|

市場調查報告書

商品編碼

1797692

胺基酸類生物刺激素市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Amino Acid-Based Biostimulants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

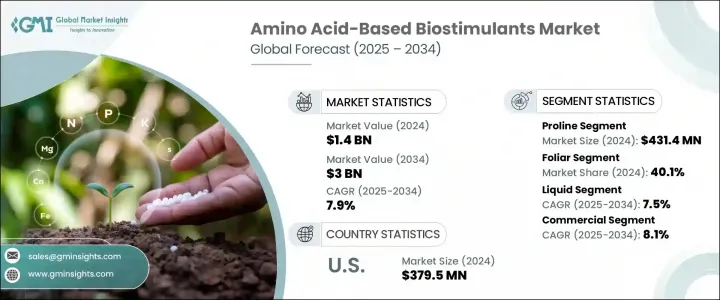

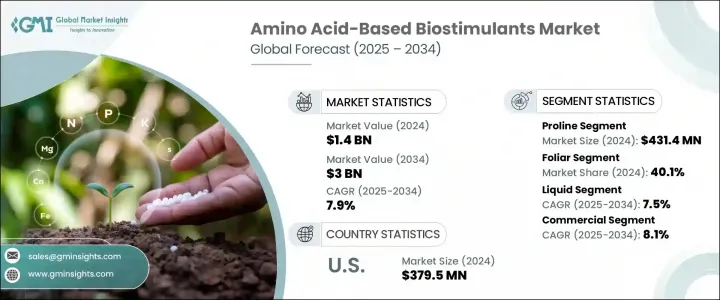

2024年,全球胺基酸類生物刺激素市場規模達14億美元,預計2034年將以7.9%的複合年成長率成長,達到30億美元。全球對永續農業解決方案的需求不斷成長,這些解決方案旨在提高產量並增強植物的抗逆性,推動了這一成長。氨基酸類生物刺激素源自甘氨酸、脯氨酸、L-精氨酸和丙氨酸等天然化合物,因其能夠提高作物產量、促進養分吸收以及增強對乾旱、高溫和鹽鹼等非生物脅迫因素的抵抗力而日益受到青睞。它們在改善土壤健康、植物代謝和作物整體品質方面發揮著重要作用,也正推動其在農業實踐中的廣泛應用。

隨著消費者日益重視環保食品生產,對綠色農業投入品的需求持續成長,胺基酸生物刺激素已成為現代農業食品體系的關鍵組成部分。這些天然投入品不僅符合永續農業實踐,還能為減少農業對化學品的依賴提供實際的解決方案。隨著在保持作物高產量的同時盡量減少環境影響的壓力日益增大,農民開始轉向使用氨基酸生物刺激素,因為它們能夠改善土壤健康,減少作物因脅迫而遭受的損失,並提高養分利用率。促進永續農業的監管政策以及對清潔標籤、有機和可追溯食品日益成長的需求也推動了這一轉變。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14億美元 |

| 預測值 | 30億美元 |

| 複合年成長率 | 7.9% |

葉面施肥由於其快速吸收率和能夠為處於逆境中的植物提供即時益處的能力,將在2024年佔據40.1%的市場佔有率。這種方法被廣泛用於促進養分吸收,並提高水果和蔬菜等作物的耐受性。土壤施肥也在穩步發展,因其能夠長期改善土壤微生物活性、養分利用率和植物整體活力而聞名。此外,市場對顆粒、封裝和奈米輸送系統的興趣日益濃厚,這些系統可以控制養分釋放,並支持精準農業技術。

脯胺酸仍然是市場上最重要的氨基酸之一,2024年的估值為4.314億美元。其價值在於增強植物的抗旱性、促進代謝穩定性以及支持植物的逆境恢復。除脯胺酸外,甘胺酸也因其螯合特性而變得越來越重要,這種特性可以提高營養物質的生物利用度,並刺激植物的強勁生長。

美國胺基酸類生物刺激素市場佔80.1%的市場佔有率,2024年市場規模達3.795億美元。受更有效率、更永續的農業實踐推動,美國市場正在顯著擴張。隨著人們對土壤退化、氣候變遷和生產力需求日益成長的擔憂,氨基酸類生物刺激素正被用作維持作物健康並以永續方式提高產量的可靠工具。

積極影響胺基酸類生物刺激素市場的關鍵公司包括科迪華公司 (Corteva, Inc.)、聯合磷化有限公司 (UPL Limited)、味之素株式會社 (Ajinomoto Co., Inc.)、巴斯夫公司 (BASF SE) 和嘉吉公司 (Cargill, Inc.)。為了加強在胺基酸類生物刺激素市場的地位,各公司正在優先考慮注重創新、永續性和區域擴張的策略。各公司正在投資先進的研發,以開發更有針對性和更有效率的配方,以滿足特定作物類型和環境條件。許多公司正在與農業科技公司和研究機構建立策略合作夥伴關係,將生物刺激素整合到精準農業解決方案中。各公司也正在擴大其分銷網路和生產能力,以滿足不斷成長的全球需求。透過專有胺基酸混合物和客製化解決方案實現產品差異化是重點,而圍繞永續性和有機農業的強大品牌建設進一步提高了市場知名度和消費者信任度。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 對永續和生態友善農業實踐的需求不斷增加。

- 提高農作物產量以滿足全球糧食需求。

- 生物刺激素配方的進步提高了植物的抗逆性。

- 產業陷阱與挑戰

- 生產成本高,規模經濟有限。

- 缺乏標準化,不同地區面臨監管挑戰。

- 市場機會

- 對環保投入的監管支持擴大了市場潛力。

- 高價值作物種植促進了生物刺激素的使用。

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依胺基酸類型,2021 - 2034

- 主要趨勢

- 甘胺酸

- 脯胺酸

- 丙胺酸

- 天門冬胺酸

- L-精胺酸

- 半胱氨酸和蛋氨酸

- 苯丙胺酸

- 其他胺基酸

- 色氨酸

- 離胺酸

- 蘇胺酸

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 葉面

- 土壤

- 種子處理

- 水耕和無土栽培

第7章:市場估計與預測:依形式類型,2021 - 2034

- 主要趨勢

- 液體

- 粉末/乾

- 顆粒狀

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 商業性農業

- 溫室和受控環境農業

- 有機農業

- 研究和學術機構

- 家庭園藝和業餘農業

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Ajinomoto Co., Inc.

- Archer Daniels Midland Company (ADM)

- BASF SE

- Bayer AG

- Cargill, Inc.

- Corteva, Inc.

- Evonik Industries AG

- Isagro SpA

- Natural Growth Biostimulants LLC

- Novozymes A/S

- Sumitomo Corporation

- UPL Limited

- Valagro SpA (Syngenta Group)

The Global Amino Acid-Based Biostimulants Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 3 billion by 2034. This growth is being fueled by the rising global demand for sustainable agricultural solutions that promote higher yields and improved plant resilience. Amino acid biostimulants, derived from naturally occurring compounds like glycine, proline, l-arginine, and alanine, are gaining traction due to their ability to boost crop productivity, support nutrient uptake, and strengthen resistance against abiotic stress factors like drought, heat, and salinity. Their role in enhancing soil health, plant metabolism, and overall crop quality is also driving strong adoption across farming practices.

With growing consumer focus on eco-friendly food production, the demand for green farming inputs continues to rise, positioning amino acid biostimulants as a key component in modern agri-food systems. These natural inputs not only align with sustainable agricultural practices but also offer a practical solution to reduce chemical dependency in farming. As pressure intensifies to minimize environmental impact while maintaining high crop productivity, farmers are turning to amino acid biostimulants for their ability to support soil health, reduce stress-related crop losses, and enhance nutrient efficiency. This shift is also being supported by regulatory policies promoting sustainable farming and a rising demand for clean-label, organic, and traceable food products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $3 Billion |

| CAGR | 7.9% |

The foliar application segment holds a 40.1% share in 2024, due to its rapid absorption rate and ability to provide immediate benefits to plants under stress. This method is widely used for boosting nutrient uptake and improving tolerance in crops like fruits and vegetables. Soil application is also expanding steadily, known for supporting long-term improvements in soil microbial activity, nutrient availability, and overall plant vigor. In addition, the market is seeing increasing interest in granular, encapsulated, and nano-delivery systems, which allow for controlled nutrient release and precision agriculture techniques.

The proline remains one of the most significant amino acids in the market, with a valuation of USD 431.4 million in 2024. Its value lies in its role in enhancing drought resistance, promoting metabolic stability, and supporting stress recovery in plants. Alongside proline, glycine is also becoming increasingly important due to its chelating properties, which improve nutrient bioavailability and stimulate robust plant growth.

United States Amino Acid-Based Biostimulants Market held an 80.1% share, generating USD 379.5 million in 2024. The U.S. is seeing notable market expansion driven by a push for more efficient and sustainable farming practices. Amid growing concerns over soil degradation, climate change, and productivity demands, amino acid biostimulants are being adopted as reliable tools to maintain crop health and improve yield outcomes in a sustainable way.

Key companies actively shaping the Amino Acid-Based Biostimulants Market include Corteva, Inc., UPL Limited, Ajinomoto Co., Inc., BASF SE, and Cargill, Inc. To strengthen their presence in the amino acid-based biostimulants market, companies are prioritizing strategies that focus on innovation, sustainability, and regional expansion. Firms are investing in advanced R&D to develop more targeted and efficient formulations that cater to specific crop types and environmental conditions. Many are forming strategic partnerships with agri-tech companies and research institutions to integrate biostimulants into precision farming solutions. Companies are also expanding their distribution networks and production capacity to meet the rising global demand. Product differentiation through proprietary amino acid blends and customized solutions is a key focus, while strong branding around sustainability and organic agriculture further enhances market visibility and consumer trust.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Amino acid type

- 2.2.3 Application

- 2.2.4 Form type

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for sustainable and eco-friendly agricultural practices.

- 3.2.1.2 Increased crop yield requirements to meet global food demands.

- 3.2.1.3 Advancements in biostimulants formulations for improved plant stress tolerance.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of production and limited economies of scale.

- 3.2.2.2 Lack of standardization and regulatory challenges in different regions.

- 3.2.3 Market opportunities

- 3.2.3.1 Regulatory support for eco-friendly inputs expands market potential.

- 3.2.3.2 High-value crop cultivation encourages biostimulant usage.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Amino Acid Type, 2021 - 2034 (USD Billion, Units)

- 5.1 Key trends

- 5.2 Glycine

- 5.3 Proline

- 5.4 Alanine

- 5.5 Asparagine

- 5.6 L-Arginine

- 5.7 Cysteine and methionine

- 5.8 Phenylalanine

- 5.9 Other amino acids

- 5.9.1 Tryptophan

- 5.9.2 Lysine

- 5.9.3 Threonine

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion, Tons)

- 6.1 Key trends

- 6.2 Foliar

- 6.3 Soil

- 6.4 Seed treatment

- 6.5 Hydroponic and soilless

Chapter 7 Market Estimates & Forecast, By Form Type, 2021 - 2034 (USD Billion, Tons)

- 7.1 Key trends

- 7.2 Liquid

- 7.3 Powder/dry

- 7.4 Granular

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion, Tons)

- 8.1 Key trends

- 8.2 Commercial agriculture

- 8.3 Greenhouse and controlled environment agriculture

- 8.4 Organic farming

- 8.5 Research and academic institutions

- 8.6 Home gardening and hobby farming

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion, Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Italy

- 9.3.4 Spain

- 9.3.5 Russia

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Ajinomoto Co., Inc.

- 10.2 Archer Daniels Midland Company (ADM)

- 10.3 BASF SE

- 10.4 Bayer AG

- 10.5 Cargill, Inc.

- 10.6 Corteva, Inc.

- 10.7 Evonik Industries AG

- 10.8 Isagro S.p.A.

- 10.9 Natural Growth Biostimulants LLC

- 10.10 Novozymes A/S

- 10.11 Sumitomo Corporation

- 10.12 UPL Limited

- 10.13 Valagro S.p.A. (Syngenta Group)