|

市場調查報告書

商品編碼

1848123

印度澱粉及澱粉衍生物:市佔率分析、產業趨勢、統計及成長預測(2025-2030)India Starch And Starch Derivative - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

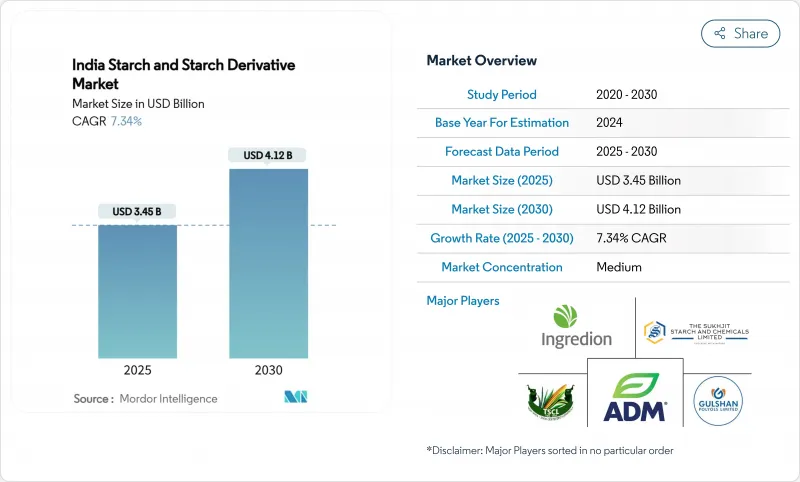

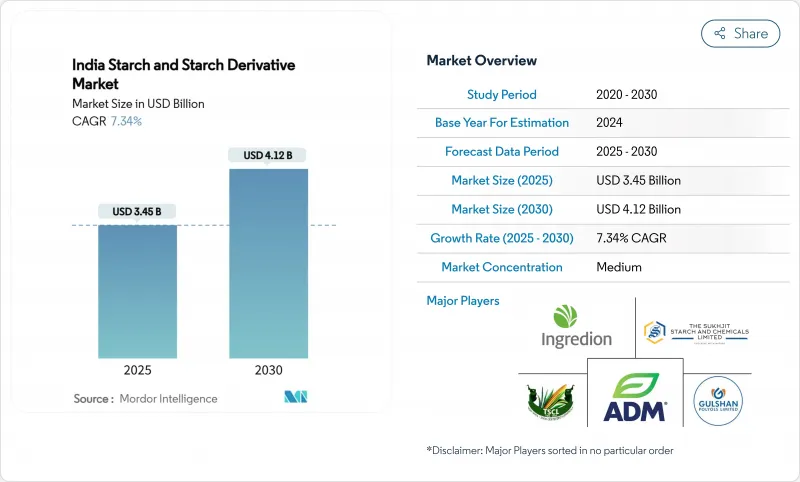

預計到 2025 年,印度澱粉及澱粉衍生物市場規模將達到 34.5 億美元,到 2030 年將達到 41.2 億美元,年複合成長率為 7.34%。

成長的促進因素包括:乙醇摻混政策帶來的玉米需求增加;食品飲料產業對潔淨標示改質澱粉的需求日益成長;以及一次性塑膠禁令實施後,政府政策轉向澱粉基生質塑膠塑膠。同時,製藥業的擴張(環糊精可改善藥物傳輸)和電商包裝產業(澱粉黏合劑取代合成黏合劑)也進一步提升了商機。關鍵的推動因素包括:印度一體化的玉米供應鏈;政府設定的到2025年2月實現17.98%乙醇摻混率的目標;以及為滿足潛在澱粉需求而對新型聚乳酸(PLA)計劃進行的持續投資。然而,玉米價格波動、基因改造生物(GMO)相關的品質審查以及濕磨產能有限等因素,在短期內將對淨利率構成壓力,凸顯了原料避險和製程改進的必要性。

