|

市場調查報告書

商品編碼

1692464

汽車安全氣囊:市場佔有率分析、產業趨勢和成長預測(2025-2030)Automotive Airbags - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

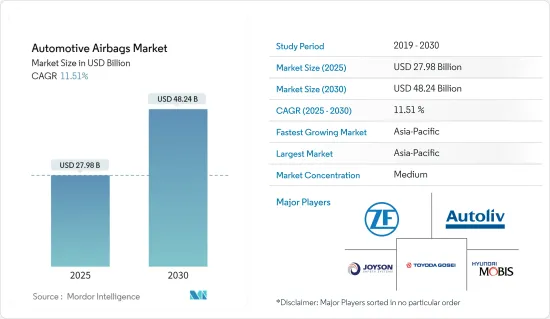

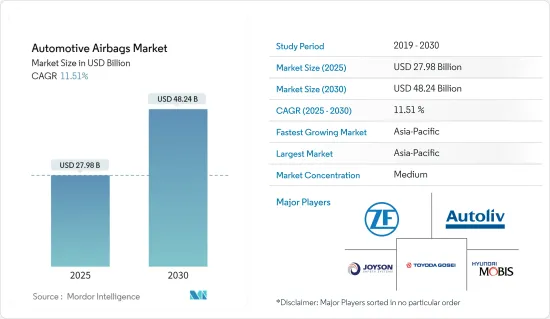

預計2025年汽車安全氣囊市場規模為279.8億美元,2030年將達482.4億美元,預測期間(2025-2030年)的複合年成長率為11.51%。

從長遠來看,汽車銷售和產量的增加,以及政府加強汽車安全系統的嚴格規定,預計將成為全球汽車安全氣囊市場成長的主要決定因素。消費者和當局安全意識的提高也有望帶來重大進展,從而提高道路安全水平並減少道路事故死亡人數。隨著技術的進一步進步,市場期待汽車和商用車的安全氣囊模組更加安全可靠。

主要亮點

- 根據國際汽車工業組織(OICA)的數據,預計2022年新輕型商用車銷量將達到1,980萬輛,而2021年為1,860萬輛,2022與前一年同期比較增7%。

- 同樣,預計 2022 年全球公車和客車產量將達到 253,100 輛,而 2021 年為 198,500 輛,2022與前一年同期比較成長 28%。

此外,高階和豪華汽車製造商越來越注重在已開發國家製造具有增強功能的新產品,這進一步推動了全球對汽車安全氣囊的需求。消費者道路安全意識的增強,加上政府法規的訂定,促使目標商標產品製造商 (OEM) 設計出包含覆蓋側窗的側氣簾的新車型結構。

然而,該行業面臨的主要挑戰之一是因汽車和商用車安全氣囊缺陷而導致的車輛召回,這對汽車製造商的品牌價值產生了負面影響,並影響了他們的財務表現。

主要亮點

- 2023 年 12 月,起亞在美國召回 2023 年 Seltos。焊接錯誤導致擴散器盤破裂,導致側氣簾在沒有警告或部署命令的情況下充氣。根據美國公路交通安全運輸部(NHTSA) 的報告,總合四個側簾式安全氣囊模組零件號影響了 1,367 輛 Seltos 跨界車。

- 2023 年 5 月,由於Takata駕駛側安全氣囊充氣系統故障,約 9 萬輛寶馬汽車收到了大規模「禁止駕駛」警告。該公司表示,裝有缺陷側面安全氣囊的舊寶馬車型一旦受到撞擊,碎片可能會飛入乘客艙並朝著前排乘客的方向飛去,對駕駛員和其他乘客構成嚴重危險。

預計亞太地區將成為市場成長的主要貢獻地區,其次是歐洲和北美。由於嚴格的安全標準和政府監管,日本和韓國預計將對收益成長做出重大貢獻。由於嚴重事故數量的增加和機動車輛持有的擴大,中國預計將成為安全氣囊需求的主要貢獻者之一。此外,消費者對新能源車的偏好正逐漸轉向汽車製造商採用電動化策略,預計這將對未來幾年汽車安全氣囊系統的需求產生正面影響。

汽車安全氣囊市場趨勢

預測期內乘用車市場將引領市場

在大眾、日產、通用和福特等主要汽車品牌的推動下,全球乘用車銷售量正在顯著成長。隨著乘用車市場的擴大,汽車製造商越來越注重安全性,提供必要的安全解決方案,以減少道路交通事故死亡人數,這對汽車安全氣囊系統需求的激增產生正面影響。

- 根據國際汽車工業組織(OICA)的數據,2022年全球新乘用車銷量將達到5,740萬輛,而2021年為5,640萬輛,較2021與前一年同期比較成長1.9%。

