|

市場調查報告書

商品編碼

1844577

黏合劑和密封劑:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Adhesives And Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

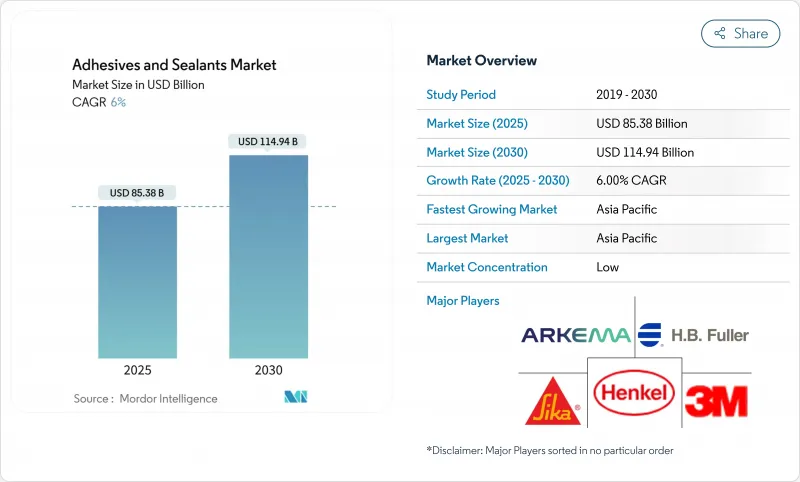

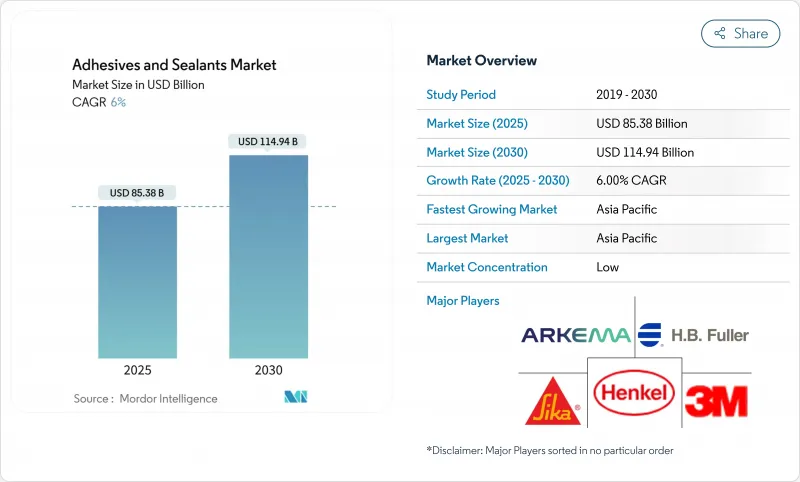

預計 2025 年黏合劑和密封劑市場規模為 853.8 億美元,到 2030 年將達到 1,149.4 億美元,預測期內(2025-2030 年)的複合年成長率為 6%。

強勁成長的動力源於對支援汽車輕量化、電商自動化包裝和模組化建築的高性能黏合劑解決方案不斷成長的需求。低排放化學品的監管壓力,尤其是在歐盟綠色交易下,正在加速向生物基和低VOC配方的轉變。亞太地區仍然是成長引擎,受工業擴張和基礎設施支出的推動,而北美和歐洲則專注於技術升級,以滿足嚴格的永續性法規。異氰酸酯和丙烯酸單體供應鏈中的脆弱性繼續影響定價,促使生產商實現原料多樣化並投資於生物基路線。競爭格局越來越受到有機矽和反應性技術的塑造,這些技術有望提供卓越的耐用性、耐熱性和更快的加工速度。

全球黏合劑和密封劑市場趨勢和洞察

輕量化多材料車輛組件的快速成長推動了結構性黏著劑的廣泛應用

電動車製造商正在用結構性黏著劑取代焊接和鉚釘,以減輕重量、提高碰撞性能,並實現鋁、複合材料和高強度鋼的連接。膠黏劑還能固定電池外殼,起到散熱和電絕緣的作用。電池組內的熱感界面材料可防止失控並延長電池壽命,從而在膠粘劑和密封劑市場中形成一個專業化的利基市場。汽車製造商期望膠合劑技術能夠在車輛整個使用壽命期間保持尺寸穩定性,並在溫度變化範圍內保持尺寸穩定性,並能抵禦液體侵蝕。這些嚴格的要求促使配方師尋求兼具強度和柔韌性的反應性聚氨酯熱熔膠和改性環氧樹脂。因此,電動車的日益普及成為膠合劑和密封劑市場結構性需求的催化劑。

