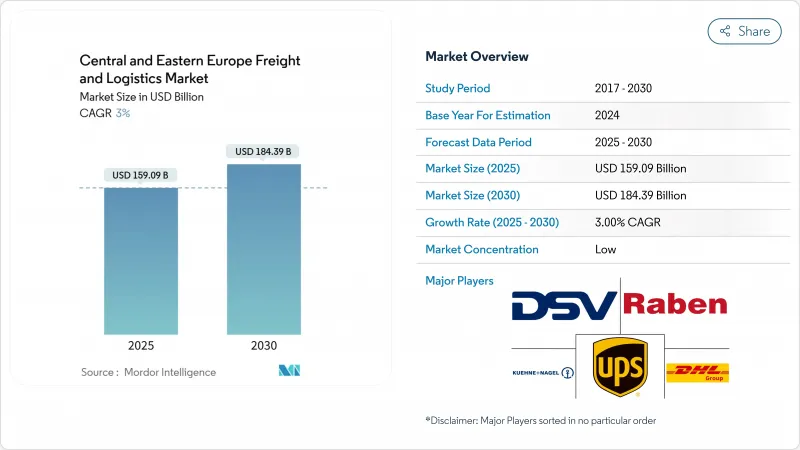

2025年,中東歐貨運和物流市場規模為1,590.9億美元,預計2030年將達到1,843.9億美元,2025年至2030年複合年成長率將達到3.00%。

德國原始設備製造商的近岸外包、泛歐交通運輸網路(TEN-T)走廊升級改造的加速以及該地區的數位轉型,正在增強關鍵物流職能的持續需求。波蘭作為中歐鐵路走廊的樞紐地位、核心物流園區5G技術的日益普及,以及歐盟綠色交易對鐵路和水路運輸的優惠待遇,進一步凸顯了中東歐貨運和物流市場與西歐市場的差異。諸如DSV收購德鐵信可(DB Schenker)等整合舉措,正在提升主導效益,而技術驅動型貨運代理商則為市場注入了競爭活力。主要風險包括專業司機日益短缺、歐盟以外邊境間歇性堵塞以及低溫運輸能力建設的延遲,這些都可能抑製成長勢頭。

中東歐貨運物流市場趨勢及洞察

升級歐盟泛歐交通運輸網(TEN-T)走廊,以提高多式聯運效率

最新一輪泛歐交通網路(TEN-T)資金籌措計畫於2024年向中東歐計劃撥款25億歐元(約27.5億美元),旨在加速歐洲鐵路交通管理系統(ERTMS)的實施,並將跨境鐵路停留時間縮短高達30%。華沙-柏林和布達佩斯-維也納線路的營運商報告稱,效率提升了15%至20%,為新的鐵路-公路聯運服務奠定了基礎,並深化了中東歐貨運和物流市場的多式聯運能力。互聯互通的改善使波蘭的貨運站能夠將日益成長的中歐鐵路貨運量分流至鄰國捷克和斯洛伐克的樞紐,從而形成網路效應,在季節性尖峰時段保持貨運價格穩定。修訂後的多式聯運指令目標進一步獎勵托運人將中程運輸從公路轉向鐵路,從而推動長期碳排放減少和成本節約。

德國汽車供應鏈將回流,重點轉向波蘭和斯洛伐克。

現代汽車、Vitesco Technologies 和 Chassix 正在中東歐地區總合投資超過 5.76 億歐元(約 6.3569 億美元)新建廠,旨在加強當地電池系統和動力傳動系統製造生態系統。僅匈牙利一國就吸引了 188 億美元的電動車領域外國直接投資,使其成為歐洲電池之都之一。一級供應商的遷址需要保稅、溫控貨物運輸和專業倉儲,從而增強了中東歐貨運和物流市場在公路、鐵路和航空運輸方式上的需求彈性。斯洛伐克優惠的稅收政策和波蘭成熟的汽車產業叢集促進了密集的物流通道,使那些專門為德國組裝廠提供限時快速運輸服務的貨運代理商受益。

中東歐道路運輸長期面臨司機短缺問題

到2024年,歐盟範圍內的司機缺口將超過23.3萬人,捷克運輸協會指出,當地就有2.5萬個職缺。司機的平均年齡超過50歲,歐盟「流動性一攬子計畫」規定的強制休息期給車隊生產力帶來了壓力。每年15%至20%的薪資通膨推高了公路貨運價格,這可能會促使托運人轉向鐵路和多式聯運。一些波蘭運輸公司正在部署高級駕駛輔助系統(ADAS),並在受控路段進行自動駕駛試驗,但全面商業化部署仍需數年時間。持續的供不應求正在影響中東歐貨運和物流市場的運力限制和服務可靠性。

細分市場分析

預計到 2024 年,批發和零售將佔 30.51% 的市場佔有率,2025 年至 2030 年的複合年成長率為 3.21%,屆時電子商務商品交易總額 (GMV) 將達到 429 億美元。大型超市和連鎖超市正在改造其配送中心,以達到當日送達的標準,並將自動化支出注入中東歐貨運和物流市場。

製造業正經歷強勁成長,主要由汽車和電子產業叢集推動。波蘭和匈牙利的電池超級工廠促進了包括鋰離子電池在內的專業入境物流,這些電池需要符合ADR標準的溫控運輸,為營運商帶來更高的收益。

至2024年,貨運代理業務將佔總收入的65.13%,凸顯其在滿足整個貨運和物流市場製造和分銷需求方面發揮的關鍵作用。公路、鐵路和多式聯運業者正受益於強勁的跨境貿易,尤其是波蘭和德國之間的貿易。在汽車近岸外包和歐亞鐵路運輸的推動下,中東歐的貨運和物流市場規模預計將進一步擴大。小包裹樞紐的自動化和收貨點網路的擴展將縮短交付週期,推動2025年至2030年複合年成長率達到3.44%。數位化平台能夠實現即時價格發現和運力匹配,使貨運代理商能夠在統一的控制面板下整合貨運代理和CEP服務。這些服務的互動支持靈活的端到端解決方案,吸引尋求高韌性的跨國托運人。

歷史韌性顯而易見。儘管2020年主權挑戰和疫情衝擊導致經濟活動放緩,但電子商務的成長推動了CEP(中東歐物流)業務在2024年的市佔率成長。倉儲物流業務維持了穩定的中個位數成長,這得益於全通路零售商對更高庫存緩衝的需求。數位仲介利用API介面連接航空公司和鐵路公司,實現貿易路線多元化,從而提升了貨運代理的價值,成為中東歐貨運物流產業新的差異化優勢。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 人口統計數據

- 按經濟活動分類的GDP分配

- 按經濟活動分類的GDP成長

- 通貨膨脹

- 經濟表現及概況

- 電子商務產業的趨勢

- 製造業趨勢

- 運輸和倉儲部門的GDP

- 出口趨勢

- 進口趨勢

- 燃油價格

- 物流績效

- 模態共享

- 貨物價格趨勢

- 貨物噸位趨勢

- 基礎設施

- 法規結構(公路和鐵路)

- 法規結構(海事和空域)

- 價值鍊和通路分析

- 市場促進因素

- 歐盟泛歐交通運輸網(TEN-T)走廊升級改造將提升多式聯運效率

- 德國汽車供應鏈正向本土轉移,目標瞄準波蘭和斯洛伐克。

- 歐盟綠色交易中鐵路和水路運輸的模式轉換資金

- 能源安全措施與供應路線多元化

- 新絲路沿線中國與歐洲之間鐵路貨運量增加

- 在主要物流樞紐部署 5G/ITS

- 市場限制

- 中歐和東歐道路運輸長期面臨司機短缺問題。

- 歐盟外部邊界堵塞

- 低溫運輸基礎設施不發達阻礙成長

- 區域內A級倉庫物資供應狀況

- 市場創新

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 終端用戶產業

- 農業、漁業、林業

- 建造

- 製造業

- 石油天然氣、採礦和採石

- 批發和零售

- 其他

- 物流職能

- 宅配、速遞和小包裹(CEP)

- 目的地類型

- 國內的

- 國際的

- 貨物運輸

- 透過交通工具

- 航空

- 海洋和內陸水道

- 其他

- 貨物運輸

- 透過交通工具

- 航空

- 管道

- 鐵路

- 路

- 海洋和內陸水道

- 倉儲和存儲

- 溫度控制

- 無溫度控制

- 溫度控制

- 其他服務

- 宅配、速遞和小包裹(CEP)

- 按地區

- 阿爾巴尼亞

- 保加利亞

- 克羅埃西亞

- 捷克共和國

- 愛沙尼亞

- 匈牙利

- 拉脫維亞

- 立陶宛

- 波蘭

- 羅馬尼亞

- 斯洛伐克共和國

- 斯洛維尼亞

- 中歐和東歐其他地區

第6章 競爭情勢

- 市場集中度

- 重大策略舉措

- 市佔率分析

- 公司簡介

- Cargus

- CMA CGM Group(Including CEVA Logistics)

- DACHSER

- DHL Group

- DSV A/S(Including DB Schenker)

- Expeditors International

- FedEx

- Gebruder Weiss

- GEODIS

- Hamburger Hafen und Logistik AG(Including METRANS)

- Kuehne+Nagel

- La Poste Group(Including GeoPost)

- Magyar Posta Zrt

- NYK(Nippon Yusen Kaisha)Line

- OBB-Holding AG(Including Rail Cargo Group)

- PKP CARGO SA

- Raben Group

- Rhenus Group

- ROHLIG SUUS Logistics SA

- United Parcel Service of America, Inc.(UPS)

- Waberer's International Nyrt.

- Walter Group

第7章 市場機會與未來展望

The Central and Eastern Europe freight and logistics market size is valued at USD 159.09 billion in 2025 and is projected to reach USD 184.39 billion by 2030, translating into a steady 3.00% CAGR over 2025-2030.

Nearshoring by German OEMs, accelerated TEN-T corridor upgrades, and the region's digital transformation are reinforcing sustained demand across all major logistics functions. Poland's hub status along the China-Europe rail corridor, rising 5G deployments in core logistics parks, and EU Green Deal incentives for rail and waterways further differentiate the Central and Eastern Europe freight and logistics market from Western European peers. Consolidation activity, such as DSV's purchase of DB Schenker, is elevating scale-driven efficiencies, while technology-enabled forwarders inject competitive dynamism. Key risks include a widening professional driver deficit, intermittent border congestion at EU external frontiers, and lagging cold-chain capacity that could temper growth momentum.

Central And Eastern Europe Freight And Logistics Market Trends and Insights

European Union TEN-T Corridor Upgrades Enabling Intermodal Efficiencies

The latest Trans-European transport network (TEN-T) financing round earmarked EUR 2.5 billion (USD 2.75 billion) for CEE projects in 2024, accelerating European rail traffic management system (ERTMS) deployment and cutting cross-border rail dwell times by up to 30%. Operators on the Warsaw-Berlin and Budapest-Vienna routes report 15-20% efficiency gains, underpinning new rail-road service offerings that deepen the Central and Eastern Europe freight and logistics market's multimodal capabilities. Improved connectivity allows Polish terminals to funnel higher China-Europe rail volumes into adjacent Czech and Slovak hubs, creating network effects that sustain rate stability during seasonal peaks. Revised Combined Transport Directive targets further incentivize shippers to shift medium-distance traffic from road to rail, fostering long-run carbon and cost savings.

