|

市場調查報告書

商品編碼

1844569

汽車側氣簾:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Automotive Curtain Airbags - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

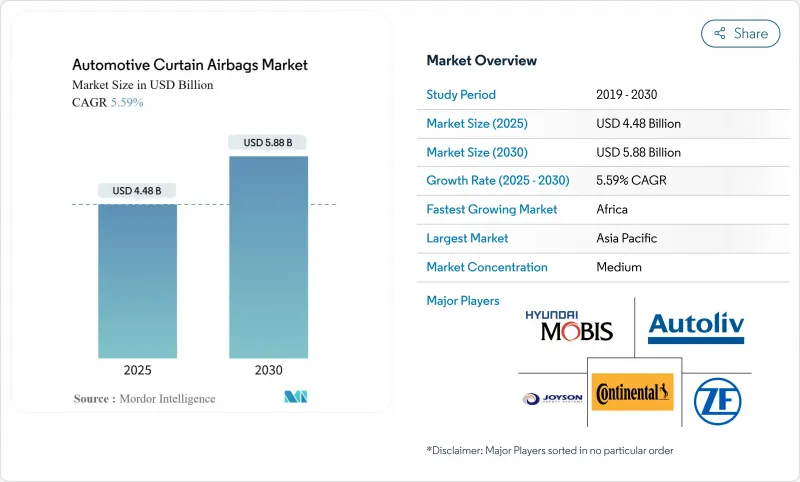

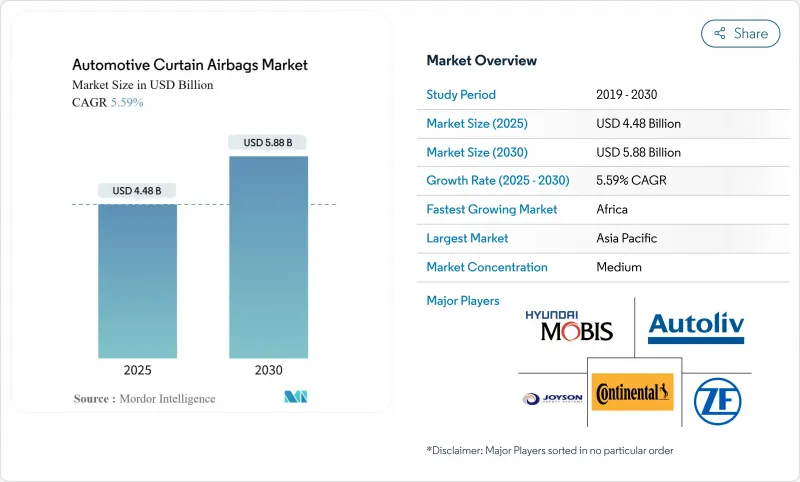

預計到 2025 年汽車側氣囊市場規模將達到 44.8 億美元,到 2030 年將達到 58.8 億美元,複合年成長率為 5.59%。

這一勢頭反映了全球側面碰撞法規趨於嚴格、運動休旅車(SUV) 出貨量激增以及電動車 (EV) 滑板平台帶來的包裝自由等因素的共同作用。強制符合 FMVSS 214、歐洲新車安全評鑑協會 (Euro NCAP) 遠端通訊協定和 GTR 14 迫使所有大眾市場原始設備製造商 (OEM) 在已開發市場和新興市場都採用車頂導軌安全氣簾,從而加快了標準安裝率。印度、巴西和東協地區消費者對五星級碰撞評分的需求加劇了 OEM 對全長安全氣簾的關注,而像 Toyobo-Indorama 在泰國的尼龍-6,6織造廠這樣的合資企業正在緩解之前阻礙生產的布料壓力。面向側翻的 SUV 系列和廣泛的跨界車產品組合構成了全球汽車車頂安全氣簾市場最大的吸收管道。

全球汽車側氣簾市場趨勢與洞察

嚴格的側面碰撞和翻車法規促進全球採用

第 14 號全球技術法規統一了各個市場的頭部傷害標準,並強制原始設備製造商在所有平台上指定使用側氣簾,而不僅僅是出口裝飾。澳洲新的側面碰撞法規在強制使用側氣簾時將乘員死亡率降低了 30%。先前,NHTSA 預測強制使用側氣簾每年將挽救 311 人的生命,現在透過對經驗碰撞資料庫的審查檢驗了這一目標。由於印度強制使用六個安全氣囊,巴西的 NCAP 將星級評定與車頂導軌側氣簾掛鉤,供應商受益於監管層疊,取消了側氣簾的可選狀態。因此,織物、氣體發生器和引發器的產量承諾提前數年鎖定,即使在景氣衰退時期也能確保生產能力。