全球電子商務的爆炸性成長需要高性能包裝黏合劑解決方案

直接面對消費者的運輸使紙箱暴露在振動、潮濕和極端溫度下,這促使品牌所有者採用高黏性熱熔膠和水性系統,以確保在整個複雜的物流鏈中保持包裝密封。包裝佔黏合劑和密封劑市場的43%,並且隨著電子商務的興起而持續成長。漢高和Packsize推出了Eco-Pax,這是一款生物基熱熔膠,每年生產3.4億個紙箱可減少32%的溫室氣體排放。自動化紙箱組裝也需要低黏度等級的膠合劑,並在較低溫度下運行以節省能源。該領域的技術創新正在推動黏合劑和密封劑市場銷售的穩定成長。

揮發性異氰酸酯和丙烯酸單體供應鏈造成成本壓力

歐盟新規要求對處理遊離異氰酸酯含量超過0.1%的聚氨酯系統的人員進行專門培訓,這增加了管理成本,並限制了小型加工商的准入。丙烯酸的供應緊縮導致價格波動,迫使最終用戶每季重新協商合約。生產商正在透過本地化原料採購和採用以植物油為原料的生物基製程來對沖供應,但這些措施需要資本支出並擠壓淨利率。原物料指數飆升已波及下游價格,導致建築和汽車計劃的核准延遲。黏合劑和密封劑市場必須抵禦成本上漲,同時保持績效。

細分分析

2024年,丙烯酸樹脂佔膠合劑和密封劑市場收益的24%,這得益於其廣泛的基材相容性和適中的成本。然而,有機矽在2025年至2030年間的複合年成長率為8.50%,顯示其將轉向耐高溫、耐候應用,尤其是在汽車電子和建築外牆領域。差異化的性能正在推動這一轉變。有機矽膠黏劑在-50°C至200°C的溫度下仍能保持彈性、電絕緣性和抗紫外線劣化,非常適合用於LED組件和5G天線模組。丙烯酸壓敏膠正採用新一代配方應對這項挑戰,得益於改進的功能單體,該配方固化速度更快,並能黏合低表面能塑膠。聚氨酯仍然是承受動態負荷的結構接頭的首選,而氰基丙烯酸酯則用於精準醫療和家用電器。由甘油和木質素製成的生物基環氧樹脂展現出早期的前景,預示著膠合劑和密封劑產業將逐步實現脫碳。

到2024年,水性系統將佔銷售額的42%,這得益於其符合區域VOC法規以及對多孔基材的強附著力。黏合劑和密封劑市場的重要細分領域——瓦楞紙箱密封、標籤覆膜和家具組裝——均以水性系統為主。聚合物分散體產品的進步正在縮短乾燥時間,從而解決了過去自動化生產線的速度限制。

反應性技術經歷了最快的複合年成長率,達到8.20%,因為它們透過交聯熱固性網路來實現曾經被認為專屬於環氧樹脂的結構強度。反應性聚氨酯熱熔膠可在濕氣暴露後提供即時的初始強度和最終的化學鍵合,從而縮短了消費性電子產品和運輸設備製造商的組裝時間。紫外光固化丙烯酸酯支援電子和醫療設備,這些設備需要去溶劑和快速生產。溶劑型和橡膠型系統適用於汽車內裝和鞋類等利基應用,其獨特的黏性和剝離強度平衡克服了監管障礙。

區域分析

到 2024 年,亞太地區將佔全球銷售額的 37%,年複合成長率為 6.60%,主要得益於基礎設施計劃和電子供應鏈東南亞國協的遷移。中國繼續投資大型高速鐵路和可再生能源項目,刺激對結構密封膠和風電葉片膠合系統的需求。印度 1.4 兆美元的國家基礎設施管道將把膠合劑消費轉向道路、機場和經濟適用房。越南和韓國的電子製造業正在加深該地區對用於半導體和顯示面板的低空隙率、高導熱性膠合劑的需求。有機矽產品是這些產業不懈追求溫度穩定性的主要受益者,有助於亞太地區在膠合劑和密封劑市場中佔據主導地位。

北美市場成熟,注重技術差異化和快速的監管調整。預計到2024年,美國電動車產量將超過100萬輛,將推動電池組和白車身總成用結構膠和抗撞膠的消費成長。聯邦政府對橋樑和寬頻的資助將進一步推動對在極端氣候條件下仍能保持柔韌性的土木工程密封膠的需求。加拿大木造建築正在加速採用聚氨酯接著劑,透過氣密組件提高能源效率。隨著生產商提供符合CARB和EPA揮發性有機化合物(VOC)限值的即用型水性替代品,膠合劑和密封膠市場正呈現穩定的中個位數成長。

歐盟綠色交易呼籲2050年實現碳中和產品,歐洲正受到該協議的影響。為了保持市場准入,製造商正在加速向木質素基酚醛樹脂替代品和生物可再生環氧樹脂的轉型。德國和斯堪的納維亞半島的預製工廠依賴經過認證的低VOC黏合劑來生產交叉層壓木材模組,這增加了對用於窗戶和建築幕牆密封的有機矽的需求。歐洲黏合劑和密封劑市場受益於更嚴格的品質要求,但合規成本正在壓低息稅前利潤率。東歐的汽車工廠正在擴大生產基地,這增加了該地區對黏合劑的需求。

南美市場規模雖小,但充滿活力。巴西的住房虧損正促使政府資助社會項目,將有機矽和丙烯酸密封膠引入廉價住房。阿根廷的農業包裝產業正受益於熱熔膠的升級,以適應長期儲存和出口路線。智利礦業公司正在膠合劑和密封膠市場中開闢新的利基成長點,並應用耐酸性混合密封膠。

中東和非洲地區的基礎建設正在快速發展,例如沙烏地阿拉伯的NEOM城和奈及利亞的拉各斯-伊巴丹鐵路。在惡劣的氣候條件下,矽酮和聚硫密封膠因其抗紫外線和抗風沙刮擦性能而備受追捧。海灣國家的進口替代政策鼓勵當地膠合劑工廠的發展,從而降低了運輸成本和交貨時間。總體而言,不同的氣候條件和監管環境推動著膠合劑和密封膠市場中各區域企業提供差異化的產品。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 輕型多材料車輛組件的激增推動了結構性黏著劑的廣泛採用

- 全球電子商務的爆炸性成長需要高性能包裝黏合劑解決方案

- 亞太地區模組化和預製建築方法的快速擴張

- 歐盟綠色新政和日益嚴格的全球法規加速了生物基低VOC黏合劑的成長

- 醫療保健和穿戴式裝置的普及推動了醫療應用對反應性熱熔膠的需求

- 市場限制

- 揮發性異氰酸酯和丙烯酸單體供應鏈的成本壓力

- 有關VOC排放的嚴格環境法規

- 新興市場機械緊固件的低替換成本限制了其採用

- 價值鏈分析

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測

- 通過粘合樹脂

- 聚氨酯

- 環氧樹脂

- 丙烯酸纖維

- 矽酮

- 氰基丙烯酸酯

- VAE/EVA

- 其他樹脂(聚酯、橡膠等)

- 按黏合技術

- 溶劑型

- 反應性

- 熱熔膠

- UV固化型

- 水性

- 密封樹脂

- 矽酮

- 聚氨酯

- 丙烯酸纖維

- 環氧樹脂

- 其他樹脂(瀝青、聚硫化物紫外線固化等)

- 按最終用戶產業

- 航太

- 車

- 建築/施工

- 鞋類和皮革

- 衛生保健

- 包裝(紙質包裝和軟包裝)

- 木工和細木工

- 其他終端用戶產業(電子、消費品/DIY等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 印尼

- 馬來西亞

- 泰國

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 土耳其

- 北歐國家

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 南非

- 阿爾及利亞

- 其他地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介{包括全球概況、市場層級、核心部門、可能的財務狀況、策略資訊、市場排名/佔有率、產品和服務、最新發展}。

- 3M

- Aica Kogyo Co. Ltd.

- Akzo Nobel NV

- Arkema SA(Bostik)

- Avery Dennison Corporation

- DELO Industrial Adhesives

- DIC Corporation

- Dow

- DuPont

- Dymax

- HB Fuller Company

- Henkel AG & Co. KGaA

- Illinois Tool Works Inc.

- MAPEI SpA

- Nanpao Resins Chemical Group

- Parker Hannifin

- Permabond LLC

- Pidilite Industries Ltd.

- RPM International Inc.

- Sika AG

- Soudal Group

- Wacker Chemie AG

第7章 市場機會與未來展望

The Adhesives And Sealants Market size is estimated at USD 85.38 billion in 2025, and is expected to reach USD 114.94 billion by 2030, at a CAGR of 6% during the forecast period (2025-2030).

Strong gains stem from rising demand for high-performance bonding solutions that support light-weighting in vehicles, automated e-commerce packaging, and modular construction. Regulatory pressure for lower-emission chemistries, especially under the EU Green Deal, is accelerating the shift toward bio-based and low-VOC formulations. Asia-Pacific remains the growth engine, supported by industrial expansion and infrastructure spending, while North America and Europe focus on technology upgrades that meet strict sustainability rules. Supply chain fragility for isocyanates and acrylic monomers continues to influence pricing, prompting producers to diversify feedstocks and invest in bio-based routes. Competitive dynamics are increasingly shaped by silicone and reactive technologies, which promise superior durability, higher temperature resistance, and improved processing speeds.

Global Adhesives And Sealants Market Trends and Insights

Surge in Lightweight Multi-material Vehicle Assemblies Boosting Structural Adhesive Uptake

Electric-vehicle makers are replacing welds and rivets with structural adhesives to save weight, improve crash performance, and enable joining of aluminum, composites, and high-strength steel. Adhesives also secure battery housings, where they manage heat and provide electrical insulation. Thermal interface materials inside packs prevent runaway and extend battery life, creating a specialized niche within the adhesives and sealants market. Automakers expect bonding technologies to remain dimensionally stable across wide temperature swings and resist fluid exposure for the entire vehicle lifespan. Such stringent requirements are pushing formulators toward reactive polyurethane hot-melts and modified epoxies that combine strength with flexibility. Growing EV penetration therefore acts as a structural demand catalyst for the adhesives and sealants market.

Explosive Growth of E-commerce Requiring High-Performance Packaging Adhesive Solutions Globally

Direct-to-consumer shipping exposes cartons to vibration, humidity, and temperature extremes, prompting brand owners to adopt high-tack hot-melt and water-based systems that keep packages sealed throughout complex logistics chains. Packaging represents 43% of the adhesives and sealants market and continues to expand as e-commerce volumes rise. Sustainability standards now require adhesives compatible with recycling streams; Henkel and Packsize introduced Eco-Pax, a bio-based hot-melt that can cut greenhouse gas emissions by 32% per 340 million boxes produced annually. Automated case-erection lines also demand low-viscosity grades that flow at reduced temperatures to save energy. Innovation in this driver underpins steady volume growth in the adhesives and sealants market.

Volatile Isocyanate & Acrylic Monomer Supply Chains Creating Cost Pressures

New EU rules require special training for anyone handling polyurethane systems with greater than 0.1% free isocyanate, adding administrative cost and limiting smaller converters' access. Parallel tightness in acrylic acid supply elevates price volatility, prompting end users to renegotiate contracts quarterly. Producers hedge by localizing feedstock procurement and adopting bio-routes from vegetable oils, yet these measures involve capital outlays that weigh on margins. Sudden spikes in raw-material indices ripple through downstream prices, delaying project approvals in construction and automotive. The adhesives and sealants market must therefore navigate cost inflation while maintaining performance, a balancing act that tempers the growth outlook.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Expansion of Modular & Prefabricated Construction Methods in Asia-Pacific

- EU Green Deal & Global Regulatory Push Accelerating Bio-based, Low-VOC Adhesives

- Stringent Environmental Regulations Regarding VOC Emissions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic resins generated 24% of the adhesives and sealants market revenue in 2024, favored for broad substrate compatibility and moderate cost. Nevertheless, silicone's 8.50% CAGR over 2025-2030 signals a pivot toward high-temperature, weather-resistant applications, notably in automotive electronics and building facades. Performance differentiation drives this shift. Silicone adhesives retain elasticity from -50 °C to 200 °C, remain electrically insulating, and resist UV degradation, making them fit for LED assemblies and 5G antenna modules. Acrylics respond with next-generation formulations that cure faster and bond low-surface-energy plastics through functional monomer modifications. Polyurethane remains the choice for structural joints exposed to dynamic loads, while cyanoacrylates serve precision medical and consumer electronics uses. Bio-based epoxies produced from glycerol and lignin showcase early-stage potential, signaling a gradual decarbonization of the adhesives and sealants industry.

Water-based systems held 42% revenue in 2024, aided by compliance with regional VOC caps and robust adhesion on porous substrates. They dominate corrugated box sealing, label lamination, and furniture assembly, all critical subsegments of the adhesives and sealants market. Product advances in polymer dispersion lower drying times, addressing historical speed constraints on automated lines.

Reactive technologies deliver the fastest 8.20% CAGR because they crosslink into thermoset networks, achieving structural strength once considered exclusive to epoxies. Reactive polyurethane hot-melts supply instant green strength plus final chemical bonding after moisture exposure, reducing assembly time for appliance and transportation manufacturers. UV-cured acrylates address electronics and medical devices where solvent elimination and rapid throughput are essential. Solvent-borne and rubber-based systems persist in niche uses, such as automotive interior trim and footwear, where their unique balance of tack and peel strength offsets regulatory hurdles.

The Adhesives and Sealants Market Report is Segmented by Adhesive Resin (Polyurethane, Epoxy, and More), Adhesives Technology (Solvent-Borne, Reactive, and More), Sealant Resin (Silicone, Polyurethane, and More), End-User Industry (Aerospace, Automotive, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 37% of global revenue in 2024 and is growing at 6.60% CAGR, driven by infrastructure megaprojects and the relocation of electronics supply chains into ASEAN nations. China continues large-scale high-speed rail and renewable-energy investments, stimulating demand for structural sealants and wind blade bonding systems. India's USD 1.4 trillion National Infrastructure Pipeline channels adhesive consumption into roads, airports, and affordable housing. Electronics manufacturing in Vietnam and South Korea deepens regional requirements for low-void, high-thermal-conductivity adhesives used in semiconductors and display panels. Silicone products benefit most, given relentless pursuit of temperature stability in these sectors, ensuring Asia-Pacific retains primacy within the adhesives and sealants market.

North America represents a mature arena emphasizing technology differentiation and rapid regulatory alignment. U.S. electric-vehicle output surpassed 1 million units in 2024, raising consumption of structural, crash-durable adhesives for battery packs and body-in-white assemblies. Federal funding for bridges and broadband further elevates demand for civil-engineering sealants that remain flexible under extreme climates. Canadian wood-frame construction accelerates adoption of polyurethane adhesives that improve energy efficiency through airtight assemblies. The adhesives and sealants market shows steady mid-single-digit growth as producers offer drop-in water-borne alternatives conforming to CARB and EPA VOC limits.

Europe is shaped by the EU Green Deal's call for carbon-neutral products by 2050. Manufacturers accelerate the transition to lignin-based phenolic alternatives and bio-renewable epoxies to retain market access. German and Nordic prefabrication plants rely on certified low-VOC adhesives in cross-laminated timber modules, reinforcing silicone demand for window and facade sealing. The adhesives and sealants market in Europe benefits from stringent quality expectations, though compliance costs lower EBIT margins. Eastern European vehicle plants broaden production footprints, amplifying regional adhesive requirements.

South America remains a small but vibrant arena. Brazil's housing deficit spurs government-funded social programs that channel silicone and acrylic sealants into low-cost housing. Argentina's agricultural packaging sector benefits from hot-melt upgrades to address prolonged storage and export routes. Chilean miners apply hybrid sealants that withstand acid exposure, adding niche growth pockets inside the adhesives and sealants market.

The Middle East & Africa lean on infrastructure ambitions such as Saudi Arabia's NEOM city and Nigeria's Lagos-Ibadan railway. Harsh climates reward silicone and polysulfide sealants with elevated UV and sand-abrasion resistance. Import substitution policies in the Gulf encourage local adhesive plants, reducing freight costs and delivery times. Overall, diverse climatic and regulatory landscapes shape differentiated product lineups for regional players in the adhesives and sealants market.

- 3M

- Aica Kogyo Co. Ltd.

- Akzo Nobel N.V.

- Arkema S.A. (Bostik)

- Avery Dennison Corporation

- DELO Industrial Adhesives

- DIC Corporation

- Dow

- DuPont

- Dymax

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Illinois Tool Works Inc.

- MAPEI S.p.A.

- Nanpao Resins Chemical Group

- Parker Hannifin

- Permabond LLC

- Pidilite Industries Ltd.

- RPM International Inc.

- Sika AG

- Soudal Group

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Lightweight Multi-material Vehicle Assemblies Boosting Structural Adhesive Uptake

- 4.2.2 Explosive Growth of E-commerce Requiring High-Performance Packaging Adhesive Solutions Globally

- 4.2.3 Rapid Expansion of Modular and Prefabricated Construction Methods in Asia-Pacific

- 4.2.4 EU Green Deal and Global Regulatory Push Accelerating Bio-based, Low-VOC Adhesives

- 4.2.5 Healthcare Wearables Adoption Driving Medical-grade Reactive Hot-Melt Adhesives

- 4.3 Market Restraints

- 4.3.1 Volatile Isocyanate and Acrylic Monomer Supply Chains Creating Cost Pressures

- 4.3.2 Stringent Environmental Regulations Regarding VOC Emissions

- 4.3.3 Low Substitution Cost of Mechanical Fasteners in Emerging Markets Limiting Penetration

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Adhesive Resin

- 5.1.1 Polyurethane

- 5.1.2 Epoxy

- 5.1.3 Acrylic

- 5.1.4 Silicone

- 5.1.5 Cyanoacrylate

- 5.1.6 VAE / EVA

- 5.1.7 Other Resins (Polyester, Rubber, etc.)

- 5.2 By Adhesive Technology

- 5.2.1 Solvent-borne

- 5.2.2 Reactive

- 5.2.3 Hot Melt

- 5.2.4 UV-cured

- 5.2.5 Water-borne

- 5.3 By Sealant Resin

- 5.3.1 Silicone

- 5.3.2 Polyurethane

- 5.3.3 Acrylic

- 5.3.4 Epoxy

- 5.3.5 Other Resins (Bituminous, Polysulfide UV-curable, etc.)

- 5.4 By End-user Industry

- 5.4.1 Aerospace

- 5.4.2 Automotive

- 5.4.3 Building and Construction

- 5.4.4 Footwear and Leather

- 5.4.5 Healthcare

- 5.4.6 Packaging (Paper and Flexible)

- 5.4.7 Woodwork and Joinery

- 5.4.8 Other End-user Industries (Electronics, Consumer/DIY, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Indonesia

- 5.5.1.6 Malaysia

- 5.5.1.7 Thailand

- 5.5.1.8 Vietnam

- 5.5.1.9 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Turkey

- 5.5.3.8 Nordic Countries

- 5.5.3.9 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 Egypt

- 5.5.5.5 South Africa

- 5.5.5.6 Algeria

- 5.5.5.7 Rest of Middle and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments}

- 6.4.1 3M

- 6.4.2 Aica Kogyo Co. Ltd.

- 6.4.3 Akzo Nobel N.V.

- 6.4.4 Arkema S.A. (Bostik)

- 6.4.5 Avery Dennison Corporation

- 6.4.6 DELO Industrial Adhesives

- 6.4.7 DIC Corporation

- 6.4.8 Dow

- 6.4.9 DuPont

- 6.4.10 Dymax

- 6.4.11 H.B. Fuller Company

- 6.4.12 Henkel AG & Co. KGaA

- 6.4.13 Illinois Tool Works Inc.

- 6.4.14 MAPEI S.p.A.

- 6.4.15 Nanpao Resins Chemical Group

- 6.4.16 Parker Hannifin

- 6.4.17 Permabond LLC

- 6.4.18 Pidilite Industries Ltd.

- 6.4.19 RPM International Inc.

- 6.4.20 Sika AG

- 6.4.21 Soudal Group

- 6.4.22 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 Increasing Awareness of Renewable and Eco-friendly Products

- 7.2 White-space and Unmet-need Assessment