|

市場調查報告書

商品編碼

1755196

非公路車輛引擎市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Off Highway Vehicle Engines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

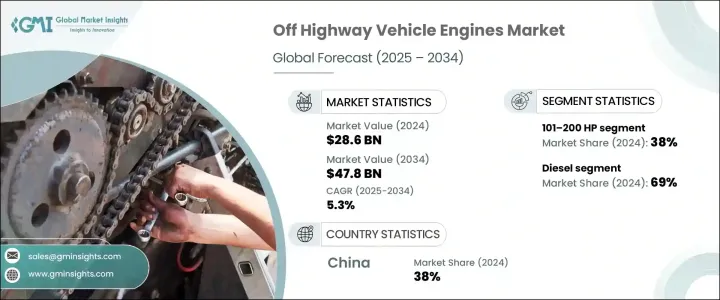

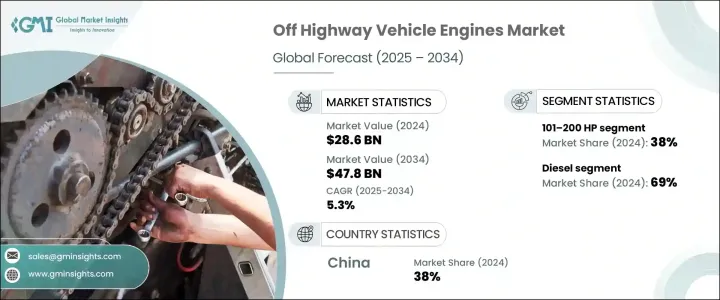

2024年,全球非公路用車引擎市場規模達286億美元,預計2034年將以5.3%的複合年成長率成長,達到478億美元。市場擴張主要得益於基礎設施的持續改進、農業機械化程度的提高以及採礦作業對設備需求的不斷成長。這些引擎對於重型應用至關重要,隨著各行各業尋求兼具耐用性和營運效率的高性能解決方案,其重要性也日益凸顯。隨著各國政府對重大公共發展項目的投資,以及全球農業和工業產出的持續成長,非公路用車領域對強勁高效引擎的需求也日益迫切。

這一成長背後的關鍵驅動力之一是對節能低排放技術的日益重視。隨著製造商投資於更清潔、混合動力和電動動力系統替代方案,市場正在經歷顯著的轉變。原始設備製造商越來越關注整合下一代引擎系統,這些系統能夠在滿足嚴格排放法規的同時降低油耗。這種轉變不僅是出於環保考慮,也源自於燃油成本的上漲以及全球對永續實踐的推動。因此,先進的引擎平台在對動力和可靠性要求極高的核心產業中越來越受歡迎。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 286億美元 |

| 預測值 | 478億美元 |

| 複合年成長率 | 5.3% |

對高輸出、節油引擎的需求日益成長,尤其是在重型設備在極端條件下運作的行業。各行各業使用的設備必須提供高扭力和強勁性能,同時又不影響燃油經濟性。這些功能性要求促使引擎製造商不斷創新和升級現有系統,以提高燃油效率、降低排放並提升性能。原始設備製造商 (OEM) 正在積極採用尖端技術,並建立合作夥伴關係,以設計滿足非公路用車不斷變化的需求的引擎。

2024年,輸出功率在101至200馬力之間的引擎將引領全球市場,佔據約38%的總佔有率。預計該細分市場在整個預測期內的複合年成長率將超過5.8%。此類引擎的受歡迎程度源於其在強度和效率之間的平衡,使其適用於多個行業的各種中型設備。其適應性確保了其在各種工作環境下的可靠性能,從而使該細分市場始終處於需求的前沿。

從燃料角度來看,柴油引擎在2024年仍佔據全球市場佔有率的69%左右,佔據榜首位置。預計該細分市場在2025年至2034年期間的複合年成長率將超過6.5%。柴油憑藉其無與倫比的扭矩和能量輸出,尤其是在持續高功率運行至關重要的環境中,仍然是首選。全球柴油供應基礎設施成熟且易於獲取,尤其是在偏遠地區或發展中地區。因此,柴油引擎將繼續成為非公路用車應用的支柱,製造商正在優先研究符合新興環保標準的先進柴油技術,同時又不犧牲可靠性或動力。

在應用方面,受基礎建設和全球城鎮化活動增加的推動,建築設備類別在2024年成為領先細分市場。住房、交通網路和商業基礎設施投資的不斷增加,轉化為對搭載強勁引擎系統的重型機械的需求成長。這些機械需要在嚴苛條件下高效運行,而對可靠引擎性能的要求使該細分市場成為市場成長的持續貢獻者。

就引擎類型而言,內燃機 (ICE) 在 2024 年保持主導地位。其廣泛應用得益於其長期的可靠性和完善的基礎設施。內燃機仍然是一個受歡迎的選擇,尤其是在充電設施稀少或不穩定的地區。這些引擎能夠不間斷運行,這在大規模、持續使用的環境中具有顯著優勢。它們在惡劣和偏遠環境中的出色表現確保了其需求持續強勁,尤其是在工業化和發展日益發展的地區。

2024年,中國引領亞太非公路用車引擎市場,佔約38%的區域佔有率,創造約44億美元的收入。中國快速的工業成長和廣泛的基礎設施建設是其保持領先地位的關鍵因素。中國開發和採礦業對重型機械的需求持續成長,推動引擎的銷售。此外,中國廣闊的農業基礎也增加了對高效耐用、能夠滿足多個垂直行業不斷成長的產量需求的引擎的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 零件製造商

- 引擎製造商(OEM)

- 汽車製造商(非公路車輛原始設備製造商)

- 經銷商和售後服務供應商

- 利潤率分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 其他國家的報復措施

- 對產業的影響

- 主要材料價格波動

- 供應鏈重組

- 電力輸出和成本影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和電力輸出策略

- 展望與未來考慮

- 對貿易的影響

- 技術與創新格局

- 價格趨勢

- 成本細分分析

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 基礎建設不斷推進

- 引擎設計的技術進步

- 對電動和混合動力非公路車的需求不斷成長

- 採礦業的成長

- 增加對智慧農業的投資

- 產業陷阱與挑戰

- 設備初始成本高

- 維護和耐用性問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依發電量,2021 - 2034

- 主要趨勢

- 低於50 HP

- 50–100 生命值

- 101–200 馬力

- 201–400 馬力

- 400 匹馬力以上

第6章:市場估計與預測:按燃料,2021 - 2034 年

- 主要趨勢

- 柴油引擎

- 汽油

- 其他

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 建築設備

- 採礦設備

- 農業設備

- 林業設備

第8章:市場估計與預測:按引擎,2021 - 2034 年

- 主要趨勢

- 內燃機(ICE)

- 油電混合引擎

- 電動引擎

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Caterpillar

- CNH Industrial

- Cummins

- Deere & Company

- Doosan Infracore

- FPT Industrial

- Hatz Diesel

- Honda Motor

- Isuzu Motors

- Kohler

- Komatsu

- Kubota

- MAN

- Mitsubishi Heavy Industries

- Perkins Engines

- Scania

- Shaanxi Fast Gear

- Tata Motors

- Volvo

- Yanmar

The Global Off-Highway Vehicle Engines Market was valued at USD 28.6 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 47.8 billion by 2034. Market expansion is largely attributed to ongoing infrastructure advancements, increased mechanization in farming, and the rising demand for equipment in mining operations. These engines are essential for heavy-duty applications, and their importance continues to grow as industries seek high-performance solutions that can deliver both durability and operational efficiency. As governments invest in major public development projects and as agricultural and industrial output continue to rise globally, the need for powerful, efficient engines across these off-highway segments is becoming more critical.

One of the key drivers behind this growth is the increased emphasis on energy-efficient and low-emission technologies. The market is witnessing a notable shift as manufacturers invest in cleaner, hybrid, and electric powertrain alternatives. OEMs are increasingly focusing on the integration of next-generation engine systems that can reduce fuel usage while meeting stringent emissions regulations. This shift is motivated not only by environmental concerns but also by the rising cost of fuel and the global push toward sustainable practices. As a result, advanced engine platforms are gaining popularity in core industries where power and reliability remain non-negotiable.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $28.6 Billion |

| Forecast Value | $47.8 Billion |

| CAGR | 5.3% |

Demand for high-output, fuel-efficient engines is on the rise, especially in sectors where heavy-duty equipment operates under extreme conditions. Equipment used across various industries must deliver high torque and strong performance without compromising fuel economy. These functional requirements are pushing engine manufacturers to innovate and upgrade existing systems with enhanced fuel efficiency, lower emissions, and improved performance capabilities. OEMs are taking an active role in adopting cutting-edge technologies and are forming partnerships to design engines that meet the evolving demands of off-highway operations.

In 2024, engines with a power output ranging between 101 and 200 horsepower led the global market, securing approximately 38% of the total share. This segment is projected to grow at a CAGR of over 5.8% throughout the forecast timeline. The popularity of engines in this category stems from their balance between strength and efficiency, making them suitable for a wide range of mid-sized equipment across multiple industries. Their adaptability ensures reliable performance in diverse work environments, which keeps this segment at the forefront of demand.

From a fuel perspective, diesel-powered engines retained the top position in 2024, making up about 69% of the global market. This segment is forecasted to grow at a CAGR exceeding 6.5% between 2025 and 2034. Diesel remains the preferred choice due to its unmatched torque and energy output, especially in environments where consistent, high-power operation is vital. The global infrastructure for diesel supply is mature and widely accessible, particularly in remote or developing regions. As a result, diesel engines continue to be the backbone of off-highway applications, and manufacturers are prioritizing research into advanced diesel technologies that align with emerging environmental standards without sacrificing reliability or power.

On the application front, the construction equipment category emerged as the leading segment in 2024, driven by increased activity in infrastructure development and global urbanization. Rising investments in housing, transportation networks, and commercial infrastructure are translating into heightened demand for heavy machinery powered by robust engine systems. These machines need to operate efficiently under tough conditions, and the requirement for dependable engine performance makes this segment a consistent contributor to market growth.

Regarding engine type, internal combustion engines (ICEs) maintained their dominance in 2024. Their widespread use can be attributed to their long-standing reliability and established infrastructure. ICEs remain a popular choice, especially in regions where electrical charging facilities are sparse or inconsistent. These engines provide uninterrupted operation, which is a significant advantage in large-scale, continuous-use settings. Their ability to perform in harsh and remote environments ensures that demand remains strong, particularly in regions with growing industrialization and development.

In 2024, China led the Asia-Pacific off-highway vehicle engines market, capturing around 38% of the regional share and generating approximately USD 4.4 billion in revenue. The country's rapid industrial growth and extensive infrastructure rollout are key contributors to this leadership position. High demand for heavy machinery within the nation's development and mining sectors continues to drive engine sales. Moreover, China's expansive agricultural base adds to the requirement for efficient, durable engines capable of meeting rising output demands across multiple verticals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Engine manufacturers (OEMs)

- 3.2.4 Vehicle manufacturers (Off-Highway OEMs)

- 3.2.5 Distributors & aftermarket service providers

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Power output and cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and Power output strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Price trends

- 3.7 Cost breakdown analysis

- 3.8 Patent analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rising infrastructure development

- 3.11.1.2 Technological advancements in engine design

- 3.11.1.3 Growing demand for electric and hybrid off-highway vehicles

- 3.11.1.4 Growth in the mining sector

- 3.11.1.5 Increased investment in smart agricultures

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial cost of equipment

- 3.11.2.2 Maintenance and durability issues

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Power output, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Below 50 HP

- 5.3 50–100 HP

- 5.4 101–200 HP

- 5.5 201–400 HP

- 5.6 Above 400 HP

Chapter 6 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Diesel

- 6.3 Gasoline

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Construction equipment

- 7.3 Mining equipment

- 7.4 Agricultural equipment

- 7.5 Forestry equipment

Chapter 8 Market Estimates & Forecast, By Engine, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Internal combustion engines (ICE)

- 8.3 Hybrid engines

- 8.4 Electric engines

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Caterpillar

- 10.2 CNH Industrial

- 10.3 Cummins

- 10.4 Deere & Company

- 10.5 Doosan Infracore

- 10.6 FPT Industrial

- 10.7 Hatz Diesel

- 10.8 Honda Motor

- 10.9 Isuzu Motors

- 10.10 Kohler

- 10.11 Komatsu

- 10.12 Kubota

- 10.13 MAN

- 10.14 Mitsubishi Heavy Industries

- 10.15 Perkins Engines

- 10.16 Scania

- 10.17 Shaanxi Fast Gear

- 10.18 Tata Motors

- 10.19 Volvo

- 10.20 Yanmar