|

市場調查報告書

商品編碼

1842569

汽車顯示器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Automotive Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

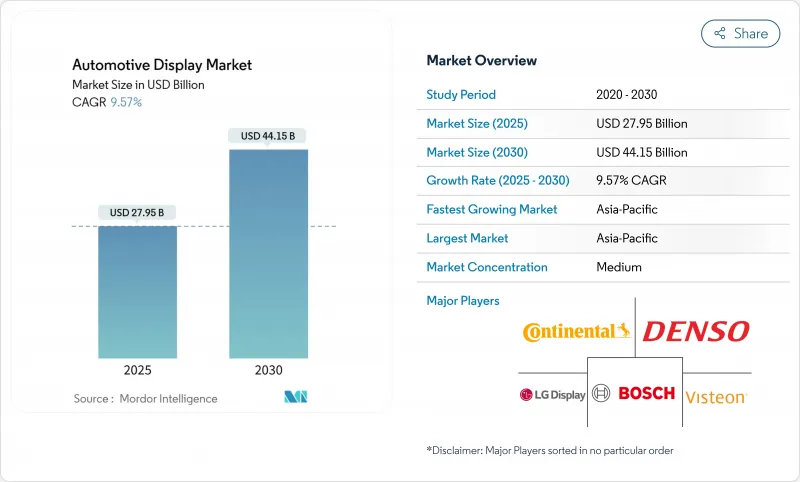

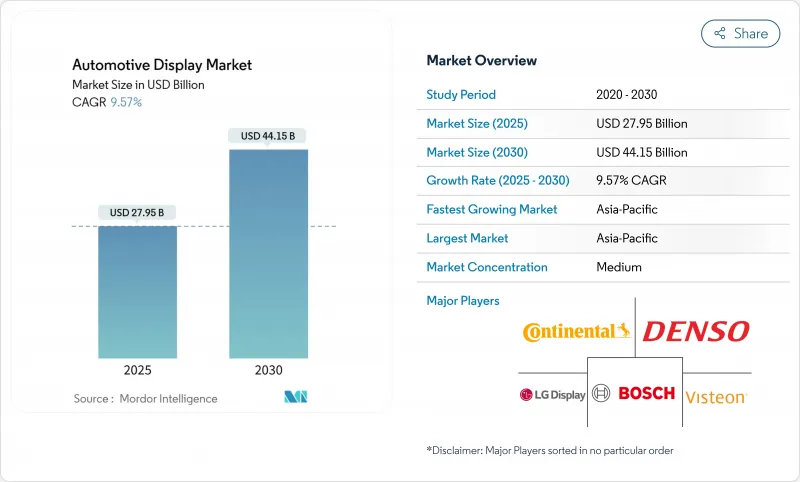

預計汽車顯示器市場規模到 2025 年將達到 279.5 億美元,到 2030 年將達到 441.5 億美元,在此期間的複合年成長率為 9.57%。

軟體定義汽車架構的擴展、身臨其境型資訊娛樂需求的不斷成長以及駕駛自動化水平的不斷提高,正在推動顯示器從簡單的資訊顯示逐漸成為人機介面 (HMI) 的核心資產。汽車製造商正在整合更多螢幕空間,以支援無線 (OTA) 功能的推出、遠端診斷和基於訂閱的內容。由於成熟的供應鏈,高亮度液晶顯示器 (LCD) 模組繼續在量產中佔據主導地位,而有機發光二極體(OLED) 和 mini-LED 替代品則專注於高階車型,以證明其較高的單位成本是合理的。

全球汽車顯示器市場趨勢與洞察

聯網汽車汽車和電動車的興起需要豐富的 HMI

電動車動力傳動系統和雲端互聯的車路基礎設施互聯的複雜性,要求圖形介面能夠顯示電池健康狀況、基於路線的續航里程預測以及Vehicle-to-Grid(V2G) 交易。現代汽車表示,買家對內建於中央顯示器的充電規劃工具表現出濃厚興趣,這凸顯了直覺的圖形介面與降低續航里程焦慮之間的關聯。

整合數位駕駛座需求激增

統一駕駛座平台將儀錶板、資訊娛樂和空調控制整合到一個共用作業系統中。哈曼基於 Linux 和 Android 的駕駛座套件可跨域傳輸內容,降低電子設備的複雜性,並為人工智慧主導的個人化創造空間。供應商應用數位雙胞胎建模來加速實體原型製作。佛吉亞基於模型的設計縮短了開發週期,並滿足了汽車製造商的上市時間目標。駕駛座內的無線 (OTA) 支援可解鎖售後功能,從而建立經常性收益模式。

玻璃和半導體供應不穩定

2024-2025年,高純度石英和傳統節點半導體經歷了間歇性供不應求,暴露了集中採購的脆弱性。颶風對一家大型石英工廠的破壞限制了玻璃基板的生產,而圍繞鎵和鍺的地緣政治緊張局勢加劇了顯示驅動積體電路的風險狀況。目前,第一線公司正在採取雙重採購和區域化庫存緩衝措施,以增強供應彈性。

細分分析

至2024年,主機中控台佔總收入的39.61%,凸顯其作為車輛指揮中心的角色。該細分市場具有可擴展螢幕大小、觸控優先互動和應用商店相容性等優勢,與汽車顯示器市場向軟體收益轉型的趨勢相契合。 HUD的安裝率將以10.14%的複合年成長率成長,這主要得益於安全法規的推出和消費者對一目了然的導航的需求。這兩條產品線的結合,展現了汽車顯示器市場如何支援分層使用者體驗策略。

網域控制器的日益普及將使叢集、HUD 和乘客螢幕之間的內容重新平衡成為可能。偉世通已獲得價值 26 億美元的駕駛座契約,合約有效期至 2024 年,其中許多合約將把多種顯示器類型捆綁到單一硬體和軟體堆疊中,從而簡化檢驗並縮短發佈時間。

2024年,LCD模組將佔出貨量的64.05%,這得益於成熟的晶圓廠、驅動IC價格的下降以及Mini LED增強技術的不斷湧現(這些技術可在不增加價格的情況下提升對比度)。大眾市場的儀錶板、數位儀錶板和車載顯示器將繼續依賴LCD可預測的成本藍圖,這確保了該技術在整個預測期內仍將是車載HMI的支柱。

OLED 是成長最快的技術,預計其複合年成長率將達到 10.42%,這得益於對高對比度曲面叢集、軟性中控台以及高階內裝價格的關注。三星顯示器的 Dolby Vision 認證面板目前峰值亮度超過 1,500 尼特,縮小了與 LCD 面板在日間可視度方面的差距,並為 OEM 升級提供了理由。 MicroLED 原型也正在湧現,但其商業性時間表將延長至 2030 年後,在此期間,LCD 和 OLED 仍將是主導技術選擇。

區域分析

亞太地區將繼續成為最大的汽車顯示器市場,到2024年將佔全球汽車顯示器市場收入的45.85%,到2030年的複合年成長率為11.77%。中國是該地區的主導地位。本土品牌正在將12英寸及更大的中控螢幕標準化,並受益於半導體、面板和整車組裝的一體化生態系統,從而縮短了開發週期並降低了成本。地方政府正在投資車路雲端基礎設施,以實現資料密集型駕駛座功能,避免延遲問題。

北美將繼續成為一個技術密集市場,汽車保有量低、單車配置高、收益可觀。 2024年,美國輕型汽車產量將達到1,646萬輛,HUD普及率將隨著L2+級駕駛輔助套件的推出而上升。矽谷軟體中心正在縮短OTA更新周期,並增強消費者對類似行動應用程式的駕駛座體驗的期望。

歐洲在優先考慮安全性和永續性的監管力度方面位居前三名。歐洲新車安全評鑑協會即將推出的分心指數和歐7排放氣體標準將加速電動車的普及,進而推動對可視化能源使用和駕駛監控數據的先進顯示器的需求。德國高階汽車在曲面OLED儀錶板和儀錶板寬玻璃層壓板方面處於領先地位,使該地區成為下一代駕駛座造型的重要影響者。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場促進因素

- 整合數位駕駛座需求激增

- 汽車高亮度液晶顯示器成本快速降低

- 原始設備製造商轉向更大的柱間螢幕

- 聯網汽車汽車和電動車的興起需要豐富的 HMI

- NCAP分心評分規則加速HUD安裝

- 軟體定義的汽車OTA UX更新周期

- 市場限制

- 汽車OLED價格昂貴

- 玻璃和半導體供應的波動

- 網路安全合規成本上升

- 大型軟性顯示器的可靠性問題

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模及成長預測

- 依產品類型

- 中控台顯示螢幕

- 儀錶群顯示幕

- 抬頭顯示器

- 後座娛樂顯示器

- 按下顯示技術

- LCD

- 有機發光二極體

- Mini LED/Micro LED

- 按車輛類型

- 搭乘用車

- 商用車

- 按顯示尺寸

- 小於5英寸

- 6到10英寸

- 10吋或以上

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 埃及

- 土耳其

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- LG Display Co., Ltd.

- Samsung Display Co., Ltd.

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Visteon Corporation

- Panasonic Holdings Corporation

- Nippon Seiki Co., Ltd.

- AUO Corporation

- Japan Display Inc.

- Sharp Corporation

- BOE Technology Group Co., Ltd.

- Hyundai Mobis Co., Ltd.

- Valeo SA

- Tianma Micro-electronics Co., Ltd.

第7章 市場機會與未來展望

The automotive display market size is valued at USD 27.95 billion in 2025 and is forecast to reach USD 44.15 billion in 2030, advancing at a 9.57% CAGR during the period.

Expanding software-defined vehicle architectures, stronger demand for immersive infotainment, and rising levels of driving automation push displays from simple information read-outs to core human-machine-interface (HMI) assets. Automakers are integrating more screen real estate to support over-the-air (OTA) feature rollouts, remote diagnostics, and subscription-based content. High-brightness liquid-crystal-display (LCD) modules continue to dominate volume production thanks to mature supply chains, while organic-light-emitting-diode (OLED) and Mini LED alternatives concentrate on premium trims to justify higher unit pricing.

Global Automotive Display Market Trends and Insights

Rise of connected & electric vehicles needing richer HMI

EV powertrain complexity and cloud-linked vehicle-road-infrastructure connectivity demand graphical interfaces that surface battery health, route-based range estimates, and V2G (vehicle-to-grid) transactions. Hyundai reports strong buyer interest in charge-planning tools embedded within its central display, highlighting the link between intuitive graphics and reduced range anxiety.

Soaring demand for integrated digital cockpits

Unified cockpit platforms consolidate instrument clusters, infotainment, and climate controls onto shared operating systems. HARMAN's Linux- and Android-based cockpit suite streams content across domains, lowering electronics complexity and creating room for AI-driven personalization . Suppliers apply digital-twin modelling to cut physical prototyping time; Faurecia's model-based design shrinks development cycles, aligning with automakers' software time-to-market targets. OTA support within the cockpit enables post-sale feature unlocks, cementing recurring-revenue models.

Glass & semiconductor supply volatility

High-purity quartz and legacy-node semiconductors experienced intermittent shortages in 2024-2025, exposing the fragility of concentrated sourcing. Hurricane damage to key quartz facilities constrained glass substrate output, while geopolitical tensions around gallium and germanium sharpened risk profiles for display driver integrated circuits. Tier-1s now dual-source and regionalize inventory buffers to harden supply resilience.

Other drivers and restraints analyzed in the detailed report include:

- Software-defined vehicle OTA UX refresh cycles

- NCAP distraction-score rules accelerating HUD fitment

- Premium pricing of automotive-grade OLEDs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Center-stack consoles held 39.61% of revenue in 2024, underlining their role as the vehicle's command center. The segment benefits from scalable screen sizes, touch-first interaction, and app-store compatibility that align with the automotive display market's shift to software monetization. HUD fitment is rising fastest at a 10.14% CAGR, buoyed by safety legislation and consumer demand for glance-free navigation cues. Combined, both product lines exemplify how the automotive display market supports tiered UX strategies-comprehensive control panels for deep interaction, and windshield projections for critical driver alerts.

Increasing domain-controller adoption allows content rebalancing between clusters, HUDs, and passenger screens. Visteon secured USD 2.6 billion in cockpit contracts during 2024, many bundling multiple display types into one hardware-software stack that simplifies validation and shortens launch timelines.

LCD modules captured 64.05% of shipments in 2024 thanks to long-established fabs, falling driver-IC pricing, and a growing slate of Mini LED enhancements that elevate contrast without premium pricing. Mass-market dashboards, digital clusters, and fleet displays continue to rely on LCD's predictable cost roadmap, ensuring the technology remains the backbone of automotive HMI for the forecast window.

OLED is the fastest-growing technology, projected to advance at a 10.42% CAGR by focusing on high-contrast curved clusters, flexible center stacks, and pillar-to-pillar treatments that command premium trim pricing. Samsung Display's Dolby Vision-certified panels now reach peaks above 1,500 nits, narrowing daytime-visibility gaps versus LCD and justifying OEM upgrades. MicroLED prototypes are also emerging, yet their commercial timeline extends past 2030, leaving LCD and OLED to define mainstream technology choice in the interim.

The Automotive Display Market Report is Segmented by Product Type (Center Stack Display, Instrument Cluster Display, and More), Display Technology (LCD, OLED, and More), Vehicle Type (Passenger Cars and Commercial Vehicles), Display Size (Less Than 5-Inch, 6 To 10 Inch, and More), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific remained the largest automotive display market, accounting for 45.85% of 2024 revenue and projected to grow at an 11.77% CAGR through 2030. China anchors the region's dominance; domestic brands install 12-inch or larger center screens as standard and benefit from integrated semiconductor, panel, and vehicle-assembly ecosystems that compress development cycles and lower cost. Local governments invest in vehicle-road-cloud infrastructure, enabling data-intensive cockpit functions without latency penalties.

North America follows as a technology-rich arena where high content per vehicle drives sizable revenue despite smaller unit totals. U.S. light-vehicle production reached 16.46 million units in 2024, and HUD penetration rose alongside Level-2+ driver-assistance packages. Silicon Valley software hubs shorten OTA update cycles and reinforce consumer expectations for mobile-app-like cockpit experiences.

Europe completes the top three with a regulatory push that prioritizes safety and sustainability. Euro NCAP's forthcoming distraction metrics and Euro 7 emissions limits accelerate electric-vehicle adoption and, by extension, demand for advanced displays that visualize energy usage and driver-monitor data. German premium marques lead in curved OLED clusters and dashboard-wide glass laminates, giving the region an outsized influence on next-generation cockpit styling.

- LG Display Co., Ltd.

- Samsung Display Co., Ltd.

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Visteon Corporation

- Panasonic Holdings Corporation

- Nippon Seiki Co., Ltd.

- AUO Corporation

- Japan Display Inc.

- Sharp Corporation

- BOE Technology Group Co., Ltd.

- Hyundai Mobis Co., Ltd.

- Valeo SA

- Tianma Micro-electronics Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Soaring demand for integrated digital cockpits

- 4.1.2 Rapid cost-down of high-brightness automotive LCDs

- 4.1.3 OEM push for larger pillar-to-pillar screens

- 4.1.4 Rise of connected & electric vehicles needing richer HMI

- 4.1.5 NCAP distraction-score rules accelerating HUD fitment

- 4.1.6 Software-defined vehicle OTA UX refresh cycles

- 4.2 Market Restraints

- 4.2.1 Premium pricing of automotive-grade OLEDs

- 4.2.2 Glass & semiconductor supply volatility

- 4.2.3 Rising cyber-security compliance costs

- 4.2.4 Reliability issues with large flexible displays

- 4.3 Value/Supply-Chain Analysis

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Product Type

- 5.1.1 Center Stack Display

- 5.1.2 Instrument Cluster Display

- 5.1.3 Head-Up Display

- 5.1.4 Rear-Seat Entertainment Display

- 5.2 By Display Technology

- 5.2.1 LCD

- 5.2.2 OLED

- 5.2.3 MiniLED / MicroLED

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 By Display Size

- 5.4.1 Less than equal to 5-inch

- 5.4.2 6 to 10 inch

- 5.4.3 Above 10 inch

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Egypt

- 5.5.5.4 Turkey

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 LG Display Co., Ltd.

- 6.4.2 Samsung Display Co., Ltd.

- 6.4.3 Robert Bosch GmbH

- 6.4.4 Continental AG

- 6.4.5 Denso Corporation

- 6.4.6 Visteon Corporation

- 6.4.7 Panasonic Holdings Corporation

- 6.4.8 Nippon Seiki Co., Ltd.

- 6.4.9 AUO Corporation

- 6.4.10 Japan Display Inc.

- 6.4.11 Sharp Corporation

- 6.4.12 BOE Technology Group Co., Ltd.

- 6.4.13 Hyundai Mobis Co., Ltd.

- 6.4.14 Valeo SA

- 6.4.15 Tianma Micro-electronics Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 Growing AR-HUD monetization potential

- 7.2 MicroLED roadmaps promise 30% power savings

- 7.3 Over-the-air subscription models for display-based features

- 7.4 China-centric cockpit-display supply chain localization

- 7.5 Aftermarket retrofit demand for Above 12-inch screens in developing markets