|

市場調查報告書

商品編碼

1766229

電腦縫紉與刺繡機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Computerized Sewing and Embroidery Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

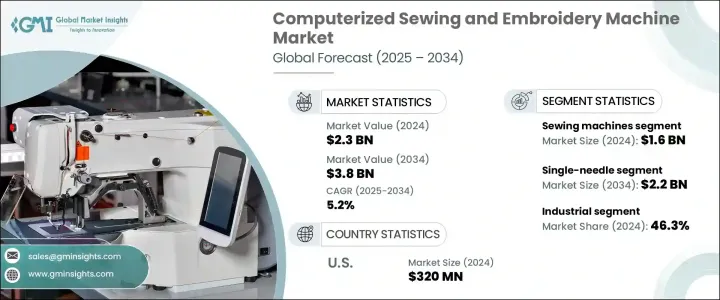

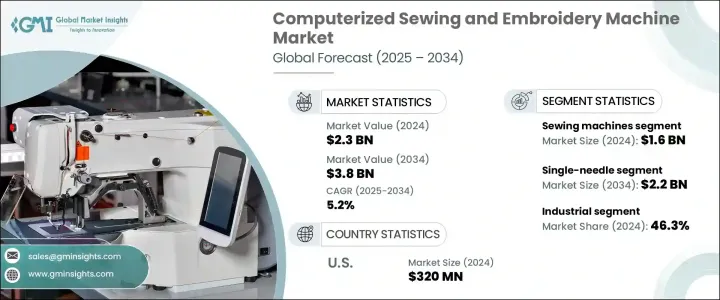

2024年,全球電腦縫紉和刺繡機市場規模達23億美元,預計到2034年將以5.2%的複合年成長率成長,達到38億美元。這一成長軌跡主要得益於全球紡織業的持續擴張。隨著人口成長和生活方式的改變,全球服裝需求不斷成長,紡織業正呈現持續成長動能。電腦縫紉和刺繡機在滿足這一需求方面發揮關鍵作用,它能夠以極低的維護成本實現大批量服裝生產,並保持始終如一的品質。這些機器尤其受到青睞,因為它們能夠在極短的時間內複製複雜精緻的剪裁。

線上零售的蓬勃發展和消費者偏好的不斷變化,極大地影響了客製化和時尚服裝的需求。隨著人們對快時尚和獨特設計的追求日益成長,製造商開始轉向自動化解決方案,以在不影響精度的情況下滿足高生產力標準。有組織的零售網路的發展,尤其是在城市地區,進一步促進了縫紉和刺繡機在不同終端使用環境中的應用。此外,全球市場動態和紡織業不斷變化的政策加劇了競爭,迫使製造商不斷創新和升級其產品。因此,先進功能和智慧技術的整合已成為保持競爭力的關鍵,無論對於大型製造商還是致力於在快速發展的行業中保持領先地位的小型生產單位而言,電腦化機器都不可或缺。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 23億美元 |

| 預測值 | 38億美元 |

| 複合年成長率 | 5.2% |

按類型分類,市場可分為縫紉機、刺繡機和多功能縫紉機。其中,縫紉機佔了相當大的佔有率,2024 年市場規模超過 16 億美元,預計 2025 年至 2034 年的複合年成長率約為 4.9%。由於其適應性強、操作簡便且經濟高效,縫紉機在家庭和各行各業中都得到了廣泛的應用。自動剪線、圖案客製化和便利針跡選擇等增強功能現已成為新縫紉機的標配,幫助用戶更方便地生產出高品質的服裝。旨在促進本地紡織製造業發展的政策支持也促進了該細分市場的成長,使現代設備更容易獲得。

按類別細分,市場分為單針縫紉機和多針縫紉機。單針縫紉機類別在2024年佔據最大佔有率,佔了整個市場的60.8%,預計到2034年將達到22億美元。單針縫紉機因其速度快、精度高且在標準服裝生產中易於使用而備受青睞。這些機器正擴大升級為數位控制,允許操作員調整縫紉圖案並即時監控性能。在品質標準高且消費者期望不斷變化且成熟的市場中,對先進單針縫紉機的需求尤其強勁。

根據應用,市場細分為住宅、商業和工業類別。工業領域在2024年以46.3%的市佔率領先市場,預計在整個預測期內將維持這一地位。工業級機器對於高容量運作至關重要,因為耐用性和速度至關重要。這些系統經過精心設計,可長時間運作而無需停機,是連續生產環境的理想選擇。紡織基礎雄厚且政府推出了旨在實現製造業基礎設施現代化的支持性政策的國家,正在推動該領域的持續成長。

2024年,美國市場規模超過3.2億美元,預計到2034年將以5.2%的複合年成長率成長。這一成長主要得益於充滿活力的時尚生態系統和濃厚的DIY文化,這兩者都推動了對精密且方便用戶使用的機器的需求。紡織生產中自動化和智慧技術的日益普及也推動了設備升級。進口資料反映出,旨在提高生產力和營運效率的高科技機械的進口量持續成長。

電腦縫紉和刺繡機市場的製造商正在運用多種策略來鞏固其市場地位。這些策略包括推出技術先進的產品、進行全球擴張、建立策略聯盟以及豐富產品組合以瞄準不同的消費群體。企業也透過探索環保材料和節能技術來回應永續發展的需求。此外,與區域分銷商和當地零售合作夥伴合作已被證明是市場滲透的有效途徑,尤其是在新興經濟體。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- MEA

- 拉丁美洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 縫紉機

- 刺繡機

- 組合機

第6章:市場估計與預測:按速度,2021 - 2034 年

- 主要趨勢

- 最高 500 SPM

- 500-1,000 SPM

- 1,000-1,500 SPM

- 1,500-2,000 SPM

- 2,500-3,000 馬裡蘭州立大學

- 3,000 SPM 以上

第7章:市場估計與預測:依類別,2021 - 2034 年

- 主要趨勢

- 單針

- 多針

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 住宅

- 商業的

- 時裝設計師和精品店

- 客製化刺繡店

- 家紡零售商

- 室內裝潢企業

- 工業的

- 大型服裝製造商

- 汽車內裝製造商

- 醫療保健紡織品製造商

- 制服供應商

- 其他

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直銷

- 間接銷售

- 大型超市

- 專賣店

- 線上零售商

- 獨立經銷商

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第 11 章:公司簡介

- Baby Lock

- Bernina International AG

- Brother Industries Ltd.

- Durkopp Adler AG

- Elna International Corp. SA

- Husqvarna AB

- Janome Sewing Machine Co., Ltd.

- Juki Corporation

- Necchi Italia Srl

- Pfaff Sewing Machines

- Ricoma International Corporation

- SunStar Precision Co., Ltd.

- Tajima Industries Ltd.

- The Singer Company Limited LLC

- ZSK Stickmaschinen GmbH

The Global Computerized Sewing and Embroidery Machine Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 3.8 billion by 2034. This growth trajectory is primarily supported by the continuous expansion of the global textile industry. As global demand for apparel increases in response to population growth and lifestyle changes, the textile industry is witnessing sustained momentum. Computerized sewing and embroidery machines play a critical role in meeting this demand by enabling high-volume garment production with minimal maintenance and consistent quality. These machines are particularly favored for their ability to replicate intricate and refined tailoring in a fraction of the time required by manual labor.

The proliferation of online retail and changing consumer preferences have significantly influenced the demand for customized and fashionable clothing. With a growing appetite for fast fashion and unique designs, manufacturers are turning to automated solutions that can meet high productivity standards without compromising on precision. The development of organized retail networks, particularly in urban areas, has further encouraged the adoption of sewing and embroidery machines across different end-use settings. Moreover, global market dynamics and constant policy shifts in the textile sector are amplifying competition, compelling manufacturers to innovate and upgrade their offerings. As a result, the integration of advanced features and smart technologies has become central to staying competitive, making computerized machines indispensable for both large-scale manufacturers and small production units aiming to stay ahead in a rapidly evolving industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 5.2% |

In terms of type, the market is segmented into sewing machines, embroidery machines, and combination machines. Among these, sewing machines accounted for a significant portion, exceeding USD 1.6 billion in 2024, and are expected to grow at a CAGR of approximately 4.9% from 2025 to 2034. These machines enjoy widespread use across households and industries alike due to their adaptability, simplicity, and cost-efficiency. Enhanced functionalities such as automatic thread cutting, pattern customization, and easy stitch selection are now standard in newer models, helping users produce high-quality garments with greater convenience. Policy support aimed at boosting local textile manufacturing has also contributed to the growth of this segment by making modern equipment more accessible.

When segmented by category, the market is classified into single-needle and multi-needle machines. The single-needle category held the largest share in 2024, capturing 60.8% of the total market, and is expected to reach USD 2.2 billion by 2034. Single-needle machines are favored for their speed, precision, and ease of use in standard garment production. They are increasingly being upgraded with digital controls that allow operators to adjust stitching patterns and monitor performance in real time. The demand for advanced single-needle machines is particularly strong in mature markets where quality standards are high and consumer expectations continue to evolve.

Based on application, the market is segmented into residential, commercial, and industrial categories. The industrial segment led the market in 2024 with a 46.3% share and is expected to maintain this position throughout the forecast period. Industrial-grade machines are essential for high-capacity operations where durability and speed are critical. These systems are engineered to handle extended usage without downtime, making them ideal for continuous production environments. Countries with a strong textile base and supportive government policies aimed at modernizing manufacturing infrastructure are contributing to the sustained growth of this segment.

The United States market surpassed USD 320 million in 2024 and is anticipated to grow at a CAGR of 5.2% through 2034. This growth is largely driven by a vibrant fashion ecosystem and a strong do-it-yourself culture, both of which are pushing the demand for sophisticated and user-friendly machines. The increasing adoption of automation and smart technologies in textile production is also fueling equipment upgrades. Import data reflects a consistent rise in the inflow of high-tech machinery designed for enhanced productivity and operational efficiency.

Manufacturers in the computerized sewing and embroidery machine market are leveraging multiple strategies to reinforce their market position. These include rolling out technologically advanced products, pursuing global expansion, establishing strategic alliances, and diversifying product portfolios to target various consumer segments. Companies are also responding to sustainability demands by exploring eco-friendly materials and energy-efficient technologies. Moreover, aligning with regional distributors and local retail partners has proven effective for market penetration, particularly in emerging economies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Speed

- 2.2.4 Category

- 2.2.5 Application

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034, (USD Billion)(Thousand Units)

- 5.1 Key trends

- 5.2 Sewing machines

- 5.3 Embroidery machines

- 5.4 Combination machines

Chapter 6 Market Estimates & Forecast, By Speed, 2021 - 2034, (USD Billion)(Thousand Units)

- 6.1 Key trends

- 6.2 Up to 500 SPM

- 6.3 500-1,000 SPM

- 6.4 1,000-1,500 SPM

- 6.5 1,500-2,000 SPM

- 6.6 2,500-3,000 SPM

- 6.7 Above 3,000 SPM

Chapter 7 Market Estimates & Forecast, By Category, 2021 - 2034, (USD Billion)(Thousand Units)

- 7.1 Key trends

- 7.2 Single?needle

- 7.3 Multi?needle

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion)(Thousand Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 Fashion designers & boutiques

- 8.3.2 Custom embroidery shops

- 8.3.3 Home textile retailers

- 8.3.4 Upholstery businesses

- 8.4 Industrial

- 8.4.1 Large?Scale apparel manufacturers

- 8.4.2 Automotive interior manufacturers

- 8.4.3 Healthcare textile manufacturers

- 8.4.4 Uniform suppliers

- 8.4.5 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion)(Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

- 9.3.1 Hypermarkets

- 9.3.2 Specialty stores

- 9.3.3 Online retailers

- 9.3.4 Independent dealers

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion)(Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Baby Lock

- 11.2 Bernina International AG

- 11.3 Brother Industries Ltd.

- 11.4 Durkopp Adler AG

- 11.5 Elna International Corp. SA

- 11.6 Husqvarna AB

- 11.7 Janome Sewing Machine Co., Ltd.

- 11.8 Juki Corporation

- 11.9 Necchi Italia S.r.l.

- 11.10 Pfaff Sewing Machines

- 11.11 Ricoma International Corporation

- 11.12 SunStar Precision Co., Ltd.

- 11.13 Tajima Industries Ltd.

- 11.14 The Singer Company Limited LLC

- 11.15 ZSK Stickmaschinen GmbH