|

市場調查報告書

商品編碼

1844640

電子黏合劑:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Electronics Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

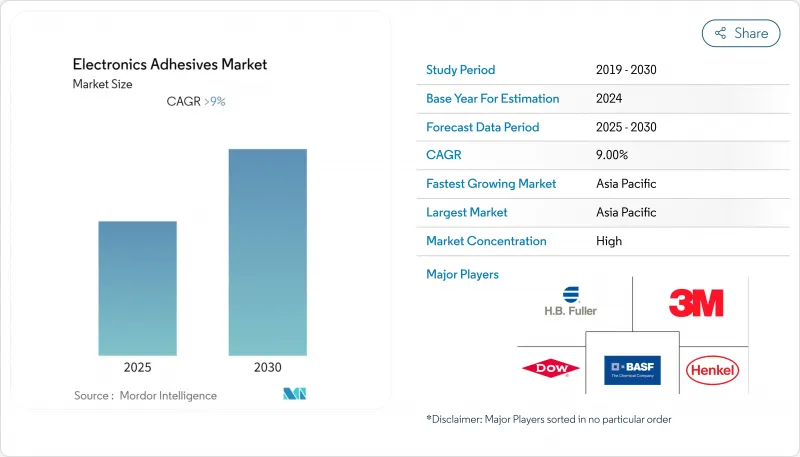

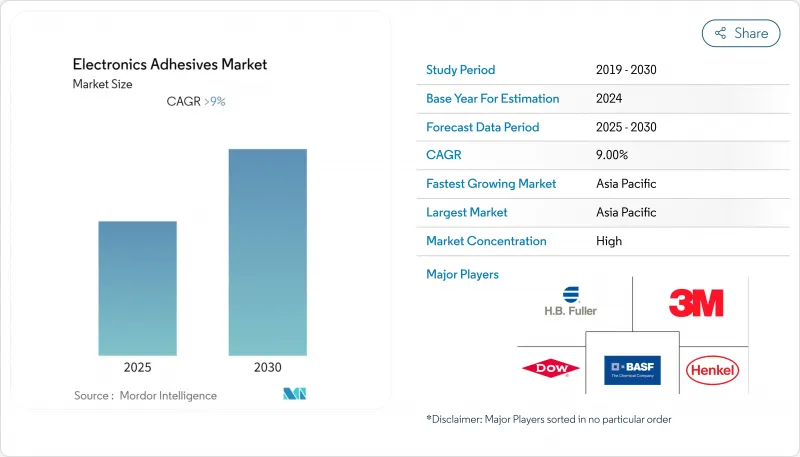

預計 2025 年電子黏合劑市場價值將達到 65.1 億美元,到 2030 年預計將達到 100.3 億美元,預測期內(2025-2030 年)的複合年成長率為 9.04%。

元件小型化、表面黏著技術(SMT) 的日益普及以及先進顯示器的快速普及是這項進步的關鍵驅動力。高密度封裝推動了需求勢頭,它增加了互連數量,同時放大了熱負荷,使得黏合劑成為越來越小的設備功能之間必不可少的熱和機械緩衝器。製造商也優先考慮快速固化化學品,以縮短大批量生產線的周期時間,尤其是在亞洲契約製造中心。同時,永續性法規正在推動向無 PFAS、生物基和低 VOC 配方的轉變,這些配方不會影響長期可靠性。這些主題結合起來表明,電子黏合劑市場的成長是由主導和價值共同主導的,創新產品在需要高耐熱性和光學純度的應用中佔據了溢價。

全球電子黏合劑市場趨勢與洞察

高密度封裝的激增

高密度封裝正在推動鍵合線的公差更接近微米級,這要求黏合劑具有嚴格的黏度窗口、可控的排氣性能以及能夠適應堆疊晶粒之間差異膨脹的模量。晶圓級封裝 (WLP) 和 3D 整合使焊點暴露在回流焊接溫度漂移中,峰值接近 260°C,而新配製的環氧-矽氧烷混合物可以滿足閾值。 DELO 最新的晶圓級產品系列能夠承受這些溫度,同時保持適用於精密噴射頭的流動特性。堅固耐用的材料的應用範圍已從智慧型手機擴展到 ADAS(高級駕駛輔助系統)控制單元和微型工業感測器,而這兩者都反映了消費設備的空間限制。

對需要黏合劑的表面黏著技術的需求不斷增加

SMT 曾經是一種降低成本的工具,如今它能夠實現超細間距組裝,其中元件間隙小於焊膏公差。底部填充膠透過重新分配覆晶封裝中的熱機械應力並防止錫晶須擴散,降低了穿戴式電子設備的現場故障率。汽車資訊娛樂闆對減震和 1000 小時熱循環耐久性的要求越來越高,這推動了對專用環氧-聚醯亞胺混合物的需求。設備製造商正在採用高吞吐量噴射點膠機和兩級熱/紫外線固化站來應對這項挑戰,這些設備可將線上生產節拍時間縮短高達 40%,從而推動整個電子膠合劑市場的膠合需求。

環氧丙烯酸酯原料價格波動

環氧氯丙烷供應中斷和運費上漲已將環氧樹脂現貨價格推至多年來的最高水平,擠壓了小型複合材料生產商的毛利率。美國國際貿易委員會對某些亞洲環氧樹脂進口的裁決,導致數週內加徵關稅並重新談判合約。複合材料級樹脂生產商的應對措施是將價格提高每噸150至200歐元,這直接增加了其黏合劑的成本基礎。雖然頂級供應商正在透過簽訂多年期供應協議來對沖成本,但區域專業供應商正面臨營運資金限制,這可能會抑制創新步伐。

細分分析

環氧樹脂仍將是電子膠合劑市場最重要的組成部分,到2024年將佔總收入的30.19%。其高內聚強度、介電穩定性和耐腐蝕性使其在汽車引擎蓋下模組和工業驅動裝置中廣受歡迎。同時,丙烯酸樹脂的複合年成長率為11.19%,因其快速的光固化和熱固化特性以及基材柔韌性而備受推崇,使其成為智慧型手機鏡頭堆疊黏合的理想選擇。利用木質素和植物油衍生物的生物基環氧樹脂舉措旨在減少碳足跡,同時不犧牲260°C的峰值溫度能力。當製造商需要在單一配方中實現快速固化特性時,專業組裝廠更青睞混合環氧-丙烯酸酯混合物。傳統的堅固性與新興的靈活性之間的這種相互作用支撐了電子膠合劑市場多樣化的配方藍圖。

第二梯隊的聚氨酯系統適用於高振動環境,例如暴露在道路衝擊下的電池模組,而有機矽和氰基丙烯酸酯則適用於高溫功率裝置和快速固定。雙酚A縮水甘油醚的監管趨勢正推動環氧樹脂製造商轉向替代單體,但長期需求基本面依然存在。製造商繼續透過專有增韌劑實現差異化,將工作溫度範圍從-55°C擴展至175°C,從而在丙烯酸銷售量加速成長的同時,鞏固了環氧樹脂的領先地位。

導電等級將佔2024年銷售額的43.90%,在焊料空洞威脅電路連續性的情況下,導電等級至關重要。銀片環氧樹脂在覆晶晶粒中占主導地位,含鎳版本為5G天線提供經濟高效的EMI屏蔽。紫外光固化膠黏劑的複合年成長率為12.04%,透過將生產線節拍縮短至數秒並實現現場光學檢測,提高了相機模組工廠的一次通過產量比率。以氮化鋁和氮化硼填料配製的導熱環氧樹脂散熱率高達5 W/mK,可提高LED光通維持率和逆變器的運作時間。

在高壓線路絕緣至關重要的領域,非導電結構環氧樹脂的需求依然旺盛,尤其是在牽引逆變器和資料中心電源領域。結合了紫外光預凝膠和熱感後固化的混合雙固化產品正成為複雜3D組件的可行選擇。目前市面上各種性能的產品正在增強電子膠合劑市場,使設計人員能夠自由地同時最佳化電氣、熱學和光學參數。

區域分析

亞太地區將成為電子膠合劑市場最大的單一區域支柱,到2024年將佔總收入的58.69%。受國家對先進封裝生產線和晶圓級底部填充產能擴張的補貼推動,中國當地2024年的電子產品產量將增加11.3%。自2025年4月起,美國部分免除電子產品進口關稅後,泰國和越南吸收了新的外國直接投資,並將組裝計畫轉向東協叢集。從樹脂反應器到全自動SMT生產線,該地區的一體化供應基地縮短了前置作業時間,並增強了成本領先優勢。

《晶片與科學法案》為北美晶圓製造撥款520億美元,推動了北美製造業的回流。這筆上游資本支出刺激了下游對無塵室級底部填充材料和液體熱感界面材料的黏合劑需求。加拿大魁北克走廊地區同樣擁有新的印刷電子試點工廠,該工廠優先發展生物基化學技術,這與歐洲的永續性概念相呼應。

隨著《歐盟晶片法案》加強該地區微電子價值鏈,歐洲電子黏合劑市場預計將迎來復甦。包括逐步實施的PFAS限制措施在內的環境法規正在推動無氟潤滑填料的研發。德國一級汽車製造商正在推進儀表板顯示器可剝離等級的認證,而斯堪地那維亞的EMS供應商則強調低溫固化以減少能源足跡。

南美洲和中東/非洲是新的前沿市場。巴西馬瑙斯自由貿易區正在擴大家用電子電器組裝,為適合熱帶潮濕環境的中等黏度丙烯酸樹脂提供了機會。阿拉伯聯合大公國(UAE)正將自己定位為區域物流樞紐,自由貿易區激勵措施與以人工智慧為重點的研發園區相結合,預計將催生本地化的黏合劑混合工廠。儘管這些地區目前規模較小,但對於那些願意規避專注於傳統生產中心風險的公司來說,它們提供了充足的多元化發展潛力。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 高密度貼裝需求快速成長

- 對需要黏合劑的表面黏著技術的需求不斷增加

- Mini LED 和 Micro LED 背光的採用率不斷提高

- 電子黏合劑技術不斷進步

- 擴大家電生產

- 市場限制

- 環氧樹脂和丙烯酸酯原料價格波動

- 嚴格的VOC和RoHS/REACH合規成本

- 超薄軟式電路板中的熱失配問題

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測

- 依樹脂類型

- 環氧樹脂

- 丙烯酸纖維

- 聚氨酯

- 其他樹脂類型(矽膠、氰基丙烯酸酯等)

- 依產品類型

- 電導率

- 熱導率

- 紫外線固化

- 其他產品類型(例如非導電)

- 按用途

- 三防膠

- 表面黏著技術

- 封裝

- 電線定位

- 其他用途(底部填充、晶片黏接)

- 按最終用戶產業

- 消費性硬體

- IT硬體

- 車

- 其他終端用戶產業(工業、電力電子等)

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率(%)/排名分析

- 公司簡介

- 3M

- Arkema

- Avery Dennison

- BASF

- DELO

- Dow

- Dymax Corporation

- HB Fuller Company

- Henkel AG and Co. KGaA

- Huntsman International LLC.

- ITW Engineered Polymers

- Master Bond Inc.

- NAMICS CORPORATION

- Panacol-Elosol GmbH

- Parker Hannifin Corp

- Permabond LLC

- Pidilite Industries Ltd.

- Shin-Etsu Chemical Co., Ltd.

第7章 市場機會與未來展望

The Electronics Adhesives Market size is estimated at USD 6.51 billion in 2025, and is expected to reach USD 10.03 billion by 2030, at a CAGR of 9.04% during the forecast period (2025-2030).

Rising component miniaturization, wider surface-mount technology (SMT) penetration, and rapid adoption of advanced displays are the primary forces guiding this progress. Demand momentum is reinforced by high-density packaging that increases interconnect counts while amplifying thermal loads, positioning adhesives as indispensable thermal and mechanical buffers between ever-smaller device features. Manufacturers are also prioritizing fast-curing chemistries that cut cycle times in high-volume lines, especially across Asian contract manufacturing hubs. At the same time, sustainability regulations are prompting shifts toward PFAS-free, bio-based, and low-VOC formulations that do not compromise long-term reliability. Taken together, these themes illustrate an electronics adhesives market whose growth is both volume-driven and value-driven, with innovative products commanding share premiums in applications requiring elevated heat resistance and optical purity.

Global Electronics Adhesives Market Trends and Insights

Surge in High-Density Packaging

High-density packaging pushes bond lines toward micron-level tolerances, demanding adhesives with tight-viscosity windows, controlled outgassing, and elastic moduli that absorb differential expansion among stacked die. Wafer-level packaging (WLP) and 3D integration expose joints to reflow excursions that peak near 260 °C, a threshold met by newly formulated epoxy-siloxane hybrids. DELO's latest wafer-level range sustains that temperature while maintaining flow behavior suitable for precision jetting heads. Robust materials have broadened beyond smartphones into advanced driver-assistance systems (ADAS) control units and compact industrial sensors, both of which mirror consumer device space constraints.

