|

市場調查報告書

商品編碼

1846218

紅外線檢測器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030)Infrared Detector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

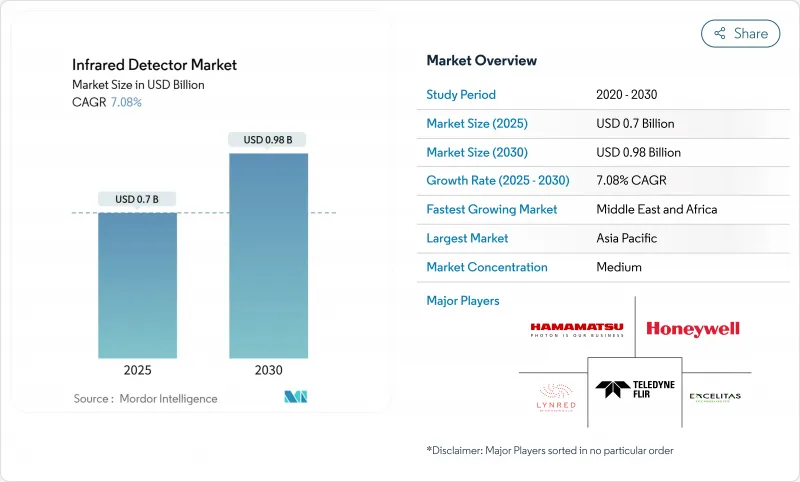

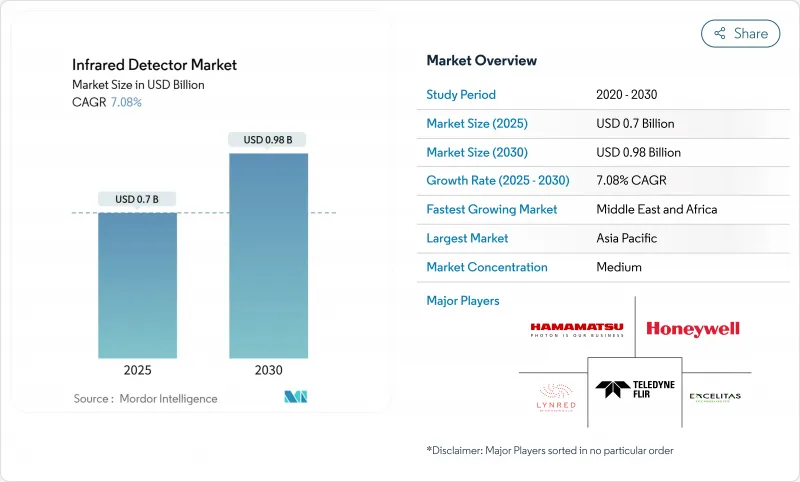

紅外線檢測器市場目前價值 7 億美元,預計到 2030 年將達到 9.8 億美元,複合年成長率為 7.08%。

微型非製冷微測輻射熱計陣列、用於自動駕駛汽車的雷射雷達級近紅外線感測器以及歐盟對預測性維護熱成像的強制要求將支撐近期的成長勢頭。綠色氫能工廠廣泛採用紅外線氣體洩漏檢測系統、東亞地區對半導體檢測的需求不斷成長以及日本國防部對高靈敏度製冷陣列的主導,將進一步增強成長勢頭。為擺脫鎵和鍺的供應限制而進行的供應鏈重組正在加速檢測器材料的替代,而以收購主導的整合正在塑造價值鏈各個環節的競爭策略。這些動態的相互作用預計將推動紅外線檢測器市場的持續擴張和技術多樣化。

全球紅外線檢測器市場趨勢與洞察

非製冷微測輻射熱計陣列的小型化為亞洲的物聯網運動感測器提供動力

阿爾託大學的鍺基光電二極體在1.55微米波長下將響應度提高了35%,從而實現了經濟高效的CMOS相容製造,解決了熱漂移問題,同時保持了亞毫瓦級的功率範圍。 MEMS與輕量級訊號處理邏輯的融合正在推動智慧建築端點的持續溫度監控,而亞洲元件製造商正在捆綁無線連接,以在其家用電子電器產品組合中實現附加價值服務的收益。

