|

市場調查報告書

商品編碼

1687298

東協施工機械-市場佔有率分析、產業趨勢與成長預測(2025-2030年)ASEAN Construction Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

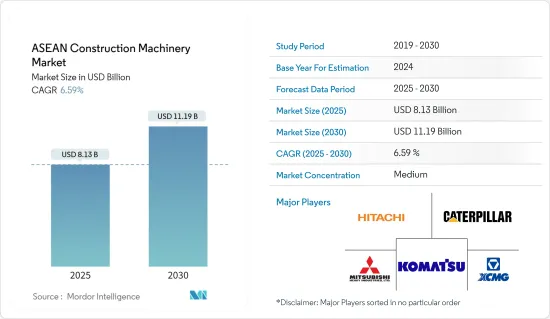

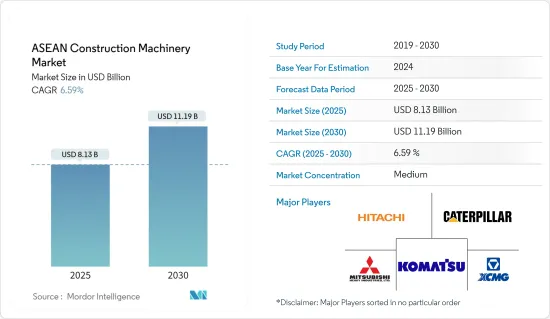

2025年東協施工機械市場規模預估為81.3億美元,預估至2030年將達111.9億美元,預測期間(2025-2030年)的複合年成長率為6.59%。

COVID-19 疫情對所研究的市場產生了負面影響,主要是由於建築和製造業活動的停止。此外,東協各國政府已暫停管道計劃並減少現場勞動力。這導致建築產量下降。然而,由於建設活動的增加,預計市場在預測期內將顯著成長,這主要得益於全球政府支持的增加和建設活動的復甦。

從中期來看,東協地區對施工機械的需求將受到基礎設施支出增加的推動。此外,隨著該地區製造業的成長,世界各地的製造商正計劃將業務轉移到東南亞國家,因為那裡成本更低、國內消費增加、基礎設施改善和擴大,從而導致對施工機械的需求增加。

此外,政府鼓勵基礎設施活動和增加採用電動化、自動化和技術先進的機器的舉措也可能為市場參與企業提供新的機會。建築業正變得越來越聰明。數位化、連結性和自動化正在推動發展並對建築計劃產生重大影響。此外,租賃公司正在投資新技術以滿足對先進施工機械日益成長的需求,以更新、升級的機器取代舊的施工機械。

快速的都市化、工業化、隨之而來的政府對基礎設施市場發展的投資增加以及全部區域房地產和建設公司的擴張和成長活動等因素預計將推動市場需求。

東協施工機械市場趨勢

混凝土和道路建設推動需求

- 去年,新冠疫情對東協建築業產生了重大影響。嚴格的封鎖和社交距離規定迫使各種規模和收入的建築工程停頓。結果,施工中通常使用的勞動力和設備都沒有被利用。

- 一段時間內銷售、出租或租賃機械的企業也受到不利影響。隨著建築業的全面停擺,對大型機械的需求已完全消失。隨著中國完全停止貿易,原料的運輸也停止了,因此沒有必要使用機器。

- 過去幾年,道路施工機械市場取得了顯著成長,主要原因是地方政府發起的道路開發項目增加。

- 由於道路建設工程的增加,對施工機械的需求不斷增加,而這些機械的進口也刺激了這種需求。新加坡對東協地區以外的重型機械出口多年來一直保持持續成長,主要原因是該地區建築計劃投資的增加。東南亞國協中經濟快速成長的例子有菲律賓和泰國。泰國從新加坡進口的重型機械的成長速度在該地區排名第二。

- 隨著道路建設活動的活性化,對施工機械的需求也上升,而這些機械的進口也支持了這項需求。近年來,受東協地區建築計劃和投資增加的主要推動,新加坡對東協以外地區的重型機械出口穩步成長。東協高成長機會的例子包括菲律賓和泰國。新加坡對泰國的重型機械出口是該地區成長速度第二快的。

- 因此,東協地區各國政府為推動計劃計劃、增加政府參與項目規劃、協調和資金籌措而採取的各種措施預計將在預測期內推動市場擴張。

越南對施工機械的需求不斷增加

越南施工機械市場近期的走勢很大程度得益於越南建築基礎設施開發計劃的增加。

過去十年來,越南機械設備產業取得了顯著成長。 2010年至2019年間,該產業公司的淨收入年增率為14.3%,證明了這一點。 2020年,越南擁有超過2,200家機械設備生產企業,總合達46億美元。

越南機場擴建等許多公共基礎設施計劃都是在官民合作關係模式下實施的。越南政府計劃在未來五年內投資 110 億美元用於機場建設,計劃預計將於 2022 年啟動。

到2030年,政府計劃投資650億美元用於道路建設。到2030年,公路網路建設預計將佔交通運輸領域總投資的48%左右。隆城機場(160億美元)、胡志明市地鐵(62億美元)、南北高速公路(185億美元)、河內環城公路(3.68億美元)、海雲2號隧道(3.12億美元)和峴港蓮照港(1.47億美元)都是預計於2022年完工的大型公路建設計劃。

考慮到越南正在進行和即將開展的所有建設活動,預計起重機市場在預測期內將實現穩步成長,從而推動該國的施工機械市場的發展。

東協施工機械產業概況

東協施工機械市場的特點是國際和區域參與企業眾多,市場競爭日益激烈。領先的公司正在成倍地增加其研發支出,以將創新與卓越的性能相結合。預計終端市場對高性能、高效、安全的搬運設備的需求將在預測期內加劇市場競爭。

2022年3月,銥星通訊公司宣布與住友建機共同開發了鏈帶式挖土機。透過此次合作,SCM 初步將銥星的短突發資訊服務整合到其遠端 CARE 服務平台中。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 建設活動的增加推動了市場

- 市場限制

- 高昂的設備成本可能會阻礙市場

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 機器類型

- 起重機

- 挖土機

- 裝載機

- 後鏟

- 平土機馬達

- 其他機器

- 應用

- 混凝土和道路建設

- 土木工程

- 物料輸送

- 地區

- 印尼

- 泰國

- 越南

- 新加坡

- 馬來西亞

- 菲律賓

- 其他東南亞國協

第6章競爭格局

- 供應商市場佔有率

- 公司簡介

- Hitachi Construction Machinery Co.

- Caterpillar Inc.

- Mitsubishi Corporation

- Komatsu Ltd.

- Xuzhou Construction Machinery Group Co., Ltd.

- Liebherr Group

- CNH Industrial

- JC Bamford Excavators Ltd(JCB)

第7章 市場機會與未來趨勢

The ASEAN Construction Machinery Market size is estimated at USD 8.13 billion in 2025, and is expected to reach USD 11.19 billion by 2030, at a CAGR of 6.59% during the forecast period (2025-2030).

The COVID-19 pandemic had a negative impact on the market studied, primarily attributed to halted construction and manufacturing activities. In addition, governments across the ASEAN countries paused the pipeline projects and reduced the workforce over the sites. This has led to a reduction in construction output. However, the market is anticipated to witness significant growth during the forecast period due to the increase in construction activities, which is likely to be primarily attributed to increasing government support and restoration of construction activities worldwide.

Over the medium term, demand for construction machinery in the ASEAN region is driven by increased infrastructure spending. Additionally, with growth in the manufacturing industry in the region, manufacturers from all across the world are planning to shift their operations to the Southeast Asian nations due to lower costs, increasing domestic consumption, and improving and expanding infrastructure, which, in turn, resulted in higher demand for construction machinery.

Moreover, the government initiatives encouraging infrastructure activities and the rising adoption of technologically advanced machinery, both electrified and autonomous, tend to offer new opportunities for players operating in the market. The construction industry is getting smarter. Digitalization, connectivity, and automation are driving the development forward, substantially impacting construction projects. Moreover, renting companies are geared to invest in new technologies to cope with the growing demand for advanced construction machinery and replace the older ones with new or upgraded machinery fleet.

Factors such as rapid urbanization, industrialization, followed by rising government investments in the development of infrastructure, and expansion and growth activities of the real estate and construction companies across the region are expected to enhance demand in the market.

ASEAN Construction Machinery Market Trends

Concrete and Road Construction To Propel The Demand

- COVID-19 significantly impacted the ASEAN construction sector over the past year. Construction work of all sizes and incomes was forced to stop due to the strict lockdown and social distance regulations. As a result, neither the labor nor the equipment typically employed for construction was utilized.

- Companies that sold, rented, or leased out the machinery for a set time were negatively impacted. The demand for heavy-duty equipment was completely lost due to the construction industry's complete shutdown. Due to China's complete closure to trade, there was no need to use the machinery because raw material transportation was also stopped.