Increase in Demand for Surface-Mount Technology Requiring Adhesives

SMT once filled cost-reduction roles but now enables ultra-fine-pitch assembly where component clearances fall below solder paste tolerances. Underfill adhesives redistribute thermo-mechanical stress in flip-chip packages and arrest tin-whisker propagation, cutting field-failure rates in wearable electronics. Automotive infotainment boards add further requirements for vibration damping and 1,000-hour thermal-cycling durability, elevating demand for specialty epoxy-polyimide blends. Equipment makers respond with high-throughput jet dispensers and dual-stage thermal/UV curing stations that shrink in-line takt times by up to 40%, reinforcing adhesive uptake throughout the electronics adhesives market.

Volatility in Epoxy and Acrylate Feedstock Prices

Epichlorohydrin supply disruptions and freight surcharges pushed spot epoxy prices to multi-year highs, crimping gross margins for small formulators. The U.S. International Trade Commission's ruling against certain Asian epoxy imports introduced additional tariffs that filtered into contract renegotiations within weeks. Composite-grade resin producers responded with EUR 150-200 per-ton price hikes, directly raising adhesive cost bases. While top-tier vendors hedge via multi-year supply deals, regional specialists face working-capital strain that may curb innovation pace.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Mini-LED and Micro-LED Backlighting Adoption

- Growing Technological Advancements in Electronic Adhesives

- Stringent VOC and RoHS/REACH Compliance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Epoxy resins remained paramount, accounting for 30.19% of 2024 revenue within the electronics adhesives market. Their high cohesive strength, dielectric stability, and resistance to harsh fluids keep them entrenched in under-the-hood automotive modules and industrial drives. Meanwhile, acrylic chemistries, expanding at an 11.19% CAGR, offer faster light-plus-heat curing and greater substrate flexibility, features prized by smartphone lens-stack bonding. Bio-based epoxy initiatives, leveraging lignin and vegetable-oil derivatives, aim to cut carbon footprints without sacrificing 260 °C peak-temperature capability. Across specialty assembly houses, hybrid epoxy-acrylate blends are gaining traction where manufacturers need snap-cure attributes in a single formulation. This interplay of legacy robustness and emerging agility underscores the diverse formulation roadmap powering the electronics adhesives market.

Second-tier polyurethane systems address vibration-rich settings such as battery modules that face road-surface shocks, whereas silicone and cyanoacrylate niches persist for high-temperature power devices and rapid fixturing. Regulatory attention on bisphenol-A diglycidyl ether is nudging epoxy suppliers toward alternative monomers, yet long-term demand fundamentals remain intact. Manufacturers continue to differentiate through proprietary toughening agents that widen operating windows from -55 °C to 175 °C, thereby cementing epoxy's leadership even as acrylic volumes accelerate.

Electrically conductive grades delivered 43.90% of 2024 sales, proving indispensable wherever solder voids threaten circuit continuity. Silver-flake epoxies dominate flip-chip die-attach, while nickel-loaded versions offer cost-effective EMI shielding for 5G antennas. UV-curing adhesives, scaling at a 12.04% CAGR, compress line tact times to seconds and enable in-situ optical inspection, elevating first-pass yields in camera module factories. Thermally conductive variants, infused with aluminum nitride or boron nitride fillers, dissipate up to 5 W/mK, extending LED lumen maintenance and inverter uptime.

Non-conductive structural epoxies sustain demand where isolation from high-voltage traces is non-negotiable, notably in traction inverters and data-center power supplies. Hybrid dual-cure products that combine UV pre-gelling with thermal post-cure are emerging as the go-to option for complex three-dimensional assemblies. The breadth of performance profiles available today strengthens the electronics adhesives market, giving designers latitude to optimize electrical, thermal, and optical parameters simultaneously.

The Electronics Adhesives Market Report is Segmented by Resin Type (Epoxy, Acrylic, and More), Product Type (Electrically Conductive, Thermally Conductive, and More), Application (Conformal Coating, Surface Mounting, and More), End-User Industry (Consumer Hardware, IT Hardware, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 58.69% of 2024 revenue, making it the single largest regional pillar of the electronics adhesives market. Mainland China raised electronics output by 11.3% in 2024 through state grants for advanced packaging lines and local wafer-level underfill capacity expansions. Thailand and Vietnam absorbed fresh foreign direct investment after the United States granted selected tariff exemptions on electronics imports from April 2025, redirecting assembly programs into ASEAN clusters. The region's integrated supply base-from resin reactors to fully automated SMT lines-compresses lead times and reinforces its cost leadership.

North America's reshoring narrative gained momentum via the CHIPS and Science Act, which allocates USD 52 billion toward domestic wafer fabrication. This upstream capital outlay is stimulating downstream adhesive demand for clean-room-grade underfills and liquid thermal interface materials. Canada's Quebec corridor likewise hosts new printed-electronics pilot plants that prioritize bio-based chemistries, mirroring sustainability pushes seen in Europe.

Europe is charting an electronics adhesives market size rebound as its own EU Chips Act strengthens local microelectronic value chains. Environmental regulations, including progressive PFAS limitations, are galvanizing R&D into fluorine-free lubricious fillers. Germany's automotive Tier 1s are qualifying debondable grades for dashboard displays, while Scandinavian EMS providers emphasize low-temperature curing to shrink energy footprints.

South America and the Middle East and Africa represent emerging frontiers. Brazil's Manaus free-trade zone is broadening consumer-electronic assembly, opening opportunities for mid-viscosity acrylics tailored to tropical humidity. The United Arab Emirates is positioning itself as a regional logistics hub, pairing free-zone incentives with AI-centered R&D parks that could seed localized adhesive blending plants. Though smaller today, these geographies add diversification prospects for firms eager to de-risk concentration within traditional production centers.

- 3M

- Arkema

- Avery Dennison

- BASF

- DELO

- Dow

- Dymax Corporation

- H.B. Fuller Company

- Henkel AG and Co. KGaA

- Huntsman International LLC.

- ITW Engineered Polymers

- Master Bond Inc.

- NAMICS CORPORATION

- Panacol-Elosol GmbH

- Parker Hannifin Corp

- Permabond LLC

- Pidilite Industries Ltd.

- Shin-Etsu Chemical Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in High-Density Packaging Demand

- 4.2.2 Increase in Demand for Surface Mount Technology requiring Adhesives

- 4.2.3 Increasing Mini-LED and Micro-LED Backlighting Adoption

- 4.2.4 Growing Technological Advancements in Electronic Adhesives

- 4.2.5 Expansion of Consumer Electronics Production

- 4.3 Market Restraints

- 4.3.1 Volatility in Epoxy and Acrylate Feedstock Prices

- 4.3.2 Stringent VOC and RoHS/REACH Compliance Costs

- 4.3.3 Thermal-Mismatch Failures in Ultra-Thin Flexible Substrates

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Epoxy

- 5.1.2 Acrylic

- 5.1.3 Polyurethane

- 5.1.4 Other Resin Types (Silicone, Cyanoacrylate, etc.)

- 5.2 By Product Type

- 5.2.1 Electrically Conductive

- 5.2.2 Thermally Conductive

- 5.2.3 UV Curing

- 5.2.4 Other Product Types (Non-conductive, etc.)

- 5.3 By Application

- 5.3.1 Conformal Coating

- 5.3.2 Surface Mounting

- 5.3.3 Encapsulation

- 5.3.4 Wire Tacking

- 5.3.5 Other Applications (Underfill, Die-Attach)

- 5.4 By End-user Industry

- 5.4.1 Consumer Hardware

- 5.4.2 IT Hardware

- 5.4.3 Automotive

- 5.4.4 Other End-user Industries (Industrial and Power Electronics, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 NORDIC Countries

- 5.5.3.8 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Avery Dennison

- 6.4.4 BASF

- 6.4.5 DELO

- 6.4.6 Dow

- 6.4.7 Dymax Corporation

- 6.4.8 H.B. Fuller Company

- 6.4.9 Henkel AG and Co. KGaA

- 6.4.10 Huntsman International LLC.

- 6.4.11 ITW Engineered Polymers

- 6.4.12 Master Bond Inc.

- 6.4.13 NAMICS CORPORATION

- 6.4.14 Panacol-Elosol GmbH

- 6.4.15 Parker Hannifin Corp

- 6.4.16 Permabond LLC

- 6.4.17 Pidilite Industries Ltd.

- 6.4.18 Shin-Etsu Chemical Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment