|

市場調查報告書

商品編碼

1689919

菲律賓瓷磚:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Philippines Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

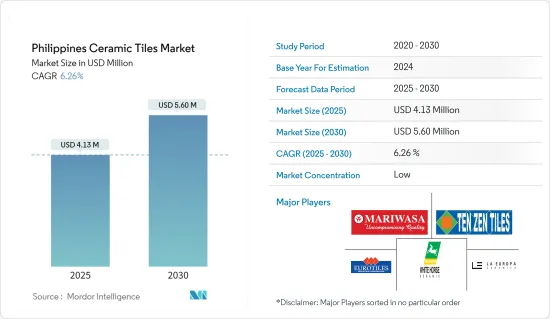

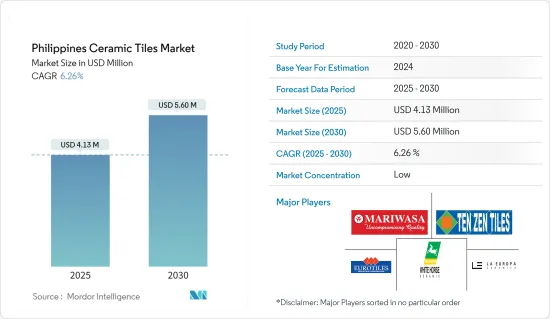

菲律賓瓷磚市場規模預計在 2025 年為 413 萬美元,預計在 2030 年達到 560 萬美元,預測期內(2025-2030 年)的複合年成長率為 6.26%。

推動該國瓷磚行業需求的關鍵因素包括建設活動的增加、可支配收入的增加以及人口的成長。

此外,中國不斷加快的都市化可能會導致公共工程需求激增,進而增加住宅需求。預計這一趨勢將在整個估計和預測期內保持一致,從而推動瓷磚市場的成長。

該公司正在採用最新的自動化生產技術,如Monopteros和單火技術,以提高產品品質並使瓷磚更具成本效益。菲律賓的瓷磚透過專賣店和非專賣店進行分銷。然後,分銷商要么將這些產品轉交給經銷商(經銷商賣給最終用戶),要么自己零售。

瓷磚使用量的增加遠超出了預期,導致市場需求增加,瓷磚行業也隨之成長。企業必須以專業化、現代化的瓷磚技術提高產品質量,才能以合理的價格在國內和國際市場上競爭。目前菲律賓大部分瓷磚均採用單燒技術、一次燒製技術等最新瓷磚技術,並提高了產品質量,使瓷磚行業更具成本效益。

陶瓷磚優於普通瓷磚,因為它們外觀更好、更堅固、使用壽命更長。這些是導致菲律賓眾多建築工地使用瓷磚的一些決定性因素。

在菲律賓,瓷磚被認為是最重要和最常見的建材之一。瓷磚的主要進口國是中國。中國也進口瓷磚,其中義大利佔菲律賓瓷磚進口量的3%,西班牙佔9%。在出口方面,日本仍然是菲律賓瓷磚出口的最大海外市場,其次是美屬薩摩亞和美國。

菲律賓瓷磚市場趨勢

建築業的成長推動了對瓷磚的需求

- 菲律賓瓷磚行業的成長依賴於建築業的成長,而建築業是房地產行業的相關行業。菲律賓的建設業目前正在蓬勃發展,全國各地的住宅和商業建築都在增加。

- 截至 2022 年,菲律賓建設業創造的總增加價值約為 1.4 兆菲律賓披索。過去四年來,建築業的增加價值一直在波動。 2019年3月28日,貿工部(DTI)和菲律賓承包商協會(PCA)發布了2020-2030年建築業藍圖,主題為“Tatag at Tapat 2030”,以確保建築業的永續性發展和競爭力。該藍圖還補充了政府的大規模基礎設施計畫「大建特建」。

- 住宅建築的興起可能會刺激對瓷磚的需求,因為它們在建築施工過程中用作地板材料和牆壁材料。瓷磚因其耐用、維護成本低且經濟實惠而被廣泛應用於住宅。磁磚多用於客廳、廚房、衛浴牆面等空間。這些產品在市場上有多種顏色、尺寸和紋理可供選擇,吸引了消費者對高階地板材料應用的注意。

- .

地磚是主要類別

- 說到菲律賓的住宅室內設計,陶瓷地磚是最重要的元素之一。地磚有助於改善住宅的美觀。馬賽克瓷磚是菲律賓最受歡迎的地磚設計之一。馬賽克以多種顏色和圖案的混合而聞名,有助於形成最終的設計。瓷磚的另一個主要特點是易於更換和安裝,使其成為理想的地板材料。

- 在非住宅領域,設計師和建築師對瓷磚作為地板材料的偏好日益增加,預計將推動對該產品的需求。該國正在經歷公寓和住宅等住宅基礎設施以及農業、機構、工業和商業等非住宅基礎設施的發展,這增加了對陶瓷地磚的需求。

菲律賓瓷磚行業概況

菲律賓瓷磚行業以本土品牌和國際品牌的混合而聞名。市場競爭激烈,眾多企業進入。沒有一家公司能夠主宰整個行業,但有些公司卻佔據著強大的地位並佔據了相當大的市場佔有率。然而,隨著技術進步和產品創新,中小企業透過贏得新契約和開拓新市場來擴大其市場佔有率。

市場的一些主要參與者包括 Mariwasa Siam Ceramics、Formosa Ceramic Tile Manufacturing(Tenzen Tiles)、Eurotiles Industrial Corporation、Whitehorse Ceramic、La Europa Ceramica、Floor Center、Tile Center、Machuca Tiles、Galleria Ceramica 和 Nilo Ceramic Philippines Inc.

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態與洞察

- 市場概覽

- 市場促進因素

- 建設產業的成長

- 房地產市場成長

- 市場限制

- 原物料價格不穩定

- 替代產品的可用性

- 市場機會

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 深入了解業界正在使用的最新技術

- 深入了解菲律賓瓷磚監管標準

- 洞察產業設計瓷磚趨勢

- COVID-19 市場影響

第5章市場區隔

- 按產品

- 釉藥

- 瓷

- 無刮痕

- 其他產品

- 按應用

- 地磚

- 牆磚

- 其他磁磚

- 依建築類型

- 新建築

- 更換和翻新

- 按最終用戶

- 住宅

- 建造

第6章競爭格局

- Market Competion Overview

- 公司簡介

- Mariwasa Siam Ceramics Inc.

- Formosa Ceramic Tiles Manufacturing Corp.(Ten Zen Tiles)

- Eurotiles Industrial Corp.

- White Horse Ceramic

- La Europa Ceramica

- Floor Center

- TILE Center

- Machuca Tile

- Galleria Ceramica

- Niro Ceramic Philippines Inc

- Reyaimpex Pvt. Ltd

- MOZZAICO BGC

- AllHome

- Taicera

- Dynasty Ceramic

第7章:市場的未來

第8章 免責聲明和出版商

The Philippines Ceramic Tiles Market size is estimated at USD 4.13 million in 2025, and is expected to reach USD 5.60 million by 2030, at a CAGR of 6.26% during the forecast period (2025-2030).

Some of the major factors fuelling the demand for the ceramic tiles industry in the country are increasing construction activities, rising disposable income, and increased population in the country.

Furthermore, the growing urbanization in the country will further lead to surging demands for utilities and, subsequently, to increased housing demands. This trend is estimated to be consistent over the forecast period and is expected to boost the ceramic tiles market growth.

The companies are using the latest production technology automation, such as monopteros or single-fire technology, to enhance product quality and improve the cost efficiency of ceramic tiles. The ceramic tiles are distributed in the Philippines through exclusive and nonexclusive distributors. Distributors pass these products on to dealers (who sell to end-users) or retail the products themselves.

The increased use of ceramic tiles was much higher than predicted, resulting in increased market demand and growth in the ceramic tile industry. Companies must improve their quality with specific and modern ceramic tile technology in order to compete in domestic and international markets at reasonable prices. Most Philippine ceramic tiles are now using the most recent ceramic tile technology, such as monopteros or single-fire technology, to improve product quality and, as a result, the ceramic tile industry's cost efficiency.

Ceramic tiles are superior to regular tiles because they are aesthetically pleasing, solid, and long-lasting. These are some of the critical factors that have led to the use of ceramic tiles on numerous construction sites throughout the Philippines.

In the Philippines, ceramic tiles are seen as one of the most important yet common forms of materials to be used in construction. China is the leading importer of ceramic tiles in the country. The country also imports ceramic tiles, with Italian tiles accounting for 3% and Spanish tiles accounting for 9% of total ceramic tile imports to the Philippines. In terms of exports, Japan remains the key foreign market for ceramic tile exports from the Philippines, followed by American Samoa and the United States.

Philippines Ceramic Tiles Market Trends

Growth of Construction Sector to Drive Demand for Ceramic Tiles

- The growth of the Philippines' ceramic tiles industry is hinged on the growth of the construction industry, which is the related industry of the property sector. The construction business in the country is currently witnessing positive growth, with a rise in residential as well as commercial construction throughout the country.

- As of 2022, the gross value added generated by the construction sector in the Philippines was approximately 1.4 trillion Philippine pesos. The construction sector's value-added has fluctuated over the last four years. On March 28, 2019, the Department of Trade and Industry (DTI) and the Philippine Contractors Association (PCA) launched the Construction Industry Roadmap 2020-2030 with the theme "Tatag at Tapat 2030," which will ensure the sustainability of the construction industry's growth and competitiveness. The roadmap will also serve as a supplement to the government's massive infrastructure program, "Build Build Build."

- The increase in residential buildings is likely to boost the demand for ceramic tiles as ceramic tiles find application for floorings and walls during the construction of buildings. Ceramic tiles are used widely in houses as they are durable, offer lower maintenance, and are cost-effective. Ceramic tiles are mainly used in the living room, kitchen and bathroom walls, and other spaces. These products are commercially available in a wide range of colors, sizes, and textures, thus gaining consumer attraction for high-end flooring applications.

- .

Floor Tiles is the Dominant Category

- When it comes to home interior design, one of the most important elements is ceramic floor tiles in the Philippines. Floor tiles help improve the aesthetic appeal of houses. Mosaic tiles are one of the most popular floor tile designs in the Philippines. Mosaics are known for being a mix of colors and patterns that help create one final design. Ease of replacement and installation are some major characteristics of ceramic tiles which makes them ideal for flooring.

- The growing presence of designers and architects for the application of porcelain ceramic tiles for flooring in the non-residential segment is anticipated to fuel product demand. The growing development of residential infrastructures, such as apartments and housing units, and non-residential infrastructure in the country, such as agricultural, institutional, industrial, and commercial, are also witnessing an increase in demand for ceramic floor tiles in the country.

Philippines Ceramic Tiles Industry Overview

The ceramic tile business in the Philippines is distinguished by a blend of local and international brands. The market is competitive, with a large number of companies in the business. While no dominating businesses control the industry, certain corporations have built a strong presence and enjoy a significant market share. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets.

Some of the leading players in the market are Mariwasa Siam Ceramics Inc, Formosa Ceramic Tiles Manufacturing Corp. (Ten Zen Tiles), Eurotiles Industrial Corp., White Horse Ceramic, La Europa Ceramica, Floor Center, TILE Center, Machuca Tile, Galleria Ceramica, Niro Ceramic Philippines Inc. among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth In Construction Sector

- 4.2.2 Growth In Real Estate Market

- 4.3 Market Restraints

- 4.3.1 Volatile Raw Material Prices

- 4.3.2 Availability of Substitutes

- 4.4 Market Opportunities

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Latest Technologies Used in the Industry

- 4.8 Inisghts on Regulatory Standards for Ceramic Tiles in Philippines

- 4.9 Insights on Design Tile Trends in the Industry

- 4.10 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Glazed

- 5.1.2 Porcelain

- 5.1.3 Scratch Free

- 5.1.4 Other Products

- 5.2 By Application

- 5.2.1 Floor Tiles

- 5.2.2 Wall Tiles

- 5.2.3 Other Tiles

- 5.3 By Construction Type

- 5.3.1 New Construction

- 5.3.2 Replacement and Renovation

- 5.4 By End-User

- 5.4.1 Residential

- 5.4.2 Construction

6 COMPETITIVE LANDSCAPE

- 6.1 Market Competion Overview

- 6.2 Company Profiles

- 6.2.1 Mariwasa Siam Ceramics Inc.

- 6.2.2 Formosa Ceramic Tiles Manufacturing Corp. (Ten Zen Tiles)

- 6.2.3 Eurotiles Industrial Corp.

- 6.2.4 White Horse Ceramic

- 6.2.5 La Europa Ceramica

- 6.2.6 Floor Center

- 6.2.7 TILE Center

- 6.2.8 Machuca Tile

- 6.2.9 Galleria Ceramica

- 6.2.10 Niro Ceramic Philippines Inc

- 6.2.11 Reyaimpex Pvt. Ltd

- 6.2.12 MOZZAICO BGC

- 6.2.13 AllHome

- 6.2.14 Taicera

- 6.2.15 Dynasty Ceramic