印度澱粉及澱粉衍生物市場趨勢與洞察

整合豐富的國內玉米供應鏈

根據美國農業部海外農業局的報告,預計印度2024/25年度的玉米產量將達到3,700萬噸。如此強勁的玉米產量為澱粉生產商帶來了戰略優勢。整合國內供應鏈不僅降低了印度對進口的依賴,還能帶來成本優勢,尤其是在全球玉米價格波動的情況下。印度約14%的玉米產量用於澱粉生產,這為該產業的擴張奠定了堅實的基礎。政府的「數位農業計畫」等舉措極大地促進了這一領域的發展,該計畫旨在透過技術整合實現農業現代化。此外,包括倉儲和加工設施收穫後基礎設施的進步也加強了供應鏈。這些發展不僅提高了農業生產力,也使國內生產商在與依賴進口的競爭對手的較量中佔據優勢,從而促進澱粉製造業的長期成長。

潔淨標示改質澱粉的需求激增

根據美國農業部預測,到2025-2026會計年度,印度食品加工業的規模將達到5,350億美元,而向「潔淨標示」產品的轉變正在改變這一行業。注重健康的都市區消費者越來越傾向選擇天然改質澱粉來替代合成添加劑。根據《食品配料第一》雜誌報道,企業目前正大力採用改性澱粉體系來改善食品的質地和口感,並優先考慮「潔淨標示」配方。交聯澱粉尤其因其在加工食品中優異的穩定性和功能性優勢而成為熱門選擇,其對逆變性和凍融循環的抵抗力尤為出色。食品生產商採用這些改性澱粉不僅是為了符合監管標準,也是為了維持產品質量,從而推動了烘焙、乳製品和簡便食品領域的持續需求成長。

由於乙醇挪用增加,玉米價格出現波動

印度從玉米出口國轉變為淨進口國,導致玉米價格劇烈波動。受乙醇需求推動,玉米價格飆升至每公擔27.35美元,乙醇每年消耗600萬至700萬噸玉米。此次價格上漲直接影響澱粉生產商的原料成本,對採購能力較弱的小型生產商打擊尤為嚴重。為因應這些挑戰,印度政府正考慮以較低的關稅進口基改玉米以緩解供不應求。然而,監管部門的核准時間表仍不明朗。同時,雞肉生產商呼籲免關稅進口玉米,凸顯了整個供應鏈面臨的壓力及其對澱粉產業競爭力的影響。由於玉米成本佔許多澱粉衍生物生產成本的60%至70%,因此這種價格波動為生產商的計畫制定帶來了巨大挑戰。因此,企業不得不採取複雜的避險策略,或將增加的成本轉嫁給下游客戶。

細分市場分析

到2024年,原澱粉將佔40.34%的市場佔有率,這主要得益於其成本優勢以及在食品加工和工業領域的廣泛應用。另一方面,改性澱粉是成長最快的細分市場,預計到2030年將以8.02%的複合年成長率成長。這種快速成長主要由一些特殊應用推動,這些應用需要增強功能特性,例如提高穩定性、改善質地以及符合潔淨標示標準。澱粉衍生物,例如葡萄糖漿和麥芽糊精,在乙醇和食品加工行業的需求都很旺盛。特別是葡萄糖漿,受益於政府強制要求與乙醇混合的政策。

這些細分市場的發展凸顯了印度澱粉產業格局的演變。雖然傳統天然澱粉在紡織和造紙行業中已佔據一席之地,但市場正顯著轉向用於製藥和特殊食品的高附加價值改性澱粉產品。交聯澱粉因其在加工食品中的穩定性而日益受到青睞。同時,正如RSC Pharm所強調的,環糊精衍生物在藥物傳遞系統的應用也日益廣泛。高果糖玉米糖漿(HFCS)和糊精雖然滿足了特定市場的需求,但卻難以與天然甜味劑競爭,這反映出消費者正在轉向「潔淨標示」產品。

到2024年,玉米將佔據62.34%的市場佔有率,這主要得益於印度作為世界第四大玉米產區的地位,以及集中在古吉拉突邦、旁遮普邦和馬哈拉斯特拉邦的強大的濕磨加工基礎設施。馬鈴薯澱粉是成長最快的細分市場,預計到2030年將維持8.55%的複合年成長率。這一成長主要得益於其優異的功能特性以及在醫藥輔料和特種食品領域日益成長的應用。小麥澱粉將繼續保持其在傳統用途方面的穩定需求,而木薯澱粉則滿足了對特定黏度特性有特殊要求的工業需求。

