|

市場調查報告書

商品編碼

1690117

北美自行車:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)North America Bicycle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

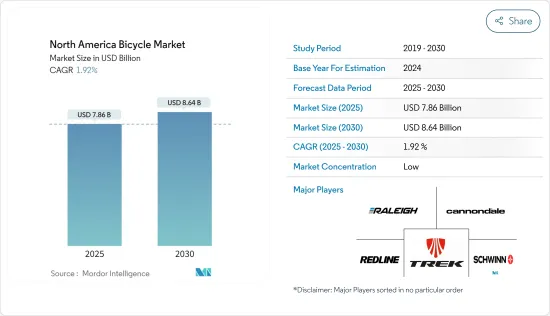

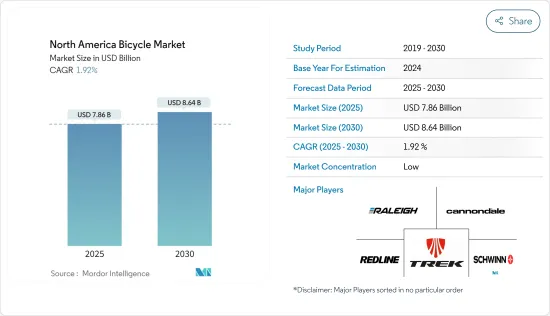

北美自行車市場規模預計在 2025 年為 78.6 億美元,預計到 2030 年將達到 86.4 億美元,預測期內(2025-2030 年)的複合年成長率為 1.92%。

在預測期內,健行和休閒活動中自行車的使用增加,加上美國自行車協會等各種組織組織的自行車賽事增多,可能會刺激對運動自行車的需求。名人代言的影響力日益增強,加上媒體對此類活動的報導增多,預計將進一步推動市場成長。例如,在美國,五月被定為“自行車月”,“騎車上班週”總是在五月的第一周或第二週。奧斯汀、波士頓、帕薩迪納、波特蘭、羅斯維爾、聖塔芭芭拉、沙加緬度、聖地牙哥、舊金山和華盛頓是積極參與此類活動的一些美國城市。

由於交通堵塞日益嚴重以及停車位短缺,尤其是在大城市,越來越多的人考慮騎自行車近距離以節省時間。同時,政府也積極發展自行車出行所需的基礎設施,並鼓勵人們選擇騎自行車。例如,為了增加就業機會、應對氣候變遷和發展更具彈性和永續的經濟,加拿大政府於 2021 年 3 月宣布首次撥出 4 億美元聯邦基金,用於在全國各地建造自行車道和小徑。

北美自行車市場趨勢

更多自行車賽事

越來越多的人開始使用自行車進行健行和休閒活動,加上自行車運動的增多,預計將推動對普通自行車和運動自行車的需求。此類活動中名人代言和媒體報道的影響力不斷增強,預計將進一步推動市場成長。自行車賽事在提高人們對自行車運動的認知以及最終鼓勵人們轉向自行車運動方面發揮著重要作用。活動可以針對特定群體,例如兒童、家庭、剛開始騎自行車的人或特定組織或地點的員工。美國自行車協會是美國所有競技自行車運動的官方統籌機構,包括小輪車越野賽、越野自行車、山地自行車、公路自行車和場地自行車。我們在該地區舉辦了 2000 多場自行車賽事。例如,2022年美國自行車協會在美國舉辦了「美國自行車麥迪遜場地全國錦標賽」。

美國佔據顯著的市場佔有率

美國自行車市場受健身和休閒自行車的需求所驅動。根據戶外基金會統計,2021年美國參與戶外活動(包括各種運動)的人數增加了57%,與2020年相比,參與戶外活動的美國增加了710萬人。因此,隨著使用自行車進行休閒的人數增加,預計市場將會發展。此外,人們對騎自行車作為一種便捷的健身方式的青睞也有望推動市場的發展。流行的山地自行車和電動自行車正在吸引全國各地的千禧世代。因此,製造商正在推出該類別的產品,以吸引該國的二輪車愛好者並提高銷售量。芝加哥、明尼阿波利斯和紐約等東部文化中心的騎自行車人數大幅增加,這表明天氣和氣候並不是影響自行車使用的唯一因素。當美國各地的許多健身中心暫時關閉時,健身房會員很快就開始尋找其他選擇。騎自行車是人們在疫情期間採取的活動,因為單獨運動就可以降低風險。人們對騎自行車興趣的激增增加了對低成本自行車的需求,而愛好者們繼續購買價值數千美元的高檔碎石車、山地自行車、公路車和電動式自行車。

北美自行車產業概況

北美自行車市場競爭激烈,由許多國際和本地參與者組成。 Trek Bicycle Corporation、Redline Bicycles、Cannondale Bicycle Corporation、Schwinn Bicycle Company、Raleigh America 等主要企業佔據著市場主導地位。此外,各公司還透過推出專門針對女性騎士和兒童的自行車來使其自行車產品組合多樣化。這些公司正在積極投資、推出新產品、引入新服務(如宅配、售後服務和高檔自行車維護),並以有競爭力的價格提供產品和服務以保持競爭力。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 波特五力分析

- 新進入者的威脅

- 購買者和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 類型

- 公路自行車

- 油電混合自行車

- 全地形自行車 (ATB)

- 電動自行車

- 其他類型

- 分銷管道

- 線下零售店

- 網路零售商

- 地區

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

第6章 競爭格局

- 最受歡迎的策略

- 市場佔有率分析

- 公司簡介

- Trek Bicycle Corporation

- Raleigh America

- Cycling Sports Group Inc.

- Cannondale Bicycle Corporation

- Schwinn Bicycle Coorporation

- Mongoose

- Roadmaster

- Diamond Back Bicycles

- HAIBIKE

- Redline Bicycles

第7章 市場機會與未來趨勢

The North America Bicycle Market size is estimated at USD 7.86 billion in 2025, and is expected to reach USD 8.64 billion by 2030, at a CAGR of 1.92% during the forecast period (2025-2030).

The growing use of bicycles for trekking and recreational activities, coupled with an increasing number of cycling events organized by various organizations like Cycling USA, may boost the demand for sports bicycles over the forecast period. The growing influence of celebrity endorsement, coupled with increasing media coverage for such events, is expected to fuel market growth further. For instance, in the United States, May is recognized as 'Bike Month,' and 'Bike-to-Work Week' is always either the first or second week of May. Austin, Boston, Pasadena, Portland, Roseville, Santa Barbara, Sacramento, San Diego, San Francisco, and Washington are among the United States cities that actively participate in these events.

The growing traffic congestion and shortage of parking space, particularly in metropolitan cities, are prompting people to consider bicycle commutation for short distances to save time. At the same time, various governments are aggressively rolling out the infrastructure necessary to support bicycle commutation, encouraging people to opt for bicycles. For instance, to increase employment possibilities, combat climate change, and develop a more resilient and sustainable economy, the Canadian government announced the first federal fund of USD 400 million in March 2021 for bike lanes and trails across the nation.

North America Bicycle Market Trends

Increasing Number of Cycling Events

An increasing application base of bicycles in trekking and recreational activities, coupled with a rising number of cycling events, is expected to propel the demand for bicycles, in both general and sports bicycles. The increasing influence of celebrity endorsement and media coverage for such events is expected to fuel market growth further. Cycling events can play an essential role in raising awareness regarding cycling and ultimately supporting efforts to encourage to shift toward bicycle use. Events may target particular groups, including children, families, those new to cycling, or employees of a specific organization or location. USA Cycling is the official governing body for all disciplines of competitive cycling in the United States, including BMX, cyclocross, mountain bike, road, and track. It organizes more than 2000 cycling events in the region. For instance, in 2022, USA Cycling organized the "USA Cycling Madison Track National Championships" in the United States.

United States Holds A Prominent Share in the Market

The United States bicycle market is driven by bicycle demand for fitness and leisure. According to Outdoor Foundation, in the United States, the number of participants in outdoor activities, including various sports, increased to 57% in 2021 and 7.1 million more Americans participated in outdoor activities than in 2020. Thus, the increase in the number of people who use a bicycle as a form of recreation is expected to develop the market. Further, the preference for bicycles as a convenient way of exercising for fitness is expected to drive the market. Trendy mountain bikes and e-bikes are gaining the grip of the millennials in the country. In consequence, this is insisting manufacturers launch products under the same category to captivate two-wheel mobility in the country and to gain sales. Eastern cultural hubs such as Chicago, Minneapolis, and New York City have seen a huge growth in cycling populations, suggesting weather and climate are not the only factors influencing bike use. When many fitness centers across the United States closed temporarily, gym members quickly looked for other alternatives. Since exercising alone was a better way to reduce risk, biking solo was among the activities folks embraced amid the pandemic. This burst of interest in biking increased demand for lower-priced bikes and, at the same time, bike aficionados continued to buy high-end gravel, mountain, road, and electric bikes that can cost thousands of dollars.

North America Bicycle Industry Overview

The North American bicycle market is highly competitive and comprises many international and regional players. Key players like Trek Bicycle Corporation, Redline Bicycles, Cannondale Bicycle Corporation, Schwinn Bicycle Company, Raleigh America, and others dominate the market. Moreover, the companies are diversifying their bicycles portfolio by launching bicycles explicitly targeted toward women riders and kids. These companies are investing aggressively; launching new products; introducing new services, such as home delivery of high-end bicycles, after-sales support, and maintenance; and pricing their products and services competitively to retain their competitiveness.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Road Bicycles

- 5.1.2 Hybrid Bicycles

- 5.1.3 All-Terrain Bicycles

- 5.1.4 E-bicycles

- 5.1.5 Other Types

- 5.2 Distribution Channel

- 5.2.1 Offline Retail Stores

- 5.2.2 Online Retail Stores

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Trek Bicycle Corporation

- 6.3.2 Raleigh America

- 6.3.3 Cycling Sports Group Inc.

- 6.3.4 Cannondale Bicycle Corporation

- 6.3.5 Schwinn Bicycle Coorporation

- 6.3.6 Mongoose

- 6.3.7 Roadmaster

- 6.3.8 Diamond Back Bicycles

- 6.3.9 HAIBIKE

- 6.3.10 Redline Bicycles