- Over the past few years, the road construction equipment market has witnessed significant growth, mainly due to increased road development programs initiated by regional governments.

- The need for construction equipment has been rising in response to the increase in road construction operations, and the importation of these machines is fueling this demand. The primary factors, led by the rising investment in building projects in the ASEAN region, have helped Singapore's heavy machinery exports to the rest of the ASEAN region rise consistently over the years. The Philippines and Thailand are two instances of ASEAN countries with fast economic growth. Thailand's imports of heavy machinery from Singapore have increased at the second-fastest rate in the region.

- With the rise in road construction activities, the demand for construction machinery has been increasing, which is supported by importing these machines. Exports of heavy machinery from Singapore to the rest of the ASEAN region have grown steadily over the years, supported by the key drivers and increased investment in construction projects in the ASEAN region. Two examples of high-growth opportunities in ASEAN are the Philippines and Thailand, among others. Singapore's heavy machinery exports to Thailand have the second-fastest growth in the region.

- Thus, various measures implemented by governments in the ASEAN area to promote infrastructure projects and increase government engagement in project planning, coordination, and financing are anticipated to fuel market expansion during the forecast period.

Increasing Demand for Construction Machinery in Vietnam

Vietnam's rising construction and infrastructure development projects are mostly to credit for the country's recent growth in the market for construction equipment.

Vietnam's machinery and equipment industry has grown significantly over the past ten years. This is demonstrated by the fact that between 2010 and 2019, the net revenue reported by businesses in this industry grew by 14.3% annually. Until 2020, Vietnam had over 2,200 businesses that produced machinery and equipment, bringing in a combined USD 4.6 billion.

Under the Public-Private Partnership model, a number of public infrastructure projects are undertaken, such as the expansion of Vietnam's airport. The Vietnamese government intends to invest USD11 billion in airport development over the following five years, with the project scheduled to begin in 2022.

By 2030, the government intends to spend 65 billion on road improvements. By 2030, the building of a road network is anticipated to account for around 48% of all investments made in the transportation sector. The Long Thanh Airport (USD16 billion), the Ho Chi Minh City Metro (USD6.2 billion), the North-South Express (USD18.5 billion), the Hanoi Ring Road (USD368 million), the Hai Van Tunnel 2 (USD312 million), and the Lien Chieu Port in Da Nang (USD147 million) are all significant road construction projects that will be completed in 2022.

Considering all the ongoing and future construction activities in Vietnam, the crane market is expected to witness steady growth over the forecast period, propelling the country's construction machinery market.

ASEAN Construction Machinery Industry Overview

The ASEAN construction machinery market is characterized by numerous international and regional players, resulting in a highly competitive market environment. The big players have increased their R&D expenditure exponentially to integrate innovation with excellence in performance. The demand for high-performance, highly efficient, and safe handling equipment from the end market is expected to make the market more competitive over the forecast period.

In March 2022, Iridium Communications Inc. announced that it had jointly developed a Link-Belt excavator with Sumitomo Construction Machinery Co., Ltd. Through this partnership, SCM initially integrated Iridium's Short Burst Data Service into its Remote CARE service platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Construction Activity May Drive the Market

- 4.2 Market Restraints

- 4.2.1 High Equipment Cost may Hamper the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Million)

- 5.1 Machinery Type

- 5.1.1 Cranes

- 5.1.2 Excavators

- 5.1.3 Loaders

- 5.1.4 Backhoe

- 5.1.5 Motor Graders

- 5.1.6 Other Machinery Types

- 5.2 Application

- 5.2.1 Concrete and Road Construction

- 5.2.2 Earth Moving

- 5.2.3 Material Handling

- 5.3 Geography

- 5.3.1 Indonesia

- 5.3.2 Thailand

- 5.3.3 Vietnam

- 5.3.4 Singapore

- 5.3.5 Malaysia

- 5.3.6 Philippines

- 5.3.7 Rest of ASEAN

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Hitachi Construction Machinery Co.

- 6.2.2 Caterpillar Inc.

- 6.2.3 Mitsubishi Corporation

- 6.2.4 Komatsu Ltd.

- 6.2.5 Xuzhou Construction Machinery Group Co., Ltd.

- 6.2.6 Liebherr Group

- 6.2.7 CNH Industrial

- 6.2.8 JC Bamford Excavators Ltd (JCB)