|

市場調查報告書

商品編碼

1844471

透明陶瓷:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Transparent Ceramics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

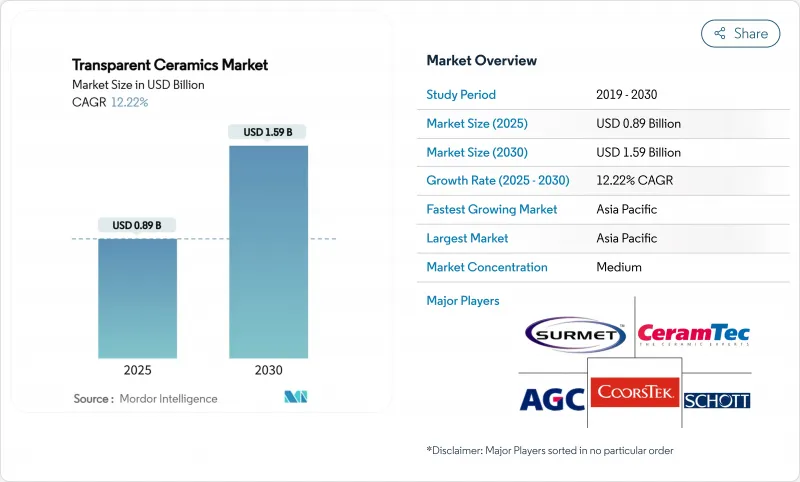

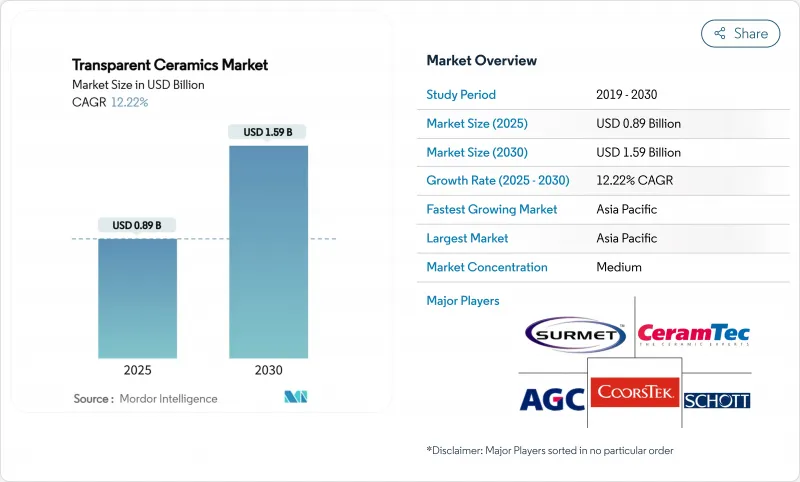

透明陶瓷市場規模預計在 2025 年為 8.9 億美元,預計到 2030 年將達到 15.9 億美元,預測期內(2025-2030 年)的複合年成長率為 12.22%。

對核融合級雷射光學元件、高超音速飛行器整流罩和下一代光電元件的需求不斷重新定義性能基準,刺激了對可降低缺陷率和擴大產量的製造技術的投資。受中國和日本半導體和航太工業建設的推動,亞太地區貢獻了最大的收益塊並創下了最快的區域成長記錄,這反映了規模經濟和協調的產業政策。晶體陶瓷目前在出貨量中占主導地位,特別是在軍用光學領域。然而,隨著家用電子電器品牌轉向抗刮性、高清晰度外殼,具有成本優勢的玻璃陶瓷變體正在湧現。雖然藍寶石在材料市場主導,但氮氧化鋁的彈道性能正在贏得高超音速平台下一代紅外線 (IR) 窗口的設計。雖然競爭格局較為鬆散,但垂直整合正趨向於稀土投入和專有燒結技術,以降低單位成本並確保人工植牙和 LED 照明等大批量應用的生產能力。

全球透明陶瓷市場趨勢與洞察

加速光學和光電子領域的應用

雷射驅動的製造、雷射雷達和光子積體電路正在推動對高純度、低缺陷透明陶瓷的需求達到創紀錄的水平。鈦:絕緣體上藍寶石原型可實現緊湊的佈局,從而減少系統佔用空間並提高功率密度,證明了晶圓級雷射陣列的商業性可行性。摻鈰石榴石陶瓷的亮度飽和閾值現已達到65 W mm-2,為LED背光和工業雷射中的單晶增益介質提供了一種耐用且熱穩定的替代方案。因此,透明陶瓷市場與寬頻通訊資訊息相關,而小型化的壓力正在放大能夠承受強光通量和高結溫的材料的價值。

航太和國防需求不斷成長

透明陶瓷滿足超音速飛機、飛彈探求者和衛星感測器窗口光纖傳輸和耐高溫的雙重要求。多孔氮化矽(Si3N4)雷達罩的孔隙率達到56%,同時保持機械完整性,從而減輕了遠距攔截飛彈的總重量。高超音速滑翔飛行器的透明罩必須承受2000°C的外殼溫度,而氮化鋁(AlON)和尖晶石材質不僅超過了這個閾值,還能承受熱衝擊。美國聯邦政府的藍圖將這些陶瓷列為高彈性能量武器光學元件和定向能系統的基礎材料。以滿足感測器頻寬需求的硫系玻璃衍生物取代鍺窗口,可降低策略性礦產供應風險,進而進一步促進透明陶瓷市場的發展。

製造成本高

透明陶瓷需要高純度原料和多級燒成工藝,因此其窯爐停留時間和功耗顯著超過標準瓷磚和結構陶瓷。兩級燒結可以提高密度,但需要高精度的熱感燈,而藍寶石組件的鑽石砂輪精加工會增加高速主軸和冷卻系統的資本投資。產業對碳排放的嚴格審查正在加速綠色氫窯爐的轉變,但短期轉換成本正在拖累利潤率。

細分分析

晶體陶瓷在0.3-5微米波段表現出持續的高透射率,抗壓強度超過2GPa,到2024年將佔據透明陶瓷市場64.67%的佔有率。細晶粒藍寶石圓頂和YAG雷射板展現了該領域在機載雷達罩和固體雷射的多功能性。同時,非晶微晶玻璃憑藉靈活的熔鑄生產線和較低的廢品率,已佔領行動電話鏡頭蓋和智慧型手錶背板市場。 12.78%的複合年成長率凸顯了價格敏感型消費通路的需求韌性。

堇青石微晶玻璃的透光率高達 82.3%,熱膨脹係數低於 2.6 ppm 度C-1,為實現無需聚合物層壓的單片移動螢幕奠定了基礎。同時,先進的成核劑系統——P2O5 + ZrO2 + TiO2——將結晶轉移到本體,在不犧牲透明度的情況下提高了機械抗張強度。火花電漿燒結技術將加工時間從數小時縮短至數分鐘,將能量輸入減半,並縮小晶粒邊界以抑制散射。

區域分析

2024年,亞太地區將佔全球銷售額的56.67%,主要得益於湖南成熟的藍寶石晶棒和名古屋的大直徑AlON板材。政府對半導體蝕刻和顯示器工廠的獎勵策略將推動需求,而中國出口導向國防企業集團將在其下一代ISR無人機中採用尖晶石圓頂。到2030年,該地區的收入將以14.23%的複合年成長率顯著成長。韓國的奈米透明螢幕計畫將每英吋成本降低至OLED的十分之一,從而擴大了可尋址顯示器的覆蓋範圍,並深化了區域供應鏈。

北美持續引領技術發展,津貼,展示定向能雷射耦合器和核融合級光學元件。 Lightpath Technologies 正在使用 BDNL4 硫系玻璃取代鍺,以保護國防基礎設施免受地緣政治風險的影響。墨西哥電子加工廠(Electronics Maquiladora)正在將微晶玻璃散熱器應用於電源模組,這標誌著先進材料正在向該地區以外的地區擴展。

在歐洲,肖特致力於高附加價值、低碳生產。肖特4.5億歐元的資本計畫包括一條氫燃浮法生產線,該生產線將於2024年生產首批二氧化碳中性玻璃,並正在檢驗陶瓷燒結爐的可行性。德國陶瓷複合材料網路的目標是到2025年將其氧化纖維加工能力加倍,這對於航太渦輪機中的陶瓷基複合材料至關重要。中東和非洲地區正在進行早期但具有戰略意義的部署,尤其是在聚光型太陽光電領域,防塵、紅外線透明的屏蔽層可以延長定日鏡的使用壽命。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 加速光學和光電子領域的應用

- 航太和國防領域的需求不斷成長

- 精密陶瓷正在取代塑膠和金屬

- 核融合級高功率陶瓷雷射

- 高超音速飛行器紅外線罩中透明陶瓷的使用日益增多

- 市場限制

- 製造成本高

- 製造複雜性和產量比率損失

- 稀土開採的永續性問題

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測

- 按結構

- 結晶質的

- 結晶質(玻璃陶瓷)

- 按材質

- 藍寶石(Al2O3)

- 釔鋁石榴石(YAG)

- 氧氮化鋁(AlON)

- 尖晶石(MgAl2O4)

- 釔安定氧化鋯(YSZ)

- 其他先進材料

- 按用途

- 光學與光電子學

- 航太/國防

- 機械/化學加工

- 醫療保健和牙科

- 消費性電子產品

- 能源和電力

- 其他

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 北歐的

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 奈及利亞

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- AGC Inc.

- CeramTec GmbH

- CILAS

- CoorsTek Inc.

- Deisenroth Engineering GmbH

- Fraunhofer IKTS

- General Electric

- II-VI Optical Systems

- Konoshima Chemical Co. Ltd

- Kyocera Corporation

- Meller Optics Inc

- Murata Manufacturing

- OptoCity Inc.

- Philips Lighting Holdings

- Raytheon Technologies(RTX)

- Saint-Gobain Group

- SCHOTT AG

- Surmet Corporation

第7章 市場機會與未來展望

The Transparent Ceramics Market size is estimated at USD 0.89 billion in 2025, and is expected to reach USD 1.59 billion by 2030, at a CAGR of 12.22% during the forecast period (2025-2030).

Demand for fusion-grade laser optics, hypersonic vehicle domes, and next-generation optoelectronic components continues to redefine performance baselines, spurring investment in manufacturing technologies that shrink defect rates and expand throughput. Asia Pacific, supported by semiconductor and aerospace buildouts in China and Japan, contributes the largest revenue block and simultaneously registers the fastest regional growth, reflecting scale economics and coordinated industrial policy. Crystalline-structure ceramics dominate current shipments, especially in military optics, yet cost-advantaged glass-ceramic variants are closing ground as consumer electronics brands pivot to scratch-resistant, high-clarity covers. Material leadership resides with sapphire, but aluminum oxynitride's ballistic performance is allowing it to seize design-in wins for next-generation infrared (IR) windows on hypersonic platforms. The competitive field, while moderately consolidated, is tilting toward vertical integration as players race to secure rare-earth inputs and proprietary sintering know-how, lowering unit costs and unlocking capacity for high-volume sectors such as dental implants and LED lighting.

Global Transparent Ceramics Market Trends and Insights

Accelerating Usage in Optics & Optoelectronics

Laser-driven manufacturing, lidar, and photonic-integrated circuits are fueling record off-take for high-purity, low-defect transparent ceramics. Titanium:sapphire-on-insulator prototypes have delivered compact layouts that cut system footprints while boosting power density, signaling commercial feasibility for wafer-level laser arrays. Ce-doped garnet ceramics now demonstrate luminance saturation thresholds of 65 W mm-2, offering durable, thermally stable alternatives to single-crystal gain media in LED backlights and industrial lasers. The transparent ceramics market is, therefore, intertwined with broadband communications, where miniaturization pressures amplify the value of materials that can survive intense photon flux and elevated junction temperatures.

Growing Demand from Aerospace & Defense

Transparent ceramics meet the dual mandate of optical transmission and high-temperature resilience imposed by supersonic aircraft, missile seekers, and satellite sensor windows. Porous Si3N4 radomes have reached 56% porosity while preserving mechanical integrity, trimming overall weight for long-range interceptors. Transparent domes on hypersonic glide bodies must tolerate 2,000 °C skin temperatures; AlON and spinel exceed such thresholds while resisting thermal shock. U.S. federal roadmaps name these ceramics as cornerstone materials for resilient energy weapon optics and directed-energy systems. Substitution away from germanium windows further elevates the transparent ceramics market, alleviating strategic mineral supply risk through chalcogenide glass derivatives that match sensor bandwidth needs.

High Production Cost

Transparent ceramics require high-purity feedstocks and multi-stage sintering profiles that push furnace dwell times and electricity usage well above standard tile or structural ceramics. Two-step sintering raises density but demands precision thermal ramps, while diamond-wheel finishing of sapphire parts adds capex for high-RPM spindles and coolant systems. Industry carbon-footprint scrutiny is accelerating shifts to green hydrogen kilns, but near-term conversion expenses weigh on margins.

Other drivers and restraints analyzed in the detailed report include:

- Advanced Ceramics Increasingly Replacing Plastics and Metals

- Fusion-Grade High-Power Ceramic Lasers

- Manufacturing Complexity & Yield Losses

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Crystalline variants secured 64.67% transparent ceramics market share in 2024, validated by consistently higher transmission in the 0.3-5 μm band and compressive strengths above 2 GPa. Fine-grain sapphire domes and YAG laser slabs illustrate the segment's versatility across radomes and solid-state lasers. Non-crystalline glass-ceramics, conversely, capitalized on agile melt-casting lines and lower scrap rates, capturing handset lens covers and smart-watch backplates. Their 12.78% CAGR underscores demand elasticity in price-sensitive consumer channels.

Cordierite glass-ceramics that combine 82.3% transmittance with sub-2.6 ppm °C-1 thermal expansion pave the way for monolithic mobile screens that forego polymer lamination. Meanwhile, advanced nucleant systems-P2O5 + ZrO2 + TiO2-shift crystallization to the bulk, enhancing mechanical tensile strength without sacrificing clarity. Spark plasma sintering reduces processing windows from hours to minutes, halving energy input and shrinking grain boundaries to suppress scattering.

The Transparent Ceramics Market Report is Segmented by Structure (Crystalline, Non-Crystalline), Material (Sapphire, Yttrium Aluminum Garnet, Aluminum Oxynitride, and More), Application (Optics & Optoelectronics, Aerospace & Defense, Mechanical & Chemical Processing, and More), and Geography (Asia Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific controlled 56.67% of 2024 sales, buoyed by entrenched sapphire boules in Hunan and wide-aperture AlON plates in Nagoya. Government stimulus for local semiconductor etching and display fabs furnishes anchor demand, while export-oriented defense conglomerates in China adopt spinel domes for next-generation ISR drones. By 2030, the region is poised to generate significant incremental revenue, growing at a rate of 14.23% CAGR. South Korea's nano transparent screen initiative cuts per-inch costs to one-tenth of OLED, broadening addressable display footprints and deepening local supply chains.

North America remains the technology vanguard, leveraging DARPA and DoE grants to demonstrate directed-energy laser couplers and fusion-grade optics. LightPath Technologies is substituting BDNL4 chalcogenide glass for germanium, insulating the defense base from geopolitical risk. Mexico's electronics maquiladoras integrate glass-ceramic heat spreaders into power modules, signaling outward regional diffusion of advanced materials.

Europe positions itself on value-added, low-carbon production. SCHOTT's EUR 450 million capital program includes a hydrogen-fired float line that delivered its first CO2-neutral glass in 2024, validating feasibility for ceramic sintering kilns. Germany's Ceramic Composites network targets a doubling of oxide-fiber throughput by 2025, critical for ceramic-matrix composites in aerospace turbines. The Middle East and Africa record nascent but strategic uptake, especially in concentrated solar power fields where dust-resistant, IR-transparent shields elongate heliostat lifetimes.

- AGC Inc.

- CeramTec GmbH

- CILAS

- CoorsTek Inc.

- Deisenroth Engineering GmbH

- Fraunhofer IKTS

- General Electric

- II-VI Optical Systems

- Konoshima Chemical Co. Ltd

- Kyocera Corporation

- Meller Optics Inc

- Murata Manufacturing

- OptoCity Inc.

- Philips Lighting Holdings

- Raytheon Technologies (RTX)

- Saint-Gobain Group

- SCHOTT AG

- Surmet Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating usage in optics and optoelectronics

- 4.2.2 Growing demand from aerospace and defense

- 4.2.3 Advanced Ceramics Increasingly Replacing Plastics and Metals

- 4.2.4 Fusion-grade high-power ceramic lasers

- 4.2.5 Rising use of transparent ceramics in IR domes for hypersonic vehicles

- 4.3 Market Restraints

- 4.3.1 High production cost

- 4.3.2 Manufacturing complexity and yield losses

- 4.3.3 Sustainability issues in rare-earth mining

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts

- 5.1 By Structure

- 5.1.1 Crystalline

- 5.1.2 Non-crystalline (Glass-ceramic)

- 5.2 By Material

- 5.2.1 Sapphire (Al2O3)

- 5.2.2 Yttrium Aluminum Garnet (YAG)

- 5.2.3 Aluminum Oxynitride (AlON)

- 5.2.4 Spinel (MgAl2O4)

- 5.2.5 Yttria-stabilized Zirconia (YSZ)

- 5.2.6 Other Advanced Materials

- 5.3 By Application

- 5.3.1 Optics and Optoelectronics

- 5.3.2 Aerospace and Defense

- 5.3.3 Mechanical and Chemical Processing

- 5.3.4 Healthcare and Dental

- 5.3.5 Consumer Electronics and Goods

- 5.3.6 Energy and Power

- 5.3.7 Others Applications

- 5.4 By Geography

- 5.4.1 Asia Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 Australia and New Zealand

- 5.4.1.6 ASEAN countries

- 5.4.1.7 Rest of Asia Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 NORDIC

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 UAE

- 5.4.5.3 South Africa

- 5.4.5.4 Egypyt

- 5.4.5.5 Nigeria

- 5.4.5.6 Rest of Middle East and Africa

- 5.4.1 Asia Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AGC Inc.

- 6.4.2 CeramTec GmbH

- 6.4.3 CILAS

- 6.4.4 CoorsTek Inc.

- 6.4.5 Deisenroth Engineering GmbH

- 6.4.6 Fraunhofer IKTS

- 6.4.7 General Electric

- 6.4.8 II-VI Optical Systems

- 6.4.9 Konoshima Chemical Co. Ltd

- 6.4.10 Kyocera Corporation

- 6.4.11 Meller Optics Inc

- 6.4.12 Murata Manufacturing

- 6.4.13 OptoCity Inc.

- 6.4.14 Philips Lighting Holdings

- 6.4.15 Raytheon Technologies (RTX)

- 6.4.16 Saint-Gobain Group

- 6.4.17 SCHOTT AG

- 6.4.18 Surmet Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Increasing Demand in the Medical Sector