|

市場調查報告書

商品編碼

1693689

越南建築化學品:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Vietnam Construction Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

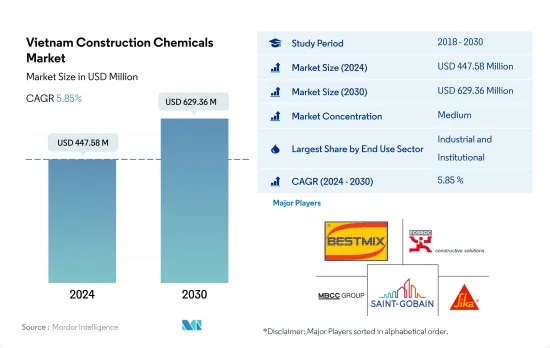

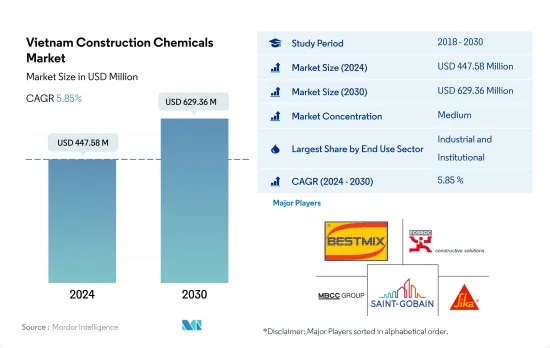

越南建築化學品市場規模預計在 2024 年為 4.4758 億美元,預計到 2030 年將達到 6.2936 億美元,預測期內(2024-2030 年)的複合年成長率為 5.85%。

越南正在成為全球製造地,大大促進了市場成長

- 2022年,受越南建設活動強勁成長的推動,越南建築化學品市場需求激增5.6%。預計2023年建設產業價值將成長7.8%,建築化學品需求預計將成長5.7%。

- 2022年,工業和機構部門將成為建築化學品的主要消費領域。由於非住宅建築範圍更廣且需求多樣化,該行業對這些化學品的需求比住宅領域更高。此外,這些計劃通常由組織資助,因此擁有充足的資金。

- 此外,商業部門在 2022 年對建築化學品的需求位居第二。繼工業和機構部門之後,商業建築的總需求超過了其他部門。越南重視私人投資,其蓬勃發展的旅遊業和快速成長的都市區正在推動該領域的建設和支出。

- 此外,越來越多的企業選擇在越南設立或遷移製造工廠,同時也可能在教育和醫療保健基礎設施方面進行投資。因此,這些有利因素預計將以最快的速度推動工業和設施領域的需求,預測期內(2023-2030 年)的複合年成長率為 6.24%。

越南建築化學品市場趨勢

國內和國際業務的成長預計將推動商業建設

- 2021 年至 2022 年,越南商業領域新增占地面積1,000 萬平方英尺。值得注意的是,2018 年至 2022與前一年同期比較成長。 2022 年,幾個著名計劃推動了該領域的擴張,包括 Cadia Qui Nhon 綜合用途開發項目、鐵市場商業綜合體和 Crystal Holidays Harbor Van Don 旅遊度假村和娛樂綜合體。展望未來,商業空間的需求預計將增加,預計 2023 年新增占地面積將比 2022 年增加 7.4%。

- 2020 年上半年,越南建設產業成長速度超過 GDP 成長速度,成長 4.5%,而 GDP 成長率為 1.8%。儘管面臨新冠疫情的挑戰,越南經濟在 2020 年仍實現了 2.9% 的成長。這種韌性導致商業領域新占地面積與 2019 年相比激增 8%。此外,受 2021 年外國直接投資 (FDI) 顯著成長 9.2% 的推動,新建商業建築的建設也隨之增加,該領域新建占地面積與前一年同期比較成長 5.51%。

- 作為世界上成長最快的經濟體之一和亞洲熱門旅遊目的地,越南正在成為一個有吸引力的投資中心。越南擁有強勁的服務業和具有競爭力的勞動力標準,吸引了國內外投資者的注意。在此背景下,預計 2023-2030 年預測期內商業空間建設的複合年成長率將達到 4.62%。