預測性維護熱成像技術成為歐盟製程工業的強制性要求

2024年歐盟機械法規將編纂風險評估通訊協定,使熱成像技術成為合規檢驗的關鍵。基於狀態的監控可以為能源密集型工廠每小時節省超過10萬美元的停機時間,而人工智慧分析可以自動執行異常檢測,從而緩解技能限制並增強投資案例。

高規格製冷檢測器的出口管制限制

《國際武器貿易條例》和《瓦森納條約》限制了60%的相機出口,包括原產於美國的子系統,迫使歐洲製造商採用雙重產品線,增加了固定成本。歐洲製造商正在推動供應鏈本地化,但圍繞鎵和鍺的地緣政治緊張局勢加劇了時間線風險。

細分分析

到2024年,熱檢測器將佔據紅外線檢測器市場的65%。然而,由於國防和科學應用領域對更高靈敏度的需求,光學或量子元件的複合年成長率高達8.5%。量子探測器紅外線探測器市場規模預計將進一步擴大,因為有機半導體光電探測器已證明其比探測器高達5.55x1012瓊斯(無需像素級圖形化),這意味著製造成本的降低。

熱檢測器憑藉其非製冷運作和低初始成本,在民用和建築自動化應用中仍然佔據主導地位。量子陣列中基於人工智慧的片上處理技術目前正在為軍事裝備提供即時威脅分類。韓國科學技術研究院 (KAIST) 的室溫中紅外線檢測器打破了低溫壁壘,為手持式和電池供電平台奠定了量子架構的基礎。

由於設計人員優先考慮低功耗和易於整合,非製冷陣列將在2024年佔據78%的收入。然而,由於與需要極高射程的國防項目相關,冷凍架構正以8.2%的複合年成長率發展。 Lynred的ATI320清楚地表明了提高非製冷靈敏度和模糊性能界限的動力。

軍事領域佔據了紅外線檢測器市場近60%的佔有率,其反艦和遠距瞄準光學系統均採用製冷型。尺寸、重量和功率的最佳化使斯特林製冷型系統適用於無人機和可攜式發射器。混合有效載荷(結合製冷和非製冷模組)正在興起,使指揮官能夠平衡成本和任務需求。

區域分析

隨著中國電動車製造商擴大雷射雷達部署,以及台灣和韓國代工廠加大短波紅外線偵測生產線的建設,亞太地區將在2024年佔據全球支出的42%。本地LiDAR公司在專利方面的領先地位凸顯了該地區的創新深度,接近性終端用戶叢集的優勢則縮短了供應鏈。日本成熟的電子產業提供先進的封裝服務,而印度在邊防安全的投資將刺激對高靈敏度冷卻的需求。

北美憑藉著雄厚的國防預算和專有感測器IP,支撐了持續的採購週期。 Teledyne公司報告稱,2024年第四季其營收達15.023億美元。 《國際武器貿易條例》(ITAR)條款保護了國內供應商,同時也增加了出口難度,鼓勵國際買家實施地理多元化策略。加拿大和墨西哥為汽車和採礦業提供支持,而熱感像儀則提升了這些行業的營運韌性。

在機械安全法規和環境指令將熱成像納入合規性審核的背景下,歐洲正經歷穩定成長。 Lynred 斥資 8,500 萬歐元(9,100 萬美元)擴建設施,體現了其產能在地化,以降低供應鏈風險。北歐國家正在擴大採用智慧建築,而中東和非洲地區預計將在綠色氫能大型企劃和安全基礎設施升級的推動下,以 8.9% 的複合年成長率成長。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查結果

- 調查前提

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 非製冷微測輻射熱計陣列的小型化為亞洲的物聯網運動感測器提供動力

- 預測性維護熱成像技術成為歐盟製程工業的強制性要求

- 中國自動駕駛和電動車平台用LiDAR級近紅外線檢測器的普及

- 中東綠色氫能工廠強制實施紅外線氣體洩漏檢測

- 台灣和韓國半導體工廠檢測對SWIR相機的需求

- 美國印邊境監視現代化計劃

- 市場限制

- 對高規格製冷檢測器的出口管制(類似 ITAR)限制

- 被動PIR元件價格下滑

- 海上油氣部署中的熱漂移與校準問題

- 新興市場的假檢測器管道

- 價值/供應鏈分析

- 監理展望

- 技術展望

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模及成長預測

- 按下檢測器類型

- 熱檢測器

- 光(量子)檢測器

- 按冷卻技術

- 非冷凍紅外線檢測器

- 冷凍紅外線探測器

- 按材質

- 微測輻射熱計

- InGaAs(銦鎵砷)

- MCT(碲鎘汞)

- 熱電電型

- 熱電堆

- 按頻譜範圍

- 近紅外線(NIR)

- 短波紅外線(SWIR)

- 中波紅外線(MWIR)

- 長波紅外線(LWIR)

- 遠紅外線(FIR)

- 按用途

- 人員和運動檢測

- 溫度測量/熱成像

- 工業程監控

- 光譜學和生物醫學成像

- 火災和氣體偵測

- 汽車 ADAS 和 LiDAR

- 環境和農業監測

- 其他應用(建築和暖通空調自動化、智慧家庭、軍事和國防等)

- 按最終用戶產業

- 航太/國防

- 工業製造

- 車

- 石油、天然氣和能源

- 醫療保健和生命科學

- 消費性電子產品

- 智慧基礎設施

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 北歐的

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 台灣

- 澳洲

- 紐西蘭

- 其他亞太地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- UAE

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Teledyne FLIR

- Lynred(ULIS+Sofradir)

- Hamamatsu Photonics

- Excelitas Technologies

- Honeywell International

- Murata Manufacturing

- Texas Instruments

- Omron Corporation

- Raytheon Technologies

- Leonardo DRS

- SCD-SemiConductor Devices

- BAE Systems plc

- L3Harris Technologies

- InfraTec GmbH

- iRay Technology

- Hikmicro(Hangzhou)

- Guide Sensmart(Wuhan Guide)

- DALI Technology

- InfraTec GmbH

第7章 市場機會與未來展望

The infrared detector market size is currently valued at USD 0.70 billion and is projected to reach USD 0.98 billion by 2030, advancing at a 7.08% CAGR.

Miniaturized uncooled microbolometer arrays, LiDAR-grade near-infrared sensors for autonomous vehicles, and mandatory predictive-maintenance thermography in the European Union underpin near-term momentum. Wider deployment of infrared gas-leak detection systems in green-hydrogen plants, expanding semiconductor inspection demand in East Asia, and defense-driven appetite for higher-sensitivity cooled arrays further reinforce the growth trajectory. Supply-chain realignment away from restricted gallium and germanium sources is accelerating substitutions in detector materials while acquisition-led consolidation is shaping competitive strategies across value-chain tiers. The interplay of these dynamics positions the infrared detector market for sustained expansion and technology diversification.

Global Infrared Detector Market Trends and Insights

Miniaturisation of Uncooled Micro-bolometer Arrays Empowering IoT Motion Sensors in Asia

Aalto University's germanium-based photodiodes raised responsivity by 35% at 1.55 μm, enabling cost-effective CMOS-compatible fabrication that tackles thermal drift while sustaining sub-milliwatt power envelopes.MEMS convergence with lightweight signal-processing logic is pushing continuous thermal monitoring into smart-building endpoints, and Asian component makers are bundling wireless connectivity to monetise value-added services across consumer electronics portfolios.

Mandatory Predictive-Maintenance Thermography in EU Process Industries

The 2024 EU machinery regulation codifies risk-assessment protocols that make thermal imaging integral to compliance validation. Condition-based monitoring reduces downtime that can exceed USD 100,000 per hour in energy-intensive plants, and AI-enabled analytics now automate anomaly detection, easing skills constraints and strengthening investment cases.