澱粉來源多元化凸顯了製造商在價格波動擔憂下,為管理風險、降低對單一來源的依賴所做的努力。例如,Anil Limited 營運著印度最大的玉米濕磨廠之一,日產能達 550 噸,展現了其在玉米加工領域的規模優勢。此外,人們也在探索其他澱粉來源,例如稗草澱粉,因為它們具有永續性和獨特的理化性質,但其商業性擴充性仍有限。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 整合豐富的國內玉米供應鏈

- 潔淨標示改質澱粉的需求激增

- 電子商務對紙張和包裝澱粉的需求

- 政府的乙醇摻混計畫促進了葡萄糖漿的生產。

- 澱粉基生質塑膠的出現,使其成為一次性塑膠的替代品

- 印度藥物遞送系統中環糊精的應用

- 市場限制

- 由於乙醇挪用增加,玉米價格出現波動

- 由於含有基因改造成分,人們對產品品質表示擔憂。

- 小型濕磨機限制了品質的一致性。

- 一次性塑膠替代品推廣應用方面的監管不確定性

- 供應鏈分析

- 監理展望

- 波特五力模型

- 新進入者的威脅

- 買方/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按類型

- 天然澱粉

- 改性澱粉

- 澱粉衍生物

- 葡萄糖漿

- 高果糖玉米糖漿(HFCS)

- 麥芽糊精

- 糊精

- 其他

- 按來源

- 玉米

- 小麥

- 木薯

- 其他

- 按形式

- 粉末

- 液體

- 透過使用

- 食品/飲料

- 製藥

- 個人護理及化妝品

- 動物飼料

- 纖維

- 紙張和紙板

- 其他

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市場排名分析

- 公司簡介

- Archer Daniels Midland Company

- Cargill Inc.

- Ingredion Incorporated

- Gulshan Polyols Ltd

- Tirupati Starch & Chemicals Ltd

- Sukhjit Starch & Chemicals Ltd

- Gayatri Bio Organics Ltd

- Universal Starch Chem Allied Ltd

- Sahyadri Starch & Industries Pvt Ltd

- Gujarat Ambuja Exports Ltd

- Bluecraft Agro Pvt Ltd

- Angel Starch & Food Pvt Ltd

- RVP Starch Pvt Ltd

- Spac Starch Products(India)Ltd

- Shalom Sales Indore

- Roquette Freres SA

- Tate & Lyle PLC

- Tereos Syral

- Avebe UA

- BASF-SE

第7章 市場機會與未來展望

The Indian starch and starch derivatives market size is valued at USD 3.45 billion in 2025 and is forecast to reach USD 4.12 billion by 2030, expanding at a 7.34% CAGR.

Growth stems from ethanol-blending policies that have lifted corn demand, rising adoption of clean-label modified starches across food and beverage categories, and policy-backed shifts toward starch-based bioplastics following the single-use plastic ban. Parallel expansion in pharmaceutical manufacturing, where cyclodextrins enhance drug-delivery performance, and in e-commerce packaging, where starch adhesives replace synthetic glues, further bolsters revenue opportunities. Key enabling factors include India's integrated maize supply chain, the government's 17.98% ethanol blend rate achieved by February 2025, and steady investment in new poly-lactic acid (PLA) projects that anchor latent starch demand. Nonetheless, corn-price volatility, GMO-related quality scrutiny, and sub-scale wet-milling capacity challenge near-term margins, underscoring the need for feedstock hedging and process upgrades.

India Starch And Starch Derivative Market Trends and Insights

Abundant Domestic Maize Supply Chain Integration

In 2024/25, India's corn production is projected to hit 37 million metric tons, as reported by the USDA Foreign Agriculture Service . This robust maize output offers strategic benefits to starch manufacturers. By integrating domestic supply chains, India not only curtails its reliance on imports but also gains a cost edge, especially amidst the backdrop of fluctuating global corn prices.In India, approximately 14% of maize production is directed towards starch manufacturing, setting a robust foundation for the industry's expansion. This segment benefits significantly from government initiatives such as the Digital Agriculture Mission, which aims to modernize the agricultural sector through technology integration. Additionally, advancements in post-harvest infrastructure, including storage and processing facilities, have strengthened the supply chain. These developments not only boost agricultural productivity but also position domestic manufacturers advantageously against their import-dependent counterparts, fostering long-term growth in the starch manufacturing industry.

Surge in Demand for Clean-Label Modified Starches

In India, a shift towards clean-label products is transforming the food processing sector, which is on track to hit USD 535 billion by 2025-26, as per the U.S. Department of Agriculture. Urban consumers, becoming more health-conscious, are turning to modified starches as natural substitutes for synthetic additives. Companies are now prioritizing clean-label formulations, heavily leaning on modified starch systems to enhance texture and mouthfeel, according to Food Ingredients First. Notably, cross-linked starches are emerging as favorites due to their superior stability and functional benefits in processed foods, showcasing better resistance to retrogradation and freeze-thaw challenges. Food manufacturers are not only adopting these modified starches to comply with regulatory standards but also to uphold product quality, driving consistent demand growth in the bakery, dairy, and convenience food sectors.

Corn-Price Volatility from Rising Ethanol Diversion

India's shift from being a corn exporter to a net importer has led to significant price fluctuations. Corn prices have jumped to USD 27.35 per quintal, driven by ethanol demand, which consumes 6-7 million tons annually. This surge in prices has a direct effect on the raw material costs for starch manufacturers, hitting smaller players with limited procurement power the hardest. In response to these challenges, the government is contemplating the import of genetically modified corn at reduced duties to address supply shortages. However, the timeline for regulatory approvals remains a gray area. Meanwhile, poultry producers are pushing for duty-free corn imports, highlighting the strain on the broader supply chain and its implications for the starch industry's competitiveness. With corn accounting for 60-70% of production costs for many starch derivatives, this volatility poses significant planning hurdles for manufacturers. As a result, companies are either resorting to advanced hedging strategies or passing the increased costs onto their downstream customers.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce-Driven Paper & Packaging Starch Uptake

- Government Ethanol-Blending Push Boosting Glucose Syrups

- Quality Concerns Due to Genetically Modified Ingredient Adulteration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, native starches command a dominant 40.34% market share, leveraging cost advantages and widespread applications in food processing and industrial sectors. Meanwhile, modified starches are the fastest-growing segment, projected to expand at an 8.02% CAGR through 2030. This surge is fueled by their specialized applications, which demand enhanced functional properties like improved stability, texture modification, and adherence to clean-label standards. Starch derivatives, such as glucose syrups and maltodextrin, are witnessing strong demand from both the ethanol and food processing industries. Notably, glucose syrups are reaping benefits from government mandates on ethanol blending.

These segment dynamics underscore India's evolving industrial landscape. While traditional native starches found their footing in textiles and paper, there's a notable shift towards higher-value modified products catering to pharmaceuticals and specialty foods. Cross-linked starches are becoming popular for their stability in processed foods. At the same time, cyclodextrin derivatives are seeing a rise in drug delivery system applications, as highlighted by RSC Pharm. Although high fructose corn syrup (HFCS) and dextrins cater to niche markets, they grapple with competition from natural sweeteners, reflecting a broader consumer shift towards clean-label products.

In 2024, maize accounts for 62.34% of the market share, supported by India's position as the 4th largest global producer by area and a robust wet-milling infrastructure concentrated in Gujarat, Punjab, and Maharashtra. Potato-based starches are the fastest-growing segment, with an expected CAGR of 8.55% through 2030. This growth is driven by their superior functional properties and increasing use in pharmaceutical excipients and specialty food products. Wheat-based starches continue to see steady demand in traditional applications, while tapioca starches cater to specialized industrial needs requiring specific viscosity characteristics.