都市化的提高和消費者人均可支配收入的增加正在推動乘用車的需求。對於政府和製造商來說,乘客安全至關重要。針對消費者安全和保障的法規促使製造商在汽車上安裝安全裝置。許多國家已強制使用安全帶和安全氣囊。此外,製造商正在積極與主要汽車製造商合作,以提升其品牌知名度。我們正在推出滿足新時代乘用車要求的新產品。

- 2023年5月,中國高性能電動車製造商蔚來汽車與領先的汽車安全氣囊和安全帶製造商奧托立夫公司簽署協議,為其電動車生產安全產品。這種安全技術的發展可能會增加對充氣式安全帶的需求,因為只有安全帶完好無損,安全氣囊才會展開。

隨著全球汽車產量和銷售量的增加,汽車乘員安全部門正在採取各種安全法規來減少乘員傷害。

- 例如,印度公路運輸和公路部已規定,到2023年10月,乘用車必須強制安裝六個安全氣囊。該規定適用於八人座乘用車,以提高道路安全性。由於全球供應鏈面臨的挑戰,該法規將於2023年10月生效。最初,印度政府相關人員曾希望從2022年10月開始實施該規則。

由於電動乘用車銷量的成長和生產市場的擴大,預計預測期內乘用車安全氣囊系統的需求將會很大。

預計亞太地區將成為預測期內成長最快的市場

預計亞太地區將成為該市場成長最快的地區,其次是北美和歐洲。亞太地區是一個龐大的乘用車市場,其中印度和中國是世界上最大的兩個乘用車市場之一,佔全球乘用車銷售量的近30%。

- 據電動車工業協會稱,預計2023會計年度的電動四輪車銷量將達到48,105輛,而2022會計年度為19,782輛,2022會計年度和2023財與前一年同期比較成長率為143.1%。

- 日本汽車經銷商協會稱,2023年10月日本國內新車市場大幅回暖,較2022年10月的359,159輛成長10.7%至397,672輛。 2024年1月,日本微型車銷量達33.4萬輛。

消費者對安全性和舒適性的偏好不斷提高、中檔汽車擴大採用側面和側氣囊以及對車輛安全功能的需求不斷成長是推動亞太地區乘用車和商用車先進安全性成長的主要驅動力。此外,由於政府採取措施提高乘客安全性以及系統和組件成本下降,預計預測期內對安全氣囊的需求將會增加。

此外,該地區各國政府越來越重視減少道路交通事故和人員死亡,刺激了對汽車安全氣囊系統的需求。由於安全氣囊對於任何車輛來說都是緩解事故衝擊的必需部件,因此整合先進的安全氣囊模組對於提高該地區的道路安全至關重要。

- 根據印度政府統計,2022年印度共發生461,312起道路交通事故,造成168,491人死亡,443,366人受傷。

預計主要汽車製造商的戰略擴張以及中國和印度等國家新車型的推出將在預測期內推動亞太地區對汽車安全氣囊系統的巨大需求。

汽車安全氣囊產業概況

汽車安全氣囊市場高度整合且競爭激烈。少數公司佔了大部分市場佔有率。主要公司包括採埃孚股份公司、奧托立夫公司、豐田合成、均勝安全系統、現代摩比斯、大陸集團、住友商事株式會社和工業。這些公司在研發方面投入大量資金,並不斷推出能提升駕駛安全性的創新安全氣囊解決方案。例如

- 2023年7月,採埃孚集團與位於中國中部湖北省武漢經濟開發區(WEDZ)簽署協議,投資新建一家專門生產開發汽車安全氣囊的工廠。該工廠將命名為採埃孚武漢汽車安全系統(武漢)。

- 2023年6月,奧托立夫推出了基於伯努利原理的新型安全氣囊技術。伯努利原理指出,隨著流體速度的增加,靜壓力會降低,讓大量周圍空氣被捲入安全氣囊充氣過程中。開創性的「伯努利安全氣囊」在美國密西根州奧本山舉行的奧托立夫投資者日上亮相。

隨著競爭對手製定策略以獲得優勢,汽車安全氣囊模組市場預計將迅速擴大。較大的公司正在尋求與汽車製造商建立長期夥伴關係以提高盈利。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 乘用車和商用車銷售成長推動成長

- 市場限制

- 安全氣囊缺陷和召回阻礙成長

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 按車輛類型

- 搭乘用車

- 商用車

- 按類型

- 前座安全氣囊

- 充氣安全帶

- 側邊氣簾

- 側邊安全氣囊

- 膝部安全氣囊

- 按銷售管道

- 目的地設備製造商(OEM)

- 更換/售後市場

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第6章競爭格局

- 供應商市場佔有率

- 公司簡介

- ZF Friedrichshafen AG

- Autoliv Inc.

- Yanfeng(Huayu Automotive Systems Co. Ltd)

- Toyoda Gosei Co. Ltd

- Continental AG

- Joyson Safety Systems

- Hyundai Mobis Co. Ltd

- Sumitomo Corporation

- Jinzhou Jinheng Automotive Safety System Co. Ltd

- Ashimori Industry Co. Ltd

第7章 市場機會與未來趨勢

- 政府大力加強車輛安全系統推動市場需求

第8章 供應商資訊

The Automotive Airbags Market size is estimated at USD 27.98 billion in 2025, and is expected to reach USD 48.24 billion by 2030, at a CAGR of 11.51% during the forecast period (2025-2030).

Over the long term, the increasing vehicle sales and production, coupled with the government's stringent regulations to enhance the safety system of vehicles, is expected to serve as the major determinant for the growth of the global automotive airbags market. The increasing awareness about safety among consumers and authorities is also anticipated to lead to significant developments, resulting in improved security and reduced accident fatalities on the road. With further technological advancements, the market is expecting even safer and more reliable airbag modules in cars and commercial vehicles.

Key Highlights

- According to the International Organization of Motor Vehicle Manufacturers (OICA), new light commercial vehicle sales touched 19.8 million units in 2022 compared to 18.6 million units in 2021 worldwide, recording a substantial Y-o-Y growth of 7% between 2021 and 2022.

- Similarly, bus and coach production worldwide reached 253.1 thousand units in 2022 compared to 198.5 thousand units in 2021, recording a Y-o-Y growth of 28% between 2021 and 2022.

In addition, the growing focus by premium and luxury car manufacturers on manufacturing new products with enhanced features in developed countries is further fostering the demand for automotive airbags worldwide. With growing awareness of road safety among consumers and a push from government regulations, original equipment manufacturers (OEM) are focusing on designing their new model structures to incorporate curtain airbags covering the side windows.

However, one of the major challenges faced by the industry is vehicle recalls due to faulty airbags being incorporated in cars and commercial vehicles, which negatively impacts the brand value of automakers, affecting their business performance.

Key Highlights

- In December 2023, Kia recalled the 2023 Seltos in the United States due to a welding error, causing the diffuser disk to break, resulting in the curtain airbags inflating without warning or deployment command. As per the National Highway Traffic Safety Administration (NHTSA) report, a total of 4-part numbers for the side curtain airbag modules had the issue, affecting 1,367 units of the Seltos crossover.

- In May 2023, a major "do not drive" warning was reported for nearly 90,000 BMW vehicles due to a faulty Takata driver-side airbag inflator system. The company stated that the older models of BMW fitted with faulty side airbags could send shrapnel flying into the cabin, in the direction of the front passengers, if nudged, which can pose a serious risk to drivers and other passengers.

Asia-Pacific is anticipated to be a major region contributing to the market's growth, followed by Europe and North America. Japan and South Korea are expected to contribute significantly to the growth in terms of revenue due to safety norms and firm government regulations. Due to an increase in the number of serious accidents and an expanded fleet, China is expected to emerge as one of the major countries that contribute significantly to the demand for airbags. Moreover, the preference of consumers toward new-energy vehicles is witnessing a gradual shift in automakers strategizing to electrify their vehicle fleets, which is expected to positively influence the demand for automotive airbag systems in the coming years.

Automotive Airbags Market Trends

Passengers Cars Segment to Gain Traction during the Forecast Period

Passenger car sales are witnessing tremendous growth globally, with leading car brands including Volkswagen, Nissan, General Motors, and Ford. With the expanding passenger car market, there exist rising safety concerns among automakers to ensure that their vehicle models can provide all necessary safety solutions that can mitigate road fatalities, which is positively impacting the surging demand for automotive airbag systems.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), new passenger car sales worldwide touched 57.4 million units in 2022 compared to 56.4 million units in 2021, representing a year-on-year growth of 1.9% between 2021 and 2022.

The rising urbanization rate and increasing per capita disposable income of consumers are aiding the demand for passenger cars as these consumers prefer private transportation mediums for their commuting purposes. Passenger safety is of utmost importance to governments and manufacturers. Regulations toward consumer safety and security have made manufacturers install safety devices in cars. Many countries have made using seat belts and airbags mandatory. Moreover, manufacturers are actively focusing on forming partnerships with major automakers to enhance their brand presence. They are introducing new products that can suit the requirements of new-age passenger cars.

- In May 2023, NIO, a Chinese-based high-performance electric vehicle manufacturer, reached an agreement with Autoliv Inc., the leading manufacturer of automotive airbags and seat belts, to manufacture safety products for electric vehicles. This development of safety technologies will increase the demand for inflatable seat belts, as airbag deployment works only when the seat belts are intact.

With the rising automobile vehicle production and sales worldwide, the automotive passenger safety authorities are adopting various safety regulations to reduce passenger injuries.

- For instance, in October 2023, the Ministry of Road Transport and Highways India made six airbags mandatory for automotive passenger vehicles. This rule will apply to eight-seater passenger cars to make road travel safer. Due to the challenges faced in the global supply chain, this rule has been in effect since October 2023. Initially, the Indian government officials wanted to roll it out in October 2022.

With the growth in electric passenger car sales and the expanding production market, a massive demand for automotive airbag systems for passenger cars is projected during the forecast period.

Asia-Pacific Region is Expected to be Fastest-Growing Market During Forecast Period

Asia-Pacific is expected to be the fastest-growing region in the market, followed by North America and Europe. Asia-Pacific is a huge market for passenger vehicles, with India and China being some of the world's largest markets for passenger vehicles, contributing to almost 30% of worldwide passenger vehicle sales.

- According to the Society of Manufacturers of Electric Vehicles, electric four-wheeler sales touched 48,105 units in FY 2023 compared to 19,782 units in FY 2022, representing a Y-o-Y growth of 143.1% between FY 2022 and FY 2023.

- According to the Japan Automobile Dealers Association, in October 2023, the new vehicle market in Japan made a strong recovery, with sales rising by 10.7% to 397,672 units from 359,159 units in October 2022. In January 2024, mini vehicle sales in Japan touched 334 thousand units.

The increased consumer preference for safety and comfort features, the increased penetration of side and curtain airbags in mid-level cars, and the rising demand for safety features in vehicles are primarily responsible for the growth of advanced safety in passenger cars and commercial vehicles in Asia-Pacific. The demand for airbags is also anticipated to increase over the forecast period due to government initiatives to improve passenger safety and falling system and component costs.

Furthermore, governments in the region are increasing their focus on reducing road accidents and fatalities, fueling the demand for automotive airbag systems. Airbags are crucial in any vehicle to mitigate the impact of an accident, and therefore, integrating advanced airbag modules is a necessity that can enhance road safety in the region.

- According to the Indian government, 461,312 road accidents were reported in the country in 2022, resulting in 168,491 fatalities and injuries to 443,366 individuals, suggesting a growing need for airbags.

With major automakers strategizing to expand their operations and launch new vehicle models in countries such as China and India, a massive demand for automotive airbag systems across Asia-Pacific is expected during the forecast period.

Automotive Airbags Industry Overview

The automotive airbags market is highly consolidated and competitive. A few players capture most of the market share. Some of the major players include ZF Friedrichshafen AG, Autoliv Inc., Toyoda Gosei Co. Ltd, Joyson Safety Systems, Hyundai Mobis Co. Ltd, Continental AG, Sumitomo Corporation, and Ashimori Industry Co. Ltd, among others. These players are investing hefty sums in research and development to constantly manufacture innovative airbag solutions that can enhance the safety of drivers. For instance,

- In July 2023, ZF Group finalized a deal with the Wuhan Economic Development Zone (WEDZ) located in Hubei province, central China, to invest in a new facility focused on producing and developing automotive airbags. The establishment will be known as ZF Wuhan Automotive Safety Systems (Wuhan) Co. Ltd. Once operational, this center is projected to achieve a maximum yearly production value of approximately CNY 3 billion (USD 4,200 million)

- In June 2023, Autoliv unveiled its new airbag technology based on the Bernoulli Principle, which states that, as the speed of a fluid increases, the static pressure decreases, which assists in significantly incorporating surrounding air into the airbag's inflation process. The pioneering 'Bernoulli airbag' was showcased at Autoliv's Investor Day in Auburn Hills, Michigan, United States.

The market is anticipated to witness rapid enhancement in automotive airbag modules as competitors strategize to gain a competitive edge. Major players seek to form long-term partnerships with automakers to boost their profitability prospects.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Passenger and Commercial Vehicle Sales to Foster Growth

- 4.2 Market Restraints

- 4.2.1 Airbag Malfunction and Recall Deters Growth

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Type

- 5.2.1 Front Airbags

- 5.2.2 Inflatable Seat Belts

- 5.2.3 Curtain Airbags

- 5.2.4 Side Airbags

- 5.2.5 Knee Airbags

- 5.3 By Sales Channel

- 5.3.1 Original Equipment Manufacturer (OEM)

- 5.3.2 Replacement/Aftermarket

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 ZF Friedrichshafen AG

- 6.2.2 Autoliv Inc.

- 6.2.3 Yanfeng (Huayu Automotive Systems Co. Ltd)

- 6.2.4 Toyoda Gosei Co. Ltd

- 6.2.5 Continental AG

- 6.2.6 Joyson Safety Systems

- 6.2.7 Hyundai Mobis Co. Ltd

- 6.2.8 Sumitomo Corporation

- 6.2.9 Jinzhou Jinheng Automotive Safety System Co. Ltd

- 6.2.10 Ashimori Industry Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Government's Aggressive Push to Enhance Vehicle Safety Systems to Propel the Market Demand