|

市場調查報告書

商品編碼

1690204

歐洲施工機械租賃市場:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Europe Construction Machinery Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

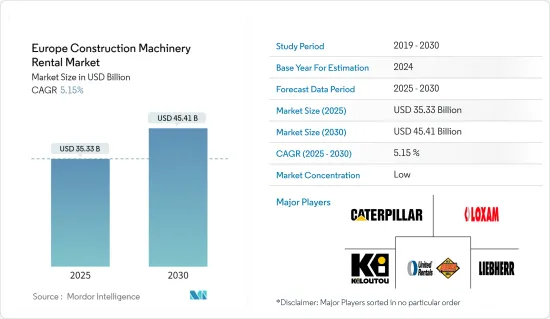

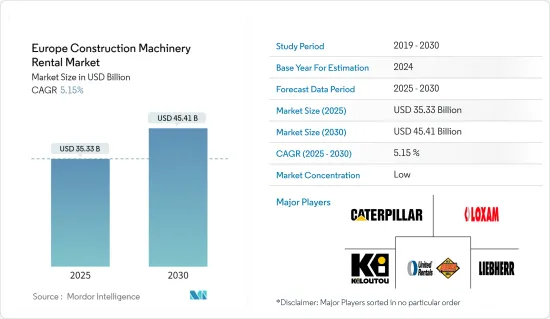

預計 2025 年歐洲施工機械租賃市場規模為 353.3 億美元,到 2030 年將達到 454.1 億美元,預測期內(2025-2030 年)的複合年成長率為 5.15%。

在預測期內,預計歐洲建設產業將受到建築業務向租賃施工機械轉變的支持,以降低營運成本。預計該行業的持續復甦也將在未來幾年推動研究市場的發展。

從長遠來看,歐洲對新基礎設施的持續需求、建築和房地產行業的擴張以及大規模道路基礎設施和智慧城市的快速建設預計將推動市場需求。此外,政府和建設公司致力於基礎設施建設的措施也有助於推動該產業的擴張。

歐洲建築市場的擴張受到都市區住宅需求上升、基礎設施開發活動活性化以及為提高能源效率而加強建築現代化和維修的推動。該地區強勁的經濟成長正在推動商業基礎設施建設的增加,包括辦公室、學校、飯店、餐廳和休閒設施。

此外,政府為改善住宅基礎設施和為社會弱勢群體提供住宅而採取的各種優惠措施和投資正在支持歐洲施工機械租賃市場的成長。 2023 年 9 月,德國政府宣布計劃暫停提案的建築法規,這是 450 億歐元(470 億美元)救助計畫的一部分,旨在幫助面臨高利率和成本上升的陷入困境的建設產業。柏林計劃在2027年前為經濟適用住宅撥款180億歐元,並從聯邦州和市政當局獲得額外資金。

歐洲施工機械租賃市場趨勢

建設產業預計將繼續成為焦點

歐洲建築市場的擴張受到都市區住宅需求增加、基礎設施建設改善以及建築現代化和維修以提高能源效率的推動。該地區強勁的經濟成長正在推動商業基礎設施建設的增加,包括辦公室、學校、飯店、餐廳和休閒設施。

政府為改善住宅基礎設施和為社會弱勢群體提供住宅而採取的各種優惠措施和投資也支持了歐洲施工機械租賃市場的成長。 2023年10月,捷克共和國更新了國家能源和氣候計畫(NCEP),表示打算在2030年建造6000兆瓦的太陽能發電廠,包括建造變電站以及安裝光伏板、渦輪機、發電機和輸電設備。 2024年3月,歐洲投資銀行(EIB)核准超過1.11億美元擴建立陶宛Kruonis抽水蓄能電站。

新興經濟體正在大力投資基礎設施,以解決交通堵塞、人口成長、生產成本上升和交通基礎設施老化等重大問題,而已開發經濟體則正在投資抗震建築和超級高鐵等技術,以改善現有的基礎設施。這些因素正在推動施工機械租賃市場的銷售。

在預計預測期內,施工機械技術的不斷進步和數位化將為施工機械租賃市場提供巨大的成長機會。在預測期內,不斷增加的產品發布和技術創新可能會進一步推動小型滑移裝載機的普及。

對具有成本效益的機械的需求和低排放氣體的監管壓力迫使施工機械製造商選擇電動式和混合動力汽車,而不是傳統的液壓和機械選項。因此,施工機械的電氣化進程正在加速。例如,

- 2024年1月,日本施工機械製造商日本小松公司首先在日本推出了電動挖土機PC138E-11作為租賃機器,隨後在歐洲推出。該機器重達 13 噸,特別適合都市區的建築計劃。

由於開發和建設活動的活性化,預計市場在預測期內將繼續成長。

德國佔最大市場佔有率

由於德國對先進設備的需求不斷增加、技術進步不斷進步以及建設活動日益增多,建築租賃機械市場正在不斷成長。推土機、挖土機和起重機是德國最受歡迎的重型機械。透過租賃施工機械,建設公司可以避免高昂的開支,以低成本實現目標。

建設產業的成長主要推動了對租賃施工機械的需求。政府增加對基礎設施計劃的投資旨在促進經濟成長並創造機會,這對德國建設產業來說是一個好兆頭。此外,都市化化和人口成長可能會刺激施工機械租賃的需求。

新冠疫情對德國建設產業造成了重大影響,許多建築計劃被推遲或取消。然而,該行業已證明具有韌性,隨著經濟重新開放,建設活動正在逐步加快。受國家基礎設施建設計劃推動,預計未來幾年施工機械租賃需求將會增加。例如

2024 年 2 月,薩克森州政府宣布了一項 1.05 億歐元(1.075 億美元)的一攬子計劃,用於住宅建設和購買公寓的 25 年固定利率低於 1% 的低息貸款。

- 2023年12月,費馬恩海峽附近的費馬恩海峽隧道將動工建設,長18.5公里,將漢堡和哥本哈根之間的旅行時間從4.5小時縮短至2.5小時,預計2029年完工。

- 2023 年 7 月,NeuConnect Interconnector 宣布啟動首個英德電力連接計劃。烏克蘭入侵後,歐洲正在尋求俄羅斯管道天然氣的替代品,該計劃旨在加強能源安全。

預計未來幾年施工機械租賃需求將會成長。預計在評估期內,對可負擔的設備解決方案的需求、政府對基礎設施計劃的支出增加以及建築業的擴張將有助於德國施工機械租賃市場的成長曲線。

歐洲施工機械租賃業概況

歐洲施工機械租賃市場由幾家主要企業主導,包括Caterpillar、神鋼建築機械、迪爾公司、小松株式會社、沃爾沃集團、斗山工程機械和徐工集團。預計全部區域施工機械租賃服務的快速擴張和主要企業收購數量的增加將推動預測期內的市場成長。

- 2023 年 6 月,Boels Rental 透露,去年已投資 5.51 億歐元用於擴大和多樣化其租賃設備系列,目前該系列包括 84 萬件租賃設備,其中 81% 為電動設備。大部分投資都投入了配備新電池、電動和混合動力技術的施工機械上,以減少碳排放並幫助客戶滿足不斷變化的政府法規和淨零目標。

- 2023 年 1 月,Ardent Hire 宣布將在貝德福德附近的肖斯頓開設一個新的超級樞紐倉庫。新設施位於 A1 高速公路上,可方便前往倫敦和北部地區。該佔地六英畝多的混凝土場地包括辦公室、研討會設施和目前正在建造的新培訓中心。

- 2023 年 1 月,約翰迪爾推出了由 Microsoft Dynamics 365 提供支援的全新經銷商業務系統,為經銷商提供涵蓋其業務諸多方面的通用技術平台,使他們能夠抓住新的成長、創新和客戶洞察機會。兩家公司將利用各自的專業知識來提供這項最尖端科技。 Dynamics 365 應用程式將無縫整合 John Deere 經銷商的銷售、租賃、售後市場和管理功能,實現更高的流程自動化和決策洞察。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 波特五力分析

- 新進入者的威脅

- 購買者和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 機器類型

- 起重機

- 伸縮臂堆高機

- 挖土機

- 裝載機

- 平土機馬達

- 道路施工機械

- 其他機器

- 驅動器類型

- 油壓

- 混合

- 按應用

- 建築學

- 道路建設

- 其他用途

- 按國家

- 德國

- 英國

- 義大利

- 西班牙

- 法國

- 其他歐洲國家

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Caterpillar Inc.

- Liebherr Group

- Deere & Company

- Komatsu Ltd

- Loxam SAS

- Ardent Hire Solutions Ltd

- Sunbelt Rentals

- Kiloutou Group

- Hitachi Construction Machinery Co. Ltd

- Ahern Rentals

第7章 市場機會與未來趨勢

The Europe Construction Machinery Rental Market size is estimated at USD 35.33 billion in 2025, and is expected to reach USD 45.41 billion by 2030, at a CAGR of 5.15% during the forecast period (2025-2030).

Over the forecast period, the European construction industry is expected to be supported by a shift in construction businesses toward renting equipment to lower operational costs. The ongoing recovery in the industry is also expected to drive the studied market positively in the coming years.

Over the long term, the market demand is expected to be fueled by the constant need for new infrastructure, increased business in the construction and real estate sectors, and the rapid construction of substantial road infrastructure and smart cities in Europe. The expansion of the industry is also aided by government and construction company initiatives aimed at infrastructural development.

The expansion of the European construction market can be attributed to rising demand for housing in urban areas, increased infrastructural development activities, and increased modernization and renovation of buildings to improve their energy efficiency. With the region's robust economic growth, commercial infrastructure construction, such as offices, schools, hotels, restaurants, and leisure facilities, is rising.

Additionally, various favorable initiatives and investments by governments to improve housing infrastructure and provide housing for the vulnerable section are supporting the growth of the European construction machinery rental market. In September 2023, the German government announced its plans to suspend proposed building regulations as part of a EUR 45 billion (USD 47 billion) relief package to support the struggling construction industry, which is facing high interest rates and rising costs. Berlin plans to allocate EUR 18 billion until 2027 for affordable housing, with additional funding from federal states and municipalities.

Europe Construction Machinery Rental Market Trends

The Building Construction Industry is Expected to Remain the Focal Point

The expansion of the European construction market can be attributed to rising demand for housing in urban areas, increased infrastructural development, and increased modernization and renovation of buildings to improve their energy efficiency. With the region's robust economic growth, commercial infrastructure construction, such as offices, schools, hotels, restaurants, and leisure facilities, is rising.

Various favorable initiatives and investments by governments to improve housing infrastructure and provide housing for the vulnerable section are also supporting the growth of the European construction machinery rental market. In October 2023, the Czech Republic updated its National Energy and Climate Plan (NCEP), intending to construct 6,000 MW of solar plants, including building a substation and installing PV panels, turbines, generators, and transmission lines by 2030. In March 2024, the European Investment Bank (EIB) approved over USD 111 million for expanding the Kruonis Pumped Storage Hydroelectric Power Plant in Lithuania, aiming to boost capacity from 900 MW in 2023 to 1 GW by 2026.

Developing economies are investing heavily in infrastructural development to address major issues such as traffic congestion, population growth, high manufacturing costs, and aging transportation infrastructure, while developed economies are investing in technologies such as earthquake-proof buildings and hyperloop to improve their current infrastructure. These factors are driving up sales in the construction machinery rental market.

Increasing technological advancements and digitalization in construction equipment are anticipated to offer enormous growth opportunities in the construction machinery rental market during the forecast period. Growing product launches and innovations may further enhance the adoption of small skid steer loaders during the forecast period.

Construction equipment manufacturers are pressured to choose electric and hybrid vehicles over traditional hydraulic and mechanical ones due to the demand for cost-effective machines and regulatory pressures for lower emissions. As a result, the electrification of construction equipment is gaining momentum. For instance,

- In January 2024, Japanese construction machinery manufacturer Komatsu introduced the PC138E-11 electric excavator as a rental machine, first in Japan, followed by Europe. The 13-ton machine is particularly suitable for urban construction projects.

Owing to such developments and rising construction activities, the market is expected to continue to grow during the forecast period.

Germany Holds the Largest Market Share

Construction rental machinery is a growing market in Germany due to the increasing need for advanced equipment, technological advancements, and the rise in construction activities in the country. Bulldozers, excavators, and cranes are among the most in-demand heavy machinery in Germany. Construction companies are meeting their objectives at a low cost while avoiding high expenses by renting construction equipment.

The growth of the construction industry primarily drives the demand for rental construction machinery. An increase in government investment in infrastructure projects is intended to spur economic growth and generate opportunities, which may be favorable to the German construction industry. Additionally, the rise in urbanization and the nation's expanding population may boost the demand for rental construction equipment.

The COVID-19 pandemic significantly impacted the German construction industry, with many construction projects being delayed or canceled. However, the industry has shown resilience, and construction activity has gradually picked up pace as the economy reopened. High demand for construction equipment rentals is expected on the back of infrastructure development projects in the country over the coming years. For instance,

In February 2024, the Saxony city government unveiled a EUR 105 million (USD 107.5 million) package for housing construction and low-interest loans under 1% with a 25-year fixed rate for purchasing condominiums.

- In December 2023, construction began on the Fehmarnbelt tunnel near the Fehmarn strait to develop an 18.5 km stretch to reduce travel time between Hamburg and Copenhagen from 4.5 hours to 2.5 hours, with completion expected by 2029.

- In July 2023, NeuConnect Interconnector announced the commencement of work on the first UK-German power link project. This project aims to enhance energy security as Europe looks for alternatives to Russian pipeline gas following the invasion of Ukraine.

The demand for construction equipment rentals is expected to grow in the coming years. The need for affordable solutions to address equipment requirements, rising government spending on infrastructure projects, and the expansion of the construction industry are expected to contribute to the growth curve of the German construction machinery rental market during the assessment period.

Europe Construction Machinery Rental Industry Overview

The European construction rental machinery market is dominated by several key players, including Caterpillar, Kobelco Construction Machinery, Deere & Company, Komatsu Ltd, Volvo Group, Doosan Infracore, and XCMG. The rapid expansion of construction machinery rental services across the region and the increasing acquisitions between key players are expected to boost the market's growth during the forecast period.

- In June 2023, Boels Rental disclosed that it spent EUR 551 million last year to expand and diversify its rental equipment range, now comprising 840,000 items, 81% of which are electric-powered. Much of the investment went into construction equipment with new battery, electric, and hybrid technologies, helping customers meet evolving government regulations and Net Zero targets by reducing their carbon footprints.

- In January 2023, Ardent Hire announced the opening of its new super-hub depot at Chawston, near Bedford. The new facility is on the A1 and offers excellent access to London and the North. With over 6 acres of concreted space, the site includes office and workshop facilities and a new training center that is being built.

- In January 2023, John Deere introduced a new dealer business system powered by Microsoft Dynamics 365 to provide a common technology platform for many aspects of a dealer's business, allowing dealers to capitalize on new opportunities for growth, innovation, and customer insights. Both companies will leverage their expertise to deliver this cutting-edge technology. Dynamics 365 applications will seamlessly integrate John Deere dealers' sales, rental, aftermarket, and administrative capabilities to enable higher levels of process automation and decision-making insights.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD Million)

- 5.1 Machinery Type

- 5.1.1 Cranes

- 5.1.2 Telescopic Handlers

- 5.1.3 Excavators

- 5.1.4 Loaders

- 5.1.5 Motor Graders

- 5.1.6 Road Construction Equipment

- 5.1.7 Other Machinery Types

- 5.2 Drive Type

- 5.2.1 Hydraulic

- 5.2.2 Hybrid

- 5.3 By Application

- 5.3.1 Building Construction

- 5.3.2 Road Construction

- 5.3.3 Other Applications

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 Italy

- 5.4.4 Spain

- 5.4.5 France

- 5.4.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Caterpillar Inc.

- 6.2.2 Liebherr Group

- 6.2.3 Deere & Company

- 6.2.4 Komatsu Ltd

- 6.2.5 Loxam SAS

- 6.2.6 Ardent Hire Solutions Ltd

- 6.2.7 Sunbelt Rentals

- 6.2.8 Kiloutou Group

- 6.2.9 Hitachi Construction Machinery Co. Ltd

- 6.2.10 Ahern Rentals