|

市場調查報告書

商品編碼

1690205

汽車差異化:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Automotive Differential - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

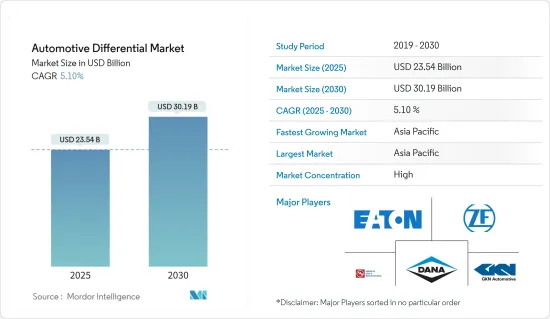

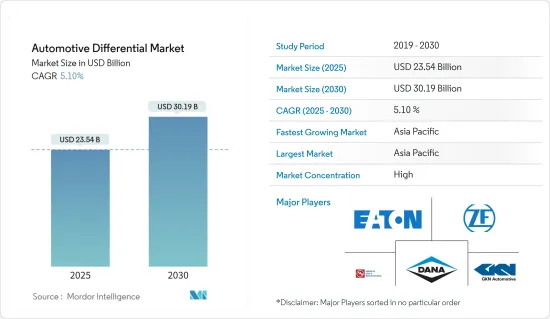

預計 2025 年汽車差速器市場規模為 235.4 億美元,到 2030 年將達到 301.9 億美元,預測期內(2025-2030 年)的複合年成長率為 5.1%。

汽車差速器市場對於任何車輛都至關重要,因為其基本功能是讓車輪以不同的速度旋轉。這就是汽車差速器一直供不應求的原因。隨著個人汽車擁有量的增加和技術的進步,對這種差速系統的需求只會增加。

在亞太地區,中國和印度的經濟成長,尤其是中階收入水準的提高,預計將推動汽車市場的成長。中國和印度佔據全球汽車差速器市場的主導地位,兩國總合佔有超過60%的市場佔有率。新興市場還包括印尼、孟加拉和越南等東南亞國家,這些國家都實現了正成長。

隨著電動車進入市場,一些汽車零件企業的市場需求下滑。然而就汽車差速器市場而言,由於電動車的興起,該產業正在蓬勃發展。大多數知名製造商的電動車都使用差速器。對於四輪驅動車型,特斯拉為前馬達提供差速器。在2WD車型中,差速器可以由單一大型電動單元組成,而不是多個電動單元,從而更加經濟。

此外,隨著電動車產業技術的進步,博格華納等公司在 2024 年 1 月於東京舉行的 EV JAPAN 2024 上展示了他們的 eMobility 解決方案。該解決方案包括一個 800V 高速超緊湊 eDrive,具有獨特的雙軸變速箱設計。差速器整合在中空轉子軸中,提高了效率並減輕了重量。這些技術創新預計將促進市場成長。

汽車差速器市場趨勢

乘用車佔最大市場佔有率

近年來,乘用車以其時尚的設計、緊湊的尺寸和經濟的價值等特點,受到廣大駕駛員的歡迎。客車是許多已開發國家最常見的交通途徑。更好的生活方式、增加購買力平價可支配收入、不斷成長的品牌知名度和不斷改善的經濟都在推動全球客戶偏好的變化,從而導致乘用車銷量高漲。

根據印度汽車工業協會的數據,2022-23 年乘用車銷量將從 14,67,039 輛增加到 17,47,376 輛。

此外,隨著全球需求的增加、成本的下降、技術的進步以及政府的支持,電動車銷售呈指數級成長,從而促進了乘用車的成長。例如,根據國際能源總署(IEA)的數據,2023年第一季電動車銷量超過230萬輛,較去年同期成長約25%。

此外,對運動型多功能車(SUV)的需求不斷增加將為市場參與者創造商機。這是全球乘用車市場成長的主要驅動力。

差速器有助於將動力傳輸至軸,由於乘用車的需求量大以及對先進功能的需求不斷增加,差速器正呈指數級成長。為了跟上市場步伐,每家公司都在致力於推出新車型和推進技術進步。例如

2023年11月,豐田申請了可變限滑差速器的專利,該差速器採用鑄件製成的新型差速器,可根據駕駛環境改變其特性,為市場成長做出貢獻。

亞太地區佔最大市場佔有率

預計未來幾年亞太地區將經歷顯著成長。該地區對汽車差速器的需求主要受到中國、印度和其他國家的乘用車和商用車銷售成長的推動。各汽車製造商都在投資自動駕駛、混合動力汽車和電動車的新技術開發,對市場產生正面影響。

這也有望為汽車差速器產業帶來新的市場機會。例如,2023年4月,印度汽車零件製造商Modern Automotives獲得核准向寶馬集團交付差速小齒輪軸。

印度政府也鼓勵使用電動車。到2035年終,政府計劃將所有燃油汽車轉變為全電動或半電動汽車。受「印度製造」等政府政策舉措,印度汽車差速器市場前景光明。汽車零件製造商正在透過各種投資和推出新的區域產品增加在印度的投資。

隨著亞太地區汽車零件製造業穩定成長,汽車製造商正致力於擴大差異化生產。這是因為市場對電動和汽油車的需求很大。

2024年3月,差速器解決方案供應商Sona BLW Precision Forgings Ltd達到了生產4億個差速齒輪和600萬個差速器總成的里程碑,滿足了印度和中國等市場的市場需求,為市場成長做出了貢獻。

汽車差速器產業概況

汽車差速器市場由全球和地區知名企業鞏固和主導。公司正在採用新產品發布、合作和合併來保持其在市場中的地位。例如

2024 年 1 月 American Axle & Manufacturing 為電動車、轎車和卡車開發創新的傳動系統技術,為一些最大的汽車製造商帶來轉變。在 2024 年國際消費電子展 (CES) 上,該公司將展示其三合一電驅動裝置 (eDU)、全整合式 e-Beam 車軸、差速器解決方案和創新組件技術,以協助定義全球移動出行的未來。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 乘用車銷量成長

- 市場限制

- 差速器維護成本高

- 波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 車型

- 搭乘用車

- 商用車

- 產品類型

- 電子限滑差速器

- 限滑差速器

- 差速鎖

- 其他產品類型

- 驅動器類型

- FWD

- AWD

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Tungaloy Corporation

- Brogwarner Inc.

- Linamar Corporation

- GKN Automotive

- ZF Friedrichshafen AG

- Dana Limited

- American Axle & Manufacturing, Inc.

- Eaton Corporation Plc

- Yager Gear Enterprise Co Ltd

第7章 市場機會與未來趨勢

The Automotive Differential Market size is estimated at USD 23.54 billion in 2025, and is expected to reach USD 30.19 billion by 2030, at a CAGR of 5.1% during the forecast period (2025-2030).

The automotive differential market is integral to any vehicle due to its basic functionality of rotating wheels at different speeds, especially while turning, as the outer wheels cover a larger circumference. As a result, the automotive differential has always remained in demand. With more extensive ownership of personal cars and growing technological advancements, the need for this differential system will only increase.

In Asia-Pacific, the rise in the Chinese and Indian economies with increased income levels, especially among middle-class consumers, will drive the growth of the automotive market. China and India are the world-leading automotive differential markets, with a combined market share of over 60%. Emerging markets also include Southeast Asian countries like Indonesia, Bangladesh, and Vietnam, which saw positive growth.

With electric vehicles entering the market, some automotive parts businesses have seen a drop in market demand. However, in the case of the automotive differential market, the industry is thriving with an increase in electric cars. Most electric vehicles from reputable manufacturers use differentials. For 4WD models, Tesla provides differentials for front and rear motors. While 2WD models can have differentials with a single large electric unit instead of multiple ones, it is highly economical.

Furthermore, with the technological advancements in the electric vehicle industry, companies like BorgWarner showcased their eMobility Solutions at EV JAPAN 2024 in Tokyo in January 2024. The solution includes an 800V high-speed, ultra-compact eDrive with a unique dual layshaft gearbox design. The differential is integrated into a hollow rotor shaft, increasing efficiency and reducing weight. These innovations are expected to contribute to the growth of the market.

Automotive Differential Market Trends

Passenger Car Holds the Highest Share in the Market

Passenger cars have gained immense popularity among drivers over the past few years due to features such as stylish design, compact size, and economic value. Passenger cars are the most common mode of transportation in numerous advanced countries. The improving lifestyles, increasing power purchase parity disposable income, raising brand awareness, and improving the economy are leading to customer preference changes across the globe, resulting in high sales of passenger cars.

According to the Society of Indian Automobile Manufacturers, sales of passenger cars increased from 14,67,039 to 17,47,376 units during 2022-2023.

Moreover, with the increase in global demand, electric car sales have grown exponentially due to falling costs, improving technology, and government support, contributing to passenger car growth. For instance, according to the International Energy Agency, over 2.3 million electric cars were sold in the first quarter of 2023, about 25% more than in the same period last year.

Also, a rise in the demand for sports utility vehicles (SUVs) creates profitable opportunities for the market players. It acts as a significant driving factor for the global passenger car market growth.

The differential, which helps send power to the shafts, is witnessing exponential growth with the high demand for passenger cars and a rise in demand for advanced features. The companies are working to launch new models and technological advancements to cater to the market. For instance,

In November 2023, Toyota filed a patent application for a variable limited-slip differential that can change its characteristics based on the driving environment using a new kind of differential consisting of a casting that contributes to the market growth.

Asia-Pacific Holds the Highest Share in the Market

Asia-Pacific is expected to grow significantly over the coming years. The demand for automotive differential in the area is mainly supported by increasing sales of passenger and commercial vehicles across China, India, and other countries. Various automakers invest in developing new technologies for autonomous, hybrid, and electric cars, positively impacting the market.

It will also result in new market opportunities for the automotive differential industry. For instance, in April 2023, Modern Automotives, an Indian motor vehicle parts manufacturing company, got approval to deliver a differential pinion shaft to BMW AG.

The Government of India is also encouraging the use of electric vehicles. By the end of 2035, the government will convert all fuel-run vehicles into whole or semi-electric-run vehicles. The automotive differential market in India is expected to have a bright future due to government policies such as the 'Make in India' initiative to improve the manufacturing sector. Automotive component manufacturers invest more in India through various investments or new regional product launches.

With positive manufacturing growth in the automotive components in Asia-Pacific, the automotive manufacturers are focusing on expanding their differential production as the market is utilized in electric and gasoline vehicles and is experiencing a huge demand.

In March 2024, Sona BLW Precision Forgings Ltd, a provider of differential solutions, reached production milestones for producing 400 million differential gears and 6 million differential assemblies to cater to the market demand of countries like India and China, contributing to the market growth.

Automotive Differential Industry Overview

The automotive differential market is consolidated and led by globally and regionally established players. The companies adopt new product launches, collaborations, and mergers to sustain their market positions. For instance,

In January 2024, American Axle & Manufacturing created a transition for the largest automakers by creating innovative driveline technologies for electric vehicles, passenger cars, and trucks. At CES 2024, the company showcased its 3-in-1 electric drive units (eDUs), fully integrated e-Beam axles, differential solutions, and innovative component technologies that are helping define the future of mobility worldwide.

Some of the major players in the market include GKN Automotive, American Axle & Manufacturing Inc., Dana Limited, ZF Friedrichshafen AG, and Eaton Corporation PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increase in Sales of Passenger Cars

- 4.2 Market Restraints

- 4.2.1 High Cost of Maintenance Required for Differentials

- 4.3 Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Passenger Car

- 5.1.2 Commercial Vehicle

- 5.2 Product Type

- 5.2.1 Electronic Limited-Slip Differential

- 5.2.2 Limited-Slip Differential

- 5.2.3 Locking Differential

- 5.2.4 Other Product Types

- 5.3 Drive Type

- 5.3.1 FWD

- 5.3.2 AWD

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Tungaloy Corporation

- 6.2.2 Brogwarner Inc.

- 6.2.3 Linamar Corporation

- 6.2.4 GKN Automotive

- 6.2.5 ZF Friedrichshafen AG

- 6.2.6 Dana Limited

- 6.2.7 American Axle & Manufacturing, Inc.

- 6.2.8 Eaton Corporation Plc

- 6.2.9 Yager Gear Enterprise Co Ltd