|

市場調查報告書

商品編碼

1693628

南美洲乘用車:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)South America Passenger Cars - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

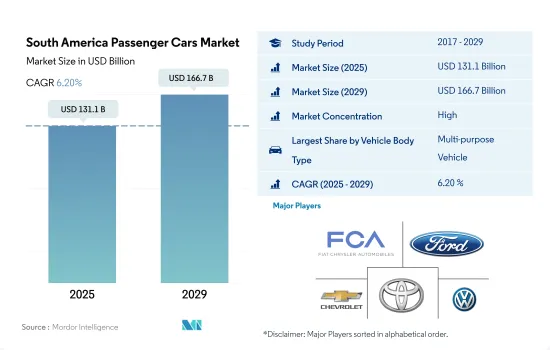

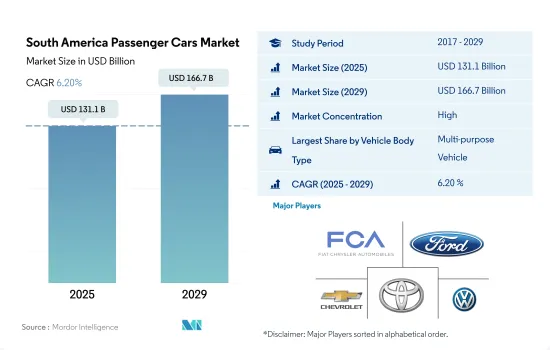

南美乘用車市場規模預計在 2025 年為 1,311 億美元,預計到 2029 年將達到 1,667 億美元,預測期內(2025-2029 年)的複合年成長率為 6.20%。

受經濟因素、消費者偏好以及向更永續的交通解決方案轉變的推動,南美洲乘用車市場正在發生重大變化。

- 與亞太國家相比,由於汽車持有率較低、可支配收入成長較快等因素,南美汽車產業可望大幅成長。值得注意的是,由於對減少排放氣體和未來能源需求的擔憂,南美洲對電動車(EV)的需求正在上升。巴西對電動車的需求尤其激增,多家外國汽車製造商在該地區設立了生產設施。

- 新冠疫情影響了消費者的購買力,導致原油價格大幅下跌,進而導致汽油成本下降。汽油價格的下降可能會使傳統內燃機汽車(ICE)更加便宜,但電動車在大多數汽車類別的總體擁有成本方面仍然佔有優勢。但這種優勢的程度各不相同,可能會影響銷售。

- 南美洲明顯正在轉向永續燃料,其中甘蔗提取的乙醇成為主要選擇。這種生質燃料的排放汽油或柴油低 90%。巴西日益普及的永續燃料在塑造該地區市場方面發揮關鍵作用。另一個重要促進因素是汽車產業對可再生能源的消耗不斷成長。隨著產業優先考慮永續性,南美洲的汽車電氣化研究正在取得進展,並且前景看好。該地區強勁的市場成長潛力使其成為具有吸引力的投資地點,為經濟收益和市場整合提供了重大機會。

南美洲乘用車市場趨勢

需求激增和政府獎勵推動南美洲電動車市場發展

- 巴西、阿根廷等南美國家汽車市場潛力巨大。近年來,南美汽車工業經歷了顯著成長。該地區對電動車(EV)的需求不斷成長,尤其是在乘用車領域。這種激增可以歸因於人們意識的提高、對環境問題的日益關注以及政府鼓勵採用電動車的舉措等因素。事實上,該地區的電動車銷量已呈現顯著成長,2022 年比 2021 年成長了 17.95%。

- 南美市場多元化,預計電動車將快速成長。巴西尤其重視可再生能源發電,並正在考慮轉向電動公車,因為巴西擁有豐富的鈮和鋰蘊藏量,這對於電動車電池的發展至關重要。 2022年12月,聖保羅宣布計畫禁止購買柴油公車,並在2024年底前引進2,600輛電動公車。預計其他南美國家也將出現類似的趨勢,預計2024年至2030年間汽車電氣化程度將會提高。

- 南美國家的政府政策和獎勵計畫將成為該地區汽車電氣化的主要驅動力。例如,稅收優惠政策發揮著至關重要的作用。例如,哥倫比亞政府設定了一個雄心勃勃的目標,即到 2030 年讓 60 萬輛電動車上路,並利用獎勵和補貼來減少碳排放。預計其他南美國家也將採取類似舉措,電動車銷量預計將在 2024 年至 2030 年間激增。

南美洲乘用車產業概況

南美乘用車市場格局較為集中,前五名廠商佔65.90%的市佔率。市場的主要企業是:飛雅特克萊斯勒汽車公司、福特汽車公司、通用汽車公司(雪佛蘭)、豐田汽車公司和大眾汽車公司(按字母順序排列)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 人均GDP

- 消費者汽車支出(cvp)

- 通貨膨脹率

- 汽車貸款利率

- 共乘

- 電氣化的影響

- 電動車充電站

- 電池組價格

- 新款 Xev 車型發布

- 二手車銷售

- 燃油價格

- OEM生產統計

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 車輛配置

- 搭乘用車

- 掀背車

- 多用途車輛

- 轎車

- SUV

- 搭乘用車

- 推進類型

- 混合動力汽車和電動車

- 按燃料類別

- BEV

- FCEV

- HEV

- PHEV

- ICE

- 按燃料類別

- 柴油引擎

- 汽油

- LPG

- 混合動力汽車和電動車

- 國家

- 阿根廷

- 巴西

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Fiat Chrysler Automobiles NV

- Ford Motor Company

- GM Motor(Chevrolet)

- Hyundai Motor Company

- Kia Corporation

- Nissan Motor Co. Ltd.

- Renault do Brasil S/A

- Stellantis NV

- Toyota Motor Corporation

- Volkswagen AG

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 93016

The South America Passenger Cars Market size is estimated at 131.1 billion USD in 2025, and is expected to reach 166.7 billion USD by 2029, growing at a CAGR of 6.20% during the forecast period (2025-2029).

The South American passenger cars market is undergoing significant changes driven by economic factors, consumer preferences, and a shift toward more sustainable transportation solutions

- The automotive industry in South America is poised for significant growth, driven by factors such as low car ownership rates and a faster rise in disposable incomes compared to Asia-Pacific countries. Notably, the demand for electric vehicles (EVs) in South America has been on the rise, fueled by concerns about emissions reduction and future energy needs. Brazil's surging demand for EVs is particularly noteworthy, attracting several foreign automakers to set up production facilities in the region.

- The COVID-19 pandemic impacted consumer purchasing power, leading to a notable drop in oil prices and subsequently reducing gasoline costs. While this decline in gas prices may make conventional internal combustion engine (ICE) vehicles more affordable, EVs still hold an advantage in terms of overall ownership costs across most vehicle classes. However, the extent of this advantage may vary, potentially influencing sales.

- South America has seen a notable shift toward sustainable fuel options, with ethanol derived from sugarcane emerging as a prominent choice. This biofuel boasts emissions up to 90% lower than gasoline or diesel equivalents. Brazil's increasing adoption of sustainable fuels has played a pivotal role in shaping the regional market. Another significant driver is the growing consumption of renewable energy in the automotive industry. As the industry emphasizes sustainability, the ongoing research into automotive electrification in South America holds promise. Given the region's attractiveness as an investment hub due to its robust market growth potential, there are significant opportunities for both financial gains and market enhancements.

South America Passenger Cars Market Trends

Surging demand and government incentives propel South America's electric vehicle market

- Countries like Brazil and Argentina in South America show significant potential in the automobile market. The South American vehicle industry has witnessed notable growth in recent years. Notably, the region has seen a rising demand for electric vehicles (EVs), especially in the passenger car segment. This surge can be attributed to factors like heightened awareness, growing environmental concerns, and governmental initiatives promoting EV adoption. In fact, EV sales in the region saw a notable increase, growing by 17.95% in 2022 compared to 2021.

- South America, with its diverse markets, is poised for a surge in electric vehicles. Brazil, in particular, is eyeing a shift toward electric buses, driven by its focus on renewable power generation and its abundant reserves of niobium and lithium, crucial for EV battery development. A significant move in this direction came in December 2022 when Sao Paulo banned diesel bus purchases and announced plans to deploy 2600 electric buses by 2024-end. Similar trends in other South American nations are expected to drive vehicle electrification from 2024 to 2030.

- Government policies and incentive programs across South American nations are set to be key drivers for vehicle electrification in the region. Tax benefits, for instance, are playing a pivotal role. Colombia's government, for instance, is leveraging incentives and subsidies with an ambitious target of putting 600,000 EVs on its roads by 2030, aiming to tackle carbon emissions. With similar initiatives anticipated in other South American countries, the sales of EVs are expected to witness a surge from 2024 to 2030.

South America Passenger Cars Industry Overview

The South America Passenger Cars Market is fairly consolidated, with the top five companies occupying 65.90%. The major players in this market are Fiat Chrysler Automobiles N.V, Ford Motor Company, GM Motor (Chevrolet), Toyota Motor Corporation and Volkswagen AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.10 New Xev Models Announced

- 4.11 Used Car Sales

- 4.12 Fuel Price

- 4.13 Oem-wise Production Statistics

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Configuration

- 5.1.1 Passenger Cars

- 5.1.1.1 Hatchback

- 5.1.1.2 Multi-purpose Vehicle

- 5.1.1.3 Sedan

- 5.1.1.4 Sports Utility Vehicle

- 5.1.1 Passenger Cars

- 5.2 Propulsion Type

- 5.2.1 Hybrid and Electric Vehicles

- 5.2.1.1 By Fuel Category

- 5.2.1.1.1 BEV

- 5.2.1.1.2 FCEV

- 5.2.1.1.3 HEV

- 5.2.1.1.4 PHEV

- 5.2.2 ICE

- 5.2.2.1 By Fuel Category

- 5.2.2.1.1 Diesel

- 5.2.2.1.2 Gasoline

- 5.2.2.1.3 LPG

- 5.2.1 Hybrid and Electric Vehicles

- 5.3 Country

- 5.3.1 Argentina

- 5.3.2 Brazil

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Fiat Chrysler Automobiles N.V

- 6.4.2 Ford Motor Company

- 6.4.3 GM Motor (Chevrolet)

- 6.4.4 Hyundai Motor Company

- 6.4.5 Kia Corporation

- 6.4.6 Nissan Motor Co. Ltd.

- 6.4.7 Renault do Brasil S/A

- 6.4.8 Stellantis N.V.

- 6.4.9 Toyota Motor Corporation

- 6.4.10 Volkswagen AG

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219