全球範圍內SUV和CUV的流行導致車頂導軌安裝率的增加。

SUV是成長最快的輕型車類別,這一趨勢直接增加了每輛車的頭部安全簾數量。福特15英尺長的第五排安全氣囊展現了保護拉伸廂型車和三排跨界車乘員所需的工程技術飛躍。美國公路安全保險協會(IHS)的數據證實,使用頭部安全簾後,駕駛死亡率可降低37%。美國國內SUV的蓬勃發展以及印度從掀背車向緊湊型SUV的轉變,將確保頭部安全簾的銷量在未來幾年持續成長,進一步鞏固其在全球需求曲線中的地位。

氣囊缺陷導致召回和訴訟,從而提高風險溢價

美國國家公路交通安全管理局 (NHTSA) 宣布,由於側面安全氣囊充氣簾存在破裂風險,將於 2024 年召回 298,700 輛克萊斯勒和道奇轎車,這再次引發了公眾對彈片傷亡的擔憂。法律和解導致供應商保險費上漲,並迫使原始設備製造商延長檢驗通訊協定,從而導致成本增加和車型發布延遲。 BMW、起亞和豐田在 2024-2025 年也面臨類似的與側氣簾相關的召回,這加劇了投資者對汽車側氣簾產業的謹慎態度。

細分分析

到2024年,頭部專用簾式氣囊將佔據汽車簾式氣囊市場佔有率的51.25%。監管機構將繼續強調頭部損傷標準,以確保持續的需求。組合式簾式氣囊(單一模組覆蓋頭部和軀幹)到2030年的複合年成長率將達到8.31%,在所需組件較少的高階三排SUV中將越來越受歡迎。

製造商正在改進編織密度和通風孔形狀,以維持六秒的充氣,從而在多滾事故中保護乘員免受二次碰撞。奧托立夫最新的三排座椅跨度為2.5米,可在35毫秒內展開。隨著中國MPV平台不斷發展以適應叫車服務,超長窗簾有望引領汽車窗簾式安全氣囊市場的下一波應用浪潮。

到2024年,SUV將佔據汽車側氣簾市場規模的44.36%,複合年成長率為9.12%。 SUV重心較高,更容易發生翻車事故,因此需要增加車頂導軌的覆蓋範圍。 B級和C級跨界車在中國、印度和美國市場銷售良好,這促使供應商開發更薄的模組,以覆蓋全景天窗框架。

雖然轎車銷量正在逐漸下降,但日本和韓國等地區的偏好仍使緊湊型四門車對窗簾的需求保持穩定。福特商用廂型車的窗簾展現了在不影響展開時效的情況下覆蓋五排座椅的複雜性。電動SUV引入了新的技術變數。地板電池加強了側裙,並將侵入力向上傳遞,因此窗簾必須保持更長時間的充氣狀態,以防止頭部接觸碎玻璃。

區域分析

受中國龐大生產基地和印度六缸安全氣囊法規收緊的推動,亞太地區將在2024年引領汽車側氣囊市場,營收佔有率達46.18%。吉利和瑪魯蒂等本土汽車製造商正在將全長側氣囊安裝到售價低於1萬美元的掀背車上,以實現出口目標。在日本,面向全球供應混合式氣體發生器的DAICEL,其煙火技術專長正在推動推進劑化學領域的突破。韓國正在將ADAS演算法與被動系統結合,以最佳化其高階電動車(EV)產品線的部署時機。

在FMVSS 214合規性和SUV強勁銷售的推動下,北美持續發揮關鍵作用。美國正在L4級自動駕駛測試中推進低溫混合氣體發生器的應用,為供應商提供極端氣候解決方案的試驗場。墨西哥組裝廠正在為跨境車型採用統一的氣簾規格,從而簡化一級供應商的工裝流程。加拿大正在根據區域零件配置規則支援模組化子次組件,為汽車產業增值。

歐洲正在優先考慮永續性和技術整合。在德國,高階電動車的普及推動了先進的排氣孔測量儀的應用;而法國和義大利則鼓勵採用機械縫合技術,以便在碰撞後快速放氣,從而方便緊急救援。非洲儘管起步較低,但卻是成長最快的地區,到2030年的複合年成長率將達到6.18%。南非的CKD工廠正在根據歐盟出口認證標準整合雙級安全簾。肯亞和奈及利亞正在啟動二手車進口限制,鼓勵銷售捆綁全套安全套件的新車。海灣合作理事會國家正採用聯合國R135標準,要求日本和美國進口的SUV在海關檢查時安裝頭部保護簾。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 嚴格的側面碰撞和翻車法規(FMVSS 214、Euro NCAP、GTR 14)

- 全球SUV和CUV的日益普及,推動了車頂橫桿安全氣囊安裝率的上升

- 整合 ADAS/主動安全套件,增強被動安全內容

- 新興國家消費者對五星 NCAP 評級的需求

- 電動車滑板平台為大型側氣簾提供了空間

- 低溫混合充氣機可實現自動駕駛計程車的安全 OOP 部署

- 市場限制

- 氣體發生器缺陷召回和訴訟(Takata、ARC)推高了風險溢價

- 入門級車型的價格壓力限制了低成本汽車的標準化

- 尼龍6,6織物和引發劑供不應求導致OEM生產延遲

- 電動車結構電池組提供替代側面碰撞保護

- 價值/供應鏈分析

- 技術展望

- 監管狀況

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模及成長預測

- 側氣簾類型

- 軀幹側氣簾

- 頭部簾式安全氣囊

- 組合式側氣簾

- 按車輛類型

- 掀背車

- 轎車

- 運動型多用途車

- 皮卡和 MPV

- 按最終用戶

- OEM

- 售後市場

- 由 Inflator Technology 提供

- 火藥

- 儲存的氣體

- 混合/低溫混合

- 按銷售管道

- 傳統零售商

- 線上/直接面對消費者

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 摩洛哥

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Autoliv Inc.

- Joyson Safety Systems

- ZF Friedrichshafen AG

- Continental AG

- Hyundai Mobis Co. Ltd

- Toyoda Gosei Co. Ltd

- Daicel Corporation

- ARC Automotive Inc.

- iSi Automotive GmbH

- Ashimori Industry Co. Ltd

- Nihon Plast Co. Ltd

- Porcher Industries SA

- Toray Industries Inc.

- East Joy Long Motor

- Neaton Auto Products

- Sumitomo Corporation

- TRW Automotive Holdings Corp.

- Visteon Corporation

- Bosch Passive Safety Systems

第7章 市場機會與未來展望

The Automotive curtain airbags market size stands at USD 4.48 billion in 2025 and is projected to reach USD 5.88 billion by 2030, registering a 5.59% CAGR.

This momentum reflects the convergence of stringent global side-impact legislation, the boom in sport-utility vehicle (SUV) deliveries, and the packaging freedom created by electric-vehicle (EV) skateboard platforms . Mandatory compliance with FMVSS 214, Euro NCAP far-side protocols, and GTR 14 forces every volume carmaker to embed roof-rail curtains in both developed and emerging markets, accelerating standard fitment rates. Consumer demand for five-star crash scores across India, Brazil, and the ASEAN bloc intensifies OEM focus on full-length curtains, while joint ventures such as Toyobo-Indorama's nylon-6,6 weaving plant in Thailand mitigate fabric tightness that previously throttled production. Rollover-oriented SUV lines and expansive crossover portfolios thus become the single largest absorption channel for Automotive curtain airbags market deployments worldwide.

Global Automotive Curtain Airbags Market Trends and Insights

Stringent Side-Impact & Rollover Regulations Drive Global Adoption

Global Technical Regulation 14 aligns head-injury criteria across markets and forces OEMs to specify curtain airbags on every platform, not just export trims. Australia's new side-impact rule lowered occupant fatalities by 30% once curtain deployment became compulsory. Earlier, NHTSA projected its side-airbag mandate would save 311 lives per year-a target now verified through empirical crash-database reviews. With India moving toward mandatory six-airbag legislation and Brazil's NCAP tying star ratings to roof-rail curtains, suppliers benefit from a regulatory cascade that eliminates optional-equipment status for side curtains. Consequently, volume commitments for fabric, inflators, and initiators stay locked years in advance, safeguarding capacity utilization even in cyclical downturns.