German Auto Supply Chains Shift Closer to Home with Poland and Slovakia in Focus

Hyundai, Vitesco Technologies, and Chassix have collectively slated more than EUR 576 million (USD 635.69 million) toward new CEE plants, reinforcing the local production ecosystem for battery systems and powertrains. Hungary alone secured USD 18.8 billion in electromobility FDI, positioning the country among Europe's battery capitals. Relocated tier-1 suppliers require bonded, temperature-controlled freight and specialized warehousing, with lifting demand elasticity across road, rail, and air modes within the Central and Eastern Europe freight and logistics market. Slovakia's favorable tax framework and Poland's established automotive clusters cultivate dense distribution lanes that benefit freight forwarders specializing in time-critical deliveries to German assembly plants.

Chronic Driver Shortage Noticed in CEE Road Haulage

EU-wide driver gaps topped 233,000 positions in 2024, with Czech transport associations citing 25,000 vacancies locally. The average driver age now exceeds 50, and stricter rest-time mandates under the EU Mobility Package squeeze fleet productivity. Wage inflation of 15-20% annually elevates road freight tariffs, potentially nudging shippers toward rail and intermodal options. Several Polish carriers have introduced advanced driver assistance Systems (ADAS) and autonomous trials on controlled corridors, though full commercial roll-out remains years away. Persistent shortages weigh on the Central and Eastern Europe freight and logistics market's capacity ceiling and service reliability.

Other drivers and restraints analyzed in the detailed report include:

- China-Europe Rail Freight Growth Witnessed via New Silk Road

- European Union Green Deal Modal Shift Funding to Rail and Waterways

- Border Congestion Witnessed at EU External Frontiers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wholesale and retail trade dominated with a 30.51% share in 2024 and is projected to grow at a 3.21% CAGR (2025-2030) as e-commerce gross merchandise value (GMV) hits USD 42.9 billion in 2024. Big-box and grocery chains are overhauling distribution centers to meet same-day delivery benchmarks, injecting automation spending into the Central and Eastern Europe freight and logistics market.

Manufacturing is growing significantly, largely on the back of auto and electronics clusters. Battery gigafactories in Poland and Hungary drive specialized inbound flows, including lithium-ion cells that demand ADR-compliant, temperature-controlled transport, boosting premium yields for operators.

Freight transport captured 65.13% of 2024 revenue, underscoring its foundational role in meeting manufacturing and distribution needs across the Central and Eastern Europe Freight and Logistics market. Road, rail, and intermodal carriers benefit from robust cross-border trade, particularly along Poland-Germany lanes. The Central and Eastern Europe freight and logistics market size is projected to grow, supported by automotive nearshoring and Eurasian rail flows. CEP, although smaller, is rising fastest; automation in parcel hubs and expansion of pick-up point networks shorten delivery cycles and fuel a 3.44% CAGR (2025-2030). Digital platforms enable real-time price discovery and capacity matching, allowing forwarders to integrate Freight Transport and CEP services under unified dashboards. The interplay of these services underpins flexible, end-to-end solutions that attract multinational shippers seeking resilience.

Historical resilience is evident: sovereignty-related challenges and pandemic shocks slowed activity in 2020, yet e-commerce growth spurred the CEP segment's share in 2024. Warehousing and storage posted stable, mid-single-digit growth as omnichannel retailers demanded higher inventory buffers. Freight Forwarding added value through trade route diversification, with digital brokers exploiting API connectivity to airlines and rail operators, an emerging differentiator in the Central and Eastern Europe freight and logistics industry.

The Central and Eastern Europe Freight and Logistics Market Report is Segmented by End User Industry (Construction, Manufacturing, Wholesale and Retail Trade, and More), by Logistics Function (Courier, Express, and Parcel (CEP), Freight Forwarding, Freight Transport, Warehousing and Storage, and More) and by Geography (Albania, Bulgaria, Croatia, Czech Republic, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Cargus

- CMA CGM Group (Including CEVA Logistics)

- DACHSER

- DHL Group

- DSV A/S (Including DB Schenker)

- Expeditors International

- FedEx

- Gebruder Weiss

- GEODIS

- Hamburger Hafen und Logistik AG (Including METRANS)

- Kuehne+Nagel

- La Poste Group (Including GeoPost)

- Magyar Posta Zrt

- NYK (Nippon Yusen Kaisha) Line

- OBB-Holding AG (Including Rail Cargo Group)

- PKP CARGO SA

- Raben Group

- Rhenus Group

- ROHLIG SUUS Logistics SA

- United Parcel Service of America, Inc. (UPS)

- Waberer's International Nyrt.

- Walter Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Logistics Performance

- 4.12 Modal Share

- 4.13 Freight Pricing Trends

- 4.14 Freight Tonnage Trends

- 4.15 Infrastructure

- 4.16 Regulatory Framework (Road and Rail)

- 4.17 Regulatory Framework (Sea and Air)

- 4.18 Value Chain and Distribution Channel Analysis

- 4.19 Market Drivers

- 4.19.1 European Union TEN-T Corridor Upgrades Enabling Intermodal Efficiencies

- 4.19.2 German Auto Supply Chains Shift Closer to Home with Poland and Slovakia in Focus

- 4.19.3 European Union Green Deal Modal Shift Funding to Rail and Waterways

- 4.19.4 Energy Security Initiatives and Supply Route Diversification

- 4.19.5 China-Europe Rail Freight Growth Witnessed via New Silk Road

- 4.19.6 5G / ITS Roll-Out Witnessed in Key Logistics Hubs

- 4.20 Market Restraints

- 4.20.1 Chronic Driver Shortage Noticed in CEE Road Haulage

- 4.20.2 Border Congestion Witnessed at EU External Frontiers

- 4.20.3 Under-Developed Cold-Chain Infrastructure Curtailing Growth

- 4.20.4 Fragmented Grade-A Warehousing Supply in the Region

- 4.21 Technology Innovations in the Market

- 4.22 Porter's Five Forces Analysis

- 4.22.1 Threat of New Entrants

- 4.22.2 Bargaining Power of Suppliers

- 4.22.3 Bargaining Power of Buyers

- 4.22.4 Threat of Substitutes

- 4.22.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.3 Geography

- 5.3.1 Albania

- 5.3.2 Bulgaria

- 5.3.3 Croatia

- 5.3.4 Czech Republic

- 5.3.5 Estonia

- 5.3.6 Hungary

- 5.3.7 Latvia

- 5.3.8 Lithuania

- 5.3.9 Poland

- 5.3.10 Romania

- 5.3.11 Slovak Republic

- 5.3.12 Slovenia

- 5.3.13 Rest of CEE

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Cargus

- 6.4.2 CMA CGM Group (Including CEVA Logistics)

- 6.4.3 DACHSER

- 6.4.4 DHL Group

- 6.4.5 DSV A/S (Including DB Schenker)

- 6.4.6 Expeditors International

- 6.4.7 FedEx

- 6.4.8 Gebruder Weiss

- 6.4.9 GEODIS

- 6.4.10 Hamburger Hafen und Logistik AG (Including METRANS)

- 6.4.11 Kuehne+Nagel

- 6.4.12 La Poste Group (Including GeoPost)

- 6.4.13 Magyar Posta Zrt

- 6.4.14 NYK (Nippon Yusen Kaisha) Line

- 6.4.15 OBB-Holding AG (Including Rail Cargo Group)

- 6.4.16 PKP CARGO SA

- 6.4.17 Raben Group

- 6.4.18 Rhenus Group

- 6.4.19 ROHLIG SUUS Logistics SA

- 6.4.20 United Parcel Service of America, Inc. (UPS)

- 6.4.21 Waberer's International Nyrt.

- 6.4.22 Walter Group

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment