|

市場調查報告書

商品編碼

1846212

縫紉機:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Sewing Machines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

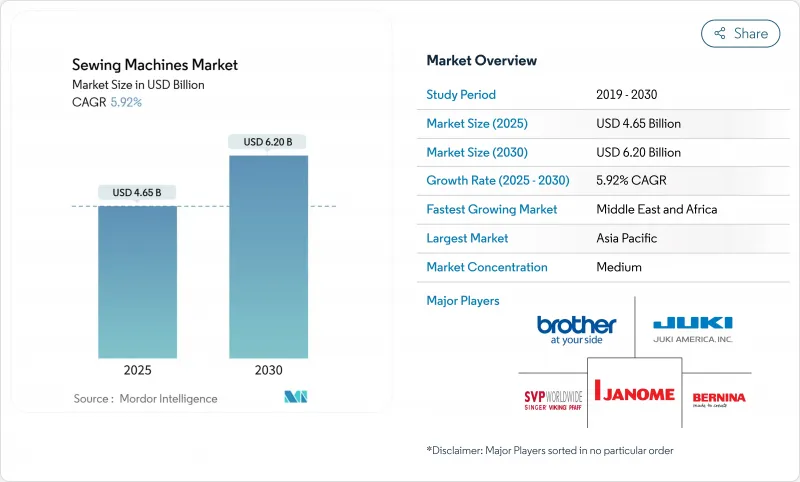

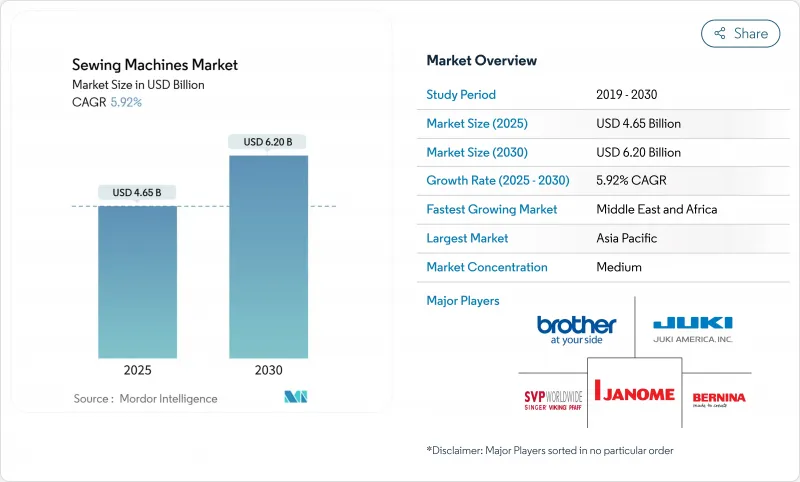

預計到 2025 年,縫紉機市場規模將達到 46.5 億美元,到 2030 年將達到 62 億美元,複合年成長率為 5.92%。

工業自動化需求正在推動成長,擴大創客機芯,而快速的技術升級則提高了生產效率,同時減少了工廠和家庭的浪費。製造商受惠於亞洲紡織品出口量龐大以及北美和歐洲的維修更換文化帶來的雙重優勢。 Wi-Fi 連接、可下載的針跡庫和可程式邏輯控制器等技術升級提高了平均售價,同時延長了更換週期,即使銷量趨於穩定,也能保證收益。服飾生產回歸美國和西歐的近岸外包模式,進一步擴大了靈活的小批量生產系統的可用基礎,使款式變更無需漫長的換型過程。

全球縫紉機市場趨勢與洞察

亞太地區服裝製造業的快速擴張

在公共獎勵和出口導向策略的推動下,亞洲服裝生產持續領先其他地區。光是印度就計劃在2030年實現3,500億美元的紡織品出口額,這刺激了高產能縫紉生產線的大量採購。針對技術紡織品的生產連結計畫縮短了無需人工干預即可處理多種布料重量的自動化機器的投資回收期。低成本傳統中心不斷上漲的工資促使製造商轉向配備伺服馬達和可程式設計縫紉模式的設備,以抵消人事費用。越南和孟加拉的工廠集群簡化了售後物流,鼓勵供應商建立區域服務中心。隨著訂單從基本款T卹轉向高價值的休閒和正裝,市場需求正轉向具有複雜縫紉結構和數位壓板調節功能的縫紉機。

在成熟經濟中,DIY和手工藝文化的復興

Z世代消費者將居家縫紉視為打造個人化時尚和減少紡織品廢棄物的途徑,而社群媒體上的教學則將這種興趣轉化為可觀的硬體銷售。零售商現在提供入門套裝,將入門級縫紉機與可下載的紙樣組合在一起,以降低學習難度。疫情期間興起的愛好熱潮在疫情結束後依然盛行,成為一種有效的減壓方式,即使其他家居用品類別恢復正常,也依然保持著零售額的高位。外形規格和類似智慧型手機的觸控螢幕深受數位原民原住民的喜愛,迫使品牌優先考慮直覺的用戶體驗而非機械的複雜性。 Etsy等手工製品二手交易平台的興起進一步收益了這項愛好的商業化,並鼓勵用戶在掌握基本功能後升級設備。

工業機械的高資本支出

雖然有供應商融資方案,但這些方案僅涵蓋硬體,培訓和維護並不包含在融資範圍內。銀行通常要求提供抵押品,而小型作坊往往缺乏抵押品,這延緩了現代化進程,導致生產基地仍然使用十年前的鎖式縫紉機。隨著品牌對縫紉強度和數位化可追溯性的要求日益嚴格,延遲投資會降低企業的競爭力。 JUKI 於 2024 年推出的租賃計畫在越南已率先實施,但在其他地區仍屬新穎。

細分市場分析

到2024年,電動縫紉機將佔總銷售量的65.00%,凸顯其在工廠和家庭中的多功能性。許多工業買家將這個細分市場視為邁向全面自動化的過渡階段,他們會加裝伺服驅動器和半自動剪線器來延長機器的使用壽命。同時,隨著工廠追求縫紉品質的穩定性和減少返工,預計到2030年,自動化縫紉機的年複合成長率將達到6.89%。自動化系統的市場規模正在擴大,反映出運動服裝和產業用紡織品工廠的需求不斷成長。手動縫紉機仍然在電力不穩定的地區使用,並且越來越受到喜歡觸感操控的工匠的歡迎。

由於備件供應充足且操作人員熟悉操作,電動縫紉機仍然佔據主導地位,從而降低了培訓需求。勝家(Singer)的M3330支援Wi-Fi功能,顯示傳統縫紉機類別正在吸收智慧功能,而無需採用複雜的數控系統。液壓絎縫機屬於「其他」類別,在床墊製造領域取得了成功,並正在將市場拓展到土耳其和波蘭。電動縫紉機和入門級自動化系統之間的價格差距已縮小至18%,這是財務長開始批准升級的閾值。

2024年,服裝銷售額將佔總銷售額的58.30%,這主要得益於快時尚巨頭和製服供應商的大訂單。運動服裝市場也日益成長,因為拉伸布料需要差動送布包縫機,而原始設備製造商(OEM)也開始捆綁銷售專用壓腳。窗簾和靠墊套等家紡產品是成長最快的細分市場,年複合成長率(CAGR)高達6.95%,主要得益於屋主對個人化家居裝飾的投入。 2023年至2024年,家用紡織品縫紉機的市佔率將成長120個基點,這預示著家庭客家用紡織品趨勢的持續發展。非服裝領域還包括汽車內裝、醫療耗材和工業過濾器,這些領域都需要高強度縫紉針和加固型工作檯面。

消費者對永續室內裝潢的偏好推動了對優質紗線的需求,使供應環保染色紗線的子公司American & Efird受益。汽車座椅製造商要求縫紉機具備每秒40針的加固縫紉能力,這為能夠整合高扭矩伺服馬達的供應商創造了機會。雖然超音波縫紉在醫療防護裝備領域也佔有一席之地,但監管審核表明,對於關鍵的罩衣接縫,縫線仍然是首選。印度都市區可支配收益的成長正在擴大專用刺繡機的市場。這種多元化經營有助於緩解服飾製造業的週期性低迷,從而在服飾低迷時期為原始設備製造商(OEM)的利潤提供緩衝。

區域分析

亞太地區2024年銷售額成長51.00%,反映出其在紡織服裝價值鏈中無可比擬的規模以及不斷成長的中階消費。印度持續推行與生產連結獎勵計畫,最高可報銷15%的資本投資,鼓勵工廠快速現代化。中國原始設備製造商(OEM)正增加對全球品牌伺服組件和人機介面的供應,縮短功能更新的前置作業時間。越南服裝出口的成長促使供應商在胡志明市建造服務倉庫,從而減少因更換備件而造成的停機時間。此外,該地區消費者對手工愛好的熱情也日益高漲,雅加達和曼谷的零售連鎖店報告稱,入門級家用電器的銷售額實現了兩位數的成長。

中東和非洲地區,在埃及蘇伊士運河經濟區等基礎設施走廊和免稅工業網路的支持下,將成為成長最快的地區,預計年複合成長率將達到7.20%。埃塞俄比亞的哈瓦薩工業目前已擁有25家服裝製造商,海關數據顯示,到2024年,該總合將進口超過5,000台可程式設計包縫機。波灣合作理事會成員國正在其「2030願景」計畫下鼓勵紡織業投資,沙烏地阿拉伯計劃為綜合工廠提供5億美元的貸款。非洲消費市場也在日趨成熟,奈及利亞的電商平台銷售的中階手機在節慶期間經常售罄。培訓仍然是一項挑戰。原始設備製造商(OEM)正與內羅畢和阿克拉的職業學校合作,為操作人員提供基礎維護認證。

北美本土製造業正在復甦,這主要得益於消費者對本地服飾的重視以及品牌面臨的跨太平洋貨運價格波動。耐吉等品牌正在奧勒岡州試點自動化生產線,這些生產線採用能夠縫製多種材料的數控縫紉機頭。北卡羅來納州和南卡羅來納州提供州級津貼,用於將傳統工廠升級為智慧工廠。加拿大服裝業的中小型企業正在採用線上配置器,允許終端用戶設計定製圖案,這間接提升了對可接收數位輸入檔案的縫紉機的需求。隨著美國買家為了適應快速反應的零售模式而選擇就近採購,墨西哥正在確保產生連鎖反應。

歐洲擁有成熟的工業基礎和前沿的永續性政策,正在重新定義設備規格。將於2027年生效的生態設計指令將要求在機器層面提供精確的能耗指標,引導原始設備製造商(OEM)採用高效能伺服馬達。德國在汽車和航太應用的技術紡織品領域持續保持領先地位,推動了對重型可程式打結機的需求。義大利奢侈時裝品牌正在採用專業的手工刺繡機以及自動化設備,以保持「義大利製造」的純正品質。由於物流不穩定,羅馬尼亞和保加利亞的東歐工廠正在將部分訂單從亞洲轉移過來,這迫使它們迅速擴大機器規模。

在南美洲,巴西聖卡塔琳娜州的服飾叢集正穩步發展,透過現代化改造和引入伺服馬達節能措施來應對不斷上漲的電費。烏拉圭和巴拉圭正積極吸引中國投資者建立從棉花到服裝的完整產業鏈,這有望實現設備需求的在地化。同時,智利日益成長的電子商務也促使業餘愛好者使用專為小型公寓設計的緊湊型家用機器。外匯波動仍然是一個主要的阻力,往往導致進口機械設備的購買決策被推遲,直到外匯穩定下來。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞太地區服裝製造業的快速擴張

- 成熟經濟體中DIY與手工藝文化的復興

- 物聯網縫紉機和數控縫紉機的進步

- 推廣工業自動化以提高生產力

- 透過近岸外包增加對小批量生產單位的需求

- 「維修與再利用」的消費運動促進了永續性。

- 市場限制

- 工業機械方面的高資本支出

- 低成本再生產品的普及

- 電子產品供應鏈中的瓶頸(MCU、伺服)

- 先進機型熟練操作人員短缺

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 洞察最新市場趨勢與創新

- 深入了解市場近期發展動態(新產品發布、策略性舉措、投資、合作、合資、市場發展、併購等)

第5章 市場規模與成長預測

- 按機器類型

- 手動型

- 電的

- 自動的

- 其他機器類型

- 透過使用

- 服裝與時尚

- 非服裝紡織品(汽車、室內裝潢)

- 鞋類和皮革製品

- 家用紡織品和工藝品

- 其他用途

- 最終用戶

- 住宅

- 工業的

- 按分銷管道

- B2C/零售

- 多品牌店

- 獨家品牌經銷店

- 線上

- 其他分銷管道

- B2B/製造商直銷

- B2C/零售

- 按地區

- 北美洲

- 加拿大

- 美國

- 墨西哥

- 南美洲

- 巴西

- 秘魯

- 智利

- 阿根廷

- 其他南美

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 比荷盧經濟聯盟(比利時、荷蘭、盧森堡)

- Nordix(丹麥、芬蘭、冰島、挪威、瑞典)

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 韓國

- 東南亞(新加坡、馬來西亞、泰國、印尼、越南、菲律賓)

- 其他亞太地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Brother Industries, Ltd.

- JUKI Corporation

- SVP Worldwide(Singer(R), Husqvarna Viking(R), Pfaff(R))

- Janome Sewing Machine Co., Ltd.

- Bernina International AG

- Mitsubishi Electric Corp.(Industrial Sewing Machinery)

- Jack Sewing Machine Co., Ltd.

- Pegasus Sewing Machine Mfg. Co., Ltd.

- Toyota Industries Corp.(TACHINO)

- Baby Lock/Tacony Corporation

- Zoje Sewing Machine Co., Ltd.

- Feiyue Group Co., Ltd.

- Union Special LLC

- Rimoldi & CF

- SunStar Co., Ltd.

- Yamato Sewing Machine Mfg. Co., Ltd.

- Typical Sewing Machine Co., Ltd.

- Seiko Sewing Machine Co., Ltd.

- Merrow Sewing Machine Company

第7章 市場機會與未來展望

The sewing machine market attained a value of USD 4.65 billion in 2025 and is forecast to rise at a 5.92% CAGR to USD 6.20 billion in 2030.

Industrial automation requirements power growth, the widening maker movement, and rapid feature upgrades that allow both factories and households to boost productivity while reducing waste. Manufacturers benefit from dual exposure: large-volume textile exports in Asia and the repair-over-replace culture in North America and Europe. Technology upgrades toward Wi-Fi connectivity, downloadable stitch libraries, and programmable logic controllers lengthen replacement cycles yet raise average selling prices, supporting revenue even when unit volumes plateau. Near-shoring of garment production back to the United States and Western Europe further expands the addressable base for flexible, small-batch industrial systems that can switch styles without lengthy retooling.

Global Sewing Machines Market Trends and Insights

Rapid Apparel-Manufacturing Expansion in Asia-Pacific

Asia continues to outpace every other region in apparel output, fueled by public incentives and export-oriented strategies. India alone targets USD 350 billion in textile exports by 2030, stimulating bulk procurement of high-throughput sewing lines . Production-linked schemes covering technical textiles lower the payback period on automated machines that handle multiple fabric weights without manual intervention. Growing wages in legacy low-cost centers push manufacturers toward units with servo motors and programmable stitch patterns that offset labor costs. Factory clustering in Vietnam and Bangladesh simplifies after-sales logistics, encouraging suppliers to embed regional service hubs. As orders shift from basic tees to higher-value athleisure and formalwear, demand tilts toward machines capable of complex seam constructions and digital platen adjustments.

DIY & Craft Culture Revival in Mature Economies

Gen Z consumers view home sewing as a route to personalized fashion and lower textile waste, and social media tutorials convert that interest into measurable hardware sales. Retailers now curate starter bundles that pair entry-level machines with downloadable patterns, easing the learning curve. Pandemic-era hobby adoption has persisted post-lockdown as a stress-relief habit, keeping retail sell-through high even as other home-improvement categories normalize. Compact form factors that fit small apartments and smartphone-like touchscreens resonate with digital natives, forcing brands to prioritize intuitive UX over mechanical complexity. The rising tide of reseller platforms for handmade items, such as Etsy, further monetizes the hobby, reinforcing equipment upgrades once users outgrow basic functions.

High Capital Outlay for Industrial Machines

Vendor financing options exist yet cover only the hardware, leaving training and maintenance outside loan packages. Banks often require collateral that small workshops lack, delaying modernization cycles and leaving production stuck with 10-year-old lockstitch units. Deferred investment saps competitiveness when brands demand tight tolerances on seam strength and digital traceability. Leasing programs introduced by JUKI in 2024 showed early adoption in Vietnam but remain a novelty elsewhere, partly because operators fear long-term commitment to proprietary software ecosystems.

Other drivers and restraints analyzed in the detailed report include:

- Advancements in IoT-Enabled and CNC Sewing Machines

- Industrial Automation Push for Productivity

- Shortage of Skilled Operators

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electric models accounted for 65.00% of revenue in 2024, underscoring their versatility for factories and households alike. Many industrial buyers regard the segment as an interim step toward full automation, adding servo drives and semi-automatic thread cutters to stretch machine life cycles. Automated units, meanwhile, are slated to expand at 6.89% CAGR through 2030 as factories chase consistent stitch quality and lower rework. The sewing machine market size for automated systems is growing, reflecting rising demand from sportswear and technical-textile plants. Manual machines linger in regions with unstable electricity grids, carving out a defensible niche among artisans who prize tactile control.

Continued dominance of the electric segment derives from abundant spare parts and universal familiarity among operators, decreasing training periods. Singer's Wi-Fi-ready M3330 illustrates how traditional categories absorb smart features without jumping to full CNC complexity. Hydraulically actuated quilting machines populate the "other" category and find success in mattress manufacturing, expanding geographic penetration into Turkey and Poland. Price gaps between electric and entry-level automated systems have narrowed to 18%, a threshold at which CFOs start green-lighting upgrades.

Apparel retained a commanding 58.30% slice of 2024 revenue due to vast order volumes from fast-fashion giants and uniform suppliers. Sportswear gains traction as stretch fabrics require differential-feed overlockers, prompting OEMs to bundle specialized presser feet. Home textiles, including curtains and cushion covers, represent the fastest-growing niche with a 6.95% CAGR as homeowners invest in personalized decor. The sewing machine market share for home-textile applications rose 120 basis points between 2023 and 2024, signaling a durable shift toward at-home customization. Automotive upholstery, medical disposables, and industrial filters round out the non-apparel group, each demanding heavy-duty needles and reinforced work tables.

Consumer preference for sustainable interiors boosts premium thread demand, benefiting subsidiaries like American & Efird that supply eco-dyed yarns. Car seat makers specify bar-tacking capabilities at 40 stitches per second, creating opportunities for providers that can integrate high-torque servo motors. In medical PPE, ultrasonic sewing alternatives compete, yet regulatory audits still favor stitched seams for critical gowns. Rising disposable income in urban India grows the market for embroidery-only machines that let users monetize home businesses. This diversification smooths cyclical dips in garment manufacturing, cushioning OEM revenue during apparel slowdowns.

The Sewing Machines Market Report is Segmented by Machine Type (Manual, Electric, and More), by Application (Apparel, Non-Apparel Textiles, and More), by End-User (Residential and Industrial), by Distribution Channel (B2C/Retail and B2B/Directly From the Manufacturers), and by Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's 51.00% revenue leadership in 2024 reflects its unmatched scale in fiber-to-fashion value chains and ascending middle-class consumption. India continues to roll out Production Linked Incentives that reimburse up to 15% of capital investment, prompting mills to modernize quickly . Chinese OEMs increasingly supply servo components and human-machine interfaces to global brands, shortening lead times for feature updates. Vietnam's apparel export growth encourages suppliers to build service warehouses in Ho Chi Minh City, reducing downtime for spare-part replacements. The region also witnesses swelling consumer enthusiasm for craft hobbies, as retail chains in Jakarta and Bangkok report double-digit sales lift for entry-level home units.

The Middle East and Africa grows the fastest, projected at 7.20% CAGR, supported by infrastructure corridors like Egypt's Suez Canal Economic Zone that bundle industrial parks with duty exemptions. Ethiopia's Hawassa Industrial Park already houses 25 apparel manufacturers that collectively imported more than 5,000 programmable lockstitch machines in 2024 according to customs data. Gulf Cooperation Council states encourage textile investments under Vision-2030 plans, with Saudi Arabia earmarking USD 500 million loans for integrated mills. African consumer markets also mature; Nigeria's e-commerce platforms now list mid-range portable models that sell out during festival seasons. The challenge lies in training; OEMs partner with vocational institutes in Nairobi and Accra to certify operators on basic maintenance.

North America experiences a revival in domestic making, powered by consumers who value locally produced garments and by brands facing unpredictable trans-Pacific freight. Brands such as Nike pilot automated lines in Oregon that rely on CNC sewing heads capable of multi-material stitching. State-level grants in North Carolina and South Carolina subsidize equipment purchases for legacy mills upgrading to smart factories. Canada's apparel SMEs embrace online configurators that allow end-users to design custom patterns, indirectly boosting demand for machines that accept digital input files. Mexico secures spill-over benefits as US buyers near-source to comply with quick-response retail models.

Europe blends mature industrial bases with avant-garde sustainability policies that redefine equipment specifications. Eco-design directives coming into force by 2027 will require precise energy-consumption metrics at the machine level, nudging OEMs toward high-efficiency servo motors. Germany continues to lead in technical textiles for automotive and aerospace, prompting demand for heavy-duty programmable bartackers. Italy's luxury fashion houses employ specialized hand-guided embroiderers alongside automated equipment to uphold "Made in Italy" authenticity. Eastern European factories in Romania and Bulgaria win orders redirected from Asia due to logistics volatility, necessitating rapid scale-up in machine fleets.

South America exhibits steady momentum as Brazil's garment cluster in Santa Catarina modernizes, deploying servo-motor retrofits to capture energy savings under rising electricity tariffs. Uruguay and Paraguay court Chinese investors for integrated cotton-to-apparel complexes that could localize equipment demand. Meanwhile, Chile's e-commerce penetration fosters hobbyist uptake of compact home machines designed for small apartments. Currency fluctuations remain the principal headwind, often delaying purchase decisions for imported machines until exchange rates stabilize.

- Brother Industries, Ltd.

- JUKI Corporation

- SVP Worldwide (Singer(R), Husqvarna Viking(R), Pfaff(R))

- Janome Sewing Machine Co., Ltd.

- Bernina International AG

- Mitsubishi Electric Corp. (Industrial Sewing Machinery)

- Jack Sewing Machine Co., Ltd.

- Pegasus Sewing Machine Mfg. Co., Ltd.

- Toyota Industries Corp. (TACHINO)

- Baby Lock / Tacony Corporation

- Zoje Sewing Machine Co., Ltd.

- Feiyue Group Co., Ltd.

- Union Special LLC

- Rimoldi & CF

- SunStar Co., Ltd.

- Yamato Sewing Machine Mfg. Co., Ltd.

- Typical Sewing Machine Co., Ltd.

- Seiko Sewing Machine Co., Ltd.

- Merrow Sewing Machine Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid apparel-manufacturing expansion in APAC

- 4.2.2 DIY & craft culture revival in mature economies

- 4.2.3 Advancements in IoT-enabled and CNC sewing machines

- 4.2.4 Industrial automation push for productivity

- 4.2.5 Near-shoring boosts demand for small-batch industrial units

- 4.2.6 Sustainability-driven "repair & reuse" consumer movement

- 4.3 Market Restraints

- 4.3.1 High capital outlay for industrial machines

- 4.3.2 Proliferation of low-cost refurbished units

- 4.3.3 Electronics supply-chain bottlenecks (MCUs, servos)

- 4.3.4 Shortage of skilled operators for advanced models

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts

- 5.1 By Machine Type

- 5.1.1 Manual

- 5.1.2 Electric

- 5.1.3 Automated

- 5.1.4 Other Machine Types

- 5.2 By Application

- 5.2.1 Apparel & Fashion

- 5.2.2 Non-apparel Textiles (Automotive, Upholstery)

- 5.2.3 Footwear & Leather Goods

- 5.2.4 Home Textiles & Crafts

- 5.2.5 Other Applications

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Industrial

- 5.4 By Distribution Channel

- 5.4.1 B2C/Retail

- 5.4.1.1 Multi-brand Stores

- 5.4.1.2 Exclusive Brand Outlets

- 5.4.1.3 Online

- 5.4.1.4 Other Distribution Channels

- 5.4.2 B2B/Directly from the Manufacturers

- 5.4.1 B2C/Retail

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 Canada

- 5.5.1.2 United States

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Peru

- 5.5.2.3 Chile

- 5.5.2.4 Argentina

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.5.3.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 India

- 5.5.4.2 China

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 South-East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, Philippines)

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Brother Industries, Ltd.

- 6.4.2 JUKI Corporation

- 6.4.3 SVP Worldwide (Singer(R), Husqvarna Viking(R), Pfaff(R))

- 6.4.4 Janome Sewing Machine Co., Ltd.

- 6.4.5 Bernina International AG

- 6.4.6 Mitsubishi Electric Corp. (Industrial Sewing Machinery)

- 6.4.7 Jack Sewing Machine Co., Ltd.

- 6.4.8 Pegasus Sewing Machine Mfg. Co., Ltd.

- 6.4.9 Toyota Industries Corp. (TACHINO)

- 6.4.10 Baby Lock / Tacony Corporation

- 6.4.11 Zoje Sewing Machine Co., Ltd.

- 6.4.12 Feiyue Group Co., Ltd.

- 6.4.13 Union Special LLC

- 6.4.14 Rimoldi & CF

- 6.4.15 SunStar Co., Ltd.

- 6.4.16 Yamato Sewing Machine Mfg. Co., Ltd.

- 6.4.17 Typical Sewing Machine Co., Ltd.

- 6.4.18 Seiko Sewing Machine Co., Ltd.

- 6.4.19 Merrow Sewing Machine Company

7 Market Opportunities & Future Outlook

- 7.1 Growing demand for compact and portable sewing machines

- 7.2 Increasing prevalence of smart (integration of IoT and AI) and computerized sewing machines