|

市場調查報告書

商品編碼

1693575

義大利營運服務諮詢:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Italy Operations Service Consulting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

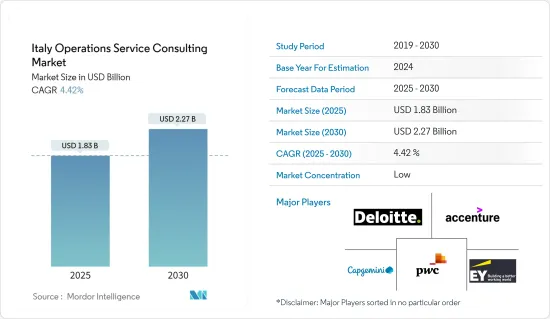

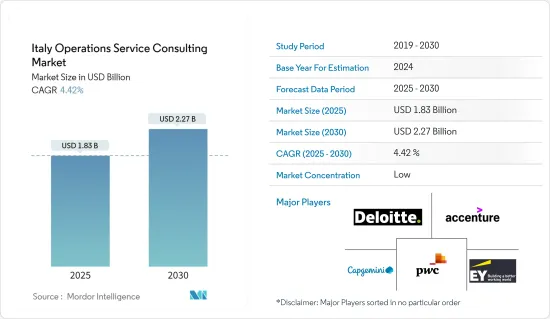

義大利營運服務諮詢市場規模預計在 2025 年為 18.3 億美元,預計到 2030 年將達到 22.7 億美元,在市場估計和預測期(2025-2030 年)內複合年成長率為 4.42%。

營運管理(有時也稱為營運諮詢)提供建議和實施服務,以改善公司的內部營運和整個價值鏈的績效。

主要亮點

- 由於科技的不斷創新和社會的數位化,義大利正處於快速成長時期。為了迎接變化、發現機會、制定新策略、明確計劃並執行計劃以實現目標,企業需要以營運顧問公司的形式尋求策略合作夥伴。

- 根據最終用戶,市場細分為金融服務、製造業、能源和公共產業、公共部門、零售和其他最終用戶。 2021年市場佔有率為26.91%,其中金融業佔據主導地位。 1990 年代,透過合併、收購、資產轉移、清算和銀行轉換,義大利的銀行數量大幅減少,這些銀行佔該國銀行資產的 60%。義大利約有1000家銀行。義大利政府正在透過多項計畫推動銀行業整合,以提高其國際競爭力。

- 隨著數位化進程,擁有獨特經營模式和策略的新企業將不斷湧現,對市場產生巨大影響。新的自由職業網站、虛擬網路和專業團隊的不斷湧現增加了客戶可用的選擇。大企業與小企業競爭。獨立承包商和鬆散的專業網路給小型企業帶來了壓力。海外人才的湧入甚至迫使獨立承包商進入市場。

- 在預測期內,義大利公共部門預計將以健康的速度採用營運服務諮詢。透過利用數位技術的顛覆性潛力,公共部門將公民、社區、工人和企業置於進步的核心,為該國的市場供應商創造機會。

- 在 COVID-19 疫情爆發期間,義大利各地的組織採取了一切必要的預防措施,以確保社區和工人的安全。許多組織已經完成了數位轉型,並選擇了完全遠端工作或結合數位和辦公室工作的混合模式。此外,新冠疫情的出現使得供應鏈更加脆弱。對於大多數 IT 公司來說,生態系統很薄弱,由關鍵業務諮詢和服務提供者組成。此外,鼓勵遠距工作的法規要求服務供應商確保其關鍵任務企業客戶能夠使用所需的工具和技術,以確保其所提供服務的速度、安全性、品質和整體效率。

義大利營運服務諮詢市場趨勢

金融服務業佔很大佔有率

- 影響金融機構的技術的快速進步將越來越要求金融服務公司進行創新、降低營運風險、降低成本、提高客戶忠誠度、提高業務績效、降低營運風險、降低成本並為客戶創造引人注目的價值提案。

- 技術和消費行為的改善繼續推動義大利付款產業的發展。金融服務公司正在迅速採用營運服務諮詢來適應不斷變化的付款環境並抓住機會。這將影響零售付款服務、現金管理和付款技術。