都市化加速和外國直接投資將推動越南住宅產業的成長

- 2022年,越南住宅新占地面積成長6.3%,超過前一年。這一成長主要由於住宅需求激增,導致越南住宅房地產市場價值增加了4.5%。展望未來,預計2023年新建築占地面積將成長6.43%。這一成長凸顯了越南的經濟發展勢頭,因為該國的人均GDP預計將成長18.1%。

- 2020年,在新冠疫情期間,新屋開工占地面積較2019年下降了10.36%。這一下降主要是由於出行限制導致的勞動力短缺、人均收入下降以及由此導致的住宅需求減弱等因素造成的。不過,2021年越南開始復甦,GDP反彈至3,661.4億美元,與前一年同期比較去年同期成長5.63%。相應地,住宅新占地面積較2020年增加5.85%。

- 在不斷壯大的中產階級的推動下,越南的住宅需求預計將保持上升趨勢。快速的都市化和不斷發展的股票購買和股權投資趨勢進一步增強了這種需求,使外國投資者更容易獲得可建造土地。此外,越南正在修改土地和住宅法,旨在保護公民和投資者的利益。因此,預計 2023-2030 年預測期內住宅領域的銷售成長率將達到 5.51%。

越南建築化學品產業概況

越南建築化學品市場適度整合,前五大公司佔45.68%。該市場的主要企業有:Bestmix Corporation、Fosroc, Inc.、MBCC Group、Saint-Gobain 和 Sika AG(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 終端使用領域的趨勢

- 商業

- 工業/設施

- 基礎設施

- 住宅

- 重大基礎建設計劃

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 最終用途領域

- 商業

- 工業/設施

- 基礎設施

- 住宅

- 產品

- 膠水

- 按子產品

- 熱熔膠

- 反應性

- 溶劑型

- 水

- 錨栓和水泥漿

- 按子產品

- 水泥基固定材料

- 樹脂固定

- 其他類型

- 混凝土外加劑

- 按子產品

- 加速器

- 引氣劑

- 高效減水劑(塑化劑)

- 阻燃劑

- 減縮劑

- 黏度調節劑

- 減水劑(塑化劑)

- 其他類型

- 混凝土保護漆

- 按子產品

- 丙烯酸纖維

- 醇酸

- 環氧樹脂

- 聚氨酯

- 其他樹脂

- 地板樹脂

- 按子產品

- 丙烯酸纖維

- 環氧樹脂

- 聚天冬醯胺

- 聚氨酯

- 其他樹脂類型

- 修復和再生化學品

- 按子產品

- 光纖纏繞系統

- 水泥漿料

- 微混凝土砂漿

- 改質砂漿

- 鋼筋保護材料

- 密封材料

- 按子產品

- 丙烯酸纖維

- 環氧樹脂

- 聚氨酯

- 矽膠

- 其他樹脂

- 表面處理化學品

- 按子產品

- 硬化劑

- 脫模劑

- 其他產品類型

- 防水解決方案

- 按子產品

- 化學產品

- 膜

- 膠水

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Arkema

- Bestmix Corporation

- Fosroc, Inc.

- KKS GROUP, JSC.

- MAPEI SpA

- MBCC Group

- MC-Bauchemie

- RPM International Inc.

- Saint-Gobain

- Sika AG

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 93386

The Vietnam Construction Chemicals Market size is estimated at 447.58 million USD in 2024, and is expected to reach 629.36 million USD by 2030, growing at a CAGR of 5.85% during the forecast period (2024-2030).

Vietnam is becoming a global manufacturing hub, boosting the growth of the market significantly

- In 2022, Vietnam's construction chemicals market witnessed a 5.6% surge in demand, driven by a robust uptick in construction activities in the country. The construction industry was predicted to experience a 7.8% value growth in 2023, further fueling a projected 5.7% uptick in the demand for construction chemicals.