The diversification of starch sources highlights manufacturers' efforts to manage risks and reduce reliance on single feedstocks amid concerns over price volatility. For example, Anil Limited operates one of India's largest corn wet-milling facilities, with a capacity of 550 tonnes per day, showcasing the scale advantages in maize processing. Additionally, alternative sources like barnyard millet starch are being explored for their sustainability and unique physicochemical properties, although their commercial scalability remains limited.

The India Starch & Starch Derivatives Market Report is Segmented by Type (Native Starch, Modified Starch, Starch Derivatives), Source (Maize, Wheat, Tapioca, Others), Form (Powder, Liquid), Application (Food and Beverage, Pharmaceutical, Personal Care & Cosmetics, Animal Feed, Textile, Paper and Corrugating, Others) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Archer Daniels Midland Company

- Cargill Inc.

- Ingredion Incorporated

- Gulshan Polyols Ltd

- Tirupati Starch & Chemicals Ltd

- Sukhjit Starch & Chemicals Ltd

- Gayatri Bio Organics Ltd

- Universal Starch Chem Allied Ltd

- Sahyadri Starch & Industries Pvt Ltd

- Gujarat Ambuja Exports Ltd

- Bluecraft Agro Pvt Ltd

- Angel Starch & Food Pvt Ltd

- RVP Starch Pvt Ltd

- Spac Starch Products (India) Ltd

- Shalom Sales Indore

- Roquette Freres SA

- Tate & Lyle PLC

- Tereos Syral

- Avebe UA

- BASF-SE

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Abundant domestic maize supply chain integration

- 4.2.2 Surge in demand for clean-label modified starches

- 4.2.3 E-commerce-driven paper & packaging starch uptake

- 4.2.4 Government ethanol-blending push boosting glucose syrups

- 4.2.5 Emergence of starch-based bioplastics replacing single-use plastics

- 4.2.6 Cyclodextrin adoption in Indian pharma drug-delivery systems

- 4.3 Market Restraints

- 4.3.1 Corn-price volatility from rising ethanol diversion

- 4.3.2 Quality Concerns Due to Genetically Modified Ingredient Adulteration

- 4.3.3 Sub-scale wet-milling plants limiting quality consistency

- 4.3.4 Regulatory uncertainty on single-use plastic alternatives adoption

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECAST

- 5.1 By Type

- 5.1.1 Native Starch

- 5.1.2 Modified Starch

- 5.1.3 Starch Derivatives

- 5.1.3.1 Glucose Syrups

- 5.1.3.2 High Fructose Corn Syrup (HFCS)

- 5.1.3.3 Maltodextrin

- 5.1.3.4 Dextrins

- 5.1.3.5 Others

- 5.2 By Source

- 5.2.1 Maize

- 5.2.2 Wheat

- 5.2.3 Tapioca

- 5.2.4 Others

- 5.3 By Form

- 5.3.1 Powder

- 5.3.2 Liquid

- 5.4 By Application

- 5.4.1 Food and Beverage

- 5.4.2 Pharmaceutial

- 5.4.3 Personal Care & Cosmetics

- 5.4.4 Animal Feed

- 5.4.5 Textile

- 5.4.6 Paper and Corrugating

- 5.4.7 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Archer Daniels Midland Company

- 6.4.2 Cargill Inc.

- 6.4.3 Ingredion Incorporated

- 6.4.4 Gulshan Polyols Ltd

- 6.4.5 Tirupati Starch & Chemicals Ltd

- 6.4.6 Sukhjit Starch & Chemicals Ltd

- 6.4.7 Gayatri Bio Organics Ltd

- 6.4.8 Universal Starch Chem Allied Ltd

- 6.4.9 Sahyadri Starch & Industries Pvt Ltd

- 6.4.10 Gujarat Ambuja Exports Ltd

- 6.4.11 Bluecraft Agro Pvt Ltd

- 6.4.12 Angel Starch & Food Pvt Ltd

- 6.4.13 RVP Starch Pvt Ltd

- 6.4.14 Spac Starch Products (India) Ltd

- 6.4.15 Shalom Sales Indore

- 6.4.16 Roquette Freres SA

- 6.4.17 Tate & Lyle PLC

- 6.4.18 Tereos Syral

- 6.4.19 Avebe UA

- 6.4.20 BASF-SE