|

市場調查報告書

商品編碼

1871096

油氣熱交換器市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Oil and Gas Heat Exchanger Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

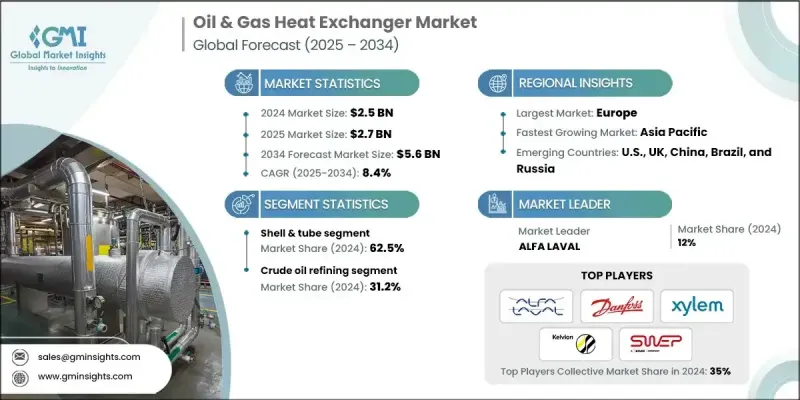

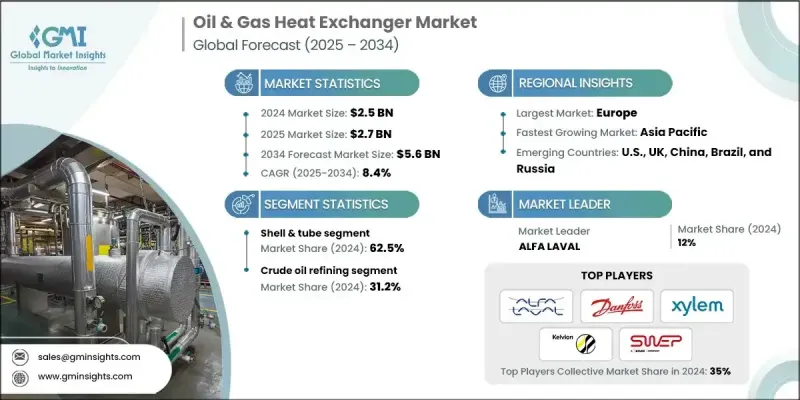

2024 年全球油氣熱交換器市場價值為 25 億美元,預計到 2034 年將以 8.4% 的複合年成長率成長至 56 億美元。

由於對油氣基礎設施的持續投資以及對高效供暖和製冷系統日益成長的需求,該行業的前景仍然強勁。熱交換器在維持油氣作業的熱平衡方面發揮著至關重要的作用,它確保流體間有效的能量傳遞,從而提高生產效率並降低營運成本。煉油、加工和探勘活動中對節能熱管理的日益重視,以及技術的進步,進一步刺激了市場擴張。專案專用、客製化熱交換器的日益普及,確保了精確的溫度控制和運作可靠性,也提高了市場滲透率。此外,適用於複雜或空間受限設施的緊湊型和適應性設計越來越受到青睞,這加速了產品的普及。向永續且經濟高效的熱力技術轉型,旨在提高能源效率和減少排放,正在重新定義產業趨勢和競爭力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 25億美元 |

| 預測值 | 56億美元 |

| 複合年成長率 | 8.4% |

2024年,管殼式熱泵市佔率達到62.5%,預計到2034年將以8%的複合年成長率成長。該細分市場持續成長,主要得益於其在原油煉製和天然氣加工領域的廣泛應用,這主要歸功於其高耐久性以及在極端壓力和溫度條件下運作的能力。上游和下游基礎設施投資的不斷增加,以及對可靠高效熱性能的持續需求,都推動了這一成長趨勢。耐腐蝕材料的引入、用於增強傳熱的改進型管束結構,以及用於預測性維護和運行最佳化的先進監控系統的整合,都在提升產品需求和營運效率。

原油煉製應用領域在2024年佔據31.2%的市場佔有率,預計到2034年將以7.5%的複合年成長率成長。全球煉油產能的提升,以及對最佳化工廠性能日益重視,是推動該領域成長的重要因素。日益嚴格的環境法規鼓勵提高能源利用率和減少排放,進一步塑造了市場格局。數位技術、預測性維護工具以及旨在提高可靠性和延長設備壽命的高效熱交換器的日益普及,也推動了這一領域的擴張。

2024年,美國油氣熱交換器市場佔據78%的市場佔有率,市場規模達4.528億美元。美國市場的成長得益於其強大的油氣基礎設施、頁岩氣開採技術的進步以及煉油和加工能力投資的不斷增加。能源基礎設施現代化建設的日益重視以及向符合永續發展目標的節能解決方案轉型,是推動這一成長的主要因素。不斷完善的環境標準和向淨零排放目標的推進,進一步促進了先進熱交換器系統在該地區得到廣泛應用。

全球油氣熱交換器市場的主要企業包括ALFA LAVAL、API Heat Transfer、BARRIQUAND Heat Exchanger、Bronswerk、Danfoss、Funke Warmeaustauscher Apparatebau GmbH、HFM、HISAKA WORKS LTD.、HRS Heatrs、KAM Thermal Equipmenter、Kmbx、Hexson、Moler、M Group、SPX Flow、SWEP International、Thermofin、TITAN Metal Fabricators、Tranter、Turnbull & Scott Group和Xylem。油氣熱交換器市場的關鍵參與者正積極採取多種策略來提升其市場佔有率和競爭力。各公司致力於擴大全球生產能力並加強供應鏈,以滿足不斷成長的需求。策略合作和併購促進了技術共享和產品組合多元化。各公司正大力投資研發,以開發高性能、耐腐蝕且節能的熱交換器,從而滿足不斷變化的產業需求。為提高運作可靠性並減少停機時間,公司正在優先考慮整合數位監控系統和預測性維護技術。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 原物料供應及採購分析

- 影響價值鏈的關鍵因素

- 中斷

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

- 油氣熱交換器的成本結構分析

- 新興機會與趨勢

- 利用物聯網技術實現數位轉型

- 新興市場滲透

- 投資分析及未來展望

第4章:競爭格局

- 介紹

- 按地區分類的公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 策略舉措

- 重要夥伴關係與合作

- 主要併購活動

- 產品創新與發布

- 市場擴張策略

- 競爭性標竿分析

- 戰略儀錶板

- 創新與永續發展格局

第5章:市場規模及預測:依技術分類,2021-2034年

- 主要趨勢

- 殼管

- 盤子

- 風冷

- 其他

第6章:市場規模及預測:依應用領域分類,2021-2034年

- 主要趨勢

- 陸上生產設施

- 原油煉製

- 石油化學加工

- 液化天然氣設施

- 管道系統

- 其他

第7章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 義大利

- 西班牙

- 波蘭

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 印尼

- 馬來西亞

- 泰國

- 越南

- 菲律賓

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 智利

第8章:公司簡介

- ALFA LAVAL

- API Heat Transfer

- BARRIQUAND Heat Exchanger

- Bronswerk

- Danfoss

- Funke Warmeaustauscher Apparatebau GmbH

- HFM

- HISAKA WORKS LTD.

- HRS Heat Exchangers

- KAM Thermal Equipment, LTD

- Kelvion Holding GmbH

- Mersen

- Metalforms, LLC

- Nexson Group

- SPX Flow

- SWEP International

- Thermofin

- TITAN Metal Fabricators

- Tranter

- Turnbull & Scott Group

- Xylem

The Global Oil & Gas Heat Exchanger Market was valued at USD 2.5 Billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 5.6 Billion by 2034.

The industry's outlook remains strong as continuous investments in oil and gas infrastructure and rising demand for efficient heating and cooling systems continue to drive growth. Heat exchangers play a vital role in maintaining thermal balance across oil and gas operations by ensuring effective energy transfer between fluid streams, which enhances productivity and reduces operational costs. The growing focus on energy-efficient thermal management across refining, processing, and exploration activities, coupled with technological advancements, is further stimulating market expansion. Increasing adoption of project-specific, customized heat exchangers that ensure precise temperature control and operational reliability is also enhancing market penetration. Moreover, the growing preference for compact and adaptable designs suitable for complex or space-constrained facilities is accelerating product adoption. The shift toward sustainable and cost-effective thermal technologies aimed at improving energy performance and reducing emissions is redefining industry trends and competitiveness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $5.6 Billion |

| CAGR | 8.4% |

The shell and tube segment held a 62.5% share in 2024 and is forecasted to grow at a CAGR of 8% through 2034. This segment continues to gain traction due to its robust use in both crude oil refining and gas processing applications, primarily driven by its high durability and ability to operate under extreme pressure and temperature conditions. Expanding investments in upstream and downstream infrastructure and the continuous need for reliable and efficient thermal performance are supporting this growth trajectory. The introduction of corrosion-resistant materials, improved tube configurations for enhanced heat transfer, and the integration of advanced monitoring systems designed for predictive maintenance and operational optimization are boosting product demand and efficiency across operations.

The crude oil refining application segment held a 31.2% share in 2024 and is expected to grow at a CAGR of 7.5% through 2034. Rising refining capacities worldwide, coupled with an increasing emphasis on optimizing plant performance, are contributing significantly to the segment's growth. Stricter environmental norms encouraging better energy utilization and reduced emissions are further shaping the market landscape. The growing integration of digital technologies, predictive maintenance tools, and high-efficiency heat exchangers designed to improve reliability and extend equipment life is fueling this expansion.

United States Oil & Gas Heat Exchanger Market held a 78% share in 2024, generating USD 452.8 million. The U.S. market is expanding due to the country's strong oil and gas infrastructure, advancements in shale extraction, and rising investments in refining and processing capacities. Increasing focus on modernizing energy infrastructure and the transition toward energy-efficient solutions in alignment with sustainability goals are major drivers behind this growth. Evolving environmental standards and the push toward net-zero objectives are further supporting widespread adoption of advanced heat exchanger systems across the region.

Leading companies operating in the Global Oil & Gas Heat Exchanger Market include ALFA LAVAL, API Heat Transfer, BARRIQUAND Heat Exchanger, Bronswerk, Danfoss, Funke Warmeaustauscher Apparatebau GmbH, HFM, HISAKA WORKS LTD., HRS Heat Exchangers, KAM Thermal Equipment LTD, Kelvion Holding GmbH, Mersen, Metalforms LLC, Nexson Group, SPX Flow, SWEP International, Thermofin, TITAN Metal Fabricators, Tranter, Turnbull & Scott Group, and Xylem. Key players in the Oil & Gas Heat Exchanger Market are actively adopting several strategies to enhance their market presence and competitiveness. Companies are focusing on expanding their global production capabilities and strengthening their supply chains to meet increasing demand. Strategic collaborations and mergers are enabling technology sharing and portfolio diversification. Firms are heavily investing in R&D to develop high-performance, corrosion-resistant, and energy-efficient heat exchangers tailored to evolving industry requirements. Integration of digital monitoring systems and predictive maintenance technologies is being prioritized to enhance operational reliability and reduce downtime.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Technology trends

- 2.4 Application trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Key factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 Cost structure analysis of oil & gas heat exchangers

- 3.8 Emerging opportunities & trends

- 3.8.1 Digital transformation with IoT technologies

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Shell & tube

- 5.3 Plate

- 5.4 Air cooled

- 5.5 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Onshore production facilities

- 6.3 Crude oil refining

- 6.4 Petrochemical processing

- 6.5 LNG facilities

- 6.6 Pipeline systems

- 6.7 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Russia

- 7.3.5 Italy

- 7.3.6 Spain

- 7.3.7 Poland

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 South Korea

- 7.4.4 India

- 7.4.5 Indonesia

- 7.4.6 Malaysia

- 7.4.7 Thailand

- 7.4.8 Vietnam

- 7.4.9 Philippines

- 7.4.10 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Egypt

- 7.5.4 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Colombia

- 7.6.4 Chile

Chapter 8 Company Profiles

- 8.1 ALFA LAVAL

- 8.2 API Heat Transfer

- 8.3 BARRIQUAND Heat Exchanger

- 8.4 Bronswerk

- 8.5 Danfoss

- 8.6 Funke Warmeaustauscher Apparatebau GmbH

- 8.7 HFM

- 8.8 HISAKA WORKS LTD.

- 8.9 HRS Heat Exchangers

- 8.10 KAM Thermal Equipment, LTD

- 8.11 Kelvion Holding GmbH

- 8.12 Mersen

- 8.13 Metalforms, LLC

- 8.14 Nexson Group

- 8.15 SPX Flow

- 8.16 SWEP International

- 8.17 Thermofin

- 8.18 TITAN Metal Fabricators

- 8.19 Tranter

- 8.20 Turnbull & Scott Group

- 8.21 Xylem