|

市場調查報告書

商品編碼

1833677

建築設備市場機會、成長動力、產業趨勢分析及2025-2034年預測Construction Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

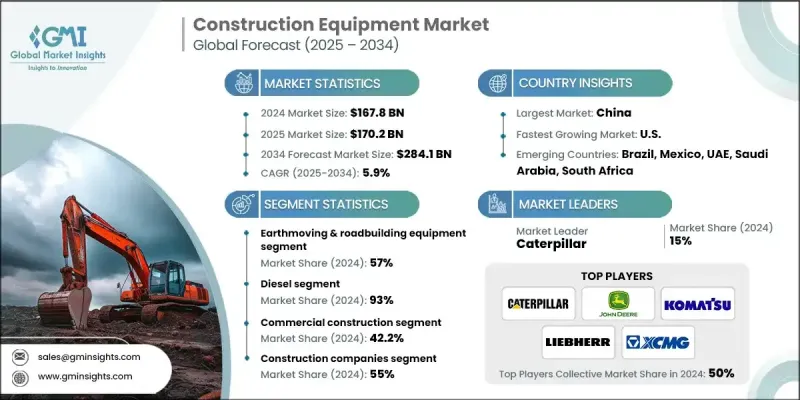

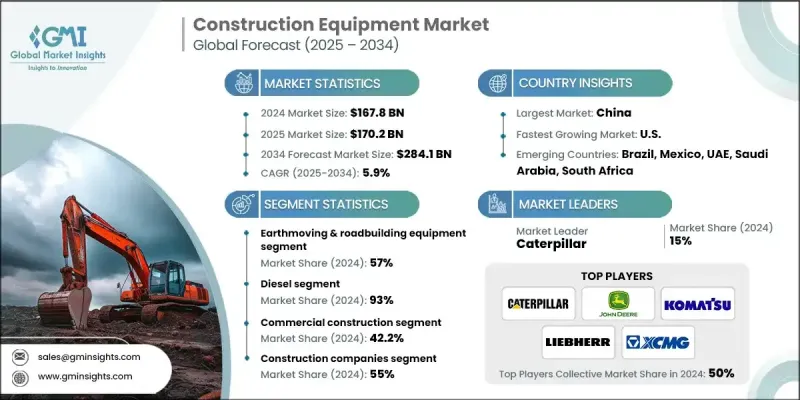

2024 年全球建築設備市場價值為 1,678 億美元,預計到 2034 年將以 5.9% 的複合年成長率成長至 2,841 億美元。

基礎設施建設和城鎮化進程的加速推動了這一成長。各國政府正大力投資道路、橋樑、機場和鐵路等基礎設施,以促進經濟成長並改善互聯互通。建築業的蓬勃發展需要先進的機械設備,從而增加了對建築設備的需求。人工智慧和物聯網等先進技術與製造設備的整合正在提高生產力和安全性,使這些設備對製造企業更具吸引力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1678億美元 |

| 預測值 | 2841億美元 |

| 複合年成長率 | 5.9% |

私部門投資和房地產開發的成長也將影響市場成長。隨著工業擴張和新興產業的興起,零售、工業和建築工程的需求不斷成長。這增加了對建築設備的需求,從挖土機、堆高機到起重機和推土機。農業和採礦業向工業化轉型至關重要,因為這些行業需要專用設備來提高效率。

土方和道路施工設備領域在2024年佔據57%的市場佔有率,預計在2025年至2034年期間的複合年成長率將達到5%。該領域包括反鏟、挖土機、裝載機和壓實機等機械,由於世界各國政府加大對公共基礎設施的投資力度以及快速實施道路建設項目,有望加速成長。對高效道路運輸系統的需求激增,以及與農村和低度開發地區更緊密的連接性,鞏固了土方和道路施工機械在整個建築設備領域的主導地位。

就燃料類型而言,柴油動力設備市場在2024年佔據了93%的佔有率,預計在2025-2034年期間的複合年成長率將達到5%。領先的製造商正在為其柴油車隊配備智慧技術,以提高性能、減少停機時間並提升燃油效率。先進的遠端資訊處理解決方案,包括GPS整合、診斷和基於感測器的監控,正在部署,以透過行動網路即時收集和傳輸營運資料。這些創新技術能夠洞察設備使用情況、進行預測性維護和效能最佳化,幫助操作員延長機器壽命,同時最大限度地提高現場生產力。

2024年,亞太地區建築設備市場佔45.7%的市佔率。電信和基礎設施領域的持續升級推動了該地區建築設備市場的擴張。電信塔建設和光纖鋪設的成長推動了對起重機和其他起重設備的需求。此外,租賃模式在該地區越來越受歡迎,尤其是對於高性能、低維護的設備。承包商擴大選擇租賃現代化設備,而不是購買老舊機械,從而最大限度地降低營運成本,並確保更高的施工效率。

