|

市場調查報告書

商品編碼

1836614

非公路用車輛引擎:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Off Highway Vehicle Engine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

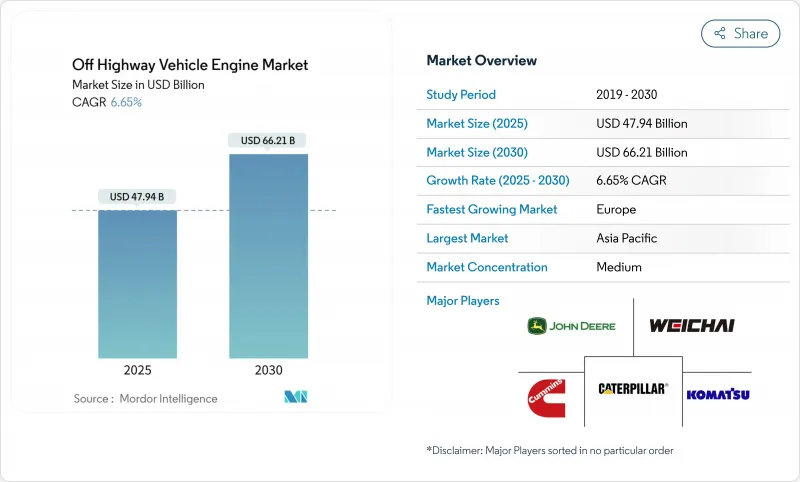

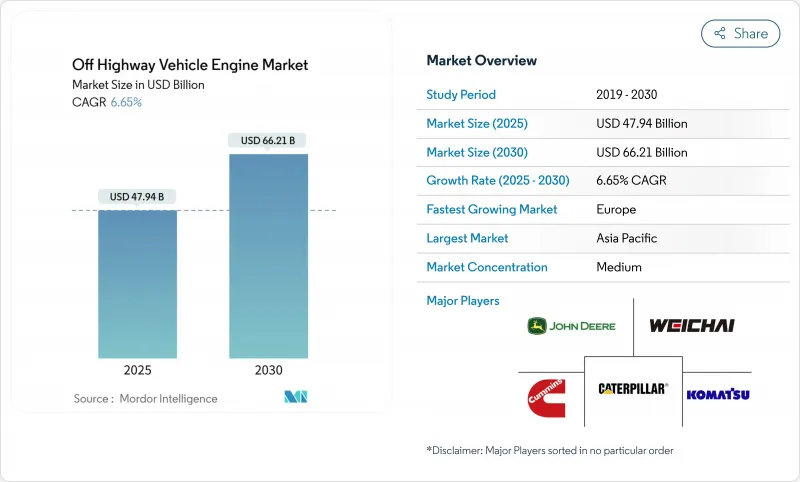

非公路用車輛引擎市場規模預計在 2025 年達到 479.4 億美元,預計到 2030 年將達到 662.1 億美元,預測期內(2025-2030 年)的複合年成長率為 6.65%。

基礎設施支出的增加、排放法規的日益嚴格以及農業、採礦和物料輸送應用領域機械化程度的提高,正在重塑引擎需求。雖然成長仍然集中在柴油技術上,但得益於遠端資訊處理、預測性維護以及與氫化植物油和可再生柴油的兼容性的快速發展,混合動力電動和燃料無關平台正在擴大其影響力。

全球非公路用車輛引擎市場趨勢與洞察

龐大的全球基礎設施管道(G7和BRI)

1.2兆美元的《基礎設施投資與就業法案》推動美國中西部各州施工機械年銷售額成長10%。中國「一帶一路」計劃下的平行投資正在刺激非洲、東南亞和東歐地區對大型挖土機和推土機的需求。中國出口商預計,2023年施工機械的海外出貨量將首次超過國內銷售量,進而重新平衡全球供應鏈,並增強非公路用車引擎市場。多年的融資資源使製造商能夠安心地擴大產能並改善混合動力相容設計。

亞太和非洲農業機械化進展

到2024年,曳引機在南亞農場的普及率將達到74%,水泵和脫粒機的普及率將超過65%。印度和中國農村工資的上漲正推動農場轉向資本密集模式,從而在30至120馬力的範圍內產生穩定的更換需求。撒哈拉以南非洲地區的機械化程度仍落後於南美洲,這意味著該地區擁有大量可在惡劣田間條件下可靠運作的小型、省油的引擎。服務型經營模式使小農戶無需擁有機械即可使用,從而擴大了引擎供應商的市場覆蓋範圍,並進一步支持了非公路用車輛引擎市場。

加速小型機械電氣化

到2024年,電動輪式裝載機將佔中國市場銷量的10%,全球電動施工機械銷售量將達到6,000至7,000台。多家中國原始設備製造商正在向100馬力以下的傳統引擎供應商施壓,力求成本平價。歐洲都市區的柴油限購政策正在加速電池在室內拆除和廢棄物作業中的應用。然而,由於柴油的能量密度高且需要快速加油,遠距採礦、林業和24小時運作作業仍依賴柴油,這仍然非公路用車引擎市場的核心需求。

報告中分析的其他促進因素和限制因素

- 更嚴格的 Stage V/Tier 5 標準引發預購與改裝週期

- 原始設備製造商轉向混合動力模組化引擎平台

- 後處理成本上升與價格敏感的買家

細分分析

2024年,施工機械將佔非公路用車引擎市場收入的58.36%,這得益於政府針對道路、橋樑和運輸系統的獎勵策略。亞太地區的計劃和美國資金的激增,正在支撐對依賴121-400馬力缸體的挖土機、推土機和裝載機的需求。隨著銅、鋰和鎳計劃的擴張以適應電池供應鏈,採礦設備正在復甦。林業和物料輸送細分市場青睞約翰迪爾PowerTech™ PSS 9.0 L等引擎,該引擎在陡峭的地形中可提供高達330馬力的動力。電動小型裝載機的複合年成長率將達到6.27%,這表明在工作週期可預測且充電設施齊全的地區,早期電氣化取得了成功。然而,大馬力柴油機對於24小時不間斷的運作鏟車和地下運輸仍然至關重要,這維持了非公路用車輛引擎市場的穩定。

歐洲輕型工程車輛正在採用遠端資訊處理技術來減少怠速時間,從而降低12%的消費量並延長大修間隔。亞洲租賃業者青睞模組化引擎,以便於維護,在繁忙的都市區上減少停機時間。非洲的「一帶一路」計劃正在推動對90-200千瓦中階引擎的需求,這些引擎兼具燃油效率和耐用性。拉丁美洲礦業巨頭要求採用符合歐盟第五階段標準的動力傳動系統,以因應當地法規的收緊。這些動態共同推動施工機械保持其領先地位,並推動採礦設備逐步獲得非公路用車輛引擎的市場佔有率。

2024年,31-70馬力的引擎將佔據非公路用車輛引擎市場佔有率的64.51%,到2030年的複合年成長率將達到7.02%。城市人口密集化需要高機動性的機器,這些機器能夠適應狹窄的道路,並減少對已完工路面的附帶損害。原始設備製造商正在整合啟停功能和先進的燃油圖,並聲稱其油耗降低了兩位數,這對車隊經理來說很有吸引力。遠端資訊處理平台可以查看怠速時間,並允許無線參數微調,以滿足當地的噪音和排放法規,而無需前往經銷商。

採礦卡車和大型挖土機(Caterpillar的 3512B-EUI(1,450 匹馬力)仍然是該領域的標竿)使用 400 匹馬力以上的高功率引擎。儘管產量低,但這些引擎價格昂貴,售後零件市場收入也很高。相反,30 馬力以下的平台受電氣化影響最大,因為現在電池組可以在草坪護理、高爾夫球場和小型市政營運中提供全班性能。因此,研發支出正轉向支援非公路用車輛引擎市場的中階產品,而高馬力的 Prestige 系列則得以保留。

區域分析

受大型基礎建設項目和農業機械化加速推動,2024年亞太地區銷售額將維持38.17%的成長率。 2023年,中國施工機械出口量超過國內銷量,緩解了國內市場的疲軟,並為長沙和徐州生產的引擎創造了全球銷售管道。在印度,政府補貼將提高曳引機的可負擔性,儘管季風波動較大,但2025年的零售量仍將增加。需求將偏向31-120馬力的引擎,適用於擁擠的都市區工地和小塊農田。區域原始設備製造商青睞獲得Tier 3和Stage V認證的模組化引擎,使其無需重新設計即可出口到非洲和歐洲,從而增強了非公路用車引擎市場的擴充性。

歐洲的複合年成長率高達 7.19%,受益於第五階段排放標準合規投資以及《綠色協議》對鐵路、可再生能源和循環經濟設施的關注。客戶優先考慮具有被動再生功能的顆粒過濾器和整合碳計量板的遠端資訊處理系統。日本小松公司的第五階段產品組合已證明具有更長的免維護期,這對於面臨嚴格運轉率目標的租賃公司來說是一個極具吸引力的提案。歐洲各市政當局也試用氫燃料內燃機垃圾車,供應商也支持替代燃料的研發。

北美正在利用《基礎設施投資與就業法案》來支持州際公路維修、橋樑更換和港口疏浚等項目對引擎的持續需求。加州即將推出的Tier 5排放法規將設定全球最嚴格的標準,促使原始設備製造商在實施數年後測試下一代SCR和氨感測器。南美、中東和非洲是高成長但成本敏感的地區。貨幣逆風和資金籌措缺口將限制短期內引擎的採用,但隨著大宗商品週期改善以及多邊金融機構對依賴從亞洲進口的可靠中馬力引擎和在巴西翻新的引擎的道路、發電廠和灌溉項目的支持,引擎仍有上漲空間。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 龐大的全球基礎設施管道(G7和「一帶一路」計劃)

- 亞太和非洲農業機械化進展

- 更嚴格的 Stage V/Tier 5 標準活性化預購和改裝週期

- 原始設備製造商轉向模組化混合動力引擎平台

- 遠端資訊主導驅動的預測性維護縮短了更換週期

- HVO/可再生柴油相容性擴大了內燃機的相關性

- 市場限制

- 加速小型設備電氣化

- 後處理成本上升以及來自價格敏感型買家的競爭

- 大宗商品價格波動對引擎淨利率帶來壓力

- 租賃車隊的檢修間隔延長

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭的激烈程度

第5章市場規模與成長預測:價值(美元)

- 按車輛類型

- 農業機械

- 施工機械

- 礦山機械

- 林業和物料輸送設備

- 按輸出功率(HP)

- 30 HP 或更少

- 31-70 HP

- 71-120 HP

- 121-400 HP

- 超過400馬力

- 按燃料類型

- 柴油引擎

- 汽油

- 天然氣/沼氣

- 混合動力/電動/燃料電池

- 按引擎排氣量(L)

- 2L以下

- 2.1~3.5 L

- 3.6~7 L

- 7公升或更多

- 依推進技術

- 傳統內燃機

- 混合

- 電池電動

- 燃料電池電力

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- 土耳其

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 市佔率分析

- 公司簡介

- AGCO Corporation

- Caterpillar Inc.

- Cummins Inc.

- Deere & Company

- Deutz AG

- Komatsu Ltd

- Mahindra Powertrain

- Scania AB

- Volvo Penta

- Yanmar Co.

- Weichai Power

- Kubota Corporation

- Perkins Engines

- MAN Engines

- Rolls-Royce Power Systems(MTU)

- Doosan Infracore

- FPT Industrial

- Kohler Engines

- Hatz Diesel

第7章 市場機會與未來展望

The Off Highway Vehicle Engine Market size is estimated at USD 47.94 billion in 2025, and is expected to reach USD 66.21 billion by 2030, at a CAGR of 6.65% during the forecast period (2025-2030).

Increasing infrastructure spending, tighter emission rules, and rising mechanization across agriculture, mining, and material-handling applications are reshaping engine demand. Growth remains anchored in diesel technology but hybrid-electric and fuel-agnostic platforms are widening their footprint, helped by rapid progress in telematics, predictive maintenance, and compatibility with hydrotreated vegetable oil and renewable diesel fuels.

Global Off Highway Vehicle Engine Market Trends and Insights

Massive Global Infrastructure Pipeline (G7 & BRI)

The USD 1.2 trillion Infrastructure Investment and Jobs Act is driving annual construction equipment sales growth of 10% across the US Midwest states. Parallel investments under China's Belt and Road Initiative stimulate demand for heavy excavators and bulldozers across Africa, Southeast Asia, and Eastern Europe. Chinese exporters shipped more construction machines abroad than they sold domestically for the first time in 2023, rebalancing global supply chains and reinforcing volume in the off-highway vehicle engine market. Multi-year funding windows enable manufacturers to scale capacity and refine hybrid-ready designs with confidence.

Growing Mechanization of Agriculture in Asia-Pacific and Africa

Tractor penetration reached 74% of South Asian farms in 2024, while water pumps and threshers exceeded 65% adoption. Rising rural wages across India and China push farms toward capital-intensive practices, creating steady replacement demand in the 30-120 HP range. Sub-Saharan Africa still trails South America in mechanization, signaling a sizeable addressable pool for compact, fuel-efficient engines that perform reliably in harsh field conditions. Service-oriented business models allow smallholders to access machinery without ownership, broadening market reach for engine suppliers and further supporting the off-highway vehicle engine market.

Accelerating Electrification of Compact Equipment

Electric wheel loaders captured 10% of Chinese sales in 2024, with 6,000-7,000 electric construction machines sold worldwide. Cost parity achieved by several Chinese OEMs pressures legacy engine providers in the sub-100 HP class. European urban zones restrict diesel, accelerating battery adoption for indoor demolition and waste-handling tasks. However, long-haul mining, forestry, and 24-hour quarry operations still rely on diesel due to energy density and quick refueling needs, preserving core demand inside the off highway vehicle engine market.

Other drivers and restraints analyzed in the detailed report include:

- Stricter Stage V / Tier 5 Norms Triggering Pre-buy & Retrofit Cycles

- OEM Shift to Modular Hybrid-Ready Engine Platforms

- Escalating After-treatment Cost vs. Price-Sensitive Buyers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Construction equipment generated 58.36% of 2024 off-highway vehicle engine market revenue, a position fortified by government stimulus in roads, bridges, and transit systems. Asia Pacific megaprojects, together with the US funding surge, sustain demand for excavators, dozers, and loaders that rely on 121-400 HP blocks. Mining equipment shows renewed momentum because copper, lithium, and nickel projects expand to meet battery supply chains. Forestry and materials-handling niches favor engines like the John Deere PowerTech(TM) PSS 9.0 L delivering up to 330 hp in steep terrain. Electric compact loaders post a 6.27% CAGR, illustrating early electrification success where duty cycles and charging access are predictable. Nevertheless, high-horsepower diesel remains essential for round-the-clock mining shovels and underground haulage, upholding volume in the off highway vehicle engine market.

Compact construction fleets in Europe adopt telematics to trim idle hours, cutting fuel burn by 12% and extending overhaul intervals. Asian rental operators prefer modular engines with easy service access, keeping downtime low on busy urban sites. Belt and Road projects in Africa pull demand for mid-range 90-200 kW engines that balance fuel efficiency and toughness. Mining majors in Latin America request EU Stage V compliant powertrains to future-proof assets against tightening local rules. Together, these dynamics keep construction equipment in pole position while mining gradually widens its share of the off highway vehicle engine market.

The 31-70 HP category held 64.51% of off-highway vehicle engine market share in 2024 and records a 7.02% CAGR to 2030, fueled by compact excavators, skid-steers, and mid-size tractors used in rice paddies and horticulture. Urban densification calls for maneuverable machinery that fits narrow streets and reduces collateral damage on finished surfaces. OEMs integrate start-stop functions and advanced fuel maps, claiming double-digit consumption cuts that appeal to fleet managers. Telematics platforms visualize idle time and enable over-the-air parameter tweaks to meet local noise or emission constraints without dealership visits.

Higher brackets above 400 HP serve mining trucks and large hydraulic shovels, segments where Caterpillar's 3512B-EUI at 1,450 hp remains a benchmark. Despite lower unit volumes, these engines command premium pricing and aftermarket parts revenue. Conversely, sub-30 HP platforms suffer most from electrification encroachment because battery packs now deliver full-shift performance for lawn care, golf course, and small municipal tasks. The resulting polarization directs R&D spending toward mid-range products that anchor the off highway vehicle engine market while preserving high-horsepower prestige lines.

The Off Highway Vehicle Engine Market Report is Segmented by Vehicle Type (Agricultural Machinery and More), Power Output (Less Than or Equal To 30 HP, 31-70 HP, and More), Fuel Type (Diesel, Gasoline, and More), Engine Displacement (Less Than or Equal 2 L, 2. 1 To 3. 5 L, and More), Propulsion Technology (Conventional ICE and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific retained 38.17% revenue in 2024 due to large-scale infrastructure programs and accelerating farm mechanization. China exported more construction equipment than it sold at home during 2023, cushioning domestic softness and creating a global channel for engines produced in Changsha and Xuzhou. India's government subsidies improve tractor affordability, lifting 2025 retail volumes despite monsoon variability. Demand skews toward 31-120 HP units maneuvering in congested urban job sites or small farm plots. Regional OEMs favor modular engines certified for both Tier 3 and Stage V so they can ship to Africa or Europe without re-engineering, reinforcing the scalability of the off-highway vehicle engine market.

Europe, growing at 7.19% CAGR, benefits from Stage V compliance investments and the Green Deal's focus on rail, renewable energy, and circular economy facilities. Customers prioritize particulate filters with passive regeneration and telematics, integrating carbon accounting dashboards. Komatsu's Stage V portfolio demonstrates maintenance-free operation for a longer duration, a compelling proposition for rental firms facing tight utilization targets. European municipalities also pilot hydrogen ICE refuse trucks, supporting supplier R&D in alternative fuels.

North America capitalizes on the Infrastructure Investment and Jobs Act, which underwrites sustained engine demand for interstate highway revamps, bridge replacements, and port dredging. California's forthcoming Tier 5 rules set the strictest global bar, pushing OEMs to test next-generation SCR and ammonia sensors several years ahead of enforcement. South America, the Middle East, and Africa represent high-growth but cost-sensitive regions. Currency headwinds and financing gaps limit immediate penetration yet offer upside as commodity cycles improve and multilateral lenders sponsor roads, power plants, and irrigation schemes that rely on reliable medium-horsepower engines imported from Asia or remanufactured in Brazil.

- AGCO Corporation

- Caterpillar Inc.

- Cummins Inc.

- Deere & Company

- Deutz AG

- Komatsu Ltd

- Mahindra Powertrain

- Scania AB

- Volvo Penta

- Yanmar Co.

- Weichai Power

- Kubota Corporation

- Perkins Engines

- MAN Engines

- Rolls-Royce Power Systems (MTU)

- Doosan Infracore

- FPT Industrial

- Kohler Engines

- Hatz Diesel

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Massive global infrastructure pipeline (G7 & BRI)

- 4.2.2 Growing mechanization of agriculture in Asia-Pacific and Africa

- 4.2.3 Stricter Stage V / Tier 5 norms triggering pre-buy & retrofit cycles

- 4.2.4 OEM shift to modular hybrid-ready engine platforms

- 4.2.5 Telematics-driven predictive maintenance shortening replacement cycles

- 4.2.6 HVO/renewable-diesel compatibility extending ICE relevance

- 4.3 Market Restraints

- 4.3.1 Accelerating electrification of compact equipment

- 4.3.2 Escalating after-treatment cost vs. price-sensitive buyers

- 4.3.3 Commodity-price volatility squeezing engine margins

- 4.3.4 Rental fleets extending overhaul intervals

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Vehicle Type

- 5.1.1 Agricultural Machinery

- 5.1.2 Construction Equipment

- 5.1.3 Mining Equipment

- 5.1.4 Forestry & Material-Handling Equipment

- 5.2 By Power Output (HP)

- 5.2.1 Less than or equal to 30 HP

- 5.2.2 31-70 HP

- 5.2.3 71-120 HP

- 5.2.4 121-400 HP

- 5.2.5 More than 400 HP

- 5.3 By Fuel Type

- 5.3.1 Diesel

- 5.3.2 Gasoline

- 5.3.3 Natural-/Bio-Gas

- 5.3.4 Hybrid-Electric & Fuel-Cell

- 5.4 By Engine Displacement (L)

- 5.4.1 Less than or equal 2 L

- 5.4.2 2.1 to 3.5 L

- 5.4.3 3.6 to 7 L

- 5.4.4 More than 7 L

- 5.5 By Propulsion Technology

- 5.5.1 Conventional ICE

- 5.5.2 Hybrid

- 5.5.3 Battery-Electric

- 5.5.4 Fuel-Cell Electric

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Russia

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Egypt

- 5.6.5.4 Turkey

- 5.6.5.5 South Africa

- 5.6.5.6 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.3.1 AGCO Corporation

- 6.3.2 Caterpillar Inc.

- 6.3.3 Cummins Inc.

- 6.3.4 Deere & Company

- 6.3.5 Deutz AG

- 6.3.6 Komatsu Ltd

- 6.3.7 Mahindra Powertrain

- 6.3.8 Scania AB

- 6.3.9 Volvo Penta

- 6.3.10 Yanmar Co.

- 6.3.11 Weichai Power

- 6.3.12 Kubota Corporation

- 6.3.13 Perkins Engines

- 6.3.14 MAN Engines

- 6.3.15 Rolls-Royce Power Systems (MTU)

- 6.3.16 Doosan Infracore

- 6.3.17 FPT Industrial

- 6.3.18 Kohler Engines

- 6.3.19 Hatz Diesel

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment