|

市場調查報告書

商品編碼

1692491

美國POS 終端:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)United States (US) Point of Sale (POS) Terminals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

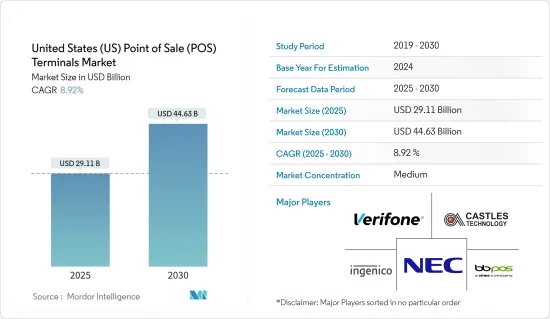

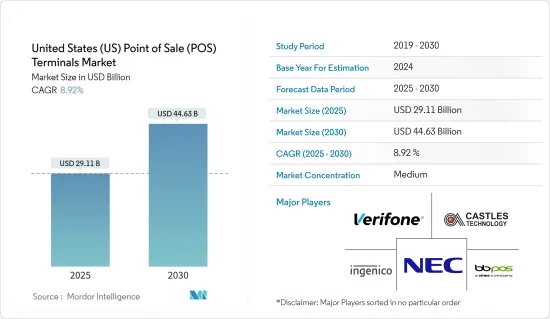

預計 2025 年美國POS 終端市場規模為 291.1 億美元,到 2030 年將達到 446.3 億美元,預測期內(2025-2030 年)的複合年成長率為 8.92%。

POS 終端系統正在從交易導向的終端和設備轉變為與公司 CRM 和其他金融解決方案互動的系統。借助這項技術創新,最終用戶現在能夠更好地管理收益來源和庫存。

消費者支出的增加直接影響了對 POS 終端作為便捷支付方式的需求。電子商務的成長以及實體零售和線上零售的交織也有望影響 POS 終端的未來發展。該地區領先的電子商務平台提供的貨到付款選項導致可攜式POS 終端的採用量激增。

預計 POS 系統中最新技術的採用將推動研究市場的發展。例如,雲端處理供應商為銷售點系統提供基於網路的金融服務,並在供應商的伺服器上遠端管理資料。該解決方案目前佔據雲端POS市場佔有率的大部分佔有率,預計長期將保持這一地位。預計最終用戶對所有重要領域部署雲端技術的接受度不斷提高將成為 POS 市場的主要成長要素。

推動POS終端快速成長的因素很多,但其中最重要的因素是它們讓企業擺脫了現金的負擔。隨著世界走向無現金社會,採用 POS 系統的企業發現自己領先,能夠提供客戶期望的快速、便利和安全的結帳體驗。美國的銷售點終端正在快速發展,以跟上正在進行的技術浪潮。兼容各行各業的先進終端的引進正在不斷推進。

近年來,由於數位付款的廣泛應用和電子商務的擴張,美國POS 終端市場經歷了顯著成長。然而,隨著這種擴張,也出現了一些有關網路攻擊和資料外洩的安全問題。這些問題已成為市場發展的重大障礙,不僅危及消費者信心,也危及總體市場的穩定。

即使在新冠疫情爆發後,非接觸式付款的受歡迎程度也並未減弱。根據萬事達卡的一項調查,約有79%的消費者使用非接觸式付款。美國許多企業已經投資了現代化的銷售點終端系統來接受這種支付方式。例如,以前優先使用傳統刷卡方式的企業正在轉向支援 NFC 的終端,以實現非接觸式付款。

美國POS終端市場趨勢

零售業預計將強勁成長

- 零售業是POS終端機的主要用戶之一,隨著全國各地實體店的重新開業,該行業正在逐步復甦。精通技術和不精通技術的顧客都要求很高,希望在他們喜歡的零售商處獲得無縫體驗。

- 隨著美國零售店數量的增加,他們透過大幅折扣和其他服務吸引顧客,但客戶維繫是留在市場中的主要挑戰。這種競爭促使企業需要重塑經營模式,以避免價格競爭,並在投資最新技術與收益之間找到平衡。

- POS 終端機提供的庫存、銷售報告、財務管理和客戶分析功能可協助零售商克服與客戶維繫相關的問題。 mPOS 系統預計將在零售店廣泛應用,因為它們將銷售報告、客戶管理、庫存管理和員工管理等核心功能整合到一個系統中。

- 此外,鑑於電子商務趨勢,數位付款正在成為美國公民的首選付款方式。例如,41% 的美國消費者希望他們的智慧型手機或平板電腦成為他們「最重要的購物工具」。此外,數位付款是千禧世代的首選付款方式,這有助於該國擴大採用 POS 系統。

行動/可攜式POS系統成長

- 行動 POS(mPOS)是一種允許商家使用行動裝置(智慧型手機或平板電腦)處理付款的技術,而不是收銀機或 POS 終端機。 mPOS(行動 POS)是一種智慧型手機、平板電腦或專用無線設備,可充當收銀機或電子銷售點終端(POS 終端)。

- mPOS 比傳統 POS 更具創新性,它可以透過藍牙連接您的智慧型手機。行動 POS 系統允許用戶透過平板電腦、智慧型手機和其他手持裝置接受付款,而無需綁定到單一銷售點。交易包括信用卡磁條、讀卡機付款和無線交易。它使用行動電話數據連接來處理交易。

- 行動 POS 系統越來越受歡迎,因為它們使銷售和服務企業能夠在客戶所在地進行交易,增加了整個流程的靈活性並改善了客戶體驗。預計美國電子商務的成長以及沃爾瑪、好市多、家得寶、克羅格公司和沃爾格林博姿聯盟等實體零售商和線上零售商的交織也將影響終端的未來發展。事實上,由於各大電子商務平台提供貨到付款服務,行動 POS 終端的普及率大幅上升。

- 中小型企業 (SMB) 對 mPOS 系統的需求不斷成長,促進了美國市場的成長。 mPOS 系統提供了一種提高效率和生產力的方法。

美國POS終端市場概況

美國POS終端市場處於半靜態。該市場由 NEC Corporation、Ingenico Inc.(阿波羅資產管理公司)、BBPOS Limited(STRIPE)、Castles Technology 和 NEC Corporation 等主要企業組成。

預計對夥伴關係和聯盟的投資將成為該市場供應商的策略重點之一。此外,市場上的供應商也致力於擴大影響力以吸引新客戶。企業集中度較高,各大主要企業都在爭奪更大的市場佔有率,競爭對手之間的敵意日益加劇。產品分銷更加便捷將帶來更激烈的競爭。總體而言,競爭對手之間以及供應商之間的競爭預計將緩慢加劇。

2023 年 6 月,Verifone 進行品牌重塑,以符合其最新願景,推出新標誌、全球網站和品牌形象,以突顯其前瞻性的付款解決方案。 Verifone 現在是「全球每家企業的付款架構師和商業專家合作夥伴」。 Verifone 強大的產品和服務組合兌現了這一承諾,涵蓋數付款解決方案、雲端託管支付即服務、安全付款設備、商家收單、由資料科學提供支援的高級商業洞察、託管服務實踐和銷售點技術。

2023 年 4 月,數位付款和軟體服務供應商 Cantaloupe 與北美非接觸式休息室、市場、自動販賣機和食品儲藏室服務供應商 Sekai Connect 建立了擴大夥伴關係關係。此次合作將使 World Connect 位於美國的附屬網路能夠利用名為 Bistro to Go! 的獨特微型市場亭計劃。提供:

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 消費者議價能力

- 供應商的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 增加對 POS 和付款產業數位化的投資

- 非接觸式付款需求不斷成長

- 對更安全的付款方式的需求不斷增加

- 市場限制

- 有關網路攻擊和資料外洩的安全性問題

- 偏遠地區缺乏強大可靠的基礎設施

- POS終端主要法規及合規標準

- 非接觸式付款的普及及其對該行業的影響說明

- 重點案例分析

- POS終端出貨量

第6章市場區隔

- 按組件

- 硬體

- 軟體

- 按服務

- 按類型

- 固定POS系統

- 行動/可攜式POS系統

- 按最終用戶產業

- 零售

- 飯店業

- 衛生保健

- 其他最終用戶產業

第7章競爭格局

- 公司簡介

- Verifone Systems Inc.

- Ingenico Inc.(Apollo Asset Management)

- BBPOS Limited(stripe)

- Castles Technology

- NEC Corporation

- PAX Technology Ltd

- Usa Technologies(Cantaloupe Inc.)

- Dspread Technology(Beijing)Inc.

- SZZT Electronics Co. Ltd

- Square Capital LLC(Block Inc.)

第8章投資分析

第9章:未來市場展望

The United States Point of Sale Terminals Market size is estimated at USD 29.11 billion in 2025, and is expected to reach USD 44.63 billion by 2030, at a CAGR of 8.92% during the forecast period (2025-2030).

POS terminal systems have changed from transaction-oriented terminals and devices to systems that interact with the company's CRM and other financial solutions. With the assistance of this innovation, end users can better manage their revenue streams and inventory.

The rise in consumer spending directly impacted the demand for POS terminals as an easy payment option. The growth in e-commerce and the entangling of brick-and-mortar and online retail practices are also expected to affect the future development of POS terminals. With the payment-on-delivery option provided by significant e-commerce platforms in the region, a sudden rise in the adoption of portable POS terminals has been noted.

Implementing the latest technology in POS systems is expected to drive the market studied. For example, cloud computing providers deliver web-based financial services for POS systems, where data is appropriately maintained on remote vendor servers. The solution currently controls most of the cloud POS market share and is anticipated to do so in the long run. Increased end-user support for the deployment of cloud technology across all the essential areas is expected to be a significant growth factor for the POS market.

The rapid growth of POS terminals is attributed to several factors, but one of the most important is that they free businesses from the burden of cash. As the world moves toward a cashless society, businesses that embrace POS systems find themselves ahead, offering their customers the fast, convenient, and safe checkout experience they expect. In line with the ongoing technological wave, POS terminals in the United States have been quickly evolving. The availability and introduction of technologically advanced terminals for all business types are significantly being adopted.

Due to the growing popularity of digital payment methods and the expansion of e-commerce, the point-of-sale (POS) terminal market in the United States has seen tremendous growth in recent years. However, along with this expansion have come several security concerns related to cyber-attacks and data breaches. These issues have grown into significant barriers for the market, endangering not only consumer confidence but also the market's general stability.

After the outbreak of COVID-19, contactless payments remained popular. According to a Mastercard survey, about 79% of consumers use contactless payments. Many US businesses are investing in modernized POS terminal systems to accept this payment method. For instance, companies that previously prioritized conventional card swipes are switching to NFC-enabled terminals to allow contactless payments.

United States (US) Point of Sale (POS) Terminals Market Trends

The Retail Segment is Expected to Grow Significantly

- The retail industry is one of the significant users of POS terminals, and the segment is slowly picking up with the reopening of brick-and-mortar stores in different parts of the country. Tech - and non-tech-savvy customers are equally demanding and desire a seamless experience at their preferred retailers.

- The rising number of retail stores across the United States attracts customers due to significant discounts and other services; however, customer retention becomes the primary challenge to sustaining in the market. This competition increases the requirement to reinvent their business models to avoid competition concerning price and find the balance between investing in the latest technologies and revenue.

- The inventory, sales reporting, financial management, and customer analytics features that POS terminals provide assist retailers in overcoming the problems related to customer retention. Hence, the industry's requirement for customer retention and competition growth promotes the development of POS terminals. mPOS systems are poised to be significantly utilized in retail outlets to integrate core functions such as sales reporting, customer management, inventory management, and employee management under one system.

- Digital payment is also becoming the preferred mode of payment for citizens across the United States, considering the e-commerce trends. For instance, 41% of all shoppers in the country expect their smartphone or tablet to become their 'most important shopping tool.' Moreover, digital payments are millennials' preferred mode of payment, contributing to the country's rising adoption of POS systems.

Mobile/Portable Point-of-sale Systems to Witness Growth

- Instead of a cash register or POS terminal, mobile point of sale (mPOS) is a technology that enables merchants to process payments via their mobile device (smartphone or tablet). An mPOS (mobile point-of-sale) is a smartphone, tablet, or dedicated wireless device that performs the functions of a cash register or electronic point-of-sale terminal (POS terminal).

- An mPOS is a more innovative alternative to traditional POS, which connects smartphones via Bluetooth. A mobile point-of-sale system allows users to accept payments via tablets, smartphones, and other handheld devices without being tied to a POS register in a single location. The transactions can include credit card magstripe, reader payments, and wireless transactions. It utilizes a mobile phone's data connection to process transactions.

- Mobile POS systems are gaining traction as they allow sales and service industries to conduct transactions at the customer's location, adding flexibility to the whole process and improving customer experience. The growth in e-commerce and the entangling of brick-and-mortar and online retail practices such as Walmart, Costco, The Home Depot, The Kroger Co., Walgreens Boots Alliance, and others in the United States are also expected to affect the future development of the terminals. In fact, with the option of cash on delivery provided by significant e-commerce platforms, a sudden surge in the adoption of mobile POS terminals has been recognized.

- The growing demand for mPOS systems among small and medium-sized businesses (SMBs) contributes to the market's growth in the United States. The mPOS systems offer ways to improve their efficiency and productivity.

United States (US) Point of Sale (POS) Terminals Market Overview

The United States POS terminals market is semi-consolidated. The market consists of major players, such as NEC Corporation, Ingenico Inc. (Apollo Asset Management), BBPOS Limited (STRIPE), Castles Technology, and NEC Corporation.

Investments in partnerships and alliances are expected to be some of the strategic focus of vendors operating in the market. In addition, the vendors in the market are focusing on expanding their presence to gain new customers. The firm concentration ratio is high, and all major players are working toward achieving a better share, increasing the competitive rivalry. With the easy distribution of products, the rivalry further increases. Overall, competitive rivalry is expected to grow moderately and grow among the vendors.

In June 2023, Verifone rebranded to underline its visionary payment solutions by introducing a new logo, global website, and brand identity to align with an updated vision. Verifone is now the 'Payments Architect and Commerce Expert partner for all businesses everywhere. Verifone's strong product and services portfolio delivers on that promise as it spans digital payment solutions, cloud-hosted payments as a service, secure payment devices, merchant acquiring, advanced business insights through data science, managed services practices, point of sale technology (POS), and more.

In April 2023, Cantaloupe Inc., a digital payments and software services company, signed an expanded partnership with GlobalConnect, North America's contactless break rooms, markets, vending, and pantry services provider. This partnership provides GlobalConnect's affiliate network of United States-based operators with a unique micro market kiosk program called Bistro to Go! By Cantaloupe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Investments in POS and Digitalization in the Payment Industry

- 5.1.2 Growing Demand for Contactless Payments

- 5.1.3 Increasing Demand for More Secured Payment Options

- 5.2 Market Restraints

- 5.2.1 Security Concerns Related to Cyber Attacks and Data Breaches

- 5.2.2 Lack of Robust and Reliable Infrastructure in Remote Regions

- 5.3 Key Regulations and Compliance Standards of POS Terminals

- 5.4 Commentary on the Rising Use of Contactless Payment and its Impact on the Industry

- 5.5 Analysis of Major Case Studies

- 5.6 POS Terminal Shipments

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Type

- 6.2.1 Fixed Point-of-sale Systems

- 6.2.2 Mobile/Portable Point-of-sale Systems

- 6.3 By End-user Industry

- 6.3.1 Retail

- 6.3.2 Hospitality

- 6.3.3 Healthcare

- 6.3.4 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Verifone Systems Inc.

- 7.1.2 Ingenico Inc. (Apollo Asset Management)

- 7.1.3 BBPOS Limited (stripe)

- 7.1.4 Castles Technology

- 7.1.5 NEC Corporation

- 7.1.6 PAX Technology Ltd

- 7.1.7 Usa Technologies (Cantaloupe Inc.)

- 7.1.8 Dspread Technology (Beijing) Inc.

- 7.1.9 SZZT Electronics Co. Ltd

- 7.1.10 Square Capital LLC (Block Inc.)