|

市場調查報告書

商品編碼

1836661

檸檬酸鉀:市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)Potassium Citrate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

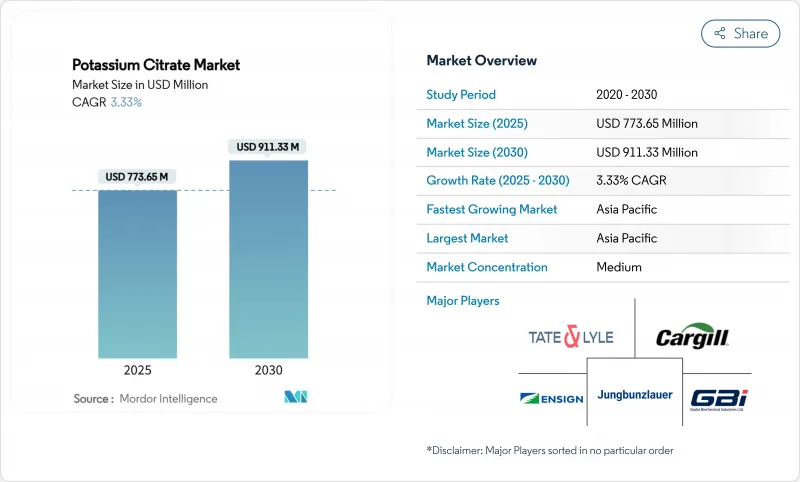

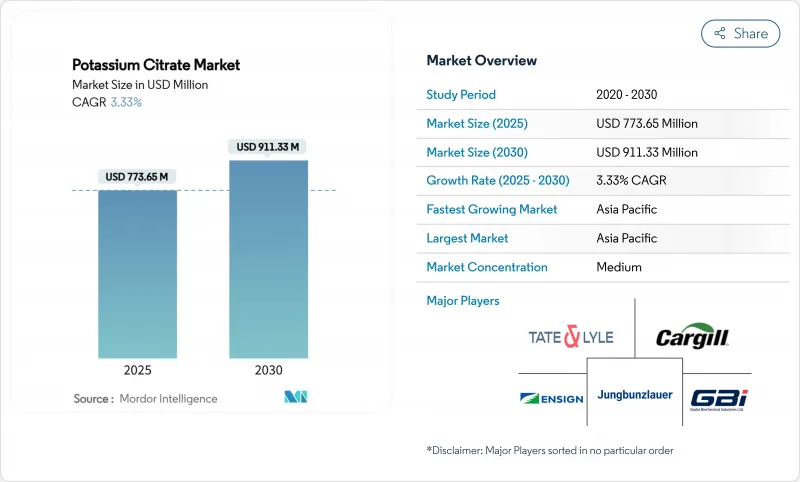

預計全球檸檬酸鉀市場規模在 2025 年將達到 7.7365 億美元,在 2030 年將達到 9.1133 億美元,預測期內複合年成長率為 3.33%。

這種緩慢但持續的成長軌跡反映了該化合物在多種高價值應用領域的強勢地位,從加工食品中的減鈉措施到用於腎臟健康管理的特殊藥物配方。檸檬酸鉀市場的韌性歸功於其獨特的雙重功能特性,即既可作為食品添加劑,又可作為活性藥物原料藥,這使其處於兩個強勁終端使用領域的交匯點,而這兩個領域始終優先考慮健康配方。監管勢頭強勁,尤其是美國食品藥物管理局 (FDA) 於 2024 年 8 月發布的第二階段減鈉指南,該指南旨在將平均鈉攝入量降至每天 2,750 毫克,這顯著增強了市場動態。食品加工商擴大替代鉀替代品取代鈉基添加劑,以滿足監管目標,同時保持產品功能性,這直接使檸檬酸鉀製造商受益。同時,飲料行業越來越重視 pH 調節劑以保持產品穩定性和偏好,這正在創造新的需求載體,尤其是在機能飲料飲料和運動飲料類別中,電解質平衡至關重要。

全球檸檬酸鉀市場趨勢與見解

檸檬酸鉀作為無鈉食品添加劑的使用量迅速增加

全球致力於減少食品系統中的鈉含量,這推動了檸檬酸鉀市場的成長。隨著監管機構提倡減少鈉的消費量,檸檬酸鉀成為可行的替代品。由於不含鈉,檸檬酸鉀可以取代傳統的鈉基添加劑,同時保持緩衝、乳化和礦物質強化等重要功能。這在加工食品中尤其重要,因為鈉鹽長期以來一直是加工食品的必需品。美國疾病管制與預防中心(2024 年 1 月)的數據突顯了這個問題:美國人平均每天攝取 3,400 毫克鈉,大大超過聯邦政府對青少年和成年人 2,300 毫克的建議。這種過量攝取導致了嚴重的健康問題。 2021 年 8 月至 2023 年 8 月期間,美國成年人高血壓發生率達 47.7%,男性為 50.8%,女性為 44.6%,並且隨著年齡的成長而增加。監管格局正在不斷演變,食品業明確推動減鈉措施,力爭在2026年前實現合規。這種迫切性推動了對檸檬酸鉀作為可靠鈉替代品的需求。檸檬酸鉀可輕鬆融入現有食品配方中,無需製造商進行複雜的調整,確保產品品質、貨架穩定性並符合健康標準。消費者健康意識的不斷提升、鈉與心血管風險之間密切的流行病學聯繫以及日益嚴格的鈉監管,正在推動檸檬酸鉀在各種食品應用中的廣泛應用。

潔淨標示和日益增強的健康意識

在消費者對潔淨標示和健康配方偏好不斷變化推動下,食品飲料產業正經歷重大變革時期,這對檸檬酸鉀市場產生了顯著影響。雖然檸檬酸鉀是工業合成的,但由於與天然檸檬酸的結合,消費者對此評價較高。深入的消費者研究表明,消費者對天然營養成分的偏好日益成長。這一趨勢在歐洲天然食品添加劑市場尤為明顯,該市場的法律規範越來越傾向於天然衍生或天然加工的成分。製造商正在巧妙地重新定位檸檬酸鉀,強調其與傳統食品保鮮的關聯以及其作為鉀來源的作用,而鉀對心血管健康和電解質平衡至關重要。國際食品資訊委員會2023年的一項調查突顯了這一趨勢,該調查發現,約26%的美國受訪者認為「天然和低鈉」是健康食品的主要指標,這證實了消費者對簡單天然配方的需求日益成長。

遵守製藥和食品行業的嚴格規定

檸檬酸鉀在醫藥領域的應用面臨日益複雜的監管要求,這延長了開發週期,並增加了製造商的合規成本。美國食品藥物管理局 (FDA) 對藥用級檸檬酸鉀的藥品主文件 (Drug Master File) 要求,必須對生產流程、雜質概況和穩定性數據進行全面的記錄,這為尋求進入高價值醫藥市場的小型供應商設置了障礙。美國藥典 (USP) 專論規定了嚴格的純度標準,要求藥品純度達到 99.5% 以上,這需要複雜的生產流程和品管系統,從而增加了生產成本。雖然國際協調的努力從長遠來看是有益的,但在短期內也會造成合規的複雜性,因為製造商必須應對各主要市場的不同要求。特別是,檸檬酸鉀與其他活性成分相互作用的組合藥物面臨著日益嚴格的監管環境,需要廣泛的穩定性和相容性測試。雖然這些合規要求有利於擁有現有監管基礎設施的製藥商,但它們也設置了市場准入壁壘,並限制了高階市場的競爭力。

報告中分析的其他促進因素和限制因素

- 化妝品和個人護理配方中螯合劑的激增

- 純素和植物性補充劑解決方案日益流行

- 食物口味的改變限制了更廣泛的接受度

細分分析

2024年,純度達到或超過99%的高純度檸檬酸鉀市場佔了42.44%的市佔率。這一趨勢凸顯了市場對超純配方日益成長的需求,尤其是在高階製藥和利基食品領域。嚴格的監管標準和對配方精度的極致重視是推動需求激增的關鍵因素。在製藥等領域,即使是微量雜質也會影響安全性和療效,因此純度至關重要。檸檬酸鉀兼具活性成分和緩衝劑的雙重作用,尤其是在腎臟治療和緩釋性藥物領域。該領域的主導地位凸顯了業界對純度和嚴格品質標準的堅定承諾。同時,98-99%純度等級在食品加工和部分工業應用中佔據利基地位,這些應用注重產品的功能性能,但對超高純度並非必需。

同時,純度低於 98% 的細分市場正經歷最快的成長,複合年成長率高達 4.64%。這一成長軌跡是由大規模生產應用的吸引力所驅動的,這些應用優先考慮成本效益和一致的操作,而不是絕對純度。關鍵促進因素包括動物營養、散裝食品生產和不同行業 pH 值調節用途的快速成長。為此,製造商正在轉向提供低成本的檸檬酸鉀配方,以滿足基本功能需求,同時避免與超純化配方相關的溢價。這種純度偏好的差異顯示市場格局日趨成熟。檸檬酸鉀正在從一種商品演變為滿足不同最終用戶需求的客製化解決方案。這種演變不僅刺激了創新,也提高了供應鏈的適應性和競爭力,涵蓋高階和低階市場。

區域分析

亞太地區不僅在 2024 年以 31.32% 的佔有率成為最大的區域市場,而且還表現出快速成長,預計到 2030 年的複合年成長率為 5.44%。這一成長主要得益於該地區不斷擴大的食品加工基礎設施和城鎮居民日益增強的健康意識。正在進行的貿易調查和反傾銷複審凸顯了中國在檸檬酸鹽生產方面的主導地位。印度快速發展的製藥業正在推動對高純度檸檬酸鉀的需求,這對於學名藥的生產至關重要。同時,印度不斷擴大的加工食品產業為食品級應用提供了重要的生產機會。同時,日本和澳洲正透過專注於機能性食品和營養保健品等高階應用來推動該地區的成長。

北美市場日趨成熟,但也不斷發展,這主要得益於重塑需求的監管措施。美國食品藥物管理局(FDA)關於減鈉的指導刺激了對檸檬酸鉀作為鈉替代品的持續需求。同時,北美先進的製藥業確保了對用於特殊治療用途的高純度產品的穩定需求。值得注意的是,加拿大與中國共同參與貿易調查,使該地區的供應鏈相互關聯,形成了影響價格和產品供應的競爭動態。此外,墨西哥的食品加工產業蓬勃發展,刺激了需求,尤其是來自注重健康的消費者的需求,他們尋求在傳統食品中添加低鈉產品。

歐洲處於潔淨標示和天然成分潮流的前沿,檸檬酸鉀正成為合成添加劑的熱門天然替代品。歐盟對天然防腐劑的監管重視,正在提升檸檬酸鉀的市場價值,尤其是在有機食品和高級食品領域。此外,歐洲成熟的化妝品行業擴大在個人保健產品中使用檸檬酸鉀作為乙二胺四乙酸 (EDTA) 的替代品。永續性是關鍵關注點。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 檸檬酸鉀作為無鈉食品添加劑的使用量迅速增加

- 人們越來越偏好選擇潔淨標示、注重健康的成分

- 化妝品和個人護理配方中螯合劑的激增

- 純素和植物來源補充劑解決方案日益流行

- 人們對食品安全中天然防腐劑的興趣日益濃厚

- 飲料業對pH調節劑的需求不斷增加

- 市場限制

- 嚴格遵守製藥和食品業的法規

- 食物口味的改變限制了更廣泛的接受度

- 長期使用過程中的儲存與穩定性問題

- 消費者對聽起來像化學的添加物持懷疑態度

- 供應鏈分析

- 監理展望

- 五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場規模及成長預測(金額)

- 按純度

- 低於98%

- 98-99%

- 超過99%

- 按用途

- 飲食

- 工業的

- 營養補充品

- 個人護理和化妝品

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 荷蘭

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 新加坡

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市場排名分析

- 公司簡介

- Cargill, Incorporated

- Tate & Lyle PLC

- Archer Daniels Midland(ADM)

- Jungbunzlauer Suisse AG

- Gadot Biochemical Industries

- Cofco Biochemical

- Huangshi Xinghua Biochemical

- Biofuran Materials

- American Tartaric Products

- Juxian Hongde Citric Acid

- Wang Pharmaceuticals & Chemicals

- Vishal Laboratories

- DPL-US

- Weifang Ensign Industry

- Spectrum Chemical Mfg Corp.

- Adani Pharmachem Private Limited

- Merck KGaA

- Dr. Paul Lohmann

- FBC Industries

- Ava Chemicals Private Limited,

第7章 市場機會與未來展望

The global potassium citrate market stands at USD 773.65 million in 2025 and is projected to reach USD 911.33 million by 2030, expanding at a CAGR of 3.33% during the forecast period.

This moderate yet consistent growth trajectory reflects the compound's entrenched position across multiple high-value applications, from sodium reduction initiatives in processed foods to specialized pharmaceutical formulations for renal health management. The market's resilience stems from potassium citrate's unique dual functionality as both a food additive and active pharmaceutical ingredient, positioning it at the intersection of two robust end-use sectors that continue to prioritize health-conscious formulations. Regulatory momentum significantly amplifies market dynamics, particularly through the FDA's Phase II sodium reduction guidance issued in August 2024, which targets average sodium intake reduction to 2,750 mg per day. This initiative directly benefits potassium citrate manufacturers, as food processors increasingly substitute sodium-based additives with potassium alternatives to meet regulatory targets while maintaining product functionality. Simultaneously, the beverage sector's growing emphasis on pH control agents for product stability and taste enhancement creates additional demand vectors, particularly in functional and sports drink categories where electrolyte balance remains paramount.

Global Potassium Citrate Market Trends and Insights

Surging Use of Potassium Citrate as a Sodium-Free Food Additive

Global efforts to reduce sodium in food systems are propelling the growth of the potassium citrate market. With regulatory bodies advocating for reduced sodium consumption, potassium citrate stands out as a viable substitute. Being sodium-free, it can replace conventional sodium-based additives, preserving crucial functions like buffering, emulsification, and mineral fortification. This is especially vital in processed foods, where sodium salts have long been essential. Data from the Centers for Disease Control and Prevention (January 2024) highlights the issue: Americans average 3,400 milligrams of sodium daily, well above the federal recommendation of 2,300 milligrams for teens and adults. This overconsumption is linked to serious health concerns. From August 2021 to August 2023, adult hypertension in the U.S. hit 47.7%, with men at 50.8% and women at 44.6%, and rates climbing with age . The regulatory landscape is shifting, with a clear push for sodium-reduction measures in the industry, aiming for compliance by 2026. This urgency boosts the demand for potassium citrate as a reliable sodium alternative. Potassium citrate can be easily incorporated into current food formulations, sparing manufacturers from intricate adjustments. This ensures product quality and shelf stability while adhering to health standards. Heightened consumer health awareness, solid epidemiological links between sodium and cardiovascular risks, and tightening regulatory sodium limits fuel the growing adoption of potassium citrate in various food applications.

Increasing Preference for Clean-Label and Health-Focused Ingredients

Driven by evolving consumer preferences for clean-label and health-centric formulations, the food and beverage industry is undergoing a significant transformation, with notable repercussions for the potassium citrate market. While potassium citrate is industrially synthesized, it enjoys a favorable consumer perception, largely due to its association with naturally occurring citric acid. In-depth consumer studies reveal a growing inclination towards ingredients perceived as natural or those that offer pronounced nutritional advantages. This trend is particularly evident in the European natural food additives market, where regulatory frameworks are increasingly endorsing ingredients sourced from natural origins or processes . Manufacturers have adeptly repositioned potassium citrate, emphasizing its ties to traditional food preservation and its role as a potassium source, vital for cardiovascular health and electrolyte balance. Highlighting this trend, the International Food Information Council's 2023 research found that about 26% of U.S. respondents view "natural and low-sodium" as the foremost indicator of healthy food . This underscores a rising consumer demand for straightforward, natural formulations.

Stringent Regulatory Compliance in Pharmaceutical and Food Sector

Pharmaceutical applications of potassium citrate face increasingly complex regulatory requirements that extend development timelines and increase compliance costs for manufacturers. The FDA's drug master file requirements for pharmaceutical-grade potassium citrate demand extensive documentation of manufacturing processes, impurity profiles, and stability data, creating barriers for smaller suppliers seeking to enter high-value pharmaceutical markets. USP monograph requirements specify stringent purity standards exceeding 99.5% for pharmaceutical applications, necessitating sophisticated manufacturing processes and quality control systems that increase production costs. International harmonization efforts, while beneficial long term, create short-term compliance complexity as manufacturers must navigate varying requirements across major markets. The regulatory landscape becomes particularly challenging for combination products where potassium citrate interacts with other active ingredients, requiring extensive stability and compatibility testing. These compliance requirements favor established pharmaceutical suppliers with existing regulatory infrastructure while creating market entry barriers that limit competitive intensity in premium segments.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Cosmetic and Personal Care Formulations Using Chelating Agents

- Rising Popularity of Vegan and Plant-Based Supplementation Solution

- Taste Alteration in Food Limiting Wider Acceptance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, the high-purity potassium citrate segment, boasting purity levels more than 99%, commanded a dominant 42.44% market share. This trend highlights a growing appetite for ultra-refined formulations, particularly in premium pharmaceuticals and niche food applications. Stringent regulatory standards and the paramount importance of formulation precision primarily drive the surge in demand. In sectors like pharmaceuticals, where even minute impurities can jeopardize safety or therapeutic outcomes, this emphasis on purity is critical. Potassium citrate, in these settings, plays dual roles: as an active ingredient and a buffering agent, notably in renal health treatments and extended-release drugs. The segment's dominance underscores the industry's unwavering commitment to purity and stringent quality benchmarks. Meanwhile, the 98-99% purity tier finds its niche in food processing and select industrial applications, where functional performance is key, but ultra-high purity isn't a prerequisite.

Meanwhile, the segment with purity levels below 98% is witnessing the most rapid expansion, boasting a notable CAGR of 4.64%. Its growth trajectory is fueled by its attractiveness in high-volume applications that prioritize cost-effectiveness and consistent operations over absolute purity. Key drivers include its burgeoning use in animal nutrition, bulk food production, and pH regulation across diverse sectors. In response, manufacturers are pivoting, rolling out more budget-friendly potassium citrate formulations that fulfill essential functional needs, sidestepping the premium of ultra-refinement. This divergence in purity preferences paints a picture of a maturing market landscape. Potassium citrate has evolved from a generic commodity to a tailored solution, catering to varied end-user demands. Such an evolution not only sparks innovation but also enhances supply chain adaptability and competitive edge, spanning both premium and budget-conscious market segments.

The Potassium Citrate Market is Segmented by Purity (Less Than 98%, 98 - 99%, and More Than 99%), by Application (Food and Beverage, Industrial, Dietary Supplement, Personal Care and Cosmetics, and Others), and by Geography (North America, Europe, Asia-Pacific, South America, and the Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, Asia-Pacific not only emerged as the largest regional market, holding a 31.32% share, but also showcased its rapid growth, boasting a 5.44% CAGR projected through 2030. This growth is largely attributed to the region's expanding food processing infrastructure and a heightened health consciousness among its urban populace. Ongoing trade investigations and antidumping reviews underscore China's leading role in citrate production. In India, the burgeoning pharmaceutical sector fuels the demand for high-purity potassium citrate, essential for generic drug manufacturing. Simultaneously, India's expanding processed food industry presents significant volume opportunities for food-grade applications. Meanwhile, Japan and Australia are driving regional growth by focusing on premium applications in functional foods and dietary supplements, with consumers willing to pay a premium for perceived health benefits.

North America, while mature, is undergoing an evolution, largely driven by regulatory initiatives reshaping demand. The FDA's guidance on sodium reduction has spurred a consistent demand for potassium citrate as a sodium substitute. Concurrently, North America's advanced pharmaceutical sector ensures a steady appetite for high-purity grades tailored for specialized therapeutic uses. Notably, Canada's involvement in trade investigations, alongside China, underscores the region's intertwined supply chains and the resultant competitive dynamics influencing pricing and product availability. Additionally, Mexico's burgeoning food processing sector amplifies the demand, especially for health-conscious consumers seeking reduced-sodium options in traditional foods.

Europe stands at the forefront of clean-label and natural ingredient trends, with potassium citrate gaining traction as a natural substitute for synthetic additives. The EU's regulatory stance, which leans towards natural preservatives, has elevated potassium citrate's market value, especially in organic and premium food sectors. Furthermore, Europe's sophisticated cosmetic industry is increasingly turning to potassium citrate as a preferred alternative to EDTA in personal care products. With a pronounced emphasis on sustainability,

- Cargill, Incorporated

- Tate & Lyle PLC

- Archer Daniels Midland (ADM)

- Jungbunzlauer Suisse AG

- Gadot Biochemical Industries

- Cofco Biochemical

- Huangshi Xinghua Biochemical

- Biofuran Materials

- American Tartaric Products

- Juxian Hongde Citric Acid

- Wang Pharmaceuticals & Chemicals

- Vishal Laboratories

- DPL-US

- Weifang Ensign Industry

- Spectrum Chemical Mfg Corp.

- Adani Pharmachem Private Limited

- Merck KGaA

- Dr. Paul Lohmann

- FBC Industries

- Ava Chemicals Private Limited,

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Use of Potassium Citrate as a Sodium-Free Food Additive

- 4.2.2 Increasing Preference for Clean-Label and Health-Focused Ingredients

- 4.2.3 Surge in Cosmetic and Personal Care Formulations Using Chelating Agents

- 4.2.4 Rising Popularity of Vegan and Plant-Based Supplementation Solution

- 4.2.5 Growing Awarness of Natural Preservatives in Food Safety

- 4.2.6 Amplyfing Demand from the Beverage Sector for pH Control Agents

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Compliance in Pharmaceutical and Food Sector

- 4.3.2 Taste Alteration in Food Limiting Wider Acceptance

- 4.3.3 Storage and Stability Challenges During Long-Tem Use

- 4.3.4 Consumer Skepticism Towards Chemical-Sounding Additives

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Purity

- 5.1.1 Less than 98%

- 5.1.2 98 - 99%

- 5.1.3 More than 99%

- 5.2 By Application

- 5.2.1 Food and Beverage

- 5.2.2 Industrial

- 5.2.3 Dietary Supplement

- 5.2.4 Personal Care and Cosmetics

- 5.2.5 Others

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 Netherlands

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Singapore

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Saudi Arabia

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Cargill, Incorporated

- 6.4.2 Tate & Lyle PLC

- 6.4.3 Archer Daniels Midland (ADM)

- 6.4.4 Jungbunzlauer Suisse AG

- 6.4.5 Gadot Biochemical Industries

- 6.4.6 Cofco Biochemical

- 6.4.7 Huangshi Xinghua Biochemical

- 6.4.8 Biofuran Materials

- 6.4.9 American Tartaric Products

- 6.4.10 Juxian Hongde Citric Acid

- 6.4.11 Wang Pharmaceuticals & Chemicals

- 6.4.12 Vishal Laboratories

- 6.4.13 DPL-US

- 6.4.14 Weifang Ensign Industry

- 6.4.15 Spectrum Chemical Mfg Corp.

- 6.4.16 Adani Pharmachem Private Limited

- 6.4.17 Merck KGaA

- 6.4.18 Dr. Paul Lohmann

- 6.4.19 FBC Industries

- 6.4.20 Ava Chemicals Private Limited,