- 隨著義大利金融服務數位化的提高,來自全球市場的供應商正成為金融改革、重組、轉虧為盈和交易的客戶。例如,國際顧問公司 FTI Consulting 於 2022 年 6 月擴大了在義大利的企業融資和重組服務範圍。幾家在義大利營運的市場供應商正在尋求合併和業務,以更好地服務尋求金融服務的客戶。

- 此外,新冠疫情也成為義大利銀行業進一步數位化的推手。例如,數位管道的使用增加正在改變客戶對一站式商店的偏好,即在單一平台上提供他們所需的所有金融服務。例如數位付款、線上保險、網路購物線上付款等。

- Parva Consulting 等提供金融領域諮詢服務的區域顧問公司憑藉其創新服務吸引了銀行、資產管理和保險業的極大興趣。 Parva Consulting 分析分銷網路並重新設計業務流程,以提高銀行業的客戶體驗和營運效率,從而騰出時間來提高業務品質。

- 根據 Accuris Global 的一項調查,摩根大通是 2021 年義大利最大的併購(M&A) 交易財務顧問公司。該公司總交易額接近 970 億美元,已成為該國頂級的併購交易顧問。高盛以 910 億美元的交易量位居第二。

新興科技投資激增

- 義大利政府正在努力建立新興企業模式並吸引其他歐洲國家的注意。儘管近期經濟環境不佳,但對企業家的支持氛圍逐漸增強。義大利曾以高稅收聞名。因此,許多義大利人經常離開該國,到更自由和靈活的地方創業。政府致力於透過加強對創新和技術的支持並授權其促進研究和技術轉移來結束這種循環。

- 為了促進該地區的新興企業生態系統,義大利政府推出了一項 10 億歐元(10.4 億美元)的投資計劃,並成立了一個名為 CDP 創業投資 的新創投機構。 CDP 創業投資管理七種類型的基金,包括加速器基金、創投母基金和「A/B 輪匹配」基金。它還啟動了兩個加速計劃,為小型企業和企業家提供指導、網路和支援服務。

- 新的國家過渡計畫4.0是義大利復甦基金的基石。約 240 億歐元(246 億美元)將投資於結構性改革,以加強所有扣除率並大幅提高利用率。目的是增加私人投資並為企業提供穩定性和可預測性。

- 義大利於2021年設立了「人工智慧」國家博士學位,這是世界上規模最大、最全面的人工智慧博士學位之一。義大利研究人員是世界上所有主要人工智慧研究網路的成員,包括CLAIRE和ELLIS等最負盛名的歐盟網路。它也是全球人工智慧夥伴關係(GPAI)的創始成員之一。

- 根據義大利經濟發展部統計,2021年第一季,義大利商業服務業新創公司9377家,製造業、能源和採礦業新創公司2138家。相較之下,商業服務業的新創企業數量最多,而運輸和物流的新創企業數量最少。

義大利營運服務顧問業概況

義大利營運服務諮詢市場競爭激烈,由許多全球性和地區性公司組成。這些公司佔有相當大的市場佔有率,並致力於擴大其全球基本客群。此外,該公司還專注於研發活動、策略聯盟和其他有機和無機成長策略,以保持更強的市場地位。

- 2022 年 10 月:安永正式在全球推出面向金融服務的 EY Nexus,這是一項為期三年、投資 100 億美元的技術、策略和人才計畫。隨著 EY Nexus 的推出,該公司推出了一個業務轉型平台,旨在快速部署金融服務的新產品和解決方案,擴大其技術生態系統的規模。

- 2022 年 9 月:Accenture宣布計畫收購世界領先的製造、培訓和顧問公司 Stellantis。此次收購將使Accenture能夠將世界級製造(WCM)方法融入其客戶解決方案中,以幫助提高生產和供應鏈網路的有效性、永續性和彈性。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 產業影響評估

第5章市場動態

- 市場促進因素

- 增加對新興技術的投資

- 採用BI和先進的資料管理策略

- 市場限制

- 諮詢市場的變化

- 案例研究: VIS-A-VIS 營運諮詢

第6章市場區隔

- 按最終用戶

- 金融服務

- 製造業

- 能源與公共產業

- 公共部門

- 零售

- 其他最終用戶產業

第7章競爭格局

- 公司簡介

- Deloitte Touche Tohmatsu Limited

- Accenture PLC

- PricewaterhouseCoopers LLP

- Ernst & Young ITALY Limited

- Capgemini SE

- KPMG International

- Boston Consulting Group Inc.

- AT Kearney Inc.(Kearney)

- Mckinsey & Company Inc.

- Bain & Company Inc.

- Roland Berger GmbH

- Simon-Kucher & Partners

- OC&C Strategy Consultants

第8章投資分析

第9章:市場的未來

The Italy Operations Service Consulting Market size is estimated at USD 1.83 billion in 2025, and is expected to reach USD 2.27 billion by 2030, at a CAGR of 4.42% during the forecast period (2025-2030).

Operations management sometimes referred to as operations consulting, provides advice and implementation services to improve a company's internal operations and performance across the value chain.

Key Highlights

- Due to continued technological breakthroughs and the digitization of society, Italy is undergoing a rapid growth period. To embrace change, discover opportunities, develop new strategies, articulate a plan, and implement plans to achieve their goals, businesses need strategic partners in the form of operations consulting firms.

- By end-user, the market is divided into financial services, manufacturing, energy and utilities, the public sector, retail, and other end users. With a share of 26.91%, the financial industry controlled most of the market in 2021. Due to bank mergers, acquisitions, asset transfers, liquidations, and conversions that accounted for 60% of all banking assets in the nation throughout the 1990s, the number of banks in Italy has drastically declined. There are about a thousand banks in Italy. The government is promoting consolidation through several programs to make the Italian banking sector more competitive abroad.

- The market is greatly impacted by increased digitization since it makes it possible for new businesses to emerge with unique business models and strategies. The ongoing appearance of new freelancing websites, virtual networks, and specialty teams has increased the options available to clients. Greater firms compete with smaller ones. Independent contractors and loosely established expert networks put a strain on smaller enterprises. Due to the influx of overseas talent, even independent contractors are under pressure to enter the market.

- Over the forecast period, the public sector in Italy is anticipated to adopt operations consulting services at a healthy rate. Public sector organizations are keeping citizens, communities, workers, and businesses at the center of progress by utilizing the disruptive potential of digital technologies, which opens up opportunities for market vendors in the nation.

- Organizations around Italy took all required precautions to safeguard the safety of communities and workers due to the COVID-19 outbreak. Many organizations finished their digital transformation and have chosen to operate entirely remotely or in a hybrid model that combines digital and in-office work. In addition, the emergence of COVID-19 has made supply chains more vulnerable. For the majority of IT firms, the ecosystem is fragile and comprises important operations consulting service providers. Mandates encouraging remote work have also prompted service providers to guarantee that mission-critical corporate clients have access to the tools and technology required to allow the speed, security, quality, and overall effectiveness of services offered.

Italy Operations Service Consulting Market Trends

Financial Service Sector to Hold Significant Share

- Due to the quick technological advancements affecting financial institutions, financial services companies will increasingly need to innovate, reduce operational risk, cut costs, increase customer loyalty, improve business performance, reduce operational risk, reduce costs, and create compelling value propositions for their clients.

- Improvements in technology and consumer behavior continue to propel the development of the payments sector in Italy. Financial services companies are quickly introducing operations consulting services to stay up with the changing payment landscape and seize the possibilities. This has ramifications for retail payments services, cash management, and payments technology.

- Global market vendors are customers for financial transformations, restructurings, turnarounds, and transactions in Italy because of the country's growing digitalization of financial services. For instance, the international consulting company FTI Consulting extended its corporate finance and restructuring service offerings in Italy in June 2022. Several market vendors operating in Italy are engaging in merger and collaboration operations to offer better services to their clients who want financial services.

- Furthermore, the COVID-19 pandemic has driven the banking sector in Italy to undergo significant digital transformation. For instance, the usage of digital channels has increased, along with changing customer preferences toward a one-stop shop with a single platform for obtaining all necessary financial services. Examples include digital payments, online insurance, online payments for online shopping, etc.

- Regional consulting companies like Parva Consulting, which provides consulting services in the financial sector, are attracting much interest from the banking, asset management, and insurance industries with their creative services. To improve customer experience and sales effectiveness in banking, the organization analyses distribution networks and redesigns operational procedures to free up commercial quality time.

- As per research by Acuris Global, JPMorgan was Italy's top financial advisory company for merger and acquisition (M&A) agreements in 2021. With a total deal value close to USD 97 billion, the company became the top advisor to M&A deals in the nation. Goldman Sachs & Co. is placed second in the leaderboard with a deal value of USD 91 billion.

Surged Investment Trends in Emerging Technologies

- The Italian government is working hard to build up its start-up model and draw the rest of Europe's attention to it. Despite the unfavorable recent economic climate, the atmosphere is evolving to support entrepreneurs. Italy used to be known for having high taxes. Hence, many Italians would regularly leave the nation to start their enterprises in places with more freedom and flexibility. The government has been focusing on ending this cycle by increasing its support for innovation and technology and granting greater power to advance research and tech transfer.

- To boost the regional start-up ecosystem, the Italian government introduced a EUR 1 billion (USD 1.04 billion) investment program and established a new venture arm named CDP Venture Capital. This manages seven different funds, including an accelerator fund, a VC fund-of-funds, and "Series A/B matching" funds. It also launched two acceleration programs to provide SMEs and entrepreneurs mentorship, networking, and support services.

- The new National Transition Plan 4.0 serves as the foundation for the Italian Recovery Fund. About EUR 24 billion (USD 24.6 billion) is being invested in a structural change that strengthens all deduction rates and significantly increases usage. It aims to increase private investment and provide businesses with stability and predictability.

- One of the world's biggest and most comprehensive artificial intelligence doctorates, the National Doctorate in "Artificial Intelligence" was launched in Italy in 2021. Italian academics are participating in all key worldwide AI research networks, including the most prestigious EU networks, such as CLAIRE and ELLIS. It is also one of the founding members of the Global Partnership on Artificial Intelligence (GPAI).

- According to the Ministry of Economics Development, the number of business services start-ups in Italy for 1Q 2021 was 9,377. There were 2,138 new start-ups in the manufacturing activities, energy, and mining sector. Business services had the highest number of start-ups, in contrast to transportation and logistics, which had the lowest.

Italy Operations Service Consulting Industry Overview

The Italian operations service consulting market is highly competitive and consists of many global and regional players. These players account for a considerable market share and focus on expanding their global client base. They focus on research and development activities, strategic alliances, and other organic and inorganic growth strategies to stay stronger in the market.

- October 2022: Ernst & Young unveiled the worldwide official launch of EY Nexus for financial services, a three-year, USD 10 billion investment in technology, strategy, and people. With the launch of EY Nexus, the company has expanded the amount of its technological ecosystem by introducing a business transformation platform intended to deploy new products and solutions quickly for financial services.

- September 2022: Accenture announced its plan to acquire Stellantis, a world-class manufacturing, training, and consulting business. By way of this takeover, Accenture could include the World Class Manufacturing (WCM) approach into its solutions for customers, assisting them in improving the effectiveness, sustainability, and resilience of their production and supply chain networks.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Investment in Emerging Technologies

- 5.1.2 Adoption of BI and Advanced Data Management Strategies

- 5.2 Market Restraints

- 5.2.1 Shift in the Consulting Marketplace

- 5.3 Case Studies VIS-A-VIS Operations Consultancy

6 MARKET SEGMENTATION

- 6.1 By End-user

- 6.1.1 Financial Services

- 6.1.2 Manufacturing

- 6.1.3 Energy and Utilities

- 6.1.4 Public Sector

- 6.1.5 Retail

- 6.1.6 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Deloitte Touche Tohmatsu Limited

- 7.1.2 Accenture PLC

- 7.1.3 PricewaterhouseCoopers LLP

- 7.1.4 Ernst & Young ITALY Limited

- 7.1.5 Capgemini SE

- 7.1.6 KPMG International

- 7.1.7 Boston Consulting Group Inc.

- 7.1.8 A. T. Kearney Inc. (Kearney)

- 7.1.9 Mckinsey & Company Inc.

- 7.1.10 Bain & Company Inc.

- 7.1.11 Roland Berger GmbH

- 7.1.12 Simon-Kucher & Partners

- 7.1.13 OC&C Strategy Consultants