|

市場調查報告書

商品編碼

1693704

法國潮汐能:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)France Tidal Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

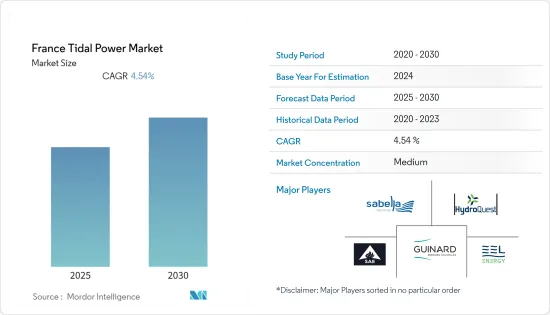

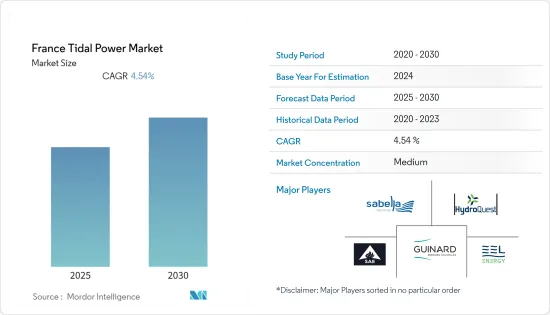

預計法國潮汐能市場在預測期內的複合年成長率將達到 4.54%

關鍵亮點

- 從長遠來看,預計在預測期內,潮汐能領域的投資增加和即將開展的計劃等因素將推動市場發展。

- 相反,替代清潔能源的日益普及正在阻礙該國潮汐能市場的成長。

- 預計在預測期內,與全國各地浮體式潮汐能平台相關的技術進步和研究能力的提高將為法國潮汐能市場帶來重大機會。

法國潮汐能市場趨勢

水平軸渦輪機預計將佔據市場主導地位

- 水平軸潮汐渦輪機使用與水流方向平行(水平)的葉片。這些渦輪機的設計與風力發電機機類似,但由於水的密度較大,因此葉片比風力發電機的葉片更小,旋轉速度也更慢。

- 與風力發電機一樣,水平潮汐渦輪機也有幾種配置,包括重力基座、單樁、樁柱導管架和浮體式。此外,它們必須承受比風力發電機更大的力量和運動。水平軸潮汐渦輪機是商用應用最廣泛的渦輪機類型,因為與其他潮汐渦輪機設計相比,它們利用潮汐發電的成本最低。

- 此外,水平軸設計在現場條件下具有高可靠性,並降低了維護成本和頻率,使其成為永續的潮流源和具有成本吸引力的洋流利用方式。

- 2022 年 12 月,Sabella 獲得了必維國際檢驗集團 (Bureau Veritas) 認證,符合 IEC 標準,適用於安裝在弗洛姆沃特航道烏尚特島近海的 D10 渦輪機的功率曲線,計劃。這是 Sabella 與 56Energies 合作開發的潮汐發電工程,旨在在莫爾比昂灣入口處的 Jument Current 安裝兩台實驗性潮汐渦輪機,運行三年。

- 因此,2023 年 1 月,薩貝拉獲得安裝兩台 250kW 潮汐渦輪機的許可。該許可證允許薩貝拉三年的時間來安裝渦輪機。 TIGER計劃的預計資金約為860萬美元。

- 考慮到上述情況和最近的發展,預計在預測期內,法國潮汐能市場將由水平軸渦輪機主導。

預計增加投資和即將開展的計劃將推動市場

- 法國是潮汐能的主要市場。據歐洲海洋能源組織 (OEE) 稱,該國預計有潛力部署 300 萬至 550 萬千瓦的發電容量。最有前景的地區是位於諾曼第海岸線和英吉利海峽奧爾德尼島之間的拉茲布蘭查德 (Raz Blanchard),預計潛在容量為 2GW。考慮到奧爾德尼島的領海,一些研究估計該地區的發電量在 3.9 至 5.1 吉瓦之間。

- 法國有幾處潮汐能試驗場。波爾多的 SEENEOH 經營一個潮汐試驗站,並為法國國家能源公司 EDF 的 Paimpol-Brehat 站提供支援。

- 展望未來,政府推出的上網電價和其他財政激勵措施等促進再生能源發展的優惠政策正在吸引更多的投資者,他們認為與煤炭和天然氣等石化燃料相比,再生能源投資是更安全、更可行的長期投資。潮汐發電工程投資的不斷增加,極大地促進了該國潮汐發電領域的成長。此外,截至2022年,該國已裝置的海洋能源容量已達211兆瓦。政府推出的諸如開發潮汐能的 TIGER計劃等措施可能會促進市場成長。

- 此外,2022 年 7 月,荷蘭公司 Hydrokinetic Power Systems (HPGS) 宣佈在波爾多的 Cineo 測試場安裝 25kW 潮汐渦輪機示範機。該渦輪機將於 2022 年 12 月連接到波爾多電網的 Pont de Pierre 部分。

- 此外,法國的下一個能源多年期計畫將在 2030 年實現 0.5-1 吉瓦的潮汐能發電量,到 2050 年的總體目標為 4 吉瓦。預計即將實施的幾個計劃將完善該領域的產業結構,增強競爭力,並為該地區創造就業機會。因此,該國的地理位置預計將在促進該國潮汐能市場的投資方面發揮關鍵作用。

- 因此,鑑於上述情況,預計在預測期內,增加的投資和即將開展的計劃將推動法國潮汐能市場的發展。

法國潮汐能產業概況

法國潮汐能市場細分程度適中。市場的主要企業(不分先後順序)包括 Sabella SAS、SIMEC Atlantis Energy Ltd、Hydroquest SAS、Guinard Energies Nouvelles 和 EEL Energy。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 2028年潮汐能裝置容量及預測(單位:MW)

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 增加潮汐能領域的投資和即將開展的計劃

- 限制因素

- 越來越多採用替代清潔能源

- 驅動程式

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 發電方式

- 潮汐堰

- 浮體式潮汐能平台

- 潮汐發電

- 動態潮汐發電

- 潮汐能轉換器

- 水平軸渦輪機

- 垂直軸渦輪機

- 其他潮汐能轉換裝置

第6章競爭格局

- 合併、收購、合作及合資

- 主要企業策略

- 公司簡介

- Sabella SAS

- Morbihan Hydro Energies SAS

- Nova Innovation

- SIMEC Atlantis Energy Ltd

- Hydroquest SAS

- EEL Energy

- Guinard Energies Nouvelles

第7章 市場機會與未來趨勢

- 各國在浮體式潮汐能平台方面的技術進步與研究能力不斷提高

簡介目錄

Product Code: 93581

The France Tidal Power Market is expected to register a CAGR of 4.54% during the forecast period.

Key Highlights

- Over the long term, factors such as increasing investments in the tidal energy sector and upcoming projects are expected to drive the market in the forecast period.

- Conversely, the increasing adoption of alternative clean power sources hinders the country's Tidal Power Market growth.

- Nevertheless, growing technological advancements and research capabilities across the country related to floating tidal power platform is expected to be a significant opportunity for the France tidal power market in the forecast period.

France Tidal Power Market Trends

Horizontal Axis Turbine Segment is Expected to Dominate the Market

- Horizontal axis tidal turbines use blades positioned parallel (horizontal) to the direction of the flow of water. The turbines are like designs used for wind turbines, but due to the higher density of water, the blades are more minor and turn more slowly than wind turbines.

- Similar to wind turbines, horizontal tidal turbines can have several configurations such as Gravity base, Monopile, Piled Jacket, and Floating. Furthermore, they must withstand greater forces and movements than wind turbines. Horizontal axis tidal turbines are the most widely deployed commercial turbine model type as they have the lowest cost of electricity from tides compared with alternative tidal turbine designs.

- Additionally, horizontal designs offer higher reliability in field conditions and reduce maintenance costs and frequency to remain a sustainable source and cost-attractive exploitation of marine currents.

- Going ahead, in December 2022, Sabella received certification of the power curve for its s D10 turbine from Bureau Veritas according to IEC standards, immersed off Ushant in the FromveurPassage, a project funded by the TIGER project. This is a tidal energy project being developed by Sabella in collaboration with 56 Energies, which aims to install two experimental tidal turbines in the current of the Jument, at the entrance to the Gulf of Morbihan, for three years.

- Consequently, in January 2023, Sabella received approval to deploy its two 250 kW tidal energy turbines. The permit will allow Sabella to install the turbines for three years. The funding received from the TIGER project is estimated to be around USD 8.6 million.

- Owing to the above points and the recent developments, the Horizontal axis turbine segment is expected to dominate the France Tidal Power Market during the forecast period.

Increasing Investments and Upcoming Projects are Expected to Drive the Market

- France is a leading market for tidal power. According to Ocean Energy Europe (OEE), it is estimated that the country has the potential to deploy 3-5.5 GW of capacity. The most promising area is the Raz Blanchard, between the Normandy coastline and the Channel Island of Alderney, with an estimated potential of 2 GW of capacity. Some studies have estimated that the capacity in this region, considering Alderney's territorial waters, could be as high as 3.9-5.1 GW.

- France is home to several leading tidal power test sites. SEENEOH, located in Bordeaux, operates a tidal test site and supports EDF, a French state-owned integrated energy company at the Paimpol-Brehat site.

- Going ahead, favorable government policies promoting the development of renewables, such as Feed-in Tariff schemes and other financial incentives, have attracted more investors, who view renewable energy investments as secure and more viable long-term investments compared to fossil fuels such as coal and natural gas. The increasing investments in tidal power projects have been providing a significant boost to the growth of the tidal power sector in the country. Also, as of 2022, the marine energy installed capacity in the country reached 211 MW. The growing government initiative such as TIGER project in order to develop tidal energy will in turn culminate in the growth of the market.

- Moreover, in July 2022, the Dutch company Hydrokinetic power generation system (HPGS) announced the installation 25 kW tidal turbine demonstrator on the Seeneohtest site in Bordeaux. The turbines were connected to the Pont de Pierre in the Bordeaux electricity grid in December 2022.

- Additionally, France's next Multiannual Energy Plan has targeted to register between 0.5 and 1 GW of Tidal stream energy by 2030, with an overall target of 4 GW by 2050. Several upcoming projects are expected to enable the sector to become industrially structured and competitive and create jobs in the regions. Thus, the country's geographical location is expected to play a vital role in boosting investment in the country's tidal power market.

- Hence, owing to the above points, the increasing investments and upcoming projects are expected to drive the France Tidal Power Market during the forecast period.

France Tidal Power Industry Overview

The France Tidal Power Market is moderately fragmented in nature. Some major companies operating in the market (in no particular order) are Sabella SAS, SIMEC Atlantis Energy Ltd, Hydroquest SAS, Guinard Energies Nouvelles, and EEL Energy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Tidal Power Installed Capacity and Forecast in MW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Investments in the Tidal Energy Sector and Upcoming Projects

- 4.5.2 Restraints

- 4.5.2.1 Increasing Adoption of Alternative Clean Power Source

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Power Generation Method

- 5.1.1 Tidal Barrage

- 5.1.2 Floating Tidal Power Platform

- 5.1.3 Tidal Stream Generation

- 5.1.4 Dynamic Tidal Power

- 5.2 Tidal Energy Converters

- 5.2.1 Horizontal Axis Turbine

- 5.2.2 Vertical Axis Turbine

- 5.2.3 Other Tidal Energy Converters

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration, and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Sabella SAS

- 6.3.2 Morbihan Hydro Energies SAS

- 6.3.3 Nova Innovation

- 6.3.4 SIMEC Atlantis Energy Ltd

- 6.3.5 Hydroquest SAS

- 6.3.6 EEL Energy

- 6.3.7 Guinard Energies Nouvelles

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Technological Advancements and Research Capabilities across the Country Related to Floating Tidal Power Platform

02-2729-4219

+886-2-2729-4219