|

市場調查報告書

商品編碼

1844711

高強度貼合黏劑:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)High Strength Laminated Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

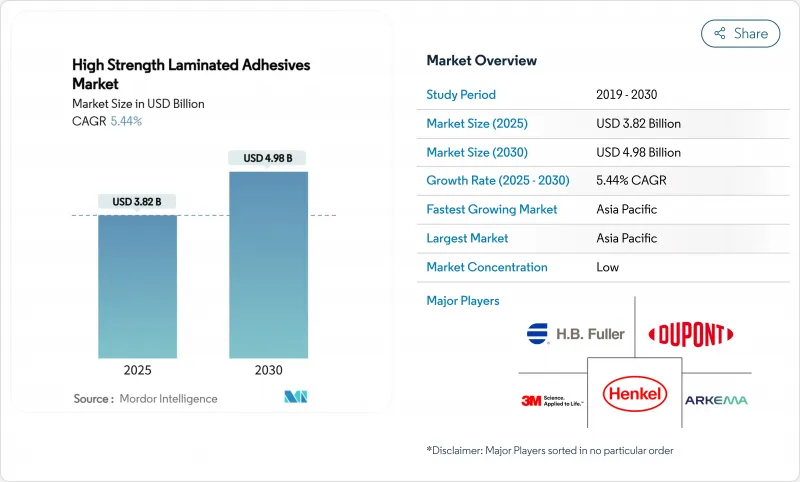

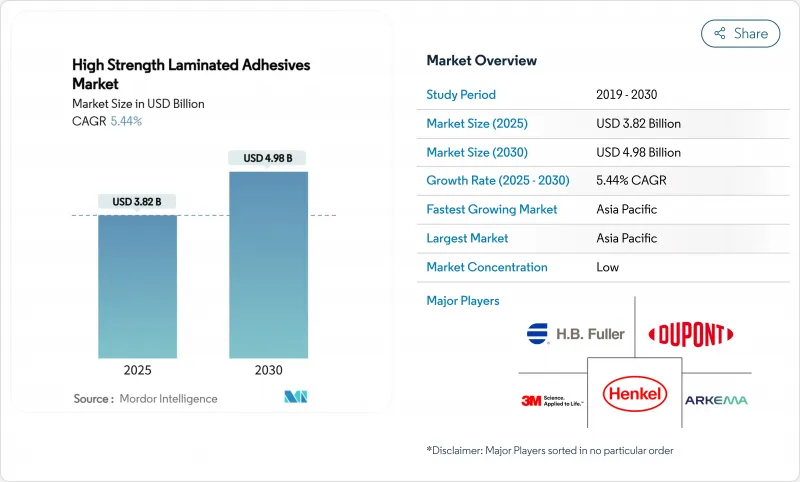

高強度貼合黏劑市場規模預計在 2025 年達到 38.2 億美元,預計到 2030 年將達到 49.8 億美元,預測期內(2025-2030 年)的複合年成長率為 5.44%。

儘管環境法規日益嚴格,但對軟包裝的強勁需求、汽車輕量化的加速以及電子產品的快速小型化正在推動市場的成長軌跡。開發商正在競相透過採用低VOC化學品、開發生物基原料和在亞太地區實現生產在地化來獲取增加的下游產能。策略性資產剝離,例如陶氏出售其軟包裝貼合黏劑生產線,標誌著該行業圍繞高價值利基市場的合理化,即使原料波動繼續擠壓淨利率。雖然技術向紫外光固化和水性系統的遷移正在加速,但溶劑型產品仍在關鍵的高性能層壓領域佔據主導地位,凸顯了市場的轉型。領先公司之間的整合受到大量區域專家的支持,這些專家支持靠近轉換器和汽車工廠的供應。

全球高強度貼合黏劑市場趨勢與洞察

對軟性和輕質包裝的需求不斷增加

隨著品牌商追求降低成本、提升消費者便利性,軟包裝的產量持續成長。預計到2028年,該產業的產值將達到3,416億美元,這將推動依賴高性能黏合劑系統的多層複合膜產量的成長。歐洲綠色新政強制要求使用單一材料包裝袋和可回收阻隔膜,這需要支援封閉式回收的黏合劑,這為產品配方師開闢了高階市場。電子商務也變得越來越緊迫,Packsize和漢高報告稱,使用Eco-Pax生物基熱熔膠解決方案,3.4億箱貨物的溫室氣體排放量減少了32%。能夠證明其食品接觸安全性、低遷移性和脫墨釋放性能的供應商正在貼合黏劑市場中獲得價格優勢。

汽車輕量化替代機械緊固件

現代汽車平均使用的黏合劑長度超過400線性英尺(約120公尺),而20年前僅為30英尺(約9公尺),這凸顯了從鉚釘和焊接到黏合線的結構性轉變。白色混合材料車身、電池組封裝和降噪層壓板都提高了剪切強度和熱循環耐久性的技術門檻。墨西哥汽車產業佔GDP的6%,預計產量將成長13%,這將擴大北美供應鏈的在地化需求。隨著原始設備製造商優先考慮錯亂型和報廢汽車回收,熱塑性聚氨酯配方的市場佔有率正在擴大。

原物料價格波動

BASF將把包括1,4-丁二醇和N-Methyl Pyrrolidone在內的關鍵聚氨酯前驅物的價格上調0.08美元至0.10美元/磅,自2025年4月起生效。 79%的複合材料製造商表示樹脂短缺,導致複合材料生產商的前置作業時間難以預測。對石油的依賴導致聚氨酯投入受原油波動影響,而生物基原料的供應規模有限。供應商正在透過季度定價條款和雙重籌資策略來應對,但不確定性仍然限制了貼合黏劑市場的利潤成長。

細分分析

到2024年,聚氨酯 (PU) 將佔全球市場收入的43.18%,這突顯了其在高軟性包裝袋層壓和高彈性汽車內裝表皮方面的多功能性。預計到2030年,該細分市場的複合年成長率將達到6.41%,並將繼續保持其在貼合黏劑市場的領先地位,因為加工商更青睞不同基材之間的強黏合。二異氰酸酯的監管壓力正在加速向非異氰酸酯聚氨酯 (PU) 和生物基多元醇的轉變,這些產品在不犧牲黏合強度的情況下減少了危險品標籤的使用。

生物基聚氨酯(Biocontent)的發展勢頭強勁,其前身源自木質素、大豆和蓖麻,可實現部分可再生的聚氨酯鏈。研究表明,非異氰酸酯聚氨酯(NIPU)的成功合成,其耐水解性與現有等級相當。丙烯酸系統在紫外光(UV)固化電子層壓領域的市場佔有率正在不斷擴大,因為該領域對光學清晰度和快速生產線速度至關重要。環氧樹脂系統繼續用於利基航太應用和風力葉片織物,這些領域需要卓越的化學穩定性,但其相對市場佔有率仍然較小。總體而言,聚氨酯創新正在推動貼合黏劑市場朝向低碳高性能解決方案邁進。

區域分析

預計到 2024 年,亞太地區將佔全球需求的 44.18%,到 2030 年的複合年成長率將達到 6.04%。該地區的主要企業,包括中國的加工商和印度的新樂泰工廠,正在實現供應本地化、縮短前置作業時間並降低跨國公司的外匯風險。

北美仍然是一個高價值地區,汽車輕量化和食品接觸安全標準推動創新。路博潤在北卡羅來納州斥資2000萬美元擴建丙烯酸乳液項目,標誌著其特種級產品產能持續擴張。

歐洲更嚴格的排放法規正在推動技術變革,並擴大生產者責任制度,優先考慮可回收複合材料,促使該地區的複合材料生產商轉向低單體聚氨酯和水性配方。拉丁美洲和中東地區正在成為新興的需求中心,這些地區與工業化計劃相關,並在私人消費方面正在迎頭趕上,但基數較低。從區域來看,靠近下游包裝和汽車製造商是貼合黏劑市場成功的關鍵。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 對軟性和輕質包裝的需求不斷增加

- 更換機械緊固件以減輕車輛重量

- 對低VOC(揮發性有機化合物)和無溶劑化學品的監管更加嚴格

- 全球製造地中電子產品的小型化

- 用於按需短版包裝的紫外線 (UV) 固化生產線

- 市場限制

- 原物料價格波動

- 嚴格的溶劑排放法規

- 生物基聚氨酯原料供應瓶頸

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測

- 依樹脂類型

- 聚氨酯

- 丙烯酸纖維

- 環氧樹脂

- 其他樹脂類型(例如醋酸乙烯酯)

- 依技術

- 水性

- 溶劑型

- 熱熔膠

- UV固化型

- 按用途

- 包裝

- 車

- 工業

- 其他用途(電子、電氣、建築等)

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率(%)/排名分析

- 公司簡介

- 3M

- Arkema

- artience Co., Ltd.

- Avery Dennison Corporation

- BASF

- Daubert Chemical Company

- DIC Corporation

- DuPont

- Franklin International

- HB Fuller Company

- Henkel AG and Co. KGaA

- Huntsman Corporation llc

- Jowat SE

- SAPICI SpA

第7章 市場機會與未來展望

The High Strength Laminated Adhesives Market size is estimated at USD 3.82 billion in 2025, and is expected to reach USD 4.98 billion by 2030, at a CAGR of 5.44% during the forecast period (2025-2030).

Robust flexible-packaging demand, accelerating automotive lightweighting and rapid electronics miniaturization keep the market firmly on a growth track despite tighter environmental rules. Producers are racing to introduce low-VOC chemistries, develop bio-based feedstocks and localize production in Asia-Pacific to capture rising downstream output. Strategic divestments, such as Dow's sale of its flexible-packaging laminating adhesives line, illustrate an industry streamlining around high-value niches while raw-material volatility pressures margins. Technology migration toward UV-curable and water-borne systems is gathering pace, yet solvent-based products still dominate critical high-performance laminations, highlighting a market in transition. Consolidation among tier-one players is tempered by a long tail of regional specialists that anchor supply close to converters and car plants.

Global High Strength Laminated Adhesives Market Trends and Insights

Escalating Demand for Flexible and Lightweight Packaging

Flexible packaging volumes keep rising as brand owners pursue down-gauging and consumer convenience. The sector is projected to hit USD 341.6 billion by 2028, lifting multilayer laminate output that relies on high-performance bonding systems . Mono-material pouches and recyclable barrier films mandated under the European Green Deal require adhesives compatible with closed-loop recycling, opening premium niches for product formulators. E-commerce adds urgency, with Packsize and Henkel reporting a 32% greenhouse-gas cut across 340 million shipper boxes when using Eco-Pax bio-based hot-melt solutions. Suppliers able to certify food-contact safety, low migration and de-inking debonding gain a pricing edge in the laminating adhesives market.

Automotive Lightweighting Replacing Mechanical Fasteners

Modern vehicles average more than 400 linear feet of adhesive versus 30 feet two decades ago, underscoring the structural shift from rivets and welds to bonding lines . Mixed-material bodies in white, battery-pack encapsulation and noise-damping laminates all raise the technical bar for shear strength and thermal-cycling durability. Mexico's auto sector, contributing 6% to national GDP, is on track for 13% production growth, amplifying localized demand in North American supply corridors. Thermoplastic polyurethane formulations gain share as OEMs prioritize dismantlability and end-of-life recycling.

Raw-Material Price Volatility

Raw material price volatility continues to pressure laminating adhesives manufacturers, with BASF implementing price increases of USD 0.08-0.10 per pound for key polyurethane precursors including 1,4-Butanediol and N-Methylpyrrolidone effective April 2025. Seventy-nine percent of composites fabricators cite resin shortages, exposing formulators to unpredictable lead times. Petroleum dependency keeps polyurethane inputs tethered to crude swings, while bio-based feedstocks face limited scale. Suppliers respond with quarterly pricing clauses and dual-sourcing strategies, yet the uncertainty still trims margin expansion in the laminating adhesives market.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push Toward Low-Volatile Organic Compound (VOC) and Solvent-Free Chemistries

- Electronics Miniaturization in Global Manufacturing Hubs

- Stringent Solvent-Emission Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyurethane (PU) claimed 43.18% of global revenue in 2024, underscoring its versatility in high-flexibility pouch laminations and resilient automotive interior skins. The segment is projected to grow at a 6.41% CAGR through 2030, keeping its lead in the laminating adhesives market as converters favor robust adhesion across heterogeneous substrates. Regulatory pressure on diisocyanates accelerates migration to non-isocyanate polyurethane (PU) and bio-based polyol routes that curb hazard labeling without sacrificing bond strength.

Bio-content gains momentum with lignin-, soy-, and castor-derived precursors enabling partially renewable polyurethane chains. Research demonstrates successful Non-Isocyanate Polyurethane (NIPU) syntheses that retain hydrolysis resistance equal to incumbent grades. Acrylic systems pick up share in ultraviolet (UV)-curable electronics laminations where optical clarity and rapid line speed are paramount. Epoxies continue to serve niche aerospace and wind-blade fabrics demanding extreme chemical stability, yet their relative market slice stays modest. Overall, innovation in polyurethane keeps the laminating adhesives market moving toward lower-carbon yet high-performance solutions.

The High Strength Laminating Adhesives Market Report is Segmented by Resin Type (Polyurethane, Acrylic, Epoxy, Other Resin Types), Technology (Water-Borne, Solvent-Based, Hot-Melt, UV-Curable), Application (Packaging, Automotive, Industrial, Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 44.18% of global demand in 2024 and is anticipated to expand at a 6.04% CAGR through 2030, fueled by chemical cluster investment and rising per-capita packaged-goods consumption. Regional heavyweights, including China's converters and India's new Loctite plant, localize supply, shorten lead times and cut currency risk for multinationals.

North America remains a high-value arena where automotive lightweighting and food-contact safety standards steer innovation. Lubrizol's USD 20 million acrylic-emulsion expansion in North Carolina illustrates continued capacity reinforcement for specialty grades.

Europe's stringent emission rules catalyze technology pivots and extend producer-responsibility schemes that prioritize recycle-ready laminations, pushing regional formulators into low-monomer polyurethane and water-borne recipes. Latin America and the Middle East present emergent demand nodes linked to industrialization projects and consumer spending catch-up, albeit from lower bases. The geography split shows that proximity to downstream packagers and automakers remains decisive for success in the laminating adhesives market.

- 3M

- Arkema

- artience Co., Ltd.

- Avery Dennison Corporation

- BASF

- Daubert Chemical Company

- DIC Corporation

- DuPont

- Franklin International

- H.B. Fuller Company

- Henkel AG and Co. KGaA

- Huntsman Corporation llc

- Jowat SE

- SAPICI S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Demand for Flexible and Lightweight Packaging

- 4.2.2 Automotive Lightweighting Replacing Mechanical Fasteners

- 4.2.3 Regulatory Push Toward Low-VOC (Volatile Organic Compound) and Solvent-Free Chemistries

- 4.2.4 Electronics Miniaturization in Global Manufacturing Hubs

- 4.2.5 Ultraviolet (UV)-Curable Lines for On-Demand Short-Run Packaging

- 4.3 Market Restraints

- 4.3.1 Raw-Material Price Volatility

- 4.3.2 Stringent Solvent-Emission Regulations

- 4.3.3 Supply Bottlenecks in Bio-Based Polyurethane Feedstocks

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Polyurethane

- 5.1.2 Acrylic

- 5.1.3 Epoxy

- 5.1.4 Other Resin Types (Vinyl Acetate, etc.)

- 5.2 By Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-based

- 5.2.3 Hot-melt

- 5.2.4 UV-curable

- 5.3 By Application

- 5.3.1 Packaging

- 5.3.2 Automotive

- 5.3.3 Industrial

- 5.3.4 Other Applications (Electronics and Electrical, Construction, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 artience Co., Ltd.

- 6.4.4 Avery Dennison Corporation

- 6.4.5 BASF

- 6.4.6 Daubert Chemical Company

- 6.4.7 DIC Corporation

- 6.4.8 DuPont

- 6.4.9 Franklin International

- 6.4.10 H.B. Fuller Company

- 6.4.11 Henkel AG and Co. KGaA

- 6.4.12 Huntsman Corporation llc

- 6.4.13 Jowat SE

- 6.4.14 SAPICI S.p.A.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Introduction of Nano-Adhesives