Rising Global SUV & CUV Penetration Increases Roof-Rail Fitment

SUV deliveries represent the fastest-growing light-vehicle category, a trend that directly lifts per-vehicle curtain count. Ford's 15-ft-long, five-row airbag points to the engineering leap required to safeguard occupants in stretched vans and three-row crossovers. Insurance Institute for Highway Safety data corroborate a 37% drop in driver deaths when head-protecting curtains deploy. China's domestic SUV boom and India's migration from hatchbacks to compact SUVs assure a multi-year uplift in curtain volumes, further embedding this driver in global demand curves.

Recalls & Litigations from Inflator Defects Raise Risk Premium

NHTSA's 2024 recall of 298,700 Chrysler and Dodge sedans for Side Airbag Inflatable Curtain rupture risk revived public anxiety around shrapnel injuries. Legal settlements inflate supplier insurance premiums, while OEMs lengthen validation protocols, adding cost and delaying model launches. BMW, Kia, and Toyota faced similar curtain-related recalls in 2024-2025, reinforcing investor caution in the Automotive curtain airbags industry.

Other drivers and restraints analyzed in the detailed report include:

- Integration of ADAS with Passive Safety Suites

- Consumer Demand for 5-Star NCAP Ratings in Emerging Economies

- Price Pressure on Entry-Level Models Limits Standardization

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Head-only curtains secured 51.25% of the Automotive curtain airbags market share in 2024, supported by a proven 31% fatality reduction in side-impact crashes. Regulatory agencies continue to weigh head-injury criteria heavily, ensuring perennial demand. Combo curtains, which merge head and torso coverage in a single module, log an 8.31% CAGR through 2030 and gain traction in premium three-row SUVs seeking simpler bill-of-material counts.

Manufacturers refine weaving density and vent-hole geometry to sustain six-second inflation, protecting occupants against secondary hits in multi-roll incidents. Autoliv's latest three-row design spans 2.5 m and deploys in 35 ms, illustrating how suppliers address cabin length growth. As Chinese MPV platforms stretch to court ride-hailing services, ultra-long curtains promise the next adoption wave for the Automotive curtain airbags market.

SUVs accounted for 44.36% of the Automotive curtain airbags market size in 2024 and are on pace for a 9.12% CAGR. Their high center of gravity increases rollover exposure, necessitating extended roof-rail coverage. Crossovers in the B- and C-segments sell briskly in China, India, and the United States, pushing suppliers to develop low-profile modules that clear panoramic-sunroof frames.

Sedans decline gradually, yet regional tastes in Japan and South Korea maintain steady curtain demand for compact four-doors. Pickup trucks and MPVs create lucrative niches; Ford's commercial van curtain illustrates the complexity of spanning five seating rows without compromising deployment timing. EV SUVs bring new engineering variables: floor batteries stiffen side sills, transferring intrusion force upward, so curtains must remain inflated longer to prevent head contact with shattered glass.

The Global Automotive Curtain Airbags Market is Segmented by Curtain Airbag Type (Torso Curtain Airbags, Head Curtain Airbags and More), Vehicle Type (Hatchback, Sedan, Sports Utility Vehicles, and More), End User (OEM and Aftermarket), Inflator Technology (Pyrotechnic, Stored Gas, and More), Sales Channel (Traditional Dealerships and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific leads the Automotive curtain airbags market with 46.18% revenue share in 2024, driven by China's large production base and India's regulatory push for six airbags. Domestic OEMs such as Geely and Maruti embed full-length curtains even in sub-USD 10,000 hatches to meet export targets. Japan's pyrotechnic expertise propels propellant chemistry breakthroughs at Daicel, which supplies hybrid inflators worldwide. South Korea pairs ADAS algorithms with passive systems to refine deployment timing across premium electric vehicle (EV) lineups.

North America remains pivotal through FMVSS 214 compliance and strong SUV sales. United States Level-4 autonomy pilots promote low-temperature hybrid inflators, giving suppliers a proving ground for extreme-climate solutions. Mexico's assembly plants adopt identical curtain specifications for cross-border models, streamlining tier-one tooling. Canada supports module sub-assembly under regional parts-content rules, adding value to its auto sector.

Europe emphasizes sustainability and technology integration. Germany's premium EV expansion drives advanced vent-hole metering, while France and Italy encourage mechanical stitching that enables rapid post-crash deflation to aid emergency access. Africa, while starting from a lower base, is the fastest-growing region with a 6.18% CAGR through 2030. South African CKD plants integrate dual-stage curtains aligned with EU export homologation. Kenya and Nigeria launch used-vehicle import restrictions, compelling new-car sales that bundle full safety suites. GCC states adopt UN R135, obliging Japanese and US SUV imports to include head-protecting curtains at customs inspection.

- Autoliv Inc.

- Joyson Safety Systems

- ZF Friedrichshafen AG

- Continental AG

- Hyundai Mobis Co. Ltd

- Toyoda Gosei Co. Ltd

- Daicel Corporation

- ARC Automotive Inc.

- iSi Automotive GmbH

- Ashimori Industry Co. Ltd

- Nihon Plast Co. Ltd

- Porcher Industries SA

- Toray Industries Inc.

- East Joy Long Motor

- Neaton Auto Products

- Sumitomo Corporation

- TRW Automotive Holdings Corp.

- Visteon Corporation

- Bosch Passive Safety Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Side-Impact & Rollover Regulations (FMVSS 214, Euro NCAP, GTR 14)

- 4.2.2 Rising Global SUV & CUV Penetration Increasing Roof-Rail Airbag Fitment

- 4.2.3 Integration of ADAS/Active Safety Suites Boosting Passive Safety Content

- 4.2.4 Consumer Demand for 5-Star NCAP Ratings in Emerging Economies

- 4.2.5 EV Skateboard Platforms Freeing Packaging Space for Larger Curtain Airbags

- 4.2.6 Low-Temperature Hybrid Inflators Enabling Safe OOP Deployment in Robo-Taxis

- 4.3 Market Restraints

- 4.3.1 Recalls & Litigations From Inflator Defects (Takata, ARC) Raise Risk Premium

- 4.3.2 Price Pressure on Entry-Level Models Limits Standardisation in Low-Cost Cars

- 4.3.3 Nylon-6,6 Fabric & Initiator Supply Shortages Causing OEM Production Delays

- 4.3.4 Structural Battery Packs in EVs Offering Alternative Side-Impact Protection

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Curtain Airbag Type

- 5.1.1 Torso Curtain Airbags

- 5.1.2 Head Curtain Airbags

- 5.1.3 Combo Curtain Airbags

- 5.2 By Vehicle Type

- 5.2.1 Hatchback

- 5.2.2 Sedan

- 5.2.3 Sports Utility Vehicle

- 5.2.4 Pick-up Trucks & MPVs

- 5.3 By End User

- 5.3.1 OEM

- 5.3.2 Aftermarket

- 5.4 By Inflator Technology

- 5.4.1 Pyrotechnic

- 5.4.2 Stored Gas

- 5.4.3 Hybrid / Low-temperature Hybrid

- 5.5 By Sales Channel

- 5.5.1 Traditional Dealerships

- 5.5.2 Online & Direct-to-Consumer

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Russia

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Morocco

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share, Products & Services, and Recent Developments)

- 6.4.1 Autoliv Inc.

- 6.4.2 Joyson Safety Systems

- 6.4.3 ZF Friedrichshafen AG

- 6.4.4 Continental AG

- 6.4.5 Hyundai Mobis Co. Ltd

- 6.4.6 Toyoda Gosei Co. Ltd

- 6.4.7 Daicel Corporation

- 6.4.8 ARC Automotive Inc.

- 6.4.9 iSi Automotive GmbH

- 6.4.10 Ashimori Industry Co. Ltd

- 6.4.11 Nihon Plast Co. Ltd

- 6.4.12 Porcher Industries SA

- 6.4.13 Toray Industries Inc.

- 6.4.14 East Joy Long Motor

- 6.4.15 Neaton Auto Products

- 6.4.16 Sumitomo Corporation

- 6.4.17 TRW Automotive Holdings Corp.

- 6.4.18 Visteon Corporation

- 6.4.19 Bosch Passive Safety Systems

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment