|

市場調查報告書

商品編碼

1846215

中國工程機械:市場佔有率分析、產業趨勢、統計及成長預測(2025-2030)China Construction Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

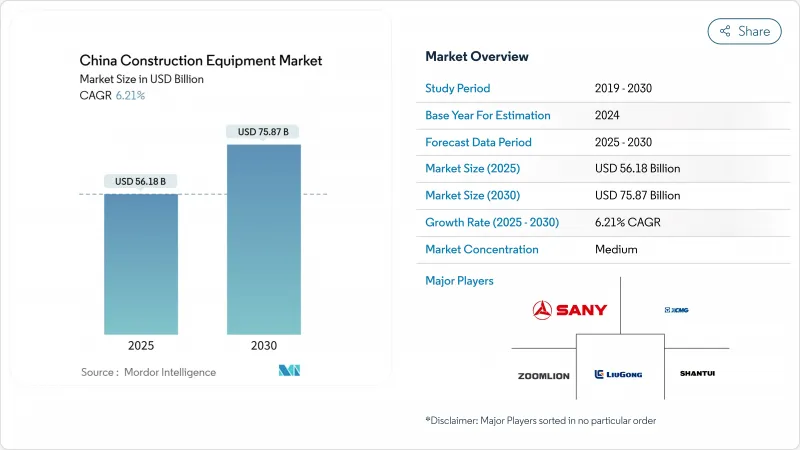

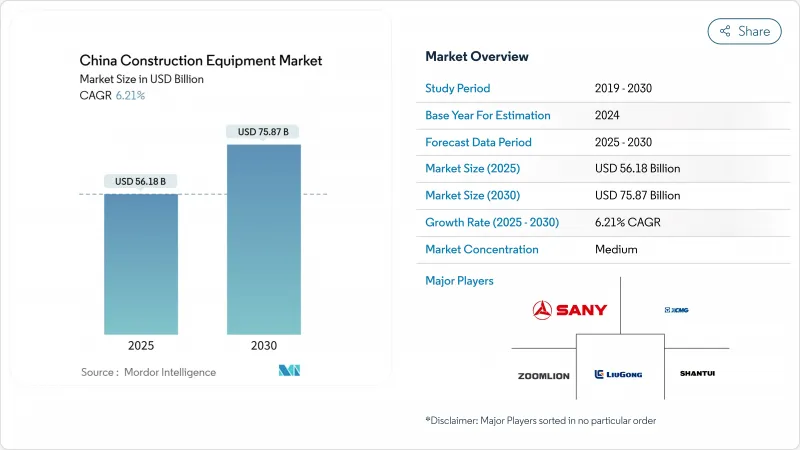

根據估計和預測,中國工程機械市場在 2025 年的價值為 561.8 億美元,預計到 2030 年將成長至 758.7 億美元,複合年成長率為 6.21%。

公共部門持續增加對鐵路、公路和城市交通網路的投入,加上對電子機械和智慧機械的強力政策支持,即使住宅房地產市場降溫,也支撐著市場需求。諸如計劃於2025年建成18萬公里國家鐵路(總投資5900億元人民幣)等大型計劃,保持了強勁的訂單,並帶動了大容量土方和起重設備的銷售。同時,隨著電氣化與柴油的成本差距縮小,以及補貼抵消了部分資本支出,電氣化正從試點計劃轉向大規模部署。海外出貨量超過國內出貨量,顯示中國目標商標產品製造商(OEM)可以透過依靠海外基礎設施建設週期來抵消國內經濟放緩的影響。

中國工程機械市場趨勢與洞察

政府基礎建設投資和「一帶一路」計劃

光是Delta地區,2024年鐵路建設投入將達到創紀錄的1,400億元人民幣,超過前一年的1,253億元。國家發展和改革委員會的《2025年裝備更新政策》將擴大對工業、能源、交通和農業等各領域的扶持力度,重點扶持高階、智慧、綠色技術,並加強貸款利息補貼以降低融資成本。由於基礎設施計劃通常需要三到五年的設備使用壽命,且更新換代模式可預測,此政策框架將創造超越傳統建設週期的持續需求。 「一帶一路」計劃的國際化維度將擴大國內製造商的出口機遇,預計2022年中國70%的挖土機出口將銷往「一帶一路」沿線國家,從而形成良性循環,使國內生產規模能夠帶來具有國際競爭力的價格。預計到 2030 年,鐵路網將擴展到 18 萬公里,其中包括 6 萬公里高速鐵路,這將需要專門的施工設備進行隧道開挖、橋樑建設和軌道鋪設,而中國製造商憑藉其在國內計劃中的經驗,在這些領域已經發展出了技術優勢。

設施現代化和電氣化政策

政府的設備現代化指令催生了獨立於新建設的更新換代需求,而工業部發布的《2024年重點技術裝備指導目錄》也優先考慮了先進工程機械。直接補貼和營運成本優勢推動了電動式工程機械的普及,中國製造商在某些應用領域實現了電動式和柴油機型的成本持平,從根本上改變了總擁有成本的計算方式。 《2024年綠色技術推廣手冊》列出了七大領域的112項尖端技術,其中工程機械在節能和環保類別中佔據顯著位置。隨著營運商在尋求利用最新技術的同時盡可能降低資本支出,設備即服務(EaaS)模式正獲得越來越多的支持,整合安裝和拆除服務能夠提高安全合規性和營運效率。這項政策催生了一個雙軌制市場:高階電動和智慧設備淨利率豐厚,而傳統柴油設備則面臨價格壓力,這使得擁有強大研發能力和技術組合的製造商受益。

房地產業去槓桿化和建築業放緩

房地產行業的去槓桿化將導致需求暫時中斷,因為開發商會減少新計畫開工和設備採購,尤其會影響小型機械和住宅建築設備領域。然而,政府的都市更新計畫和保障性住宅計畫將提供替代需求來源,各大城市也優先考慮基礎設施和公共建設,而非投機性開發。這將造成維持穩定的國有企業與面臨資金限制的私人開發人員之間的市場分化,並為設備租賃和靈活的資金籌措模式創造機會,從而降低建設公司的資本需求。

細分市場分析

到2024年,挖土機和其他土木機械將佔據中國工程機械市場55.28%的佔有率,鞏固其在土方工程、採礦和地鐵隧道計劃中的重要地位。同時,由於補貼和電池成本下降削弱了柴油引擎的全生命週期成本優勢,電動挖土機到2030年將以12.15%的複合年成長率成長。堆高機、伸縮臂操作車和高空作業平台將受惠於電商履約相關的倉庫自動化,獲得穩定的市場需求。道路施工設備將受益於不斷擴展的17.7萬公里國家高速公路網的維護週期縮短,其中自動壓路機和攤舖機將成為高規格高速公路升級改造的關鍵設備。

技術融合將定義未來的競爭格局。如今,挖掘機標配遠端資訊處理系統、半自動挖掘演算法和工廠預先安裝的快速連接器,從而縮短了附件更換時間。混凝土攪拌機和泵浦車整合了物聯網感測器,以最佳化坍落度和車輛物流,確保在人口密集的城市中心按時澆築混凝土。預計到2030年,光是中國工程機械挖土機市場規模就將接近370億美元,將為投資於專有電池組和控制軟體的原始設備製造商(OEM)帶來規模經濟效益。隨著互通性標準的日益成熟,擁有開放式架構控制器的零件供應商將獲得更大的議價能力,將價值鏈再形成為以軟體為中心的生態系統。

2024年,內燃機(柴油)仍將佔據92.64%的銷售佔有率,這得益於完善的加油基礎設施、較長的作業週期以及較低的初始價格。然而,純電動工程機械將帶來決定性的變革,預計到2030年將以37.85%的複合年成長率成長。到2030年,中國純電動工程機械市場規模預計將超過80億美元,因為北京、上海和深圳的零排放法規限制了市政建設中柴油新車的採購。混合動力系統提供了一種過渡方案,在頻繁怠速的作業週期中可降低20-25%的油耗。

成本平衡取決於電池密度、充電物流和轉售價值。目前,原始設備製造商 (OEM) 的財務部門正將充電站和太陽能微電網納入設備租賃契約,從而保證承包商在計劃週期內收益固定的千瓦時價格。同時,國家電網營運商正在試點Vehicle-to-Grid)方案,將閒置的機器電池在非工作時間變現,增加額外的收益來源。在極端高溫的礦場和無法連接電網的偏遠「一帶一路」沿線地區,柴油仍可能佔據重要地位。然而,在噪音和排放法規最嚴格的大都市土木工程領域,柴油的市場佔有率可能會下降得最快。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 政府的「2025-30年新基礎設施」規劃

- 碳中和政策推動電子機械發展

- 透過整車製造商促進出口,將在國內實現規模經濟。

- 「一帶一路」計劃導致零件製造商訂單積壓。

- 當地碳權市場青睞混合動力汽車

- 數位設備租賃平台刺激了中小企業的需求。

- 市場限制

- 房地產市場長期低迷

- 國內產能過剩引發的價格競爭

- 收緊對中小型承包商的信貸准入

- 電子設備逆變器和電池管理系統晶片短缺

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按機器類型

- 土木機械

- 挖土機

- 裝載機

- 推土機

- 物料輸送機械

- 起重機

- 堆高機

- 伸縮臂操作車

- 道路施工設備

- 平土機機

- 壓路機/壓實機

- 鋪路機

- 混凝土設備

- 混凝土攪拌機

- 混凝土泵

- 土木機械

- 按驅動類型

- 內燃機(柴油)

- 混合

- 純電動

- 按銷售管道

- OEM直銷

- 由授權經銷商出售

- 透過使用

- 建築施工

- 基礎設施建設

- 能源和自然資源

- 其他

第6章 競爭情勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Sany Group

- Xuzhou Construction Machinery Group Co., Ltd.(XCMG)

- Caterpillar Inc.

- Zoomlion Heavy Industry

- LiuGong Machinery

- Komatsu Ltd.

- Hitachi Construction Machinery

- AB Volvo(Volvo CE)

- Liebherr Group

- Shantui Construction Machinery

- Tadano Ltd.

- JC Bamford Excavators Limited

- Doosan Bobcat Ltd.

- Hyundai Construction Equipment Ltd.

- Yanmar Holdings Co. Ltd.

- Terex Corporation

- China Railway Construction Heavy Industry Co., Ltd.

第7章 市場機會與未來展望

The China construction equipment market is estimated at USD 56.18 billion in 2025 and is forecast to advance to USD 75.87 billion by 2030, reflecting a 6.21% CAGR.

Sustained public-sector spending on railway, highway, and urban transit links, paired with a strong policy push for electric and smart machinery, underpins demand even as residential real-estate activity cools. Large-scale projects such as the 180,000 km national railway build-out, for which CNY 590 billion was earmarked in 2025, keep order books healthy and favor high-capacity earth-moving and lifting equipment. At the same time, electrification is moving from pilot projects to scaled deployment as cost parity with diesel narrows and subsidies offset capital outlays. Export momentum offers an additional cushion: overseas shipments have overtaken domestic deliveries, signaling that Chinese original-equipment manufacturers (OEMs) can lean on foreign infrastructure cycles to balance local slowdowns.

China Construction Equipment Market Trends and Insights

Government Infrastructure Investment and Belt Road Initiative

China's infrastructure investment surge represents the primary growth catalyst, with the Yangtze River Delta region alone allocating CNY 140 billion for railway construction in 2024, marking a record high that surpasses the previous year's CNY 125.3 billion. The National Development and Reform Commission's 2025 equipment update policy expands support across industrial, energy, transportation, and agricultural sectors, emphasizing high-end, intelligent, and green technologies with enhanced loan interest subsidies to reduce financing costs. This policy framework creates sustained demand beyond traditional construction cycles, as infrastructure projects typically require 3-5 year equipment lifecycles with predictable replacement patterns. The Belt and Road Initiative's international dimension amplifies domestic manufacturers' export opportunities, with 70% of Chinese excavator exports directed to BRI countries in 2022, creating a virtuous cycle where domestic production scale enables competitive international pricing. Railway network expansion to 180,000 km by 2030, including 60,000 km of high-speed rail, necessitates specialized construction equipment for tunneling, bridge construction, and track laying, segments where Chinese manufacturers have developed technological advantages through domestic project experience.

Equipment Modernization and Electrification Policies

The government's equipment modernization mandate creates replacement demand independent of new construction activity, with the Ministry of Industry and Information Technology's 2024 Major Technological Equipment Guidance Catalog prioritizing advanced construction machinery. Electric construction equipment adoption accelerates through direct subsidies and operational cost advantages, with Chinese manufacturers achieving cost parity between electric and diesel versions in certain applications, fundamentally altering total cost of ownership calculations. The Green Technology Promotion Directory (2024 Edition) includes 112 advanced technologies across seven sectors, with construction equipment featuring prominently in energy-efficient and environmental protection categories. Equipment-as-a-service models gain traction as operators seek to minimize capital expenditure while accessing latest technology, with integrated installation-dismantling services improving safety compliance and operational efficiency. The policy creates a two-tier market where premium electric and smart equipment commands higher margins while conventional diesel equipment faces pricing pressure, benefiting manufacturers with strong R&D capabilities and technology portfolios.

Real Estate Sector Deleveraging and Construction Slowdown

The real estate sector's deleveraging process creates temporary demand disruption as developers reduce new project starts and equipment purchases, particularly affecting compact machinery and residential construction equipment segments. However, government urban renewal initiatives and affordable housing programs provide alternative demand sources, with major cities prioritizing infrastructure upgrades and public facility construction over speculative development. Market differentiation emerges between state-owned enterprises maintaining stable operations and private developers facing financial constraints, creating opportunities for equipment leasing and flexible financing models that reduce capital requirements for construction firms.

Other drivers and restraints analyzed in the detailed report include:

- Export Market Expansion and International Competitiveness

- Digitalization and Smart Construction Technology Adoption

- Trade Tensions and Tariff Barriers in International Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Earth-moving machinery such as excavators controlled 55.28% of China construction equipment market share in 2024, cementing their role across earthwork, mining and metro tunnelling projects. Rising infrastructure outlays and export demand keep delivery volumes elevated, while electric excavators record a 12.15% CAGR to 2030 as subsidies and falling battery costs erode diesel's lifetime cost advantage. Forklifts, telescopic handlers and aerial platforms gain steady traction from warehouse automation linked to e-commerce fulfilment. Road-building machines benefit from maintenance cycles for an expanding 177,000 km national highway grid, with autonomous rollers and pavers proving headline features on high-profile expressway upgrades.

Technology convergence defines future competition. Excavators now ship with standard telematics, semi-autonomous dig algorithms, and factory-installed quick couplers that cut attachment changeover time. Concrete mixers and pumps integrate IoT sensors to optimize slump quality and dispatch logistics, ensuring on-time pours in dense urban cores. China construction equipment market size for excavators alone is projected to approach USD 37 billion by 2030, providing scale economies for OEMs investing in proprietary battery packs and control software. As interoperability standards mature, component suppliers with open-architecture controllers will gain bargaining power, reshaping the value chain toward software-centric ecosystems.

Internal Combustion Engine (Diesel) still powered 92.64% of units sold in 2024, supported by established fueling infrastructure, long duty cycles, and lower upfront pricing. However, full-electric options post a 37.85% CAGR through 2030, signaling a decisive phase-change. The China construction equipment market size for battery-electric models is set to cross USD 8 billion by 2030, thanks to zero-emission mandates in Beijing, Shanghai, and Shenzhen that restrict new diesel purchases for municipal works. Hybrid drivetrains offer a bridge solution, trimming fuel burn by 20-25% on duty cycles involving frequent idling.

Cost parity hinges on battery density, charging logistics, and resale values. OEM finance arms now bundle charging depots and solar-powered micro-grids into equipment leases, giving contractors guaranteed kilowatt-hour pricing over project lifetimes. Meanwhile, state grid operators trial vehicle-to-grid schemes that monetize idle machinery batteries during off-shift hours, adding an ancillary revenue stream. Diesel's role will remain pronounced in extreme-temperature mines and remote Belt and Road corridors without grid access. Still, its share will erode fastest in metropolitan civil works segments where noise and emissions rules bite hardest.

The China Construction Equipment Market Report is Segmented by Machinery Type (Earth-Moving Machinery, Material-Handling Machinery, and More), Drive Type (Internal-Combustion, Hybrid, and More), Sales Channel (OEM Direct Sales, and Authorized Dealer Sales), and Application (Building Construction, Infrastructure Construction, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Sany Group

- Xuzhou Construction Machinery Group Co., Ltd. (XCMG)

- Caterpillar Inc.

- Zoomlion Heavy Industry

- LiuGong Machinery

- Komatsu Ltd.

- Hitachi Construction Machinery

- AB Volvo (Volvo CE)

- Liebherr Group

- Shantui Construction Machinery

- Tadano Ltd.

- J.C. Bamford Excavators Limited

- Doosan Bobcat Ltd.

- Hyundai Construction Equipment Ltd.

- Yanmar Holdings Co. Ltd.

- Terex Corporation

- China Railway Construction Heavy Industry Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Govt. 'New Infrastructure 2025-30' pipeline

- 4.2.2 Carbon-neutral mandate spurring electric machinery

- 4.2.3 OEM export push enables domestic economies of scale

- 4.2.4 Belt and Road back-orders for component suppliers

- 4.2.5 Provincial carbon-credit markets favouring hybrids

- 4.2.6 Digital equipment-rental platforms unlocking SME demand

- 4.3 Market Restraints

- 4.3.1 Prolonged real-estate downturn

- 4.3.2 Domestic price wars from over-capacity

- 4.3.3 Tight credit to SME contractors

- 4.3.4 Inverter and BMS chip shortages for e-equipment

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD))

- 5.1 By Machinery Type

- 5.1.1 Earth-moving Machinery

- 5.1.1.1 Excavators

- 5.1.1.2 Loaders

- 5.1.1.3 Dozers

- 5.1.2 Material-Handling Machinery

- 5.1.2.1 Cranes

- 5.1.2.2 Fork-lifts

- 5.1.2.3 Telescopic Handlers

- 5.1.3 Road-Construction Machinery

- 5.1.3.1 Motor Graders

- 5.1.3.2 Rollers/Compactors

- 5.1.3.3 Pavers

- 5.1.4 Concrete Equipment

- 5.1.4.1 Concrete Mixers

- 5.1.4.2 Concrete Pumps

- 5.1.1 Earth-moving Machinery

- 5.2 By Drive Type

- 5.2.1 Internal-Combustion (Diesel)

- 5.2.2 Hybrid

- 5.2.3 Full-Electric

- 5.3 By Sales Channel

- 5.3.1 OEM Direct Sales

- 5.3.2 Authorized Dealer Sales

- 5.4 By Application

- 5.4.1 Building Construction

- 5.4.2 Infrastructure Construction

- 5.4.3 Energy and Natural Resources

- 5.4.4 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Sany Group

- 6.4.2 Xuzhou Construction Machinery Group Co., Ltd. (XCMG)

- 6.4.3 Caterpillar Inc.

- 6.4.4 Zoomlion Heavy Industry

- 6.4.5 LiuGong Machinery

- 6.4.6 Komatsu Ltd.

- 6.4.7 Hitachi Construction Machinery

- 6.4.8 AB Volvo (Volvo CE)

- 6.4.9 Liebherr Group

- 6.4.10 Shantui Construction Machinery

- 6.4.11 Tadano Ltd.

- 6.4.12 J.C. Bamford Excavators Limited

- 6.4.13 Doosan Bobcat Ltd.

- 6.4.14 Hyundai Construction Equipment Ltd.

- 6.4.15 Yanmar Holdings Co. Ltd.

- 6.4.16 Terex Corporation

- 6.4.17 China Railway Construction Heavy Industry Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment