|

市場調查報告書

商品編碼

1690744

美國託管服務業:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)United States (US) Managed Services Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

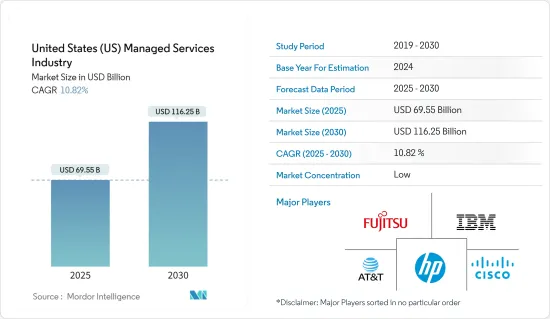

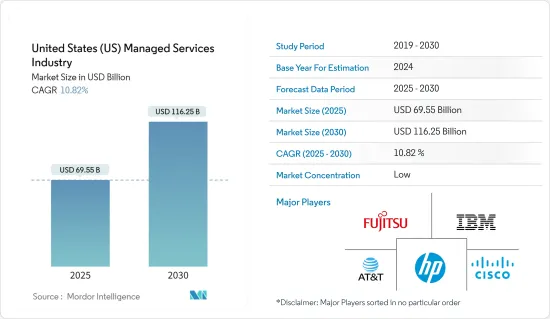

美國託管服務業預計將從 2025 年的 695.5 億美元成長到 2030 年的 1,162.5 億美元,預測期內(2025-2030 年)的複合年成長率為 10.82%。

關鍵亮點

- 託管服務旨在透過將某些 IT 功能和流程外包給第三方供應商來提高業務效率並降低成本。這種方法提高了服務品質、業務效率和客戶滿意度,同時降低了成本。

- 根據市場研究,物聯網 (IoT) 設備的激增正在推動對託管物聯網服務的需求,並凸顯了保護、監控和最佳化這些連接設備的需求。針對此, IT基礎設施供應商正在共同合作開發物聯網解決方案。

- 混合 IT 是內部部署基礎架構和雲端基礎的解決方案的組合。物聯網 (IoT) 的興起迫使企業重新思考客戶參與策略。託管服務供應商(MSP) 在加強安全性和確保物聯網生態系統的強大保護方面發揮關鍵作用。

- 美國託管服務市場格局經常受到多種技術整合和行業法規遵守的挑戰。企業必須遵循影響託管服務實施和營運的一系列標準和法律要求。

- 當新冠疫情和隨後的停工首次爆發時,由於企業專注於生存並推遲了非必要的投資,需求暫時下降。這推遲了託管服務協議的推出。然而,遠距工作的突然增加凸顯了對安全性、雲端遷移、協作工具和網路的需求,為託管服務供應商(MSP) 創造了產業成長機會。

美國託管服務業的趨勢

雲端運算將推動市場成長

- 雲端基礎的託管服務提供靈活性和可擴展性,並允許服務供應商遠端存取、監控和解決其雲端環境中的問題。此外,市場資料顯示,人工智慧/機器學習、巨量資料分析、威脅情報和先進自動化平台等技術的採用正在推動向雲端基礎的服務的轉變。市場參與企業正在根據行業趨勢推出創新和協作服務。

- 例如,2023 年 11 月,全球網路安全供應商 SonicWall 收購了資安管理服務供應商 (MSP) Solutions Granted Inc. (SGI),後者為數百家託管服務供應商(MSP) 提供服務。此次收購加強了 SonicWall 對合作夥伴的承諾。擴展 SonicWall 的產品組合,包括美國的安全營運中心即服務 (SOCaaS)、託管檢測和回應 (MDR) 以及其他針對 MSP 和 MSSP 的客製化託管服務。

- IT 和通訊部門在雲端託管服務產業中佔有重要佔有率。 2023會計年度,美國聯邦政府已撥款約244億美元用於主要聯邦IT投資。雲端託管服務在美國越來越受歡迎,因為它們能夠簡化 IT 營運、增強安全性並提供可擴展的解決方案,反映出穩定的市場成長率。

- 這些服務有助於雲端基礎設施的遠端系統管理和維護,使企業能夠專注於其核心目標,同時利用外部專業知識,從而促進行業成長。隨著雲端運算應用的激增,對託管服務的需求預計會增加,從而推動數位領域的創新和效率。

IT 和電訊是最大的終端用戶產業

- 美國通訊業對資安管理服務的需求強勁,被公認為產業關鍵趨勢之一。這主要是因為電信業者處理大量敏感資料,例如客戶資訊和網路基礎設施詳細資訊,使其成為網路攻擊的理想目標。此外,通訊網路的複雜性和不斷演變的網路威脅需要專業知識才能進行有效保護。

- 隨著 5G 網路的出現,重點已轉移到確保最終用戶的安全性和高品質體驗,通訊託管服務產業概覽中強調了這一轉變。根據VIAVISION統計,截至2023年4月,美國已有503個城市可以接入5G網路,比世界上任何其他國家都多,這要求美國必須從傳統的以技術為中心的網路管理和最佳化方法發生重大轉變。因此,對通訊管理服務的需求不斷增加,以協助實現這一轉變,從而促進市場的成長。

- 2023 年 7 月,領先的託管 IT、網路安全和雲端解決方案供應商資料收購了總部位於德克薩斯州的安全託管服務供應商LevelSec。此次收購擴大了資料的全國影響力和行業專業知識,同時為 RevelSec 的客戶提供了更廣泛的資料服務。

- 根據市場報告,由於物聯網、人工智慧和邊緣運算等技術進步需要先進的網路基礎設施,託管基礎設施將佔據相當大的市場佔有率。託管服務在加速這些技術的採用方面發揮關鍵作用。

美國美國服務業概況

美國託管服務市場概況分為富士通、思科系統公司、IBM 公司、AT&T 公司和惠普公司等最大的公司,這些公司在市場上擁有強大的基本客群。這些公司總是提供越來越多的服務。隨著公司採取強力的競爭策略以在市場中生存並留住客戶,市場競爭日益激烈。

- 2024 年 2 月 - Ubiquity 與富士通合作,增強最後一哩數位基礎設施的彈性。 Ubiquity 將利用富士通的網路營運中心來支援其在美國四大主要市場的最後一哩光纖寬頻基礎設施。富士通在 Ubiquity 上列出了其位於德克薩斯州的營運商級 NOC 的全天候託管網路服務。

- 2024 年 1 月-思科宣布與日立子公司 Hitachi Vantara 合作推出新一代混合雲端託管服務,Hitachi Vantara 專門從事資料儲存、基礎架構和混合雲端管理。這些服務專門針對解決現代企業面臨的持續資料管理挑戰。該聯合解決方案名為“日立 EverFlex 與思科混合雲”,將自動化解決方案與預測分析結合。日立 EverFlex 與思科支援的混合雲是自動化和預測分析的結合,旨在為企業提供面向未來的套件,以簡化基礎設施管理、最佳化成本並提高營運效率。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 工業影響評估

第5章市場動態

- 市場促進因素

- 轉向混合IT的轉變日益加劇

- 提高成本和業務效率

- 市場問題

- 整合和監管問題、可靠性問題

第6章市場區隔

- 按部署

- 本地

- 雲

- 按類型

- 託管資料中心

- 託管安全

- 託管通訊

- 主機網路

- 託管基礎設施

- 託管行動性

- 按公司規模

- 中小型企業

- 大型企業

- 按行業

- BFSI

- 資訊科技/通訊

- 醫療保健

- 娛樂媒體

- 零售

- 製造業

- 政府

- 其他最終用戶產業

第7章競爭格局

- 公司簡介

- Fujitsu Limited

- Cisco Systems Inc.

- IBM Corporation

- AT& T Inc.

- HP Inc.

- Microsoft Corporation

- Verizon Communications Inc.

- Dell Technologies Inc.

- Rackspace Technology Inc.

- Tata Consultancy Services Limited

- Citrix Systems Inc.

- Wipro Limited

第8章投資分析

第9章:市場的未來

The United States Managed Services Industry is expected to grow from USD 69.55 billion in 2025 to USD 116.25 billion by 2030, at a CAGR of 10.82% during the forecast period (2025-2030).

Key Highlights

- Managed services comprise outsourcing specific IT functions or processes to third-party providers, aiming to streamline operations and reduce costs. This approach enhances service quality, operational efficiency, and customer satisfaction while lowering expenses.

- Market research indicates that the soaring number of Internet of Things (IoT) devices has heightened the demand for managed IoT services, emphasizing the need to secure, monitor, and optimize these connected devices. In response, IT infrastructure providers are collaborating on IoT solutions.

- Hybrid IT combines on-premise infrastructure with cloud-based solutions. The rise of the Internet of Things (IoT) has prompted organizations to rethink their customer engagement strategies. Managed service providers (MSPs) play a crucial role in bolstering security within the IoT ecosystem, ensuring robust protection.

- Relatively speaking, managed services are known to be cost-effective and efficient, as compared to in-house services in the US, as they enable organizations to focus on their core competencies while outsourcing the non-core areas.In the US managed services market outlook, the integration of diverse technologies and adherence to industry regulations often pose challenges. Companies must navigate a web of standards and legal requirements, impacting the implementation and operation of managed services.

- The initial days of the COVID-19 pandemic and subsequent lockdowns caused a temporary dip in demand as businesses focused on survival and delayed non-essential investments. This led to a delay in implementing managed services contracts. However, the surge in remote work highlighted the need for security, cloud migration, collaboration tools, and networking, creating opportunities for industry growth among Managed Service Providers (MSPs).

United States (US) Managed Services Industry Trends

Cloud to Witness Significant Market Growth

- Cloud-based managed services offer flexibility and scalability, empowering service providers to remotely access, monitor, and resolve issues within the cloud environment. Furthermore, market data shows that the adoption of technologies like AI/ML, big data analytics, threat intelligence, and advanced automation platforms is propelling this transition to cloud-based services. Market players are launching innovative and collaborative services in response to industry trends.

- For example, in November 2023, SonicWall, a global cybersecurity provider, acquired Solutions Granted Inc. (SGI), a Managed Security Service Provider (MSSP) catering to hundreds of Managed Service Providers (MSPs). This acquisition bolsters SonicWall's commitment to its partners. It expands its portfolio to include US-based Security Operations Center services (SOCaaS), Managed Detection and Response (MDR), and other tailored managed services for MSPs and MSSPs.

- The IT and Telecom sector holds a significant market share in the cloud-managed services industry. For the 2023 fiscal year, the US federal government allocated around USD 24.4 billion for major federal IT investments, where cloud-managed services are gaining traction in the United States due to their ability to streamline IT operations, bolster security, and offer scalable solutions, thereby reflecting a steady market growth rate.

- These services facilitate remote management and maintenance of cloud infrastructure, which enables businesses to focus on their core objectives while leveraging external expertise, thereby fostering industry growth. The demand for managed services is set to rise as cloud adoption continues to surge, fostering innovation and efficiency in the digital realm.

IT and Telecom to be the Largest End-user Vertical

- The telecom industry in the United States has a strong demand for managed security services and is identified as one of the major significant industry trends. This is primarily due to the telecom companies' handling of vast volumes of sensitive data, including customer information and network infrastructure details, making them prime targets for cyberattacks. Additionally, the complexity of telecom networks and the evolving nature of cyber threats necessitate specialized expertise for effective protection.

- With the advent of 5G networks, the focus has shifted to ensuring end users' security and quality experiences, a shift highlighted in the industry overview of telecom-managed services. According to VIAVISION, as of April 2023, 5G network access was available in 503 United States cities, the most of any country globally, and this requires a significant shift in managing and optimizing networks, moving away from the traditional technology-centric approach. As a result, there is a rising demand for telecom-managed services to aid in this transition, contributing to market growth.

- In July 2023, Dataprise, a leading provider of managed IT, cybersecurity, and cloud solutions, acquired RevelSec, a Texas-based security managed service provider. This acquisition expands Dataprise's national presence and enhances its vertical expertise while providing RevelSec clients access to a broader range of services from Dataprise.

- According to the market report, managed infrastructure holds a significant market share, driven by innovations like IoT, AI, and edge computing, which necessitate advanced network infrastructure. Managed services play an important role in facilitating the adoption of these technologies.

United States (US) Managed Services Industry Overview

The United States managed services market overview is fragmented and is dominated by largest companies, such as Fujitsu Limited, Cisco Systems Inc., IBM Corporation, AT&T Inc., and HP Inc., among other companies that have a strong client base in the market. These players are constantly providing increased and enhanced offerings. Companies are employing powerful competitive strategies in order to survive in the market and retain their clients, thereby intensifying competitive rivalry in the market.

- February 2024 - Ubiquity partnered with Fujitsu to augment Last-Mile Digital Infrastructure Resilience. Ubiquity would utilize the Fujitsu Network Operations Center to support last-mile fiber broadband infrastructure in four major US markets. Fujitsu delivers Ubiquity with 24x7 managed network services from their carrier-class NOC in Texas.

- January 2024 - Cisco, in collaboration with Hitachi Vantara, the subsidiary of Hitachi Ltd specializing in data storage, infrastructure, and hybrid cloud management, unveiled Next-Gen hybrid cloud managed services. These services are specifically tailored to tackle the persistent data management hurdles faced by contemporary businesses. The joint solution, known as Hitachi EverFlex with Cisco Powered Hybrid Cloud, combines automation solutions and predictive analytics. It aims to equip organizations with a forward-looking toolkit for streamlined infrastructure management, cost optimization, and enhanced operational efficiency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Shift to Hybrid IT

- 5.1.2 Improved Cost and Operational Efficiency

- 5.2 Market Challenges

- 5.2.1 Integration and Regulatory Issues and Reliability Concerns

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Type

- 6.2.1 Managed Data Center

- 6.2.2 Managed Security

- 6.2.3 Managed Communications

- 6.2.4 Managed Network

- 6.2.5 Managed Infrastructure

- 6.2.6 Managed Mobility

- 6.3 By Enterprise Size

- 6.3.1 Small and Medium Enterprises

- 6.3.2 Large Enterprises

- 6.4 By End-user Vertical

- 6.4.1 BFSI

- 6.4.2 IT and Telecom

- 6.4.3 Healthcare

- 6.4.4 Entertainment and Media

- 6.4.5 Retail

- 6.4.6 Manufacturing

- 6.4.7 Government

- 6.4.8 Other End-user Verticals

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fujitsu Limited

- 7.1.2 Cisco Systems Inc.

- 7.1.3 IBM Corporation

- 7.1.4 AT&T Inc.

- 7.1.5 HP Inc.

- 7.1.6 Microsoft Corporation

- 7.1.7 Verizon Communications Inc.

- 7.1.8 Dell Technologies Inc.

- 7.1.9 Rackspace Technology Inc.

- 7.1.10 Tata Consultancy Services Limited

- 7.1.11 Citrix Systems Inc.

- 7.1.12 Wipro Limited