|

市場調查報告書

商品編碼

1844558

汽車熱交換器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Automotive Heat Exchanger - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

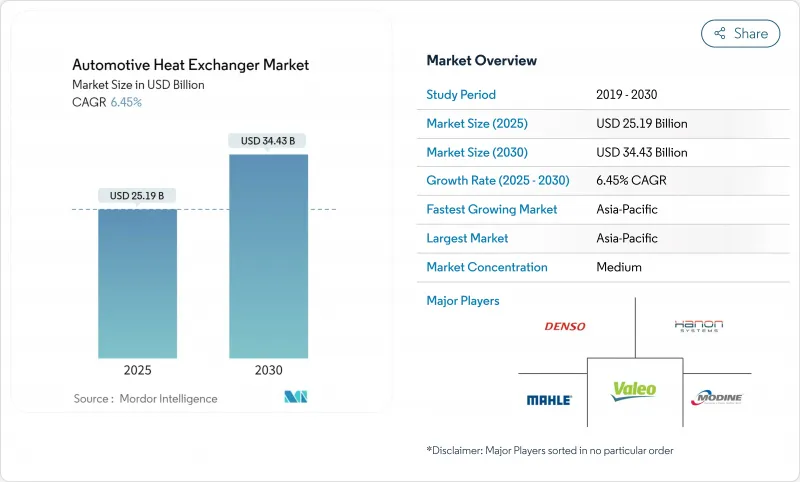

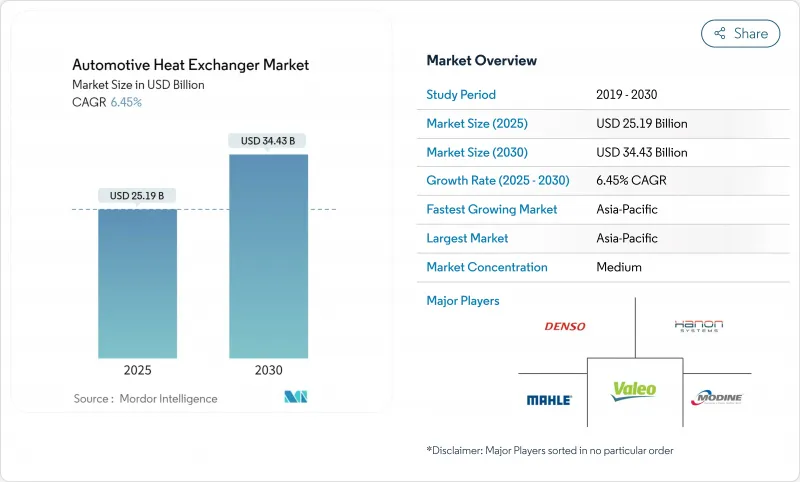

預計2025年汽車熱交換器市場規模將達251.9億美元,2030年將擴大至344.3億美元,複合年成長率為6.45%。

從內燃機冷卻迴路到電池、電力電子和座艙氣候控制的多迴路架構的轉變,正在推動汽車熱交換器市場的擴張。電氣化平台需要能夠防止電池熱失控、管理800V充電負載並延長車輛續航里程的組件。亞太地區電動車的普及、歐7耐久性法規以及熱泵整合也提升了汽車熱交換器市場的產品複雜性和價值。供應商正在透過微通道設計、耐腐蝕合金和熱泵整合模組來應對這項挑戰,而鋁和銅等材料的波動性則持續對整個汽車熱交換器市場的利潤率造成壓力。

全球汽車熱交換器市場趨勢與洞察

電動車銷售推動先進溫度控管需求

電動車所需的鋁材比內燃機汽車多出約30%,這迫使散熱器以外的熱交換器必須重新設計。電池迴路必須將電池溫度保持在2°C以內,以避免失控,而碳化矽逆變器會造成局部熱峰值,這些峰值由微通道芯體處理。低電導率流體(例如Preston符合GB29743-2標準的冷卻液形狀和塗層選項)以及直接浸入式冷卻技術,為消除電導率風險的介電單元開闢了新的市場。

嚴格的全球排放法規

將於2024年5月公佈的歐7法規將統一廢氣排放法規,並增加煞車和輪胎顆粒物限值,間接增加了熱負荷,同時迫使汽車製造商追求更高的能源效率。該法規將要求電池的耐用性,要求交換器壽命超過10年,並推動使用防腐釬焊板,而機載診斷將實現預測性流量控制。該計畫將持續到2026年11月,將縮短檢驗窗口,並有利於擁有預認證測試台架的供應商。

鋁和銅的價格波動

電動車型的銅用量高達80公斤,是內燃機車的四倍。汽車製造商透過多年期封閉式和閉迴路回收進行對沖,但地區溢價仍然扭曲了籌資策略。合金創新提高了單位重量的導電性,有助於限制對原金屬的需求,並在外匯飆升時穩定成本。

細分分析

散熱器將成為汽車熱交換器市場最大的細分市場,到2024年將佔銷售額的39.29%。到2030年,電池和電力電子冷卻器的複合年成長率將達到13.20%,市場佔有率將下降,這反映了電氣化的優先性。鋰離子電池組需要+-2°C的熱穩定性才能快速充電,這推動了汽車熱交換器市場對整合冷卻板和介電浸沒模組的需求。增壓空氣系統正與渦輪增壓保持同步發展,而油冷卻器將重點轉向電橋潤滑。座艙蒸發器和冷凝器正在演變為可逆熱泵熱交換器,而氫燃料電池加濕器正在成為一個新興的利基市場。

汽車熱交換器市場仍專注於散熱器容量。然而,燃料電池客車和卡車的堆疊式加濕模組市場仍有閒置頻段,而埃貝赫的排氣裝置則將水回收與聲音阻尼相結合。混合廢熱回收對於符合歐盟7標準的動力傳動系統仍然至關重要,隨著純電池應用的增加,它為供應商提供了過渡產品。

由於模具成熟且成本低廉,管翅芯式熱交換器到2024年將佔據汽車熱交換器市場佔有率的47.28%。由於原始設備製造商為了在滑板底盤中實現碰撞封裝而犧牲了厚度,板條組件的複合年成長率將達到8.84%。微通道和扁管單元是汽車熱交換器市場中成長最快的部分。熱管和均熱板正在高階電池組中得到應用,隨著固體電池降低熱負荷並提高對溫度均勻性的要求,這一趨勢可能會呈現級聯式成長。

在高壓迴路中,管殼式熱交換器已站穩腳跟,主要用於氫燃料電池和廢熱回收系統,而板棒式設計採用內部偏置翅片來降低流速和噪音,正在加強其在商用車增壓空氣冷卻中的地位。

區域分析

預計到2024年,亞太地區將佔據汽車熱交換器市場的47.23%,複合年成長率為8.78%。預計到2025年,中國汽車產量將超過3,500萬輛,電動車銷量年均成長50%,這將有利於能夠大規模生產微通道管的垂直整合鋁擠型機。日本的燃料電池藍圖和韓國在輻射供暖方面的進步將進一步豐富汽車熱交換器市場的技術需求。

北美市場發出的訊號喜憂參半:電動車零售需求疲軟導致福特削減了F-150 Lightning的產量,而抗擊通膨的立法則推動了供應鏈的區域化。 Gentherm公佈2025年第一季銷售額為3.54億美元,新訂單累計4億美元。國內擠壓和硬焊投資或能為抵禦外部材料衝擊提供緩衝。

歐洲的佔有率將取決於2026年11月歐7標準的合規期限。汽車製造商正在利用76%的回收率,並增加再生鋁的使用。安森美半導體在捷克共和國投資20億美元的碳化矽工廠,由於更高的鍵結溫度,將推動當地散熱器需求。此外,國家預算正瞄準氫能卡車市場,使燃料電池加濕器在汽車熱交換器市場中保持領先。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 電動車銷售推動先進溫度控管需求

- 嚴格的全球排放法規

- 新興市場暖通空調滲透率不斷上升

- 電動汽車熱泵系統的整合

- 800V高壓XEV架構

- 燃料電池加濕器的使用

- 市場限制

- 鋁和銅的價格波動

- 嚴格的耐久性和腐蝕檢驗成本

- 降低固態電池組的熱負荷

- 微通道擠壓進料瓶頸

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 按用途

- 散熱器

- 增壓空氣冷卻器/中冷器

- 油冷卻器

- EGR及廢氣熱回收設備

- 座艙 HVAC(蒸發器和冷凝器)

- 電池/電力電子冷卻器

- 燃料電池加濕器

- 其他用途

- 依設計類型

- 管翅式

- 板材棒材

- 微通道扁管

- 殼管式

- 其他

- 按材質

- 鋁

- 銅/黃銅

- 防鏽的

- 複合材料和聚合物

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 重型商用車和非公路用車

- 按動力傳動系統

- 內燃機(ICE)

- 混合動力電動車(HEV/PHEV)

- 純電動車(BEV)

- 燃料電池電動車(FCEV)

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- DENSO Corporation

- MAHLE GmbH

- Valeo SA

- Hanon Systems

- Modine Manufacturing Company

- Dana Incorporated

- Marelli(Calsonic Kansei)

- Sanden Holdings

- GEA Group

- Kelvion Holdings

- T.RAD Co. Ltd.

- Behr Hella Service

- AKG Thermal Systems

- American Industrial Heat Transfer

- Banco Products(India)Ltd.

- Climetal SL

- Constellium SE

- GandM Radiator

- Nippon Light Metal Holdings

- Valeo SA(Thermal Systems)

第7章 市場機會與未來展望

The automotive heat exchanger market reached USD 25.19 billion in 2025 and is projected to rise to USD 34.43 billion by 2030, advancing at a 6.45% CAGR.

The shift from internal-combustion cooling loops to multi-loop architectures for battery, power electronics, and cabin climate control underpins this expansion across the automotive heat exchanger market. Electrified platforms demand components that prevent battery thermal runaway, manage 800-V charging loads, and conserve vehicle range. Strong electric-vehicle adoption in Asia-Pacific, Euro 7 durability rules, and heat-pump integration also elevate product complexity and value content in the automotive heat exchanger market. Suppliers are responding with micro-channel designs, corrosion-resistant alloys, and integrated heat-pump modules, while materials volatility in aluminum and copper continues to pressure margins across the automotive heat exchanger market.

Global Automotive Heat Exchanger Market Trends and Insights

EV Sales-Driven Demand for Advanced Thermal Management

Electric vehicles require roughly 30% more aluminum than combustion cars, forcing the redesign of exchangers beyond radiator duty. Battery loops must keep cell temperatures within a 2 °C band to avoid runaway, while silicon-carbide inverters impose localized heat spikes handled by micro-channel cores. Low-conductivity fluids, such as Prestone's GB29743-2-compliant coolant shape alloy and coating choices, and direct-immersion cooling, open a niche for dielectric units that eliminate conductivity risk.

Stringent Global Emission Regulations

Euro 7 rules published in May 2024 unify tailpipe limits and add brake- and tire-particulate caps, indirectly raising thermal loads as automakers chase efficiency gains. Required battery durability pushes exchanger life targets beyond a decade, spurring corrosion-proof brazing sheets while onboard diagnostics enable predictive flow control. Program timelines to November 2026 tighten validation windows, favoring suppliers with pre-certified test benches.

Aluminum and Copper Price Volatility

Electric models can contain up to 80 kg copper-four times that of combustion cars-making exchanger cost highly sensitive to spot prices. Automakers hedge with multiyear contracts and closed-loop recycling, yet regional premiums still skew sourcing strategies. Alloy innovation that lifts conductivity per unit weight helps limit primary metal demand, stabilizing costs when exchange rates spike.

Other drivers and restraints analyzed in the detailed report include:

- Heat-pump System Integration in Electric Vehicles

- Rising HVAC Penetration in Emerging Markets

- Micro-channel Extrusion Supply Bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Radiators accounted for the largest slice of the automotive heat exchanger market size, holding 39.29% revenue in 2024. Their share slips as battery and power-electronics coolers record a 13.20% CAGR to 2030, reflecting electrification priorities. Lithium-ion packs demand +-2 °C thermal stability for fast charging, prompting integrated chill plates and dielectric immersion modules in the automotive heat exchanger market. Charge-air systems keep pace with turbocharging, while oil coolers pivot toward e-axle lubrication. Cabin evaporators and condensers evolve into reversible heat-pump exchangers, and hydrogen fuel-cell humidifiers surface as a nascent niche.

The automotive heat exchanger market continues to prize radiator volumes. Yet, white-space lies in stack humidification modules for fuel-cell buses and trucks, where Eberspacher's exhaust-air unit blends water recovery with acoustic damping. Hybrid exhaust-heat recovery remains relevant in Euro-7-compliant powertrains, giving suppliers a bridge product as pure battery adoption climbs.

Tube-fin cores represented 47.28% of automotive heat exchanger market share in 2024 owing to mature tooling and low cost. Plate-bar assemblies grow 8.84% CAGR as OEMs trade off thickness for crash packaging in skateboard chassis. The automotive heat exchanger market size for micro-channel flat tube units is scaling fastest because superior transfer coefficients enable slim modules around crowded battery trays. Heat pipes and vapor chambers appear in premium battery packs, a trend likely to cascade as solid-state cells lower heat loads but tighten temperature uniformity needs.

In high-pressure loops, shell-and-tube exchangers preserve a foothold, mainly in hydrogen fuel-cell and waste-heat recovery systems where robustness outweighs weight penalties. Concurrently, plate-bar variants adopt internal offset fins to temper flow velocity and noise, reinforcing their position in commercial-vehicle charge-air cooling.

The Automotive Heat Exchanger Market Report is Segmented by Application (Radiator, Charge-Air Coolers / Intercoolers, and More), Design Type (Tube-Fin, Plate-Bar, and More), Material (Aluminum, Copper / Brass, and More) Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Powertrain Type (Internal Combustion Engine Vehicles, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated the automotive heat exchanger market with 47.23% share in 2024 and is forecast to expand 8.78% CAGR. China exceeded 35 million vehicle builds in 2025, with EV sales up 50% yearly, benefiting vertically integrated aluminum extruders that produce micro-channel tubes at scale. Japan's fuel-cell roadmap and South Korea's radiant heating breakthroughs further diversify technical demand across the automotive heat exchanger market.

North America confronts mixed signals: softer retail EV demand led Ford to trim F-150 Lightning volumes, yet the Inflation Reduction Act spurs localized supply chains. Gentherm booked USD 400 million in new awards while achieving USD 354 million Q1 2025 revenue, reflecting resilience in climate-comfort niches. Domestic extrusion and brazing investment could cushion against foreign material shocks.

Europe's share is shaped by Euro 7's November 2026 compliance deadline. Automakers are boosting recycled aluminum use, leveraging a 76% collection rate. Onsemi's USD 2 billion SiC facility in Czechia elevates regional heat-sink demand owing to higher junction temperatures. National funding also targets hydrogen truck corridors, keeping fuel-cell humidifier lines viable within the automotive heat exchanger market

- DENSO Corporation

- MAHLE GmbH

- Valeo SA

- Hanon Systems

- Modine Manufacturing Company

- Dana Incorporated

- Marelli (Calsonic Kansei)

- Sanden Holdings

- GEA Group

- Kelvion Holdings

- T.RAD Co. Ltd.

- Behr Hella Service

- AKG Thermal Systems

- American Industrial Heat Transfer

- Banco Products (India) Ltd.

- Climetal SL

- Constellium SE

- GandM Radiator

- Nippon Light Metal Holdings

- Valeo SA (Thermal Systems)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EV Sales-Driven Demand For Advanced Thermal Management

- 4.2.2 Stringent Global Emission Regulations

- 4.2.3 Rising HVAC Penetration In Emerging Markets

- 4.2.4 Heat-Pump System Integration In Electric Vehicles

- 4.2.5 800-V High-Voltage XEV Architectures

- 4.2.6 Fuel-Cell Humidifier Exchanger Adoption

- 4.3 Market Restraints

- 4.3.1 Aluminum and Copper Price Volatility

- 4.3.2 Stringent Durability and Corrosion Validation Costs

- 4.3.3 Declining Heat-Load In Solid-State Battery Packs

- 4.3.4 Micro-Channel Extrusion Supply Bottlenecks

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD))

- 5.1 By Application

- 5.1.1 Radiators

- 5.1.2 Charge-Air Coolers / Intercoolers

- 5.1.3 Oil Coolers

- 5.1.4 EGR and Exhaust Gas Heat Recovery

- 5.1.5 Cabin HVAC (Evaporator and Condenser)

- 5.1.6 Battery / Power-electronics Coolers

- 5.1.7 Fuel-cell Humidifiers

- 5.1.8 Other Applications

- 5.2 By Design Type

- 5.2.1 Tube-Fin

- 5.2.2 Plate-Bar

- 5.2.3 Micro-channel Flat Tube

- 5.2.4 Shell-and-Tube

- 5.2.5 Others

- 5.3 By Material

- 5.3.1 Aluminum

- 5.3.2 Copper / Brass

- 5.3.3 Stainless Steel

- 5.3.4 Composites and Polymers

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Light Commercial Vehicles

- 5.4.3 Heavy Commercial and Off-Highway Vehicles

- 5.5 By Powertrain Type

- 5.5.1 Internal Combustion Engine (ICE)

- 5.5.2 Hybrid Electric Vehicles (HEV/PHEV)

- 5.5.3 Battery Electric Vehicles (BEV)

- 5.5.4 Fuel-Cell Electric Vehicles (FCEV)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Russia

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 DENSO Corporation

- 6.4.2 MAHLE GmbH

- 6.4.3 Valeo SA

- 6.4.4 Hanon Systems

- 6.4.5 Modine Manufacturing Company

- 6.4.6 Dana Incorporated

- 6.4.7 Marelli (Calsonic Kansei)

- 6.4.8 Sanden Holdings

- 6.4.9 GEA Group

- 6.4.10 Kelvion Holdings

- 6.4.11 T.RAD Co. Ltd.

- 6.4.12 Behr Hella Service

- 6.4.13 AKG Thermal Systems

- 6.4.14 American Industrial Heat Transfer

- 6.4.15 Banco Products (India) Ltd.

- 6.4.16 Climetal SL

- 6.4.17 Constellium SE

- 6.4.18 GandM Radiator

- 6.4.19 Nippon Light Metal Holdings

- 6.4.20 Valeo SA (Thermal Systems)