|

市場調查報告書

商品編碼

1801933

黏合劑和密封劑市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Adhesives and Sealants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

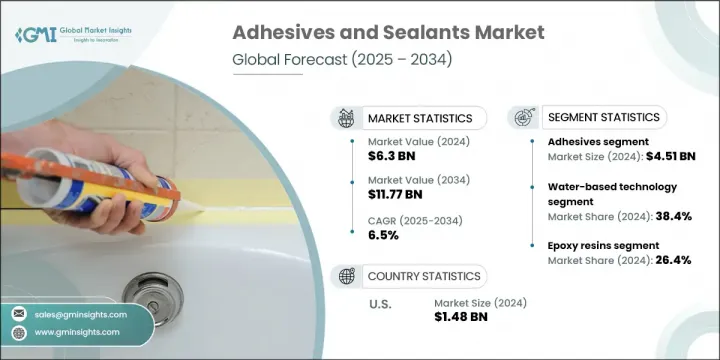

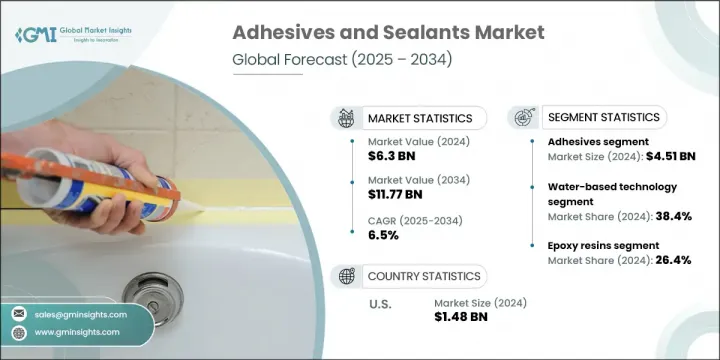

2024年,全球黏合劑和密封劑市場規模達63億美元,預計到2034年將以6.5%的複合年成長率成長,達到117.7億美元。該市場專注於黏合和密封材料的開發和使用,這些材料可增強各行各業產品的強度、使用壽命和耐用性。這些材料在建築、汽車、電子和包裝應用中發揮關鍵作用,能夠有效防止產品受到天氣、洩漏和外部污染物的侵害。隨著全球基礎設施現代化和輕量化節能汽車的推動,對黏合劑和密封劑的需求持續成長。

專注於性能、環保合規性和材料多功能性的創新正在幫助製造商滿足不斷發展的行業標準,同時提高產品的可靠性和效率。各公司正在不斷開發先進的黏合劑和密封劑配方,以在極端條件下提供更強的黏合力,抵抗化學物質和溫度波動,並縮短固化時間以支援更快的組裝流程。這些改進不僅提高了營運效率,也延長了最終用途產品的生命週期。同時,對環保解決方案的追求正在推動人們轉向符合全球永續發展目標的低揮發性有機化合物 (VOC)、生物基和可回收材料。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 63億美元 |

| 預測值 | 117.7億美元 |

| 複合年成長率 | 6.5% |

2024年,黏合劑市場規模達45.1億美元,預計2034年將維持6.5%的強勁複合年成長率。環氧樹脂和聚氨酯等結構膠粘劑因其在汽車和航太應用中的卓越粘合性能而引領市場。黏合劑市場包括壓敏膠、熱熔膠以及溶劑型和水性黏合劑。

在各類技術中,受永續低揮發性有機化合物 (VOC) 產品興起的推動,水性黏合劑在 2024 年佔據了 38.4% 的市場。水性黏合劑更安全的應用和環保特性使其在家具、汽車、包裝和建築業的應用日益廣泛。隨著製造商致力於遵守空氣品質法規,水性黏合劑在工業和商業應用中的普及度持續提升。

美國黏合劑和密封劑市場佔據88.5%的市場佔有率,2024年市場規模達14.8億美元。由於對先進製造業、電動車生產和國家基礎設施升級的強勁投資,美國市場預計將持續成長至2034年。針對交通網路和公共建築的聯邦資助計劃正在刺激對高性能黏合劑和密封產品的需求。此外,航太、電子和永續建築的興起,也鞏固了美國作為黏合劑技術關鍵市場的地位。

全球黏合劑和密封劑市場的知名企業包括巴斯夫、陶氏、漢高股份公司、西卡公司和3M公司。黏合劑和密封劑行業的主要公司正在透過有針對性的研發投資、環保產品開發和區域擴張來提升其市場地位。為了滿足環境法規和消費者的永續需求,企業正向低揮發性有機化合物 (VOC) 和生物基黏合劑進行策略轉變。各公司正在加強供應鏈,並擴大高成長地區的製造能力,以縮短交貨時間並提高營運效率。策略性併購和合作夥伴關係正在擴大產品組合和市場准入。針對電動車、電子產品和智慧基礎設施量身定做的黏合劑解決方案也是重點,有助於滿足下一代工業需求。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 轉向輕量化製造

