|

市場調查報告書

商品編碼

1693382

西班牙黏合劑:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Spain Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

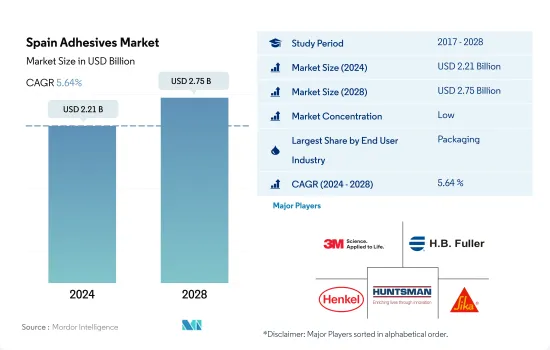

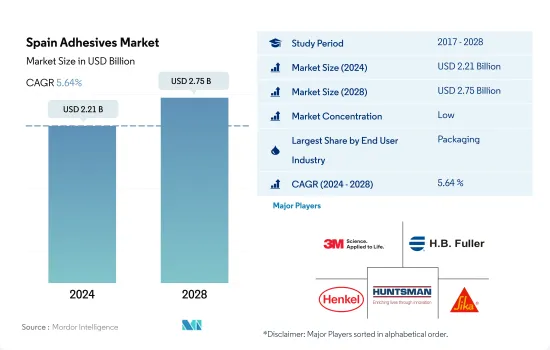

西班牙黏合劑市場規模估計預計在 2024 年為 22.1 億美元,預計到 2028 年將達到 27.5 億美元,預測期內(2024-2028 年)的複合年成長率為 5.64%。

軟包裝新趨勢可望推動西班牙黏合劑消費

- 黏合劑在黏合和連接各行各業使用的各種基材方面發揮著至關重要的作用。這些黏合劑可幫助製造商減輕零件和組件的重量,並快速、輕鬆、準確地形成接頭。 2020年受新冠疫情影響,消費量較2019年下降8.91%。

- 受各終端用戶產業包裝應用成長的推動,2021 年黏合劑消費量增加了 411,363 多噸。儘管面臨諸多挑戰,但 2020 年紙板產量仍達 321,600 噸。此外,預計到 2022 年,西班牙的食品包裝量將以 0.3% 的速度大幅成長。包裝肉類和魚貝類、加工水果和蔬菜的需求不斷增加,以及番茄醬和食物泥液體包裝的普及等因素預計將在未來幾年推動軟包裝中黏合劑的消費。由於成本低且應用所需的黏合強度高,水基黏合劑在工業中被大量消費量。 2021年國內包裝產業預計消耗水性黏合劑近20.1萬噸。

- 正在進行的幾個基礎設施計劃正在推動該國對黏合劑的需求。 2019 年,亞馬遜網路服務 (AWS) 在西班牙推出了一個新的基礎設施區域,成為其在歐洲的第七個區域。此外,預計預測期後半段住宅將大幅成長。根據西班牙國家統計局(INE)的數據,2019年至2025年間,淨家庭建設預計將以每年平均約135,000套的速度成長。預計這將對西班牙黏合劑市場產生影響。

西班牙黏合劑市場趨勢

隨著先進包裝的出現以及塑膠可回收性帶來的食品飲料產業需求,塑膠包裝將引領包裝產業

- 包裝是設計和工程方面成長最快的行業之一,旨在保護和提高產品的安全性和壽命。近年來,西班牙包裝業受到食品和飲料行業快速成長的推動。農產品產業是西班牙最具前景的領域,也是歐洲第四大農產品市場,擁有超過 30,000 家企業。西班牙憑藉對本土品牌的先鋒推廣,已成為全球領先的食品和飲料出口國。

- 由於新冠疫情,全國各地的製造工廠關閉或暫停,造成了一些問題,包括供應鏈和進出口中斷。因此,2020年全國包裝產量較去年與前一年同期比較6%,對市場造成較大衝擊。該國的包裝生產主要由紙和紙板驅動,到 2021 年,它們將佔包裝產量的近 52%。然而,由於塑膠可回收性的提高,預測期內塑膠生產部門可能會以約 4.27% 的複合年成長率快速成長。

- 西班牙包裝產業的成長與該國對生鮮食品的需求不斷成長相吻合。疫情過後,人們對公共衛生議題的關注度不斷提高,加上全國電子商務活動的興起,可能會推動食品加工產業的成長,從而進一步推動未來幾年的包裝需求。

電動車需求的不斷成長以及價值 240 億歐元的公共和私人電動交通投資將推動汽車需求

- 西班牙是繼德國之後歐洲第二大汽車生產國。 2019 年,西班牙汽車供應商生產了價值 358.22 億歐元的商品,其中 60% 出口到歐洲國內外。

- 近年來,該國的汽車產量保持相當穩定。 2019年,該國汽車產量約28,222,355輛,與2018年相比僅成長0.1%。 2020年,該國汽車產量約2,268,185輛。由於新冠疫情導致供應鏈中斷,2020 年汽車產量下降了 18.6%。

- 2021年前第三季汽車產量比2020年前第三季成長4%,達到1,592,277輛。預測期內,該國汽車產業的需求可能適中。然而,2021年該國汽車產量約為2,098,133輛,較2020年下降8%。半導體晶片短缺和供應鏈限制對該國的汽車產量產生了不利影響。

- 汽車產量短缺近期進一步加劇,預計2022年將強勁復甦,產量將成長18%。西班牙的電動車市場應該受益於下一代歐盟基金,該基金支持供應商轉型為電動車。此外,西班牙政府宣布未來三年將向公共和私人電子交通領域投資 240 億歐元。

西班牙黏合劑產業概況

西班牙黏合劑市場細分化,前五大公司佔9.10%。市場的主要企業有:3M、HB Fuller Company、Henkel AG & Co. KGaA、Huntsman International LLC 和 Sika AG。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築與施工

- 鞋類皮革

- 包裝

- 木製品和配件

- 法律規範

- 西班牙

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 航太

- 車

- 建築與施工

- 鞋類和皮革

- 醫療保健

- 包裝

- 木製品和配件

- 其他

- 科技

- 熱熔膠

- 反應性

- 溶劑型

- 紫外線固化膠合劑

- 水性

- 樹脂

- 丙烯酸纖維

- 氰基丙烯酸酯

- 環氧樹脂

- 聚氨酯

- 矽膠

- VAE,EVA

- 其他

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- 3M

- AC Marca

- AVERY DENNISON CORPORATION

- Beardow Adams

- Dow

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- MAPEI SpA

- Sika AG

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 全球黏合劑和密封劑產業概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 促進因素、限制因素和機會

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 92437

The Spain Adhesives Market size is estimated at 2.21 billion USD in 2024, and is expected to reach 2.75 billion USD by 2028, growing at a CAGR of 5.64% during the forecast period (2024-2028).

Emerging trend of flexible packaging expected to boost the consumption of adhesives in Spain

- Adhesives play an important role in bonding and joining various substrates that are used across industries. These adhesives help manufacturers lower the weight of their components and assemblies and form joints quickly, easily, and accurately. As a result of the COVID-19 outbreak in 2020, consumption fell by 8.91% compared to 2019.

- Adhesive consumption increased by more than 411,363 ton in 2021 due to the growth of packaging applications among various end-user industries. In 2020, carton board production reached 321.6 thousand ton despite several challenges. Moreover, Spanish food packaging volume is expected to witness considerable growth at a rate of 0.3% through 2022. Factors such as rising demand for packaged meat and seafood, processed fruits and vegetables, and widespread usage of liquid cartons for tomato pastes and purees are expected to foster adhesives consumption in flexible packaging over the coming years. Waterborne adhesives are highly consumed in the industry because of their cheaper cost and high bonding strength which is required in these applications. It is seen that nearly 201 thousand tons of water-borne adhesives are consumed in the packaging industry of the country during 2021.

- Several ongoing infrastructure projects have boosted the demand for adhesives in the country. In 2019, Amazon Web Services (AWS) launched a new infrastructure region in Spain, making it its seventh region in Europe. Moreover, residential construction is expected to grow significantly over the later parts of the forecast period. According to Spain's National Statistics Institute (INE), net household construction is anticipated to increase at an average pace of around 135,000 units annually from 2019 to 2025. This is expected to influence the market for adhesives in Spain.

Spain Adhesives Market Trends

With the advancement in plastic recyclability and demand from the food and beverage industry, plastic packaging to lead the packaging industry

- Packaging is one of the fastest-growing industries in terms of design and technology for protecting and enhancing products' safety and longevity. The Spanish packaging industry has been majorly driven by the rapid growth of the food and beverages industry in recent years. The agri-food industry is the most promising sector in Spain and the fourth-largest agri-food market in Europe, with over 30,000 companies. Owing to the high-level promotion of country brands, Spain has positioned itself as a major exporter of food and drinks worldwide.

- Due to the COVID-19 pandemic, the country-wide lockdowns and temporary shutdown of manufacturing facilities caused several issues, including disruptions in supply chains and imports and exports. As a result, the country's packaging production declined by 6% in 2020 compared to the previous year, significantly affecting the market. Packaging production is majorly driven by paper and paperboard in the country, which accounts for nearly 52% of the packaging produced in 2021. However, with the advancement of plastic recyclability, the plastic production segment is likely to register the fastest growth of around 4.27% CAGR during the forecast period.

- The growth of the packaging industry in Spain is in line with the growing demand for fresh food domestically. The growing interest in public health issues post-pandemic, along with the emerging e-commerce activities across the nation, is likely to boost the growth of the food processing industry and further drive the demand for packaging over the coming years.

Increasing EVs demand and government investment of public and private e-mobility investments worth EUR 24 billion to boost the automotive demand

- Spain is the second-largest automobile producer in Europe, after Germany. Spanish automotive suppliers produced EUR 35,822 million worth of products in 2019, of which 60% were exported inside and outside the European region.

- Automobile production in the country has been almost constant in the past few years. In 2019, the country produced about 28,22,355 units, registering a meager growth rate of 0.1% over 2018. The country produced about 22,68,185 units of vehicles in 2020. Automotive vehicle production contracted by 18.6% in 2020 as the COVID-19 pandemic halted the supply chain.

- In the first three quarters of 2021, automotive production increased by 4% over Q1-Q3 of 2020 and reached 1,592,277 vehicles. The country's automotive industry is likely to witness moderate demand during the forecast period. However, in 2021, the country produced about 2,098,133 vehicles, which was a decline of 8% from 2020. The semiconductor chip shortage and supply chain restrictions negatively affected the production of automotive vehicle units in the country.

- The automotive production shortfalls have recently worsened, and a strong rebound is expected in 2022, with output increasing by 18%. The Spanish electric vehicles market should benefit from the Next Generation EU fund, which supports suppliers in their shift toward e-mobility. Additionally, the Spanish government has announced public and private e-mobility investments worth EUR 24 billion over the coming three years.

Spain Adhesives Industry Overview

The Spain Adhesives Market is fragmented, with the top five companies occupying 9.10%. The major players in this market are 3M, H.B. Fuller Company, Henkel AG & Co. KGaA, Huntsman International LLC and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Packaging

- 4.1.6 Woodworking and Joinery

- 4.2 Regulatory Framework

- 4.2.1 Spain

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Packaging

- 5.1.7 Woodworking and Joinery

- 5.1.8 Other End-user Industries

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Solvent-borne

- 5.2.4 UV Cured Adhesives

- 5.2.5 Water-borne

- 5.3 Resin

- 5.3.1 Acrylic

- 5.3.2 Cyanoacrylate

- 5.3.3 Epoxy

- 5.3.4 Polyurethane

- 5.3.5 Silicone

- 5.3.6 VAE/EVA

- 5.3.7 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 AC Marca

- 6.4.3 AVERY DENNISON CORPORATION

- 6.4.4 Beardow Adams

- 6.4.5 Dow

- 6.4.6 H.B. Fuller Company

- 6.4.7 Henkel AG & Co. KGaA

- 6.4.8 Huntsman International LLC

- 6.4.9 MAPEI S.p.A.

- 6.4.10 Sika AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219