|

市場調查報告書

商品編碼

1906060

拉丁美洲乘用車:市場佔有率分析、行業趨勢和統計數據、成長預測(2026-2031 年)Latin America Passenger Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

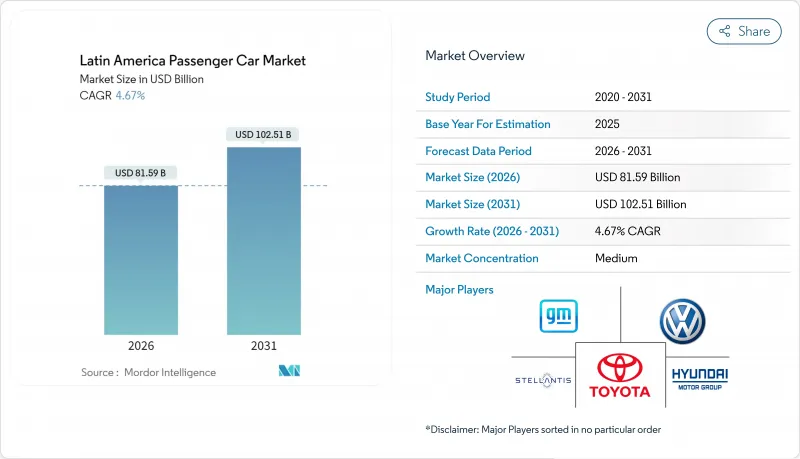

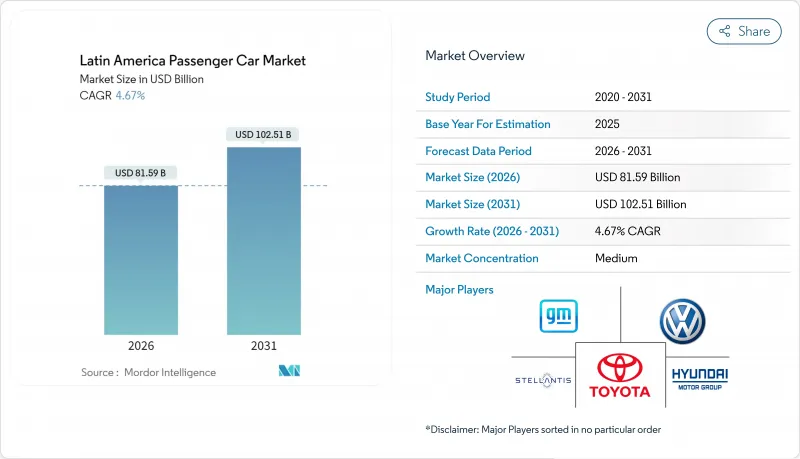

預計到 2026 年,拉丁美洲乘用車市場價值將達到 815.9 億美元。

這代表著從 2025 年的 779.5 億美元成長到 2031 年的 1,025.1 億美元,2026 年至 2031 年的複合年成長率為 4.67%。

儘管匯率波動和貿易政策變化,強勁的家庭需求、加速的電氣化以及汽車生產的回流仍然支撐著這一成長。製造商正在擴大區域生產規模,以符合美國墨加協定(USMCA)和南方共同市場(Mercosur)的在地採購要求。同時,政府獎勵,例如巴西的“Mover計劃”,正在刺激國內電動車的生產。中國品牌正抓住這一趨勢,迫使現有汽車製造商重新評估產品系列和定價策略,推出具有成本競爭力的車型。此外,半導體供應的穩定性正在恢復生產節奏,使汽車製造商能夠解決因2021年至2023年供不應求訂單。

拉丁美洲乘用車市場趨勢及分析

疫情後家庭汽車擁有率的韌性

隨著疫情限制措施的逐步解除,私家車擁有率顯著上升。這一激增主要受工作模式轉變、共用出行依賴性降低以及大量人口向郊區遷移的推動。在墨西哥,這種轉變導致輕型汽車銷售大幅成長,預計在經濟復甦的支撐下,這一趨勢將持續到2025年。同時,在巴西,近期的經濟復甦提振了消費者信心,促使人們開始購買先前推遲的汽車,尤其是在農村地區。有限的公共運輸基礎設施也使得汽車展示室客流量穩定,從而維持了對私家車出行方式的持續需求。

中國汽車製造商資本的快速流入和低成本電動車進口

憑藉強大的國內電池供應鏈和政府支持的資金籌措,中國汽車製造商正逐步進軍拉丁美洲市場。例如,比亞迪透過將生產轉移到巴西本地,迅速擴大了在巴西的市場佔有率。這項策略不僅規避了進口關稅,也增強了其價格競爭力。隨後,長城汽車和奇瑞等品牌也紛紛效仿,加劇了該地區的價格競爭。雖然日益激烈的競爭擴大了消費者可選擇的經濟型電動車的範圍,但也給現有汽車製造商帶來了壓力,擠壓了它們的利潤空間,並改變了競爭格局。

披索和雷亞爾貶值推高進口成本

宏觀經濟壓力正在削弱拉丁美洲主要市場汽車的價格競爭力。巴西面臨外貿失衡,阿根廷的工業產能仍未充分利用,這兩點都凸顯了更廣泛的經濟緊張。同時,疲軟的該地貨幣推高了進口零件的成本。為因應這一局面,汽車製造商紛紛提高車輛價格,這可能會延長更換週期,並抑制非必要升級的需求。這些舉措有可能拖慢成長預期,並使維持長期市場擴張的努力變得更加複雜。

細分市場分析

預計到2025年,SUV/跨界車將佔拉丁美洲乘用車市場的40.85%,在預測期(2026-2031年)內以4.88%的複合年成長率超越其他車型。小型車和B級車的日益普及推動了入門價格的下降。更高的離地間隙(非常適合未鋪設路面和易澇道路)以及消費者普遍認為更高的安全性是推動市場需求的主要因素。豐田的混合動力SUV策略不僅充分利用了現有的乙醇基礎設施,而且符合排放氣體法規。與此同時,新興的中國汽車製造商正在推出價格與傳統緊湊型轎車相當的多功能跨界車,這促使偏好轉向更高車身的車型。

在都市區擁擠和燃油效率是購車決策關鍵因素的地區,轎車和掀背車仍然佔有一席之地,尤其是在巴西沿海城市。然而,隨著家庭在車輛更換週期中升級換代,它們的總合佔有率正在下降。多用途汽車(MPV)仍然是一個小眾市場,主要面向農村車隊營運商和大家庭,在這些地區,載客量比燃油效率更為重要。

2025年,入門級A/B級車型佔拉丁美洲乘用車市場的47.83%,預計在預測期(2026-2031年)內將以5.08%的複合年成長率成長,這主要得益於緊湊型汽車融資管道的便利性和政府的稅收優惠政策。巴西和墨西哥融資管道的改善提高了汽車的可負擔性,同時汽車製造商正透過平台通用降低單位成本。

中型C級車迎合了不斷壯大的中產階級的需求,但隨著消費者直接轉向緊湊型SUV,它們面臨著被替代的風險。豪華D/E級車目前主要針對富裕的都市區專業人士和政府用車,但電動車正在開拓一個新的高階消費群體。比亞迪的Dolphin Mini就是一個很好的例子,它展示了價格親民的小型電動車,加上稅收優惠政策,如何加速科技的普及應用。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 疫情後家庭汽車擁有量呈現強勁反彈

- 中國整車廠資本快速湧入和低成本電動車進口

- 為規避美墨加協定/南方共同市場關稅上漲,汽車製造商紛紛重返日本市場

- 汽車製造商恢復對靈活燃料的投資計劃

- 巴西和哥倫比亞的電動車稅收優惠政策

- 穩定半導體供應鏈,使生產能趕上需求

- 市場限制

- 由於披索和雷亞爾貶值,進口成本上升。

- 加速大都會區快速公車系統(BRT)的擴張

- 主要都會區以外地區公共充電基礎設施密度不足

- 加強區域二氧化碳排放平均目標(2027年)

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模及成長預測(以金額為準/數量)

- 按車輛類型

- 掀背車

- 轎車

- SUV/跨界車

- 多用途汽車(MPV)

- 按車輛類別

- 入門級(A/B)

- 中型車(C)

- 全尺寸(D/E)

- 按推進/燃料類型

- 汽油

- 柴油引擎

- 彈性燃料汽車

- 油電混合車

- 電池式電動車

- 按銷售管道

- 廠商直營店

- 獨立經銷商

- 按國家/地區

- 巴西

- 墨西哥

- 阿根廷

- 哥倫比亞

- 智利

- 秘魯

- 其他拉丁美洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- General Motors Company

- Volkswagen AG

- Stellantis NV

- Toyota Motor Corporation

- Hyundai Motor Company

- Ford Motor Company

- Nissan Motor Corporation

- Renault SA

- Honda Motor Co., Ltd.

- Kia Corporation

- BMW AG

- Daimler AG(Mercedes-Benz)

- Chery Automobile

- BYD Auto

- SAIC-GM-Wuling

- Subaru Corporation

- Mazda Motor Corporation

- Geely Auto

- Audi AG

- Suzuki Motor Corporation

第7章 市場機會與未來展望

Latin America passenger car market size in 2026 is estimated at USD 81.59 billion, growing from 2025 value of USD 77.95 billion with 2031 projections showing USD 102.51 billion, growing at 4.67% CAGR over 2026-2031.

Robust household demand, accelerating electrification, and on-shoring of vehicle production continue to underpin this growth despite currency volatility and shifting trade policies. Manufacturers are scaling regional plants to comply with USMCA and Mercosur content rules, while government incentives-led by Brazil's Mover program-stimulate domestic EV output. Chinese brands capitalize on these dynamics with cost-effective models that pressure incumbent OEMs to update product portfolios and pricing strategies. Meanwhile, stabilizing semiconductor supplies restores production rhythm, enabling automakers to address deferred orders accumulated during 2021-2023 shortages.

Latin America Passenger Car Market Trends and Insights

Resilient Post-Pandemic Rebound in Household Car Ownership

As pandemic restrictions eased, personal vehicle ownership saw a notable uptick. This surge was fueled by changing work habits, a diminished reliance on shared mobility, and a notable migration trend towards suburban areas. In Mexico, this shift has led to a pronounced increase in light-vehicle sales, a momentum that's projected to persist into 2025, buoyed by an improving economy. Meanwhile, in Brazil, a recent economic upswing has rekindled consumer confidence, prompting many to make vehicle purchases they had previously postponed. Notably, demand is particularly robust in secondary cities. Here, a limited public transportation infrastructure has resulted in consistent showroom traffic and a sustained appetite for personal mobility solutions.

Rapid Inflow of Chinese OEM Capital and Low-Cost EV Imports

Chinese automakers, bolstered by robust domestic battery supply chains and state-backed financing, are making significant inroads into Latin America. BYD, for instance, has swiftly captured market share in Brazil by localizing its production. This strategy not only sidesteps import tariffs but also allows for more competitive pricing. Following suit, brands like GWM and Chery are amplifying price competition in the region. While this surge in competition offers consumers a wider array of affordable electric vehicle choices, it simultaneously strains established manufacturers, squeezing their profit margins and altering the competitive dynamics.

Peso and Real Depreciation Inflating Import Costs

Key Latin American markets are feeling the pinch of macroeconomic pressures, impacting automotive affordability. Brazil grapples with external trade imbalances, and Argentina's industrial capacity remains underutilized, both highlighting broader economic strains. Concurrently, local currency weaknesses are inflating the costs of imported components. In response, automakers are hiking vehicle prices, potentially elongating replacement cycles and curbing demand for non-essential upgrades. Such dynamics could temper growth forecasts and complicate efforts to maintain long-term market expansion.

Other drivers and restraints analyzed in the detailed report include:

- OEM On-Shoring to Skirt USMCA/Mercosur Tariff Escalation

- Resumption of Automaker Flex-Fuel Investment Programs

- Acceleration of BRT Expansion in Major Metros

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SUVs/Crossovers accounted for 40.85% of the Latin America passenger car market in 2025 and are forecast to outpace all other body styles at a 4.88% CAGR during the forecast period (2026-2031). Buoyed by the increasing availability of sub-compact and B-segment variants, entry prices have seen a decline. Demand is driven by the vehicles' higher ground clearance, making them suitable for unpaved or flood-prone roads, and a prevailing perception of enhanced safety. Toyota's hybrid-flex SUV initiative not only leverages the current ethanol infrastructure but also tackles emissions caps. Meanwhile, Chinese newcomers are introducing feature-rich crossovers, priced similarly to traditional compacts, swaying consumer preference towards these taller vehicles.

Sedans and hatchbacks maintain relevance where urban congestion and fuel economy dominate decision factors, particularly across Brazil's coastal cities. However, their combined share continues to decline as households upgrade during replacement cycles. Multi-purpose vehicles remain niche, catering mainly to fleet operators and large families in rural areas where passenger capacity trumps efficiency.

Entry-level A/B models captured 47.83% of the Latin America passenger car market share in 2025, and with a 5.08% CAGR during the forecast period (2026-2031). Driven by competitive financing and governmental tax credits for compact cars. Credit access improvements in Brazil and Mexico expand the eligible buyer pool, while OEMs utilize platform commonality to cut per-unit costs.

Mid-size C-segment offerings cater to an expanding middle class, yet they face substitution risk as consumers transition directly to compact SUVs. Premium D/E classes stay limited to affluent urban professionals and government fleets, although EV variants add a new aspirational layer. BYD's Dolphin Mini illustrates how low-priced electric compacts can accelerate technology diffusion when paired with tax exemptions.

The Latin America Passenger Car Market Report is Segmented by Vehicle Type (Hatchback, Sedan, and More), Vehicle Class (Entry-Level (A/B), Mid-Size (C), and More), Propulsion/Fuel Type (Gasoline, Diesel, and More), Sales Channel (OEM-Owned Stores and Independent Dealers), and Country. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- General Motors Company

- Volkswagen AG

- Stellantis N.V.

- Toyota Motor Corporation

- Hyundai Motor Company

- Ford Motor Company

- Nissan Motor Corporation

- Renault S.A.

- Honda Motor Co., Ltd.

- Kia Corporation

- BMW AG

- Daimler AG (Mercedes-Benz)

- Chery Automobile

- BYD Auto

- SAIC-GM-Wuling

- Subaru Corporation

- Mazda Motor Corporation

- Geely Auto

- Audi AG

- Suzuki Motor Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Resilient Post-Pandemic Rebound in Household Car Ownership

- 4.2.2 Rapid Inflow of Chinese OEM Capital and Low-Cost EV Imports

- 4.2.3 OEM On-Shoring to Skirt USMCA/Mercosur Tariff Escalation

- 4.2.4 Resumption of Automaker Flex-Fuel Investment Programs

- 4.2.5 EV-Friendly Fiscal Credits in Brazil and Colombia

- 4.2.6 Stabilizing Semiconductor Supply Chain Enabling Production Catch-Up

- 4.3 Market Restraints

- 4.3.1 Peso and Real Depreciation Inflating Import Costs

- 4.3.2 Acceleration of BRT Expansion in Major Metros

- 4.3.3 Limited Public Charging Density Outside Tier-1 Cities

- 4.3.4 Tightening Regional CO2 Fleet-Average Targets by 2027

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value and Volume)

- 5.1 By Vehicle Type

- 5.1.1 Hatchback

- 5.1.2 Sedan

- 5.1.3 SUV / Crossover

- 5.1.4 Multi-Purpose Vehicle (MPV)

- 5.2 By Vehicle Class

- 5.2.1 Entry-Level (A/B)

- 5.2.2 Mid-Size (C)

- 5.2.3 Full-Size (D/E)

- 5.3 By Propulsion / Fuel Type

- 5.3.1 Gasoline

- 5.3.2 Diesel

- 5.3.3 Flex-Fuel

- 5.3.4 Hybrid Electric Vehicle

- 5.3.5 Battery-Electric Vehicle

- 5.4 By Sales Channel

- 5.4.1 OEM-Owned Stores

- 5.4.2 Independent Dealers

- 5.5 By Country

- 5.5.1 Brazil

- 5.5.2 Mexico

- 5.5.3 Argentina

- 5.5.4 Colombia

- 5.5.5 Chile

- 5.5.6 Peru

- 5.5.7 Rest of Latin America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 General Motors Company

- 6.4.2 Volkswagen AG

- 6.4.3 Stellantis N.V.

- 6.4.4 Toyota Motor Corporation

- 6.4.5 Hyundai Motor Company

- 6.4.6 Ford Motor Company

- 6.4.7 Nissan Motor Corporation

- 6.4.8 Renault S.A.

- 6.4.9 Honda Motor Co., Ltd.

- 6.4.10 Kia Corporation

- 6.4.11 BMW AG

- 6.4.12 Daimler AG (Mercedes-Benz)

- 6.4.13 Chery Automobile

- 6.4.14 BYD Auto

- 6.4.15 SAIC-GM-Wuling

- 6.4.16 Subaru Corporation

- 6.4.17 Mazda Motor Corporation

- 6.4.18 Geely Auto

- 6.4.19 Audi AG

- 6.4.20 Suzuki Motor Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment