|

市場調查報告書

商品編碼

1693763

中國生物刺激素:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030)China Biostimulants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

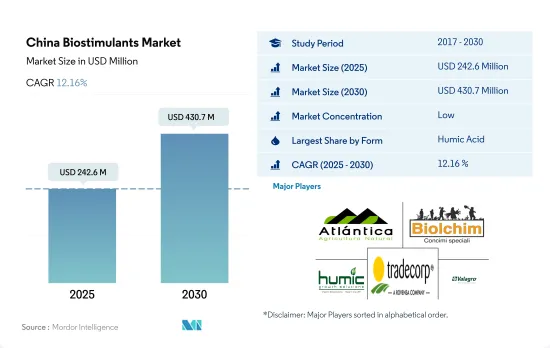

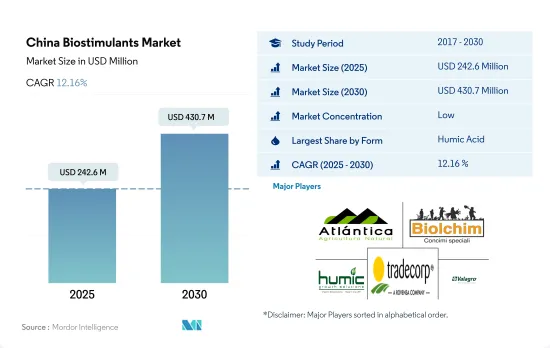

預計 2025 年中國生物刺激素市場規模為 2.426 億美元,到 2030 年將達到 4.307 億美元,預測期內(2025-2030 年)的複合年成長率為 12.16%。

- 中國的生物刺激素市場包含多種活性成分,如腐植酸和富裡酸酸、胺基酸、蛋白質水解物、海藻萃取物和其他有機植物和動物來源的生物刺激素。

- 2022年,腐植酸在中國生物刺激素市場佔據主導地位,價值和數量分別佔整個市場的約25.2%和28.9%。腐殖酸有助於改善大豆、小麥、水稻和玉米等作物,馬鈴薯、番茄、黃瓜和辣椒等蔬菜作物,以及柑橘(Citrus limon)和葡萄(Vitis vinifera)等水果作物的根系。腐植酸促進黃瓜、番茄、洋蔥、豌豆、小麥、玉米、辣椒等作物新芽的生長。

- 在中國,2022 年胺基酸佔生物刺激素市場總量的 24.2%。預計氨基酸生物刺激素的消費量將增加 49.1%,從 2022 年的 14,200 噸增加到 2029 年的 21,900 噸。這主要是由於中國日益傾向於採用永續和有機農業實踐。

- 2022年,海藻萃取物佔中國生物刺激素市場的11.3%。與其他類型的生物刺激素相比,海藻萃取物生物刺激素預計將呈現最快的成長率,因為它們可以以循環和永續的方式製備,並且可以與其他成分混合作為肥料的一部分。對提高作物產量也有特異性的效果。

- 儘管生物刺激素對多種作物都有潛在的積極作用,但人們對其對柑橘類水果和草莓等商業性種植作物或番茄和辣椒等蔬菜的影響知之甚少。

中國生物刺激素市場趨勢

農藥使用量降至零,有機產品出口增加,有機農業推廣。

- 根據FiBL和IFOAM的最新報告,中國有機食品市場正以每年25.0%的速度成長。鑑於中國每年出口29.1億美元的農產品,從傳統農業向有機農業的轉變意味著中國轉向更永續的食品體系的轉變。

- 隨著收入的增加和食品安全日益重要,越來越多的人開始購買有機產品,中國的有機農場面積迅速成長。過去三年,中國有機種植面積增加了10%,2020年達到240萬公頃。此外,國家推出了推動有機生產的政策,並提出了「綠水青山就是金山銀山」和「綠色發展」的口號。

- 中國的有機農業主要以出口為導向。出口和進口商品包括穀物、大豆、水果和蔬菜。中國東北三省(遼寧、吉林、黑龍江)是全國有機農產品生產總量、數量、面積最大的省區。中國北方(如山東省和遼寧省)的大多數有機農場都向周邊城市供應有機蔬菜和水果。另外部分產品也出口到日本、韓國、歐美等美國。

- 由於過度使用合成肥料和殺蟲劑導致土壤污染,人們越來越擔心土壤毒性,中國對永續農業實踐和有機食品生產的需求正在成長。農業實踐的這種變化是一個緩慢但不斷成長的趨勢,並且它正在增加對作物營養和保護產品的需求。

由於對有機產品的需求不斷成長,約73%的中國消費者希望購買有機食品。

- 中國有機食品市場發展迅速,中國消費者對有機食品的潛在需求龐大。更富裕的中階的崛起和對健康影響的認知不斷提高是這一現象背後的驅動力。 2021年,中國有機食品銷售額約達775.4億美元。

- 由於政府的各項法律都傾向於有機食品而非食品安全,且消費者偏好有機食品而非傳統食品,因此對有機食品的需求大幅增加。中國的有機蔬菜價格是傳統蔬菜的3至15倍,而有機蔬菜的價格一般是傳統蔬菜的5至10倍。然而,儘管價格因素是一個障礙,富裕家庭和有健康問題的個人仍願意擴大預算,約有 73% 的中國消費者願意為有機食品支付額外費用。

- 中國政府正逐步實現有機食品領域的自給自足。例如,透過鼓勵農民減少使用化學肥料,轉而使用生物替代品,經濟正逐步走向綠色農業。中國連鎖專利權協會2020年的調查顯示,中國發達城市民眾中了解永續食品生產概念的有機意識已達83%。儘管中國的有機食品產業仍然很小,遠遠無法滿足國內外消費者的需求,但考慮到2021年國內銷售額預計將成長4.01%,可以說中國有機食品在國內和海外市場都具有巨大的潛力。

中國生物刺激素產業概況

中國生物刺激素市場細分化,前五大企業市佔率合計7.87%。市場的主要企業包括 Atlantica Agricola、Biolchim SpA、Humic Growth Solutions Inc.、Trade Corporation International、Valagro 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 有機種植區

- 有機產品人均支出

- 法律規範

- 中國

- 價值鍊和通路分析

第5章市場區隔

- 形式

- 胺基酸

- 富裡酸

- 腐植酸

- 蛋白質水解物

- 海藻萃取物

- 其他生物刺激素

- 作物類型

- 經濟作物

- 園藝作物

- 田間作物

第6章 競爭格局

- 重大策略舉措

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Agrinos

- Atlantica Agricola

- Binzhou Jingyang Biological Fertilizer Co. Ltd

- Biolchim SpA

- Corteva Agriscience

- Haifa Group

- Humic Growth Solutions Inc.

- Plant Response BIoTech Inc.

- Trade Corporation International

- Valagro

第7章 CEO 的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 500023

The China Biostimulants Market size is estimated at 242.6 million USD in 2025, and is expected to reach 430.7 million USD by 2030, growing at a CAGR of 12.16% during the forecast period (2025-2030).

- The biostimulant market in China consists of many active ingredients such as humic acid and fulvic acid, amino acids, protein hydrolysates, seaweed extracts, and other biostimulants like organic plants and animal derivatives.

- In 2022, humic acid dominated the Chinese biostimulants market, accounting for about 25.2% and 28.9% of the total market by value and volume, respectively. Humic acid helps improve the root system of crops such as soybean, wheat, rice, and maize; vegetable crops such as potato, tomato, cucumber, and pepper; fruit crops such as citrus (Citrus limon) and grape (Vitis vinifera). Humic acid promotes shoot growth in crops like cucumber, tomato, leeks, peas, wheat, maize, and pepper.

- In China, amino acids accounted for 24.2% of the total biostimulants market value in 2022. The consumption volume of amino acid biostimulants is expected to increase by 49.1%, from 14.2 thousand metric tons in 2022 to 21.9 thousand metric tons in 2029. This is mainly due to the increasing trend in adopting sustainable or organic agriculture in the country.

- Seaweed extracts accounted for 11.3% of the Chinese biostimulants market in 2022. Seaweed extracts biostimulants are expected to witness the fastest growth rate compared to other types of biostimulants as seaweed biostimulants can be prepared in a circular and sustainable way and can be mixed with other ingredients as a part of fertilizer. They offer specificity of action to improve the yield of crops.

- Despite the potential positive effects on different crops, there is little knowledge of the impacts of biostimulants on commercially grown crops like citrus and strawberry and vegetables like tomato and capsicum.

China Biostimulants Market Trends

Country's zero growth in pesticides use and increasing exports under organic products driving the organic cultivation.

- According to the latest reports by FiBL and the IFOAM, the market for organic food in China is growing at an annual rate of 25.0%. The shift from conventional to organic is a transformation toward a more sustainable food system within China, given the USD 2.91 billion of agri-food commodities exported from China each year.

- The size of organic farmland increased rapidly in China because more people started buying organic products due to increased incomes and the increasing importance of food safety. In the last three years, China's organic planting area increased by 10%, reaching 2.4 million ha in 2020. In addition, national policies have been adopted to promote organic production, advocating the slogans that state, "lucid waters and lush mountains are invaluable assets" and "green development".

- Organic farming in China is majorly export-oriented. The products that are both exported and imported include cereals, soybeans, fruits, and vegetables. China's three northeastern provinces (Liaoning, Jilin, and Heilongjiang) support the largest organic production nationally in terms of output, volume, and area. Most organic farms located in the northern part of China (e.g., Shandong and Liaoning) supply organic vegetables and fruits to nearby cities. In addition, they export some products to Japan, South Korea, Europe, and the United States.

- With the increasing concerns of soil toxicity due to the overuse of synthetic fertilizers and pesticides that lead to soil contamination, the demand for sustainable agriculture practices and organic food production is on the rise in China. This moderately slow yet increasing shift in cultivation practices has also subsequently increased the demand for crop nutrition and protection products.

The growing demand for organic products, approximately 73% of Chinese consumers are willing to have organic food

- China's organic food market is developing rapidly, and the potential demand for organic food among Chinese consumers is enormous. This is due to the growth of the wealthier middle classes and a greater awareness of the health implications. In 2021, organic food sales in China amounted to about USD 77.54 billion.

- Due to various government laws that favor organic food over food safety and customer preferences for organic food over conventional food, the demand for organic food items has considerably expanded. While prices of organic vegetables in China range from 3 to 15 times the cost of conventional produce, prices for organic vegetables are generally between 5 and 10 times that of their conventional counterparts. However, despite the price factor being a barrier, wealthy families and individuals with health problems are eager to increase their budget, with approximately 73% of Chinese consumers willing to pay extra for organic foods.

- The Chinese government is slowly aiming to become self-reliant in the organic food sector. For instance, the economy is slowly moving toward a green agriculture practice by encouraging farmers to scale back the use of chemical fertilizers and switch to bio-based alternatives. The China Chain Store and Franchise Association (CCFA) research in 2020 declared that organic awareness among the Chinese population in developed cities was at 83% when it came to an understanding of the concept of sustainable food production. Although China's organic food sector is still quite small and falls far short of satisfying domestic and international consumer demand, it can be stated that organic food in China has enormous potential in both the domestic and foreign markets, considering the rise in domestic sales by 4.01% in 2021.

China Biostimulants Industry Overview

The China Biostimulants Market is fragmented, with the top five companies occupying 7.87%. The major players in this market are Atlantica Agricola, Biolchim SpA, Humic Growth Solutions Inc., Trade Corporation International and Valagro (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.3.1 China

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Form

- 5.1.1 Amino Acids

- 5.1.2 Fulvic Acid

- 5.1.3 Humic Acid

- 5.1.4 Protein Hydrolysates

- 5.1.5 Seaweed Extracts

- 5.1.6 Other Biostimulants

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Agrinos

- 6.4.2 Atlantica Agricola

- 6.4.3 Binzhou Jingyang Biological Fertilizer Co. Ltd

- 6.4.4 Biolchim SpA

- 6.4.5 Corteva Agriscience

- 6.4.6 Haifa Group

- 6.4.7 Humic Growth Solutions Inc.

- 6.4.8 Plant Response Biotech Inc.

- 6.4.9 Trade Corporation International

- 6.4.10 Valagro

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219