|

市場調查報告書

商品編碼

1693674

歐洲乾混砂漿市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Europe Dry Mix Mortar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

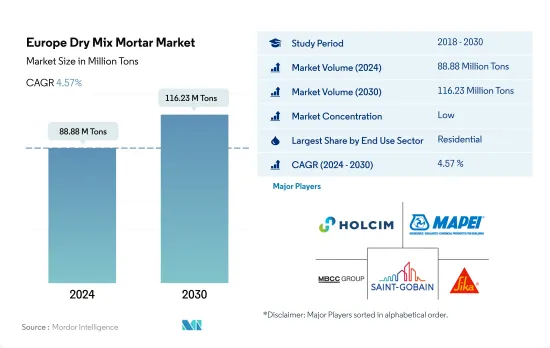

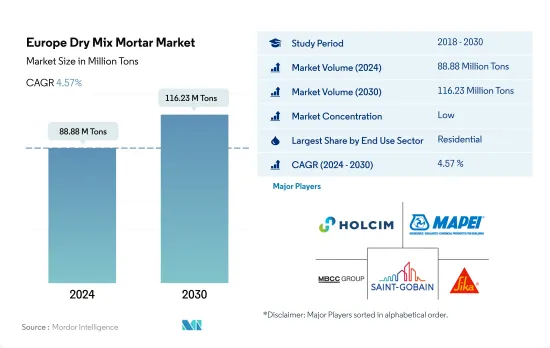

預計 2024 年歐洲乾混砂漿市場規模為 8,888 萬噸,到 2030 年將達到 1.1623 億噸,預測期內(2024-2030 年)的複合年成長率為 4.57%。

歐洲維修熱潮興起推動乾混砂漿市場成長

- 2022年,歐洲終端使用領域的乾混砂漿消耗量將成長5%,超過前一年。值得注意的是,商業領域消費量成長最快。 2023年,俄羅斯和義大利預計將分別實現5.6%和5%的顯著成長,該全部區域消費量預計將比2022年成長約4%。

- 歐洲乾混砂漿的消費主要集中在住宅領域,尤其是住宅的灰泥塗料和粉刷應用。這些應用將佔2022年該產業乾混砂漿總消費量的64%。由於更加重視節能重建,預計住宅領域的消費量將顯著成長。

- 繼住宅領域之後,商業領域在該地區乾混砂漿的使用中佔有最大的佔有率。值得注意的是,抹灰、石膏和防水漿料是該領域最受歡迎的應用,佔 2022 年總消費量的 71%。

- 預測期內(2023-2030 年),商業部門預計在歐洲市場終端使用產業中乾混砂漿消費量將呈現最高的複合年成長率,為 5.39%。此次激增是由於歐盟委員會掀起的維修新浪潮所致,預計該領域的維修率將大幅上漲。升級的商業建築具有租金更高、租戶更容易獲得等優勢,比老舊商業建築更具吸引力。

義大利乾混砂漿市場的快速擴張以及德國和俄羅斯的高需求正在推動市場成長

- 在歐洲,2022年乾混砂漿的需求將激增5%,超過前一年的數據。義大利和俄羅斯將引領這一成長,2022 年的需求將分別成長 7.7%。在歐洲,預計 2023 年乾混砂漿的需求將增加 4%,主要由住宅和商業領域的推動。

- 德國繼續主導歐洲乾混砂漿需求,到 2022 年平均佔有率將達到 15%。這一優勢得益於其強勁的住宅領域,由於德國是歐洲第二人口大國,到 2022 年,住宅領域將佔歐洲乾混砂漿總消費量的 12% 左右。

- 俄羅斯是歐洲第二大乾混砂漿消費國。雖然住宅領域引領消費,但商業領域緊隨其後。 2022年,商業部門佔俄羅斯總消費量的12%。隨著住宅建築占地面積的快速擴大,乾混砂漿的消費量將會上升,預計2023-2030年期間的複合年成長率將達到6%左右。

- 預計義大利將成為歐洲乾混砂漿需求成長最快的國家,預測期內複合年成長率預計為 5.28%。義大利的綠色住宅計畫正在進一步推動,目標是到 2033 年每天重建約 7,400住宅,使其達到 D 級能源標準。預計磁磚膠黏劑和水泥漿的需求將會成長,2023 年至 2030 年期間的複合年成長率分別為 6.56% 和 6.41%。

歐洲乾混砂漿市場趨勢

西班牙、義大利等國辦公大樓擴建計劃推動歐洲商業建築市場

- 在歐洲,由於更重視建造節能辦公大樓以符合 2030 年碳排放目標,新的商業占地面積在 2022 年增加了 12.70%。隨著員工重返辦公空間,歐洲公司也相應活性化了租賃決策,導致 2022 年新增辦公空間 570 萬平方英尺。預計 2023 年將繼續保持這一成長勢頭,預計成長率將比 2022 年提高 2.68%。

- 新冠疫情造成嚴重的勞動力和材料短缺,導致多個商用建築計劃被取消或延遲。然而,隨著關閉措施的放鬆和建設活動的恢復,歐洲 2021 年新增商業占地面積強勁成長 16.60%,其中西班牙以 105.05% 的成長率領先。

- 歐洲商業建築業預計將經歷顯著成長,預計預測期內新占地面積的複合年成長率將達到 3.88%。一些值得關注的計劃,例如位於義大利米蘭的美國總領事館綜合大樓(耗資 6500 萬美元,預計於 2025 年竣工)和位於西班牙的 Arteixo 辦公大樓擴建項目(耗資 2.6 億美元,佔地 180 萬平方英尺,預計於 2024 年運作),預計將增強該地區的商業建築格局。隨著消費者偏好從線上零售轉向線下零售,預計到 2030 年歐洲新零售商場占地面積將比 2022 年增加 4.283 億平方英尺。

預計英國和歐洲各地經濟適用住宅計劃和已完工住宅計劃的增加將推動新住宅占地面積的成長。

- 在歐洲住宅建築領域,2022年新占地面積較去年與前一年同期比較成長2.71%。其背景是都市化的上升,預計城市人口將從2020年的73.5%上升到2022年的75%。預計這一趨勢將在2023年繼續,預計成長率為2022年的3.21%。根據EURO CONSTRUCT網路的數據,預計2023年歐洲已竣工住宅計劃數量將增加2.7%,其中匈牙利、愛爾蘭、挪威和波蘭將顯著成長。

- 新冠疫情導致景氣衰退,許多住宅計劃被取消或推遲。因此,2020年歐洲新建住宅占地面積較去年與前一年同期比較9.40%。然而,隨著封鎖限制的放鬆和建設活動的恢復,該行業強勁復甦,2021 年的新占地面積比 2020 年飆升 18.28%。西班牙成長顯著,增幅達 40.23%,其次是義大利,增幅達 25.07%。

- 預計預測期內歐洲新住宅占地面積的複合年成長率將達到 3.89%。英國將引領這一成長,複合年成長率為 5.94%。這種成長是由對經濟適用住宅的需求不斷成長所推動的,特別是在人口成長和住宅供應有限的都市區。英國政府的經濟適用房計畫旨在2026年提供13萬套住宅,擴大英國的住宅占地面積,投資額為80億美元。

歐洲乾混砂漿產業概況

歐洲乾混砂漿市場較為分散,前五大公司佔16.74%的市佔率。市場的主要企業包括 Holcim、MAPEI SpA、MBCC Group、Saint-Gobain、Sika AG 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用途細分趨勢

- 商業的

- 工業/設施

- 基礎設施

- 住宅

- 重大基礎設施計劃(目前和已宣布)

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 最終用途部分

- 商業的

- 工業/設施

- 基礎設施

- 住宅

- 應用

- 混凝土保護與維修

- 水泥漿

- 絕緣和飾面系統

- 石膏

- 使成為

- 磁磚膠

- 防水漿料

- 其他

- 國家

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 英國

- 其他歐洲國家

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Ardex Group

- Baumit Group

- Grupo Puma

- Henkel AG & Co. KGaA

- Holcim

- Knauf Digital GmbH

- MAPEI SpA

- MBCC Group

- Saint-Gobain

- Sika AG

第7章 CEO 的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 93234

The Europe Dry Mix Mortar Market size is estimated at 88.88 million Tons in 2024, and is expected to reach 116.23 million Tons by 2030, growing at a CAGR of 4.57% during the forecast period (2024-2030).

The rising renovation wave in Europe to boost the dry mix mortar market's growth

- In 2022, Europe witnessed a 5% uptick in its consumption of dry mix mortar across end-use sectors, surpassing the previous year. Notably, the commercial sector saw the most significant surge in consumption. Driven by notable increases of 5.6% and 5% from Russia and Italy, respectively, in 2023, the region's overall consumption was projected to rise by around 4% compared to 2022.

- The residential sector dominates Europe's dry mix mortar consumption, particularly for plaster and render applications in residential buildings. These applications accounted for 64% of the sector's total consumption of dry mix mortar in 2022. With a growing emphasis on energy-efficient renovations, the residential sector's consumption is set to witness a notable upswing.

- Following the residential sector, the commercial sector commands the largest share of dry-mix mortar utilization in the region. Notably, render, plaster, and waterproofing slurries are the most preferred applications in this sector, collectively accounting for a 71% share of its total consumption in 2022.

- The commercial sector is projected to witness the highest CAGR of 5.39% in dry mix mortar consumption among end-use sectors across the European market during the forecast period (2023-2030). This surge is attributed to the sector's anticipated surge in renovation rates, driven by the European Commission's renovation wave. Upgraded commercial buildings offer advantages such as higher rental charges and enhanced tenant accessibility, making them more appealing than their outdated counterparts.

The rapidly expanding dry mix mortar market in Italy, coupled with high demand from Germany and Russia, will aid market growth

- Europe witnessed a 5% surge in its dry mix mortar demand in 2022, surpassing the figures from the previous year. Notably, Italy and Russia led this growth, with demand surges of 7.7% each in 2022. Europe witnessed a 4% uptick in dry mix mortar demand in 2023, driven primarily by the residential and commercial sectors.

- Germany has consistently topped the charts for dry mix mortar demand in Europe, commanding an average share of 15% until 2022. This dominance is attributed to its robust residential sector, which accounted for nearly 12% of Europe's total consumption in 2022, as Germany is the second most populous country in Europe.

- Russia stands as Europe's second-largest consumer of dry mix mortar. While the residential sector leads in consumption, the commercial sector follows closely. In 2022, the commercial sector accounted for a 12% share of Russia's total consumption. With the residential sector's floor area set for rapid expansion, its dry mix mortar consumption is projected to grow, registering a CAGR of approximately 6% from 2023 to 2030.

- Italy is poised to witness the swiftest growth in dry mix mortar demand across Europe, with a projected CAGR of 5.28% during the forecast period. Italy's push for green homes adds further impetus, as it aims to renovate around 7,400 homes per day by 2033 to meet energy class D standards. The demand for tile adhesives and grouts is expected to grow, with CAGRs of 6.56% and 6.41%, respectively, from 2023 to 2030.

Europe Dry Mix Mortar Market Trends

Office building expansion projects in countries such as Spain and Italy are boosting the commercial construction market in Europe

- Europe witnessed a 12.70% surge in the new floor area for commercial construction in 2022, driven by an increased focus on constructing energy-efficient office buildings, which aligns with the region's 2030 carbon emission targets. As employees returned to office spaces, European companies, in turn, ramped up their leasing decisions, resulting in the addition of 5.7 million square feet of new office space in 2022. This growth was expected to persist in 2023, with a projected growth rate of 2.68% over 2022.

- The COVID-19 pandemic caused a significant labor and material shortage, leading to the cancellation or postponement of several commercial construction projects. However, as lockdowns eased and construction activities resumed, Europe witnessed a robust 16.60% growth in new floor area for commercial construction in 2021, with Spain being the leader with a 105.05% growth rate.

- The commercial construction sector in Europe is poised for substantial growth, with the new floor area anticipated to register a CAGR of 3.88% during the forecast period. Noteworthy projects, such as the USD 65 million Milan US Consulate General Complex in Italy, slated for completion by 2025, and the USD 260 million Arteixo Office Building Expansion in Spain, spanning 1.8 million square feet and set to be operational in 2024, are expected to bolster the region's commercial construction landscape. As consumer preferences shift from online to in-person retail experiences, the new floor area is expected to increase by 428.3 million square feet for retail shopping malls in Europe by 2030 compared to 2022.

Affordable housing schemes in the UK and Europe and growth in housing project completions are expected to increase the new floor area for residential construction

- Europe's residential construction sector witnessed a 2.71% growth in new floor area in 2022 compared to the previous year. This can be attributed to the escalating urbanization rate, with the urban population accounting for 75% of the total in 2022, up from 73.5% in 2020. This trend was expected to persist in 2023, with a projected growth rate of 3.21% over 2022. According to the EURO CONSTRUCT network, Europe witnessed a 2.7% rise in housing project completions in 2023, with notable increases in Hungary, Ireland, Norway, and Poland.

- The COVID-19 pandemic led to an economic downturn, resulting in the cancellation or postponement of numerous residential construction projects. Consequently, the new floor area for residential construction in Europe plummeted by 9.40% in 2020 compared to the preceding year. However, as lockdown restrictions eased and construction activities resumed, the sector rebounded strongly, with an 18.28% surge in new floor area in 2021 compared to 2020. Spain led the growth with a remarkable 40.23% increase, followed by Italy at 25.07%.

- The new floor area for residential construction in Europe is projected to witness a CAGR of 3.89% during the forecast period. The United Kingdom is poised to lead this growth, recording a CAGR of 5.94%. This growth can be attributed to factors such as a mounting demand for affordable housing, particularly in urban centers grappling with population growth and limited housing supply. The UK government's Affordable Homes Programme, backed by an investment of USD 8 billion, aims to deliver 130,000 housing units by 2026, bolstering the nation's residential construction floor area.

Europe Dry Mix Mortar Industry Overview

The Europe Dry Mix Mortar Market is fragmented, with the top five companies occupying 16.74%. The major players in this market are Holcim, MAPEI S.p.A., MBCC Group, Saint-Gobain and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End Use Sector Trends

- 4.1.1 Commercial

- 4.1.2 Industrial and Institutional

- 4.1.3 Infrastructure

- 4.1.4 Residential

- 4.2 Major Infrastructure Projects (current And Announced)

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size, forecasts up to 2030 and analysis of growth prospects.)

- 5.1 End Use Sector

- 5.1.1 Commercial

- 5.1.2 Industrial and Institutional

- 5.1.3 Infrastructure

- 5.1.4 Residential

- 5.2 Application

- 5.2.1 Concrete Protection and Renovation

- 5.2.2 Grouts

- 5.2.3 Insulation and Finishing Systems

- 5.2.4 Plaster

- 5.2.5 Render

- 5.2.6 Tile Adhesive

- 5.2.7 Water Proofing Slurries

- 5.2.8 Other Applications

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Russia

- 5.3.5 Spain

- 5.3.6 United Kingdom

- 5.3.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Ardex Group

- 6.4.2 Baumit Group

- 6.4.3 Grupo Puma

- 6.4.4 Henkel AG & Co. KGaA

- 6.4.5 Holcim

- 6.4.6 Knauf Digital GmbH

- 6.4.7 MAPEI S.p.A.

- 6.4.8 MBCC Group

- 6.4.9 Saint-Gobain

- 6.4.10 Sika AG

7 KEY STRATEGIC QUESTIONS FOR CONCRETE, MORTARS AND CONSTRUCTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219