Export-Control Limits on High-Spec Cooled Detectors

ITAR and Wassenaar regimes constrain 60% of camera exports that contain US-origin subsystems, forcing dual product lines that elevate fixed costs. European manufacturers are localising supply chains, yet geopolitical tensions around gallium and germanium amplify timeline risks.

Other drivers and restraints analyzed in the detailed report include:

- Surge in LiDAR-grade Near-Infrared Detectors for Autonomous & EV Platforms in China

- IR Gas-Leak Detection Mandates for Green-Hydrogen Plants across Middle East

- Price Erosion in Passive PIR Components

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, thermal detectors captured 65% of the infrared detector market. Photo- or quantum-based devices are, however, expanding at an 8.5% CAGR as defense and scientific use cases favor higher sensitivity. The infrared detector market size for quantum detectors is forecast to widen as organic semiconductor photodetectors demonstrated specific detectivity of 5.55X1012 Jones without pixel-level patterning, signaling lower fabrication overheads.

Thermal detectors still dominate consumer and building-automation applications due to uncooled operation and lower upfront costs. AI-enabled on-chip processing inside quantum arrays is now providing real-time threat classification for military inventories, a shift likely to recalibrate procurement strategies. KAIST's room-temperature mid-infrared photodetector removes cryogenic barriers, positioning quantum architectures for handheld and battery-operated platforms.

Uncooled arrays delivered 78% of 2024 revenue as designers prized low power and simple integration. Yet cooled architectures are advancing at 8.2% CAGR tied to defense programs that demand extreme range. Lynred's ATI320 underscores the push to elevate uncooled sensitivity, blurring historical performance lines.

The military segment, nearly 60% of the total infrared detector market size, still specifies cooled formats for anti-ship and long-range targeting optics. Size, weight, and power optimisation is making Stirling-cooler packages suitable for drones and portable launchers. Hybrid payloads that combine cooled and uncooled modules are emerging, allowing unit commanders to balance cost and mission profiles.

The Infrared Detector Market is Segmented by Detector Type (Thermal Detector, Photo Detector), Cooling Technology (Uncooled, Cooled), Material (Microbolometer, Ingaas, and More), Spectral Range (NIR, SWIR, and More), Application (Motion Sensing, Thermography, Process Monitoring, and More), End-Use Industry (Aerospace and Defense, Industrial, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 42% of 2024 spending as Chinese EV makers scaled LiDAR rollouts and foundries in Taiwan and South Korea ramped SWIR inspection lines. Patent leadership by local LiDAR firms emphasises regional innovation depth, and proximity to end-use clusters shortens supply chains. Japan's mature electronics sector supplies advanced packaging services, and India's border-security investments boost high-sensitivity cooled demand.

North America leverages strong defense budgets and proprietary sensor IP, with Teledyne recording USD 1,502.3 million Q4 2024 sales that underline sustained procurement cycles. ITAR provisions shield domestic vendors yet complicate exports, prompting regional diversification strategies among international buyers. Canada and Mexico support the automotive and extractive verticals where thermal cameras enhance operational resilience.

Europe grows steadily under machinery-safety regulations and environmental directives that embed thermography into compliance audits. Lynred's EUR 85 million (USD 91 million) facility expansion evidences capacity localisation aimed at de-risking supply lines. Nordic nations champion smart-building deployments, while the Middle East and Africa forecast 8.9% CAGR on the back of green-hydrogen megaprojects and security infrastructure upgrades that specify long-range imagers.

- Teledyne FLIR

- Lynred (ULIS + Sofradir)

- Hamamatsu Photonics

- Excelitas Technologies

- Honeywell International

- Murata Manufacturing

- Texas Instruments

- Omron Corporation

- Raytheon Technologies

- Leonardo DRS

- SCD - SemiConductor Devices

- BAE Systems plc

- L3Harris Technologies

- InfraTec GmbH

- iRay Technology

- Hikmicro (Hangzhou)

- Guide Sensmart (Wuhan Guide)

- DALI Technology

- InfraTec GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Miniaturisation of Uncooled Micro-bolometer Arrays Empowering IoT Motion Sensors in Asia

- 4.2.2 Mandatory Predictive-Maintenance Thermography in EU Process Industries

- 4.2.3 Surge in LiDAR-grade Near-IR Detectors for Autonomous and EV Platforms in China

- 4.2.4 IR Gas-Leak Detection Mandates for Green-Hydrogen Plants across Middle East

- 4.2.5 Semiconductor Fab Inspection Demand for SWIR Cameras in Taiwan and South Korea

- 4.2.6 Border-Surveillance Modernisation Programs in US and India

- 4.3 Market Restraints

- 4.3.1 Export-control (ITAR-like) Limits on High-spec Cooled Detectors

- 4.3.2 Price Erosion in Passive PIR Components

- 4.3.3 Thermal Drift and Calibration Issues in Offshore Oil-and-Gas Deployment

- 4.3.4 Counterfeit Detector Channels in Emerging Markets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Detector Type

- 5.1.1 Thermal Detector

- 5.1.2 Photo (Quantum) Detector

- 5.2 By Cooling Technology

- 5.2.1 Uncooled Infrared Detector

- 5.2.2 Cooled Infrared Detector

- 5.3 By Material

- 5.3.1 Microbolometer

- 5.3.2 InGaAs (Indium Gallium Arsenide)

- 5.3.3 MCT (Mercury Cadmium Telluride)

- 5.3.4 Pyroelectric

- 5.3.5 Thermopile

- 5.4 By Spectral Range

- 5.4.1 Near-Wave Infrared (NIR)

- 5.4.2 Short-Wave Infrared (SWIR)

- 5.4.3 Mid-Wave Infrared (MWIR)

- 5.4.4 Long-Wave Infrared (LWIR)

- 5.4.5 Far-Infrared (FIR)

- 5.5 By Application

- 5.5.1 People and Motion Sensing

- 5.5.2 Temperature Measurement / Thermography

- 5.5.3 Industrial Process Monitoring

- 5.5.4 Spectroscopy and Biomedical Imaging

- 5.5.5 Fire and Gas Detection

- 5.5.6 Automotive ADAS and LiDAR

- 5.5.7 Environmental and Agriculture Monitoring

- 5.5.8 Other Applications (Building and HVAC Automation, Smart Homes, Military and Defense, and others)

- 5.6 By End-Use Industry

- 5.6.1 Aerospace and Defense

- 5.6.2 Industrial Manufacturing

- 5.6.3 Automotive

- 5.6.4 Oil, Gas and Energy

- 5.6.5 Healthcare and Life Sciences

- 5.6.6 Consumer Electronics

- 5.6.7 Smart Infrastructure

- 5.6.8 Others

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 France

- 5.7.3.3 United Kingdom

- 5.7.3.4 Italy

- 5.7.3.5 Nordics

- 5.7.3.6 Rest of Europe

- 5.7.4 Asia Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South Korea

- 5.7.4.5 Taiwan

- 5.7.4.6 Australia

- 5.7.4.7 New Zealand

- 5.7.4.8 Rest of Asia Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 UAE

- 5.7.5.1.3 Turkey

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Egypt

- 5.7.5.2.3 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Teledyne FLIR

- 6.4.2 Lynred (ULIS + Sofradir)

- 6.4.3 Hamamatsu Photonics

- 6.4.4 Excelitas Technologies

- 6.4.5 Honeywell International

- 6.4.6 Murata Manufacturing

- 6.4.7 Texas Instruments

- 6.4.8 Omron Corporation

- 6.4.9 Raytheon Technologies

- 6.4.10 Leonardo DRS

- 6.4.11 SCD - SemiConductor Devices

- 6.4.12 BAE Systems plc

- 6.4.13 L3Harris Technologies

- 6.4.14 InfraTec GmbH

- 6.4.15 iRay Technology

- 6.4.16 Hikmicro (Hangzhou)

- 6.4.17 Guide Sensmart (Wuhan Guide)

- 6.4.18 DALI Technology

- 6.4.19 InfraTec GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment