|

市場調查報告書

商品編碼

1694010

虛擬擴增實境與混合實境(VR/AR) - 市場佔有率分析、產業趨勢與統計、成長預測 (2025-2030)Virtual Augmented and Mixed Reality (VR/AR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

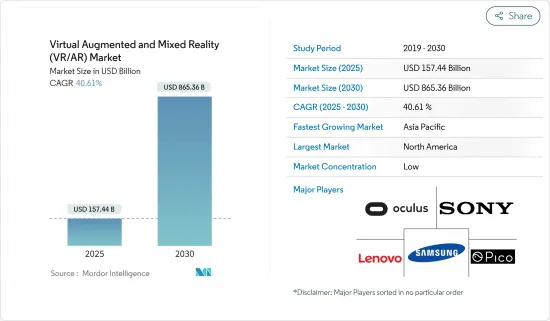

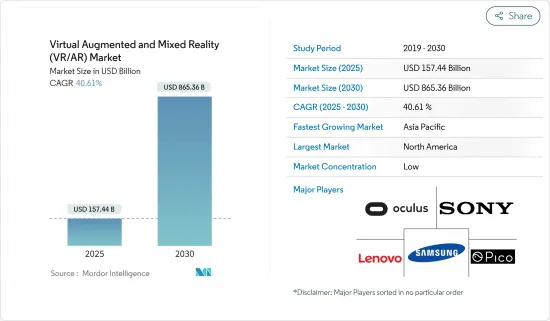

虛擬和混合實境( VR/AR)市場規模預計在 2025 年達到 1,574.4 億美元,預計到 2030 年將達到 8,653.6 億美元,預測期內(2025-2030 年)的複合年成長率為 40.61%。

關鍵亮點

- 虛擬實境是電腦技術的應用,主要目的是產生模擬環境。與傳統使用者介面相比,VR 允許使用者沉浸在身臨其境的體驗中,而不是簡單地觀察監視器螢幕。這項技術透過提供視覺、觸覺、聽覺、嗅覺等多感官模擬,無疑在許多方面徹底改變了世界。

- 相較之下,擴增實境是一種令人著迷的體驗,它透過結合電腦生成的感官資訊來豐富現實世界。擴增實境使用軟體、應用程式和硬體(如 AR 眼鏡)將數位內容無縫地融入我們的周圍環境和物體中。

- 擴增實境(AR) 技術在商業環境中的廣泛應用,該技術正在經歷顯著成長。考慮到蘋果、谷歌、Facebook、微軟和亞馬遜等知名科技市場領導者在創新和採用方面投入了大量資金,預計它將在未來幾年佔據突出地位。智慧型手機的日益普及以及 AR 在手機遊戲中的日益融合是該市場的主要驅動力,從而促使該領域的主要供應商向市場推出解決方案。

- 混合實境可以讓教師展示概念的虛擬範例並結合遊戲元素來補充教科書,從而提高課堂教育的互動性。因此,這種創新方法加速了學生的學習並提高了資訊的保留能力。

- 值得承認的是,越來越多的學生,尤其是大專院校的學生,面臨著在整個學習過程中保持專注的挑戰。他們也可能遇到一系列心理健康問題,包括憂鬱症和焦慮。

- 虛擬實境正在成為一項革命性的技術,對各種終端使用者產業產生顯著影響。這項技術的接受度不斷成長,導致其使用案例顯著擴展。虛擬實境技術也提供了多種優勢,正在改變傳統企業和商業企業的動態。

- 例如,該技術正在零售業中用於改善消費者體驗。您可以在購買產品之前在虛擬環境中查看產品。透過利用這項技術,各個終端用戶產業的企業可以進行強大的行銷宣傳活動來吸引更多客戶的注意。它還透過在虛擬環境中提供說明來幫助提供遠端維護和支援。

- 培訓和技能發展是虛擬實境技術需求預計將出現顯著成長的主要領域之一,這主要是因為它為流程帶來了便利。此外,它還最大限度地降低了整體培訓成本,同時提供了比傳統方法更安全的過程。例如,為了培訓員工在危險環境中工作,組織可以使用模擬虛擬環境,而不是派遣員工到實際現場。

- AR/VR/MR市場正在向各個行業擴張,然而,由於這些都是新興技術,尚未實現標準化和大規模接受,因此市場仍然存在技術和成本限制。此外,這些技術非常複雜,需要熟練的勞動力來進一步開發。因此,無法確保足夠數量的技術純熟勞工也是市場成長的一大障礙。

虛擬擴增實境與混合實境(VR/AR) 市場趨勢

遊戲是 VR 成長最快的終端用戶

- 虛擬實境 (VR) 因其能夠提供身臨其境的動態體驗而在遊戲領域變得流行。透過將參與企業直接置於虛擬環境中,VR 創造了一種真實感和沈浸感。虛擬實境耳機讓參與企業能夠以第一人稱觀點體驗遊戲。這種身臨其境的體驗增強了遊戲體驗,讓參與企業感覺與虛擬世界及其角色更加緊密地聯繫在一起。

- 全高清 (FHD)、超高清 (UHD) 和 4K 顯示器等新技術的研究和開發正在推動電視用於玩遊戲。遊戲產業虛擬實境的成長也受到新技術投資增加的推動。預計圖形效能的持續改進將推動 VR 遊戲產業的未來。遊戲公司正在使用強大的圖形處理器來提供融合物理和幻想環境的最佳 VR 遊戲。圖形在提供逼真的遊戲體驗方面發揮著至關重要的作用。 3D效果和互動式圖形等技術為使用者在虛擬實境平台上玩遊戲或行走時提供即時專業知識。

- 全球AR和VR遊戲玩家的快速成長正在拓寬市場視野。據人工智慧、機器學習、巨量資料分析和 AR/VR 解決方案提供商 NewGenApps 稱,到 2025 年,全球 AR 和 VR 遊戲用戶群將成長到 2.16 億。

- 對電玩遊戲的需求不斷成長,為供應商提供VR頭戴裝置創造了機會。根據娛樂零售商協會的數據,2022 年英國消費者在電子遊戲上的花費約為 46.6 億英鎊(59.5 億美元),與前一年同期比較成長了 2.3%。 2028年, VR頭戴裝置市場規模預計將超過2,700萬台。

- 遊戲產業認知到VR的市場潛力。隨著這項技術變得越來越普及和便宜,對 VR 遊戲體驗的需求也不斷成長。遊戲開發商和市場先驅將 VR 視為創造令人興奮、身臨其境的體驗的機會,可以吸引新的受眾並在擁擠的市場中脫穎而出。

北美將在虛擬實境和混合實境( VR/AR)市場佔據主要市場佔有率

- 北美對虛擬實境 (VR) 的需求正在快速成長,這主要是由於各個領域的個人擴大參與技術。需求的成長是由 VR 技術的多樣化用途所推動的,從娛樂和遊戲到教育、醫療保健和企業解決方案。

- 技術進步使得 VR 設備更加易於存取和方便用戶使用,進一步推動了對 VR 的需求。 VR頭戴裝置價格低廉且效能不斷提升,促使其在北美廣泛普及,從技術愛好者到尋求新穎有趣體驗的普通用戶。因此,許多公司正在推出新產品以增加市場佔有率。

- 隨著 VR 變得越來越容易獲得和使用,它為政府探索創新方法提供了巨大的潛力。因此,美國政府正在利用 VR 作為跨多個領域的寶貴工具。例如,美國食品藥物管理局於2023年9月宣布,一些通常只在診所或醫院提供的臨床服務可以在患者家中或其他非臨床環境中提供;明年這一數字可能會增加,從而推動對 VR 的需求。

- 由於多家供應商大力投資市場創新,且美國在全球軟體市場佔據主導地位,預計北美擴增實境市場在預測期內將大幅成長。

- 北美市場行動裝置普及率的提高和新主機的推出促進了過去幾年遊戲產業的顯著成長。美國是世界上最大的遊戲市場之一,為其公民提供各種各樣的遊戲。在美國,人們報告稱,在 COVID-19 疫情隔離期間,他們玩電子遊戲的時間與前一周相比增加了 45%。

- 北美對混合實境(MR) 的需求正在快速成長,這主要是由於各個領域的個人擴大參與技術。由於多家供應商大力投資市場創新,且美國在全球市場佔據主導地位,預計北美混合實境市場在預測期內將大幅成長。

虛擬擴增實境與混合實境(VR/AR) 市場概覽

虛擬擴增實境和混合實境(VR/AR) 市場高度細分,主要企業包括 Oculus VR LLC(Meta Platform Technologies)、索尼公司、三星電子、聯想Group Limited和 Pico Interactive Inc.。市場參與企業正在採用聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2023 年 11 月—三星電子宣布計劃於 2024 年下半年與 Galaxy Z Flip 6 和 Galaxy Z Fold 6 一起推出其下一代混合實境耳機。據該公司稱,三星正在與谷歌和高通合作開發混合實境實境耳機。

- 2023 年 9 月 - Oculus VR LLC 宣布與 15 所美國大學建立新的合作計劃,教授身臨其境型技術。各大學正在舉辦虛擬實境課堂和練習,探索身臨其境型科技如何推動未來教育的發展。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 和其他宏觀經濟因素對市場的影響

- 企業需求急劇下降

- 遊戲領域將成為未來幾個月成長的領頭羊

- 遠距遠端保健的普及將推動醫療保健領域的成長

- 比較VR和AR的相對影響

- 技術簡介

第5章市場動態

- 市場促進因素

- AR/VR 在商業應用的採用率不斷提高

- 不同終端使用者群體對 VR 培訓設備的需求不斷成長

- 技術進步、網路化和連結性增強

- 市場挑戰/限制

- 長期使用 AR/ VR頭戴裝置的健康風險

- 開發 AR/VR 設備的複雜性和高成本

- 網路安全和資料隱私問題

第6章市場區隔

- 按類型

- 硬體

- 系留式 HMD

- 獨立式 HMD

- 無螢幕檢視器

- 軟體

- 硬體

- 按行業

- 遊戲

- 媒體娛樂

- 零售

- 醫療保健

- 軍事和國防

- 房地產

- 教育

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章擴增實境(AR)市場區隔

- 按類型

- 硬體

- 軟體

- 按行業

- 遊戲

- 媒體娛樂

- 零售

- 醫療保健

- 軍事和國防

- 房地產

- 教育

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第8章混合實境(MR)市場區隔

- 按行業

- 遊戲

- 媒體和娛樂

- 零售

- 醫療保健

- 軍事和國防

- 房地產

- 教育

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第9章競爭格局

- 公司簡介

- Oculus VR LLC

- Sony Corporation

- Samsung Electronics Co. Ltd

- Lenovo Group Ltd

- Pico Interactive Inc.

- Qualcomm Technologies Inc.

- FOVE Inc.

- Unity Technologies Inc

- Unreal Engine(Epic Games Inc.)

- DPVR(Lexiang Technology Co. Ltd)

- Autodesk Inc.

- Eon Reality Inc.

- 3D Systems Corporation

- Dassault Systemes SE

- HTC Vive(HTC Corporation)

- Google LLC(Alphabet Inc.)

- Seiko Epson Corporation

- Vuzix Corporation

- Realwear Inc.

- Dynabook Americas Inc.(Sharp Corporation)

- Niantic Inc.

- Optinvent

- Atheer Inc.

- Blippar.com Ltd

- PTC Inc.

- Ultraleap Limited

- Wikitude GmbH

- TechSee Augmented Vision Ltd

- Microsoft Corporation

- HP Development Company LP

- Dell Technologies Inc.

- AsusTek Computer Inc.

- Acer Inc.

- Magic Leap Inc.

- Amber Garage(Holokit)

- Barco

第 10 章供應商市場佔有率

第11章投資分析

第12章:投資分析市場的未來

The Virtual Augmented and Mixed Reality Market size is estimated at USD 157.44 billion in 2025, and is expected to reach USD 865.36 billion by 2030, at a CAGR of 40.61% during the forecast period (2025-2030).

Key Highlights

- Virtual reality is the utilization of computer technology primarily aimed at generating a simulated environment. In contrast to the conventional user interface, VR enables users to fully engage in an immersive experience rather than merely observing a monitor screen. This technology has undoubtedly revolutionized various aspects globally by providing a multi-sensory simulation encompassing aspects like vision, touch, hearing, and smell.

- In contrast, augmented reality is a captivating experience that enriches the real world by incorporating computer-generated perceptual information. Augmented reality seamlessly incorporates digital content into our surroundings and objects by utilizing software, apps, and hardware like AR glasses.

- Augmented reality (AR) has experienced remarkable growth due to the widespread utilization of this technology in commercial settings. It is anticipated to hold significant importance in the upcoming years, considering the substantial investments made in innovation and adoption by prominent technology market leaders like Apple, Google, Facebook, Microsoft, and Amazon. The expanding presence of smartphones and the increasing integration of AR in mobile gaming are key drivers of this market, leading to the development of more solutions by major vendors in this segment.

- Using mixed reality may enhance the interactivity of classroom education, as it empowers teachers to present virtual examples of concepts and incorporate gaming elements to supplement textbooks. Consequently, this innovative approach facilitates accelerated learning and improved retention of information for students.

- It is worth acknowledging that an increasing number of students face challenges in maintaining focus and concentration during their educational journey, particularly at universities and colleges. They may also encounter various mental health issues, such as depression and anxiety.

- Virtual reality is emerging as a revolutionary technology that may notably impact various end-user industries. The acceptance of the technology is witnessing continuous growth, leading to significant expansion in the number of use cases. Virtual reality technology also offers several advantages that are changing the dynamics of businesses and commercial enterprises used to operate earlier.

- For instance, the technology is being used in the retail industry to enhance consumer experience. Before purchasing, they may use it to check the product in a virtual environment. By using the technology, businesses across various end-user industries may develop robust marketing campaigns to attract the attention of more customers. It also helps them offer remote maintenance and support by providing the procedures in a virtual environment.

- Training and skill development are among the major sectors wherein the demand for virtual reality technology is anticipated to witness substantial growth primarily due to factors such as the convenience the technology adds to the process. Furthermore, it also helps minimize the overall training cost while making the process safer than traditional methods. For instance, to train employees to work in hazardous environments, organizations may use a simulated virtual environment rather than sending the employee to the actual site.

- Although the AR/VR/MR market is finding an enhanced footprint across various industries, the technological and cost limitations remain relevant in the market as these are emerging technologies and are yet to achieve standardization and mass acceptance. Furthermore, these technologies are complex and require a skilled workforce for further development. Hence, the lack of sufficient availability of a skilled workforce is another major factor challenging the market's growth.

Virtual Augmented and Mixed Reality (VR/AR) Market Trends

Gaming to be the Fastest Growing End-user for VR

- Virtual reality (VR) has become widely used in the gaming sector because of its ability to deliver an immersive and dynamic experience. By sending players directly into the virtual environment, VR creates a sense of presence and immersion. Virtual reality headsets allow players to experience games from a first-person perspective. This heightened immersion enhances the gaming experience and makes players feel more connected to the virtual world and its characters.

- R&D of new technologies, such as Full High-Definition (FHD), Ultra-High Definition (UHD), and 4K displays, has boosted the adoption of TVs for playing games. The growth of virtual reality in the gaming industry has also been stimulated by increasing investments in new technologies. The future of the VR gaming industry is projected to be driven by continued improvement in graphics performance. Gaming companies use potent graphics processors to provide the best VR games to integrate physical and fantasy environments. Graphics play an essential role in providing a realistic gaming experience. Real-time expertise is offered to users by technologies such as 3D effects and interactive graphics while playing games or walking on virtual reality platforms.

- Rapid growth in AR and VR gamers worldwide has expanded the market's horizon. According to NewGenApps, a provider of Artificial Intelligence, Machine Learning, Big Data Analytics, and AR/VR solutions, the global user base of AR and VR games will increase to 216 million users by 2025.

- The increasing demand for video games creates an opportunity for vendors to offer VR headsets. According to the Entertainment Retailers Association, in 2022, British consumers spent approximately GBP 4.66 billion (USD 5.95 billion) on video games. This represents a 2.3% increase from the previous year. By 2028, the market volume of VR headsets is expected to be over 27 million.

- The gaming industry recognizes the market potential of VR. As the technology becomes more accessible and affordable, the demand for VR gaming experiences is increasing. Game developers and publishers see VR as an opportunity to reach new audiences and create exciting, immersive experiences that stand out in a crowded market.

North America to Hold Major Market Share in the Virtual, Augmented, and Mixed Reality Market

- The demand for virtual reality (VR) in North America has experienced rapid growth owing to the significant shift in individuals across various sectors engaging with technology. This increasing demand is fueled by the various applications of VR technology, from entertainment and gaming to education, healthcare, enterprise solutions, and others.

- The demand for VR is further propelled by technological advancements, making VR devices more accessible and user-friendly. The affordability and improved performance of VR headsets have contributed to broader adoption across North America, from tech enthusiasts to casual users seeking novel and engaging experiences. Hence, many companies are launching new products to increase their market share.

- As VR becomes more accessible and easier to use, it offers a lot of great possibilities for the government to explore innovative approaches. Hence, the US government uses VR as a valuable tool across multiple sectors. For instance, in September 2023, the US Food and Drug Administration announced that VR could deliver some clinical services, normally delivered only in clinics and hospitals, to patients in their homes or other non-clinical settings, and in the coming year, this will increase, which will boost the demand of VR.

- Due to several vendors making significant investments in market innovation and the US's dominant position in the global software market, the augmented reality market in North America is expected to grow significantly during the forecast period.

- Increased mobile penetration and the availability of new consoles in the North American market have contributed to tremendous growth in the gaming sector over the last few years. The US is one of the world's biggest gaming markets and offers many games for its citizens. In the United States, video gamers reported an increase of 45% in the time spent playing video games during the quarantine period of the COVID-19 pandemic compared to previous weeks.

- The demand for mixed reality (MR) in North America has experienced rapid growth owing to the significant shift in individuals across various sectors engaging with technology. Due to several vendors making substantial investments in market innovation and the US's dominant position in the global market, the mixed reality market in North America is expected to grow significantly during the forecast period.

Virtual Augmented and Mixed Reality (VR/AR) Market Overview

The virtual, augmented, and mixed reality market is highly fragmented with the presence of major players like Oculus VR LLC (Meta Platform Technologies), Sony Corporation, Samsung Electronics Co. Ltd, Lenovo Group Ltd, and Pico Interactive Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- November 2023 - Samsung Electronics Co. Ltd announced plans to launch its upcoming mixed-reality headset in the second half of 2024 alongside the Galaxy Z Flip6 and the Galaxy Z Fold6. According to the company, Samsung is working on a mixed-reality headset in partnership with Google and Qualcomm.

- September 2023 - Oculus VR LLC announced a new partnership program with 15 US universities teaching immersive technology. Every university is hosting virtual reality classrooms and exercises to explore how immersive technology may advance the future of education.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

- 4.3.1 Sharp Decline in Demand Observed in the Enterprise Segment

- 4.3.2 The Gaming Segment to be at the Forefront of Growth in the Upcoming Months

- 4.3.3 Rise in Telehealth-based Implementation to Drive Growth in the Healthcare Segment

- 4.3.4 How Does VR Stack Up Against AR in Terms of the Relative Impact

- 4.4 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of AR/VR in Commercial Application

- 5.1.2 Increasing Demand for VR Setup for Training Across Various End-user Segments

- 5.1.3 Technological Advancements, Networking, and Connectivity Improvements

- 5.2 Market Challenges/Restraints

- 5.2.1 Health Risks from Using AR/VR Headsets in the Longer Run

- 5.2.2 Development Complexity and High Cost of AR/VR Devices

- 5.2.3 Cybersecurity and Data Privacy Issues

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.1.1 Tethered HMD

- 6.1.1.2 Standalone HMD

- 6.1.1.3 Screenless Viewer

- 6.1.2 Software

- 6.1.1 Hardware

- 6.2 By End-user Vertical

- 6.2.1 Gaming

- 6.2.2 Media and Entertainment

- 6.2.3 Retail

- 6.2.4 Healthcare

- 6.2.5 Military and Defense

- 6.2.6 Real Estate

- 6.2.7 Education

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 AUGMENTED REALITY (AR) MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Hardware

- 7.1.2 Software

- 7.2 By End-user Vertical

- 7.2.1 Gaming

- 7.2.2 Media and Entertainment

- 7.2.3 Retail

- 7.2.4 Healthcare

- 7.2.5 Military and Defense

- 7.2.6 Real Estate

- 7.2.7 Education

- 7.3 By Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia

- 7.3.4 Australia and New Zealand

- 7.3.5 Latin America

- 7.3.6 Middle East and Africa

8 MIXED REALITY (MR) MARKET SEGMENTATION

- 8.1 By End-user Vertical

- 8.1.1 Gaming

- 8.1.2 Media and Entertainment

- 8.1.3 Retail

- 8.1.4 Healthcare

- 8.1.5 Military and Defense

- 8.1.6 Real Estate

- 8.1.7 Education

- 8.2 By Geography

- 8.2.1 North America

- 8.2.2 Europe

- 8.2.3 Asia

- 8.2.4 Australia and New Zealand

- 8.2.5 Latin America

- 8.2.6 Middle East and Africa

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Oculus VR LLC

- 9.1.2 Sony Corporation

- 9.1.3 Samsung Electronics Co. Ltd

- 9.1.4 Lenovo Group Ltd

- 9.1.5 Pico Interactive Inc.

- 9.1.6 Qualcomm Technologies Inc.

- 9.1.7 FOVE Inc.

- 9.1.8 Unity Technologies Inc

- 9.1.9 Unreal Engine (Epic Games Inc.)

- 9.1.10 DPVR (Lexiang Technology Co. Ltd)

- 9.1.11 Autodesk Inc.

- 9.1.12 Eon Reality Inc.

- 9.1.13 3D Systems Corporation

- 9.1.14 Dassault Systemes SE

- 9.1.15 HTC Vive (HTC Corporation)

- 9.1.16 Google LLC (Alphabet Inc.)

- 9.1.17 Seiko Epson Corporation

- 9.1.18 Vuzix Corporation

- 9.1.19 Realwear Inc.

- 9.1.20 Dynabook Americas Inc. (Sharp Corporation)

- 9.1.21 Niantic Inc.

- 9.1.22 Optinvent

- 9.1.23 Atheer Inc.

- 9.1.24 Blippar.com Ltd

- 9.1.25 PTC Inc.

- 9.1.26 Ultraleap Limited

- 9.1.27 Wikitude GmbH

- 9.1.28 TechSee Augmented Vision Ltd

- 9.1.29 Microsoft Corporation

- 9.1.30 HP Development Company LP

- 9.1.31 Dell Technologies Inc.

- 9.1.32 AsusTek Computer Inc.

- 9.1.33 Acer Inc.

- 9.1.34 Magic Leap Inc.

- 9.1.35 Amber Garage (Holokit)

- 9.1.36 Barco