|

市場調查報告書

商品編碼

1848065

印尼化肥:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Indonesia Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

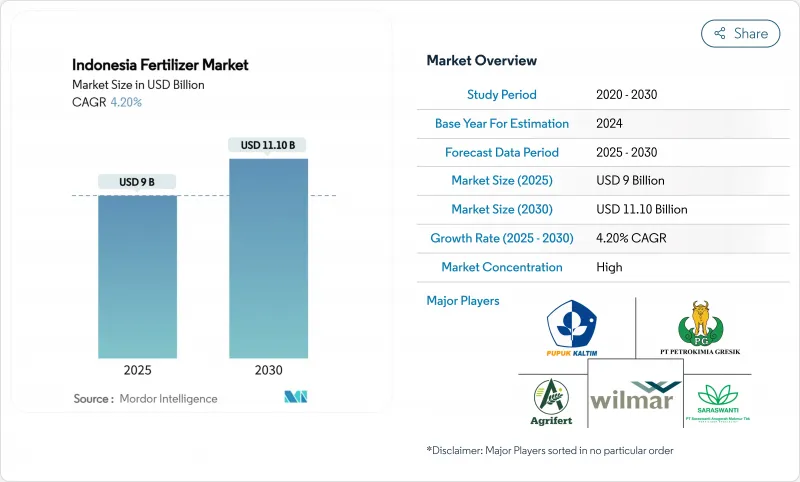

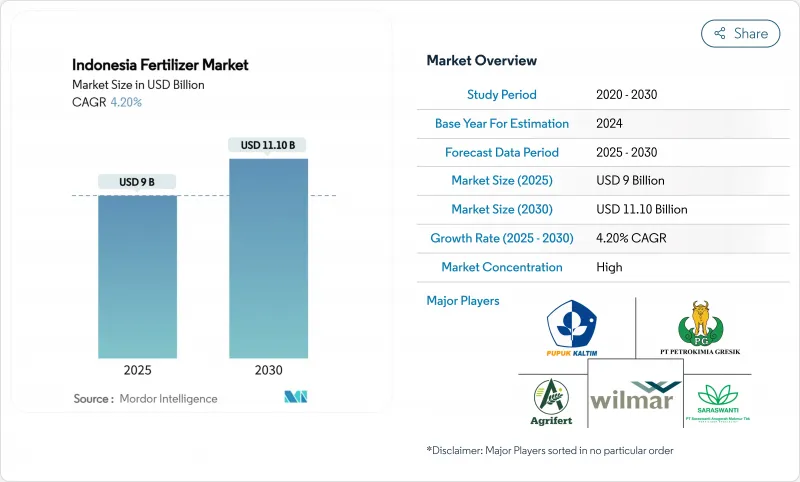

預計印尼化肥市場將以 4.2% 的複合年成長率成長,到 2025 年達到 90 億美元,到 2030 年達到 111 億美元。

政府對老舊油棕種植園的更新換代給予了大力補貼,這構成了印尼化肥市場整體需求的支柱。在最高零售價制度下,政府提供了950萬噸的補貼,即使天然氣價格高企擠壓了生產商的利潤空間,化肥消費量仍保持穩定。價值超過10億美元的新型NPK複合肥摻混計劃正在提升國內化肥的附加價值,並使印尼化肥市場能夠更好地滿足區域出口需求。

競爭動態反映出極高的市場集中度,前五大公司,包括PT Pupuk Kalimantan Timur (PKT)、PT Petrokimia Gresik、Wilmar International Limited、PT Saraswanti Anugerah Makmur Tbk和Agrifert Marketing Pte Ltd(一體化的棕櫚油業務佔據了重要地位。這種集中度既造成了營運效率低下,也帶來了戰略上的脆弱性,因為主要生產商的供應中斷可能會對國家的糧食安全產生重大影響。

印尼化肥市場趨勢及洞察

擴大政府化肥補貼(HET)

根據印尼農業部的數據,2025年的預算累計950萬噸補貼化肥(460萬噸尿素、420萬噸複合肥和50萬噸有機肥),尿素價格為每公斤2250印尼幣(約合0.14美元),複合肥價格為每公斤2300印尼幣(約合0.15美元)。這些價格遠低於市場價格。這項有保障的供應支撐了印尼的化肥市場,同時政府支出也達到了約33億美元,約佔GDP的2.8%。透過將化肥供應與農民資料庫「e-RDKK」連接起來,政府最大限度地減少了詐欺行為,並確保了重點作物所需的養分供應。供應商還可以追蹤季度需求,從而改善生產計畫和營運資金規劃。

稻米和玉米自給自足計劃

普拉博沃總統提出的2026年實現水稻自給自足、三年內實現玉米自給自足的目標,正推動蘇拉威西島和加里曼丹島等新興種植區廣泛採用均衡型氮磷鉀複合肥,而非單一營養素肥料。高種植密度和計畫中的雙季種植將增加每公頃的養分需求,抵消精密農業未來帶來的效率提升。根據「卡蒂尼·塔尼」(Kartini Tani)計畫發放的種子包中包含推薦肥料,鼓勵農民進行綜合土壤肥力管理。據私人經銷商稱,自2024年中期以來,東部島嶼對富鋅氮磷鉀複合肥的需求增加了兩倍。

天然氣價格波動推高了尿素成本。

目前,再氣化液化天然氣的交易價格為每百萬英熱單位16.77美元,而先前補貼政策下的價格僅為每百萬英熱單位6美元,這使得每噸尿素的成本增加了50至70美元,擠壓了國內生產商的淨利率。生產商正在尋求與布蘭特原油價格掛鉤的長期天然氣契約,以穩定投入成本。一些工廠正在評估與碳捕獲相關的藍氨生產方案,以獲得優惠資金籌措並對石化燃料波動風險。

細分市場分析

2024年,尿素將佔印尼化肥市場氮肥佔有率的60%,這得益於政府對高產量水稻種植技術(HET)的支持,預計2025年尿素產量將達460萬噸。同時,普通肥料將佔據主導地位,市場佔有率為54%。豐富的本地氨原料供應使得尿素成本保持在較低水平,而廣泛的經銷商網路則將產品分銷到偏遠的水稻和玉米種植區,這些地區消耗了“Swasembada Pangan”計劃下大部分的氮肥投入。硝酸銨鈣和硫酸銨則滿足了特定土壤的需求,而國內氨的合成基本上滿足了國內需求,進一步鞏固了氮肥在印尼化肥市場規模中的領先地位。

微量元素肥料將實現最快成長,到2030年複合年成長率將達到8.1%,這得益於精密農業從爪哇島擴展到蘇門答臘島,並支持出口導向園藝業的發展。複合肥料(NPK)的銷售量也將強勁成長,新增的200萬噸複合肥產能將使國內名目產量增至1400萬噸,從而降低對進口的依賴,並根據不同微區的需求客製化微量元素包衣。磷酸鹽和鉀肥的價格仍受運費波動的影響,因為印尼大部分磷酸二銨(DAP)、磷酸一銨(MAP)和氯化鉀(MOP)依賴進口。同時,次要營養元素在加里曼丹島和蘇門答臘島的酸性土壤中越來越受歡迎,這限制了人工林的長期產量。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 擴大政府化肥補貼(HET)

- 稻米和玉米自給自足計劃

- Pupuk 印尼的新 NPK 混合工廠

- 棕櫚油人工林再種植週期

- 種植需要特殊營養的出口園藝作物

- 爪哇島早期採用無人機精準施肥技術

- 市場限制

- 補貼預算削減導致的供應缺口

- 天然氣價格波動導致尿素成本上漲

- 假化肥料透過非官方管道廣泛流通。

- 泥炭地養分徑流面臨的環境壓力

- 監管狀態

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場規模與成長預測

- 依產品類型

- 複合肥

- 純肥料

- 氮肥

- 尿素

- 硝酸銨鈣(CAN)

- 氨

- 硝酸銨

- 硫酸銨

- 其他氮肥

- 磷肥

- 磷酸一銨(MAP)

- 磷酸二銨(DAP)

- 三重過磷酸鈣(TSP)

- 其他磷肥

- 鉀肥

- 鉀肥(MOP)

- 其他鉀肥

- 次要營養元素肥料

- 微量營養素

- 按作物類型

- 穀物和穀類

- 豆類和油籽

- 經濟作物

- 水果和蔬菜

- 草坪和觀賞作物

第6章 競爭情勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- PT Pupuk Kalimantan Timur(PKT)

- PT Petrokimia Gresik

- Wilmar International Limited

- Agrifert Marketing Pte Ltd(Kuok Group)

- PT Saraswanti Anugerah Makmur Tbk

- Yara International ASA

- EuroChem Group AG

- ICL Group Ltd.

- OCI Global NV

- PT Meroke Tetap Jaya

- PT Jadi Mas

- PT Dupan Anugerah Lestari

- PT Pupuk Sriwidjaya Palembang

- PT Pupuk Kujang Cikampek

- PT Pupuk Iskandar Muda

第7章 市場機會與未來展望

The Indonesia fertilizer market size stands at USD 9 billion in 2025 and is forecast to reach USD 11.1 billion by 2030, expanding at a 4.2% CAGR.

Strong public funding for input subsidies and the replanting of aging oil-palm estates forms the backbone of demand across the Indonesia fertilizer market. A government allocation of 9.5 million metric tons of subsidized product under the Highest Retail Price scheme stabilizes consumption even when natural-gas prices spike, compressing producer margins. New NPK blending projects worth more than USD 1 billion enhance domestic value addition and keep the Indonesia fertilizer market on track to serve regional export demand.

Competitive dynamics reflect extreme market concentration, with the top 5 companies, including PT Pupuk Kalimantan Timur (PKT), PT Petrokimia Gresik, Wilmar International Limited, PT Saraswanti Anugerah Makmur Tbk, and Agrifert Marketing Pte Ltd (Kuok Group), maintaining significant positions through integrated palm oil operations. This concentration creates both operational efficiency and strategic vulnerability, as supply disruptions from major producers can significantly impact national food security.

Indonesia Fertilizer Market Trends and Insights

Government Fertilizer Subsidy (HET) Expansion

As per the Indonesian ministry, the 2025 budget earmarked 9.5 million metric tons of subsidized fertilizer, 4.6 million metric tons of urea, 4.2 million metric tons of NPK, and 500,000 metric tons of organic keeping prices at IDR 2,250/kg (USD 0.14) for urea and IDR 2,300/kg (USD 0.15) for NPK, levels far below commercial quotations This guaranteed volume underpins the Indonesia fertilizer market even as fiscal outlays approach USD 3.3 billion, roughly 2.8% of GDP. By linking deliveries to the e-RDKK farmer database, authorities minimize leakages and channel nutrients to priority crops. Suppliers also gain visibility on quarterly offtake, allowing smoother production scheduling and working-capital planning.

Rice And Corn Self-Sufficiency Programs

President Prabowo targets rice self-sufficiency by 2026 and corn self-sufficiency within three years, spurring wider adoption of balanced NPK over single-nutrient products across new cultivation zones in Sulawesi and Kalimantan. Higher planting density and double-cropping schedules lift per-hectare nutrient requirements, offsetting future efficiency gains from precision farming. Seed packages issued under the Kartini Tani program include fertilizer recommendations, nudging farmers toward integrated soil fertility management. Private distributors report that demand for zinc-enriched NPK has tripled in the eastern islands since mid-2024.

Natural-Gas Price Volatility Raising Urea Costs

Regasified LNG now trades at USD 16.77 per MMBtu versus USD 6 under the previous subsidy, adding USD 50-70 to the cost of every metric ton of urea and squeezing margins for domestic manufacturers. Producers seek long-term gas contracts indexed to Brent-minus formulas to stabilize input costs. Several plants are evaluating carbon-capture linked blue ammonia pathways to unlock concessional finance and hedge against fossil fuel volatility.

Other drivers and restraints analyzed in the detailed report include:

- New NPK Blending Plants Under Pupuk Indonesia

- Palm-Oil Plantation Replanting Cycle

- Environmental Pressure on Peatland Nutrient Runoff

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Straight fertilizers led with 54% of the Indonesia fertilizer market share in 2024, a position anchored by urea's 60% slice of nitrogen volume and by the government's HET-backed allocation of 4.6 million metric tons for the 2025 season. Abundant local ammonia feedstock keeps urea costs low, while wide dealer networks push product into remote rice and corn belts that consume the bulk of nitrogen inputs under the swasembada pangan plan. Calcium ammonium nitrate and ammonium sulfate fill soil-specific niches, and in-country ammonia synthesis largely feeds domestic demand, reinforcing leadership for nitrogenous grades within the Indonesia fertilizer market size.

Micronutrient fertilizers post the quickest climb, advancing at an 8.1% CAGR to 2030 as precision farming spreads from Java to Sumatra and supports export-oriented horticulture. Complex NPK sales also rise steadily because 2 million metric tons of new blending capacity lifts national nameplate output to 14 million metric tons, curbing reliance on imports and tailoring micronutrient coatings by micro-region. Phosphatic and potash grades remain exposed to freight swings because Indonesia imports almost all DAP, MAP, and MOP, while secondary nutrients gain traction in acidic soils across Kalimantan and Sumatra that limit long-term plantation yields.

The Indonesia Fertilizer Market Report is Segmented by Type (Complex Fertilizers and Straight Fertilizers {Nitrogenous Fertilizers, Phosphatic Fertilizers, Potash Fertilizers, and More}), and by Crop Type (Grains and Cereals, Pulses and Oilseeds, Commercial Crops, Fruits and Vegetables, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- PT Pupuk Kalimantan Timur (PKT)

- PT Petrokimia Gresik

- Wilmar International Limited

- Agrifert Marketing Pte Ltd (Kuok Group)

- PT Saraswanti Anugerah Makmur Tbk

- Yara International ASA

- EuroChem Group AG

- ICL Group Ltd.

- OCI Global N.V.

- PT Meroke Tetap Jaya

- PT Jadi Mas

- PT Dupan Anugerah Lestari

- PT Pupuk Sriwidjaya Palembang

- PT Pupuk Kujang Cikampek

- PT Pupuk Iskandar Muda

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government fertilizer subsidy (HET) expansion

- 4.2.2 Rice and corn self-sufficiency programs

- 4.2.3 New NPK blending plants under Pupuk Indonesia

- 4.2.4 Palm-oil plantation replanting cycle

- 4.2.5 Growth in export-oriented horticulture needing specialty nutrients

- 4.2.6 Early adoption of drone-based precision fertilization in Java

- 4.3 Market Restraints

- 4.3.1 Subsidy budget cuts creating supply gaps

- 4.3.2 Natural-gas price volatility raising urea costs

- 4.3.3 Proliferation of counterfeit fertilizers in informal channels

- 4.3.4 Environmental pressure on peatland nutrient runoff

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Complex Fertilizers

- 5.1.2 Straight Fertilizers

- 5.1.2.1 Nitrogenous Fertilizers

- 5.1.2.1.1 Urea

- 5.1.2.1.2 Calcium Ammonium Nitrate (CAN)

- 5.1.2.1.3 Ammonia

- 5.1.2.1.4 Ammonium Nitrate

- 5.1.2.1.5 Ammonium Sulfate

- 5.1.2.1.6 Other Nitrogenous Fertilizers

- 5.1.2.2 Phosphatic Fertilizers

- 5.1.2.2.1 Mono-ammonium Phosphate (MAP)

- 5.1.2.2.2 Di-ammonium Phosphate (DAP)

- 5.1.2.2.3 Triple Super-phosphate (TSP)

- 5.1.2.2.4 Other Phosphatic Fertilizers

- 5.1.2.3 Potash Fertilizers

- 5.1.2.3.1 Muriate of Potash (MOP)

- 5.1.2.3.2 Other Potash Fertilizers

- 5.1.2.4 Secondary Nutrient Fertilizers

- 5.1.2.5 Micronutrients

- 5.2 By Crop Type

- 5.2.1 Grains and Cereals

- 5.2.2 Pulses and Oil Seeds

- 5.2.3 Commercial Crops

- 5.2.4 Fruits and Vegetables

- 5.2.5 Turf and Ornamental Crops

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 PT Pupuk Kalimantan Timur (PKT)

- 6.4.2 PT Petrokimia Gresik

- 6.4.3 Wilmar International Limited

- 6.4.4 Agrifert Marketing Pte Ltd (Kuok Group)

- 6.4.5 PT Saraswanti Anugerah Makmur Tbk

- 6.4.6 Yara International ASA

- 6.4.7 EuroChem Group AG

- 6.4.8 ICL Group Ltd.

- 6.4.9 OCI Global N.V.

- 6.4.10 PT Meroke Tetap Jaya

- 6.4.11 PT Jadi Mas

- 6.4.12 PT Dupan Anugerah Lestari

- 6.4.13 PT Pupuk Sriwidjaya Palembang

- 6.4.14 PT Pupuk Kujang Cikampek

- 6.4.15 PT Pupuk Iskandar Muda