|

市場調查報告書

商品編碼

1836726

蝦青素:市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)Astaxanthin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

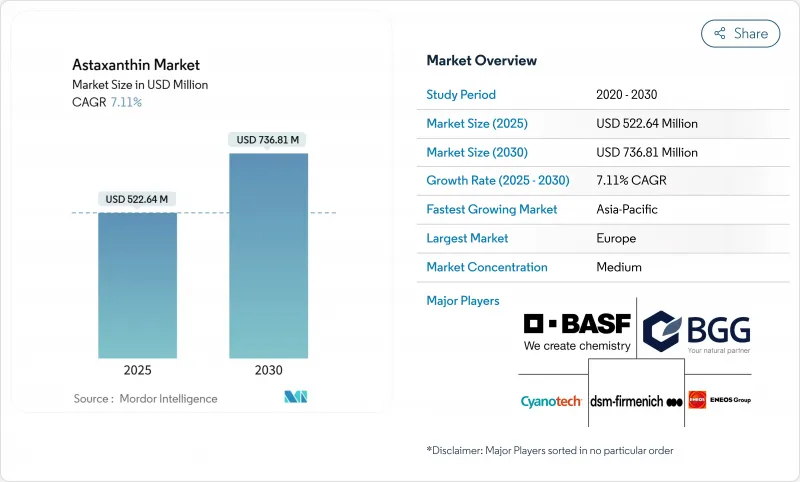

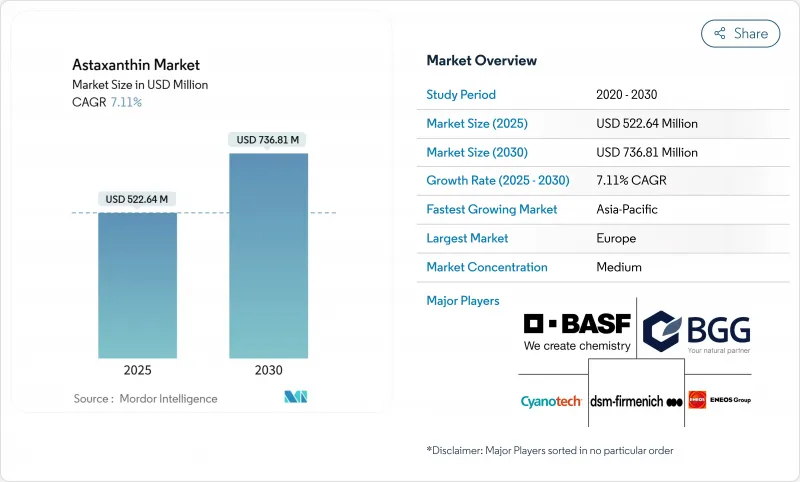

預計 2025 年蝦青素市場規模為 5.2264 億美元,到 2030 年將達到 7.3681 億美元,預測期內(2025-2030 年)的複合年成長率為 7.11%。

全球蝦青素市場正處於強勁的成長軌跡,這得益於其抗氧化、抗發炎和認知支持特性越來越多的臨床檢驗。隨著美國、歐洲和亞洲的監管機構繼續核准用於食品、補充劑和化妝品的新型蝦青素,需求正在穩步擴大。天然蝦青素主要來自微藻類,由於其卓越的生物利用度和清潔標籤的吸引力,正在推動新產品的推出,引起當今注重健康、精通成分的消費者的共鳴。雖然合成飼料仍然主導著對成本敏感的動物飼料領域,但技術創新正在穩步縮小成本差距。微藻類培養、人工智慧最佳化的光生物反應器系統和深共晶溶劑等綠色萃取技術的突破不僅降低了營運成本,也提高了永續性和擴充性。這些進步,加上消費者對天然和功能性成分的偏好變化,正在推動膳食補充劑、機能性食品和高階護膚的新收益來源。對於希望利用有前景的、有科學依據的健康成分的公司來說,蝦青素提供了一個由技術創新、消費者信任和監管勢頭支持的引人注目的成長故事。

全球蝦青素市場趨勢與見解

預防保健和抗衰老趨勢蓬勃發展

研究表明,經常攝取蝦青素與降低氧化壓力標記、改善內皮功能以及在精神疲勞評估中提高成年人的認知能力有關。市場顯示消費者越來越偏好預防性保健解決方案,各公司紛紛將天然蝦青素軟膠囊作為綜合保健產品進行行銷。這一定位得益於蝦青素比維生素 C 具有更出色的細胞膜穿透能力和中和單線態氧的能力。來自藥局和線上零售商的銷售數據表明,與傳統抗氧化劑相比,消費者願意為優質蝦青素產品支付更高的價格。化妝品行業也將蝦青素添加到旨在減輕光老化影響和促進膠原蛋白生成的局部產品中。不斷擴大的應用基礎將推動蝦青素市場持續的研究投資、法規發展和消費者的廣泛採用。

天然和植物來源補充劑日益流行

隨著天然成分需求的不斷成長,尤其是圍繞α-硫辛酸補充劑日益成長的安全擔憂,歐洲各地正在大力推動配方改良。蝦青素萃取自雨生紅球藻,是一種天然的非基因改造替代品,已在臨床試驗中展現出卓越的功效,與合成產品相比,其血漿濃度更高,保存期限更長。據新興國家進口促進中心 (CBI) 稱,天然成分在各種健康應用中越來越受歡迎,主要用於食品補充劑、草藥和替代醫學治療。這為蝦紅素等天然成分帶來了機會。

生產成本限制了天然蝦青素市場的成長

天然蝦青素的生產成本仍然很高,下游加工佔總生產成本的很大一部分,導致其價格高於合成替代品。從微藻類物質中提取和純化蝦青素需要複雜的製程、專用設備和受控環境。雖然技術進步正在降低生產成本,但價格差異仍然限制了天然蝦青素在成本敏感應用中的應用,尤其是在動物飼料市場。儘管對天然成分的需求不斷成長,合成蝦紅素仍保持著成本優勢。市場動態對平衡生產經濟效益與日益成長的消費者偏好提出了持續的挑戰,尤其影響了製造商在各個終端用途領域拓展業務和保持競爭性定價策略的能力。

報告中分析的其他促進因素和限制因素

- 藻類培養和萃取技術的進步提高了產品質量

- 消費者轉向潔淨標示、非基因改造成分

- 新興市場消費者意識的局限性

細分分析

到2024年,合成蝦蝦青素市場將佔據84.47%的市場佔有率,這得益於成熟的合成生產線,這些生產線能夠為水產養殖加工商提供穩定的成本和著色力。幾十年來,合成蝦紅素的生產過程基本上保持不變,為製造商提供了可靠的生產方法和標準化的產出品質。

天然萃取物領域,基於紅球藻和法夫酵母的生產方法,預計到2030年將以8.74%的複合年成長率成長,這主要得益於健康和美容產品製造商尋求天然成分認證。研究表明,天然萃取物具有高抗氧化活性、增強的組織保留性和高穩定性,非常適合用於高階營養保健品和護膚品。

2024年,粉劑型蝦青素市場營收佔比75.55%,這得益於其與現有的膠囊、錠劑和預混合料生產線的兼容性。粉劑型的保存期限為兩年,即使在海運過程中的溫度變化下也能保持穩定。預計到2030年,包括乳化和珠粒在內的液體型蝦紅素市場將以8.24%的複合年成長率成長,這得益於其冷水分散性的提高。目前,製造商生產的速溶小袋可在幾秒鐘內溶解在飲料中,使蝦青素能夠補充功能性美容飲品中的膠原蛋白和益生菌。

Soravia Algatec 開發了一種濃度為 2.5% 的冷水可分散蝦青素粉末,兼具粉末穩定性和液體應用能力。該配方使飲料製造商能夠將蝦青素添加到其產品中,並充分利用其功能特性和臨床益處。這項開發成果滿足了飲料業對天然抗氧化劑日益成長的需求,並拓展了製造商的應用可能性。粉末分散性得到改善,降低了生產複雜性和添加蝦青素的成本,並有望提升其在各個飲料領域的應用。

區域分析

歐洲擁有完善的法規結構,包括歐洲食品安全局(EFSA)的全面安全評估以及歐盟委員會對蝦青素成分的新型食品的核准,因此,歐洲將在2024年保持市場主導,市場佔有率達32.94%。該地區成熟的補充劑市場和消費者對優質天然保健產品的接受度為蝦青素的普及創造了有利條件,而嚴格的品質標準則推動了對高純度製劑的需求。受監管發展和不斷壯大的中產階級尋求預防性醫療保健解決方案的推動,亞太地區預計將成為成長最快的地區,複合年成長率達5.55%。

亞太地區加速成長軌跡的原因是人口結構和監管趨勢的融合有利於蝦青素的應用。中國監管體系的現代化,包括批准微藻類油作為新型食品成分,正在消除其在機能性食品中的應用障礙,同時,中國不斷壯大的中階也對高階健康產品的需求。日本的功能性食品標籤制度簡化了健康聲明的佐證程序,使製造商能夠更輕鬆地向消費者傳達蝦青素的益處,從而推動了市場的顯著成長。該地區人口老化正在對認知健康和抗衰老應用產生巨大的需求,而成熟的水產養殖業為蝦青素在多種應用領域的應用奠定了基礎。

北美市場成熟,儘管美國食品藥物管理局 (FDA)核准蝦青素製劑為一般公認安全認證 (GRAS),使其得以進入市場,但現有抗氧化成分的競爭限制了其成長。該地區對臨床檢驗的重視,有助於擴大蝦青素的研究證據。儘管天然蝦青素成本較高,但消費者對潔淨標示和永續成分的偏好將推動其需求。南美、中東和非洲代表著新興的市場潛力,隨著人們蝦青素健康益處的認知不斷提高,其在補充劑和水產養殖領域的應用也逐漸增加。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 預防醫學和抗衰老趨勢蓬勃發展

- 天然和植物來源補充劑日益流行

- 藻類培養和萃取技術的進步提高了生產質量

- 消費者轉向潔淨標示和非基因改造成分

- 關注永續和環境友好的營養

- 擴大具有健康功效的功能性食品和飲料

- 市場限制

- 生產成本限制

- 新興市場消費者意識有限

- 對食品污染的擔憂日益加劇

- 嚴格的政府法規限制了市場成長

- 供應鏈分析

- 監理展望

- 五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場規模及成長預測(金額)

- 按產地

- 自然的

- 合成

- 按形式

- 粉末

- 液體

- 按生產方式

- 微藻類培養

- 化學合成

- 發酵

- 按用途

- 飲食

- 營養補充品

- 動物飼料

- 個人護理和化妝品

- 製藥

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 英國

- 德國

- 西班牙

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市場排名分析

- 公司簡介

- BASF SE

- dsm-firmenich

- Fuji Chemical Industry/AstaReal

- Cyanotech Corporation

- Beijing Gingko Group(BGG)

- Algatech Ltd.

- Algalif Iceland ehf.

- Divi's Laboratories Ltd.

- ENEOS Holdings Inc.

- Biogenic Co. Ltd.

- Otsuka Holdings Co. Ltd.

- INNOBIO Ltd.

- Yunnan Alphy Biotech Co.

- NOW Health Group Inc.

- Archer-Daniels-Midland Company

- Givaudan Active Beauty

- Kemin Industries

- Evonik Nutrition & Care

- Valensa International

- Atacama Bio(Northeastern Biotech)

第7章 市場機會與未來展望

The Astaxanthin Market size is estimated at USD 522.64 million in 2025, and is expected to reach USD 736.81 million by 2030, at a CAGR of 7.11% during the forecast period (2025-2030).

The global astaxanthin market is witnessing a powerful growth trajectory, driven by increasing clinical validation of its antioxidant, anti-inflammatory, and cognitive-support properties. As regulatory bodies across the U.S., Europe, and Asia continue approving new astaxanthin formats for use in food, supplements, and cosmetics, demand is steadily expanding. Natural astaxanthin, sourced primarily from microalgae, is gaining traction in new product launches, thanks to its superior bioavailability and clean-label appeal, which resonates well with today's health-conscious and ingredient-savvy consumers. While synthetic variants continue to dominate the cost-sensitive animal feed segment, technological innovations are steadily bridging the cost gap. Breakthroughs in microalgae cultivation, AI-optimised photobioreactor systems, and green extraction technologies like deep eutectic solvents are not only reducing operational costs but also enhancing sustainability and scalability. These advances, combined with shifting consumer preferences toward natural, functional ingredients, are opening new revenue streams across dietary supplements, functional foods, and premium skincare. For businesses looking to tap into a high-potential, science-backed wellness ingredient, astaxanthin offers a compelling growth story anchored in innovation, consumer trust, and regulatory momentum.

Global Astaxanthin Market Trends and Insights

Booming Preventive Healthcare and Anti-Aging Trends

Research demonstrates that regular astaxanthin consumption correlates with reduced oxidative-stress markers, improved endothelial function, and enhanced cognitive performance in adults during mental-fatigue assessments. The market shows increasing consumer preference for preventive health solutions, with companies marketing natural astaxanthin softgels as comprehensive wellness products. This positioning is supported by astaxanthin's superior ability to cross cell membranes and neutralize singlet oxygen compared to vitamin C. Sales data from pharmacies and online retailers indicates consumers willingly pay more for premium astaxanthin products compared to conventional antioxidants. The cosmetics industry has also incorporated astaxanthin in topical products designed to reduce photo-aging effects and enhance collagen production. This expanding application base drives continued research investment, regulatory development, and broader consumer adoption in the astaxanthin market.

Growing Popularity of Natural and Plant-Based Supplements

The growing demand for natural ingredients has driven significant reformulation efforts across Europe, particularly following heightened safety concerns surrounding alpha-lipoic acid supplements. Astaxanthin extracted from Haematococcus pluvialis offers a natural, non-GMO alternative that demonstrates superior performance, with clinical studies showing higher plasma concentration and longer retention periods compared to synthetic versions. According to the CBI (Centre for the Promotion of Imports from developing countries), natural ingredients have become increasingly prevalent in various health applications, primarily in food supplements, herbal medicinal products, and alternative medicine treatments . This translates into opportunities for natural ingredients like astaxanthin

Production Costs Limit Natural Astaxanthin Market Growth

Natural astaxanthin production costs remain high, with downstream processing representing a significant majority of total production expenses, resulting in higher prices compared to synthetic alternatives. The extraction and purification of astaxanthin from microalgae biomass requires complex processes, specialized equipment, and controlled environments. Although technological improvements are reducing production costs, the price difference continues to restrict natural astaxanthin adoption in cost-sensitive applications, especially in animal feed markets where synthetic versions maintain their cost advantage despite increasing demand for natural ingredients. The market dynamics indicate a persistent challenge in balancing production economics with growing consumer preferences, particularly affecting manufacturers' ability to scale operations and maintain competitive pricing strategies in various end-use segments.

Other drivers and restraints analyzed in the detailed report include:

- Advancement in Algae Farming and Extraction Boosting Output Quality

- Consumer Shift Towards Clean-Label, Non-GMO Ingredients

- Limited Consumer Awareness in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Synthetic astaxanthin segment held a 84.47% market share in 2024, supported by established chemical synthesis production lines that supply aquaculture processors with consistent costs and color potency. The manufacturing process has remained largely unchanged for decades, providing manufacturers with reliable production methods and standardized output quality.

The natural segment, based on Haematococcus and Phaffia production methods, is expected to grow at a CAGR of 8.74% through 2030, driven by wellness and beauty product manufacturers seeking natural ingredient certifications. Research shows that natural extracts offer higher antioxidant activity, enhanced tissue retention, and greater stability, making them suitable for premium dietary supplements and skincare products.

Powder formats accounted for 75.55% revenue share of the Astaxanthin market in 2024, driven by their compatibility with existing capsule, tablet, and premix production lines. The powder form offers a two-year shelf life and maintains stability during maritime shipping temperature variations. The liquid segment, including nano-emulsions and beadlets, is projected to grow at an 8.24% CAGR through 2030, following improvements in cold-water dispersibility. Manufacturers now produce quick-dissolving sachets that integrate into beverages within seconds, enabling astaxanthin to complement collagen and probiotics in functional beauty drinks.

Solabia-Algatech developed a 2.5% cold-water-dispersible astaxanthin powder that combines powder stability with liquid application capabilities. This formulation enables beverage manufacturers to incorporate astaxanthin into their products, leveraging its functional properties and clinical benefits. The development addresses the growing demand for natural antioxidants in the beverage industry and expands the application possibilities for manufacturers. The improved dispersibility characteristics of the powder reduce production complexities and costs associated with astaxanthin incorporation, potentially increasing its adoption across various beverage segments.

The Astaxanthin Market Report is Segmented by Nature (Natural and Synthetic), Form (Powder and Liquid), Production Method (Microalgae Cultivation, Chemical Synthesis, and Fermentation), Application (Food and Beverage, Dietary Supplement, Animal Feed, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe maintains market leadership with 32.94% share in 2024, supported by established regulatory frameworks including EFSA's comprehensive safety assessments and the European Commission's novel food approvals for astaxanthin-rich ingredients. The region's mature supplement market and consumer acceptance of premium natural health products create favorable conditions for astaxanthin adoption, while stringent quality standards drive demand for high-purity formulations. Asia-Pacific emerges as the fastest-growing region at 5.55% CAGR, propelled by regulatory developments and expanding middle-class populations seeking preventive healthcare solutions.

Asia-Pacific's accelerated growth trajectory stems from converging demographic and regulatory trends that favor astaxanthin adoption. China's regulatory modernization, including the approval of microalgae oil as a new food material, removes barriers to functional food applications while the country's expanding middle class seeks premium health products. Japan's Foods with Function Claims system has simplified health claim substantiation, driving significant market growth as manufacturers can more easily communicate astaxanthin's benefits to consumers. The region's aging population creates substantial demand for cognitive health and anti-aging applications, while established aquaculture industries provide a foundation for astaxanthin adoption across multiple applications.

North America represents a mature market where FDA GRAS approvals for astaxanthin formulations enable market access, though competition from established antioxidant ingredients limits growth. The region's focus on clinical validation supports astaxanthin's expanding research evidence. Consumer preferences for clean-label and sustainable ingredients drive demand for natural astaxanthin, despite higher costs. South America, Middle East, and Africa show emerging market potential, with increasing awareness of astaxanthin's health benefits driving gradual adoption in supplements and aquaculture applications.

- BASF SE

- dsm-firmenich

- Fuji Chemical Industry / AstaReal

- Cyanotech Corporation

- Beijing Gingko Group (BGG)

- Algatech Ltd.

- Algalif Iceland ehf.

- Divi's Laboratories Ltd.

- ENEOS Holdings Inc.

- Biogenic Co. Ltd.

- Otsuka Holdings Co. Ltd.

- INNOBIO Ltd.

- Yunnan Alphy Biotech Co.

- NOW Health Group Inc.

- Archer-Daniels-Midland Company

- Givaudan Active Beauty

- Kemin Industries

- Evonik Nutrition & Care

- Valensa International

- Atacama Bio (Northeastern Biotech)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Booming in Preventive Heathcare and Ant-Aging Trends

- 4.2.2 Growing Popularity of Natural and Plant-Based Supplements

- 4.2.3 Advancement in Algae Farming and Extraction Boosting Output Quality

- 4.2.4 Consumer Shift Towards Clean-Label, Non-GMO Ingredients

- 4.2.5 Focus on Sustaniable and Eco-Friendly Nutritional Ingredients

- 4.2.6 Expansion of Functional Food and Beverage with Added Health Claims

- 4.3 Market Restraints

- 4.3.1 Production Costs Limit

- 4.3.2 Limited Consumer Awareness in Emerging Markets

- 4.3.3 Growing Concerns Over Food Adulteration

- 4.3.4 Stringent Government Regulation to Retrain the Market Growth

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE & GROWTH FORECASTS (VALUE)

- 5.1 By Nature

- 5.1.1 Natural

- 5.1.2 Synthetic

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Liquid

- 5.3 By Production Method

- 5.3.1 Microalgae Cultivation

- 5.3.2 Chemical Synthesis

- 5.3.3 Fermentation

- 5.4 By Application

- 5.4.1 Food and Beverage

- 5.4.2 Dietary Supplement

- 5.4.3 Animal Feed

- 5.4.4 Personal Care and Cosmetics

- 5.4.5 Pharmaceuticals

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 Spain

- 5.5.2.4 France

- 5.5.2.5 Italy

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 dsm-firmenich

- 6.4.3 Fuji Chemical Industry / AstaReal

- 6.4.4 Cyanotech Corporation

- 6.4.5 Beijing Gingko Group (BGG)

- 6.4.6 Algatech Ltd.

- 6.4.7 Algalif Iceland ehf.

- 6.4.8 Divi's Laboratories Ltd.

- 6.4.9 ENEOS Holdings Inc.

- 6.4.10 Biogenic Co. Ltd.

- 6.4.11 Otsuka Holdings Co. Ltd.

- 6.4.12 INNOBIO Ltd.

- 6.4.13 Yunnan Alphy Biotech Co.

- 6.4.14 NOW Health Group Inc.

- 6.4.15 Archer-Daniels-Midland Company

- 6.4.16 Givaudan Active Beauty

- 6.4.17 Kemin Industries

- 6.4.18 Evonik Nutrition & Care

- 6.4.19 Valensa International

- 6.4.20 Atacama Bio (Northeastern Biotech)