|

市場調查報告書

商品編碼

1693373

英國黏合劑:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)United Kingdom Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

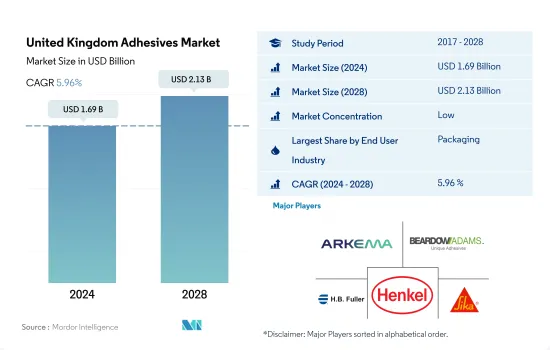

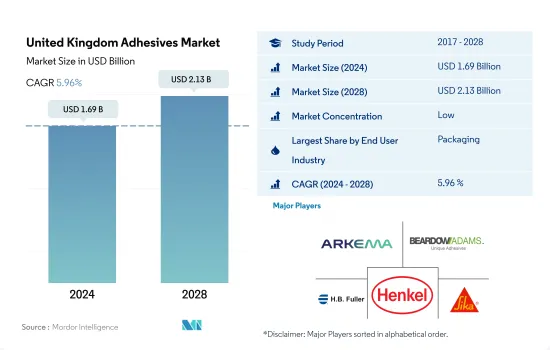

預計 2024 年英國黏合劑市場規模將達到 16.9 億美元,預計到 2028 年將達到 21.3 億美元,預測期內(2024-2028 年)的複合年成長率為 5.96%。

醫療保健投資增加推動黏合劑需求

- 黏合劑在黏合和連接各行各業使用的各種基材方面發揮著至關重要的作用。這些黏合劑可幫助製造商製造更輕的零件和組裝,並更快、更輕鬆、更精確地形成接頭。 2020年,受新冠疫情影響,消費量較2019年下降10.57%。

- 包裝是黏合劑的最大消費產業,2021 年需要 144,451 噸黏合劑,比 2020 年增加 6%。軟包裝在英國正在經歷顯著成長。廉價、輕質包裝在英國的流行使得製造商對一系列產品採用軟包裝。因此,這些因素正在推動市場的成長。

- 醫療保健也是該國消耗黏合劑的主要行業之一。國家醫療服務體系(NHS)是英國最大的醫療產品購買者。英國國家醫療服務體系(NHS)每年在醫療產品和服務上花費約 250 億美元。 NHS England 服務 84% 的人口。預計預測期內,國家對醫療保健的投資增加將推動對黏合劑的需求。

- 英國是歐洲第四大國家,2021 年的市佔率約為 7.8%。丙烯酸和聚氨酯黏合劑可供多個終端用戶產業使用,包括建築、汽車和醫療保健。在所有樹脂基黏合劑中,丙烯酸黏合劑將佔2021年英國黏合劑市場總量的約29%,其次是聚氨酯和EVA。預計 2022 年至 2028 年期間英國環氧膠合劑市場的複合年成長率將達到 7.08%。

英國黏合劑市場趨勢

塑膠包裝的先進可回收性以及食品飲料行業的需求將使塑膠包裝在包裝行業中佔據主導地位

- 由於全國範圍內的封鎖和製造工廠的暫時關閉,COVID-19 疫情造成了許多問題,包括供應鏈和進出口貿易中斷。因此,2020年該國包裝產量與前一年同期比較下降了3%,對市場造成了重大影響。

- 然而,由於疫情的影響,消費模式發生了變化,越來越多的人選擇在網上購物,這使得包裝變得更加重要。英國擁有最先進的電子商務市場,是世界第四大電子商務市場,預計將引領包裝生產市場。說到網路購物,英國是歐洲最受歡迎的市場。 2021年英國電子商務產業創造的收益為1,290億英鎊,是2015年英國電子商務收益的三倍多,比2020年的1,127億英鎊高出約15%。

- 這約佔 2021 年包裝產量的 77%。在英國,約有 44.3% 的塑膠用於包裝。由於塑膠的可回收性不斷提高,塑膠生產領域可能會實現最快的成長率,預測期內複合年成長率約為 3.37%。

2030年綠色交通及電動車註冊量增加可望推動汽車產量

- 英國汽車業對英國經濟至關重要,其營業額超過 602 億歐元,為英國經濟貢獻了 119 億歐元。然而,2020年英國汽車產量與2019年同期相比下降了29.5%,因為該行業面臨歷史上最大的挑戰,包括應對COVID-19疫情和重新定位以應對英國脫歐的影響。

- 英國汽車產量在 2020 年下降了 29.5%,由於半導體短缺嚴重影響了生產,2021 年又下降了 4.7%。 2021 年 9 月新車註冊量與去年同期相比下降了 34%,預計將對未來英國密封劑市場產生影響。

- 英國計劃在2030年逐步淘汰汽油和柴油汽車,促進綠色交通轉型。該國還計劃投資超過18億英鎊用於基礎設施和補貼,以擴大零排放汽車的使用範圍並支持綠色經濟復甦,增加該國電動車市場的需求。

- 2021 年,英國BEV、PHEV 和 HEV 註冊總數增至 452,527 輛,而 2020 年為 285,199 輛,與前一年同期比較去年同期成長 58.7%。 2021年註冊車輛總數(年成長/減少)為197,227輛純電動車(76.3%)、114,554輛插電式混合動力電動車(70.6%)和147,246輛混合動力電動車(34.0%)。 2021年,BEV、PHEV和HEV將佔車輛註冊量的約27.5%。

英國黏合劑產業概況

英國黏合劑市場分散,前五大公司佔39.41%。該市場的主要企業有:阿科瑪集團、Beardow Adams、HB Fuller Company、漢高股份公司和西卡股份公司(按字母順序排列)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 航太

- 車

- 建築與施工

- 鞋類和皮革

- 包裝

- 木製品和配件

- 法律規範

- 英國

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 航太

- 車

- 建築與施工

- 鞋類和皮革

- 衛生保健

- 包裝

- 木製品和配件

- 其他最終用戶產業

- 科技

- 熱熔膠

- 反應性

- 溶劑型

- 紫外線固化膠合劑

- 水

- 樹脂

- 丙烯酸纖維

- 氰基丙烯酸酯

- 環氧樹脂

- 聚氨酯

- 矽膠

- VAE,EVA

- 其他樹脂

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- 3M

- Arkema Group

- AVERY DENNISON CORPORATION

- Beardow Adams

- Dow

- Follmann Chemie GmbH

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Sika AG

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 全球黏合劑和密封劑產業概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 促進因素、阻礙因素和機會

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 92428

The United Kingdom Adhesives Market size is estimated at 1.69 billion USD in 2024, and is expected to reach 2.13 billion USD by 2028, growing at a CAGR of 5.96% during the forecast period (2024-2028).

Increasing investments in healthcare to augment the demand for adhesives

- Adhesives play an important role in bonding and joining various substrates that are used across industries. These adhesives help manufacturers to lower the weight of their components and assemblies, to form the joints quickly, easily, and accurately. The COVID-19 outbreak impacted the country in 2020, which reduced consumption by 10.57% compared to 2019.

- Packaging is the largest consumer of adhesives, as it required 144,451 tons of adhesives in 2021, which was 6% more than in 2020. Flexible packaging has experienced substantial growth in the United Kingdom. As cheap and lightweight packaging is gaining popularity in the United Kingdom, it is encouraging manufacturers to use flexible packaging for different products. Hence, these factors are responsible for the market's growth.

- Healthcare is also one of the major industries where adhesives are consumed in the country. The largest purchaser of medical products in the United Kingdom is the National Health Service (NHS). The National Health Service (NHS) spends approximately USD 25 billion annually on medical goods and services. NHS England serves 84% of the population. The increasing investments in healthcare by the country are estimated to drive the demand for adhesives during the forecast period.

- The United Kingdom is the 4th-largest European country, holding about 7.8% of shares in 2021. Acrylic and polyurethane adhesives are the potential types of adhesives consumed across several end-user industries, including construction, automotive, and healthcare. Among all resin-based adhesives, acrylic adhesives held about 29% of the overall UK adhesives market share in 2021, followed by polyurethane and EVA. The UK epoxy adhesives market is expected to record a CAGR of 7.08% from 2022-2028.

United Kingdom Adhesives Market Trends

With the advancement in plastic recyclability and demand for food and beverage industry, plastic packaging to lead the packaging industry

- Due to the COVID-19 pandemic, the country-wide lockdowns and temporary shutdown of manufacturing facilities caused several issues, including supply chain and import and export trade disruptions. As a result, the country's packaging production declined by 3% in 2020 compared to the previous year, significantly affecting the market.

- However, as a result of the pandemic, consumption patterns have changed, more people started shopping online, and packaging has become much more significant. The United Kingdom has the most advanced e-commerce market and is the fourth largest in the world, which will drive the packaging production market. When it comes to internet shopping, the United Kingdom is the most popular market in Europe. The UK's e-commerce industry generated GBP 129 billion in revenue in 2021, more than triple the revenue generated by UK e-commerce in 2015, and it was around 15% higher than the GBP 112.7 billion in 2020.

- Packaging production is majorly driven by plastics in the country, accounting for around 77% of the packaging produced in 2021. Around 44.3% of plastics produced were consumed by packaging in the United Kingdom. With the advancement of plastic recyclability, the plastic production segment is likely to register the fastest growth rate of around 3.37% CAGR during the projected period.

In addition to eco-friendly transportation by 2030, electric vehicle registrations growth is likely to propel the automotive production

- The UK automotive industry is a vital part of the UK economy, worth more than EUR 60.2 billion in turnover and adding EUR 11.9 billion value to the UK economy. However, in 2020, the automotive vehicle production in the country reduced by 29.5% compared to the same period in 2019, as the UK automotive sector faced some of the biggest challenges in its history while responding to the COVID-19 pandemic and repositioning for Brexit implications.

- After contracting by 29.5% in 2020, British automotive vehicle production further declined by 4.7% in 2021, as the semiconductor shortage severely affected production. New car registrations decreased 34% Y-o-Y in September 2021, which is excepted to affect the UK sealants market in the future.

- The United Kingdom is planning to phase out gasoline and diesel vehicles to promote the transition to more eco-friendly transportation by 2030. The country also planned an investment of over GBP 1.8 billion in infrastructure and grants to expand access to zero-emission vehicles and support a green economic recovery, thereby increasing the demand for the electric vehicles market in the country.

- The total number of BEV, PHEV, and HEV registrations in the United Kingdom accounted for 452,527 in 2021, registering a growth rate of 58.7% Y-o-Y, compared to 285,199 registrations in 2020. Out of total registrations in 2021 (with percentage Y-o-Y change), 190,727 (76.3%) were BEVs, 114,554 (70.6%) were PHEVs, and 147,246 (34.0%) were HEVs. In 2021, BEV, PHEV, and HEV captured around 27.5% share of total car registrations in the country.

UK Adhesives Industry Overview

The United Kingdom Adhesives Market is fragmented, with the top five companies occupying 39.41%. The major players in this market are Arkema Group, Beardow Adams, H.B. Fuller Company, Henkel AG & Co. KGaA and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Packaging

- 4.1.6 Woodworking and Joinery

- 4.2 Regulatory Framework

- 4.2.1 United Kingdom

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Packaging

- 5.1.7 Woodworking and Joinery

- 5.1.8 Other End-user Industries

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Solvent-borne

- 5.2.4 UV Cured Adhesives

- 5.2.5 Water-borne

- 5.3 Resin

- 5.3.1 Acrylic

- 5.3.2 Cyanoacrylate

- 5.3.3 Epoxy

- 5.3.4 Polyurethane

- 5.3.5 Silicone

- 5.3.6 VAE/EVA

- 5.3.7 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 AVERY DENNISON CORPORATION

- 6.4.4 Beardow Adams

- 6.4.5 Dow

- 6.4.6 Follmann Chemie GmbH

- 6.4.7 H.B. Fuller Company

- 6.4.8 Henkel AG & Co. KGaA

- 6.4.9 Huntsman International LLC

- 6.4.10 Sika AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219