- The industrial and institutional sectors emerged as the key consumers of construction chemicals in the country in 2022. This sector, with its expansive non-residential construction footprint and diverse requirements, exhibited a higher demand for these chemicals compared to the residential segment. In addition, these projects are typically funded by organizations, ensuring ample financial resources.

- Furthermore, the commercial sector secured the second-highest demand for construction chemicals in 2022. Following the industrial and institutional sectors, the collective demand from commercial buildings outpaced other segments. Vietnam's emphasis on private investments, a thriving tourism industry, and a surging urban population have propelled construction and spending in this sector.

- Moreover, there is a growing trend among firms to establish or relocate their manufacturing facilities to Vietnam, alongside potential investments in educational and healthcare infrastructure. Consequently, the industrial and institutional sectors are anticipated to witness the swiftest demand growth due to such favorable factors, with a projected CAGR of 6.24% during the forecast period (2023-2030).

Vietnam Construction Chemicals Market Trends

Rising domestic and international businesses are expected to boost commercial construction

- The commercial sector in Vietnam witnessed a 10 million sq. ft increase in new floor construction from 2021 to 2022. Notably, the sector displayed a consistent year-on-year growth from 2018 to 2022. In 2022, several prominent projects, including Cadia Qui Nhon Mixed-Use Development, Iron Market Commercial Complex, and Crystal Holidays Harbor Van Don Tourism Resort and Entertainment Complex, bolstered the sector's expansion. Looking ahead, the demand for commercial spaces was projected to rise in 2023, with an estimated 7.4% increase in new floor area compared to 2022.

- During the first half of 2020, the Vietnamese construction industry outpaced the nation's GDP growth, expanding by 4.5% compared to the 1.8% GDP growth. Despite the challenges posed by the COVID-19 pandemic, Vietnam's economy still managed a 2.9% growth in 2020. This resilience translated into the commercial sector's new floor area witnessing an 8% surge over 2019. Furthermore, buoyed by a notable 9.2% rise in foreign direct investment (FDI) in 2021, the construction of new commercial buildings escalated, propelling the sector's new floor area to grow by 5.51% from the previous year.

- With its status as one of the world's fastest-growing economies and a sought-after tourist destination in Asia, Vietnam has emerged as an enticing investment hub. Leveraging its robust service sector and competitive labor standards, the country has garnered attention from both domestic and international investors. Against this backdrop, the construction of commercial spaces is projected to witness a CAGR of 4.62% during the forecast period of 2023-2030.

Rising urbanization and foreign direct investment to propel the growth of Vietnam's residential sector

- In 2022, Vietnam's residential sector witnessed a 6.3% increase in new floor area construction, surpassing the figures from the previous year. This uptick was primarily driven by a surge in housing demand, resulting in a 4.5% uptick in the value of the country's residential real estate market. Looking ahead, the sector was projected to witness a 6.43% rise in new floor area construction in 2023. This growth was expected to be bolstered by an anticipated 18.1% increase in Vietnam's GDP per capita, highlighting the country's economic momentum.

- The year 2020, marked by the COVID-19 pandemic, saw a notable 10.36% dip in new floor area construction compared to 2019. This decline was largely attributed to factors such as labor shortages due to travel restrictions, reduced per capita income, and consequent dampened demand for residential spaces. However, in 2021, as Vietnam began its recovery, the GDP rebounded to USD 366.14 billion, marking a 5.63% upswing from the previous year. Correspondingly, the residential sector saw a 5.85% increase in new floor area construction compared to 2020.

- Driven by a burgeoning middle-class segment, Vietnam's demand for housing is poised to sustain its upward trajectory. This demand is further bolstered by rapid urbanization and evolving trends in share purchase and capital contribution, which facilitate foreign investors' access to construction-ready land plots. Additionally, Vietnam is in the process of amending its land and housing laws, aiming to safeguard the interests of both the public and investors. As a result, the residential sector is projected to witness volume growth at a CAGR of 5.51% during the forecast period of 2023-2030.

Vietnam Construction Chemicals Industry Overview

The Vietnam Construction Chemicals Market is moderately consolidated, with the top five companies occupying 45.68%. The major players in this market are Bestmix Corporation, Fosroc, Inc., MBCC Group, Saint-Gobain and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End Use Sector Trends

- 4.1.1 Commercial

- 4.1.2 Industrial and Institutional

- 4.1.3 Infrastructure

- 4.1.4 Residential

- 4.2 Major Infrastructure Projects (current And Announced)

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size, forecasts up to 2030 and analysis of growth prospects.)

- 5.1 End Use Sector

- 5.1.1 Commercial

- 5.1.2 Industrial and Institutional

- 5.1.3 Infrastructure

- 5.1.4 Residential

- 5.2 Product

- 5.2.1 Adhesives

- 5.2.1.1 By Sub Product

- 5.2.1.1.1 Hot Melt

- 5.2.1.1.2 Reactive

- 5.2.1.1.3 Solvent-borne

- 5.2.1.1.4 Water-borne

- 5.2.2 Anchors and Grouts

- 5.2.2.1 By Sub Product

- 5.2.2.1.1 Cementitious Fixing

- 5.2.2.1.2 Resin Fixing

- 5.2.2.1.3 Other Types

- 5.2.3 Concrete Admixtures

- 5.2.3.1 By Sub Product

- 5.2.3.1.1 Accelerator

- 5.2.3.1.2 Air Entraining Admixture

- 5.2.3.1.3 High Range Water Reducer (Super Plasticizer)

- 5.2.3.1.4 Retarder

- 5.2.3.1.5 Shrinkage Reducing Admixture

- 5.2.3.1.6 Viscosity Modifier

- 5.2.3.1.7 Water Reducer (Plasticizer)

- 5.2.3.1.8 Other Types

- 5.2.4 Concrete Protective Coatings

- 5.2.4.1 By Sub Product

- 5.2.4.1.1 Acrylic

- 5.2.4.1.2 Alkyd

- 5.2.4.1.3 Epoxy

- 5.2.4.1.4 Polyurethane

- 5.2.4.1.5 Other Resin Types

- 5.2.5 Flooring Resins

- 5.2.5.1 By Sub Product

- 5.2.5.1.1 Acrylic

- 5.2.5.1.2 Epoxy

- 5.2.5.1.3 Polyaspartic

- 5.2.5.1.4 Polyurethane

- 5.2.5.1.5 Other Resin Types

- 5.2.6 Repair and Rehabilitation Chemicals

- 5.2.6.1 By Sub Product

- 5.2.6.1.1 Fiber Wrapping Systems

- 5.2.6.1.2 Injection Grouting Materials

- 5.2.6.1.3 Micro-concrete Mortars

- 5.2.6.1.4 Modified Mortars

- 5.2.6.1.5 Rebar Protectors

- 5.2.7 Sealants

- 5.2.7.1 By Sub Product

- 5.2.7.1.1 Acrylic

- 5.2.7.1.2 Epoxy

- 5.2.7.1.3 Polyurethane

- 5.2.7.1.4 Silicone

- 5.2.7.1.5 Other Resin Types

- 5.2.8 Surface Treatment Chemicals

- 5.2.8.1 By Sub Product

- 5.2.8.1.1 Curing Compounds

- 5.2.8.1.2 Mold Release Agents

- 5.2.8.1.3 Other Product Types

- 5.2.9 Waterproofing Solutions

- 5.2.9.1 By Sub Product

- 5.2.9.1.1 Chemicals

- 5.2.9.1.2 Membranes

- 5.2.1 Adhesives

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 Bestmix Corporation

- 6.4.3 Fosroc, Inc.

- 6.4.4 KKS GROUP, JSC.

- 6.4.5 MAPEI S.p.A.

- 6.4.6 MBCC Group

- 6.4.7 MC-Bauchemie

- 6.4.8 RPM International Inc.

- 6.4.9 Saint-Gobain

- 6.4.10 Sika AG

7 KEY STRATEGIC QUESTIONS FOR CONCRETE, MORTARS AND CONSTRUCTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219