建築設備產業的主要參與者包括特雷克斯、小松、凱斯紐荷蘭工業、Caterpillar、徐工集團、日立建機、利勃海爾、沃爾沃、斗山、迪爾公司和三一重工。領先的建築設備製造商正專注於創新、永續發展和數位轉型,以加強其全球影響力。許多製造商正在整合遠端資訊處理、物聯網和自動化技術,以提高設備效能、安全性和遠端操作能力。各公司正在擴展其混合動力和純電動產品線,以符合日益嚴格的排放法規並滿足綠色建築需求。與科技公司的策略合作夥伴關係正在推動支持智慧建築實踐的下一代機械。此外,各公司正在加強其售後服務、零件供應鏈和全球經銷商網路,以改善客戶體驗和支援。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 都市化和基礎設施發展

- 政府對智慧城市和公共工程的投資不斷增加

- 技術進步(自動化、遠端資訊處理、物聯網)

- 轉向電動和混合動力建築設備

- 租賃業繁榮

- 產業陷阱與挑戰

- 資本和維護成本高

- 原物料價格波動

- 熟練操作員短缺

- 監管和排放合規要求

- 租賃和二手設備的激烈競爭

- 市場機會

- 電動和混合動力設備採用加速

- 自主施工運作與人工智慧整合

- 精密施工技術與GPS導航

- 設備即服務(EaaS)商業模式

- 舊設備改造與升級市場

- 成長動力

- 成長潛力分析

- 主要市場趨勢和中斷

- 未來市場趨勢

- 監管格局

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利分析

- 價格趨勢

- 按地區

- 按產品

- 成本分解分析

- 生產統計

- 生產中心

- 進出口

- 主要進口國家

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依產品,2021 - 2034

- 主要趨勢

- 土方和道路建設設備

- 反鏟

- 挖土機

- 裝載機

- 壓實設備

- 其他

- 物料搬運和起重機

- 儲存和搬運設備

- 工程系統

- 工業卡車

- 散裝物料處理設備

- 混凝土設備

- 混凝土泵

- 破碎機

- 混凝土攪拌車

- 瀝青攤舖機

- 配料廠

第6章:市場估計與預測:以推進方式,2021 - 2034 年

- 主要趨勢

- 柴油引擎

- 壓縮天然氣/液化天然氣

- 電的

第7章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 住宅建築

- 商業建築

- 工業建築

- 採礦和採石

第 8 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 建築公司

- 採礦業者

- 租賃公司

- 政府和市政當局

- 工業用戶

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球參與者

- Caterpillar

- Komatsu

- John Deere

- Volvo

- Liebherr

- Hitachi

- JCB

- Sany

- Regional Champions

- Case

- New Holland

- Doosan

- Hyundai

- XCMG

- Zoomlion

- Terex

- Manitou

- Wacker Neuson

- 新興企業和服務提供者

- United Rentals

- Ashtead Group / Sunbelt Rentals

- H&E Equipment Services

- Home Depot Tool Rental

- Built Robotics

- SafeAI

- Trimble

- Topcon

The Global Construction Equipment Market was valued at USD 167.8 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 284.1 billion by 2034.

The growth is driven by the rising infrastructure development and urbanization. Governments are investing heavily in infrastructure such as roads, bridges, airports, and railways to boost economic growth and improve connectivity. This increase in construction demands advanced machinery, increasing the demand for construction equipment. The integration of technological advancements such as AI and IoT into manufacturing devices is increasing productivity and safety, making these devices more attractive to manufacturing companies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $167.8 Billion |

| Forecast Value | $284.1 Billion |

| CAGR | 5.9% |

The rise in private sector investments and real estate development will also influence market growth. As industry expands and new industries emerge, the need for retail, industrial, and construction work increases. This increases the demand for construction equipment, ranging from excavators and forklifts to cranes and bulldozers. The shift towards industrialization in agriculture and mining is important, as these industries require specialized equipment to be efficient.

The earthmoving and road-building equipment segment held a 57% share in 2024 and is forecasted to grow at a CAGR of 5% between 2025 and 2034. This segment, which includes machinery such as backhoes, excavators, loaders, and compactors, is poised for accelerated growth due to increasing investments in public infrastructure and the rapid execution of road development projects by governments worldwide. The surge in demand for efficient road transportation systems and better connectivity to rural and underdeveloped regions has solidified the dominance of earthmoving and road construction machinery in the overall construction equipment sector.

In terms of fuel type, the diesel-powered equipment segment held a 93% share in 2024 and is anticipated to grow at a CAGR of 5% during 2025-2034. Leading manufacturers are equipping their diesel fleets with smart technologies to enhance performance, reduce downtime, and improve fuel efficiency. Advanced telematics solutions featuring GPS integration, diagnostics, and sensor-based monitoring are being deployed to collect and transmit operational data in real time via mobile networks. These innovations provide insights into equipment usage, predictive maintenance, and performance optimization, helping operators extend machine life while maximizing job site productivity.

Asia Pacific Construction Equipment Market held a 45.7% share in 2024. The regional expansion is underpinned by consistent upgrades in telecommunications and infrastructure sectors. Growth in telecommunication tower construction and fiber-optic rollout is propelling demand for cranes and other lifting equipment. Additionally, rental models are gaining popularity across the region, especially for high-performance, low-maintenance machines. Contractors are increasingly opting to rent modern equipment rather than purchasing older machinery, minimizing operational costs and ensuring better efficiency on construction sites.

Major players operating in the construction equipment industry include Terex, Komatsu, CNH Industrial, Caterpillar, XCMG, Hitachi Construction Machinery, Liebherr, Volvo, Doosan, Deere & Co., and Sany. Leading construction equipment manufacturers are focusing on innovation, sustainability, and digital transformation to strengthen their global footprint. Many are integrating telematics, IoT, and automation technologies to enhance equipment performance, safety, and remote operability. Companies are expanding their hybrid and electric product lines to comply with tightening emission regulations and meet green construction demands. Strategic partnerships with technology firms are enabling next-gen machinery that supports smart construction practices. Additionally, firms are strengthening their aftermarket services, parts supply chains, and global dealer networks to improve customer experience and support.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Propulsion

- 2.2.4 Application

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization and infrastructure development

- 3.2.1.2 Rising government investments in smart cities & public works

- 3.2.1.3 Technological advancements (automation, telematics, IoT)

- 3.2.1.4 Shift toward electric and hybrid construction equipment

- 3.2.1.5 Rental and leasing boom

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital and maintenance costs

- 3.2.2.2 Volatility in raw material prices

- 3.2.2.3 Shortage of skilled operators

- 3.2.2.4 Regulatory and emission compliance requirements

- 3.2.2.5 Intense competition from rental and used equipment

- 3.2.3 Market opportunities

- 3.2.3.1 Electric & Hybrid Equipment Adoption Acceleration

- 3.2.3.2 Autonomous Construction Operations & AI Integration

- 3.2.3.3 Precision Construction Technology & GPS Guidance

- 3.2.3.4 Equipment-as-a-Service (EaaS) Business Models

- 3.2.3.5 Retrofit & Upgrade Market for Legacy Equipment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Major market trends and disruptions

- 3.5 Future market trends

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 MEA

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent analysis

- 3.11 Price trends

- 3.11.1 By region

- 3.11.2 By product

- 3.12 Cost breakdown analysis

- 3.13 Production statistics

- 3.13.1 Production hubs

- 3.13.2 Import and export

- 3.13.3 Major import countries

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly initiatives

- 3.14.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Earthmoving & roadbuilding equipment

- 5.2.1 Backhoe

- 5.2.2 Excavator

- 5.2.3 Loader

- 5.2.4 Compaction equipment

- 5.2.5 Others

- 5.3 Material handling and cranes

- 5.3.1 Storage and handling equipment

- 5.3.2 Engineered systems

- 5.3.3 Industrial trucks

- 5.3.4 Bulk material handling equipment

- 5.4 Concrete equipment

- 5.4.1 Concrete pumps

- 5.4.2 Crusher

- 5.4.3 Transit mixers

- 5.4.4 Asphalt pavers

- 5.4.5 Batching plants

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Diesel

- 6.3 CNG/LNG

- 6.4 Electric

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Residential construction

- 7.3 Commercial construction

- 7.4 Industrial construction

- 7.5 Mining & quarrying

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Construction companies

- 8.3 Mining operators

- 8.4 Rental companies

- 8.5 Government & municipalities

- 8.6 Industrial users

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Caterpillar

- 10.1.2 Komatsu

- 10.1.3 John Deere

- 10.1.4 Volvo

- 10.1.5 Liebherr

- 10.1.6 Hitachi

- 10.1.7 JCB

- 10.1.8 Sany

- 10.2 Regional Champions

- 10.2.1 Case

- 10.2.2 New Holland

- 10.2.3 Doosan

- 10.2.4 Hyundai

- 10.2.5 XCMG

- 10.2.6 Zoomlion

- 10.2.7 Terex

- 10.2.8 Manitou

- 10.2.9 Wacker Neuson

- 10.3 Emerging Players & Service Providers

- 10.3.1 United Rentals

- 10.3.2 Ashtead Group / Sunbelt Rentals

- 10.3.3 H&E Equipment Services

- 10.3.4 Home Depot Tool Rental

- 10.3.5 Built Robotics

- 10.3.6 SafeAI

- 10.3.7 Trimble

- 10.3.8 Topcon