|

市場調查報告書

商品編碼

1693780

南美洲生物肥料市場佔有率分析、產業趨勢與成長預測(2025-2030)South America Biofertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

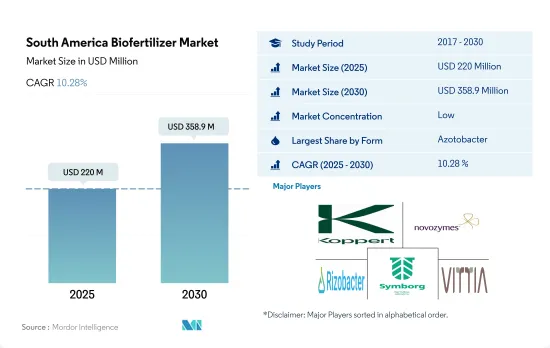

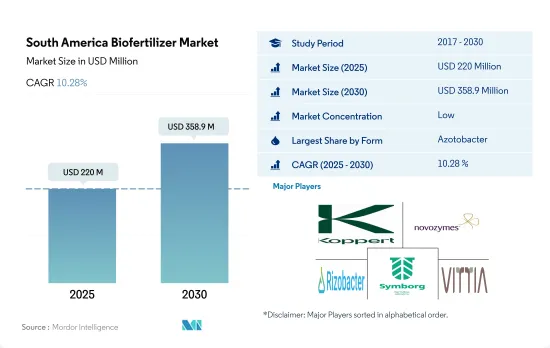

南美生物肥料市場規模預計在 2025 年為 2.2 億美元,預計到 2030 年將達到 3.589 億美元,預測期內(2025-2030 年)的複合年成長率為 10.28%。

- 生物肥料是一種永續且環保的方法,可以促進植物生長和生產力。生物肥料由活微生物組成,可以改善土壤中的養分,使植物更容易吸收必需元素。最常用的生物肥料包括菌根真菌、固氮螺菌、固氮菌、根瘤菌和解磷細菌。

- 選擇這些微生物是因為它們具有改善土壤健康和肥力以及為作物提供必要營養的能力。這些微生物透過分解有機物來釋放必需的營養物質或直接增加土壤中某些營養物質的可用性。

- 固氮菌佔該地區生物肥料總消耗量的28.6%。在不同農業氣候條件下對固氮菌進行的田間試驗表明,該生物肥料適合接種洋蔥、番茄和捲心菜等作物的種子和幼苗。在典型的田間條件下,接種固氮菌可使這些作物對氮肥的需求減少 10-20%。因此,預計未來幾年固氮菌在農業的應用將會擴大。

- 巴西的研究表明,巴西固氮螺菌Ab-V5和Ab-V6兩種菌株的組合可以提高大豆、甘蔗、水稻、小麥和牧草等主要作物的產量。這兩種菌株的應用也與這些作物上常用的其他農藥有很好的協同作用。

- 由於對有機食品的需求不斷增加,以及政府強調永續農業實踐對維持土壤和環境安全的重要性,該地區的生物肥料市場預計將成長。

- 巴西是南美洲領先的農業國家之一,2022 年佔該地區生物肥料市場總量的 65.3%。據全球有機貿易組織稱,該國農民正在滿足全球對有機食品的需求,2021 年有機食品銷售額達到 8,100 萬美元,比與前一年同期比較成長 9.5%。

- 該地區有機作物作物面積從 2017 年的 495,700 公頃增加到 2021 年的 717,200 公頃。預計有機作物整體成長趨勢將推動這些國家的生物肥料市場發展,預計 2023-2029 年期間的複合年成長率為 10.0%。

- 隨著人們對土壤和環境污染的擔憂日益加劇,各國政府和其他組織正在大力推動全部區域使用生物作物投入。在阿根廷,糧農組織2022-2031年戰略架構優先考慮採用農業經濟方法向更有效率、更永續的農業糧食體系轉型,重點是減少農業中化肥和農藥的使用。這為採用生物肥料作為更永續的替代品提供了機會。

- 此外,豆類作物的產量也大幅增加。根瘤菌菌株會產生吲哚乙酸等生長激素,能迅速刺激根瘤的形成和發育,對植物的生長產生有利的影響。生物肥料的使用效益預計將促進其在南美洲的使用。然而,農民意識低下以及從化學農業到有機農業的過渡期較長,在一定程度上阻礙了生物肥料市場的成長。

南美洲生物肥料市場趨勢

由於國際上對大豆、玉米、向日葵和小麥的需求增加,有機種植面積增加。

- 根據有機農業研究所(FibL Statistics)的數據,2021年南美洲作物有機種植面積為672,800公頃。阿根廷和烏拉圭是該地區主要的有機生產國,種植了大面積的有機作物,其中阿根廷在2021年佔該地區有機種植面積的11.5%。阿根廷主要生產的有機作物包括甘蔗、原毛、水果、蔬菜和豆類。主要有機出口產品為大豆、玉米、向日葵和小麥。

- 2021年作物作物種植面積為38.43萬公頃,其中經濟作物佔比最大,為53.9%。該地區是甘蔗、可可、咖啡和棉花等經濟作物的主要產地。巴西是該地區最大的甘蔗生產國。

- 同時,烏拉圭是該地區有機蔬菜和水果的主要生產國。烏拉圭有機農民協會透過與各種有機零售商合作,在該國推廣有機農業。世界銀行資助的自然資源永續管理和氣候變遷計劃(DACC)支持5,139名農民在2022年採用氣候智慧型農業(CSA),為該地區有機作物種植面積的增加做出了貢獻。

- 數百萬南美農民繼續在沒有外部投入的情況下耕種,儘管國內產量大幅下降,但他們可能是該地區經濟的未來。人們的健康意識日益增強,為南美洲日益環保和永續的農業系統創造了更大的市場。

阿根廷、巴西和哥倫比亞約有 49.0% 的消費者有興趣購買有機食品。

- 南美洲是世界上最重要的有機食品生產地和出口地之一。南美洲的人均有機食品支出相對世界其他地區較低。 2022年人均支出為4.3美元。這些出口導向國家正在創造目前被忽視的國內需求。

- 在阿根廷、巴西和哥倫比亞等南美國家,對有機食品等自然生長產品的需求日益成長。 2021 年威斯康辛州經濟發展調查證明,消費者願意為有機食品支付更高的價格。調查顯示,43-49%的消費者注重健康。巴西在有機包裝食品和食品飲料的人均支出排名世界第43名。

- 根據2021年全球有機貿易數據,2021年阿根廷有機產品市場規模達1,590萬美元,佔全球市場規模的0.03%,人均消費量為0.35美元。

- 目前,該地區的有機食品市場高度分散,只有少數超級市場和專賣店有販售。該地區的許多超級市場、專賣店和當地農貿市場,尤其是哥斯達黎加、墨西哥和南美洲的都市區,現在都出售有機食品以滿足日益成長的需求。消費者意識和購買動機的提高有望使人們更了解該地區有機食品的永續性屬性。

南美洲生物肥料產業概況

南美洲生物肥料市場細分,前五大公司佔19.47%的市佔率。市場的主要企業包括 Koppert Biological Systems Inc.、Novozymes、Rizobacter、Symborg Inc.、Vittia Group 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 有機種植區

- 有機產品人均支出

- 法律規範

- 阿根廷

- 巴西

- 價值鍊和通路分析

第5章市場區隔

- 形式

- 固氮螺菌

- 固氮菌

- 菌根真菌

- 解磷細菌

- 根瘤菌

- 其他生物肥料

- 作物類型

- 經濟作物

- 園藝作物

- 田間作物

- 國家

- 阿根廷

- 巴西

- 南美洲其他地區

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Atlantica Agricola

- IPL Biologicals Limited

- Koppert Biological Systems Inc.

- Novozymes

- Plant Response BIoTech Inc.

- Rizobacter

- Sustane Natural Fertilizer Inc.

- Symborg Inc.

- T.Stanes and Company Limited

- Vittia Group

第7章 CEO 的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 500040

The South America Biofertilizer Market size is estimated at 220 million USD in 2025, and is expected to reach 358.9 million USD by 2030, growing at a CAGR of 10.28% during the forecast period (2025-2030).

- Biofertilizers are a sustainable and eco-friendly way of enhancing plant growth and productivity. They are composed of living microorganisms that can improve the soil's nutrient content, making essential elements more accessible to plants. Some of the most commonly used biofertilizers include mycorrhiza, Azospirillum, Azotobacter, Rhizobium, and phosphate-solubilizing bacteria.

- These microorganisms are selected for their ability to improve the soil's health and fertility, providing crops with the nutrients required. They work by either breaking down organic matter to release essential nutrients or directly increasing the availability of specific nutrients in the soil.

- Azotobacter accounted for 28.6% of the total biofertilizers consumed in the region. Field tests on Azotobacter under various agro-climatic conditions revealed that the biofertilizer is suitable for inoculating with seeds or seedlings of crops such as onion, tomato, and cabbage. Under typical field circumstances, Azotobacter inoculation reduces the need for nitrogenous fertilizers in these crops by 10-20%. Thus, the usage of Azotobacter in agriculture is expected to grow in the coming years.

- Research in Brazil has demonstrated that the combination of two strains of Azospirillum brasilense, Ab-V5 and Ab-V6, increased yields in key crops such as soybean, sugarcane, rice, wheat, and pasture. The application of these two strains is also compatible with other pesticides commonly used in these crops.

- The market for biofertilizers in the region is expected to grow due to the rising demand for organically-grown food and the government's emphasis on the importance of sustainable agricultural practices to keep the soil and environment safer.

- Brazil is a leading agriculture nation in South America and held 65.3% of the total biofertilizer market in the region in 2022. The country's farmers are keeping up with the worldwide demand for organic food and achieved organic food sales worth USD 81.0 million in 2021, which rose 9.5% compared to the previous year, as per the Global Organic Trade.

- The area under cultivation of organic crops in the region increased from 495.7 thousand hectares in 2017 to 717.2 thousand hectares in 2021. The increasing trend in the overall organic crop is expected to drive the market for biofertilizers in these countries and is estimated to register a CAGR of 10.0% between 2023 and 2029.

- With growing concern for soil and environmental pollution, the government and other organizations are highly promoting the usage of biological crop inputs across the region. In Argentina, the FAO's 2022-2031 Strategic Framework prioritizes transforming agri-food systems to be more efficient and sustainable, using agroeconomic methods, with a focus on reducing the use of chemical fertilizers and pesticides in agriculture. This opens up opportunities for adopting biofertilizers as a more sustainable alternative.

- Moreover, there has been a remarkable increase in the crop yield of leguminous crops. Strains of rhizobium produce growth hormones like indole acetic acid, which influences positive growth in plants by stimulating the formation and development of root nodules quickly. The advantages of biofertilizer usage are expected to drive their usage in South America. However, less awareness among the farmers and the long transition period from chemical farming to organic farming are slightly hindering the market growth of biofertilizers.

South America Biofertilizer Market Trends

Growing organic acreage owning to the rising international demand for soy, corn, sunflower, and wheat.

- The area under organic cultivation of crops in South America was recorded at 672.8 thousand hectares in 2021, according to the data provided by The Research Institute of Organic Agriculture (FibL statistics). Argentina and Uruguay are the major organic-producing countries in the region, with a large area under organic crop cultivation, with Argentina occupying a share of 11.5% of the organic area in the region in 2021. The primary organic crops produced in Argentina include sugarcane, raw wool, fruits, vegetables, and beans. The primary organic exports are soy, corn, sunflower, and wheat.

- Cash crops accounted for the maximum share of 53.9% under organic crop cultivation in 2021, with 384.3 thousand hectares of land. The region is a major grower of cash crops like sugarcane, cocoa, coffee, and cotton. Brazil is the largest sugarcane-growing country in the region.

- On the other hand, Uruguay is a large grower of organic fruits and vegetables in the region. The Organic Farmers' Association of Uruguay promotes organic cultivation in the country by partnering with various organic retail outlets. The World Bank-financed Sustainable Management of Natural Resources and Climate Change project (DACC) assisted 5,139 farmers in 2022 to adopt climate-smart agriculture (CSA), which helped increase the area under cultivation of organic crops in the region.

- Millions of farmers in South America continue to practice no-external input agriculture, which may very well represent the future of the region's economy despite the noticeably low domestic production. The population is becoming more health conscious, which creates a larger market for South America's increasingly eco-friendly and sustainable farming system.

Approximately 49.0% consumers in Argentina, Brazil and Colombia are interested in purchasing organic food.

- South America is one of the important producers and exporters of organic food products globally. The per capita spending on organic food products in South America is comparatively lesser than in other parts of the world. The average per capita spending was recorded as USD 4.3 in 2022. Nevertheless, these export-oriented countries are now generating an often-overlooked domestic demand.

- The demand for naturally grown products like organic food in South American countries like Argentina, Brazil, and Colombia has increased. A survey conducted by Wisconsin Economic Development in 2021 proved that consumers are willing to pay higher prices for organically grown food. The study revealed that 43-49% of consumers are conscious about their health. Brazil ranks 43rd globally for per capita spending on organic packaged food and beverages.

- The organic products market in Argentina reached a value of USD 15.9 million in 2021, representing 0.03% of the global market value, with a per capita consumption of USD 0.35, as per the data given by Global Organic Trade in 2021.

- Currently, the market for organic foods in the region is very fragmented, with its availability limited to a few supermarkets and specialty stores, as only people from higher-income families are potential customers. Many supermarkets, specialized stores, and local farmers' markets in the region are now selling organic food to satisfy the growing latent demand for such products, mainly in Costa Rica, Mexico, and urban centers of South America. Growing awareness among consumers and their buying motives are expected to lead to a better understanding of the sustainability attributes of organic food in the region.

South America Biofertilizer Industry Overview

The South America Biofertilizer Market is fragmented, with the top five companies occupying 19.47%. The major players in this market are Koppert Biological Systems Inc., Novozymes, Rizobacter, Symborg Inc. and Vittia Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Brazil

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Form

- 5.1.1 Azospirillum

- 5.1.2 Azotobacter

- 5.1.3 Mycorrhiza

- 5.1.4 Phosphate Solubilizing Bacteria

- 5.1.5 Rhizobium

- 5.1.6 Other Biofertilizers

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

- 5.3 Country

- 5.3.1 Argentina

- 5.3.2 Brazil

- 5.3.3 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Atlantica Agricola

- 6.4.2 IPL Biologicals Limited

- 6.4.3 Koppert Biological Systems Inc.

- 6.4.4 Novozymes

- 6.4.5 Plant Response Biotech Inc.

- 6.4.6 Rizobacter

- 6.4.7 Sustane Natural Fertilizer Inc.

- 6.4.8 Symborg Inc.

- 6.4.9 T.Stanes and Company Limited

- 6.4.10 Vittia Group

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219