- 綠建築與環保配方

- 電動交通和電子產品的成長

- 包裝創新和安全要求

- 產業陷阱與挑戰

- 環境和監管壓力

- 原物料價格波動

- 市場機會

- 對永續和生物基替代品的需求

- 模組化和預製建築的興起

- 不斷擴大的醫療保健和醫療器材市場

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 黏合劑市場

- 結構膠合劑

- 環氧膠黏劑

- 聚氨酯黏合劑

- 丙烯酸黏合劑

- 甲基丙烯酸甲酯黏合劑

- 氰基丙烯酸酯黏合劑

- 壓敏膠

- 丙烯酸壓敏膠

- 橡膠基壓敏膠

- 矽膠壓敏膠

- 熱熔膠

- EVA熱熔膠

- 聚醯胺熱熔膠

- 聚烯烴熱熔膠

- 反應性熱熔膠

- 水性黏合劑

- 溶劑型黏合劑

- 其他黏合劑類型

- 結構膠合劑

- 密封劑市場

- 矽酮密封膠

- RTV矽酮密封膠

- 結構玻璃密封膠

- 聚氨酯密封膠

- 丙烯酸密封膠

- 聚硫密封膠

- 丁基密封膠

- 其他密封膠類型

- 矽酮密封膠

第6章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 水性技術

- 溶劑型技術

- 熱熔技術

- 反應技術

- UV/光固化技術

- 壓力感應技術

- 其他

第7章:市場估計與預測:按樹脂類型,2021 - 2034

- 主要趨勢

- 環氧樹脂

- 聚氨酯樹脂

- 丙烯酸樹脂

- 矽樹脂

- 聚醋酸乙烯酯(PVA)

- 乙烯醋酸乙烯酯 (EVA)

- 苯乙烯嵌段共聚物

- 其他

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 結構黏合

- 組裝操作

- 密封和襯墊

- 表面保護

- 電絕緣

- 熱管理

- 避震

- 其他

第9章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 建築和施工

- 住宅建築

- 商業建築

- 基礎設施項目

- 汽車和運輸

- 搭乘用車

- 商用車

- 電動車

- 售後市場

- 包裝

- 軟包裝

- 硬質包裝

- 標籤和膠帶

- 電子和電氣

- 消費性電子產品

- 半導體封裝

- PCB組裝

- 顯示技術

- 航太和國防

- 商業航空

- 軍事應用

- 空間應用

- 醫療保健

- 醫療器材

- 外科手術應用

- 醫藥包裝

- 鞋類和皮革

- 木工和家具

- 船舶應用

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第 11 章:公司簡介

- 3M Company

- Arkema Group (Bostik)

- Ashland Global Holdings Inc.

- Avery Dennison Corporation

- BASF SE

- Dow Inc.

- DuPont de Nemours, Inc.

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman Corporation

- Illinois Tool Works Inc. (ITW)

- Momentive Performance Materials Inc.

- RPM International Inc.

- Sika AG

- Wacker Chemie AG

The Global Adhesives and Sealants Market was valued at USD 6.3 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 11.77 billion by 2034. This market revolves around the development and use of bonding and sealing materials that enhance the strength, longevity, and resistance of products across multiple industries. These materials play a key role in construction, automotive, electronics, and packaging applications, where they provide protection against weather, leakage, and external contaminants. With the global push toward infrastructure modernization and lightweight, energy-efficient vehicles, demand continues to accelerate.

Innovations focused on performance, eco-compliance, and material versatility are helping manufacturers meet evolving industry standards while improving product reliability and efficiency. Companies are increasingly developing advanced adhesive and sealant formulations that deliver stronger bonding under extreme conditions, resist chemicals and temperature fluctuations, and reduce cure times to support faster assembly processes. These improvements not only boost operational efficiency but also extend the lifecycle of end-use products. Simultaneously, the push for eco-friendly solutions is driving the shift toward low-VOC, bio-based, and recyclable materials that align with global sustainability goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.3 Billion |

| Forecast Value | $11.77 Billion |

| CAGR | 6.5% |

The adhesives segment accounted for USD 4.51 billion in 2024 and is expected to maintain a strong CAGR of 6.5% through 2034. Structural adhesives such as epoxy and polyurethane lead the market due to their superior bonding in automotive and aerospace applications. The adhesives segment includes pressure-sensitive adhesives, hot melts, and both solvent- and water-based variants.

Among technologies, the water-based adhesives segment held 38.4% share in 2024, driven by the rise of sustainable, low-VOC products. Their safer application and environmental compatibility have increased adoption across furniture, automotive, packaging, and construction sectors. As manufacturers aim to align with air quality regulations, water-based adhesives continue to gain popularity for both industrial and commercial applications.

United States Adhesives and Sealants Market held an 88.5% share and generated USD 1.48 billion in 2024. The U.S. market is set for continued growth through 2034, supported by robust investments in advanced manufacturing, EV production, and national infrastructure upgrades. Federal funding initiatives targeting transportation networks and public buildings are boosting the demand for high-performance adhesive and sealing products. Additionally, the rise of aerospace, electronics, and sustainable construction is reinforcing the country's role as a key market for adhesive technologies.

Prominent players in the Global Adhesives and Sealants Market include BASF SE, Dow Inc., Henkel AG & Co. KGaA, Sika AG, and 3M Company. Major companies in the adhesives and sealants industry are enhancing their market position through targeted R&D investments, eco-friendly product development, and regional expansion. There's a strategic shift toward low-VOC and bio-based adhesives to address environmental regulations and consumer sustainability demands. Companies are strengthening supply chains and expanding manufacturing capabilities in high-growth regions to reduce lead times and boost operational efficiency. Strategic mergers, acquisitions, and partnerships are enabling broader product portfolios and market access. Custom adhesive solutions tailored for electric vehicles, electronics, and smart infrastructure are also a focus, helping meet next-gen industrial demands.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Technology

- 2.2.4 Resin type

- 2.2.5 Application

- 2.2.6 End Use Industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Shift toward lightweight manufacturing

- 3.2.1.2 Green building and eco-friendly formulations

- 3.2.1.3 Growth of e-mobility and electronics

- 3.2.1.4 Packaging innovation and safety requirements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Environmental and regulatory pressure

- 3.2.2.2 Raw material price volatility

- 3.2.3 Market opportunities

- 3.2.3.1 Demand for sustainable and bio-based alternatives

- 3.2.3.2 Rise in modular and prefabricated construction

- 3.2.3.3 Expanding healthcare and medical devices market

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Adhesives market

- 5.2.1 Structural adhesives

- 5.2.1.1 Epoxy adhesives

- 5.2.1.2 Polyurethane adhesives

- 5.2.1.3 Acrylic adhesives

- 5.2.1.4 Methyl methacrylate adhesives

- 5.2.1.5 Cyanoacrylate adhesives

- 5.2.2 Pressure sensitive adhesives

- 5.2.2.1 Acrylic PSA

- 5.2.2.2 Rubber-based PSA

- 5.2.2.3 Silicone PSA

- 5.2.3 Hot melt adhesives

- 5.2.3.1 EVA hot melts

- 5.2.3.2 Polyamide hot melts

- 5.2.3.3 Polyolefin hot melts

- 5.2.3.4 Reactive hot melts

- 5.2.4 Water-based adhesives

- 5.2.5 Solvent-based adhesives

- 5.2.6 Other adhesive types

- 5.2.1 Structural adhesives

- 5.3 Sealants market

- 5.3.1 Silicone sealants

- 5.3.1.1 RTV silicone sealants

- 5.3.1.2 Structural glazing sealants

- 5.3.2 Polyurethane sealants

- 5.3.3 Acrylic sealants

- 5.3.4 Polysulfide sealants

- 5.3.5 Butyl sealants

- 5.3.6 Other sealant types

- 5.3.1 Silicone sealants

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Water-based technology

- 6.3 Solvent-based technology

- 6.4 Hot melt technology

- 6.5 Reactive technology

- 6.6 UV/light curable technology

- 6.7 Pressure sensitive technology

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Resin Type, 2021 - 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Epoxy resins

- 7.3 Polyurethane resins

- 7.4 Acrylic resins

- 7.5 Silicone resins

- 7.6 Polyvinyl acetate (PVA)

- 7.7 Ethylene vinyl acetate (EVA)

- 7.8 Styrenic block copolymers

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Structural bonding

- 8.3 Assembly operations

- 8.4 Sealing and gasketing

- 8.5 Surface protection

- 8.6 Electrical insulation

- 8.7 Thermal management

- 8.8 Vibration damping

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 Building and construction

- 9.2.1 Residential construction

- 9.2.2 Commercial construction

- 9.2.3 Infrastructure projects

- 9.3 Automotive and transportation

- 9.3.1 Passenger vehicles

- 9.3.2 Commercial vehicles

- 9.3.3 Electric vehicles

- 9.3.4 Aftermarket

- 9.4 Packaging

- 9.4.1 Flexible packaging

- 9.4.2 Rigid packaging

- 9.4.3 Labels and tapes

- 9.5 Electronics and electrical

- 9.5.1 Consumer electronics

- 9.5.2 Semiconductor packaging

- 9.5.3 PCB assembly

- 9.5.4 Display technologies

- 9.6 Aerospace and defense

- 9.6.1 Commercial aviation

- 9.6.2 Military applications

- 9.6.3 Space applications

- 9.7 Medical and healthcare

- 9.7.1 Medical devices

- 9.7.2 Surgical applications

- 9.7.3 Pharmaceutical packaging

- 9.8 Footwear and leather

- 9.9 Woodworking and furniture

- 9.10 Marine applications

- 9.11 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion, Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 3M Company

- 11.2 Arkema Group (Bostik)

- 11.3 Ashland Global Holdings Inc.

- 11.4 Avery Dennison Corporation

- 11.5 BASF SE

- 11.6 Dow Inc.

- 11.7 DuPont de Nemours, Inc.

- 11.8 H.B. Fuller Company

- 11.9 Henkel AG & Co. KGaA

- 11.10 Huntsman Corporation

- 11.11 Illinois Tool Works Inc. (ITW)

- 11.12 Momentive Performance Materials Inc.

- 11.13 RPM International Inc.

- 11.14 Sika AG

- 11.15 Wacker Chemie AG